0001471265false00014712652024-07-232024-07-23

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2024

Northwest Bancshares, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-34582 | | 27-0950358 |

| (State or other jurisdiction of incorporation) | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

| 3 Easton Oval Suite 500 | Columbus | Ohio | | 43219 |

| (Address of principal executive office) | | (Zip code) |

(814) 726-2140

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, 0.01 Par Value | | NWBI | | NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Indicate by a check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 23, 2024, Northwest Bancshares, Inc. issued a press release announcing its financial results for the three and six month period ended June 30, 2024 (the "Press Release"), and posted on its website its second quarter 2024 supplemental earnings release presentation (the "Supplemental Earnings Release Presentation"). The Press Release and Supplemental Earnings Release Presentation are being furnished as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in the preceding paragraph, as well as Exhibit 99.1 and Exhibit 99.2 referenced therein, is being furnished to the SEC and shall not be deemed “filed” for any purpose.

Item 9.01 Financial Statements and Exhibits

(a) Not applicable

(b) Not applicable

(c) Not applicable

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| | Press release dated July 23, 2024 |

| | Supplemental Earnings Release Presentation reviewed during the conference call |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | NORTHWEST BANCSHARES, INC. |

| | | |

| Date: | July 23, 2024 | | By: | /s/ Douglas M. Schosser |

| | | | Douglas M. Schosser |

| | | | Chief Financial Officer |

EXHIBIT 99.1

PRESS RELEASE OF NORTHWEST BANCSHARES, INC.

EARNINGS RELEASE

FOR IMMEDIATE RELEASE

| | | | | |

| Contact: | Louis J. Torchio, President and Chief Executive Officer |

| Douglas M. Schosser, Chief Financial Officer (814) 726-2140 |

Northwest Bancshares, Inc. Announces Second Quarter 2024 net income of $5 million,

or $0.04 per diluted share

The Company’s adjusted net operating income was $35 million, or $0.27 per diluted share(1)

Previously announced balance sheet restructure successfully completed

Net interest margin expands 10 basis points to 3.20%

Credit quality remains strong

119th consecutive quarterly dividend of $0.20 per share declared

Columbus, Ohio — July 23, 2024

Northwest Bancshares, Inc., (the “Company”), (NasdaqGS: NWBI) announced net income for the quarter ended June 30, 2024 of $5 million, or $0.04 per diluted share. This represents a decrease of $28 million compared to the same quarter last year, when net income was $33 million, or $0.26 per diluted share, and a decrease of $24 million compared to the prior quarter, when net income was $29 million, or $0.23 per diluted share. The annualized returns on average shareholders’ equity and average assets for the quarter ended June 30, 2024 were 1.24% and 0.13% compared to 8.72% and 0.93% for the same quarter last year and 7.57% and 0.81% from the prior quarter.

Excluding loss on the sale of investments of $28 million, net of tax, and restructuring expense of $1 million, net of tax, the Company’s adjusted net operating income was $35 million, or $0.27 per diluted share for the quarter ended June 30, 2024. This represents an increase of $1 million from the same quarter last year, when adjusted net operating income was $34 million, or $0.27 per diluted share, and an increase of $5 million compared to the prior quarter, where adjusted net operating income was $30 million, or $0.23 per diluted share. The adjusted annualized returns on average shareholders’ equity and average assets for the quarter ended June 30, 2024 were 9.00% and 0.96% compared to 9.02% and 0.96% for the same quarter last year and 7.75% and 0.83% from the prior quarter.

The Company also announced that its Board of Directors declared a quarterly cash dividend of $0.20 per share payable on August 14, 2024 to shareholders of record as of August 2, 2024. This is the 119th consecutive quarter in which the Company has paid a cash dividend. Based on the market value of the Company’s common stock as of June 30, 2024, this represents an annualized dividend yield of approximately 6.9%.

In the quarter, as previously disclosed, the Company repositioned its security portfolio by selling 15% of its investment securities with proceeds totaling $276 million at a pre-tax loss of $39 million, or $28 million after tax. The proceeds of the sale were immediately used to repay short-term borrowings. In addition, $258 million has already been invested into securities netting a 420 basis point higher yield. The Company currently expects to earn-back the loss over the next three years.

Louis J. Torchio, President and CEO, added, “Our core earnings this quarter reflect our commitment to responsible growth, with particularly strong performance in our commercial division. I’m especially proud of the flawless execution of our previously announced securities restructuring, which has yielded results surpassing our initial projections. This success underscores our team’s ability to implement strategic initiatives effectively while maintaining focus on our core business objectives.”

“Performance this quarter highlights the significant progress in our commercial transformation strategy. We’ve seen solid loan growth, particularly in commercial and industrial originations, which aligns with our strategic focus. This targeted growth outpaces less preferred categories in the current market, such as commercial office space or long-term health care. Our success in this area not only validates our strategic direction but also positions us well for sustained, quality growth in the commercial sector.”

(1) See reconciliation of non-GAAP financial measures for additional information relating to these items.

Balance Sheet Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in thousands | | | | | | | | | Change 2Q24 vs. | | | | | | | | | | | | |

| 2Q24 | | 1Q24 | | 2Q23 | | | | 1Q24 | | | | 2Q23 | | | | | | | | | | | | |

| Average loans receivable | $ | 11,368,749 | | | 11,345,308 | | | 11,065,660 | | | | | 0.2 | % | | | | 2.7 | % | | | | | | | | | | | | |

| Average investments | 2,021,347 | | | 2,051,058 | | | 2,233,987 | | | | | (1.4) | % | | | | (9.5) | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Average deposits | 12,086,362 | | | 11,887,954 | | | 11,420,702 | | | | | 1.7 | % | | | | 5.8 | % | | | | | | | | | | | | |

| Average borrowed funds | 323,191 | | | 469,697 | | | 837,358 | | | | | (31.2) | % | | | | (61.4) | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

•Average loans receivable increased $303 million from the quarter ended June 30, 2023 driven by our commercial banking portfolio, which grew by $631 million in total, including a $444 million increase in our commercial and industrial portfolio as we have continued to build-out our commercial lending verticals. Compared to the first quarter of 2024, average loans receivable increased by $23 million, also driven by growth in the commercial banking portfolio.

•Average investments declined $213 million from the quarter ended June 30, 2023 and $30 million from the quarter ended March 31, 2024. The decline from the prior year was driven by the investment portfolio restructure described above and from lack of reinvestment of cash flow over the past year. The decline in investments from the prior quarter is expected to be temporary and was also driven by the timing of the investment portfolio repositioning activity.

•Average deposits grew $666 million from the quarter ended June 30, 2023, driven by a $1.1 billion increase in our average time deposits as we continued competitively positioning our deposit products. This increase was partially offset by a decrease in money market balances as customers shifted balances into higher yielding time deposit accounts. Compared to the first quarter of 2024, average deposits grew $198 million, also driven by an increase in time deposits.

•Average borrowings saw a significant reduction of $514 million compared to the quarter end June 30, 2023 and $147 million compared to the quarter ended March 31, 2024. The decrease in average borrowings is primarily attributable to the strategic pay-down of wholesale borrowings. This decrease was made possible by our repositioning of our securities portfolio as well as a substantial increase in cash reserves resulting from the notable rise in the average balance of deposits noted above.

Income Statement Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in thousands | | | | | | | | Change 2Q24 vs. | | | | |

| 2Q24 | | 1Q24 | | 2Q23 | | | | 1Q24 | | | | 2Q23 | | |

| Interest income | $ | 166,854 | | | 160,239 | | | 143,996 | | | | | 4.1 | % | | | | 15.9 | % | | | | | | | | |

| Interest expense | 60,013 | | | 57,001 | | | 35,447 | | | | | 5.3 | % | | | | 69.3 | % | | | | | | | | |

| Net interest income | $ | 106,841 | | | 103,238 | | | 108,549 | | | | | 3.5 | % | | | | (1.6) | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net interest margin | 3.20 | % | | 3.10 | % | | 3.28 | % | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net interest income decreased $2 million and net interest margin decreased to 3.20% for the quarter ended June 30, 2024 from 3.28% for the quarter ended June 30, 2023. This decrease in net interest income resulted primarily from:

•A $23 million increase in interest income that was the result of cash and marketable securities being redeployed into higher yielding loans. Driven by higher market interest rates, the average yield on loans improved to 5.47% for the quarter ended June 30, 2024 from 4.83% for the quarter ended June 30, 2023.

•A $25 million increase in interest expense more than offset the increase in interest income as the result of higher costs of deposits due to the higher interest rate environment and competitive pressure for liquidity. The cost of interest-bearing liabilities increased to 2.40% for the quarter ended June 30, 2024 from 1.47% for the quarter ended June 30, 2023.

Compared to the quarter ended March 31, 2024, net interest income increased $4 million and net interest margin increased to 3.20% for the quarter ended June 30, 2024. This increase in net interest income resulted from the following:

•A $7 million increase in interest income driven by higher interest income on loans receivable as both the average balance and average yield increased compared to the prior quarter. The average yield on loans improved to 5.47% from 5.33% for the quarter ended March 31, 2024.

