0001659323false00-000000000016593232025-02-072025-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 07, 2025 |

Iterum Therapeutics plc

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ireland |

001-38503 |

Not applicable |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3 Dublin Landings North Wall Quay |

|

Dublin 1, Ireland |

|

Not applicable |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: +353 1 6694820 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Ordinary Shares, par value $0.01 per share |

|

ITRM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2025, Iterum Therapeutics plc issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1. The information in this current report on Form 8-K, including the press release attached as Exhibit 99.1 hereto, is being furnished, but shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Iterum Therapeutics plc, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

99.1 Press Release of Iterum Therapeutics plc, dated February 7, 2025

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Iterum Therapeutics plc |

|

|

|

|

Date: |

February 7, 2025 |

By: |

/s/ Corey N. Fishman |

|

|

|

Corey N. Fishman

Chief Executive Officer |

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

Iterum Therapeutics Reports Fourth Quarter and Full Year 2024 Financial Results

--ORLYNVAHTM Approved by FDA in Q4 2024—

--Extended Cash Runway--

--Company to host conference call today at 8:30amET--

DUBLIN, Ireland and CHICAGO, February 7, 2025 -- Iterum Therapeutics plc (Nasdaq: ITRM), a company focused on delivering next generation oral and IV antibiotics to treat infections caused by multi-drug resistant pathogens in both community and hospital settings, today reported financial results for the fourth quarter and year ended December 31, 2024.

“While outreach to potential strategic partners is our priority and ongoing, we have begun pre-commercialization work to ensure ORLYNVAHTM is made available to patients as soon as possible to address the substantial unmet need for effective treatment options for uncomplicated urinary tract infections (uUTIs),” said Corey Fishman, Iterum’s Chief Executive Officer. “ORLYNVAHTM will potentially be the first branded uUTI product to enter the U.S. market in over 25 years and the first and only oral penem approved for use in the U.S.”

Highlights and Recent Events

•Approval by U.S. Food and Drug Administration (FDA) of ORLYNVAHTM for uUTIs: In the fourth quarter of 2024, Iterum received approval from the FDA of its new drug application (NDA) for ORLYNVAH™ for the treatment of uUTIs caused by the designated microorganisms Escherichia coli, Klebsiella pneumoniae, or Proteus mirabilis in adult women with limited or no alternative oral antibacterial treatment options.

•Repaid 6.500% Exchangeable Senior Subordinated Notes due 2025 (Exchangeable Notes): In January 2025, Iterum repaid the outstanding principal and interest due under its Exchangeable Notes, in accordance with their terms.

•Expansion of Patent Estate: The Australian Patent Office (IP Australia) has issued Iterum a Notice of Allowance for Australian patent application number 2019281018 entitled “Combinations of Beta-Lactam Compounds and Probenecid and Uses Thereof” that covers the use of a combination of sulopenem etzadroxil and probenecid in treating multiple diseases, including uncomplicated urinary tract infection. This Notice of Allowance concludes the substantive examination of the patent application and will result in the issuance of an Australian patent after

administrative processes are completed. The Australian patent scheduled to issue from this application will expire June 7, 2039, absent any extensions.

Fourth Quarter and Full Year 2024 Financial Results

Cash and cash equivalents were $24.1 million as of December 31, 2024. Based on Iterum’s current operating plan, Iterum expects that its cash and cash equivalents, including $4.8 million of net proceeds raised under its at-the-market offering program from January 1, 2025 through February 6, 2025, will be sufficient to fund its operations into the second half of 2025. The foregoing estimate gives effect to the repayment of the Exchangeable Notes in January 2025 and includes Iterum’s currently planned pre-commercialization activities. As of February 6, 2025, Iterum had approximately 34.6 million ordinary shares outstanding.

Cost of sales expenses for the fourth quarter and full year 2024 were $0.3 million and $0.3 million, respectively, and represents the amortization related to the finite-lived intangible asset recognized in relation to the regulatory milestone payment payable to Pfizer upon approval of ORLYNVAH™ by the FDA.

Research and development (R&D) expenses for the fourth quarter and full year 2024 were $1.3 million and $10.5 million, respectively, compared to $9.7 million and $40.0 million for the same periods in 2023. The decrease for the three- and twelve-month periods was primarily due to a decrease in clinical trial costs associated with the REASSURE trial.

General and administrative (G&A) expenses for the fourth quarter and full year 2024 were $2.1 million and $8.0 million, respectively, compared to $1.7 million and $7.5 million for the same periods in 2023. The increase for the three-month period was primarily due to an increase in legal fees. The increase for the full year was primarily due to an increase in legal fees and an increase in consultants used to support pre-commercial activities.

