NVIDIA (NASDAQ: NVDA) today reported revenue for the fourth quarter

ended January 26, 2025, of $39.3 billion, up 12% from the previous

quarter and up 78% from a year ago.

For the quarter, GAAP earnings per diluted share was $0.89, up

14% from the previous quarter and up 82% from a year ago. Non-GAAP

earnings per diluted share was $0.89, up 10% from the previous

quarter and up 71% from a year ago.

For fiscal 2025, revenue was $130.5 billion, up 114% from a year

ago. GAAP earnings per diluted share was $2.94, up 147% from a year

ago. Non-GAAP earnings per diluted share was $2.99, up 130% from a

year ago.

“Demand for Blackwell is amazing as reasoning AI adds another

scaling law — increasing compute for training makes models smarter

and increasing compute for long thinking makes the answer smarter,”

said Jensen Huang, founder and CEO of NVIDIA.

“We’ve successfully ramped up the massive-scale production of

Blackwell AI supercomputers, achieving billions of dollars in sales

in its first quarter. AI is advancing at light speed as agentic AI

and physical AI set the stage for the next wave of AI to

revolutionize the largest industries.”

NVIDIA will pay its next quarterly cash dividend of $0.01 per

share on April 2, 2025, to all shareholders of record on March 12,

2025.

Q4 Fiscal 2025 Summary

|

GAAP |

|

($ in millions, except earnings per share) |

Q4 FY25 |

Q3 FY25 |

Q4 FY24 |

Q/Q |

Y/Y |

| Revenue |

$39,331 |

$35,082 |

$22,103 |

Up 12% |

Up 78% |

| Gross margin |

73.0% |

74.6% |

76.0% |

Down 1.6 pts |

Down 3.0 pts |

| Operating expenses |

$4,689 |

$4,287 |

$3,176 |

Up 9% |

Up 48% |

| Operating income |

$24,034 |

$21,869 |

$13,615 |

Up 10% |

Up 77% |

| Net income |

$22,091 |

$19,309 |

$12,285 |

Up 14% |

Up 80% |

| Diluted earnings per

share* |

$0.89 |

$0.78 |

$0.49 |

Up 14% |

Up 82% |

|

Non-GAAP |

|

($ in millions, except earnings per share) |

Q4 FY25 |

Q3 FY25 |

Q4 FY24 |

Q/Q |

Y/Y |

|

Revenue |

$39,331 |

$35,082 |

$22,103 |

Up 12% |

Up 78% |

| Gross margin |

73.5% |

75.0% |

76.7% |

Down 1.5 pts |

Down 3.2 pts |

| Operating expenses |

$3,378 |

$3,046 |

$2,210 |

Up 11% |

Up 53% |

| Operating income |

$25,516 |

$23,276 |

$14,749 |

Up 10% |

Up 73% |

| Net income |

$22,066 |

$20,010 |

$12,839 |

Up 10% |

Up 72% |

| Diluted earnings per

share* |

$0.89 |

$0.81 |

$0.52 |

Up 10% |

Up 71% |

Fiscal 2025 Summary

|

GAAP |

|

($ in millions, except earnings per share) |

FY25 |

FY24 |

Y/Y |

| Revenue |

$130,497 |

$60,922 |

Up 114% |

| Gross margin |

75.0% |

72.7% |

Up 2.3 pts |

| Operating expenses |

$16,405 |

$11,329 |

Up 45% |

| Operating income |

$81,453 |

$32,972 |

Up 147% |

| Net income |

$72,880 |

$29,760 |

Up 145% |

| Diluted earnings per

share* |

$2.94 |

$1.19 |

Up 147% |

|

Non-GAAP |

|

($ in millions, except earnings per share) |

FY25 |

FY24 |

Y/Y |

| Revenue |

$130,497 |

$60,922 |

Up 114% |

| Gross margin |

75.5% |

73.8% |

Up 1.7 pts |

| Operating expenses |

$11,716 |

$7,825 |

Up 50% |

| Operating income |

$86,789 |

$37,134 |

Up 134% |

| Net income |

$74,265 |

$32,312 |

Up 130% |

| Diluted earnings per

share* |

$2.99 |

$1.30 |

Up 130% |

*All per share amounts presented herein have

been retroactively adjusted to reflect the ten-for-one stock split,

which was effective June 7, 2024.

OutlookNVIDIA’s outlook for the first quarter

of fiscal 2026 is as follows:

- Revenue is expected to be $43.0 billion, plus or minus 2%.