•Partially offsetting the increase in interest income was a $3 million increase in interest expense due to increases in both the average balance and average yield of interest-earning deposits. The cost of interest-bearing liabilities increased to 2.40% from 2.28% for the quarter ended March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in thousands | | | | | | | | | Change 2Q24 vs. | | | | |

| 2Q24 | | 1Q24 | | 2Q23 | | | | 1Q24 | | | | 2Q23 | | |

| Provision for credit losses - loans | $ | 2,169 | | | 4,234 | | | 6,010 | | | | | (48.8) | % | | | | (63.9) | % | | | | | | | | |

| Provision for credit losses - unfunded commitments | (2,539) | | | (799) | | | 2,920 | | | | | 217.8 | % | | | | (187.0) | % | | | | | | | | |

| Total provision for credit losses expense | $ | (370) | | | 3,435 | | | 8,930 | | | | | (110.8) | % | | | | (104.1) | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

The total provision for credit losses for the quarter ended June 30, 2024 was a credit of $0.4 million primarily driven by improvements in the economic forecasts coupled with a decline in our reserves for unfunded commitments in the current period. This decline is based on the timing of origination and funding of commercial construction loans and lines of credit.

Additionally, the Company continued to experience low levels of classified loans with a slight increase to $257 million or 2.26% of total loans at June 30, 2024 from $214 million, or 1.90% of total loans, at June 30, 2023 and $229 million, or 1.99% of total loans, at March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in thousands | | | | | | | | Change 2Q24 vs. | | | | |

| 2Q24 | | 1Q24 | | 2Q23 | | | | 1Q24 | | | | 2Q23 | | |

| Noninterest income: | | | | | | | | | | | | | | | | | | | | | |

| Loss on sale of investments | $ | (39,413) | | | — | | | (8,306) | | | | NA | | | | 374.5 | % | | | | | | | | |

| Gain on sale of mortgage servicing rights | — | | | — | | | 8,305 | | | | NA | | | | (100.0) | % | | | | | | | | |

| Gain on sale of SBA loans | 1,457 | | | 873 | | 832 | | | | 66.9 | % | | | | 75.1 | % | | | | | | | | |

| Service charges and fees | 15,527 | | | 15,523 | | | 14,833 | | | | | — | % | | | | 4.7 | % | | | | | | | | |

| Trust and other financial services income | 7,566 | | | 7,127 | | | 6,866 | | | | | 6.2 | % | | | | 10.2 | % | | | | | | | | |

| Gain on real estate owned, net | 487 | | | 57 | | | 785 | | | | | 754.4 | % | | | | (38.0) | % | | | | | | | | |

| Income from bank-owned life insurance | 1,371 | | | 1,502 | | | 1,304 | | | | | (8.7) | % | | | | 5.1 | % | | | | | | | | |

| Mortgage banking income | 901 | | | 452 | | | 1,028 | | | | | 99.3 | % | | | | (12.4) | % | | | | | | | | |

| Other operating income | 3,255 | | | 2,429 | | | 4,150 | | | | | 34.0 | % | | | | (21.6) | % | | | | | | | | |

| Total noninterest (loss)/income | (8,849) | | | 27,963 | | | 29,797 | | | | | (131.6) | % | | | | (129.7) | % | | | | | | | | |

Noninterest income for the quarter ended June 30, 2024 showed a loss of $9 million inclusive of a $39 million loss on the sale of investment securities, excluding the loss on sale of securities net interest income grew by $1 million, or 3%, from the quarter ended June 30, 2023 and $3 million, or 9% from the quarter ended March 31, 2024. In addition, in the prior year period we realized a gain on sale of mortgage servicing rights of $8 million and an offsetting loss on the sale of investments of $8 million.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in thousands | | | | | | | | Change 2Q24 vs. | | | | |

| 2Q24 | | 1Q24 | | 2Q23 | | | | 1Q24 | | | | 2Q23 | | |

| Noninterest expense: | | | | | | | | | | | | | | | | | | | | | |

| Personnel expense | $ | 53,531 | | | 51,540 | | | 47,650 | | | | | 3.9 | % | | | | 12.3 | % | | | | | | | | |

| Non personnel expense | 38,889 | | 38,484 | | 38,208 | | | | 1.1 | % | | | | 1.8 | % | | | | | | | | |

| Total noninterest expense | $ | 92,420 | | | 90,024 | | | 85,858 | | | | | 2.7 | % | | | | 7.6 | % | | | | | | | | |

Noninterest expense increased from the quarter ended June 30, 2023 due to a $6 million increase in personnel expenses driven by the build-out of the commercial business and related credit, risk management and internal audit support functions over the past year.

Compared to the quarter ended March 31, 2024, noninterest expense increased due to a $2 million increase in personnel expense driven by an annual salary merit increase, additional contracted employees utilized during the quarter and an increase in incentive compensation expenses.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in thousands | | | | | | | | Change 2Q24 vs. | | | | |

| 2Q24 | | 1Q24 | | 2Q23 | | | | 1Q24 | | | | 2Q23 | | |

| Income before income taxes | $ | 5,942 | | | 37,742 | | | 43,558 | | | | | (84.3) | % | | | | (86.4) | % | | | | | | | | |

| Income tax expense | 1,195 | | 8,579 | | 10,514 | | | | (86.1) | % | | | | (88.6) | % | | | | | | | | |

| Net income | $ | 4,747 | | | 29,163 | | | 33,044 | | | | | (83.7) | % | | | | (85.6) | % | | | | | | | | |

The provision for income taxes decreased by $9 million from the quarter ended June 30, 2023 and $7 million from the quarter ended March 31, 2024 primarily due to lower income before income taxes.

Net income declined compared to both the quarter ended June 30, 2023 and the quarter ended March 31, 2024 due to loss on sale of investments from the current period balance sheet restructuring as well as the additional factors discussed above.

Headquartered in Columbus, Ohio, Northwest Bancshares, Inc. is the bank holding company of Northwest Bank. Founded in 1896 Northwest Bank is a full-service financial institution offering a complete line of business and personal banking products, as well as employee benefits and wealth management services. As of June 30, 2024, Northwest operated 131 full-service financial centers and eight free standing drive-through facilities in Pennsylvania, New York, Ohio and Indiana. Northwest Bancshares, Inc.’s common stock is listed on the NASDAQ Global Select Market (“NWBI”). Additional information regarding Northwest Bancshares, Inc. and Northwest Bank can be accessed on-line at www.northwest.com.

# # #

Forward-Looking Statements - This release may contain forward-looking statements with respect to the financial condition and results of operations of Northwest Bancshares, Inc. including, without limitations, statements relating to the earnings outlook of the Company. These forward-looking statements involve certain risks and uncertainties. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements, include among others, the following possibilities: (1) changes in the interest rate environment; (2) competitive pressure among financial services companies; (3) general economic conditions including inflation and an increase in non-performing loans; (4) changes in legislation or regulatory requirements; (5) difficulties in continuing to improve operating efficiencies; (6) difficulties in the integration of acquired businesses or the ability to complete sales transactions; (7) increased risk associated with commercial real-estate and business loans; (8) changes in liquidity, including the size and composition of our deposit portfolio; (9) reduction in the value of our goodwill and other intangible assets; and (10) the effect of any pandemic, including COVID-19, war or act of terrorism. Management has no obligation to revise or update these forward-looking statements to reflect events or circumstances that arise after the date of this release.

Northwest Bancshares, Inc. and Subsidiaries

Consolidated Statements of Financial Condition (Unaudited)

(dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 | | June 30,

2023 |

| Assets | | | | | |

| Cash and cash equivalents | $ | 228,433 | | | 122,260 | | | 127,627 | |

| | | | | |

| | | | | |

Marketable securities available-for-sale (amortized cost of $1,202,354, $1,240,003 and $1,287,101, respectively) | 1,029,191 | | | 1,043,359 | | | 1,073,952 | |

Marketable securities held-to-maturity (fair value of $663,292, $699,506 and $718,676, respectively) | 784,208 | | | 814,839 | | | 847,845 | |

| Total cash and cash equivalents and marketable securities | 2,041,832 | | | 1,980,458 | | | 2,049,424 | |

| | | | | |

| Loans held-for-sale | 9,445 | | | 8,768 | | | 16,077 | |

| Residential mortgage loans | 3,315,303 | | | 3,419,417 | | | 3,479,080 | |

| Home equity loans | 1,180,486 | | | 1,227,858 | | | 1,276,062 | |

| Consumer loans | 2,080,058 | | | 2,126,027 | | | 2,201,062 | |

| Commercial real estate loans | 3,026,958 | | | 2,974,010 | | | 2,895,224 | |

| Commercial loans | 1,742,114 | | | 1,658,729 | | | 1,403,726 | |

| Total loans receivable | 11,354,364 | | | 11,414,809 | | | 11,271,231 | |

| Allowance for credit losses | (125,070) | | | (125,243) | | | (124,423) | |

| Loans receivable, net | 11,229,294 | | | 11,289,566 | | | 11,146,808 | |

| | | | | |

| | | | | |

| FHLB stock, at cost | 20,842 | | | 30,146 | | | 44,613 | |

| Accrued interest receivable | 48,739 | | | 47,353 | | | 37,281 | |

| Real estate owned, net | 74 | | | 104 | | | 371 | |

| Premises and equipment, net | 128,208 | | | 138,838 | | | 139,915 | |

| Bank-owned life insurance | 253,890 | | | 251,895 | | | 257,614 | |

| Goodwill | 380,997 | | | 380,997 | | | 380,997 | |

| Other intangible assets, net | 3,954 | | | 5,290 | | | 6,809 | |

| Other assets | 277,723 | | | 294,458 | | | 227,659 | |

| Total assets | $ | 14,385,553 | | | 14,419,105 | | | 14,291,491 | |

| Liabilities and shareholders’ equity | | | | | |

| Liabilities | | | | | |

| Noninterest-bearing demand deposits | $ | 2,581,699 | | | 2,669,023 | | | 2,820,563 | |

| Interest-bearing demand deposits | 2,565,750 | | | 2,634,546 | | | 2,577,653 | |

| Money market deposit accounts | 1,964,841 | | | 1,968,218 | | | 2,154,253 | |

| Savings deposits | 2,148,727 | | | 2,105,234 | | | 2,120,215 | |

| Time deposits | 2,826,362 | | | 2,602,881 | | | 1,989,711 | |

| Total deposits | 12,087,379 | | | 11,979,902 | | | 11,662,395 | |

| | | | | |

| | | | | |

| Borrowed funds | 242,363 | | | 398,895 | | | 632,313 | |

| Subordinated debt | 114,364 | | | 114,189 | | | 114,015 | |

| Junior subordinated debentures | 129,703 | | | 129,574 | | | 129,444 | |

| Advances by borrowers for taxes and insurance | 52,271 | | | 45,253 | | | 57,143 | |

| Accrued interest payable | 21,423 | | | 13,669 | | | 4,936 | |

| Other liabilities | 181,452 | | | 186,306 | | | 179,744 | |

| Total liabilities | 12,828,955 | | | 12,867,788 | | | 12,779,990 | |

| Shareholders’ equity | | | | | |

Preferred stock, $0.01 par value: 50,000,000 shares authorized, no shares issued | — | | | — | | | — | |

