0001651721false00016517212024-08-232024-08-230001651721us-gaap:CommonStockMember2024-08-232024-08-230001651721us-gaap:WarrantMember2024-08-232024-08-23

A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 23, 2024

GENERATION INCOME PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

Maryland |

|

001-40771 |

|

47-4427295 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

401 East Jackson Street, Suite 3300 Tampa, Florida |

|

33602 |

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (813)-448-1234

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

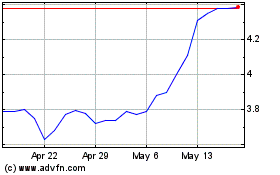

Common Stock, par value $0.01 per share |

|

GIPR |

|

The Nasdaq Stock Market LLC |

Warrants to purchase Common Stock |

|

GIPRW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into Material Definitive Agreement.

The information set forth under Items 2.01 and 2.03 below is hereby incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

On August 23, 2024, Generation Income Properties, L.P., the operating partnership (the “Operating Partnership”) of Generation Income Properties, Inc. (the “Company”), completed the acquisition of a 30,465 square-foot, single-tenant retail property in Ames, Iowa (the “Ames Property”). The acquisition was made by GIPIA 1220 S Duff Avenue, LLC, a Delaware limited liability company and single-purpose subsidiary of the Operating Partnership that was formed for the purpose of effecting the acquisition (the “Iowa SPE”). The Operating Partnership, through the Iowa SPE, purchased the Property pursuant to a Purchase and Sale Agreement, dated June 13, 2024, between the Operating Partnership and Duff Daniels, LLC, an Iowa limited liability company, Westbrook Daniels, LLC, an Iowa limited liability company, and Westbrook Wolf, LLC, an Iowa limited liability company (collectively, the “Seller”), at a purchase price of approximately $5.5 million, excluding transaction costs (as amended, the “Ames Purchase and Sale Agreement”). Pursuant to an Assignment and Assumption of Purchase and Sale Agreement, effective as of August 23, 2024 (the “Ames Assignment Agreement”), the Operating Partnership assigned, and the Iowa SPE assumed, all of the Operating Partnership’s right, title and interest in and under the Ames Purchase and Sale Agreement, giving the Iowa SPE the right to acquire the Ames Property pursuant to the Ames Purchase and Sale Agreement. The Seller is not an affiliate of the Company or the Operating Partnership. The purchase price of the Ames Property and related transaction costs were funded using preferred equity of the Iowa SPE of approximately $3,080,000 purchased by JCWC Funding, LLC, a third-party investor (“JCWC”), and approximately $2,495,000 of debt financing from Valley National Bank (“Valley”), as discussed below.

The Ames Property is 100% leased to Best Buy Stores, L.P., a Virginia limited partnership, pursuant to a triple net lease agreement, dated December 20, 2004 (as amended, the “Ames Lease”). The term of the Ames Lease commenced on December 20, 2004, and originally ended on December 19, 2019. The first extended lease term of the Ames Lease commenced on December 19, 2019, and ends on March 31, 2025. The second extended lease term of the Ames Lease commences on April 1, 2025, and ends on March 31, 2030, with two options to renew for a five-year term. Under the Ames Lease, Best Buy Stores, L.P. is responsible for operating expenses, real estate taxes, insurance, repairs, maintenance and capital expenditures, in addition to base rent. In connection with the acquisition of the Ames Property, the Iowa SPE entered into an Assignment and Assumption of Lease, Security Deposit and Guaranty (“Assignment and Assumption of Ames Lease”) with the Seller, dated August 23, 2024, pursuant to which the Seller assigned, and the Iowa SPE assumed, all of the Seller’s rights and obligations under the Ames Lease.

The following table provides certain information about the Ames Property and the Ames Lease:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Type |

|

Property Location |

Lease Expiration

Date |

|

Rentable

Square Feet |

|

|

Annualized Base Rent in 2024 (1) |

|

|

|

Tenant Renewal

Options |

Retail |

|

Ames, Iowa |

3/31/2030 |

|

|

30,465 |

|

|

$405,470 |

|

|

|

|

Two, five-year renewal option remaining |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________________

(1)Annualized base rent escalates to $452,372 commencing on April 1, 2025.

In connection with the preferred equity investment in the Ames SPE by JCWC, on August 23, 2024, the Operating Partnership and JCWC entered into an Amended and Restated Limited Liability Company Agreement for the Iowa SPE (the “GIPIA Operating Agreement”). Under the GIPIA Operating Agreement, JCWC made a $3.08 million capital contribution to GIPLP in exchange for a preferred equity interest in GIPIA (the “Preferred Interest”). The Preferred Interest has a cumulative accruing distribution preference of 8% per year, compounded monthly (the “Preferred Return”), a portion of which in the amount of 6.5% per annum (compounded monthly) is deemed to be the “Current Preferred Return”, and the remainder of which in the amount of 1.5% per annum (compounded monthly) is

deemed to be the “Accrued Preferred Return.” The GIPIA Operating Agreement provides that operating distributions by GIPIA will be made first to JCWC to satisfy any accrued but unpaid Current Preferred Return, with the balance being paid to the Operating Partnership. The GIPIA Operating Agreement also provides that distributions from capital transactions will be paid first to JCWC to satisfy any accrued but unpaid Preferred Return (comprised of both the Current Preferred Return and Accrued Preferred Return), and then to the GIP Operating Partnership.

The foregoing descriptions of the Ames Purchase and Sale Agreement, Ames Assignment Agreement, Assignment and Assumption of Ames Lease, and GIPIA Operating Agreement are only summaries and are qualified in their entirety by reference to the complete text of such documents, each of which is attached as exhibits to this Current Report on Form 8-K and incorporated by reference herein. The above description of the Ames lease is summary in nature and qualified in its entirety by reference to the complete text of the Ames Lease, a copy of which will be filed with (or before) the Company’s next Quarterly Report on Form 10-Q.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Loan Agreement and Note with Valley National Bank

On August 23, 2024, the Iowa SPE entered into a Loan Agreement with Valley (the “Valley Loan Agreement”) pursuant to which Valley made a loan to the Iowa SPE in the amount of $2.495 million (the “Valley Loan”) to finance the acquisition of the Ames Property. Pursuant to the Valley Loan Agreement, the Iowa SPE executed and delivered to Valley a Promissory Note, dated August 23, 2024, in the original principal amount of $2.495 million (the “Note”).

The outstanding principal amount of the Valley Loan bears interest at an annual rate for each 30-day interest period equal to the compounded average of the secured overnight financing rate published by Federal Reserve Bank of New York for the thirty-day period prior to the last day of each 30-day interest rate for the applicable interest rate period plus 2.50%, with interest payable monthly after each 30-day interest period. However, Iowa SPE has entered into an interest rate swap to fix the interest rate at 6.29% per annum. Payments of interest only are due and payable monthly for the first twelve months and then payments of interest and principal in the amount of approximately $16,641 are due and payable monthly thereafter, with all remaining principal and accrued but unpaid interest due and payable on a maturity date of August 23, 2029. The Valley Loan is secured by a first mortgage and assignment of rents in the Ames Property and is guaranteed by the Operating Partnership.

The Valley Loan Agreement requires the Iowa SPE to maintain a minimum debt-service coverage ratio 1.50:1 on a trailing twelve-month basis, tested as of December 31, 2024 and annually thereafter. The Valley Loan Agreement provides for customary events of default and other customary affirmative and negative covenants that are applicable to the Iowa SPE and its subsidiaries, including reporting covenants and restrictions on investments, additional indebtedness, liens, sales of properties, certain mergers, and certain management changes.

