FALSE000080788200008078822025-02-252025-02-25

_____________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2025

JACK IN THE BOX INC.

(Exact name of registrant as specified in its charter)

_________________

| | | | | | | | |

Delaware | 1-9390 | 95-2698708 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

9357 Spectrum Center Blvd, San Diego, CA 92123

(Address of principal executive offices) (Zip Code)

(858) 571-2121

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | JACK | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

______________________________________________________________________

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 25, 2025, Jack in the Box Inc. issued a press release announcing its first quarter fiscal 2025 financial results and disclosing other information.

A copy of the press release is attached as Exhibit 99.1.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | | | | |

| Exhibit No. | Description | | |

| 99.1 | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | JACK IN THE BOX INC. |

| | | |

| | /s/ Lance Tucker | |

| | Lance Tucker | |

| | Interim Chief Executive Officer (principal executive officer) | |

Date: February 25, 2025

| | | | | | | | |

| | Contact: Chris Brandon Vice President, Investor Relations chris.brandon@jackinthebox.com 619.902.0269 |

Jack in the Box Inc. Reports First Quarter 2025 Earnings

Jack in the Box same-store sales growth of 0.4%

Del Taco same-store sales of (4.5%)

Jack in the Box systemwide sales growth of 0.5%; Del Taco systemwide sales of (1.9%)

Diluted earnings per share of $1.75; Operating EPS of $1.92

Jack in the Box completed development agreements for 2 new franchisees to expand in Chicago, in addition to the 8 company-owned restaurants set to begin opening in Summer of 2025

Jack in the Box progressing on tech and digital transformation with nearly 1,000 restaurants on our new POS system, which includes immediate counter kiosk capabilities

SAN DIEGO, Calif. February 25, 2025 – Jack in the Box Inc. (NASDAQ: JACK) announced financial results for the Jack in the Box and Del Taco brands in the first quarter, ended January 19, 2025.

“The first quarter saw a good start to top-line performance and bottom-line earnings flow through as we battled through a difficult industry-wide macro environment,” said Lance Tucker, Jack in the Box Interim Principal Executive Officer. “In my new role, I will be continuing to assess capital allocation, investments and leverage reduction — all while executing on our fundamentals to ensure we regain our sales momentum as we move through 2025.”

Jack in the Box Performance

Same-store sales increased 0.4% in the first quarter, comprised of franchise same-store sales increase of 0.5% and company-owned same-store sales decline of 0.4%. Price was higher versus prior year, while both transactions and mix were down compared to prior year, but were sequentially positive. Systemwide sales for the first quarter increased 0.5%.

Restaurant-Level Margin(1), a non-GAAP measure, was $31.0 million, or 23.2%, up from $30.4 million, or 23.1%, a year ago driven primarily by lower food and packaging costs, partially offset by higher costs for labor and other restaurant operating costs. The decrease in food and packaging was primarily due to a favorable increase of beverage funding relating to a new contract, a portion of which

Jack in the Box Inc.

Page 2

was one-time benefit. The increase in labor was driven from implementing California's minimum wage law.

Franchise-Level Margin(1), a non-GAAP measure, was $97.1 million, or 40.9%, a decrease from $97.5 million, or 41.2%, a year ago.

The decrease was mainly driven by lower percentage rent, partially offset by lower IT support costs as well as higher royalties from higher sales.

Jack in the Box net restaurant count decreased slightly in the first quarter, with five restaurant openings and six restaurant closures. In the first quarter, Jack in the Box signed 3 development agreements with new franchisees for 10 new restaurants.

| | | | | | | | | | | | | | | |

| Jack in the Box Same-Store Sales: | 16 Weeks Ended | | |

| January 19, 2025 | | January 21, 2024 | | | | |

| Company | (0.4 %) | | 2.0 % | | | | |

| Franchise | 0.5 % | | 0.7 % | | | | |

| System | 0.4 % | | 0.8 % | | | | |

Jack in the Box Restaurant Counts:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2025 | | 2024 |

| | Company | | Franchise | | Total | | Company | | Franchise | | Total |

| Restaurant count at beginning FY | 150 | | | 2,041 | | | 2,191 | | | 142 | | | 2,044 | | | 2,186 | |

| New | 2 | | | 3 | | | 5 | | | 2 | | | 5 | | | 7 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Closed | — | | | (6) | | | (6) | | | — | | | (1) | | | (1) | |

| Restaurant count at end of Q1 | 152 | | | 2,038 | | | 2,190 | | | 144 | | | 2,048 | | | 2,192 | |

| Q1'25 QTD Net Restaurant Increase/(Decrease) | 2 | | | (3) | | | (1) | | | | | | | |

| | | | | | | | | | | |

| YTD Net Restaurant Increase/(Decrease) | 1.3 | % | | (0.1) | % | | — | % | | | | | | |

Del Taco Performance

Same-store sales decreased 4.5% in the first quarter, comprised of franchise same-store sales decline of 5.1% and company-operated same-store sales decline of 2.5%. Sales performance resulted from declines compared to prior year in both transactions and mix, partially offset by an increase in price. Systemwide sales for the fiscal first quarter decreased 1.9%.

Restaurant-Level Margin(1), a non-GAAP measure, was $9.3 million, or 13.8%, down from $14.4 million, or 15.6%, a year ago. The decrease was due mainly to a decrease in restaurant count from refranchising restaurants. The margin percentage decline was driven by the increased costs for labor as a

Jack in the Box Inc.

Page 3

result of implementing California's new minimum wage law and the change in the mix of restaurants from refranchising, partially offset by lower food and packaging as a result of menu price increases and favorable beverage funding.