Common stock, $0.01 par value: 500,000,000 shares authorized, 127,307,997, 127,110,453 and 127,088,963 shares issued and outstanding, respectively | 1,273 | | | 1,271 | | | 1,271 | |

| Additional paid-in capital | 1,027,703 | | | 1,024,852 | | | 1,022,189 | |

| Retained earnings | 657,706 | | | 674,686 | | | 657,292 | |

| | | | | |

| Accumulated other comprehensive loss | (130,084) | | | (149,492) | | | (169,251) | |

| Total shareholders’ equity | 1,556,598 | | | 1,551,317 | | | 1,511,501 | |

| Total liabilities and shareholders’ equity | $ | 14,385,553 | | | 14,419,105 | | | 14,291,491 | |

| | | | | |

| Equity to assets | 10.82 | % | | 10.76 | % | | 10.58 | % |

| Tangible common equity to assets* | 8.37 | % | | 8.30 | % | | 8.08 | % |

| Book value per share | $ | 12.23 | | | 12.20 | | | 11.89 | |

| Tangible book value per share* | $ | 9.20 | | | 9.17 | | | 8.84 | |

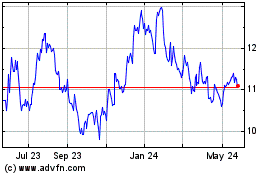

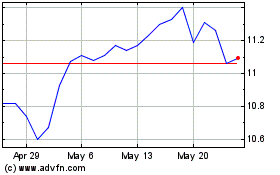

| Closing market price per share | $ | 11.55 | | | 12.48 | | | 10.60 | |

| Full time equivalent employees | 1,991 | | | 2,098 | | | 2,025 | |

| Number of banking offices | 139 | | | 142 | | | 142 | |

* Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items.

Northwest Bancshares, Inc. and Subsidiaries

Consolidated Statements of Income (Unaudited)

(dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended |

| | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 |

| | | | | |

| Interest income: | | | | | | | | | |

| Loans receivable | $ | 153,954 | | | 149,571 | | | 146,523 | | | 140,667 | | | 132,724 | |

| Mortgage-backed securities | 9,426 | | | 7,944 | | | 7,951 | | | 8,072 | | | 8,326 | |

| Taxable investment securities | 728 | | | 794 | | | 786 | | | 786 | | | 841 | |

| Tax-free investment securities | 457 | | | 491 | | | 492 | | | 491 | | | 667 | |

| FHLB stock dividends | 498 | | | 607 | | | 666 | | | 668 | | | 844 | |

| Interest-earning deposits | 1,791 | | | 832 | | | 970 | | | 914 | | | 594 | |

| Total interest income | 166,854 | | | 160,239 | | | 157,388 | | | 151,598 | | | 143,996 | |

| Interest expense: | | | | | | | | | |

| Deposits | 52,754 | | | 47,686 | | | 40,600 | | | 31,688 | | | 21,817 | |

| Borrowed funds | 7,259 | | | 9,315 | | | 10,486 | | | 11,542 | | | 13,630 | |

| Total interest expense | 60,013 | | | 57,001 | | | 51,086 | | | 43,230 | | | 35,447 | |

| Net interest income | 106,841 | | | 103,238 | | | 106,302 | | | 108,368 | | | 108,549 | |

| Provision for credit losses - loans | 2,169 | | | 4,234 | | | 3,801 | | | 3,983 | | | 6,010 | |

| Provision for credit losses - unfunded commitments | (2,539) | | | (799) | | | 4,145 | | | (2,981) | | | 2,920 | |

| Net interest income after provision for credit losses | 107,211 | | | 99,803 | | | 98,356 | | | 107,366 | | | 99,619 | |

| Noninterest income: | | | | | | | | | |

| Loss on sale of investments | (39,413) | | | — | | | (1) | | | — | | | (8,306) | |

| Gain on sale of mortgage servicing rights | — | | | — | | | — | | | — | | | 8,305 | |

| Gain on sale of SBA loans | 1,457 | | | 873 | | | 388 | | | 301 | | | 832 | |

| Gain on sale of loans | — | | | — | | | 726 | | | — | | | — | |

| Service charges and fees | 15,527 | | | 15,523 | | | 15,922 | | | 15,270 | | | 14,833 | |

| Trust and other financial services income | 7,566 | | | 7,127 | | | 6,884 | | | 7,085 | | | 6,866 | |

| Gain on real estate owned, net | 487 | | | 57 | | | 1,084 | | | 29 | | | 785 | |

| Income from bank-owned life insurance | 1,371 | | | 1,502 | | | 1,454 | | | 4,561 | | | 1,304 | |

| Mortgage banking income | 901 | | | 452 | | | 247 | | | 632 | | | 1,028 | |

| | | | | | | | | |

| Other operating income | 3,255 | | | 2,429 | | | 2,465 | | | 3,010 | | | 4,150 | |

| Total noninterest (loss)/income | (8,849) | | | 27,963 | | | 29,169 | | | 30,888 | | | 29,797 | |

| Noninterest expense: | | | | | | | | | |

| Compensation and employee benefits | 53,531 | | | 51,540 | | | 50,194 | | | 51,243 | | | 47,650 | |

| Premises and occupancy costs | 7,464 | | | 7,627 | | | 7,049 | | | 7,052 | | | 7,579 | |

| Office operations | 3,819 | | | 2,767 | | | 3,747 | | | 3,398 | | | 2,800 | |

| Collections expense | 406 | | | 336 | | | 328 | | | 551 | | | 429 | |

| Processing expenses | 14,695 | | | 14,725 | | | 15,017 | | | 14,672 | | | 14,648 | |

| Marketing expenses | 2,410 | | | 2,149 | | | 1,317 | | | 2,379 | | | 2,856 | |

| Federal deposit insurance premiums | 2,865 | | | 3,023 | | | 2,643 | | | 2,341 | | | 2,064 | |

| Professional services | 3,728 | | | 4,065 | | | 6,255 | | | 3,002 | | | 3,804 | |

| Amortization of intangible assets | 635 | | | 701 | | | 724 | | | 795 | | | 842 | |

| Real estate owned expense | 57 | | | 66 | | | 51 | | | 141 | | | 83 | |

| Merger, asset disposition and restructuring expense | 1,915 | | | 955 | | | 2,354 | | | — | | | 1,593 | |

| Other expenses | 895 | | | 2,070 | | | 997 | | | 1,996 | | | 1,510 | |

| Total noninterest expense | 92,420 | | | 90,024 | | | 90,676 | | | 87,570 | | | 85,858 | |

| Income before income taxes | 5,942 | | | 37,742 | | | 36,849 | | | 50,684 | | | 43,558 | |

| Income tax expense | 1,195 | | | 8,579 | | | 7,835 | | | 11,464 | | | 10,514 | |

| Net income | $ | 4,747 | | | 29,163 | | | 29,014 | | | 39,220 | | | 33,044 | |

| | | | | | | | | |

| Basic earnings per share | $ | 0.04 | | | 0.23 | | | 0.23 | | | 0.31 | | | 0.26 | |

| Diluted earnings per share | $ | 0.04 | | | 0.23 | | | 0.23 | | | 0.31 | | | 0.26 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Annualized return on average equity | 1.24 | % | | 7.57 | % | | 7.64 | % | | 10.27 | % | | 8.72 | % |

| Annualized return on average assets | 0.13 | % | | 0.81 | % | | 0.80 | % | | 1.08 | % | | 0.93 | % |

| Annualized return on average tangible common equity * | 1.65 | % | | 10.08 | % | | 10.28 | % | | 13.80 | % | | 11.71 | % |

| | | | | | | | | |

| Efficiency ratio | 94.31 | % | | 68.62 | % | | 66.93 | % | | 62.88 | % | | 62.06 | % |

| Efficiency ratio, excluding certain items ** | 65.41 | % | | 67.35 | % | | 64.66 | % | | 62.31 | % | | 60.30 | % |

| Annualized noninterest expense to average assets | 2.57 | % | | 2.51 | % | | 2.51 | % | | 2.42 | % | | 2.42 | % |

| Annualized noninterest expense to average assets, excluding certain items** | 2.50 | % | | 2.47 | % | | 2.43 | % | | 2.39 | % | | 2.35 | % |

* Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items.