- GAAP and non-GAAP gross margins are expected to be 70.6% and

71.0%, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be

approximately $5.2 billion and $3.6 billion, respectively.

- GAAP and non-GAAP other income and expense are expected to be

an income of approximately $400 million, excluding gains and losses

from non-marketable and publicly-held equity securities.

- GAAP and non-GAAP tax rates are

expected to be 17.0%, plus or minus 1%, excluding any discrete

items.

Highlights

NVIDIA achieved progress since its previous earnings

announcement in these areas:

Data Center

- Fourth-quarter revenue was a record $35.6 billion, up 16% from

the previous quarter and up 93% from a year ago. Full-year revenue

rose 142% to a record $115.2 billion.

- Announced that NVIDIA will serve as a key technology partner

for the $500 billion Stargate Project.

- Revealed that cloud service providers AWS, CoreWeave, Google

Cloud Platform (GCP), Microsoft Azure and Oracle Cloud

Infrastructure (OCI) are bringing NVIDIA® GB200 systems to cloud

regions around the world to meet surging customer demand for

AI.

- Partnered with AWS to make the NVIDIA DGX™ Cloud AI computing

platform and NVIDIA NIM™ microservices available through AWS

Marketplace.

- Revealed that Cisco will integrate NVIDIA Spectrum-X™ into its

networking portfolio to help enterprises build AI

infrastructure.

- Revealed that more than 75% of the systems on the TOP500 list

of the world’s most powerful supercomputers are powered by NVIDIA

technologies.

- Announced a collaboration with Verizon to integrate NVIDIA AI

Enterprise, NIM and accelerated computing with Verizon’s private 5G

network to power a range of edge enterprise AI applications and

services.

- Unveiled partnerships with industry leaders including IQVIA,

Illumina, Mayo Clinic and Arc Institute to advance genomics, drug

discovery and healthcare.

- Launched NVIDIA AI Blueprints and Llama Nemotron model families

for building AI agents and released NVIDIA NIM microservices to

safeguard applications for agentic AI.

- Announced the opening of NVIDIA’s first R&D center in

Vietnam.

- Revealed that Siemens Healthineers has adopted MONAI Deploy for

medical imaging AI.

Gaming and AI PC

- Fourth-quarter Gaming revenue was $2.5 billion, down 22% from

the previous quarter and down 11% from a year ago. Full-year

revenue rose 9% to $11.4 billion.

- Announced new GeForce RTX™ 50 Series graphics cards and laptops

powered by the NVIDIA Blackwell architecture, delivering

breakthroughs in AI-driven rendering to gamers, creators and

developers.

- Launched GeForce RTX 5090 and 5080 graphics cards, delivering

up to a 2x performance improvement over the prior generation.

- Introduced NVIDIA DLSS 4 with Multi Frame Generation and image

quality enhancements, with 75 games and apps supporting it at

launch, and unveiled NVIDIA Reflex 2 technology, which can reduce

PC latency by up to 75%.

- Unveiled NVIDIA NIM microservices, AI Blueprints and the Llama

Nemotron family of open models for RTX AI PCs to help developers

and enthusiasts build AI agents and creative workflows.

Professional Visualization

- Fourth-quarter revenue was $511 million, up 5% from the

previous quarter and up 10% from a year ago. Full-year revenue rose

21% to $1.9 billion.

- Unveiled NVIDIA Project DIGITS, a personal AI supercomputer

that provides AI researchers, data scientists and students

worldwide with access to the power of the NVIDIA Grace™ Blackwell

platform.

- Announced generative AI models and blueprints that expand

NVIDIA Omniverse™ integration further into physical AI

applications, including robotics, autonomous vehicles and vision

AI.

- Introduced NVIDIA Media2, an AI-powered initiative transforming

content creation, streaming and live media experiences, built on

NIM and AI Blueprints.

Automotive and Robotics

- Fourth-quarter Automotive revenue was $570 million, up 27% from

the previous quarter and up 103% from a year ago. Full-year revenue

rose 55% to $1.7 billion.

- Announced that Toyota, the world’s largest automaker, will

build its next-generation vehicles on NVIDIA DRIVE AGX Orin™

running the safety-certified NVIDIA DriveOS operating

system.

- Partnered with Hyundai Motor Group to create safer, smarter

vehicles, supercharge manufacturing and deploy cutting-edge

robotics with NVIDIA AI and NVIDIA Omniverse.