Franchise-Level Margin(1), a non-GAAP measure, was $7.9 million, or 25.7%, compared to $8.0 million, or 29.3%, a year ago. The decrease in margin percentage was driven by refranchising and the associated impact of pass-thru rent and marketing fees.

Del Taco restaurant count in the first quarter had one restaurant opening and six restaurant closings. As of the end of the first quarter and since being acquired by Jack in the Box, Del Taco has signed 40 agreements for a total of 303 restaurants, with 14 restaurants opened to date. During the first quarter, 13 Del Taco company-owned restaurants were refranchised, which included a development agreement for 12 new future restaurants. Del Taco also completed a development agreement to enter Indianapolis, marking its 12th new market announcement in the past three years.

| | | | | | | | | | | | | | | |

| Del Taco Same-Store Sales: | 16 Weeks Ended | | |

| January 19, 2025 | | January 21, 2024 | | | | |

| Company | (2.5 %) | | 1.8 % | | | | |

| Franchise | (5.1 %) | | 2.4 % | | | | |

| System | (4.5 %) | | 2.2 % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Del Taco Restaurant Counts: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2025 | | 2024 |

| | Company | | Franchise | | Total | | Company | | Franchise | | Total |

| Restaurant count at beginning FY | 133 | | | 461 | | | 594 | | | 171 | | | 421 | | | 592 | |

| New | 1 | | | — | | | 1 | | | — | | | 3 | | | 3 | |

| Acquired from franchisees | — | | | — | | | — | | | 9 | | | (9) | | | — | |

| Refranchised | (13) | | | 13 | | | — | | | — | | | — | | | — | |

| Closed | (2) | | | (4) | | | (6) | | | (1) | | | (2) | | | (3) | |

| Restaurant count at end of Q1 | 119 | | | 470 | | | 589 | | | 179 | | | 413 | | | 592 | |

| Q1'25 QTD Net Restaurant Increase/(Decrease) | (14) | | | 9 | | | (5) | | | | | | | |

| | | | | | | | | | | |

| YTD Net Restaurant Increase/(Decrease) | (10.5) | % | | 2.0 | % | | (0.8) | % | | | | | | |

Company-Wide Performance

First quarter diluted earnings per share was $1.75. Operating Earnings Per Share(2), a non-GAAP measure, was $1.92 in the first quarter of fiscal 2025 compared with $1.95 in the prior year quarter.

Total revenues decreased 3.7% to $469.4 million, compared to $487.5 million in the prior year quarter. The lower revenue is primarily the result of the Del Taco refranchising transactions. Net income was $33.7 million for the first quarter of fiscal 2025. This compared with net earnings of $38.7 million for

Jack in the Box Inc.

Page 4

the first quarter of the prior year. Adjusted EBITDA(3), a non-GAAP measure, was $97.2 million in the first quarter of fiscal 2025 compared with $101.8 million for the prior year quarter.

Company-wide SG&A expense for the first quarter was $50.7 million, a increase of $4.3 million compared to the prior year quarter. The increase was due primarily to the fluctuations in the cash surrender value of our company-owned life insurance policies, partially offset by lower incentive-based compensation. When excluding net COLI gains, G&A was 2.3% of systemwide sales.

The income tax provisions reflect a year-to-date effective tax rate of 29.8% in the first quarter of 2025, as compared to 26.9% in the first quarter of fiscal year 2024. The non-GAAP adjusted tax rate for the first quarter of 2025 was 27.2%.

(1) Restaurant-Level Margin and Franchise-Level Margin are non-GAAP measures. These non-GAAP measures are reconciled to earnings from operations, the most comparable GAAP measure, in the attachment to this release. See "Reconciliation of Non-GAAP Measurements to GAAP Results."

(2) Operating Earnings Per Share represents the diluted earnings per share on a GAAP basis, excluding certain adjustments. See "Reconciliation of Non-GAAP Measurements to GAAP Results." Operating earnings per share may not add due to rounding.

(3) Adjusted EBITDA represents net earnings on a GAAP basis excluding certain adjustments. See "Reconciliation of Non-GAAP Measurements to GAAP Results."

Capital Allocation

The Company repurchased 0.1 million shares of our common stock for an aggregate cost of $5.0 million in the first quarter. As of the end of the first quarter, there was $175.0 million remaining under the Board-authorized stock buyback program.

On February 21, 2025, the Board of Directors declared a cash dividend of $0.44 per share, to be paid on April 8, 2025, to shareholders of record as of the close of business on March 20, 2025.

Guidance & Outlook Updates

The following guidance and underlying assumptions reflect the company’s current expectations for the fiscal year ending September 28, 2025. Any guidance measures not listed below remain the same as provided on November 20, 2024.

•Capital Expenditures of $100-$105 million (previously $105-115 million)

•Share repurchases of approximately $5 million in FY 2025 (previously approx. $20 million)

Jack in the Box Inc.

Page 5

Conference Call

The Company will host a conference call for analysts and investors on Tuesday, February 25, 2025, beginning at 2:00 p.m. PT (5:00 p.m. ET). The call will be webcast live via the Investors section of the Jack in the Box company website at http://investors.jackinthebox.com. A replay of the call will be available through the Jack in the Box Inc. corporate website for 21 days. The call can be accessed via phone by dialing (888) 596-4144 and using ID 7573961.

About Jack in the Box Inc.

