Matthews International Corporation (NASDAQ GSM: MATW)

(“Matthews” or the “Company”) today sent a letter to its

shareholders emphasizing the Company’s commitment to long-term

value creation.

Key highlights from the letter include:

- Your Board has taken decisive actions to enhance long-term

shareholder value – particularly the strategic sale of SGK Brand

Solutions and the ongoing evaluation of strategic

alternatives.

- Matthews’ stock price increased significantly on the day the

transaction was announced, and the Company’s equity sell side

analysts commended management for the deal.

- Matthews’ nominees offer the diverse and relevant experience

needed to maintain the current momentum.

- Barington’s nominees lack critical skills and were handpicked

by a shareholder with a history of pushing for short-term

gains.

The full text of the letter mailed to shareholders is pasted

below:

January 22, 2025

Dear Fellow Shareholder,

At the upcoming Annual Meeting scheduled for February 20, 2025,

you will have an important decision to make regarding the

composition of the Matthews Board of Directors. This election will

impact the future direction of the Company, which has existed for

175 years, and the value of your investment.

The Matthews Board and management team are pursuing a deliberate

strategy, with board members carefully selected for their skills

and experience relevant to our business. A key component of our

strategic plan is the recently announced sale of SGK Brand

Solutions (SGK), a transformative transaction that provides

Matthews with immediate cash to prioritize debt reduction upon

closing. Furthermore, we are in the middle of a comprehensive

evaluation of strategic alternatives for all of our businesses and

are focused on enhancing long-term value for all of our

shareholders – not just one.

In contrast to our efforts to enhance shareholder value, an

activist investor, Barington Capital, has nominated three directors

for election to the Matthews Board with the stated goal of ousting

the Company’s Chief Executive Officer, Joe Bartolacci, and

immediately monetizing the Company’s growth investments,

potentially for a fraction of their potential value.

We believe this short-term approach will destroy

shareholder value and it’s why we are asking shareholders to

support Matthews’ director nominees – Terry L. Dunlap, Alvaro

Garcia-Tunon and J. Michael Nauman – on the WHITE proxy card

today.

The SGK Transaction Highlights Your

Board’s Prudent Stewardship and Why James Mitarotonda and

Barington’s Other Nominees Won’t Safeguard Your

Investment

Our recently announced sale of SGK demonstrates how your Board’s

thoughtful actions and long-term view have generated value for

shareholders—and why Barington founder James Mitarotonda and his

other nominees are the wrong people to safeguard your investment in

Matthews. In 2019, your Board and management began to evaluate

alternatives for SGK, and after discussing with multiple financial

advisors, believed that it could create significantly more value

for shareholders by improving the SGK business and seeking the

right transaction over time.

In a December 2022 presentation regarding Matthews, Barington

included a valuation estimate for SGK between $453.6 million and

$583.2 million on a pre-corporate EBITDA basis.1 Once you deduct

corporate expenses, Barington’s valuation range would be closer to

$400 million to $500 million.

The Board’s long-term approach to value creation ultimately

delivered superior results:

- Upon closing of the transaction, Matthews will realize $350

million in upfront consideration, the cash portion of which the

Board intends to use for immediate debt repayment.

- Matthews will receive 40% of the common equity in the combined

business and benefit from continued upside, including the potential

for synergies that could lead to a valuation higher than

Barington’s.

- The combined business will have an enterprise value of

approximately $900 million, representing a 9x adjusted EBITDA

multiple on a trailing-twelve-month basis.

This transaction, which is expected to close by mid-2025 pending

receipt of customary regulatory approvals, is the result of a

deliberate process overseen by the Matthews Board and executed by

the Matthews management team. Discussions related to the sale of

SGK began in earnest in 2019, involving five different

counterparties. Contrary to Barington’s statements, your Board

started this sale process long before Barington was even a

shareholder.

If Matthews had pursued a transaction based on Barington’s

projections, it would have generated a short-term benefit at the

expense of long-term value.

The Market is Recognizing the Value of

the SGK Transaction Overseen by Your Board and Executed by Your

Management Team

Matthews’ stock price increased nearly 15 percent on the day the

transaction was announced, and the Company’s equity sell side

analysts commended management for the deal.

For example, JMP Securities stated: “From an economic

perspective, the deal is highly attractive and should begin to

unlock hidden value in MATW’s share price…In summary, we believe

this transaction ‘flips the script’ from the recent macro and

competitive/customer related challenges and sets the stage for a

series of potentially positive and accretive events over the

subsequent 12- 24+ months. While it may take some time, as more

investors become aware of this dynamic, we expect the share price

to continue to drift higher as well.”2

Your Board Continues to Work Deliberately

to Enhance Value. Barington Has Instead Demonstrated a Short-Term

Focus That May Undercut the Value of Matthews

Your Board and management team are responsible for the

value-creating SGK transaction, and your Board and management team

will continue to seek ways to enhance value for shareholders. As we

previously announced, Matthews has retained J.P. Morgan to assist

us with the review of potential strategic alternatives for our

entire portfolio. As part of that process, we expect to announce

several initiatives to enhance long-term value over the course of

2025.