The foregoing description of the Valley Loan Agreement and Valley Note is summary in nature and is qualified in its entirety by reference to the full text of the Valley Loan Agreement and Valley Note, copies of which are filed as exhibits hereto and are incorporated by reference herein.

Second Note and Loan Modification with Bayport Credit Union

On August 23, 2024, GIPVA 130 Corporate Blvd, LLC ("Corporate SPE") entered into a Second Note and Loan Modification Agreement with Bayport Credit Union (the "Loan Modification Agreement") to amend and extend the loan currently secured by the Companys Norfolk, VA office building at 130 Corporate Blvd. Pursuant to the Loan Modification Agreement the Corporate SPE delivered to Bayport Credit Union a Third Allonge to Promissory Note, dated August 23, 2024, and made part of, the Promissory Note, dated October 23, 2017, in the original principal amount of $5.2 million.

The Loan Modification Agreement extends the current debt maturity date to August 23, 2029 and bears an interest rate of 6.15% per annum. Payments of interest and principal in the amount of approximately $32,268.70 are

due and payable monthly thereafter beginning on September 23, 2024, with all remaining principal and accrued but unpaid interest due and payable on the maturity date of August 23, 2029.

The foregoing description of the Loan Modification Agreement and Third Allonge to Promissory Note is summary in nature and is qualified in its entirety by reference to the full text of the Loan Modification Agreement and Third Allonge to Promissory Note, copies of which are filed as exhibits hereto and are incorporated by reference herein.

Item 3.02. Unregistered Sales of Equity Securities.

The issuance of the Preferred Interests by the Iowa SPE to JCWC was made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The offer and sale of the Preferred Interests did not and does not involve a “public offering” as defined in Section 4(a)(2) of the Securities Act, was made without any form of general solicitation to a sophisticated party, and was made with full access to any information requested regarding the Iowa SPE.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Second Amended and Restated Employment Agreement with David Sobelman

On August 26, 2024, the Company entered into a Second Amended and Restated Employment Agreement (the “Amended Employment Agreement”) with David Sobelman, the Company’s President and Chief Executive Officer. The Amended Employment Agreement, which was approved by the Company’s Board of Directors on August 26, 2024 (the “Board”), amends and restates in its entirety the First Amended and Restated Employment Agreement, dated June 23, 2022, previously entered into between the Company and Mr. Sobelman.

The Amended Employment Agreement provides that Mr. Sobelman will continue to receive a base salary of $200,000 per year, provided that the annual base salary will increase to (i) $300,000 upon the Company and its subsidiaries achieving $115 million or greater in gross asset value of real estate assets owned, (ii) $400,000 upon the Company and its subsidiaries achieving $150 million or greater in gross asset value of real estate assets owned, and (iii) $600,000 upon the Company and its subsidiaries achieving $500 million or greater in gross asset value of real estate assets owned. The base salary may be increased, but not decreased, in the discretion of the Board. The Amended Employment Agreement further provides that Mr. Sobelman will receive an annual nondiscretionary bonus on the first trading day of each December during the term of employment in the amount of 35% of his base salary then in effect. In addition, Mr. Sobelman will be entitled to receive, upon approval of the board, a discretionary annual performance-based bonus with a bonus target amount of 200% (and a bonus opportunity of up to 300%) of his then- current salary based on the Company materially meeting the Board-approved budget for the immediately preceding fiscal year.

In addition to the base salary and the foregoing bonuses, the Amended Employment Agreement provides that Mr. Sobelman will be paid $7,500 a year to be used solely to cover the actual cost to Mr. Sobelman of obtaining a death and disability insurance policy on his life for and for related costs and expenses. He will also be entitled to a guarantee fee for Company obligations that are personally guaranteed by Mr. Sobelman (but only if the personal guaranty is approved by the Board), with the amount of the guarantee fee being 1% of the guaranteed amount for a full guarantee and 0.5% for a non-recourse or fraud exception guarantee (with the guarantee fee increased to 10% on the 60th day following a termination without “cause” or termination for “good reason”, as those terms are defined in the agreement, unless the guarantee is removed during such 60-day period). Mr. Sobelman is also eligible to receive such medical, health, vacation, and other benefits as are provided by the Company and its subsidiaries generally, and Mr. Sobelman will be eligible to participate in any 401(k) plan that the Company or its related entities may adopt in the future.

The Amended Employment Agreement provides that, on the first trading date of December of each year during the term of Mr. Sobelman’s employment, Mr. Sobelman will receive an annual grant of fully vested stock

under the Generation Income Properties, Inc. 2020 Omnibus Incentive Plan for a number of shares equal to Executive’s base salary as then in effect divided by the higher of the closing price of the Company’s common stock on the grant date or $10.00 per share.

Under the Amended Employment Agreement, Mr. Sobelman is subject to non-solicitation and non-competition covenants that expire one year following termination of employment and to customary confidentiality obligations.

The term of Mr. Sobelman’s employment under the Amended Employment Agreement will continue until terminated by either the Company or Mr. Sobelman at any time, whether or not for cause, upon 60-days notice to the other party or until Mr. Sobelman’s death or disability. The Amended Employment Agreement may also be terminated by the Company for “cause” (as defined in the agreement) or by Mr. Sobelman for “good reason” (as defined in the agreement). “Good reason” includes certain changes in Mr. Sobelman’s responsibilities or duties without his consent, reductions in compensation or a material reduction in benefits, a material breach by the Company of the Amended Employment Agreement that remains uncured following notice of the breach, or a material relocation of his principal place of employment without his consent.

In the event that the Company terminates Mr. Sobelman’s employment without cause or Mr. Sobelman resigns for good reason, the Amended Employment Agreement provides that Mr. Sobelman will be entitled to receive severance compensation equal to two times (or three times if the termination occurs within 12 months of a “change in control”, as defined in the agreement) the sum of his then-current base salary plus his average bonus for the preceding three years. For this purpose, Mr. Sobelman’s then-current base salary shall be deemed to be equal to what his base salary would have then been if the properties included in the Company’s acquisition pipeline (as approved from time to time by the chair of the Board Compensation Committee) had been acquired prior to employment termination. In addition, in such event, Mr. Sobelman will be entitled to additional separation compensation in an amount equal to the premium payments for continuing healthcare coverage for Mr. Sobelman and his family for a period of 18 months. The foregoing severance compensation, if due, will be paid in 18 equal monthly installments. In addition, upon a termination without cause or for good reason, any unvested equity awards (if any) held by Mr. Sobelman will immediately vest.

The foregoing does not purport to be a complete description of the Amended Employment Agreement and is qualified in its entirety by reference to the full text of such Agreement, which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

The Company issued a press release on August 29, 2024, announcing the completion of the acquisition of the Ames Property. A copy of such press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended or the Exchange Act except as set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

|

|

(a) |

Financial Statements of Businesses Acquired. |

The Company intends to file the financial statements required by Item 9.01(a), in accordance with Rule 3-14 of Regulation S-X, by amendment to this Current Report on Form 8-K no later than 71 calendar days following the date that this Current Report on Form 8-K is required to be filed.

|

|

|

|

(b) |

Pro Forma Financial Information. |

To the extent required by this item, pro forma financial information relating to the acquisition described in Item 2.02 of this Current Report on Form 8-K will be filed in an amendment to this current report on Form 8-K not later than 71 days after the date on which this initial Current Report on Form 8-K is required to be filed.