Jack in the Box Inc. (NASDAQ: JACK), founded and headquartered in San Diego, California, is a restaurant company that operates and franchises Jack in the Box®, one of the nation's largest hamburger chains with approximately 2,200 restaurants across 22 states, and Del Taco®, the second largest Mexican-American QSR chain by units in the U.S. with approximately 600 restaurants across 17 states. For more information on both brands, including franchising opportunities, visit www.jackinthebox.com and www.deltaco.com.

Category: Earnings

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “goals,” “guidance,” “intend,” “plan,” “project,” “may,” “will,” “would” and similar expressions. These statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate. These estimates and assumptions involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. Factors that may cause our actual results to differ materially from any forward-looking statements include, but are not limited to: the success of new products, marketing initiatives and restaurant remodels and drive-thru enhancements; the impact of competition, unemployment, trends in consumer spending patterns and commodity costs; the company’s ability to achieve and manage its planned growth, which is affected by the availability of a sufficient number of suitable new restaurant sites, the performance of new restaurants, risks relating to expansion into new markets and successful franchise development; the ability to attract, train and retain top-performing personnel, litigation risks; risks associated with disagreements with franchisees; supply chain disruption; food-safety incidents or negative publicity impacting the reputation of the company's brand; increased

Jack in the Box Inc.

Page 6

regulatory and legal complexities, risks associated with the amount and terms of the securitized debt issued by certain of our wholly owned subsidiaries; and stock market volatility. These and other factors are discussed in the company’s annual report on Form 10-K and its periodic reports on Form 10-Q filed with the Securities and Exchange Commission, which are available online at http://investors.jackinthebox.com or in hard copy upon request. The company undertakes no obligation to update or revise any forward-looking statement, whether as the result of new information or otherwise.

Jack in the Box Inc.

Page 7

JACK IN THE BOX INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(In thousands, except per share data)

(Unaudited) | | | | | | | | | | | | | | | |

| 16 Weeks Ended | | |

| January 19, 2025 | | January 21, 2024 | | | | |

| Revenues: | | | | | | | |

| Company restaurant sales | $ | 201,406 | | | $ | 224,040 | | | | | |

| Franchise rental revenues | 116,546 | | | 113,196 | | | | | |

| Franchise royalties and other | 74,034 | | | 73,330 | | | | | |

| Franchise contributions for advertising and other services | 77,452 | | | 76,932 | | | | | |

| 469,438 | | | 487,498 | | | | | |

| Operating costs and expenses, net: | | | | | | | |

| Food and packaging | 51,648 | | | 64,132 | | | | | |

| Payroll and employee benefits | 70,273 | | | 73,054 | | | | | |

| Occupancy and other | 39,146 | | | 42,053 | | | | | |

| Franchise occupancy expenses | 78,833 | | | 72,624 | | | | | |

| Franchise support and other costs | 5,198 | | | 5,194 | | | | | |

| Franchise advertising and other services expenses | 78,998 | | | 80,234 | | | | | |

| Selling, general and administrative expenses | 50,672 | | | 46,365 | | | | | |

| Depreciation and amortization | 18,270 | | | 18,473 | | | | | |

| Pre-opening costs | 1,476 | | | 465 | | | | | |

| | | | | | | |

| Other operating expenses, net | 3,519 | | | 5,170 | | | | | |

| (Gains) losses on the sale of company-operated restaurants | (2,806) | | | 254 | | | | | |

| 395,227 | | | 408,018 | | | | | |

| Earnings from operations | 74,211 | | | 79,480 | | | | | |

| Other pension and post-retirement expenses, net | 1,789 | | | 2,106 | | | | | |

| Interest expense, net | 24,425 | | | 24,486 | | | | | |

| Earnings before income taxes | 47,997 | | | 52,888 | | | | | |

| Income taxes | 14,311 | | | 14,205 | | | | | |

| Net earnings | $ | 33,686 | | | $ | 38,683 | | | | | |

| | | | | | | |

| Net earnings per share: | | | | | | | |

| Basic | $ | 1.77 | | | $ | 1.94 | | | | | |

| Diluted | $ | 1.75 | | | $ | 1.93 | | | | | |

| | | | | | | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 19,050 | | | 19,893 | | | | | |

| Diluted | 19,215 | | | 20,051 | | | | | |

| | | | | | | |

| Dividends declared per common share | $ | 0.44 | | | $ | 0.44 | | | | | |

Jack in the Box Inc.

Page 8

JACK IN THE BOX INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

(Unaudited) | | | | | | | | | | | |

| January 19,

2025 | | September 29,

2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash | $ | 74,978 | | | $ | 24,745 | |

| Restricted cash | 29,655 | | | 29,422 | |

| Accounts and other receivables, net | 68,081 | | | 83,567 | |

| Inventories | 3,856 | | | 3,922 | |

| Prepaid expenses | 8,130 | | | 13,126 | |

| Assets held for sale | 12,432 | | | 16,493 | |

| Other current assets | 16,854 | | | 10,002 | |

| Total current assets | 213,986 | | | 181,277 | |

| Property and equipment: | | | |

| Property and equipment, at cost | 1,293,448 | | | 1,278,530 | |

| Less accumulated depreciation and amortization | (856,923) | | | (848,491) | |

| Property and equipment, net | 436,525 | | | 430,039 | |

| Other assets: | | | |

| Operating lease right-of-use assets | 1,416,958 | | | 1,410,083 | |

| Intangible assets, net | 10,270 | | | 10,515 | |

| Trademarks | 283,500 | | | 283,500 | |

| Goodwill | 161,344 | | | 161,209 | |

| | | |

| Other assets, net | 251,321 | | | 259,006 | |

| Total other assets | 2,123,393 | | | 2,124,313 | |

| $ | 2,773,904 | | | $ | 2,735,629 | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 29,725 | | | $ | 35,880 | |

