FALSE00018112107373 Gateway BoulevardNewarkCA00018112102025-02-212025-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 21, 2025

Lucid Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39408 | 85-0891392 |

(State or other jurisdiction of

incorporation or organization) | (Commission File

Number) | (I.R.S. Employer Identification No.) |

| | |

7373 Gateway Boulevard Newark, CA |

| 94560 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (510) 648-3553

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | | LCID | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 25, 2025, Lucid Group, Inc. (“Lucid” or the “Company”) announced that Peter Rawlinson, the Company’s Chief Executive Officer (“CEO”) and Chief Technology Officer, resigned from his positions and the Company’s board of directors (the “Board”) on February 21, 2025 (the “Effective Date”). On the Effective Date, Mr. Rawlinson was appointed as Strategic Technical Advisor to the Chairman of the Board and will be available in this role through February 21, 2027. Mr. Rawlinson’s departure is not related to any disagreements with the Company on any matter relating to its operations, policies, or practices (financial or otherwise), or any issues regarding financial disclosures, accounting or legal matters. Attached as Exhibit 17.1 is a copy of Mr. Rawlinson’s letter of resignation.

On the Effective Date, in connection with Mr. Rawlinson’s departure, the Board appointed Marc Winterhoff, the current Chief Operating Officer (“COO”) of the Company, as Interim CEO, effective immediately.

Additional information regarding the foregoing actions is set forth below.

Transition Agreement for Mr. Rawlinson

The Company has entered into a transition agreement with Mr. Rawlinson (the “Transition Agreement”). Subject to the terms of the Transition Agreement, Mr. Rawlinson will be entitled to receive: (i) a monthly payment of $120,000 for services rendered during the 24-month consulting term (the “Consulting Term”), (ii) a Lucid vehicle, (iii) Company-paid COBRA health insurance premiums, (iv) in each calendar year of 2025 and 2026, a payment of up to $10,000 for tax preparation services (including an additional true-up payment equal to the amount of personal income tax due in connection with such payment), and (v) a supplemental restricted stock unit grant for that number of shares having an aggregate grant date fair value of $2,000,000, which will vest in three equal installments over a 24-month period on the following dates: (A) February 21, 2026, (B) August 21, 2026, and (C) February 21, 2027.

The foregoing description of the terms of Mr. Rawlinson’s Transition Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of his Transition Agreement, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ending March 31, 2025.

Appointment of Interim Chief Executive Officer

Marc Winterhoff, the current COO of the Company, has been appointed as Interim CEO until the next CEO is identified. The Board will conduct a search process to identify the next CEO.

Mr. Winterhoff, age 56, has been the Company’s COO since December 2023, with responsibility for overseeing the Company’s operational efficiency, international expansion, go-to-market strategy, and manufacturing operations. Prior to joining the Company, Mr. Winterhoff was a partner at Roland Berger, the European management consultancy, where he focused on operational leadership for large automotive manufacturers, managing manufacturing and cost efficiency, introduction of sales, service, and new mobility concepts, and long-term strategies for renowned automotive brands. Mr. Winterhoff holds a M.A. in electrical and electronics engineering and management from the Technische Universität Darmstadt.

In connection with his appointment, Mr. Winterhoff’s annual base salary and annual incentive plan bonus opportunities will remain the same, and Mr. Winterhoff will receive the following additional compensation and benefits: (i) a monthly stipend of $20,000 for any month or partial month that Mr. Winterhoff serves as the Interim CEO; (ii) an award of restricted stock units with a grant value of $4,000,000 granted pursuant to the Lucid Group, Inc. Second Amended and Restated 2021 Stock Incentive Plan, which will vest quarterly over sixteen quarters on Lucid’s Company Vesting Dates (March 5, June 5, September 5, December 5), and provides for accelerated vesting protections upon a termination without cause or resignation following a constructive termination; (iii) an increase from nine months’ pay and benefits to twelve months’ pay and benefits that Mr. Winterhoff is eligible to receive under the Lucid Group, Inc. Executive Severance Plan; and (iv) elevated executive security services as needed.