In contrast, we have well-founded concerns that Barington and

its nominees will pursue the same short-sighted approach for the

Company’s other valuable business units that it applied to SGK,

including our Industrial Technologies and Energy Solutions

businesses.

Matthews is Well Positioned to Deliver

Further Value Creation Under Your Board’s Leadership

As you vote at this year’s Annual Meeting, we urge you to

carefully consider the backgrounds of the Matthews Board nominees

vs. those proposed by Barington. On one side, you have Matthews’

nominees, all of whom have been carefully selected. Our nominees

offer many years of expertise at public companies, including across

relevant industrial and manufacturing industries. On the other

side, you have Barington’s nominees who have little to no relevant

experience and a fund manager whose only valid suggestion would

have destroyed long-term shareholder value.

Matthews’ leadership team will be faced with many important

decisions over the coming years. Shareholders are also faced with

an important decision at the Annual Meeting: do you want a Board

with relevant industry experience focused on long-term value

creation or do you want a Board that has Barington candidates who

lack critical skills and were handpicked by a shareholder with a

history of pushing for short-term gains?

Vote Today “FOR” Matthews’ Director

Nominees on the WHITE Proxy Card

and “WITHHOLD” on Barington’s Director Nominees

The Board urges you to DISCARD all gold proxy cards and

materials sent to you by Barington. Shareholders should NOT sign,

return or vote any gold proxy card sent to you by Barington. Only

the latest validly executed proxy card will count at the Annual

Meeting.

Thank you for your investment in Matthews and for your ongoing

support.

Sincerely,The Matthews Board of Directors

|

YOUR VOTE IS IMPORTANT!Your vote is important, and

we ask that you please vote “FOR” the election of

our three nominees: Terry L. Dunlap, Alvaro Garcia-Tunon and J.

Michael Nauman using the WHITE proxy card and

“WITHHOLD” on Barington’s nominees.Simply follow

the easy instructions on the

enclosed WHITE proxy card to vote by

internet or by signing, dating and returning the

WHITE proxy card in the postage-paid envelope

provided. If you received this letter by email, you may also vote

by pressing the WHITE “VOTE NOW” button

in the accompanying email. The Board of Directors urges you to

disregard any such materials and does not endorse any of

Barington’s nominees. If you have any questions or

require any assistance with voting your shares, please call the

Company’s proxy solicitor at: (888) 755-7097

or email MATWinfo@Georgeson.com |

| |

AdvisorsJ.P. Morgan Securities LLC is serving

as financial advisor to Matthews. Sidley Austin LLP is serving as

legal counsel to Matthews.

About Matthews InternationalMatthews

International Corporation is a global provider of memorialization

products, industrial technologies, and brand solutions. The

Memorialization segment is a leading provider of memorialization

products, including memorials, caskets, cremation-related products,

and cremation and incineration equipment, primarily to cemetery and

funeral home customers that help families move from grief to

remembrance. The Industrial Technologies segment includes the

design, manufacturing, service and sales of high-tech custom energy

storage solutions; product identification and warehouse automation

technologies and solutions, including order fulfillment systems for

identifying, tracking, picking and conveying consumer and

industrial products; and coating and converting lines for the

packaging, pharma, foil, décor and tissue industries. The SGK Brand

Solutions segment is a leading provider of packaging solutions and

brand experiences, helping companies simplify their marketing,

amplify their brands and provide value. The Company has over 11,000

employees in more than 30 countries on six continents that are

committed to delivering the highest quality products and

services.

Additional InformationIn connection with the

Company’s 2025 Annual Meeting, the Company has filed with the U.S.

Securities and Exchange Commission (“SEC”) and commenced mailing to

the shareholders of record entitled to vote at the 2025 Annual

Meeting a definitive proxy statement and other documents, including

a WHITE proxy card. SHAREHOLDERS ARE ENCOURAGED TO READ THE

DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) FILED BY THE COMPANY AND ALL OTHER RELEVANT DOCUMENTS WHEN

FILED WITH THE SEC AND WHEN THEY BECOME AVAILABLE BECAUSE THOSE

DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and other

interested parties will be able to obtain the documents free of

charge at the SEC’s website, www.sec.gov, or from the Company

at its website: http://www.matw.com/investors/sec-filings. You

may also obtain copies of the Company’s definitive proxy statement

and other documents, free of charge, by contacting the Company’s

Investor Relations Department at Matthews International

Corporation, Two NorthShore Center, Pittsburgh, Pennsylvania

15212-5851, Attention: Investor Relations, telephone (412)

442-8200.

Participants in the SolicitationThe

participants in the solicitation of proxies in connection with the

2025 Annual Meeting are the Company, Alvaro Garcia-Tunon, Gregory

S. Babe, Joseph C. Bartolacci, Katherine E. Dietze, Terry L.

Dunlap, Lillian D. Etzkorn, Morgan K. O’Brien, J. Michael Nauman,

Aleta W. Richards, David A. Schawk, Jerry R. Whitaker, Francis S.