** Excludes loss on sale of investments, gain on sale of mortgage servicing rights, amortization of intangible assets and merger, asset disposition and restructuring expenses (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items.

Northwest Bancshares, Inc. and Subsidiaries

Consolidated Statements of Income (Unaudited)

(dollars in thousands, except per share amounts)

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | 2023 |

| Interest income: | | | |

| Loans receivable | $ | 303,525 | | | 256,469 | |

| Mortgage-backed securities | 17,370 | | | 16,863 | |

| Taxable investment securities | 1,522 | | | 1,686 | |

| Tax-free investment securities | 948 | | | 1,367 | |

| FHLB stock dividends | 1,105 | | | 1,534 | |

| Interest-earning deposits | 2,623 | | | 1,017 | |

| Total interest income | 327,093 | | | 278,936 | |

| Interest expense: | | | |

| Deposits | 100,440 | | | 33,055 | |

| Borrowed funds | 16,574 | | | 24,868 | |

| Total interest expense | 117,014 | | | 57,923 | |

| Net interest income | 210,079 | | | 221,013 | |

| Provision for credit losses - loans | 6,403 | | | 10,880 | |

| Provision for credit losses - unfunded commitments | (3,338) | | | 3,046 | |

| Net interest income after provision for credit losses | 207,014 | | | 207,087 | |

| Noninterest income: | | | |

| Loss on sale of investments | (39,413) | | | (8,306) | |

| Gain on sale of mortgage servicing rights | — | | | 8,305 | |

| Gain on sale of SBA loans | 2,330 | | | 1,111 | |

| | | |

| Service charges and fees | 31,050 | | | 28,022 | |

| | | |

| | | |

| Trust and other financial services income | 14,693 | | | 13,315 | |

| | | |

| Gain on real estate owned, net | 544 | | | 893 | |

| Income from bank-owned life insurance | 2,873 | | | 2,573 | |

| Mortgage banking income | 1,353 | | | 1,552 | |

| Other operating income | 5,684 | | | 6,301 | |

| Total noninterest income | 19,114 | | | 53,766 | |

| Noninterest expense: | | | |

| Compensation and employee benefits | 105,071 | | | 94,254 | |

| Premises and occupancy costs | 15,091 | | | 15,050 | |

| Office operations | 6,586 | | | 5,810 | |

| Collections expense | 742 | | | 816 | |

| Processing expenses | 29,420 | | | 28,998 | |

| Marketing expenses | 4,559 | | | 5,748 | |

| Federal deposit insurance premiums | 5,888 | | | 4,287 | |

| Professional services | 7,793 | | | 8,562 | |

| Amortization of intangible assets | 1,336 | | | 1,751 | |

| Real estate owned expense | 123 | | | 264 | |

| Merger, asset disposition and restructuring expense | 2,870 | | | 4,395 | |

| Other expenses | 2,965 | | | 3,373 | |

| Total noninterest expense | 182,444 | | | 173,308 | |

| Income before income taxes | 43,684 | | | 87,545 | |

| Income tax expense | 9,774 | | | 20,822 | |

| Net income | $ | 33,910 | | | 66,723 | |

| | | |

| Basic earnings per share | $ | 0.27 | | | 0.53 | |

| Diluted earnings per share | $ | 0.27 | | | 0.52 | |

| | | |

| | | |

| | | |

| | | |

| Annualized return on average equity | 4.41 | % | | 8.91 | % |

| Annualized return on average assets | 0.47 | % | | 0.95 | % |

| Annualized return on tangible common equity * | 5.88 | % | | 12.01 | % |

| | | |

| Efficiency ratio | 79.60 | % | | 63.07 | % |

| Efficiency ratio, excluding certain items ** | 66.36 | % | | 60.83 | % |

| Annualized noninterest expense to average assets | 2.54 | % | | 2.46 | % |

| Annualized noninterest expense to average assets, excluding certain items ** | 2.48 | % | | 2.38 | % |

* Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items.

** Excludes loss on sale of investments, gain on sale of mortgage servicing rights, amortization of intangible assets and merger, asset disposition and restructuring expenses (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items.

Northwest Bancshares, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures (Unaudited) *

(dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended June 30, |

| June 30, 2024 | | March 31, 2024 | | June 30, 2023 | | 2024 | | 2023 |

| Reconciliation of net income to adjusted net operating income: | | | | | | | | | |

| Net income (GAAP) | $ | 4,747 | | | 29,163 | | | 33,044 | | | 33,910 | | | 66,723 | |

| Non-GAAP adjustments | | | | | | | | | |

| | | | | | | | | |

| Add: merger, asset disposition and restructuring expense | 1,915 | | | 955 | | | 1,593 | | | 2,870 | | | 4,395 | |

| Add: loss on the sale of investments | 39,413 | | | — | | | 8,306 | | | 39,413 | | | 8,306 | |

| Less: gain on sale of mortgage servicing rights | — | | | — | | | (8,305) | | | — | | | (8,305) | |

| Less: tax benefit of non-GAAP adjustments | (11,572) | | | (267) | | | (446) | | | (11,839) | | | (1,231) | |

| Adjusted net operating income (non-GAAP) | $ | 34,503 | | | 29,851 | | | 34,192 | | | 64,354 | | | 69,888 | |

| Diluted earnings per share (GAAP) | $ | 0.04 | | | 0.23 | | | 0.26 | | | 0.27 | | | 0.52 | |

| Diluted adjusted operating earnings per share (non-GAAP) | $ | 0.27 | | | 0.23 | | | 0.27 | | | 0.51 | | | 0.55 | |

| | | | | | | | | |

| Average equity | $ | 1,541,434 | | | 1,549,870 | | | 1,519,990 | | | 1,545,651 | | | 1,509,466 | |

| Average assets | 14,458,592 | | | 14,408,612 | | | 14,245,917 | | | 14,433,602 | | | 14,184,050 | |

| Annualized return on average equity (GAAP) | 1.24 | % | | 7.57 | % | | 8.72 | % | | 4.41 | % | | 8.91 | % |

| Annualized return on average assets (GAAP) | 0.13 | % | | 0.81 | % | | 0.93 | % | | 0.47 | % | | 0.95 | % |

| Annualized return on average equity, excluding merger, asset disposition and restructuring expense, loss on the sale of investments and gain on sale of mortgage servicing rights, net of tax (non-GAAP) | 9.00 | % | | 7.75 | % | | 9.02 | % | | 8.37 | % | | 9.34 | % |

| Annualized return on average assets, excluding merger, asset disposition and restructuring expense, loss on sale of investments, and gain on sale of mortgage servicing rights, net of tax (non-GAAP) | 0.96 | % | | 0.83 | % | | 0.96 | % | | 0.90 | % | | 0.99 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

The following non-GAAP financial measures used by the Company provide information useful to investors in understanding our operating performance and trends, and facilitate comparisons with the performance of our peers. The following table summarizes the non-GAAP financial measures derived from amounts reported in the Company’s Consolidated Statements of Financial Condition.

| | | | | | | | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 | | June 30,

2023 |

| Tangible common equity to assets | | | | | |

| Total shareholders’ equity | $ | 1,556,598 | | | 1,551,317 | | | 1,511,501 | |

| Less: goodwill and intangible assets | (384,951) | | | (386,287) | | | (387,806) | |

| Tangible common equity | $ | 1,171,647 | | | 1,165,030 | | | 1,123,695 | |

| | | | | |

| Total assets | $ | 14,385,553 | | | 14,419,105 | | | 14,291,491 | |

| Less: goodwill and intangible assets | (384,951) | | | (386,287) | | | (387,806) | |

| Tangible assets | $ | 14,000,602 | | | 14,032,818 | | | 13,903,685 | |

| | | | | |

| Tangible common equity to tangible assets | 8.37 | % | | 8.30 | % | | 8.08 | % |

| | | | | |

| Tangible common equity to tangible assets, including unrealized losses on held-to-maturity investments | | | | | |

| Tangible common equity | $ | 1,171,647 | | | 1,165,030 | | | 1,123,695 | |

| Less: unrealized losses on held to maturity investments | (120,916) | | | (115,334) | | | (129,169) | |

| Add: deferred taxes on unrealized losses on held to maturity investments | 33,856 | | | 32,294 | | | 36,167 | |

| Tangible common equity, including unrealized losses on held-to-maturity investments | $ | 1,084,587 | | | 1,081,990 | | | 1,030,693 | |

| | | | | |

| Tangible assets | $ | 14,000,602 | | | 14,032,818 | | | 13,903,685 | |

| | | | | |

| Tangible common equity to tangible assets, including unrealized losses on held-to-maturity investments | 7.75 | % | | 7.71 | % | | 7.41 | % |

| | | | | |

| Tangible book value per share | | | | | |

| Tangible common equity | $ | 1,171,647 | | | 1,165,030 | | | 1,123,695 | |

| Common shares outstanding | 127,307,997 | | | 127,110,453 | | | 127,088,963 | |

| Tangible book value per share | 9.20 | | | 9.17 | | | 8.84 | |

Northwest Bancshares, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures (Unaudited) *

(dollars in thousands, except per share amounts)