- Announced that the NVIDIA DriveOS safe autonomous driving

operating system received ASIL-D functional safety certification

and launched the NVIDIA DRIVE™ AI Systems Inspection Lab.

- Launched NVIDIA Cosmos™, a platform comprising state-of-the-art

generative world foundation models, to accelerate physical AI

development, with adoption by leading robotics and automotive

companies 1X, Agile Robots, Waabi, Uber and others.

- Unveiled the NVIDIA Jetson Orin Nano™ Super, which delivers up

to a 1.7x gain in generative AI performance.

CFO CommentaryCommentary on the quarter by

Colette Kress, NVIDIA’s executive vice president and chief

financial officer, is available at https://investor.nvidia.com.

Conference Call and Webcast InformationNVIDIA

will conduct a conference call with analysts and investors to

discuss its fourth quarter and fiscal 2025 financial results and

current financial prospects today at 2 p.m. Pacific time (5 p.m.

Eastern time). A live webcast (listen-only mode) of the conference

call will be accessible at NVIDIA’s investor relations website,

https://investor.nvidia.com. The webcast will be recorded and

available for replay until NVIDIA’s conference call to discuss its

financial results for its first quarter of fiscal 2026.

Non-GAAP MeasuresTo supplement NVIDIA’s

condensed consolidated financial statements presented in accordance

with GAAP, the company uses non-GAAP measures of certain components

of financial performance. These non-GAAP measures include non-GAAP

gross profit, non-GAAP gross margin, non-GAAP operating expenses,

non-GAAP operating income, non-GAAP other income (expense), net,

non-GAAP net income, non-GAAP net income, or earnings, per diluted

share, and free cash flow. For NVIDIA’s investors to be better able

to compare its current results with those of previous periods, the

company has shown a reconciliation of GAAP to non-GAAP financial

measures. These reconciliations adjust the related GAAP financial

measures to exclude stock-based compensation expense,

acquisition-related and other costs, other, gains from

non-marketable and publicly-held equity securities, net, interest

expense related to amortization of debt discount, and the

associated tax impact of these items where applicable. Free cash

flow is calculated as GAAP net cash provided by operating

activities less both purchases related to property and equipment

and intangible assets and principal payments on property and

equipment and intangible assets. NVIDIA believes the presentation

of its non-GAAP financial measures enhances the user’s overall

understanding of the company’s historical financial performance.

The presentation of the company’s non-GAAP financial measures is

not meant to be considered in isolation or as a substitute for the

company’s financial results prepared in accordance with GAAP, and

the company’s non-GAAP measures may be different from non-GAAP

measures used by other companies.

|

NVIDIA CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

|

(In millions, except per share data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