Adjustments to the fair value of derivatives for the fourth quarter and full year 2024 were $2.0 million and $3.3 million, respectively, compared to $0.3 million and ($11.1 million) for the same periods in 2023. The non-cash adjustment for the fourth quarter 2024 and full year 2024 primarily related to an increase in the fair value of the Limited Recourse Royalty-Linked Subordinated Notes (the Royalty-Linked Notes) upon the FDA’s approval of our NDA for ORLYNVAH™ and due to the passage of time. The non-cash adjustment for the full year 2023 primarily related to a decrease in the fair value of the Royalty-Linked Notes due to a reduction in management’s revenue forecast of U.S. sulopenem sales.

Net loss for the fourth quarter and full year 2024 was $6.6 million and $24.8 million, respectively, compared to a net loss of $12.4 million and $38.4 million for the same periods in 2023. Non-GAAP1 net loss for the fourth quarter and full year 2024 of $3.4 million and $17.9 million, respectively, compared to a non-GAAP1 net loss of $10.7 million and $43.8 million for the same periods in 2023.

1 Definition and reconciliations of applicable GAAP reported to non-GAAP adjusted information are included at the end of this press release

Conference Call Details

•Iterum will host a conference call today, Friday, February 7, 2025 at 8:30 a.m. Eastern Time. The dial-in information for the call is as follows: United States: 1 833 470 1428; International: 1 404 975 4839; Access code: 719739

Non-GAAP Financial Measures

To supplement Iterum’s financial results presented in accordance with U.S. generally accepted accounting principles (“GAAP”), Iterum presents non-GAAP net loss and non-GAAP net loss per share to exclude from reported GAAP net loss and GAAP net loss per share, intangible asset amortization ($0.3 million and $0.3 million); share-based compensation expense ($0.1 million and $0.4 million); the interest expense associated with accrued interest on the Exchangeable Notes ($0.2 million and $0.7 million); the non-cash amortization of the Exchangeable Notes ($0.6 million and $2.3 million); the interest expense associated with accrued interest on the promissory note issued to Pfizer Inc. ($0.3 million and $0.3 million); and the non-cash adjustments to the fair value of the Royalty-Linked Notes ($2.0 million and $3.3 million) for the three and twelve months ended December 31, 2024, respectively, and intangible asset amortization ($0.4 million and $1.7 million); share-based compensation expense ($0.1 million and $0.8 million); the interest expense associated with accrued interest on the Exchangeable Notes ($0.2 million and $0.8 million); the non-cash amortization of the Exchangeable Notes ($0.6 million and $2.4 million); and the non-cash adjustments to the fair value of derivatives and Royalty-Linked Notes ($0.3 million and ($11.1 million)) for the three and twelve months ended December 31, 2023, respectively.

Iterum believes that the presentation of non-GAAP net loss and non-GAAP net loss per share, when viewed with its results under GAAP and the accompanying reconciliation, provides useful supplementary information to, and facilitates additional analysis by investors, analysts, and Iterum’s management in assessing Iterum’s performance and results from period to period. These non-GAAP financial measures closely align with the way management measures and evaluates Iterum’s performance. These non-GAAP financial measures should be considered in addition to, and not a substitute for, or superior to, net loss or other financial measures calculated in accordance with GAAP. Non-GAAP net loss and non-GAAP net loss per share are not based on any standardized methodology prescribed by GAAP and represents GAAP net loss, which is the most directly comparable GAAP measure, adjusted to exclude intangible asset amortization; share-based compensation expense; the interest expense associated with accrued interest on the Exchangeable Notes; the non-cash amortization of the Exchangeable Notes; the interest expense associated with accrued interest on the promissory note issued to Pfizer Inc.; and the non-cash adjustments to the fair value of derivatives and Royalty-Linked Notes for the three and twelve months ended December 31, 2024 and December 31, 2023. Because of the non-standardized definitions of non-GAAP financial measures, non-GAAP net loss and non-GAAP net loss per share used by Iterum in this press release and accompanying tables has limits in its usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. A reconciliation of non-GAAP net loss to GAAP net loss and non-GAAP net loss per share to GAAP net loss per share have been provided in the tables included in this press release.