(d) Exhibits.

|

|

|

Exhibit No. |

|

Description |

|

|

|

10.1 |

|

Second Amended and Restated Employment Agreement, dated August 26, 2024, between Generation Income Properties, Inc. and David Sobelman. |

10.2 |

|

Ames Purchase and Sale Agreement dated June 13, 2024. |

10.3 |

|

Ames Assignment Agreement dated August 23, 2024 |

10.4 |

|

Assignment and Assumption of Ames Lease |

10.5 |

|

Loan Agreement dated August 23, 2024, between GIPIA 1220 S Duff Avenue, LLC and Valley National Bank |

10.6 |

|

Promissory Note dated August 23, 2024, between GIPIA 1220 S Duff Avenue, LLC and Valley National Bank |

10.7 |

|

Amended and Restated Limited Liability Company Agreement for GIPIA S Duff Avenue, LLC dated August 23, 2024. |

10.8 |

|

Third Allonge to Promissory Note for GIPVA 130 Corporate Blvd, LLC dated August 23, 2024 |

10.9 |

|

Second Note and Loan Modification Agreement for GIPVA 130 Corporate Blvd, LLC dated August 23, 2024 |

99.1 |

|

Press Release, dated August 29, 2024 |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainty. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Such statements are based on management’s current expectations and are subject to a number of risks and uncertainties, many of which are beyond management’s control, that could cause actual results to differ materially from those described in the forward-looking statements, as well as risks relating to general economic conditions, market conditions, interest rates, and other factors. Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various factors. Please refer to the risks detailed from time to time in the reports we file with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC, as well as other filings on Form 10-Q and periodic filings on Form 8-K, for additional factors that could cause actual results to differ materially from those stated or implied by such forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GENERATION INCOME PROPERTIES, INC. |

|

|

|

Date: August 29, 2024 |

|

By: |

|

/s/ David Sobelman |

|

|

|

|

David Sobelman |

|

|

|

|

Chief Executive Officer |

SECOND AMENDED AND RESTATED EMPLOYMENT AGREEMENT

THIS SECOND AMENDED AND RESTATED EMPLOYMENT AGREEMENT (the “Agreement”) is made and entered into as August 26, 2024 by and between GENERATION INCOME PROPERTIES, INC., a Maryland corporation (the “REIT”), and DAVID SOBELMAN, an individual residing in the State of Florida (“Executive”). This Agreement amends and restates in its entirety that certain First Amended and Restated Employment Agreement, dated June 23, 2022, previously entered into between the REIT and Executive (the “Prior Employment Agreement”).

RECITALS

WHEREAS, Executive is currently employed as President and Chief Executive Officer of the REIT upon the terms and conditions set forth in the Prior Employment Agreement; and

WHEREAS, the REIT seeks to continue to employ Executive as the President and Chief Executive Officer of the REIT and to amend and restate the Prior Employment Agreement upon the terms and conditions set forth herein.

NOW THEREFORE, in consideration of Executive’s continued employment with the REIT and the mutual covenants and promises set forth in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound, agree as follows:

1.RECITALS. All of the foregoing recitals are true and correct and incorporated herein by this reference.

(i)Work for REIT. Executive shall be employed by REIT as its President and Chief Executive Officer, reporting to the Board of Directors of REIT (the “Board”), and he shall have such job duties as are assigned to Executive by the Board from time to time that are generally consistent with the title of President and Chief Executive Officer. As President and Chief Executive Officer, Executive serves as REIT’s “principal executive officer” for purposes of the rules and regulations of the Securities and Exchange Commission. The Executive’s employment by REIT shall be full-time, and the Executive agrees to diligently and conscientiously devote substantially all of his business time and attention to the performance of the Executive’s duties hereunder and will not engage in any other business, profession, occupation, or activity for compensation or otherwise which would conflict or interfere with the performance of such services either directly or indirectly without the prior written consent of the Board.

(ii)Location of Employment Services. Executive’s regular place of employment will be the REIT’s principal executive office in Tampa, Florida, subject to such travel as will be required in furtherance of the performance of Executive’s duties hereunder.

(iii)Subsidiaries and Affiliates. With respect to REIT’s direct and indirect subsidiaries, affiliated corporations, partnerships, or joint ventures, including serving as the President and Chief Executive Officer of REIT’s operating partnership, Generation Income Properties, L.P., (collectively, “Related Entities”), Executive shall perform the above-described duties to promote these Related Entities and to promote and protect their respective interests to the same extent as the interests of the REIT without additional compensation. Compensation for all services performed by Executive as described herein will be paid Generation Income Properties, L.P. For purposes hereof, the term “REIT Group” refers to REIT and the Related Entities collectively.

(i)Base Salary. Executive shall be initially paid a base salary of $200,000.00 per year (the “Base Salary”). The Base Salary will be (i) pro-rated for any period less than twelve (12) months; (ii) paid in accordance with the REIT Group’s customary payroll procedures and (iii) subject to applicable taxes and

withholdings. The Base Salary may be increased by the Board, but not decreased, unless otherwise agreed to in writing by Executive.

(ii)Automatic Increases to Base Salary. The Base Salary shall be automatically increased as follows:

(A)In the event that the publicly reported gross asset value of the real estate assets of the REIT Group (“GAV”) first reaches a total value of $115,000,000.00 or greater as of the last day of any fiscal quarter, Executive’s Base Salary shall automatically increase to $300,000.00 effective as of the first day of the immediately subsequent fiscal quarter.

(B)In the event that the publicly reported GAV of the REIT Group first reaches a total value of $150,000,000.00 or greater as of the last day of any fiscal quarter, Executive’s Base Salary shall automatically increase to $400,000.00 effective as of the first day of the immediately subsequent fiscal quarter.

(C)In the event that the publicly reported GAV of the REIT Group first reaches a total value of $500,000,000.00 or greater as of the last day of any fiscal quarter, Executive’s Base Salary shall automatically increase to $600,000.00 effective as of the first day of the immediately subsequent fiscal quarter.

(iii)Benefits. Executive is eligible to receive such medical, health, vacation, and other benefits as are provided by the REIT Group, in its discretion, from time to time to its employees generally, provided that REIT Group will pay 100% of the premium cost of such benefits. Executive will also be eligible to participate in any 401(k) plan that the REIT or its Related Entities may adopt in the future. The REIT Group shall reimburse Executive for all reasonable costs and out-of-pocket expenses incurred by Executive in connection with the performance of Executive’s duties under this Agreement, subject to and in accordance with REIT Group’s standard policies (including expense verification policies) regarding the reimbursement of business expenses incurred by employees of REIT Group on its behalf, as the same may be modified from time to time. Nothing in this Agreement will preclude REIT Group from amending or terminating any of the employee benefit plans or programs applicable to employees of the REIT Group as long as such amendment or termination is applicable to all similarly-situated employees.

(iv)Equity Compensation. On the first trading day of December of each year, beginning on the first trading day of December 2024, Executive shall receive an annual grant of fully vested stock under the Generation Income Properties, Inc. 2020 Omnibus Incentive Plan, for a number of shares equal to Executive’s Base Salary then in effect divided by the higher of (A) the closing price of the REIT’s common stock on the date of grant or (B) $10.00 per share (subject to adjustment for stock splits, stock dividends, reverse stock splits or the like occurring after the date of this Agreement).