January 26, |

|

January 28, |

|

January 26, |

|

January 28, |

|

|

|

|

|

2025 |

|

|

|

2024 |

|

|

|

2025 |

|

|

|

2024 |

|

| |

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

39,331 |

|

|

$ |

22,103 |

|

|

$ |

130,497 |

|

|

$ |

60,922 |

|

| Cost of

revenue |

|

10,608 |

|

|

|

5,312 |

|

|

|

32,639 |

|

|

|

16,621 |

|

| Gross

profit |

|

28,723 |

|

|

|

16,791 |

|

|

|

97,858 |

|

|

|

44,301 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

| |

Research and

development |

|

3,714 |

|

|

|

2,465 |

|

|

|

12,914 |

|

|

|

8,675 |

|

|

|

Sales,

general and administrative |

|

975 |

|

|

|

711 |

|

|

|

3,491 |

|

|

|

2,654 |

|

| |

|

Total operating

expenses |

|

4,689 |

|

|

|

3,176 |

|

|

|

16,405 |

|

|

|

11,329 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

income |

|

24,034 |

|

|

|

13,615 |

|

|

|

81,453 |

|

|

|

32,972 |

|

| |

Interest

income |

|

511 |

|

|

|

294 |

|

|

|

1,786 |

|

|

|

866 |

|

| |

Interest

expense |

|

(61 |

) |

|

|

(63 |

) |

|

|

(247 |

) |

|

|

(257 |

) |

|

|

Other,

net |

|

733 |

|

|

|

260 |

|

|

|

1,034 |

|

|

|

237 |

|

| |

|

Other income (expense),

net |

|

1,183 |

|

|

|

491 |

|

|

|

2,573 |

|

|

|

846 |

|

| |

|

|

|

|

|

|

|

|

|

| Income before

income tax |

|

25,217 |

|

|

|

14,106 |

|

|

|

84,026 |

|

|

|

33,818 |

|

| Income

tax expense |

|

3,126 |

|

|

|

1,821 |

|

|

|

11,146 |

|

|

|

4,058 |

|

| Net

income |

$ |

22,091 |

|

|

$ |

12,285 |

|

|

$ |

72,880 |

|

|

$ |

29,760 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income per

share: |

|

|

|

|

|

|

|

| |

Basic |

$ |

0.90 |

|

|

$ |

0.51 |

|

|

$ |

2.97 |

|

|

$ |

1.21 |

|

| |

Diluted |

$ |

0.89 |

|

|

$ |

0.49 |

|

|

$ |

2.94 |

|

|

$ |

1.19 |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted average

shares used in per share computation: |

|

|

|

|

|

|

|

| |

Basic |

|

24,489 |

|

|

|

24,660 |

|

|

|

24,555 |

|

|

|

24,690 |

|

| |

Diluted |

|

24,706 |

|

|

|

24,900 |

|

|

|

24,804 |

|

|

|

24,940 |

|

|

NVIDIA CORPORATION |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In millions) |

|

(Unaudited) |

| |

|

|

|

|

|

|

| |

|

|

|

January 26, |

|

January 28, |

| |

|

|

|

2025 |

|

2024 |

|

ASSETS |

|

|

|

|

| |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

| |

Cash, cash

equivalents and marketable securities |

|

$ |

43,210 |

|

$ |

25,984 |

| |

Accounts

receivable, net |

|

|

23,065 |

|

|

9,999 |

| |

Inventories |

|

|

10,080 |

|

|

5,282 |

|

|

Prepaid

expenses and other current assets |

|

|

3,771 |

|

|

3,080 |

|

|

|

Total current assets |

|

|

80,126 |

|

|

44,345 |

| |

|

|

|

|

|

|

| Property and

equipment, net |

|

|

6,283 |

|

|

3,914 |

| Operating lease

assets |

|

|

1,793 |

|

|

1,346 |

| Goodwill |

|

|

5,188 |

|

|

4,430 |

| Intangible assets,

net |

|

|

807 |

|

|

1,112 |

| Deferred income

tax assets |

|

|

10,979 |

|

|

6,081 |

| Other

assets |

|

|

6,425 |

|

|

4,500 |

| |

|

Total

assets |

|

$ |

111,601 |

|

$ |

65,728 |

| |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

| |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

| |

Accounts

payable |

|

$ |

6,310 |

|

$ |

2,699 |

| |

Accrued and other

current liabilities |

|

|

11,737 |

|

|

6,682 |

|

|

Short-term debt |

|

|

- |

|

|

1,250 |

| |

|

Total current

liabilities |

|

|

18,047 |

|

|

10,631 |

| |

|

|

|

|

|

|

| Long-term

debt |

|

|

8,463 |

|

|

8,459 |

| Long-term

operating lease liabilities |

|

|

1,519 |

|

|

1,119 |

| Other

long-term liabilities |

|

|

4,245 |

|

|

2,541 |

| |

|

Total

liabilities |

|

|

32,274 |

|

|

22,750 |

| |

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

79,327 |

|

|

42,978 |

| |

|

Total liabilities and

shareholders’ equity |

|

$ |

111,601 |

|

$ |

65,728 |

|

NVIDIA CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In millions) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