About Iterum Therapeutics plc

Iterum Therapeutics plc is focused on delivering differentiated anti-infectives aimed at combatting the global crisis of multi-drug resistant pathogens to significantly improve the lives of people affected by serious and life-threatening diseases around the world. Iterum is advancing the development of its first compound, sulopenem, a novel penem anti-infective compound, with an oral formulation and IV formulation. Sulopenem has demonstrated potent in vitro activity against a wide variety of gram-negative, gram-positive and anaerobic bacteria resistant to other antibiotics. Iterum has received approval of its NDA for ORLYNVAH™ (oral sulopenem) for the treatment of uncomplicated urinary tract infections caused by the designated microorganisms Escherichia coli, Klebsiella pneumoniae, or Proteus mirabilis in adult women with limited or no alternative oral antibacterial treatment options by the FDA and has received Qualified Infectious Disease Product (QIDP) and Fast Track designations for its oral and IV formulations of sulopenem in seven indications. For more information, please visit www.iterumtx.com.

About ORLYNVAH™

ORLYNVAH™ is a novel oral penem antibiotic for the treatment of uUTI. ORLYNVAH™ possesses potent activity against species of Enterobacterales including those that encode extended spectrum beta-lactamase (ESBL) or AmpC-type beta-lactamases that confer resistance to third generation cephalosporins.

Cautionary Note Regarding Forward-looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding Iterum’s plans, strategies and prospects for its business, including the development, therapeutic and market potential of ORLYNVAH™, the expected issuance of an Australian patent following receipt of a notice of allowance in relation thereto and the term and coverage provided by such patent on issue, the sufficiency of Iterum’s cash resources to fund its operating expenses into the second half of 2025, Iterum’s strategic process to sell, license, or otherwise dispose of its rights to ORLYNVAH™, and Iterum’s ability to complete pre-commercialization activities for ORLYNVAH™, pending the outcome of Iterum’s strategic process. In some cases, forward-looking statements can be identified by words such as “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “could,” “would,” “will,” “future,” “potential” or the negative of these or similar terms and phrases. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Iterum’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include all matters that are not historical facts. Actual future results may be materially different from what is expected due to factors largely outside Iterum’s control, including risks and uncertainties concerning the outcome, impact, effects and results of Iterum’s evaluation of strategic alternatives, including the terms, timing, structure, value, benefits and costs of any strategic alternatives, Iterum’s ability to complete a strategic alternative transaction, Iterum’s ability to raise sufficient capital and successfully prepare and implement commercialization plans for ORLYNVAH™ with a commercial partner or directly, including the Iterum’s ability to build and maintain a sales force and prepare for commercial launch of ORLYNVAH™, if Iterum is unsuccessful

at entering into or completing a strategic transaction, the ability of shareholders and other stakeholders to realize any value or recovery as part of a wind down process if Iterum is unsuccessful at entering into or completing a strategic transaction or preparing and implementing commercialization plans for ORLYNVAH™, the market opportunity for and the potential market acceptance of ORLYNVAH™ for uUTIs caused by certain designated microorganisms in adult women who have limited or no alternative oral antibacterial treatment options, Iterum’s ability to continue as a going concern, uncertainties inherent in the conduct of clinical and non-clinical development, changes in regulatory requirements or decisions of regulatory authorities, the timing or likelihood of regulatory filings and approvals, changes in public policy or legislation, commercialization plans and timelines, the actions of third-party clinical research organizations, suppliers and manufacturers, the accuracy of Iterum’s expectations regarding how far into the future Iterum’s cash on hand will fund Iterum’s ongoing operations, Iterum’s ability to maintain its listing on the Nasdaq Capital Market and other factors discussed under the caption “Risk Factors” in its Annual Report on Form 10-K filed with the SEC on February 7, 2025, and other documents filed with the SEC from time to time. Forward-looking statements represent Iterum’s beliefs and assumptions only as of the date of this press release. Except as required by law, Iterum assumes no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

Investor Contact:

Judy Matthews

Chief Financial Officer 312-778-6073

IR@iterumtx.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITERUM THERAPEUTICS PLC |

|

Consolidated Statement of Operations |

|

(In thousands except share and per share data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