(v)Annual Bonuses. Executive shall receive, on or before the first trading day of December of each year, an annual nondiscretionary bonus equal to thirty-five percent (35%) of Executive’s Base Salary then in effect. In addition, on or before January 30th of each year, Executive shall be entitled to receive, upon the approval of the Board, a discretionary annual performance-based bonus with a bonus target amount of a minimum of 200% (the “Performance Bonus Target”), and up to 300%, of his then current Base Salary so long as the Board determines the REIT materially met the Board-approved budget for the immediately preceding full fiscal year.

(vi)Death and Disability Policy. In addition to the foregoing compensation, the REIT Group shall pay Executive an amount equal to $7,500 per calendar year to be used solely to cover the actual cost to Executive of obtaining a death and disability insurance policy on Executive’s life and for related costs and expenses.

(vii)Withholding. The REIT Group shall be entitled to deduct or withhold from any amounts owing from the REIT Group to Executive any federal, state, local or foreign withholding taxes, excise taxes or employment taxes imposed with respect to Executive’s compensation or other payments from the REIT Group, including wages, bonuses, distributions and/or the receipt or vesting of incentive equity.

(viii)Clawback Provisions. Notwithstanding any other provisions in this Agreement to the contrary, any bonus (if any) paid to the Executive will be subject to such potential clawback as may be required to be made pursuant to applicable federal or state law or applicable stock exchange listing requirements governing potential clawback of Executive compensation upon a determination by legal counsel to REIT that clawback is required by federal or state law or applicable stock exchange listing requirements

(c)Term of Employment. Subject to the terms and conditions of this Agreement, the term of Executive’s employment by REIT shall commence on the date of this Agreement and shall continue until terminated in accordance with Section 2 herein. The parties acknowledge, subject to the provisions of Section 3 of this Agreement, that Executive’s employment with the REIT Group is on an at-will basis, and either REIT Group or Executive may therefore terminate the Executive’s employment, with or without cause, at any time and for any reason upon the terms and conditions specified in Section 3 below.

(d)Guarantee and Guarantee Fee. For any guarantee for which Executive is personally the guarantor, then upon separation of employment, Executive shall immediately be removed from such guarantee or, if that cannot be effectuated, then the REIT will use commercially reasonable efforts to retire or refinance the debt within thirty (30) days of Executive’s separation. So long as Executive remains on the guarantee, Executive shall receive an annual guarantee fee of one percent (1%) of the amount of the guaranteed indebtedness for a full guarantee and a half percent (0.5%) for any non-recourse/fraud exception guarantee (“Guarantee Fee”). Only in the event of a termination of Executive’s employment by the REIT without Cause pursuant to Section 3(a)(iv) below or by the Executive pursuant to a Good Reason Resignation (as defined below), if the REIT is unable to retire or refinance the debt within sixty (60) days of Executive’s separation, the annual guarantee fee for any debt subject to guarantee by Executive shall increase to ten percent (10%) of the guaranteed indebtedness from and after such 60-day period. The Guarantee Fee will be paid in arrears and prorated for any portion of any calendar in which Executive makes the guarantee. The Guarantee Fee is to be paid in four (4) equal installments, to be paid by the last payroll period of the first month of each quarter (e.g., January 31, April 30, July 31, October 31) in accordance with the REIT Group’s customary payroll procedures. The Guarantee Fee will be paid only on guarantees by Executive that are approved by the Board. In the event of a Change in Control, the entire amount of the Guarantee Fee shall become immediately due and owing and shall be paid by the REIT on or before the date of the Change in Control.

(a)Types of Terminations. This Agreement and Executive’s employment hereunder shall terminate upon the happening of any of the following events:

(i)Executive’s death (“Termination Upon Death”);

(ii)The effective date of a written notice sent to Executive stating REIT’s determination, made in good faith, that due to a mental or physical condition, Executive has been unable and failed to substantially render the services to be provided by Executive to REIT for a period of at least (x) 180 days out of any consecutive 360 days or (y) 90 consecutive days (“Termination For Disability”);

(iii)The effective date of a written notice sent to Executive stating REIT’s determination, made in good faith, that it is terminating Executive’s employment for Cause (as defined below) (“Termination For Cause”);

(iv)The effective date of a termination based on a notice sent to Executive stating that REIT is terminating Executive’s employment not for Cause, which written notice shall be provided to Executive at least sixty (60) days in advance of the effective date of termination, with the REIT reserving the right in its sole discretion to require Executive not to work any portion of the notice period and to not access REIT premises and assets, provided that the REIT will nevertheless continue to pay Executive’s compensation for the entire notice period (“Termination Without Cause”); or

(v)The effective date of a termination based on a notice sent to REIT from Executive stating that the Executive is resigning, which notice must be given by Executive to REIT at least sixty (60) days in advance of the intended date of termination (a “Resignation”), provided that if the Resignation is a Good Reason Resignation, then Executive shall follow the procedures described in Section 3(c)(v) below.

(b)Effect of Termination.

(i)In the event of Termination Upon Death or Termination For Disability:

(A)Executive (or Executive’s legal representative) shall be entitled to receive wages in an amount equal to any earned but unpaid Base Salary owing by REIT to Executive as of the termination date (the “Accrued Salary”); and

(B)Executive shall be entitled to receive an amount equal to any unpaid Performance Bonus Target for any completed fiscal year plus a prorated portion of the Performance Bonus Target for the fiscal year of termination (“Accrued Bonus”).

(ii)Termination For Cause or Resignation. In the event of a Termination For Cause or a Resignation (other than a Good Reason Resignation), Executive shall be entitled to receive only an amount equal to any Accrued Salary.

(iii)In the event of Termination Without Cause or a Good Reason Resignation:

(A)Executive (or Executive’s legal representative) shall be entitled to receive Accrued Salary through the sixty (60) days after Employer gives Executive advance notice of the intended date of termination;

(B)Executive shall be entitled to any Accrued Bonus;

(C)Executive shall pay Separation Compensation to Executive in an amount equal to the “Severance Multiple” times the sum of (A) Executive’s then-current Base Salary, and (B) the average of the Annual Bonuses earned by Executive in accordance with Section 2(b)(v) hereof for the three (3) calendar years preceding the year of termination. In the event of a Termination Without Cause or a Good Reason Resignation during a Change in Control Period, the Executive’s Base Salary shall solely for purposes of this paragraph (C) be deemed to be an amount equal to what Executive’s Base Salary would have been on the date of termination if all Pipeline Properties (as defined below) were acquired by the REIT Group on the last day of the most recently completed fiscal quarter prior to the termination date for a purchase price equal to the Indicated Purchase Price (as defined below). The term “Pipeline Property” means any property that was in the REIT Group’s formal Compensation Committee Chairperson-approved acquisition pipeline (“Acquisition Pipeline”) as of the of termination of Executive’s employment and for which one of the following conditions existed as of such date: (i) the REIT Group had, as of the date of Executive’s termination, entered into a letter of intent, mutual term sheet, purchase agreement with respect to such property executed by the seller of the property, or the property was entered into the Approved Pipeline, and such letter of intent, mutual terms sheet, or purchase agreement did not terminate or expire, nor was such property removed from the Approved Pipeline, prior to Executive’s termination, or (ii) the Compensation Committee of the Board (as in effect immediately prior to the Change in Control) otherwise determines that closing of the acquisition of such property is reasonably likely to occur. The term “Approved Pipeline” shall mean any property provided by Executive to the REIT’s Compensation Committee Chairperson via email by the fifth day of each month for review and approval, and which shall be reviewed by the Compensation Committee Chairperson within three (3) business days thereof. Any disputes relating to the approval of any property as part of the Approved Pipeline must be resolved between Executive and the REIT’s Compensation Committee Chairperson no later than 10 days following Executive’s written notice

via email to the REIT’s Compensation Committee Chairperson as to any proposed property. For the avoidance of doubt, failure on behalf of the REIT’s Compensation Committee Chairperson to respond to such notice within the time period prescribed herein shall serve as approval of such property as part of the Approved Pipeline. The term “Indicated Purchase Price” means, in the case of clause “(i)” of the preceding sentence, the proposed good faith purchase price set forth in the Approved Pipeline, letter of intent, mutual term sheet, or purchase agreement, or, in the case of clause “(ii)” of the preceding sentence, the likely acquisition price as determined by the Company and approved by the Compensation Committee of the Board (as in effect immediately prior to the Change in Control);