January 26, |

|

January 28, |

|

January 26, |

|

January 28, |

|

|

|

|

2025 |

|

|

|

2024 |

|

|

|

2025 |

|

|

|

2024 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

| Net income |

$ |

22,091 |

|

|

$ |

12,285 |

|

|

$ |

72,880 |

|

|

$ |

29,760 |

|

| Adjustments to

reconcile net income to net cash |

|

|

|

|

|

|

|

| provided by

operating activities: |

|

|

|

|

|

|

|

| |

Stock-based

compensation expense |

|

1,321 |

|

|

|

993 |

|

|

|

4,737 |

|

|

|

3,549 |

|

| |

Depreciation and

amortization |

|

543 |

|

|

|

387 |

|

|

|

1,864 |

|

|

|

1,508 |

|

| |

Deferred income

taxes |

|

(598 |

) |

|

|

(78 |

) |

|

|

(4,477 |

) |

|

|

(2,489 |

) |

| |

Gains on

non-marketable equity securities and publicly-held equity

securities, net |

|

(727 |

) |

|

|

(260 |

) |

|

|

(1,030 |

) |

|

|

(238 |

) |

| |

Other |

|

(138 |

) |

|

|

(109 |

) |

|

|

(502 |

) |

|

|

(278 |

) |

| Changes in

operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

|

| |

Accounts

receivable |

|

(5,370 |

) |

|

|

(1,690 |

) |

|

|

(13,063 |

) |

|

|

(6,172 |

) |

| |

Inventories |

|

(2,424 |

) |

|

|

(503 |

) |

|

|

(4,781 |

) |

|

|

(98 |

) |

| |

Prepaid expenses and

other assets |

|

331 |

|

|

|

(1,184 |

) |

|

|

(395 |

) |

|

|

(1,522 |

) |

| |

Accounts payable |

|

867 |

|

|

|

281 |

|

|

|

3,357 |

|

|

|

1,531 |

|

| |

Accrued and other

current liabilities |

|

360 |

|

|

|

1,072 |

|

|

|

4,278 |

|

|

|

2,025 |

|

|

|

Other

long-term liabilities |

|

372 |

|

|

|

305 |

|

|

|

1,221 |

|

|

|

514 |

|

| Net cash

provided by operating activities |

|

16,628 |

|

|

|

11,499 |

|

|

|

64,089 |

|

|

|

28,090 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

| |

Proceeds from

maturities of marketable securities |

|

1,710 |

|

|

|

1,731 |

|

|

|

11,195 |

|

|

|

9,732 |

|

| |

Proceeds from

sales of marketable securities |

|

177 |

|

|

|

50 |

|

|

|

495 |

|

|

|

50 |

|

| |

Proceeds from

sales of non-marketable equity securities |

|

- |

|

|

|

- |

|

|

|

171 |

|

|

|

1 |

|

| |

Purchases of

marketable securities |

|

(7,010 |

) |

|

|

(7,524 |

) |

|

|

(26,575 |

) |

|

|

(18,211 |

) |

| |

Purchase related

to property and equipment and intangible assets |

|

(1,077 |

) |

|

|

(253 |

) |

|

|

(3,236 |

) |

|

|

(1,069 |

) |

| |

Purchases of

non-marketable equity securities |

|

(478 |

) |

|

|

(113 |

) |

|

|

(1,486 |

) |

|

|

(862 |

) |

| |

Acquisitions, net

of cash acquired |

|

(542 |

) |

|

|

- |

|

|

|

(1,007 |

) |

|

|

(83 |

) |

|

|

Other |

|

22 |

|

|

|

- |

|

|

|

22 |

|

|

|

(124 |

) |

| Net cash

used in investing activities |

|

(7,198 |

) |

|

|

(6,109 |

) |

|

|

(20,421 |

) |

|

|

(10,566 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

| |

Proceeds related

to employee stock plans |

|

- |

|

|

|

- |

|

|

|

490 |

|

|

|

403 |

|

| |

Payments related

to repurchases of common stock |

|

(7,810 |

) |

|

|

(2,660 |

) |

|

|

(33,706 |

) |

|

|

(9,533 |

) |

| |

Payments related

to tax on restricted stock units |

|

(1,861 |

) |

|

|

(841 |

) |

|

|

(6,930 |

) |

|

|

(2,783 |

) |

| |

Repayment of

debt |

|

- |

|

|

|

- |

|

|

|

(1,250 |

) |

|

|

(1,250 |

) |

| |

Dividends

paid |

|

(245 |

) |

|

|

(99 |

) |

|

|

(834 |

) |

|

|

(395 |

) |

| |

Principal payments

on property and equipment and intangible assets |

|

(32 |

) |

|

|

(29 |

) |

|

|

(129 |

) |

|

|

(74 |

) |

|

|

Other |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

| Net cash

used in financing activities |