There is no arrangement or understanding with any person pursuant to which Mr. Winterhoff was appointed as Interim CEO. Mr. Winterhoff does not have any family relationship with any director or executive officer of the Company, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The foregoing description of the terms of Mr. Winterhoff’s promotion does not purport to be complete and is qualified in its entirety by reference to the full text of his promotion letter, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ending March 31, 2025.

Item 7.01 Regulation FD Disclosure.

The information contained in Item 5.02 of this Current Report on Form 8-K is incorporated by reference herein.

On February 25, 2025, the Company issued a press release (the “Press Release”) announcing the Company’s CEO transition as described herein. A copy of this Press Release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| 17.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: February 25, 2025 | | |

| | |

| Lucid Group, Inc. |

| | |

| By: | /s/ Gagan Dhingra |

| | Gagan Dhingra |

| | Interim Chief Financial Officer |

Friday, February 21, 2025

Dear Board of Directors:

Now that we have successfully launched the Lucid Gravity, I have decided it is finally the right time for me to step aside from my roles including CEO, CTO, and as a member of the Board of Directors at Lucid.

I am incredibly proud of the accomplishments the Lucid team have achieved together through my tenure of these past twelve years. We grew from a tiny company with a big ambition, to a widely recognized technological world leader in sustainable mobility. It has been my honor to have led and grown this remarkable, truly world class team, because Lucid has always been first and foremost about a team effort.

Aside from co-founding Lucid and guiding its growth into a public company, we have been able to create and realize in production the most advanced car in the world, the widely acclaimed Lucid Air, incorporating many of my technical concepts to advance the state-of-the-art of electric cars, in line with the vision of innovation I set for the company. Together we have created, developed and started production of the Lucid Gravity, which is set to establish new standards of what an SUV can be. Also, very recently, I have had the satisfaction of signing off the advanced engineering phase of two of the three planned Lucid Midsize variants of our forthcoming $50k world car platform. These will now progress through to their development and industrialization phases. Our new Atlas electric powertrain is well under development, and aside from powering Midsize, is set to establish new standards in cost effective electromobility.

We recently successfully completed a significant expansion of our Arizona factory in readiness for Lucid Gravity, and our second factory is well underway in Saudi Arabia. We’ve also paved the way for Lucid to be a technology supplier, with a deal already in place to power Aston Martin’s electric future, and hopefully many more to come. It’s vital to recognize that any such supply deals are in addition to our car business, not in lieu of. Such is the potential enormity of opportunity in this space.

But against this backdrop, it should not be forgotten that the single most important thing we have achieved is to advance the state of the art of sustainable mobility, for it is this which will yield profound benefits for all mankind, both tomorrow and for future generations to inherit. Specifically, Lucid has developed technological solutions to travel further with less energy, in ways previously widely considered impossible. This is true sustainability in action.

As I step aside it’s important to recognize that Lucid has always been about the team, and the time has now come for me to hand the baton to that very team.

I would like to take this opportunity to thank everyone at Lucid, our partners, and the Public Investment Fund for their steadfast support. Serving Lucid has been the privilege of a lifetime, and I entrust the Lucid team to be good stewards of this rare and precious company.

I look forward to continuing to serve as Strategic Technical Advisor to the Chairman of the Board and hence I am delighted to remain a part of the Lucid family to support the continued success and growth of the company.

Peter Rawlinson

Lucid Announces CEO Transition

Peter Rawlinson steps aside from prior roles, transitions to Strategic Technical Advisor to the Chairman, Marc Winterhoff Appointed Interim CEO

NEWARK, CA., February 25, 2025 – Lucid Group, Inc. (NASDAQ: LCID), maker of the world’s most advanced electric vehicles, today announced Peter Rawlinson has stepped aside from his prior roles. He will transition to the role of Strategic Technical Advisor to the Chairman of the Board. Marc Winterhoff, Chief Operating Officer, has been appointed Interim Chief Executive Officer.

As part of the company’s regular succession planning process, the Board has initiated a search to identify Lucid’s next Chief Executive Officer with the support of a leading executive search firm. The new CEO will help Lucid execute its strategy and prepare for the next chapter.

