UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| Matthews International Corporation

|

(Name of Registrant as Specified In Its Charter)

|

| |

BARINGTON COMPANIES EQUITY PARTNERS, L.P.

BARINGTON COMPANIES INVESTORS, LLC

BARINGTON CAPITAL GROUP, L.P.

LNA CAPITAL CORP.

JAMES MITAROTONDA

ANA B. AMICARELLA

CHAN W. GALBATO

1 NBL EH, LLC

JOSEPH GROMEK

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Barington Companies Equity

Partners, L.P. (“Barington”), together with the other participants named herein, has filed a definitive proxy statement and

accompanying GOLD universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes

for the election of Barington’s slate of director nominees at the 2025 annual meeting of shareholders (the “Annual Meeting”)

of Matthews International Corporation, a Pennsylvania corporation (the “Company”).

Item 1: On January 23, 2025, Barington

issued the following press release, which attached certain material that was previously filed with the SEC:

Barington Capital Group Releases Investor Presentation

Outlining the Path to Maximizing Value at Matthews International Corporation

Details Prolonged Period of Shareholder Value Destruction

Caused by Poor Performance, Poor Operating Execution and Poor Capital Allocation

Believes CEO and Incumbent Board Are Ineffective,

Over Tenured and Entrenched and Cannot be Trusted to Oversee Much-Needed Change Following Years of Empty Promises

Barington’s Nominees Bring the Leadership

Experience and Sector Expertise the Board Urgently Needs to Unlock Matthews’ Embedded Value

Urges Shareholders to Vote the GOLD

Proxy Card “FOR” the Election of ALL of Barington Capital’s Nominees

NEW YORK, January 23, 2025 – Barington

Capital Group, L.P. (“Barington Capital”), a fundamental, value-oriented activist investor that, together with the other participants

in its solicitation (collectively “Barington” or “we”), beneficially owns approximately 1.9% of the outstanding

shares of Matthews International Corporation (NASDAQ: MATW) (“Matthews” or the “Company”), today announced that

it has released a comprehensive presentation outlining the path to maximizing value at Matthews following a prolonged period of shareholder

value destruction overseen by the Company’s long-tenured Board of Directors (the “Board”) and Chief Executive Officer.

The presentation also highlights why Barington’s director nominees are the change agents urgently needed on the Board to ensure

the Board is acting in the best interest of shareholders.

Barington encourages Matthews’ shareholders

to review the presentation so they can make an informed decision at the Company’s 2025 Annual Meeting of Shareholders regarding

the future of their investment.

Barington’s presentation can be found at https://barington.com/matthews.

Key highlights of the presentation include:

| · | Barington’s Extended Engagement with

Matthews: Since entering into an agreement in December 2022 pursuant to which Barington served as consultant to the Company, the Matthews

team has kept Barington at arms-length, limiting interactions to mostly quarterly phone calls, and, in our view, demonstrating little

intent to meaningfully engage. As a result, we witnessed little evidence of progress on any of our recommendations until we called for

the Company to replace its CEO and indicated our intent to nominate directors. |

| · | Many Years of Underperformance, Poor Capital

Allocation, Poor Operating Execution and Excessive Spending at Matthews: We believe poor capital allocation and deteriorating operating

results – caused in large part by failed acquisitions and ineffective capital expenditures – have caused Matthews’ shares

to trade at declining multiples since Joseph Bartolacci started his role as CEO in 2006. |

| · | Matthews Has Significant Value Potential:

As set forth in more detail in the presentation, our analysis suggests that the Company’s businesses could have a combined value

of $44-57 per share, not including any additional value from its Energy Storage business. |

| · | Matthews’ CEO and Board are Ineffective,

Over Tenured and Entrenched: We believe Mr. Bartolacci has a long history of using promises of future value creation from the Company’s

investments to divert attention from its deteriorating performance. Worse, we believe the incumbent Board has failed to hold Mr. Bartolacci

accountable for making empty promises that have resulted in shareholder value destruction. |

| · | Change Must Begin at the Top: Despite

Matthews’ claims, we do not believe that the Company is implementing most of Barington’s recommendations. We strongly believe

that a vote for Matthews’ director nominees will embolden the Company to maintain its untenable status quo, resulting in continued

value destruction for shareholders. |

| · | The Strength of Barington’s Nominees:

Barington has nominated Ana Amicarella, Chan Galbato and James Mitarotonda – three highly accomplished executives with much-needed

expertise in key sectors crucial to Matthews’ success, considerable experience leading value-creating businesses as CEO, fresh perspectives

and an unwavering commitment to putting shareholders’ interests first. |

| · | The Path to Driving Long-Term Value Creation

at Matthews: Barington recommends that Matthews immediately: 1) refresh

the Board and improve corporate governance; 2) promptly commence a search for a new CEO; 3) focus on businesses where Matthews can create

long-term shareholder value; and 4) increase the amount of Matthews’ planned SG&A expense reduction and allocate cash to reduce

indebtedness. |

SHOW THE BOARD THAT YOU WILL NO LONGER TOLERATE

THE STATUS QUO AND VOTE THE GOLD PROXY CARD TODAY TO HELP MAXIMIZE VALUE AT MATTHEWS

ABOUT BARINGTON CAPITAL GROUP, L.P.

Barington Capital Group, L.P. is a fundamental, value-oriented

activist investment firm established by James Mitarotonda in January 2000. Barington invests in undervalued publicly traded companies

that Barington believes can appreciate significantly in value when substantive improvements are made to their operations, corporate strategy,

capital allocation and corporate governance. Barington’s investment team, advisors and network of industry experts draw upon their

extensive strategic, operating and boardroom experience to assist companies in designing and implementing initiatives to improve long-term

shareholder value.

Media Contact:

Jonathan Gasthalter/Amanda Shpiner

Gasthalter & Co.

212-257-4170

Important Information and Participants in the Solicitation

Barington has filed a definitive proxy statement and

associated GOLD proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the

election of its slate of highly-qualified director nominees at the upcoming annual meeting of stockholders of the Company. Details regarding

the Barington nominees and the participants in its solicitation are included in its proxy statement and Barington strongly advises all

shareholders of the company to read the proxy statement and other proxy materials as they contain important information.

The participants in Barington’s proxy solicitation

are Barington, Barington Companies Investors, LLC, Barington Capital Group, L.P., LNA Capital Corp., James Mitarotonda, 1 NBL EH, LLC,

Joseph Gromek, Ana B. Amicarella and Chan W. Galbato.

If you have any questions, require assistance in voting

your GOLD universal proxy card,

or need additional copies of Barington’s proxy

materials,

please contact:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Shareholders and All Others Call Toll-Free: (877) 285-5990

E-mail: info@okapipartners.com

Item 2: On January 23, 2025, Barington

uploaded the following material to www.barington.com/matthews:

Important Information and Participants in the Solicitation

Barington has filed a definitive proxy statement and

associated GOLD proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the

election of its slate of highly-qualified director nominees at the upcoming annual meeting of stockholders of the Company. Details regarding

the Barington nominees and the participants in its solicitation are included in its proxy statement and Barington strongly advises all

shareholders of the company to read the proxy statement and other proxy materials as they contain important information.

The participants in Barington’s proxy solicitation

are Barington, Barington Companies Investors, LLC, Barington Capital Group, L.P., LNA Capital Corp., James Mitarotonda, 1 NBL EH, LLC,

Joseph Gromek, Ana B. Amicarella and Chan W. Galbato.

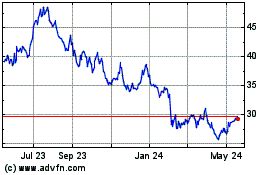

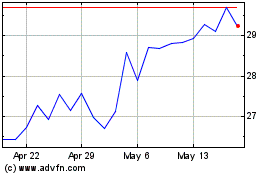

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Jan 2024 to Jan 2025