| Current operating lease liabilities | 159,219 | | | 162,017 | |

| Accounts payable | 69,394 | | | 69,494 | |

| Accrued liabilities | 168,359 | | | 166,868 | |

| Total current liabilities | 426,697 | | | 434,259 | |

| Long-term liabilities: | | | |

| Long-term debt, net of current maturities | 1,693,453 | | | 1,699,433 | |

| Long-term operating lease liabilities, net of current portion | 1,290,800 | | | 1,286,415 | |

| Deferred tax liabilities | 11,624 | | | 13,612 | |

| Other long-term liabilities | 178,461 | | | 153,708 | |

| Total long-term liabilities | 3,174,338 | | | 3,153,168 | |

| Stockholders’ deficit: | | | |

| Preferred stock $0.01 par value, 15,000,000 shares authorized, none issued | — | | | — | |

| Common stock $0.01 par value, 175,000,000 shares authorized, 82,971,349 and 82,825,851 issued and outstanding, respectively | 829 | | | 828 | |

| Capital in excess of par value | 537,568 | | | 533,818 | |

| Retained earnings | 1,891,977 | | | 1,866,660 | |

| Accumulated other comprehensive loss | (56,880) | | | (57,475) | |

| Treasury stock, at cost, 64,120,270 and 63,996,399 shares, respectively | (3,200,625) | | | (3,195,629) | |

| Total stockholders’ deficit | (827,131) | | | (851,798) | |

| $ | 2,773,904 | | | $ | 2,735,629 | |

Jack in the Box Inc.

Page 9

JACK IN THE BOX INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited) | | | | | | | | | | | |

| | Sixteen Weeks Ended |

| January 19, 2025 | | January 21, 2024 |

| Cash flows from operating activities: | | | |

| Net earnings | $ | 33,686 | | | $ | 38,683 | |

| Adjustments to reconcile net earnings to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 18,270 | | | 18,473 | |

| Amortization of franchise tenant improvement allowances and incentives | 1,655 | | | 1,418 | |

| Deferred finance cost amortization | 1,473 | | | 1,493 | |

| | | |

| Excess tax deficiency (benefit) from share-based compensation arrangements | 1,111 | | | (9) | |

| Deferred income taxes | (5,018) | | | (719) | |

| Share-based compensation expense | 3,689 | | | 4,820 | |

| Pension and post-retirement expense | 1,789 | | | 2,106 | |

| Gains on cash surrender value of company-owned life insurance | (189) | | | (6,161) | |

| (Gains) losses on the sale of company-operated restaurants | (2,806) | | | 254 | |

| Gains on acquisition of restaurants | (6) | | | (2,357) | |

| Losses on the disposition of property and equipment, net | 521 | | | 1,011 | |

| Impairment charges and other | 736 | | | 28 | |

| Changes in assets and liabilities: | | | |

| Accounts and other receivables | 17,822 | | | 40,139 | |

| Inventories | 66 | | | (484) | |

| Prepaid expenses and other current assets | (1,892) | | | 9,587 | |

| Operating lease right-of-use assets and lease liabilities | (5,788) | | | 12,208 | |

| Accounts payable | 4,776 | | | (13,826) | |

| Accrued liabilities | 6,684 | | | (125,861) | |

| Pension and post-retirement contributions | (2,218) | | | (1,698) | |

| Franchise tenant improvement allowance and incentive disbursements | (1,924) | | | (523) | |

| Other | 33,219 | | | (1,257) | |

| Cash flows provided by (used in) operating activities | 105,656 | | | (22,675) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (35,099) | | | (38,829) | |

| Proceeds from the sale of property and equipment | — | | | 516 | |

| | | |

| Proceeds from the sale of company-operated restaurants | 5,712 | | | 1,739 | |

| Other | 3,303 | | | — | |

| Cash flows used in investing activities | (26,084) | | | (36,574) | |

| Cash flows from financing activities: | | | |

| | | |

| Repayments of borrowings on revolving credit facilities | (6,000) | | | — | |

| | | |

| Principal repayments on debt | (7,464) | | | (7,481) | |

| | | |

| Dividends paid on common stock | (8,308) | | | (8,652) | |

| Proceeds from issuance of common stock | 1 | | | 1 | |

| Repurchases of common stock | (4,999) | | | (25,000) | |

| Payroll tax payments for equity award issuances | (2,336) | | | (2,992) | |

| Cash flows used in financing activities | (29,106) | | | (44,124) | |

| Net increase (decrease) in cash and restricted cash | 50,466 | | | (103,373) | |

| Cash and restricted cash at beginning of period | 54,167 | | | 185,907 | |

| Cash and restricted cash at end of period | $ | 104,633 | | | $ | 82,534 | |

Jack in the Box Inc.