“Now that we have successfully launched the Lucid Gravity, I have decided it is finally the right time for me to step aside from my roles at Lucid,” said Rawlinson. “I am incredibly proud of the accomplishments the Lucid team have achieved together through my tenure of these past twelve years. We grew from a tiny company with a big ambition, to a widely recognized technological world leader in sustainable mobility. It has been my honor to have led and grown this remarkable, truly world-class organization, because Lucid has always been first and foremost about a team effort. The time has now come for me to hand the baton to that very team. I would like to take this opportunity to thank everyone at Lucid, our partners, and the Public Investment Fund for their steadfast support. Serving Lucid has been the privilege of a lifetime and I look forward to continuing to contribute as Strategic Technical Advisor to the Chairman of the Board. I am delighted to remain part of the Lucid family to support the continued success and growth of the company.”

“On behalf of the Board, I would like to thank Peter for his years of service and dedication to Lucid as CEO and CTO. Since launching Lucid in 2016, Peter has been instrumental in the company’s transition from concept to reality and in developing unique, world-leading technology that has defined the next generation of EVs,” said Turqi Alnowaiser, Chairman of the Lucid Board of Directors. “Having assembled a deep bench of technology leaders and positioned the company for its next phase, Peter has decided to step aside from the day-to-day operations and take on an advisory role. With his extensive background in the automotive industry, Marc is uniquely suited to leading the company during this transition period. The Board looks forward to partnering with Marc and our talented senior leadership team as we execute our strategic initiatives to position the company for long-term growth and gross margin improvement. Under Marc’s leadership, we expect business and operations to continue as usual.”

“Lucid’s technology leadership is now well-established and our roadmap well-defined,” said Winterhoff. “I am honored to step into this role as we enter the next stage in our transformational journey, and I look forward to capitalizing on the tremendous opportunity this presents. Our team remains focused on further ramping production of the Lucid Gravity, preparing for the launch of our three midsize platform vehicles, and continuing development of our low-cost Atlas drive unit while we aggressively reduce our costs.”

About Lucid Group

Lucid (NASDAQ: LCID) is a Silicon Valley-based technology company focused on creating the most advanced EVs in the world. The award-winning Lucid Air and new Lucid Gravity deliver best-in-class performance, sophisticated design, expansive interior space and unrivaled energy efficiency. Lucid assembles both vehicles in its state-of-the-art, vertically integrated factory in Arizona. Through its industry-leading technology and innovations, Lucid is advancing the state-of-the-art of EV technology for the benefit of all.

Investor Relations Contact

investor@lucidmotors.com

Media Contact

media@lucidmotors.com

Forward-Looking Statements

This communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “shall,” “expect,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding plans and expectations with respect to the production ramp-up of the Lucid Gravity, the Midsize platform, lower cost drive unit, plans and expectations with respect to cost reduction and gross margin improvement, plans and expectations regarding management transition as well as Lucid’s future operations. Actual events and circumstances may differ from these forward-looking statements. These forward-looking statements are subject to a number of risks and uncertainties, including those factors discussed under the heading “Risk Factors” in Part I, Item 1A of Lucid’s Annual Report on Form 10-K for the year ended December 31, 2024, as well as in other documents Lucid has filed or will file with the Securities and Exchange Commission. If any of these risks materialize or Lucid’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Lucid currently does not know or that Lucid currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Lucid’s expectations, plans or forecasts of future events and views as of the date of this communication. Lucid anticipates that subsequent events and developments will cause Lucid’s assessments to change. However, while Lucid may elect to update these forward-looking statements at some point in the future, Lucid specifically disclaims any obligation to do so. Accordingly, undue reliance should not be placed upon the forward-looking statements.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

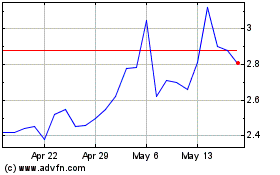

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Jan 2025 to Feb 2025

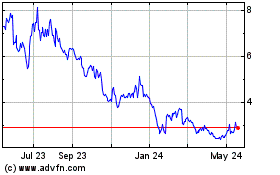

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Feb 2024 to Feb 2025