Wlodarczyk, Steven F. Nicola and Brian D. Walters.

Certain information about the compensation of the Company’s

named executive officers and non-employee directors and the

participants’ holdings of the Company’s Common Stock is set forth

in the sections entitled “Compensation of Directors” (on page 36

and available here), “Stock Ownership of Certain Beneficial

Owners and Management” (on page 64 and available here),

“Executive Compensation and Retirement Benefits” (on page 66 and

available here), and “Appendix A” (on page A-1 and

available here), respectively, in the Company’s definitive

proxy statement, dated January 7, 2025, for its 2025 Annual Meeting

as filed with the SEC on Schedule 14A, available here.

Additional information regarding the interests of these

participants in the solicitation of proxies in respect of the 2025

Annual Meeting and other relevant materials will be filed with the

SEC when they become available. These documents are or will be

available free of charge at the SEC’s website

at www.sec.gov.

Forward-Looking StatementsAny forward-looking

statements contained in this release are included pursuant to the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, but

are not limited to, statements regarding the expectations, hopes,

beliefs, intentions or strategies of the Company regarding the

future, including statements regarding the anticipated timing and

benefits of the proposed joint venture transaction, and may be

identified by the use of words such as “expects,” “believes,”

“intends,” “projects,” “anticipates,” “estimates,” “plans,”

“seeks,” “forecasts,” “predicts,” “objective,” “targets,”

“potential,” “outlook,” “may,” “will,” “could” or the negative of

these terms, other comparable terminology and variations thereof.

Such forward-looking statements involve known and unknown risks and

uncertainties that may cause the Company’s actual results in future

periods to be materially different from management’s expectations,

and no assurance can be given that such expectations will prove

correct. Factors that could cause the Company’s results to differ

materially from the results discussed in such forward-looking

statements principally include our ability to satisfy the

conditions precedent to the consummation of the proposed joint

venture transaction on the expected timeline or at all, our ability

to achieve the anticipated benefits of the proposed joint venture

transaction, uncertainties regarding future actions that may be

taken by Barington in furtherance of its intention to nominate

director candidates for election at the Company’s 2025 Annual

Meeting, potential operational disruption caused by Barington’s

actions that may make it more difficult to maintain relationships

with customers, employees or partners, changes in domestic or

international economic conditions, changes in foreign currency

exchange rates, changes in interest rates, changes in the cost of

materials used in the manufacture of the Company’s products, any

impairment of goodwill or intangible assets, environmental

liability and limitations on the Company’s operations due to

environmental laws and regulations, disruptions to certain

services, such as telecommunications, network server maintenance,

cloud computing or transaction processing services, provided to the

Company by third-parties, changes in mortality and cremation rates,

changes in product demand or pricing as a result of consolidation

in the industries in which the Company operates, or other factors

such as supply chain disruptions, labor shortages or labor cost

increases, changes in product demand or pricing as a result of

domestic or international competitive pressures, ability to achieve

cost-reduction objectives, unknown risks in connection with the

Company’s acquisitions and divestitures, cybersecurity concerns and

costs arising with management of cybersecurity threats,

effectiveness of the Company’s internal controls, compliance with

domestic and foreign laws and regulations, technological factors

beyond the Company’s control, impact of pandemics or similar

outbreaks, or other disruptions to our industries, customers, or

supply chains, the impact of global conflicts, such as the current

war between Russia and Ukraine, the outcome of the Company’s

dispute with Tesla, Inc. (“Tesla”), the Company’s plans and

expectations with respect to its exploration, and contemplated

execution, of various strategies with respect to its portfolio of

businesses, the Company’s plans and expectations with respect to

its Board, and other factors described in the Company’s Annual

Report on Form 10-K and other periodic filings with the U.S.

Securities and Exchange Commission.

Matthews International CorporationCorporate

OfficeTwo NorthShore CenterPittsburgh, PA 15212-5851Phone: (412)

442-8200

ContactsMatthews International

Co.Steven F.

Nicola Chief

Financial Officer and Secretary(412) 442-8262

Sodali & Co.Michael Verrechia/Bill

Dooley(800) 662-5200MATW@investor.sodali.com

Georgeson LLCBill Fiske / David

FarkasMATWinfo@Georgeson.com

Collected StrategiesDan Moore / Scott Bisang /

Clayton ErwinMATW-CS@collectedstrategies.com

1 Barington Capital Presentation at Bloomberg Activism Forum

(December 12, 2022)2 Permission to use quote neither sought nor

obtained.

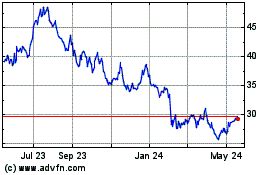

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Dec 2024 to Jan 2025

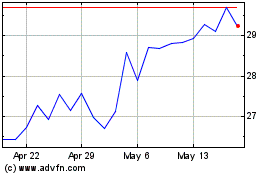

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Jan 2024 to Jan 2025