Page 10

JACK IN THE BOX INC. AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS DATA

(Unaudited)

The following table presents certain income and expense items included in our condensed consolidated statements of earnings as a percentage of total revenues, unless otherwise indicated. Percentages may not add due to rounding.

| | | | | | | | | | | | | | | |

| | 16 Weeks Ended | | |

| | January 19, 2025 | | January 21, 2024 | | | | |

| Revenues: | | | | | | | |

| Company restaurant sales | 42.9 | % | | 46.0 | % | | | | |

| Franchise rental revenues | 24.8 | % | | 23.2 | % | | | | |

| Franchise royalties and other | 15.8 | % | | 15.0 | % | | | | |

| Franchise contributions for advertising and other services | 16.5 | % | | 15.8 | % | | | | |

| 100.0 | % | | 100.0 | % | | | | |

| Operating costs and expenses, net: | | | | | | | |

| Food and packaging (1) | 25.6 | % | | 28.6 | % | | | | |

| Payroll and employee benefits (1) | 34.9 | % | | 32.6 | % | | | | |

| Occupancy and other (1) | 19.4 | % | | 18.8 | % | | | | |

| Franchise occupancy expenses (2) | 67.6 | % | | 64.2 | % | | | | |

| Franchise support and other costs (3) | 7.0 | % | | 7.1 | % | | | | |

| Franchise advertising and other services expenses (4) | 102.0 | % | | 104.3 | % | | | | |

| Selling, general and administrative expenses | 10.8 | % | | 9.5 | % | | | | |

| Depreciation and amortization | 3.9 | % | | 3.8 | % | | | | |

| Pre-opening costs | 0.3 | % | | 0.1 | % | | | | |

| | | | | | | |

| Other operating expenses, net | 0.7 | % | | 1.1 | % | | | | |

| (Gains) losses on the sale of company-operated restaurants | (0.6) | % | | 0.1 | % | | | | |

| Earnings from operations | 15.8 | % | | 16.3 | % | | | | |

| Income tax rate (5) | 29.8 | % | | 26.9 | % | | | | |

____________________________

(1)As a percentage of company restaurant sales.

(2)As a percentage of franchise rental revenues.

(3)As a percentage of franchise royalties and other.

(4)As a percentage of franchise contributions for advertising and other services.

(5)As a percentage of earnings from operations and before income taxes.

Jack in the Box Inc.

Page 11

| | | | | | | | | | | | | | | |

Jack in the Box systemwide sales (in thousands): | 16 Weeks Ended | | |

| | January 19, 2025 | | January 21, 2024 | | | | |

| Company-operated restaurant sales | $ | 133,755 | | | $ | 132,057 | | | | | |

| Franchised restaurant sales (1) | 1,232,347 | | | 1,226,750 | | | | | |

| Systemwide sales (1) | $ | 1,366,102 | | | $ | 1,358,807 | | | | | |

| | | | | | | | | | | | | | | |

Del Taco systemwide sales (in thousands): | 16 Weeks Ended | | |

| | January 19, 2025 | | January 21, 2024 | | | | |

| Company-operated restaurant sales | $ | 67,651 | | | $ | 91,983 | | | | | |

| Franchised restaurant sales (1) | 217,283 | | | 198,476 | | | | | |

| Systemwide sales (1) | $ | 284,934 | | | $ | 290,459 | | | | | |

____________________________

(1)Franchised restaurant sales represent sales at franchised restaurants and are revenues of our franchisees. Systemwide sales include company and franchised restaurant sales. We do not record franchised sales as revenues; however, our royalty revenues, marketing fees and percentage rent revenues are calculated based on a percentage of franchised sales. We believe franchised and systemwide restaurant sales information is useful to investors as they have a direct effect on the company's profitability.

Jack in the Box Inc.

Page 12

JACK IN THE BOX INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASUREMENTS TO GAAP RESULTS

(Unaudited)

To supplement the condensed consolidated financial statements, which are presented in accordance with GAAP, the company uses the following non-GAAP measures: Adjusted Net Income, Operating Earnings Per Share, Adjusted EBITDA, Restaurant-Level Margin and Franchise-Level Margin. Management believes that these measurements, when viewed with the company's results of operations in accordance with GAAP and the accompanying reconciliations in the tables below, provide useful information about operating performance and period-over-period changes, and provide additional information that is useful for evaluating the operating performance of the company's core business without regard to potential distortions.

Operating Earnings Per Share

Operating Earnings Per Share represents diluted earnings per share on a GAAP basis excluding integration and strategic initiatives, net COLI gains, pension and post-retirement benefit costs, losses (gains) on the sale of company-operated restaurants, excess tax (benefits) shortfall from share-based compensation arrangements, and the tax-related impacts of the above adjustments.

Operating Earnings Per Share should be considered as a supplement to, not as a substitute for, analysis of results as reported under U.S. GAAP or other similarly titled measures of other companies. Management believes Operating Earnings Per Share provides investors with a meaningful supplement of the company’s operating performance and period-over-period changes without regard to potential distortions.

Jack in the Box Inc.

Page 13

Below is a reconciliation of Non-GAAP Adjusted Net Income to the most directly comparable GAAP measure of net income. Also below is a reconciliation of Non-GAAP Operating Earnings Per Share to the most directly comparable GAAP measure, diluted earnings per share: | | | | | | | | | | | | | | | | | | |

| | 16 Weeks Ended | | |

| | January 19, 2025 | | January 21, 2024 | | | | |

| Net income, as reported | | $ | 33,686 | | | $ | 38,683 | | | | | |

| Integration and strategic initiatives (1) | | 1,415 | | | 5,621 | | | | | |

| Net COLI gains (2) | | 1,391 | | | (4,834) | | | | | |

| Pension and post-retirement benefit costs (3) | | 1,789 | | | 2,106 | | | | | |

| | | | | | | | |

| Restaurant impairment charges | | 748 | | | — | | | | | |

| (Gain) losses on the sale of company-operated restaurants (4) | | (2,806) | | | 254 | | | | | |

| Losses on the sale of real estate to franchisees | | — | | | 1 | | | | | |

| Gains on acquisition of restaurants | | (6) | | | (2,357) | | | | | |

| Excess tax shortfall (benefit) from share-based compensation arrangements | | 1,110 | | | (10) | | | | | |