(D)REIT shall pay additional Separation Compensation to Executive, in eighteen (18) equal monthly installments (and subject to applicable tax and other withholdings), an amount equal to the premium payments for continuing healthcare coverage for Executive and his family under the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) for an 18-month period following the effective date of termination, if Executive elects and remains entitled to COBRA continuation coverage during that 18-month time period (“Benefit Payments”); and

(E)Notwithstanding anything to the contrary set forth in any REIT equity plan or award agreement, all unvested stock options, restricted stock awards, or other equity awards then held by Executive shall immediately vest as of the date of termination and thereafter be exercisable in accordance with the terms and conditions of such awards.

(c)Additional Provisions.

(i)Subject to the provisions in the following paragraph, any amounts to be paid pursuant to this Section 3 shall be paid in accordance with REIT’s existing payroll or bonus payment practices, as applicable, subject to applicable taxes and withholdings.

(ii)The Separation Compensation (if payable), including the Benefits Payments, will be paid according to REIT’s normal payroll cycle in eighteen (18) equal monthly installments (“Separation Payments”) beginning with the first payroll which occurs at least seven (7) days after REIT’s receipt of a fully executed Release (as defined below) and ending upon the final payment of the Severance Compensation. Separation Payments and Accrued Bonus shall be subject to tax withholdings and other required withholdings. Notwithstanding the foregoing, the Executive’s right to receive any Separation Compensation, Separation Payments or Accrued Bonus pursuant to this Agreement is conditioned upon the Executive signing (and not revoking), by the twenty-first (21st) day after the Executive’s last day of employment, a general release of claims (except those rights arising under this Agreement) in substantially the form provided by attached as “Exhibit A” (the “Release”).

(iii)Notwithstanding any provision of this Agreement to the contrary, the obligations and commitments under Section 5 of this Agreement shall survive and continue in full force and effect in accordance with their terms notwithstanding any termination of Executive’s employment for any reason or termination of this Agreement for any reason.

(iv)Notwithstanding anything in this Agreement to the contrary, REIT shall have no obligation to pay any amounts payable under Section 3(b)(iii)(C) of this Agreement during such times as it is determined by a court of law that Executive is in breach of Section 5 of this Agreement, after REIT provides Executive with notice of such breach.

(v)Executive shall have the right to resign his employment for “Good Reason” if: (A) there is a material adverse change or material diminution in Executive’s duties, responsibilities, functions, reporting lines, or title with REIT, including if Executive ceases to be the principal executive officer of the REIT and/or ceases to report directly to a board of directors comprised of a majority of directors that are “independent” within the rules and regulations of Nasdaq, (B) there is a material reduction in the compensation or benefits payable to Executive hereunder, (C) there is a material breach of the provisions of this Agreement or (D) without Executive’s

consent, Executive’s principal place of employment is relocated to a place outside of a 50 mile radius from the location of the REIT’s offices in Tampa, Florida. Executive cannot terminate his employment for Good Reason unless he has provided written notice to the REIT of the existence of the circumstances providing grounds for termination for Good Reason within fifteen (15) days of the initial existence of such grounds and if curable, REIT has had at least thirty (30) days from the date on which such notice is provided to cure such circumstances (and has failed to cure such circumstances within such period). If not curable, or if REIT has not, within such thirty (30) day period, cured the circumstances providing ground for termination for Good Reason and Executive does not terminate his employment for Good Reason within ten (10) days after the expiration of REIT’s cure period in the preceding sentence, Executive will be deemed to have waived his right to terminate for Good Reason with respect to such grounds. The Executive acknowledges that the Board has flexibility under Section 2(a) to reasonably assign Executive a broad range of responsibilities and duties that are consistent with his duties as President and Chief Executive Officer and to make changes in the Executive’s responsibilities in a manner that is materially consistent with the duties described under Section 2(a), and such assignments and change will not constitute “Good Reason.” A Resignation that is effected in accordance with this paragraph is referred to as a “Good Reason Resignation.”

(vi)Upon termination of Executive’s employment for any reason, Executive shall be deemed to have resigned from all positions held with REIT and its Related Entities, including, without limitation, any position as an officer, agent, trustee, or consultant of REIT or any Related Entity, unless the Board expressly determines otherwise; provided, however, that unless otherwise agreed in writing by Executive, Executive’s termination of employment will not result in Executive’s deemed resignation as a member of the Board. Upon request of REIT, Executive shall promptly sign and deliver to the REIT Group any and all documents reflecting such resignations as of the effective date of termination.

(a)“Cause” shall mean any of the following:

(i)Executive’s conviction of, or plea of guilty or nolo contendere to, a felony (excluding traffic-related felonies), or any financial crime involving the REIT or any subsidiary of the REIT (including, but not limited to, fraud, embezzlement or misappropriation of REIT assets);

(ii)Executive’s willful and gross misconduct in the performance of his duties (other than by reason of his incapacity or disability), it being expressly understood that the REIT’s dissatisfaction with Executive’s performance that is not willful and gross misconduct in the performance of Executive’s duties shall not constitute Cause under this clause (ii);

(iii)Executive’s continuous, willful and material breach of this Agreement after written notice of such breach has been given by the Board in its reasonable discretion exercised in good faith; provided that, in no event shall any action or omission in subsection (ii) or (iii) constitute “Cause” unless (1) the REIT gives notice to Executive (which notice shall be provided no later than ninety (90) days after the Board becomes aware of the event or condition purportedly giving rise to Cause) stating that Executive will be terminated for Cause, specifying the particulars thereof in reasonable detail and the effective date of termination (which date of termination shall be no earlier than the date the Board makes its final determination in accordance with this paragraph) (the “Cause Termination Notice”), (2) the REIT provides Executive and his counsel with an opportunity to appear before the Board to rebut or dispute the alleged reason for termination on a specified date that is at least ten (10) business days following the date on which the Cause Termination Notice is given, and (3) a majority of the Board (calculated without regard to Executive, if applicable) determines that Executive has failed to materially cure or cease such misconduct or breach within twenty (20) business days after the Cause Termination Notice is given to him. For purposes of the foregoing sentence, no act, or failure to act, on Executive’s part shall be considered willful unless done or omitted to be done, by him not in good faith and without reasonable belief that his action or omission was in the best interest of the REIT, and any act or omission by Executive pursuant to the authority given pursuant to a resolution duly adopted by the Board or on the written advice of counsel to the REIT will be deemed made in good faith and in the best interest of the REIT.

