false

0000749660

0000749660

2025-01-27

2025-01-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

January 27, 2025

________________________

iCAD, INC.

(Exact Name of Registrant as Specified in Its

Charter)

________________________

Delaware

(State or Other Jurisdiction of Incorporation)

| 001-09341 |

|

02-0377419 |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

| 98 Spit Brook Road, Suite 100, Nashua, New Hampshire |

|

03062 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(603) 882-5200

(Registrant’s Telephone Number,

Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.01 par value |

|

ICAD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition |

On January 27, 2025, iCAD, Inc. (the “Company”) issued

a press release announcing certain preliminary, unaudited financial information, for the fourth quarter ended December 31, 2024, and other

corporate updates. A copy of the press release is attached hereto as Exhibit 99.1.

| Item 9.01 |

Financial Statements and exhibit |

Exhibit 99.1 shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities

of that section, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as expressly set forth by specific reference in such filing.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

iCAD, INC.

(Registrant) |

| |

|

|

| |

By: |

/s/ Dana Brown |

| |

|

Dana Brown

Chief Executive Officer and President |

Date: January 27, 2025

iCAD

Pre-Announces Estimated Q4 2024 Revenue

iCAD to Participate in the

BTIG at Snowbird:

12th Annual MedTech,

Digital Health, Life Science & Diagnostic Tools Conference

NASHUA, NH., January 28, 2025 (GLOBE NEWSWIRE)

-- iCAD, Inc. (NASDAQ: ICAD) (“iCAD” or the “Company”), a global leader on a mission to create a world where cancer

can’t hide by providing clinically proven AI-powered breast health solutions, today reported select

preliminary, unaudited financial results for the fourth quarter of 2024. Based on preliminary, unaudited financial information, the Company

expects total revenue for the fourth quarter of 2024 to be between approximately $5.1 and approximately $5.3 million. Total Annual Recurring

Revenue (T-ARR) was approximately $9.8 million, up 11% year-over-year. In the fourth quarter of 2024, the Company closed 106 deals, 19

of which were cloud deals with both new and established customers.

iCAD also announces it will participate in the BTIG at Snowbird: 12th

Annual MedTech, Digital Health, Life Science & Diagnostic Tools Conference from February 11-12, 2025, in Snowbird, Utah. Dana Brown,

Chief Executive Officer, and Eric Lonnqvist, Chief Financial Officer, of iCAD will participate in one-on-one meetings with investors at

the event. To request a meeting with iCAD, investors should contact their BTIG representative.

iCAD’s consolidated financial statements for the twelve months

ended December 31, 2024, are not yet available, and full audited results for the fourth quarter and year ended December 31, 2024 will

be announced in March 2025.

The preliminary estimated financial information included in this press

release for the fourth quarter ended December 31, 2024 is based solely on management’s estimates reflecting currently available

preliminary information, and remains subject to iCAD’s consideration of subsequent events, particularly as it relates to material

estimates and assumptions used in preparing our consolidated financial statements for the twelve months ended December 31, 2024. iCAD’s

final consolidated financial results as of and for the three months ended December 31, 2024 may differ materially from estimates and the

interim balances set forth in this release. Furthermore, the information presented herein does not include all information necessary for

an understanding of the Company’s full fiscal year ended December 31, 2024.

Use of Non-GAAP Financial Measures

In its news releases, conference calls, slide presentations or webcasts,

the Company may use or discuss non-GAAP financial measures as defined by SEC Regulation G. The GAAP financial measures most directly comparable

to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure

and the comparable GAAP financial measure, are included in this press release after the condensed consolidated financial statements. When

analyzing the Company’s operating performance, investors should not consider these non-GAAP measures as a substitute for the comparable

financial measures prepared in accordance with GAAP. The Company’s quarterly news releases containing such non-GAAP reconciliations

can be found on the Investors section of the Company’s website at www.icadmed.com