The following table summarizes the non-GAAP financial measures derived from amounts reported in the Company’s Consolidated Statements of Income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Six months ended June 30, |

| June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | 2024 | | 2023 |

| | | | | | |

| Annualized return on average tangible common equity | | | | | | | | | | | | | |

| Net income | $ | 4,747 | | | 29,163 | | | 29,014 | | | 39,220 | | | 33,044 | | | 33,910 | | | 66,723 | |

| | | | | | | | | | | | | |

| Average shareholders’ equity | 1,541,434 | | | 1,549,870 | | | 1,506,895 | | | 1,515,287 | | | 1,519,990 | | | 1,545,651 | | | 1,509,466 | |

| Less: average goodwill and intangible assets | (385,364) | | | (386,038) | | | (386,761) | | | (387,523) | | | (388,354) | | | (385,701) | | | (388,793) | |

| Average tangible common equity | $ | 1,156,070 | | | 1,163,832 | | | 1,120,134 | | | 1,127,764 | | | 1,131,636 | | | 1,159,950 | | | 1,120,673 | |

| | | | | | | | | | | | | |

| Annualized return on average tangible common equity | 1.65 | % | | 10.08 | % | | 10.28 | % | | 13.80 | % | | 11.71 | % | | 5.88 | % | | 12.01 | % |

| | | | | | | | | | | | | |

| Efficiency ratio, excluding loss on the sale of investments, gain on the sale of mortgage servicing rights, amortization and merger, asset disposition and restructuring expenses | | | | | | | | | | | | | |

| Non-interest expense | $ | 92,420 | | | 90,024 | | | 90,676 | | | 87,570 | | | 85,858 | | | 182,444 | | | 173,308 | |

| Less: amortization expense | (635) | | | (701) | | | (724) | | | (795) | | | (842) | | | (1,336) | | | (1,751) | |

| Less: merger, asset disposition and restructuring expenses | (1,915) | | | (955) | | | (2,354) | | | — | | | (1,593) | | | (2,870) | | | (4,395) | |

| Non-interest expense, excluding amortization and merger, assets disposition and restructuring expenses | $ | 89,870 | | | 88,368 | | | 87,598 | | | 86,775 | | | 83,423 | | | 178,238 | | | 167,162 | |

| | | | | | | | | | | | | |

| Net interest income | $ | 106,841 | | | 103,238 | | | 106,302 | | | 108,368 | | | 108,549 | | | 210,079 | | | 221,013 | |

| Non-interest income | (8,849) | | | 27,963 | | | 29,169 | | | 30,888 | | | 29,797 | | | 19,114 | | | 53,766 | |

| Add: loss on the sale of investments | 39,413 | | | — | | | 1 | | | — | | | 8,306 | | | 39,413 | | | 8,306 | |

| Less: gain on sale of mortgage servicing rights | — | | | — | | — | | — | | — | | — | | | (8,305) | | | — | | | (8,305) | |

| Net interest income plus non-interest income, excluding loss on sale of investments and gain on sale of mortgage servicing rights | $ | 137,405 | | | 131,201 | | | 135,472 | | | 139,256 | | | 138,347 | | | 268,606 | | | 274,780 | |

| | | | | | | | | | | | | |

| Efficiency ratio, excluding loss on sale of investments, gain on sale of mortgage servicing rights, amortization and merger, asset disposition and restructuring expenses | 65.41 | % | | 67.35 | % | | 64.66 | % | | 62.31 | % | | 60.30 | % | | 66.36 | % | | 60.83 | % |

| | | | | | | | | | | | | |

| Annualized non-interest expense to average assets, excluding amortization and merger, asset disposition and restructuring expense | | | | | | | | | | | | | |

| Non-interest expense excluding amortization and merger, asset disposition and restructuring expenses | $ | 89,870 | | | 88,368 | | | 87,598 | | | 86,775 | | | 83,423 | | | 178,238 | | | 167,162 | |

| Average assets | 14,458,592 | | | 14,408,612 | | | 14,329,020 | | | 14,379,323 | | | 14,245,917 | | | 14,433,602 | | | 14,184,050 | |

| Annualized non-interest expense to average assets, excluding amortization and merger, asset disposition and restructuring expense | 2.50 | % | | 2.47 | % | | 2.43 | % | | 2.39 | % | | 2.35 | % | | 2.48 | % | | 2.38 | % |

* The table summarizes the Company’s results from operations on a GAAP basis and on an operating (non-GAAP) basis for the periods indicated. Operating results exclude merger, asset disposition and restructuring expense, loss on sale of investments and gain on sale of mortgage servicing rights. The net tax effect was calculated using statutory tax rates of approximately 28.0%. The Company believes this non-GAAP presentation provides a meaningful comparison of operational performance and facilitates a more effective evaluation and comparison of results to assess performance in relation to ongoing operations.

Northwest Bancshares, Inc. and Subsidiaries

Deposits (Unaudited)

(dollars in thousands)

Generally, deposits in excess of $250,000 are not federally insured. The following table provides details regarding the Company’s uninsured deposits portfolio:

| | | | | | | | | | | | | | | | | |

| As of June 30, 2024 |

| Balance | | Percent of

total deposits | | Number of

relationships |

| Uninsured deposits per the Call Report (1) | $ | 3,019,897 | | | 24.98 | % | | 5,062 | |

| Less intercompany deposit accounts | 1,163,566 | | | 9.62 | % | | 12 | |

| Less collateralized deposit accounts | 468,815 | | | 3.88 | % | | 243 | |

| Uninsured deposits excluding intercompany and collateralized accounts | $ | 1,387,516 | | | 11.48 | % | | 4,807 |

| | | | | |

| | | | | |

(1) Uninsured deposits presented may be different from actual amounts due to titling of accounts.

Our largest uninsured depositor, excluding intercompany and collateralized deposit accounts, had an aggregate uninsured deposit balance of $19.4 million, or 0.16% of total deposits, as of June 30, 2024. Our top ten largest uninsured depositors, excluding intercompany and collateralized deposit accounts, had an aggregate uninsured deposit balance of $102 million, or 0.84% of total deposits, as of June 30, 2024. The average uninsured deposit account balance, excluding intercompany and collateralized accounts, was $289,000 as of June 30, 2024.

The following table provides additional details for the Company’s deposit portfolio:

| | | | | | | | | | | | | | | | | | | | | |

| As of June 30, 2024 | | |

| Balance | | Percent of

total deposits | | Number of

accounts | | | | |

| Personal noninterest bearing demand deposits | $ | 1,350,520 | | | 11.2 | % | | 286,513 | | | | | |

| Business noninterest bearing demand deposits | 1,231,179 | | | 10.2 | % | | 43,499 | | | | | |

| Personal interest-bearing demand deposits | 1,396,825 | | | 11.5 | % | | 57,185 | | | | | |

| Business interest-bearing demand deposits | 1,168,925 | | 9.7 | % | | 7,786 | | | | | |

| Personal money market deposits | 1,390,162 | | | 11.5 | % | | 24,906 | | | | | |

| Business money market deposits | 574,679 | | | 4.7 | % | | 2,777 | | | | | |

| Savings deposits | 2,148,727 | | | 17.8 | % | | 187,406 | | | | | |

| Time deposits | 2,826,362 | | | 23.4 | % | | 81,844 | | | | | |

| Total deposits | $ | 12,087,379 | | | 100.0 | % | | 691,916 | | | | |

Our average deposit account balance as of June 30, 2024 was $17,000. The Company’s insured cash sweep deposit balance was $394 million as of June 30, 2024.

The following table provides additional details regarding the Company’s deposit portfolio over time:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | 3/31/2023 | | 6/30/2023 | | 9/30/2023 | | 12/31/2023 | | 3/31/2024 | | 6/30/2024 | | |

| Personal noninterest bearing demand deposits | $ | 1,412,227 | | | 1,428,232 | | | 1,397,167 | | | 1,375,144 | | | 1,357,875 | | | 1,369,294 | | | 1,350,520 | | | |

| Business noninterest bearing demand deposits | 1,581,016 | | | 1,467,860 | | | 1,423,396 | | | 1,399,147 | | | 1,311,148 | | | 1,249,085 | | | 1,231,179 | | | |

| Personal interest-bearing demand deposits | 1,718,806 | | | 1,627,546 | | | 1,535,254 | | | 1,477,617 | | | 1,464,058 | | | 1,427,140 | | | 1,396,825 | | | |

| Business interest-bearing demand deposits | 499,059 | | | 466,105 | | | 624,252 | | | 689,914 | | | 812,433 | | | 805,069 | | | 815,358 | | | |

| Municipal demand deposits | 468,566 | | | 447,852 | | | 418,147 | | | 430,549 | | | 358,055 | | | 325,657 | | | 353,567 | | | |

| Personal money market deposits | 1,832,583 | | | 1,626,614 | | | 1,511,652 | | | 1,463,689 | | | 1,435,939 | | | 1,393,532 | | | 1,390,162 | | | |

| Business money market deposits | 624,986 | | | 701,436 | | | 642,601 | | | 579,124 | | | 532,279 | | | 559,005 | | | 574,679 | | | |

| Savings deposits | 2,275,020 | | | 2,194,743 | | | 2,120,215 | | | 2,116,360 | | | 2,105,234 | | | 2,156,048 | | | 2,148,727 | | | |

| Time deposits | 1,052,285 | | | 1,576,791 | | | 1,989,711 | | | 2,258,338 | | | 2,602,881 | | | 2,786,814 | | | 2,826,362 | | | |

| Total deposits | $ | 11,464,548 | | | 11,537,179 | | | 11,662,395 | | | 11,789,882 | | | 11,979,902 | | | 12,071,644 | | | 12,087,379 | | | |