| Tax impact of adjustments (5) | | (523) | | | (371) | | | | | |

| Non-GAAP Adjusted Net Income | | $ | 36,804 | | | $ | 39,093 | | | | | |

| | | | | | | | |

| Weighted-average shares outstanding - diluted | | 19,215 | | | 20,051 | | | | | |

| | | | | | | | |

| Diluted earnings per share – GAAP | | $ | 1.75 | | | $ | 1.93 | | | | | |

| Integration and strategic initiatives (1) | | 0.07 | | | 0.28 | | | | | |

| Net COLI gains (2) | | 0.07 | | | (0.24) | | | | | |

| Pension and post-retirement benefit costs (3) | | 0.09 | | | 0.11 | | | | | |

| | | | | | | | |

| Restaurant impairment charges | | 0.04 | | | — | | | | | |

| (Gain) losses on the sale of company-operated restaurants (4) | | (0.15) | | | 0.01 | | | | | |

| Losses on the sale of real estate to franchisees | | — | | | 0.00 | | | | | |

| Gains on acquisition of restaurants | | 0.00 | | | (0.12) | | | | | |

| Excess tax (benefits) shortfall from share-based compensation arrangements | | 0.06 | | | (0.00) | | | | | |

| Tax impact of adjustments (5) | | (0.03) | | | (0.02) | | | | | |

| Operating Earnings Per Share – non-GAAP (6) | | $ | 1.92 | | | $ | 1.95 | | | | | |

| | | | | | | | |

____________________

(1) Integration and strategic initiatives reflect charges that are not part of our ongoing operations, including consulting fees for discrete project-based strategic initiatives that are not expected to recur in the foreseeable future.

(2) Net COLI gains reflect market-based adjustments on the company-owned life insurance policies, net of changes in our non-qualified deferred compensation obligation supported by these policies.

(3) Pension and post-retirement benefit costs relating to our two legacy defined benefit pension plans, as well as our two legacy post-retirement plans.

(4) Losses (gains) on the sale of company-operated restaurants

(5) Tax impacts for the quarter calculated based on the non-GAAP Operating EPS tax rate of 27.2% in the current quarter and 27.2% in the prior year quarter.

(6) Operating Earnings Per Share may not add due to rounding.

Jack in the Box Inc.

Page 14

Adjusted EBITDA

Adjusted EBITDA represents net earnings on a GAAP basis excluding income taxes, interest expense, net, losses (gains) on the sale of company-operated restaurants, other operating expenses (income), net, depreciation and amortization, amortization of cloud computing costs, amortization of favorable and unfavorable leases and subleases, net, amortization of franchise tenant improvement allowances and other, net COLI gains, and pension and post-retirement benefit costs.

Adjusted EBITDA should be considered as a supplement to, not as a substitute for, analysis of results as reported under U.S. GAAP or other similarly titled measures of other companies. Management believes Adjusted EBITDA is useful to investors to gain an understanding of the factors and trends affecting the company's ongoing cash earnings, from which capital investments are made and debt is serviced.

Below is a reconciliation of non-GAAP Adjusted EBITDA to the most directly comparable GAAP measure, net earnings (in thousands): | | | | | | | | | | | |

| 16 Weeks Ended |

| January 19, 2025 | | January 21, 2024 |

| Net income - GAAP | $ | 33,686 | | | $ | 38,683 | |

| Income taxes | 14,311 | | | 14,205 | |

| Interest expense, net | 24,425 | | | 24,486 | |

| (Gains) losses on the sale of company-operated restaurants | (2,806) | | | 254 | |

| Other operating expenses, net (1) | 3,519 | | | 5,170 | |

| | | |

| Depreciation and amortization | 18,270 | | | 18,473 | |

| Amortization of cloud-computing costs (2) | 1,002 | | 1,606 | |

| Amortization of favorable and unfavorable leases and subleases, net (3) | 2 | | 124 | |

| Amortization of franchise tenant improvement allowances and other | 1,655 | | | 1,511 | |

| Net COLI gains (4) | 1,391 | | | (4,834) | |

| Pension and post-retirement benefit costs (5) | 1,789 | | | 2,106 | |

| Adjusted EBITDA – non-GAAP | $ | 97,244 | | | $ | 101,784 | |

(1) Other operating expense, net includes: integration and strategic initiatives; costs of closed restaurants; operating restaurant impairment charges; accelerated depreciation and gains/losses on disposition of property and equipment, net.

(2) Amortization of cloud computing costs includes the amounts for the non-cash amortization of capitalized implementation costs related to cloud-based software arrangements that are included within selling, general and administrative expenses.

(3) Amortization of favorable and unfavorable leases and subleases, net, which is not already included in the other operating expense, net, noted above.

(4) Net COLI gains reflect market-based adjustments on the company-owned life insurance policies, net of changes in our non-qualified deferred compensation obligation supported by these policies.

(5) Pension and post-retirement benefit costs relating to our two legacy defined benefit pension plans, as well as the two legacy post-retirement plans.

Jack in the Box Inc.