|

(9,948 |

) |

|

|

(3,629 |

) |

|

|

(42,359 |

) |

|

|

(13,633 |

) |

| |

|

|

|

|

|

|

|

|

| Change in cash,

cash equivalents, and restricted cash |

|

(518 |

) |

|

|

1,761 |

|

|

|

1,309 |

|

|

|

3,891 |

|

| Cash,

cash equivalents, and restricted cash at beginning of period |

|

9,107 |

|

|

|

5,519 |

|

|

|

7,280 |

|

|

|

3,389 |

|

| Cash, cash

equivalents, and restricted cash at end of period |

$ |

8,589 |

|

|

$ |

7,280 |

|

|

$ |

8,589 |

|

|

$ |

7,280 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

| Cash paid for

income taxes, net |

$ |

4,129 |

|

|

$ |

1,874 |

|

|

$ |

15,118 |

|

|

$ |

6,549 |

|

| Cash paid for

interest |

$ |

22 |

|

|

$ |

26 |

|

|

$ |

246 |

|

|

$ |

252 |

|

| |

NVIDIA CORPORATION |

| |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES |

| |

(In millions, except per share data) |

| |

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

|

|

January 26, |

|

October 27, |

|

January 28, |

|

January 26, |

|

January 28, |

|

|

|

|

|

|

2025 |

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2025 |

|

|

|

2024 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP cost of

revenue |

$ |

10,608 |

|

|

$ |

8,926 |

|

|

$ |

5,312 |

|

|

$ |

32,639 |

|

|

$ |

16,621 |

|

| |

GAAP gross

profit |

$ |

28,723 |

|

|

$ |

26,156 |

|

|

$ |

16,791 |

|

|

$ |

97,858 |

|

|

$ |

44,301 |

|

| |

GAAP

gross margin |

|

73.0 |

% |

|

|

74.6 |

% |

|

|

76.0 |

% |

|

|

75.0 |

% |

|

|

72.7 |

% |

| |

|

Acquisition-related

and other costs (A) |

|

118 |

|

|

|

116 |

|

|

|

119 |

|

|

|

472 |

|

|

|

477 |

|

| |

|

Stock-based

compensation expense (B) |

|

53 |

|

|

|

50 |

|

|

|

45 |

|

|

|

178 |

|

|

|

141 |

|

| |

|

Other (C) |

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

(3 |

) |

|

|

40 |

|

| |

Non-GAAP cost

of revenue |

$ |

10,437 |

|

|

$ |

8,759 |

|

|

$ |

5,144 |

|

|

$ |

31,992 |

|

|

$ |

15,963 |

|

| |

Non-GAAP gross profit |

$ |

28,894 |

|

|

$ |

26,322 |

|

|

$ |

16,959 |

|

|

$ |

98,505 |

|

|

$ |

44,959 |

|

| |

Non-GAAP gross margin |

|

73.5 |

% |

|

|

75.0 |

% |

|

|

76.7 |

% |

|

|

75.5 |

% |

|

|

73.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP operating

expenses |

$ |

4,689 |

|

|

$ |

4,287 |

|

|

$ |

3,176 |

|

|

$ |

16,405 |

|

|

$ |

11,329 |

|

| |

|

Stock-based compensation expense

(B) |

|

|

(1,268 |

) |

|

|

(1,202 |

) |

|

|

(948 |

) |

|

|

(4,559 |

) |

|

|

(3,408 |

) |

| |

|

Acquisition-related

and other costs (A) |

|

(43 |

) |

|

|

(39 |

) |

|

|

(18 |

) |

|

|

(130 |

) |

|

|

(106 |

) |

| |

|

Other (C) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10 |

|

| |

Non-GAAP

operating expenses |

$ |

3,378 |

|

|

$ |

3,046 |

|

|

$ |

2,210 |

|

|

$ |

11,716 |

|

|

$ |

7,825 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP operating

income |

$ |

24,034 |

|

|

$ |

21,869 |

|

|

$ |

13,615 |

|

|

$ |

81,453 |

|

|

$ |

32,972 |

|

| |

|

Total

impact of non-GAAP adjustments to operating income |

|

1,482 |

|

|

|

1,407 |

|

|

|

1,134 |

|

|

|

5,336 |

|

|

|

4,162 |

|

| |

Non-GAAP

operating income |

$ |

25,516 |

|

|

$ |

23,276 |

|

|

$ |

14,749 |

|

|

$ |

86,789 |

|

|

$ |

37,134 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP other income

(expense), net |

$ |

1,183 |

|

|

$ |

447 |

|

|

$ |

491 |

|

|

$ |

2,573 |

|

|

$ |

846 |

|

| |

|

Gains from

non-marketable equity securities and publicly-held equity

securities, net |

|

(727 |

) |

|

|

(37 |

) |

|

|

(260 |

) |

|

|

(1,030 |