Northwest Bancshares, Inc. and Subsidiaries

Regulatory Capital Requirements (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | At June 30, 2024 |

| | Actual | | Minimum capital

requirements (1) | | Well capitalized

requirements |

| | Amount | | Ratio | | Amount | | Ratio | | Amount | | Ratio |

| Total capital (to risk weighted assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | $ | 1,784,604 | | | 16.674 | % | | $ | 1,123,831 | | | 10.500 | % | | $ | 1,070,315 | | | 10.000 | % |

| Northwest Bank | 1,537,783 | | | 14.380 | % | | 1,122,827 | | | 10.500 | % | | 1,069,359 | | | 10.000 | % |

| | | | | | | | | | | |

| Tier 1 capital (to risk weighted assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | 1,536,552 | | | 14.356 | % | | 909,768 | | | 8.500 | % | | 856,252 | | | 8.000 | % |

| Northwest Bank | 1,404,095 | | | 13.130 | % | | 908,955 | | | 8.500 | % | | 855,487 | | | 8.000 | % |

| | | | | | | | | | | |

| Common equity tier 1 capital (to risk weighted assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | 1,410,837 | | | 13.182 | % | | 749,220 | | | 7.000 | % | | 695,705 | | | 6.500 | % |

| Northwest Bank | 1,404,095 | | | 13.130 | % | | 748,551 | | | 7.000 | % | | 695,083 | | | 6.500 | % |

| | | | | | | | | | | |

| Tier 1 capital (leverage) (to average assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | 1,536,552 | | | 10.654 | % | | 576,913 | | | 4.000 | % | | 721,142 | | | 5.000 | % |

| Northwest Bank | 1,404,095 | | | 9.742 | % | | 576,521 | | | 4.000 | % | | 720,651 | | | 5.000 | % |

(1) Amounts and ratios include the capital conservation buffer of 2.5%, which does not apply to Tier 1 capital to average assets (leverage ratio). For further information related to the capital conservation buffer, see "Item 1. Business - Supervision and Regulation" of our 2023 Annual Report on Form 10-K.

Northwest Bancshares, Inc. and Subsidiaries

Marketable Securities (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 |

| Marketable securities available-for-sale | | Amortized cost | | Gross unrealized

holding gains | | Gross unrealized

holding losses | | Fair value | | Weighted average duration |

| Debt issued by the U.S. government and agencies: | | | | | | | | | | |

| | | | | | | | | | |

| Due after ten years | | $ | 47,263 | | | — | | | (10,292) | | | 36,971 | | | 6.08 | |

| | | | | | | | | | |

| Debt issued by government sponsored enterprises: | | | | | | | | | | |

| | | | | | | | | | |

| Due after one year through five years | | 185 | | | — | | | (5) | | | 180 | | | 1.19 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Municipal securities: | | | | | | | | | | |

| | | | | | | | | | |

| Due after one year through five years | | 880 | | | 8 | | | (3) | | | 885 | | | 1.83 | |

| Due after five years through ten years | | 9,157 | | | 5 | | | (1,565) | | | 7,597 | | | 7.89 | |

| Due after ten years | | 58,872 | | | 13 | | | (8,626) | | | 50,259 | | | 10.17 | |

| | | | | | | | | | |

| Corporate debt issues: | | | | | | | | | | |

| | | | | | | | | | |

| Due after five years through ten years | | 14,373 | | | 20 | | | (886) | | | 13,507 | | | 4.79 | |

| Due after ten years | | 3,250 | | | — | | | — | | | 3,250 | | | 10.04 | |

| | | | | | | | | | |

| Mortgage-backed agency securities: | | | | | | | | | | |

| Fixed rate pass-through | | 228,855 | | | 83 | | | (16,874) | | | 212,064 | | | 7.64 | |

| Variable rate pass-through | | 4,093 | | | 24 | | | (13) | | | 4,104 | | | 3.59 | |

| | | | | | | | | | |

| Fixed rate agency CMOs | | 789,673 | | | 293 | | | (135,258) | | | 654,708 | | | 4.72 | |

| Variable rate agency CMOs | | 45,753 | | | 38 | | | (125) | | | 45,666 | | | 7.18 | |

| Total mortgage-backed agency securities | | 1,068,374 | | | 438 | | | (152,270) | | | 916,542 | | | 5.52 | |

| Total marketable securities available-for-sale | | $ | 1,202,354 | | | 484 | | | (173,647) | | | 1,029,191 | | | 5.78 | |

| | | | | | | | | | |

| Marketable securities held-to-maturity | | | | | | | | | | |

| Government sponsored | | | | | | | | | | |

| Due after one year through five years | | $ | 89,472 | | | — | | | (10,845) | | | 78,627 | | | 3.66 | |

| Due after five years through ten years | | 34,988 | | | — | | | (5,645) | | | 29,343 | | | 5.08 | |

| | | | | | | | | | |

| Mortgage-backed agency securities: | | | | | | | | | | |

| Fixed rate pass-through | | 140,245 | | | — | | | (21,704) | | | 118,541 | | | 4.84 | |

| Variable rate pass-through | | 414 | | | — | | | (4) | | | 410 | | | 4.23 | |

| Fixed rate agency CMOs | | 518,560 | | | — | | | (82,714) | | | 435,846 | | | 5.85 | |

| Variable rate agency CMOs | | 529 | | | — | | | (4) | | | 525 | | | 5.09 | |

| Total mortgage-backed agency securities | | 659,748 | | | — | | | (104,426) | | | 555,322 | | | 5.63 | |

| Total marketable securities held-to-maturity | | $ | 784,208 | | | — | | | (120,916) | | | 663,292 | | | 5.38 | |

Northwest Bancshares, Inc. and Subsidiaries

Borrowed Funds (Unaudited)

(dollars in thousands)

| | | | | | | | | | | |

| June 30, 2024 |

| Amount | | Average rate |

| Term notes payable to the FHLB of Pittsburgh, due within one year | $ | 175,000 | | | 5.65 | % |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Collateralized borrowings, due within one year | 26,213 | | | 1.83 | % |

| Collateral received, due within one year | 41,150 | | | 5.17 | % |

| Subordinated debentures, net of issuance costs | 114,364 | | | 4.28 | % |

| Junior subordinated debentures | 129,703 | | | 7.61 | % |

| Total borrowed funds * | $ | 486,430 | | | 5.61 | % |

* As of June 30, 2024, the Company had $3.4 billion of additional borrowing capacity available with the FHLB of Pittsburgh, including a $250 million overnight line of credit, which has no balance as of June 30, 2024, as well as $404 million of borrowing capacity available with the Federal Reserve Bank and $105 million with two correspondent banks.

Northwest Bancshares, Inc. and Subsidiaries

Analysis of Loan Portfolio by Loan Sector (Unaudited)

Commercial real estate loans outstanding

The following table provides the various loan sectors in our commercial real estate portfolio at June 30, 2024:

| | | | | | | | | |

| Property type | | | Percent of portfolio |

| 5 or more unit dwelling | | | 16.8 | % |

| Nursing home | | | 12.5 | |

| Retail building | | | 11.7 | |

| Commercial office building - non-owner occupied | | | 8.9 | |

| Manufacturing & industrial building | | | 4.8 | |

| Residential acquisition & development - 1-4 family, townhouses and apartments | | | 4.3 | |

| Multi-use building - commercial, retail and residential | | | 4.0 | |

| Warehouse/storage building | | | 3.9 | |

| Commercial office building - owner occupied | | | 3.9 | |

| Multi-use building - office and warehouse | | | 3.0 | |

| Other medical facility | | | 3.0 | |

| Single family dwelling | | | 2.6 | |

| Student housing | | | 2.1 | |

| Hotel/motel | | | 2.1 | |

| Agricultural real estate | | | 2.0 | |

| | | |

| All other | | | 14.4 | |

| Total | | | 100.0 | % |

The following table describes the collateral of our commercial real estate portfolio by state at June 30, 2024:

| | | | | | | | | |

| State | | | Percent of portfolio |

| New York | | | 32.7 | % |

| Pennsylvania | | | 29.4 | |

| Ohio | | | 20.7 | |

| Indiana | | | 9.0 | |

| All other | | | 8.2 | |

| Total | | | 100.0 | % |

Northwest Bancshares, Inc. and Subsidiaries

Asset Quality (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 |

| Nonaccrual loans current: | | | | | | | | | |

| Residential mortgage loans | $ | 1,563 | | | 1,351 | | | 959 | | | 1,951 | | | 1,559 | |

| Home equity loans | 1,088 | | | 974 | | | 871 | | | 947 | | | 1,089 | |

| Consumer loans | 1,268 | | | 1,295 | | | 1,051 | | | 1,049 | | | 1,009 | |

| Commercial real estate loans | 66,181 | | | 66,895 | | | 64,603 | | | 44,639 | | | 48,468 | |

| Commercial loans | 788 | | | 934 | | | 1,182 | | | 1,369 | | | 995 | |

| Total nonaccrual loans current | $ | 70,888 | | | 71,449 | | | 68,666 | | | 49,955 | | | 53,120 | |

| Nonaccrual loans delinquent 30 days to 59 days: | | | | | | | | | |

| Residential mortgage loans | $ | 100 | | | 1,454 | | | 933 | | | 48 | | | 49 | |

| Home equity loans | 260 | | | 125 | | | 174 | | | 92 | | | 37 | |

| Consumer loans | 305 | | | 294 | | | 225 | | | 274 | | | 309 | |

| Commercial real estate loans | 699 | | | 574 | | | 51 | | | 1,913 | | | 1,697 | |

| Commercial loans | 183 | | | 161 | | | 139 | | | 90 | | | 855 | |

| Total nonaccrual loans delinquent 30 days to 59 days | $ | 1,547 | | | 2,608 | | | 1,522 | | | 2,417 | | | 2,947 | |