(b)“Change in Control” means the occurrence of any of the following after the Effective Date:

(i) the direct or indirect sale, transfer, conveyance or other disposition, in one or a series of related transactions, of all or substantially all of the properties or assets of the REIT and its Subsidiaries, taken as a whole, to any Exchange Act Person; (ii) the following individuals cease for any reason to constitute a majority of the number of directors then serving on the Board: individuals who, as of the Effective Date, constitute the Board and any new director (other than a director whose initial assumption of office is in connection with an actual or threatened election contest, including, but not limited to, a consent solicitation, relating to the election of directors of the REIT) whose appointment or election by the Board or nomination for election by the REIT’s shareholders was approved or recommended by a vote of at least a majority of the directors then still in office who either were directors on the Effective Date or whose appointment, election or nomination for election was previously so approved or recommended; (iii) an Exchange Act Person becomes the “beneficial owner” (as used in Rule 13d-3 under the Exchange Act) of 50% or more of the total voting power of the stock of the REIT; or (iv) the consummation of a reorganization, merger, consolidation, statutory share exchange or similar form of corporate transaction involving the REIT if, immediately after the consummation of such transaction, the shareholders of the REIT immediately prior thereto do not own, directly or indirectly, either outstanding voting securities representing more than fifty percent (50%) of the combined outstanding voting power of the surviving entity in such transaction or more than fifty percent (50%) of the combined outstanding voting power of the parent of the surviving entity in such transaction. Notwithstanding the foregoing, (A) a Change in Control shall not be deemed to have occurred by virtue of any transaction or series of integrated transactions immediately following which the shareholders of the REIT immediately prior to such transaction or series of transactions continue to have substantially the same proportionate ownership in a Person that owns all or substantially all of the voting securities or assets of the REIT immediately following such transaction or series of transactions, and (B) if the severance payable under Section 3 constitutes deferred compensation under Section 409A of the Code, a Change in Control shall be deemed to have occurred for purposes of this Agreement only if a change in the ownership or effective control of the REIT or a change in ownership of a substantial portion of the assets of the REIT shall also be deemed to have occurred under Section 409A of the Code.

(c)“Change in Control Period” means the period beginning on the date of a Change in Control and ending on the twelve (12) month anniversary of the date of the Change in Control.

(d) “Severance Multiple” means (i) two (2.0) pursuant to Section 3(b) if the Severance Amount is payable under Section 3(b) on account of termination that does not occur during the Change in Control Period, and (ii) three (3.0) if the Severance Amount is payable under Section 3(b) on account of a termination that occurs during the Change in Control Period.

5.NON-COMPETITION, NON-SOLICITATION AND CONFIDENTIALITY.

(i)“REIT’s Business” means the REIT Group’s business of purchasing and leasing to tenants triple-net lease business properties.

(ii)“Competitor” means any company, other entity or association or individual that directly or indirectly is engaged in REIT’s Business.

(iii)“Confidential Information” means any confidential information with respect to the REIT or any Related Entity or the REIT’s Business including, but not limited to: the trade secrets of REIT and any Related Entities; manuals and documentation; databases; REIT Group’s existing and prospective clients and customers (including tenants), sales lists, agent lists, vendor lists, plans, specifications, price lists, and other similar and related information in whatever form. The term Confidential Information does not include, and there shall be no obligation hereunder with respect to, information that (i) is generally available to the public on the date of this Agreement, (ii) becomes generally available to the public other than as a result of a disclosure by Executive not otherwise permissible hereunder or (iii) Executive has learned or learns from other sources where, to Executive’s knowledge, such sources have not violated their confidentiality obligation to REIT or any other applicable obligation of confidentiality.

(b)Non-competition. Executive covenants and agrees that during the period of his

employment with REIT and ending twelve (12) months following termination of his employment with the REIT, regardless of the reason (the “Restricted Period”), Executive will not, directly or indirectly, own, manage, engage, participate on behalf of himself or any other person or entity, operate, control, become employed by, or render any service to (whether as owner, beneficial owner, partner, associate, agent, independent contractor, consultant, lender, employee, stockholder, officer or in any other capacity) any Competitor anywhere in the United States of America in any state where the REIT owns property (or has a property under contract) as of the day of Executive’s separation.

(c)Non-solicitation of Executives. Executive covenants and agrees that during the period of his employment with the REIT and ending twelve (12) months following termination of his employment with the REIT, regardless of the reason for termination, Executive will not, directly or indirectly, employ or solicit, receive or accept the performance of services by any then current officer, manager, employee or independent contractor of REIT or any subsidiary or affiliate of REIT, or in any way interfere with the relationship between REIT or any subsidiary or affiliate of REIT, on the one hand, and any such officer, manager, employee or independent contractor, on the other hand.

(d)Representations and Covenants by Executive. Executive represents and warrants that: (i) Executive’s execution, delivery and performance of this Agreement do not and will not conflict with, breach, violate or cause a default under any contract, agreement, instrument, order, judgment or decree to which Executive is a party or by which Executive is bound; (ii) Executive is not a party to or bound by any employment agreement, noncompete agreement or confidentiality agreement with any other person or entity (other than REIT) and Executive is not subject to any other agreement that would prevent or in any manner restrict Executive from performing Executive’s duties for REIT or otherwise complying with this Agreement; (iii) Executive is not subject to or in breach of any nondisclosure agreement, including any agreement concerning trade secrets or confidential information owned by any other party; and (iv) upon the execution and delivery of this Agreement by REIT, this Agreement shall be the valid and binding obligation of Executive, enforceable in accordance with its terms.

(e)Non-disclosure of Confidential Information. Executive hereby acknowledges and represents that Executive has consulted with independent legal counsel regarding Executive’s rights and obligations under this Agreement and that Executive fully understands the terms and conditions contained herein and Executive agrees that Executive will not, directly or indirectly: (i) use, disclose, reverse engineer or otherwise exploit for Executive’s own benefit or for the benefit of anyone other than REIT the Confidential Information except as authorized by REIT; (ii) during Executive’s employment with REIT, use, disclose, or reverse engineer (x) any confidential information or trade secrets of any former employer or third party, or (y) any works of authorship developed in whole or in part by Executive during any former employment or for any other party, unless authorized in writing by the former employer or third party; or (iii) upon Executive’s resignation or termination (x) retain Confidential Information, including any copies existing in any form (including electronic form), that are in Executive’s possession or control, or (y) destroy, delete or alter the Confidential Information without REIT’s consent. Notwithstanding the foregoing, Executive may use the Confidential Information in the course of performing Executive’s duties on behalf of REIT or any subsidiary or affiliate of REIT as described hereunder, provided that such use is made in good faith. Further, to the extent required by subpoena or applicable law, Executive is permitted to utilize such information in connection with any governmental request, subpoena, investigation or audit. REIT simply requests advance notice of seven (7) business days prior to any such disclosure so that REIT can assert objections (if necessary) or otherwise participate. Upon separation of employment or suspension (for any reason), Executive will immediately surrender possession of all Confidential Information to REIT. Nothing in this Agreement is intended to discourage or restrict Executive from reporting any theft of trade secrets pursuant to the Defend Trade Secrets Act of 2016 (the “DTSA”) or other applicable state or federal law. The DTSA prohibits retaliation against an employee because of whistleblower activity in connection with the disclosure of trade secrets, so long as any such disclosure is made either (i) in confidence to an attorney or a federal, state, or local government official and solely to report or investigate a suspected violation of the law, or (ii) under seal in a complaint or other document filed in a lawsuit or other proceeding.