Page 15

Restaurant-Level Margin

Restaurant-Level Margin is defined as company restaurant sales less restaurant operating costs (food and packaging, labor, and occupancy costs) and is neither required by, nor presented in accordance with GAAP. Restaurant-Level Margin excludes revenues and expenses of our franchise operations and selling, general, and administrative expenses. Certain other costs, such as depreciation and amortization, other operating expenses, net, gains/ losses on the sale of company-operated restaurants, and other costs that are considered normal operating costs are excluded as they are considered corporate-level shared service costs. As such, Restaurant-Level Margin is not indicative of the overall results of the company and does not accrue directly to the benefit of shareholders because of the exclusion of corporate-level expenses. Restaurant-Level Margin should be considered as a supplement to, not as a substitute for, analysis of results as reported under GAAP or other similarly titled measures of other companies. The company is presenting Restaurant-Level Margin because it believes that it provides a meaningful supplement to net earnings of the company's core business operating results, as well as a comparison to those of other similar companies. Management utilizes Restaurant-Level Margin as a key performance indicator to evaluate the profitability of company-operated restaurants.

Below is a reconciliation of non-GAAP Restaurant-Level Margin to the most directly comparable GAAP measure, earnings from operations (in thousands):

| | | | | | | | | | | | | | | | | | | | | | |

| | 16 weeks ended January 19, 2025 | | |

| | Jack in the Box | Del Taco | Other (1) | Total (2) | | | | | |

| Earnings from operations - GAAP | | $ | 113,151 | | $ | 10,546 | | $ | (49,485) | | $ | 74,212 | | | | | | |

| Franchise rental revenues | | (105,781) | | (10,765) | | — | | (116,546) | | | | | | |

| Franchise royalties and other | | (63,615) | | (10,419) | | — | | (74,034) | | | | | | |

| Franchise contributions for advertising and other services | | (67,913) | | (9,539) | | — | | (77,452) | | | | | | |

| Franchise occupancy expenses | | 67,916 | | 10,916 | | — | | 78,832 | | | | | | |

| Franchise support and other costs | | 3,301 | | 1,897 | | — | | 5,198 | | | | | | |

| Franchise advertising and other services expenses | | 68,992 | | 10,007 | | — | | 78,999 | | | | | | |

| Selling, general and administrative expenses | | 12,274 | | 8,597 | | 29,800 | | 50,671 | | | | | | |

| Depreciation and amortization | | — | | — | | 18,270 | | 18,270 | | | | | | |

| Pre-opening costs | | 1,457 | | 19 | | — | | 1,476 | | | | | | |

| | | | | | | | | | |

| Other operating expenses, net | | 1,216 | | 888 | | 1,415 | | 3,519 | | | | | | |

| Gains on the sale of company-operated restaurants | | — | | (2,806) | | — | | (2,806) | | | | | | |

| Restaurant-Level Margin - Non-GAAP | | $ | 30,998 | | $ | 9,341 | | $ | — | | $ | 40,339 | | | | | | |

| | | | | | | | | | |

| Company restaurant sales | | $ | 133,755 | | $ | 67,651 | | $ | — | | $ | 201,406 | | | | | | |

| | | | | | | | | | |

| Restaurant-Level Margin % - Non-GAAP | | 23.2 | % | 13.8 | % | N/A | 20.0 | % | | | | | |

Jack in the Box Inc.

Page 16

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 16 weeks ended January 21, 2024 |

| | | | | | | Jack in the Box | Del Taco | Other (1) | Total (2) |

| Earnings from operations - GAAP | | | | | | | $ | 117,707 | | $ | 11,073 | | $ | (49,300) | | $ | 79,480 | |

| Franchise rental revenues | | | | | | | (105,578) | | (7,618) | | — | | (113,196) | |

| Franchise royalties and other | | | | | | | (63,343) | | (9,987) | | — | | (73,330) | |

| Franchise contributions for advertising and other services | | | | | | | (67,362) | | (9,569) | | — | | (76,931) | |

| Franchise occupancy expenses | | | | | | | 65,188 | | 7,436 | | — | | 72,624 | |

| Franchise support and other costs | | | | | | | 3,747 | | 1,446 | | — | | 5,193 | |

| Franchise advertising and other services expenses | | | | | | | 69,893 | | 10,341 | | — | | 80,234 | |

| Selling, general and administrative expenses | | | | | | | 10,841 | | 10,316 | | 25,117 | | 46,274 | |

| Depreciation and amortization | | | | | | | — | | — | | 18,473 | | 18,473 | |

| Pre-opening costs | | | | | | | 343 | | 122 | | — | | 465 | |

| | | | | | | | | | |

| Other operating expenses, net | | | | | | | 667 | | (1,117) | | 5,710 | | 5,260 | |

| (Gains) losses on the sale of company-operated restaurants | | | | | | | (1,655) | | 1,909 | | — | | 254 | |

| Restaurant-Level Margin - Non-GAAP | | | | | | | $ | 30,448 | | $ | 14,352 | | $ | — | | $ | 44,800 | |

| | | | | | | | | | |

| Company restaurant sales | | | | | | | $ | 132,057 | | $ | 91,983 | | $ | — | | $ | 224,040 | |

| | | | | | | | | | |

| Restaurant-Level Margin % - Non-GAAP | | | | | | | 23.1 | % | 15.6 | % | N/A | 20.0 | % |

(1) The "Other" category includes shared services costs and other unallocated costs

(2) The totals might not agree to consolidated within the Form 10-Q due to rounding.

Jack in the Box Inc.

Page 17

Franchise-Level Margin

Franchise-Level Margin is defined as franchise revenues less franchise operating costs (occupancy expenses, advertising contributions, and franchise support and other costs) and is neither required by, nor presented in accordance with GAAP. Franchise-Level Margin excludes revenue and expenses of our company-operated restaurants and selling, general, and administrative expenses. Certain other costs, such as depreciation and amortization, other operating expenses, net, gains/ losses on the sale of company-operated restaurants, and other costs that are considered normal operating costs are excluded as they are considered corporate-level shared service costs. As such, Franchise-Level Margin is not indicative of the overall results of the company and does not accrue directly to the benefit of shareholders because of the exclusion of corporate-level expenses. Franchise-Level Margin should be considered as a supplement to, not as a substitute for, analysis of results as reported under GAAP or other similarly titled measures of other companies. The company is presenting Franchise-Level Margin because it believes that it provides a meaningful supplement to net earnings of the company's core business operating results, as well as a comparison to those of other similar companies. Management utilizes Franchise-Level Margin as a key performance indicator to evaluate the profitability of our franchise operations.