) |

|

|

(238 |

) |

| |

|

Interest

expense related to amortization of debt discount |

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

4 |

|

| |

Non-GAAP

other income (expense), net |

$ |

457 |

|

|

$ |

411 |

|

|

$ |

232 |

|

|

$ |

1,547 |

|

|

$ |

612 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP net income |

$ |

22,091 |

|

|

$ |

19,309 |

|

|

$ |

12,285 |

|

|

$ |

72,880 |

|

|

$ |

29,760 |

|

| |

|

Total pre-tax impact

of non-GAAP adjustments |

|

756 |

|

|

|

1,371 |

|

|

|

875 |

|

|

|

4,310 |

|

|

|

3,928 |

|

| |

|

Income tax

impact of non-GAAP adjustments (D) |

|

(781 |

) |

|

|

(670 |

) |

|

|

(321 |

) |

|

|

(2,925 |

) |

|

|

(1,376 |

) |

| |

Non-GAAP net

income |

$ |

22,066 |

|

|

$ |

20,010 |

|

|

$ |

12,839 |

|

|

$ |

74,265 |

|

|

$ |

32,312 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted net income

per share (E) |

|

|

|

|

|

|

|

|

|

| |

|

GAAP |

|

$ |

0.89 |

|

|

$ |

0.78 |

|

|

$ |

0.49 |

|

|

$ |

2.94 |

|

|

$ |

1.19 |

|

| |

|

Non-GAAP |

|

$ |

0.89 |

|

|

$ |

0.81 |

|

|

$ |

0.52 |

|

|

$ |

2.99 |

|

|

$ |

1.30 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average

shares used in diluted net income per share computation (E) |

|

24,706 |

|

|

|

24,774 |

|

|

|

24,900 |

|

|

|

24,804 |

|

|

|

24,936 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP net cash

provided by operating activities |

$ |

16,628 |

|

|

$ |

17,629 |

|

|

$ |

11,499 |

|

|

$ |

64,089 |

|

|

$ |

28,090 |

|

| |

|

Purchases related to

property and equipment and intangible assets |

|

(1,077 |

) |

|

|

(813 |

) |

|

|

(253 |

) |

|

|

(3,236 |

) |

|

|

(1,069 |

) |

| |

|

Principal

payments on property and equipment and intangible assets |

|

(32 |

) |

|

|

(29 |

) |

|

|

(29 |

) |

|

|

(129 |

) |

|

|

(74 |

) |

| |

Free cash

flow |

|

$ |

15,519 |

|

|

$ |

16,787 |

|

|

$ |

11,217 |

|

|

$ |

60,724 |

|

|

$ |

26,947 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(A) Acquisition-related and other costs are comprised of

amortization of intangible assets, transaction costs, and certain

compensation charges and are included in the following line

items: |

| |

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

|

|

January 26, |

|

October 27, |

|

January 28, |

|

January 26, |

|

January 28, |

| |

|

|

|

|

2025 |

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2025 |

|

|

|

2024 |

|

| |

|

Cost of revenue |

|

$ |

118 |

|

|

$ |

116 |

|

|

$ |

119 |

|

|

$ |

472 |

|

|

$ |

477 |

|

| |

|

Research and development |

|

$ |

27 |

|

|

$ |

23 |

|

|

$ |

12 |

|

|

$ |

79 |

|

|

$ |

49 |

|

| |

|

Sales, general and

administrative |

|

$ |

16 |

|

|

$ |

16 |

|

|

$ |

6 |

|

|

$ |

51 |

|

|

$ |

57 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(B)

Stock-based compensation consists of the following: |

|

|

|

| |

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

|

|

January 26, |

|

October 27, |

|

January 28, |

|

January 26, |

|

January 28, |

| |

|

|

|

|

2025 |

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2025 |

|

|

|

2024 |

|

| |

|

Cost of revenue |

|

$ |

53 |

|

|

$ |

50 |

|

|

$ |

45 |

|

|

$ |

178 |

|

|

$ |

141 |

|

| |

|

Research and development |

|

$ |

955 |

|

|

$ |

910 |

|

|

$ |

706 |

|

|

$ |

3,423 |

|

|

$ |

2,532 |

|

| |

|

Sales, general and

administrative |

|

$ |

313 |

|

|

$ |

292 |

|

|

$ |

242 |

|

|

$ |

1,136 |

|

|

$ |

876 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(C) Other consists of IP-related costs and assets held for sale