(f)Inventions and Patents. Executive acknowledges that all (i) inventions, innovations, improvements, developments, methods, designs, analysis, drawings, reports, processes, novel concepts, ideas, copyrights, trademarks and service marks relating to any present or prospective activities of REIT, including but not limited to structures, processes, software, formula, techniques and improvements to the foregoing or to know how, and all similar or related information (whether or not patentable) that relate to the REIT Business, (ii) research and

development and (iii) existing or future products or services that are, to any extent, conceived, developed or made by Executive while employed by REIT or any subsidiary or affiliate of REIT (“Work Product”) belong to REIT or such subsidiary or affiliate. Executive shall promptly disclose such Work Product to REIT and, at the cost and expense of REIT, perform all actions reasonably necessary or requested by REIT (whether during or after the Term) to establish and confirm such ownership (including, without limitation, executing assignments, consents, powers of attorney and other instruments).

(i)Executive acknowledges that (x) Executive’s position is a position of trust and responsibility with access to Confidential Information of REIT, (y) the Confidential Information, and the relationship between REIT and each of its employees, customers, tenants, and vendors, are valuable assets of REIT and may not be converted to Executive’s own use and (z) the restrictions contained in this Section 5 are reasonable and necessary to protect the legitimate business interests of REIT and will not impair or infringe upon Executive’s right to work or earn a living after Executive’s employment with REIT ends.

(ii)Each of the foregoing obligations shall be enforceable independent of any other obligation, and the existence of any claim or cause of action that Executive may have against REIT, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by REIT of these obligations.

(iii)Executive acknowledges that monetary damages will not be an adequate remedy for REIT in the event of a breach of this Agreement and that it would be impossible for REIT to measure damages in the event of such a breach. Therefore, Executive agrees that, in addition to other rights that REIT may have at law or equity, REIT is entitled to seek an injunction preventing Executive from any breach of this Agreement.

(iv)In the event of a breach or violation of any restriction in Sections 5(b) or 5(c) of this Agreement, the prior of time such any such restriction remains in effect shall be tolled until such breach or violation has been cured.

(v)The parties agree that the foregoing restrictive covenants are reasonable and necessary to protect REIT’s legitimate business interests. The parties, however, do not intend to include a provision that contravenes the public policy of any state. Therefore, if any provision of this Section 5 is unlawful, against public policy or otherwise declared void, such provision shall not be deemed part of this Agreement, which otherwise shall remain in full force and effect. If, at the time of enforcement of this Agreement, a court or other tribunal holds that the duration, scope or area restriction stated herein is unreasonable under the circumstances then existing, the parties agree that the court should enforce the restrictions to the extent it deems reasonable.

(vi)Executive hereby agrees that prior to accepting employment with any other person or entity during the term of employment or during the Restricted Period following the termination date, Executive will provide such prospective employer with written notice of the existence of this Agreement and the provisions of this Section 5 of this Agreement, with a copy of such notice delivered simultaneously to REIT in accordance with Section 8 of this Agreement.

(vii)Notwithstanding any provision of this Agreement, the obligations and commitments of this Section 5 shall survive and continue in full force and effect in accordance with their terms notwithstanding any termination of Executive’s employment for any reason or termination of this Agreement for any reason.

(a)Executive agrees and acknowledges that a breach on the part of Executive of the covenants contained in Section 5 will cause irreparable harm to REIT and that damages arising out of such breach may be difficult to determine. Executive, therefore, further agrees that in addition to all other remedies provided at law or at equity, REIT shall be entitled as a matter of course to specific performance and temporary and permanent injunctive relief, from any court of competent jurisdiction restraining any further breach of any such covenant by Executive, his

employers, employees, partners, agents or other associates, or any of them, without the necessity of proving actual damage to REIT by reason of any such breach. If the REIT is the prevailing party in any suit under this Agreement, Executive will reimburse REIT for its expenses incurred in connection with such a suit, including attorneys’ fees and costs incurred at any level (including all appeals). In addition, the period of the restriction specified in Section 5 above shall cease to run during the continuance of any violation of Section 5 and any portion of the period remaining at the commencement of any such violation will begin to run again only upon the full cure of the violation.

(b)Executive further agrees and acknowledges that in addition to any injunctive relief and recovery of attorneys’ fees and costs as set forth above and because the exact amount of damage suffered by REIT in the event of a violation by Executive of any of the restrictions set forth in Section 5 may be difficult to calculate, and as such Executive shall be liable to REIT for any monetary damages suffered. The existence of any claim or cause of action of Executive against REIT of whatever nature shall not constitute a defense to the enforcement by REIT of the covenants set forth in Section 5 of this Agreement.

7.ASSIGNMENT. REIT may assign this Agreement and any of the rights or obligations hereunder to any third party in connection with the sale, merger, consolidation, reorganization, liquidation or transfer, in whole or in part, of REIT’s control and/or ownership of its assets or business. In such event, Executive continues to be bound by the terms of this Agreement. An assignment of this Agreement by Executive or any right or obligation hereunder is strictly prohibited.

8.NOTICES. All notices, requests, consents and other communications required or permitted to be given hereunder, shall be in writing and shall be delivered personally or sent by overnight courier or mailed, first class, postage prepaid by registered or certified mail, as follows:

If to REIT: c/o Generation Income Properties, Inc.

401 East Jackson Street, Suite 3300

Tampa, Florida 33602

If to Executive: To Executive’s address as reflected on the payroll records of REIT or such other address as either party shall designate by notice in writing to the other in accordance herewith. Any such notice shall be deemed given when so delivered personally, by e-mail, by facsimile transmission, or if sent by overnight courier, one day after delivery to such courier by the sender or if mailed, five days after deposit by the sender in the U.S. mails.

9.GOVERNING LAW. This Agreement shall be subject to and governed by the laws of the State of Florida, without giving effect to the principles of conflicts of law under Florida law that would require or permit the application of the laws of a jurisdiction other than the State of Florida and irrespective of the fact that the parties now or at any time may be residents of or engage in activities in a different state.

(a)Arbitration. REIT and Executive agree that any dispute, controversy or claim arising out of or related in any way to Executive’s employment relationship with REIT, the termination of that relationship, this Agreement, and/or any breach of this Agreement, shall be submitted to and decided by binding arbitration in Hillsborough County in the State of Florida. By continuing employment with REIT, Executive accepts and consents to be bound by this agreement to arbitrate (the “Arbitration Provision”). This Arbitration Provision covers all grievances, disputes, claims or causes of action that otherwise could be brought in a federal, state or local court under applicable federal, state or local laws, arising out of or relating to Executive’s employment with REIT and the termination thereof, including claims Executive may have against REIT or against its officers, directors, supervisors, managers, employees or agents in their capacity as such or otherwise. The claims covered by this Arbitration Provision include, but are not limited to, claims for breach of any contract or covenant (express or implied); tort claims; claims for wages or other compensation due; claims for wrongful termination (constructive or actual); claims for discrimination or harassment (including, but not limited to, harassment or discrimination based on race, age, color, sex, gender, national origin, alienage or citizenship status, creed, religion, marital status, partnership status, military status, predisposing genetic characteristics, medical condition, psychological condition, mental condition,

criminal accusations and convictions, disability, sexual orientation, or any other trait or characteristic protected by federal, state or local law); claims for violation of any federal, state, local or other governmental law, statute, regulation or ordinance; and claims or disputes concerning the validity, enforceability, arbitrability or scope of this Arbitration Provision. Claims not covered by this Arbitration Provision are claims for workers’ compensation or unemployment compensation benefits; at REIT’s sole option, claims by REIT for injunctive or other equitable relief for the breach or threatened breach of the covenants above; and any other claims that, as a matter of law, REIT and Executive cannot agree to arbitrate. Nothing herein shall impair Executive’s right to report possible violations of law to any government agency or cooperate with any agency’s investigation. REIT shall pay all costs associated with any arbitration, including the filing fee, hearing costs, and any other arbitration costs, but excluding the cost and expense of legal counsel to Executive.