About iCAD

iCAD, Inc. (NASDAQ: ICAD) is a global leader on a mission to create

a world where cancer can’t hide by providing clinically proven AI-powered solutions that enable medical providers to accurately

and reliably detect cancer earlier and improve patient outcomes. Headquartered in Nashua, N.H., iCAD’s industry-leading ProFound

Breast Health Suite provides AI-powered mammography analysis for breast cancer detection, density assessment and risk

evaluation. The ProFound Breast Health Suite is cleared by the U.S. Food & Drug Administration (FDA) and has received CE mark and

Health Canada licensing. Used by thousands of providers serving millions of patients, ProFound is available in over 50 countries. In the

last five years alone, iCAD estimates reading more than 40 million mammograms worldwide, with nearly 30% being tomosynthesis. For more

information, visit www.icadmed.com.

Forward-Looking

Statements

Certain statements contained in this News Release constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements about the Company’s financial results, expansion of access to the

Company’s products, improvement of performance, acceleration of adoption, expected benefits of ProFound AI®, the benefits of

the Company’s products, and future prospects for the Company’s technology platforms and products. Such forward-looking statements

involve a number of known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements

of the Company to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking

statements. Such factors include, but are not limited, to the Company’s ability to achieve business and strategic objectives, the

willingness of patients to undergo mammography screening in light of risks of potential exposure to illnesses including Covid-19, whether

mammography screening will be treated as an essential procedure, whether ProFound AI will improve reading efficiency, improve specificity

and sensitivity, reduce false positives and otherwise prove to be more beneficial for patients and clinicians, the impact of supply and

manufacturing constraints or difficulties on our ability to fulfill our orders, uncertainty of future sales levels, to defend itself in

litigation matters, protection of patents and other proprietary rights, product market acceptance, possible technological obsolescence

of products, increased competition, government regulation, changes in Medicare or other reimbursement policies, risks relating to our

existing and future debt obligations, competitive factors, the effects of a decline in the economy or markets served by the Company; and

other risks detailed in the Company’s filings with the Securities and Exchange Commission. The words “believe,” “demonstrate,”

“intend,” “expect,” “estimate,” “will,” “continue,” “anticipate,”

“likely,” “seek,” and similar expressions identify forward-looking statements. Readers are cautioned not to place

undue reliance on those forward-looking statements, which speak only as of the date the statement was made. The Company is under no obligation

to provide any updates to any information contained in this release. For additional disclosure regarding these and other risks faced by

iCAD, please see the disclosure contained in our public filings with the Securities and Exchange Commission, available on the Investors

section of our website at http://www.icadmed.com and on the SEC’s website at http://www.sec.gov.

Media Inquiries:

pr@icadmed.com

Investor Inquiries:

ir@icadmed.com

v3.24.4

Cover

|

Jan. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 27, 2025

|

| Entity File Number |

001-09341

|

| Entity Registrant Name |

iCAD, INC.

|

| Entity Central Index Key |

0000749660

|

| Entity Tax Identification Number |

02-0377419

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

98 Spit Brook Road, Suite 100

|

| Entity Address, City or Town |

Nashua

|

| Entity Address, State or Province |

NH

|

| Entity Address, Postal Zip Code |

03062

|

| City Area Code |

(603)

|

| Local Phone Number |

882-5200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

ICAD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

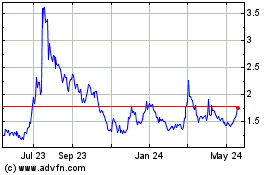

Icad (NASDAQ:ICAD)

Historical Stock Chart

From Feb 2025 to Mar 2025

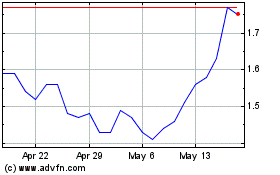

Icad (NASDAQ:ICAD)

Historical Stock Chart

From Mar 2024 to Mar 2025