| Nonaccrual loans delinquent 60 days to 89 days: | | | | | | | | | |

| Residential mortgage loans | $ | 578 | | | — | | | 511 | | | 66 | | | 185 | |

| Home equity loans | 234 | | | 488 | | | 347 | | | 319 | | | 363 | |

| Consumer loans | 603 | | | 381 | | | 557 | | | 312 | | | 360 | |

| Commercial real estate loans | 2,243 | | | 52 | | | 831 | | | 212 | | | 210 | |

| Commercial loans | 8,088 | | | 201 | | | 56 | | | 291 | | | 245 | |

| Total nonaccrual loans delinquent 60 days to 89 days | $ | 11,746 | | | 1,122 | | | 2,302 | | | 1,200 | | | 1,363 | |

| Nonaccrual loans delinquent 90 days or more: | | | | | | | | | |

| Residential mortgage loans | $ | 4,162 | | | 4,304 | | | 6,324 | | | 7,695 | | | 6,290 | |

| Home equity loans | 2,473 | | | 2,822 | | | 3,100 | | | 2,073 | | | 1,965 | |

| Consumer loans | 2,433 | | | 2,659 | | | 3,212 | | | 2,463 | | | 2,033 | |

| Commercial real estate loans | 5,849 | | | 6,931 | | | 6,488 | | | 8,416 | | | 8,575 | |

| Commercial loans | 3,061 | | | 3,165 | | | 2,770 | | | 2,435 | | | 2,296 | |

| Total nonaccrual loans delinquent 90 days or more | $ | 17,978 | | | 19,881 | | | 21,894 | | | 23,082 | | | 21,159 | |

| Total nonaccrual loans | $ | 102,159 | | | 95,060 | | | 94,384 | | | 76,654 | | | 78,589 | |

| Total nonaccrual loans | $ | 102,159 | | | 95,060 | | | 94,384 | | | 76,654 | | | 78,589 | |

| Loans 90 days past due and still accruing | 2,511 | | | 2,452 | | | 2,698 | | | 728 | | | 532 | |

| Nonperforming loans | 104,670 | | | 97,512 | | | 97,082 | | | 77,382 | | | 79,121 | |

| Real estate owned, net | 74 | | | 50 | | | 104 | | | 363 | | | 371 | |

| Nonperforming assets | $ | 104,744 | | | 97,562 | | | 97,186 | | | 77,745 | | | 79,492 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Nonperforming loans to total loans | 0.92 | % | | 0.85 | % | | 0.85 | % | | 0.68 | % | | 0.70 | % |

| Nonperforming assets to total assets | 0.73 | % | | 0.67 | % | | 0.67 | % | | 0.54 | % | | 0.56 | % |

| Allowance for credit losses to total loans | 1.10 | % | | 1.09 | % | | 1.10 | % | | 1.10 | % | | 1.10 | % |

| | | | | | | | | |

| Allowance for credit losses to nonperforming loans | 119.49 | % | | 128.08 | % | | 129.01 | % | | 161.33 | % | | 157.26 | % |

Northwest Bancshares, Inc. and Subsidiaries

Loans by Credit Quality Indicators (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At June 30, 2024 | | Pass | | Special

mention * | | Substandard ** | | Doubtful | | Loss | | Loans

receivable |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ | 3,312,368 | | | — | | | 11,700 | | | — | | | — | | | 3,324,068 | |

| Home equity loans | | 1,176,187 | | | — | | | 4,299 | | | — | | | — | | | 1,180,486 | |

| Consumer loans | | 2,074,869 | | | — | | | 5,189 | | | — | | | — | | | 2,080,058 | |

| Total Personal Banking | | 6,563,424 | | | — | | | 21,188 | | | — | | | — | | | 6,584,612 | |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,682,766 | | | 130,879 | | | 213,993 | | | — | | | — | | | 3,027,638 | |

| Commercial loans | | 1,673,052 | | | 47,400 | | | 21,662 | | | — | | | — | | | 1,742,114 | |

| Total Commercial Banking | | 4,355,818 | | | 178,279 | | | 235,655 | | | — | | | — | | | 4,769,752 | |

| Total loans | | $ | 10,919,242 | | | 178,279 | | | 256,843 | | | — | | | — | | | 11,354,364 | |

| At March 31, 2024 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ | 3,370,307 | | | — | | | 12,541 | | | — | | | — | | | 3,382,848 | |

| Home equity loans | | 1,191,957 | | | — | | | 4,650 | | | — | | | — | | | 1,196,607 | |

| Consumer loans | | 2,113,050 | | | — | | | 5,317 | | | — | | | — | | | 2,118,367 | |

| Total Personal Banking | | 6,675,314 | | | — | | | 22,508 | | | — | | | — | | | 6,697,822 | |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,714,857 | | | 131,247 | | | 182,424 | | | — | | | — | | | 3,028,528 | |

| Commercial loans | | 1,698,519 | | | 52,461 | | | 23,916 | | | — | | | — | | | 1,774,896 | |

| Total Commercial Banking | | 4,413,376 | | | 183,708 | | | 206,340 | | | — | | | — | | | 4,803,424 | |

| Total loans | | $ | 11,088,690 | | | 183,708 | | | 228,848 | | | — | | | — | | | 11,501,246 | |

| At December 31, 2023 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ | 3,413,846 | | | — | | | 14,339 | | | — | | | — | | | 3,428,185 | |

| Home equity loans | | 1,223,097 | | | — | | | 4,761 | | | — | | | — | | | 1,227,858 | |

| Consumer loans | | 2,120,216 | | | — | | | 5,811 | | | — | | | — | | | 2,126,027 | |

| Total Personal Banking | | 6,757,159 | | | — | | | 24,911 | | | — | | | — | | | 6,782,070 | |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,670,510 | | | 124,116 | | | 179,384 | | | — | | | — | | | 2,974,010 | |

| Commercial loans | | 1,637,879 | | | 6,678 | | | 14,172 | | | — | | | — | | | 1,658,729 | |

| Total Commercial Banking | | 4,308,389 | | | 130,794 | | | 193,556 | | | — | | | — | | | 4,632,739 | |

| Total loans | | $ | 11,065,548 | | | 130,794 | | | 218,467 | | | — | | | — | | | 11,414,809 | |

| At September 30, 2023 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ | 3,459,251 | | | — | | | 13,512 | | | — | | | — | | | 3,472,763 | |

| Home equity loans | | 1,254,985 | | | — | | | 3,780 | | | — | | | — | | | 1,258,765 | |

| Consumer loans | | 2,150,464 | | | — | | | 4,655 | | | — | | | — | | | 2,155,119 | |

| Total Personal Banking | | 6,864,700 | | | — | | | 21,947 | | | — | | | — | | | 6,886,647 | |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,632,472 | | | 123,935 | | | 166,610 | | | — | | | — | | | 2,923,017 | |

| Commercial loans | | 1,476,833 | | | 3,690 | | | 20,086 | | | — | | | — | | | 1,500,609 | |

| Total Commercial Banking | | 4,109,305 | | | 127,625 | | | 186,696 | | | — | | | — | | | 4,423,626 | |

| Total loans | | $ | 10,974,005 | | | 127,625 | | | 208,643 | | | — | | | — | | | 11,310,273 | |

| At June 30, 2023 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ | 3,483,098 | | | — | | | 12,059 | | | — | | | — | | | 3,495,157 | |

| Home equity loans | | 1,272,363 | | | — | | | 3,699 | | | — | | | — | | | 1,276,062 | |

| Consumer loans | | 2,196,938 | | | — | | | 4,124 | | | — | | | — | | | 2,201,062 | |

| Total Personal Banking | | 6,952,399 | | | — | | | 19,882 | | | — | | | — | | | 6,972,281 | |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,649,535 | | | 74,170 | | | 171,519 | | | — | | | — | | | 2,895,224 | |

| Commercial loans | | 1,377,981 | | | 3,040 | | | 22,705 | | | — | | | — | | | 1,403,726 | |

| Total Commercial Banking | | 4,027,516 | | | 77,210 | | | 194,224 | | | — | | | — | | | 4,298,950 | |

| Total loans | | $ | 10,979,915 | | | 77,210 | | | 214,106 | | | — | | | — | | | 11,271,231 | |

* Includes $2.5 million, $2.4 million, $7.8 million, $6.9 million, and $4.9 million of acquired loans at June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, and June 30, 2023, respectively.

** Includes $24.3 million, $27.2 million, $20.3 million, $28.9 million, and $31.2 million of acquired loans at June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, and June 30, 2023, respectively.