$ |

(254 |

) |

|

$ |

- |

|

|

$ |

(254 |

) |

|

$ |

- |

|

Research and development |

|

|

(1,299 |

) |

|

|

(9,744 |

) |

|

|

(10,458 |

) |

|

|

(39,992 |

) |

General and administrative |

|

|

(2,117 |

) |

|

|

(1,687 |

) |

|

|

(7,984 |

) |

|

|

(7,476 |

) |

Total operating expenses |

|

|

(3,670 |

) |

|

|

(11,431 |

) |

|

|

(18,696 |

) |

|

|

(47,468 |

) |

Operating loss |

|

|

(3,670 |

) |

|

|

(11,431 |

) |

|

|

(18,696 |

) |

|

|

(47,468 |

) |

Interest expense, net |

|

|

(874 |

) |

|

|

(405 |

) |

|

|

(2,522 |

) |

|

|

(1,428 |

) |

Adjustments to fair value of derivatives |

|

|

(2,043 |

) |

|

|

(305 |

) |

|

|

(3,269 |

) |

|

|

11,056 |

|

Other income, net |

|

|

30 |

|

|

|

(79 |

) |

|

|

(47 |

) |

|

|

82 |

|

Income tax expense |

|

|

(25 |

) |

|

|

(142 |

) |

|

|

(240 |

) |

|

|

(613 |

) |

Net loss attributable to ordinary shareholders |

|

$ |

(6,582 |

) |

|

$ |

(12,362 |

) |

|

$ |

(24,774 |

) |

|

$ |

(38,371 |

) |

Net loss per share attributable to ordinary shareholders – basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.94 |

) |

|

$ |

(1.26 |

) |

|

$ |

(2.96 |

) |

Weighted average ordinary shares outstanding – basic and diluted |

|

|

26,687,281 |

|

|

|

13,180,447 |

|

|

|

19,699,260 |

|

|

|

12,962,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of non-GAAP net loss to GAAP net loss |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss - GAAP |

|

$ |

(6,582 |

) |

|

$ |

(12,362 |

) |

|

$ |

(24,774 |

) |

|

$ |

(38,371 |

) |

Intangible asset amortization |

|

|

254 |

|

|

|

432 |

|

|

|

254 |

|

|

|

1,719 |

|

Share based compensation |

|

|

89 |

|

|

|

139 |

|

|

|

363 |

|

|

|

784 |

|

Interest expense - accrued interest and amortization on exchangeable notes |

|

|

756 |

|

|

|

782 |

|

|

|

3,011 |

|

|

|

3,150 |

|

Interest on promissory note - non-cash |

|

|

300 |

|

|

|

- |

|

|

|

300 |

|

|

|

- |

|

Adjustments to fair value of derivatives |

|

|

2,043 |

|

|

|

305 |

|

|

|

3,269 |

|

|

|

(11,056 |

) |

Non-GAAP net loss |

|

$ |

(3,140 |

) |

|

$ |

(10,704 |

) |

|

$ |

(17,577 |

) |

|

$ |

(43,774 |

) |

Net loss per share attributable to ordinary shareholders – basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.94 |

) |

|

$ |

(1.26 |

) |

|

$ |

(2.96 |

) |

Non-GAAP net loss per share attributable to ordinary shareholders – basic and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.81 |

) |

|

$ |

(0.89 |

) |

|

$ |

(3.38 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

ITERUM THERAPEUTICS PLC |

|

|

|

|

|

|

|

Consolidated Balance Sheet Data |

|

|

|

|

|

|

|

(In thousands) |

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

As of |

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

|

December 31, |

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments |

|

$ |

24,159 |

|

|

$ |

23,964 |

|

|

|

|

|

|

|

Intangible asset, net |

|

|

19,746 |

|

|

|

- |

|

|

|

|

|

|

|

Other assets |

|

|

690 |

|

|

|

2,295 |

|

|

|

|

|

|

|

Total assets |

|

$ |

44,595 |

|

|

$ |

26,259 |

|

|

|

|

|

|

|

Exchangeable notes |

|

$ |

14,463 |

|

|

$ |

11,453 |

|

|

|

|

|

|

|

Royalty-linked notes |

|

|

10,771 |

|

|

|

7,503 |

|

|

|

|

|

|

|

Long-term debt, less current portion |

|

|

20,300 |

|

|

|

- |

|

|

|

|

|

|

|

Other liabilities |

|

|

3,142 |

|

|

|

13,706 |

|

|

|

|

|

|

|

Total liabilities |

|

$ |

48,676 |

|

|

$ |

32,662 |

|

|

|

|

|

|

|

Total shareholders' deficit |

|

|

(4,081 |

) |

|

|

(6,403 |

) |

|

|

|

|

|

|

Total liabilities and shareholders' deficit |

|

$ |

44,595 |

|

|

$ |

26,259 |

|

|

|

|

|

|

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

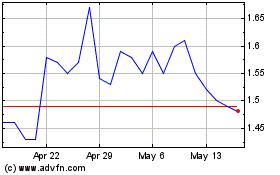

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Mar 2024 to Mar 2025