related adjustments |

| |

| |

(D) Income tax impact of non-GAAP adjustments, including the

recognition of excess tax benefits or deficiencies related to

stock-based compensation under GAAP accounting standard (ASU

2016-09). |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(E) Reflects a ten-for-one stock split on June 7, 2024 |

|

NVIDIA CORPORATION |

|

RECONCILIATION OF GAAP TO NON-GAAP

OUTLOOK |

|

|

|

|

| |

|

Q1 FY2026 Outlook |

| |

|

($ in millions) |

| |

|

|

| GAAP gross

margin |

|

70.6 |

% |

|

|

Impact of stock-based compensation expense, acquisition-related

costs, and other costs |

|

0.4 |

% |

| Non-GAAP

gross margin |

|

71.0 |

% |

| |

|

|

| GAAP operating

expenses |

$ |

5,150 |

|

|

|

Stock-based compensation expense, acquisition-related costs, and

other costs |

|

(1,550 |

) |

| Non-GAAP

operating expenses |

$ |

3,600 |

|

| |

|

|

|

About NVIDIANVIDIA (NASDAQ: NVDA) is the world

leader in accelerated computing.

| For further information, contact: |

| |

|

| Stewart Stecker |

Mylene Mangalindan |

| Investor Relations |

Corporate Communications |

| NVIDIA Corporation |

NVIDIA Corporation |

| sstecker@nvidia.com |

mmangalindan@nvidia.com |

Certain statements in this press release including, but not

limited to, statements as to: AI advancing at light speed as

agentic AI and physical AI set the stage for the next wave of AI to

revolutionize the largest industries; expectations with respect to

growth, performance and benefits of NVIDIA’s products, services and

technologies, including Blackwell, and related trends and drivers;

expectations with respect to supply and demand for NVIDIA’s

products, services and technologies, including Blackwell, and

related matters including inventory, production and distribution;

expectations with respect to NVIDIA’s third party arrangements,

including with its collaborators and partners; expectations with

respect to technology developments and related trends and drivers;

future NVIDIA cash dividends or other returns to stockholders;

NVIDIA’s financial and business outlook for the first quarter of

fiscal 2026 and beyond; projected market growth and trends;

expectations with respect to AI and related industries; and other

statements that are not historical facts are risks and

uncertainties that could cause results to be materially different

than expectations. Important factors that could cause actual

results to differ materially include: global economic and political

conditions; NVIDIA’s reliance on third parties to manufacture,

assemble, package and test NVIDIA’s products; the impact of

technological development and competition; development of new

products and technologies or enhancements to NVIDIA’s existing

product and technologies; market acceptance of NVIDIA’s products or

NVIDIA’s partners’ products; design, manufacturing or software

defects; changes in consumer preferences or demands; changes in

industry standards and interfaces; unexpected loss of performance

of NVIDIA’s products or technologies when integrated into systems;

and changes in applicable laws and regulations, as well as other

factors detailed from time to time in the most recent reports

NVIDIA files with the Securities and Exchange Commission, or SEC,

including, but not limited to, its annual report on Form 10-K and

quarterly reports on Form 10-Q. Copies of reports filed with the

SEC are posted on the company’s website and are available from

NVIDIA without charge. These forward-looking statements are not

guarantees of future performance and speak only as of the date

hereof, and, except as required by law, NVIDIA disclaims any

obligation to update these forward-looking statements to reflect

future events or circumstances.

© 2025 NVIDIA Corporation. All rights reserved. NVIDIA, the

NVIDIA logo, GeForce RTX, NVIDIA Cosmos, NVIDIA Spectrum-X, NVIDIA

DGX, NVIDIA DRIVE, NVIDIA DRIVE AGX Orin, NVIDIA Grace, NVIDIA

Jetson Orin Nano, NVIDIA NIM and NVIDIA Omniverse are trademarks

and/or registered trademarks of NVIDIA Corporation in the U.S.

and/or other countries. Other company and product names may be

trademarks of the respective companies with which they are

associated. Features, pricing, availability and specifications are

subject to change without notice.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/aabe86db-ce89-4434-b83c-495082979801

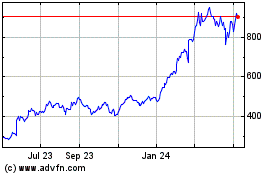

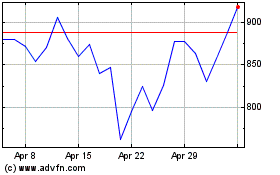

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Feb 2025 to Mar 2025

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Mar 2025