Below is a reconciliation of non-GAAP Franchise-Level Margin to the most directly comparable GAAP measure, earnings from operations (in thousands):

Jack in the Box Inc.

Page 18

| | | | | | | | | | | | | | | | | | | | | | |

| | 16 weeks ended January 19, 2025 | | |

| | Jack in the Box | Del Taco | Other (1) | Total (2) | | | | | |

| Earnings from operations - GAAP | | $ | 113,151 | | $ | 10,546 | | $ | (49,485) | | $ | 74,212 | | | | | | |

| Company restaurant sales | | (133,755) | | (67,651) | | — | | (201,406) | | | | | | |

| Food and packaging | | 34,690 | | 16,959 | | — | | 51,649 | | | | | | |

| Payroll and employee benefits | | 44,528 | | 25,745 | | — | | 70,273 | | | | | | |

| Occupancy and other | | 23,540 | | 15,606 | | — | | 39,146 | | | | | | |

| Selling, general and administrative expenses | | 12,274 | | 8,597 | | 29,800 | | 50,671 | | | | | | |

| Depreciation and amortization | | — | | — | | 18,270 | | 18,270 | | | | | | |

| Pre-opening costs | | 1,457 | | 19 | | — | | 1,476 | | | | | | |

| | | | | | | | | | |

| Other operating expenses, net | | 1,216 | | 888 | | 1,415 | | 3,519 | | | | | | |

| Gains on the sale of company-operated restaurants | | — | | (2,806) | | — | | (2,806) | | | | | | |

| Franchise-Level Margin - Non-GAAP | | $ | 97,101 | | $ | 7,903 | | $ | — | | $ | 105,004 | | | | | | |

| | | | | | | | | | |

| Franchise rental revenues | | $ | 105,781 | | $ | 10,765 | | $ | — | | $ | 116,546 | | | | | | |

| Franchise royalties and other | | 63,615 | | 10,419 | | — | | 74,034 | | | | | | |

| Franchise contributions for advertising and other services | | 67,913 | | 9,539 | | — | | 77,452 | | | | | | |

| Total franchise revenues | | $ | 237,309 | | $ | 30,723 | | $ | — | | $ | 268,032 | | | | | | |

| | | | | | | | | | |

| Franchise-Level Margin % - Non-GAAP | | 40.9 | % | 25.7 | % | N/A | 39.2 | % | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 16 weeks ended January 21, 2024 |

| | | | | | | Jack in the Box | Del Taco | Other (1) | Total (2) |

| Earnings from operations - GAAP | | | | | | | $ | 117,707 | | $ | 11,073 | | $ | (49,300) | | $ | 79,480 | |

| Company restaurant sales | | | | | | | (132,057) | | (91,983) | | — | | (224,040) | |

| Food and packaging | | | | | | | 39,261 | | 24,872 | | — | | 64,133 | |

| Payroll and employee benefits | | | | | | | 40,689 | | 32,366 | | — | | 73,055 | |

| Occupancy and other | | | | | | | 21,659 | | 20,394 | | — | | 42,053 | |

| Selling, general and administrative expenses | | | | | | | 10,841 | | 10,316 | | 25,117 | | 46,274 | |

| Depreciation and amortization | | | | | | | — | | — | | 18,473 | | 18,473 | |

| Pre-opening costs | | | | | | | 343 | | 122 | | — | | 465 | |

| | | | | | | | | | |

| Other operating expenses, net | | | | | | | 667 | | (1,117) | | 5,710 | | 5,260 | |

| (Gains) losses on the sale of company-operated restaurants | | | | | | | (1,655) | | 1,909 | | — | | 254 | |

| Franchise-Level Margin - Non-GAAP | | | | | | | $ | 97,455 | | $ | 7,952 | | $ | — | | $ | 105,407 | |

| | | | | | | | | | |

| Franchise rental revenues | | | | | | | $ | 105,578 | | $ | 7,618 | | $ | — | | $ | 113,196 | |

| Franchise royalties and other | | | | | | | 63,343 | | 9,987 | | — | | 73,330 | |

| Franchise contributions for advertising and other services | | | | | | | 67,362 | | 9,569 | | — | | 76,931 | |

| Total franchise revenues | | | | | | | $ | 236,283 | | $ | 27,174 | | $ | — | | $ | 263,457 | |

| | | | | | | | | | |

| Franchise-Level Margin % - Non-GAAP | | | | | | | 41.2 | % | 29.3 | % | N/A | 40.0 | % |

(1) The "Other" category includes shared services costs and other unallocated costs

(2) The totals might not agree to consolidated within the Form 10-Q due to rounding.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

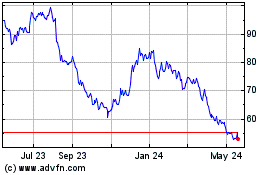

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Jan 2025 to Feb 2025

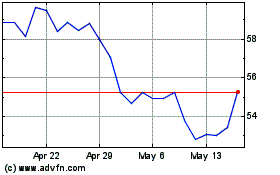

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Feb 2024 to Feb 2025