Northwest Bancshares, Inc. and Subsidiaries

Loan Delinquency (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30,

2024 | | * | | March 31,

2024 | | * | | December 31,

2023 | | * | | September 30,

2023 | | * | | June 30,

2023 | | * |

| (Number of loans and dollar amount of loans) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans delinquent 30 days to 59 days: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential mortgage loans | 12 | | | $ | 616 | | | — | % | | 351 | | | $ | 38,502 | | | 1.1 | % | | 307 | | | $ | 30,041 | | | 0.9 | % | | 6 | | | $ | 573 | | | — | % | | 14 | | | $ | 627 | | | — | % |

| Home equity loans | 104 | | | 3,771 | | | 0.3 | % | | 113 | | | 4,608 | | | 0.4 | % | | 121 | | | 5,761 | | | 0.5 | % | | 112 | | | 4,707 | | | 0.4 | % | | 92 | | | 3,395 | | | 0.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans | 742 | | | 10,372 | | | 0.5 | % | | 737 | | | 9,911 | | | 0.5 | % | | 896 | | | 11,211 | | | 0.5 | % | | 733 | | | 9,874 | | | 0.5 | % | | 602 | | | 7,955 | | | 0.4 | % |

| Commercial real estate loans | 21 | | | 4,310 | | | 0.1 | % | | 25 | | | 6,396 | | | 0.2 | % | | 23 | | | 3,204 | | | 0.1 | % | | 22 | | | 3,411 | | | 0.1 | % | | 13 | | | 2,710 | | | 0.1 | % |

| Commercial loans | 59 | | | 4,366 | | | 0.3 | % | | 62 | | | 3,091 | | | 0.2 | % | | 59 | | | 4,196 | | | 0.3 | % | | 52 | | | 2,847 | | | 0.2 | % | | 38 | | | 15,658 | | | 1.1 | % |

| Total loans delinquent 30 days to 59 days | 938 | | | $ | 23,435 | | | 0.2 | % | | 1,288 | | | $ | 62,508 | | | 0.5 | % | | 1,406 | | | $ | 54,413 | | | 0.5 | % | | 925 | | | $ | 21,412 | | | 0.2 | % | | 759 | | | $ | 30,345 | | | 0.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans delinquent 60 days to 89 days: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential mortgage loans | 70 | | | $ | 8,223 | | | 0.2 | % | | 3 | | | $ | 70 | | | — | % | | 69 | | | $ | 7,796 | | | 0.2 | % | | 56 | | | $ | 5,395 | | | 0.2 | % | | 52 | | | $ | 3,521 | | | 0.1 | % |

| Home equity loans | 35 | | | 1,065 | | | 0.1 | % | | 26 | | | 761 | | | 0.1 | % | | 37 | | | 982 | | | 0.1 | % | | 40 | | | 1,341 | | | 0.1 | % | | 31 | | | 1,614 | | | 0.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans | 295 | | | 3,198 | | | 0.2 | % | | 231 | | | 2,545 | | | 0.1 | % | | 322 | | | 3,754 | | | 0.2 | % | | 236 | | | 2,707 | | | 0.1 | % | | 250 | | | 2,584 | | | 0.1 | % |

| Commercial real estate loans | 9 | | | 3,155 | | | 0.1 | % | | 5 | | | 807 | | | — | % | | 9 | | | 1,031 | | | — | % | | 13 | | | 1,588 | | | 0.1 | % | | 12 | | | 1,288 | | | — | % |

| Commercial loans | 22 | | | 8,732 | | | 0.5 | % | | 27 | | | 1,284 | | | 0.1 | % | | 16 | | | 703 | | | — | % | | 15 | | | 981 | | | 0.1 | % | | 23 | | | 11,092 | | | 0.8 | % |

| Total loans delinquent 60 days to 89 days | 431 | | | $ | 24,373 | | | 0.2 | % | | 292 | | | $ | 5,467 | | | — | % | | 453 | | | $ | 14,266 | | | 0.1 | % | | 360 | | | $ | 12,012 | | | 0.1 | % | | 368 | | | $ | 20,099 | | | 0.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans delinquent 90 days or more: ** | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential mortgage loans | 53 | | | $ | 5,553 | | | 0.2 | % | | 50 | | | $ | 5,813 | | | 0.2 | % | | 70 | | | $ | 7,995 | | | 0.2 | % | | 79 | | | $ | 7,695 | | | 0.2 | % | | 63 | | | $ | 6,290 | | | 0.2 | % |

| Home equity loans | 51 | | | 2,506 | | | 0.2 | % | | 71 | | | 2,823 | | | 0.2 | % | | 81 | | | 3,126 | | | 0.3 | % | | 73 | | | 2,206 | | | 0.2 | % | | 68 | | | 1,965 | | | 0.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans | 358 | | | 3,012 | | | 0.1 | % | | 398 | | | 3,345 | | | 0.2 | % | | 440 | | | 3,978 | | | 0.2 | % | | 357 | | | 3,020 | | | 0.1 | % | | 314 | | | 2,447 | | | 0.1 | % |

| Commercial real estate loans | 19 | | | 6,034 | | | 0.2 | % | | 22 | | | 6,931 | | | 0.2 | % | | 27 | | | 6,712 | | | 0.2 | % | | 27 | | | 8,416 | | | 0.3 | % | | 20 | | | 8,575 | | | 0.3 | % |

| Commercial loans | 72 | | | 3,385 | | | 0.2 | % | | 62 | | | 3,421 | | | 0.2 | % | | 53 | | | 2,780 | | | 0.2 | % | | 39 | | | 2,472 | | | 0.2 | % | | 38 | | | 2,414 | | | 0.2 | % |

| Total loans delinquent 90 days or more | 553 | | | $ | 20,490 | | | 0.2 | % | | 603 | | | $ | 22,333 | | | 0.2 | % | | 671 | | | $ | 24,591 | | | 0.2 | % | | 575 | | | $ | 23,809 | | | 0.2 | % | | 503 | | | $ | 21,691 | | | 0.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total loans delinquent | 1,922 | | | $ | 68,298 | | | 0.6 | % | | 2,183 | | | $ | 90,308 | | | 0.8 | % | | 2,530 | | | $ | 93,270 | | | 0.8 | % | | 1,860 | | | $ | 57,233 | | | 0.5 | % | | 1,630 | | | $ | 72,135 | | | 0.6 | % |

* Represents delinquency, in dollars, divided by the respective total amount of that type of loan outstanding.

** Includes purchased credit deteriorated loans of $82,000, $446,000, $646,000, $1.4 million, and $605,000 at June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, and June 30, 2023, respectively.

Northwest Bancshares, Inc. and Subsidiaries

Allowance for Credit Losses (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 |

| Beginning balance | $ | 124,897 | | | 125,243 | | | 124,841 | | | 124,423 | | | 121,257 | |

| | | | | | | | | |

| | | | | | | | | |

| Provision | 2,169 | | | 4,234 | | | 3,801 | | | 3,983 | | | 6,010 | |

| Charge-offs residential mortgage | (252) | | | (162) | | | (266) | | | (171) | | | (545) | |

| Charge-offs home equity | (237) | | | (412) | | | (133) | | | (320) | | | (235) | |

| | | | | | | | | |

| Charge-offs consumer | (2,561) | | | (4,573) | | | (3,860) | | | (3,085) | | | (2,772) | |

| Charge-offs commercial real estate | (500) | | | (349) | | | (742) | | | (484) | | | (483) | |

| Charge-offs commercial | (1,319) | | | (1,163) | | | (806) | | | (1,286) | | | (1,209) | |

| Recoveries | 2,873 | | | 2,079 | | | 2,408 | | | 1,781 | | | 2,400 | |

| Ending balance | $ | 125,070 | | | 124,897 | | | 125,243 | | | 124,841 | | | 124,423 | |

| Net charge-offs to average loans, annualized | 0.07 | % | | 0.16 | % | | 0.12 | % | | 0.13 | % | | 0.10 | % |

| | | | | | | | | | | |

| Six months ended June 30, |

| 2024 | | 2023 |

| Beginning balance | $ | 125,243 | | | 118,036 | |

| ASU 2022-02 Adoption | — | | | 426 | |

| Provision | 6,403 | | | 10,880 | |

| Charge-offs residential mortgage | (414) | | | (752) | |

| Charge-offs home equity | (649) | | | (399) | |

| Charge-offs consumer | (7,134) | | | (5,506) | |

| Charge-offs commercial real estate | (849) | | | (1,140) | |

| Charge-offs commercial | (2,482) | | | (2,074) | |

| Recoveries | 4,952 | | | 4,952 | |

| Ending balance | $ | 125,070 | | | 124,423 | |

| Net charge-offs to average loans, annualized | 0.12 | % | | 0.09 | % |

Northwest Bancshares, Inc. and Subsidiaries

Average Balance Sheet (Unaudited)

(dollars in thousands)

The following table sets forth certain information relating to the Company’s average balance sheet and reflects the average yield on assets and average cost of liabilities for the periods indicated. Such yields and costs are derived by dividing income or expense by the average balance of assets or liabilities, respectively, for the periods presented. Average balances are calculated using daily averages.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended |

| June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 |

| Average

balance | | Interest | | Avg. yield/ cost (h) | | Average

balance | | Interest | | Avg.

yield/

cost (h) | | Average

balance | | Interest | | Avg.

yield/

cost (h) | | Average

balance | | Interest | | Avg.

yield/

cost (h) | | Average

balance | | Interest | | Avg.

yield/

cost (h) |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential mortgage loans | $ | 3,342,749 | | | 32,182 | | | 3.85 | % | | $ | 3,392,524 | | | 32,674 | | | 3.85 | % | | $ | 3,442,308 | | | 32,739 | | | 3.80 | % | | $ | 3,476,446 | | | 32,596 | | | 3.75 | % | | $ | 3,485,517 | | | 32,485 | | | 3.73 | % |

| Home equity loans | 1,183,497 | | | 17,303 | | | 5.88 | % | | 1,205,273 | | | 17,294 | | | 5.77 | % | | 1,238,420 | | | 17,590 | | | 5.64 | % | | 1,264,134 | | | 17,435 | | | 5.47 | % | | 1,273,298 | | | 16,898 | | | 5.32 | % |

| Consumer loans | 2,048,396 | | | 26,334 | | | 5.17 | % | | 2,033,620 | | | 25,033 | | | 4.95 | % | | 2,055,783 | | | 24,667 | | | 4.76 | % | | 2,092,023 | | | 23,521 | | | 4.46 | % | | 2,143,804 | | | 22,662 | | | 4.24 | % |