(b)REIT and Executive expressly intend and agree that: (a) class, collective and/or representative action procedures shall not be asserted, nor will they apply, in any arbitration pursuant to this Arbitration Provision; (b) Executive will not assert class, collective and/or representative action claims against REIT or its officers, directors, supervisors, managers, employees or agents in arbitration or otherwise; and (c) Executive shall only submit his own, individual claims in arbitration and will not seek to represent the interests of any other person. Further, REIT and Executive expressly intend and agree that any claims by Executive will not be joined, consolidated or heard together with claims of any other employee.

(c)The Arbitrator shall apply the substantive law of the State of Florida or federal law (and the law of remedies, if applicable) as applicable to the claims asserted and shall apply the same rules of evidence as a federal court. Arbitration shall be administered in accordance with the AAA Employment Arbitration Rules in effect at the time the arbitration is commenced. To the extent not provided for in the AAA Employment Arbitration Rules, the Arbitrator has the power to order discovery upon a showing that discovery is necessary for a party to have a fair opportunity to present a claim or defense, and the Arbitrator shall decide all discovery disputes. Executive’s agreements to arbitrate and participate only in his individual capacity are contracts under the Federal Arbitration Act and any other laws validating such agreements. No failure to strictly enforce these agreements will constitute a waiver or create any future waivers. If any part of this Arbitration Provision is adjudged to be void or otherwise unenforceable, in whole or in part, the void or unenforceable portion shall be severed and such adjudication shall not affect the validity of the remainder of this Arbitration Provision and/or this Agreement. Any arbitral award determination shall be final and binding upon the parties. Judgment on the award rendered by the arbitrator may be entered in any court having jurisdiction thereof.

(d)Injunctive Relief. Nothing in the Arbitration Provision and/or this Agreement shall prevent REIT from applying to and obtaining from a court of competent jurisdiction a writ of attachment, a temporary restraining order, a permanent restraining order, a temporary injunction, a permanent injunction, or other injunctive relief available to safeguard and protect REIT’s interests, including but not limited to REIT’s interests in the restrictive covenants contained herein. Any action, suit or other proceeding initiated for these purposes shall be brought in the State of Florida in the Thirteenth Judicial Circuit in and for Hillsborough County, Florida or in the United States District Court for the Middle District of Florida and Executive agrees to submit himself to the exclusive personal jurisdiction and venue of those courts for such purposes.

(e)WAIVER OF JURY TRIAL. COMPANY AND EMPLOYEE UNDERSTAND AND AGREE THAT THEY ARE WAIVING ANY RIGHT TO JURY TRIAL WITH RESPECT TO ANY DISPUTE, CONTROVERSY OR CLAIM ARISING OUT OF OR RELATED IN ANY WAY TO EMPLOYEE’S EMPLOYMENT RELATIONSHIP WITH THE COMPANY, THE TERMINATION OF THAT RELATIONSHIP, THIS AGREEMENT, AND/OR ANY BREACH OF THIS AGREEMENT. COMPANY AND EMPLOYEE EXPRESSLY ACKNOWLEDGE AND AGREE THAT THEY ARE WAIVING ANY RIGHT THEY MAY HAVE TO A JURY TRIAL BY SIGNING THIS AGREEMENT.

11.INVALIDITY. Any provision herein which in any way contravenes the applicable laws of any country, state or jurisdiction shall be severed from this Agreement and deemed not to be considered part of this Agreement and this Agreement shall not be invalid as a whole because of any such determination.

12.INDULGENCE. No indulgence extended by either party hereto to the other party shall be construed

as a waiver of any breach on the part of such other party, nor shall any waiver of one breach be construed as a waiver of any rights or remedies with respect to any subsequent breach.

13.ENTIRE AGREEMENT AND CHANGES TO BE IN WRITING. Except as otherwise indicated herein, this Agreement shall constitute the entire agreement between Executive and REIT concerning the subject matter hereof. This Agreement supersedes and preempts any prior employment agreement or other understandings, agreements or representations by or among the parties, written or oral, that may have related to the subject matter hereof. No provisions of this Agreement may be modified, waived or discharged unless such waiver, modification or discharge is agreed to in writing, signed by Executive and an authorized officer of REIT.

14.NON-DISPARAGEMENT. Executive agrees to not make any statements, written or oral, while employed by REIT and thereafter, which would be reasonably likely to disparage or damage REIT, its affiliates or subsidiaries or the personal or professional reputation of any present or former employees, officers or members of the managing or directorial boards or committees of REIT or its affiliates or subsidiaries. REIT shall not make official statements disparaging Executive and shall further instruct all officers and directors of the REIT not to make disparaging comments regarding Executive.

15.STRICT COMPLIANCE. Executive’s or REIT’s failure to insist upon strict compliance with any provision of this Agreement or the failure to assert any right Executive or REIT may have hereunder shall not be deemed to be a waiver of such provision or right or any other provision or right of this Agreement. The waiver, whether express or implied, by either party of a violation of any of the provisions of this Agreement shall not operate or be construed as a waiver of any subsequent violation of any such provision.

16.280G. Notwithstanding any other provision of this Agreement, or any other agreement, plan, or arrangement to the contrary, if any portion of any payment or benefit to Executive under this Agreement, or under any other agreement, plan, or arrangement (in the aggregate, “Total Payments”), would constitute an “excess parachute payment” under Section 280G of the Code, and would, but for this Section 16, result in the imposition on Executive of an excise tax (the “Excise Tax”) under Section 4999 of the Internal Revenue Code (the “Code”), then the Total Payments to be made to the Executive shall either be (a) delivered in full, or (b) delivered in a reduced amount that is $1.00 less than the amount that would cause any portion of such Total Payments to be subject to the Excise Tax, whichever of the foregoing results in the receipt by the Executive of the greatest benefit on an after-tax basis (taking into account the Excise Tax, as well as the applicable federal, state, and local income and employment taxes, for which the Executive shall be deemed to pay at the highest marginal rate for the applicable calendar year). To the extent the foregoing reduction applies, then any such payment or benefit shall be reduced or eliminated by applying the following principles, in order: (1) the payment or benefit with the higher ratio of the parachute payment value to present economic value (determined using reasonable actuarial assumptions) shall be reduced or eliminated before a payment or benefit with a lower ratio; (2) the payment or benefit with the later possible payment date shall be reduced or eliminated before a payment or benefit with an earlier payment date; and (3) cash payments shall be reduced prior to non-cash benefits; provided that if the foregoing order of reduction or elimination would violate Section 409A of the Code, then the reduction shall be made pro rata among the payment or benefits (on the basis of the relative present value of the parachute payments). The determination of whether the Excise Tax or the foregoing reduction will apply will be made by independent tax counsel selected and paid by the REIT (which may be regular counsel of the REIT).

17.SURVIVAL. Any provision of this Agreement that is expressly or by implication intended to survive the termination of this Agreement shall survive or remain in effect after the termination of this Agreement.

18.COUNTERPARTS. This Agreement may be executed in separate counterparts, either one of which need not contain the signature of more than one party, but both such counterparts taken together shall constitute one and the same agreement. Counterparts may be delivered via facsimile, electronic mail (including .pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

19.UNDERSTANDING OF EMPLOYEE. Executive agrees and acknowledges that Executive has read

this Agreement in its entirety, that Executive understands it and that Executive has entered into it voluntarily.