Northwest Bancshares, Inc. (“Northwest”) (NASDAQ: NWBI) the bank

holding company for Northwest Bank, and Penns Woods Bancorp, Inc.

(“Penns Woods”) (NASDAQ: PWOD), the multi-bank holding company of

Jersey Shore State Bank and Luzerne Bank, jointly announced today

that they have entered into a definitive Agreement and Plan of

Merger (“Agreement”) whereby Northwest will acquire Penns Woods in

an all-stock transaction valued at approximately $270.4 million.

Combining the two organizations will significantly enhance the

combined company’s presence in North Central and Northeastern

Pennsylvania.

Headquartered in Williamsport, Pennsylvania,

Penns Woods has approximately $2.3 billion in assets, $1.7 billion

in total deposits, and $1.9 billion in total loans as of September

30, 2024. The combined company is expected to have pro forma total

assets in excess of $17 billion and is expected to be one of the

nation’s top 100 largest banks. The combined company’s Pennsylvania

banking presence will be enhanced through the addition of 24 branch

locations across Blair, Centre, Clinton, Luzerne, Lycoming,

Montour, and Union counties. The complementary footprint of Penns

Woods links Northwest's presence in both eastern and western

Pennsylvania. When the transaction is completed, Northwest will

have more than 150 financial centers, as well as loan production

offices, across four states.

Under the terms of the Agreement, which has been

unanimously approved by the board of directors of both companies,

Northwest will exchange shares of its common stock for all of the

outstanding shares of Penns Woods common stock, in an all-stock

transaction. Penns Woods shareholders will be entitled to receive

2.385 shares of Northwest common stock for each share of Penns

Woods common stock they own upon the effective time of the merger.

Any unexercised stock options of Penns Woods will be canceled in

exchange for a cash payment at the spread value over the exercise

price. Based on Northwest’s closing stock price of $14.44 as of

December 16, 2024, the transaction consideration is valued at

$34.44 for each share of Penns Woods which equates to a 139.0%

multiple of tangible book value, a 12.8x multiple on LTM core

earnings and a core deposit premium of 5.2% as of September 30,

2024. Including the consideration paid to option holders, the

aggregate consideration is approximately $270.4 million. The merger

is expected to qualify as a tax-free reorganization. Following

completion of the transaction, Penns Woods shareholders would be

expected to receive, on a per share equivalent basis, a dividend

equal to approximately $0.48 per share based on Northwest’s current

quarterly dividend of $0.20 per share. This dividend is

approximately 49% higher than Penns Woods’ current quarterly

dividend of $0.32 per share.

Louis J. Torchio, President and CEO of

Northwest, stated, “We are very excited to announce this

partnership with the Penns Woods team as this transaction marks

another milestone in our long-term growth strategy and executes on

our strategic plan. Jersey Shore State Bank and Luzerne Bank have

outstanding reputations throughout their respective markets, and we

look forward to welcoming our new colleagues and their customers to

the Northwest family. We will be strongly positioned to continue to

serve communities that are familiar to Northwest, expand our

presence into new markets, and deliver exceptional banking services

across our entire footprint. Through this acquisition, we look

forward to building on Northwest’s rich history of

community-focused banking and delivering even greater value to our

customers, employees, communities, and shareholders.”

Richard A. Grafmyre, CEO of Penns Woods, added,

“As Lou mentioned, we are very excited to announce this partnership

and are looking forward to bringing together two like-minded

institutions. This combination will provide the best path for the

long-term success of our organization, employees, customers, and

shareholders. We believe that the combination of our highly

compatible organizations will create a catalyst for growth and

benefit all of the communities we serve. The merger will provide

increased scale and additional capabilities for our customers, and

it will provide greater opportunities for our employees to advance

their careers as a part of a larger organization.”

Upon completion of the merger, the shares issued

to Penns Woods shareholders are expected to comprise approximately

12% of the outstanding shares of the combined company. The

Agreement also provides that Northwest will appoint Richard A.

Grafmyre to the boards of Northwest and Northwest Bank after

closing.

Excluding one-time transaction costs, Northwest

expects the transaction to be approximately 23% accretive to 2026

fully diluted earnings per share. Tangible book value dilution is

expected to be approximately 9% at closing, with an expected

tangible book value earn-back period of under 3 years using the

“cross-over” method. The “pay-to-trade” multiple is 0.91x.

Northwest and Northwest Bank capital ratios are expected to be

significantly above “well-capitalized” regulatory thresholds upon

closing.

The companies expect to complete the transaction

in the third quarter of 2025, subject to the satisfaction of

customary closing conditions, including regulatory approvals and

approval by Penns Woods shareholders. At closing, Jersey Shore

State Bank and Luzerne Bank branches will become branches of

Northwest Bank.

Janney Montgomery Scott, LLC is acting as

financial advisor to Northwest, and Dinsmore & Shohl LLP is

acting as its legal advisor in the transaction. Stephens Inc. is

acting as financial advisor to Penns Woods, and Stevens & Lee,

P.C. is acting as its legal advisor in the transaction. An investor

presentation that provides additional details regarding this

transaction is available online at

investorrelations.northwest.bank.

About Northwest Bancshares,

Inc.

Headquartered in Columbus, Ohio, Northwest

Bancshares, Inc. is the bank holding company of Northwest Bank.

Founded in 1896, Northwest Bank is a full-service financial

institution which offers a complete line of business and consumer

banking products, as well as employee benefits and wealth

management services. Currently, Northwest operates 130 full-service

financial centers and eleven free standing drive-up facilities in

Pennsylvania, New York, Ohio, and Indiana. Northwest Bancshares,

Inc.’s common stock is listed on the NASDAQ Global Select Market

under the symbol NWBI. Additional information regarding Northwest

Bancshares, Inc. and Northwest Bank can be accessed online at

www.northwest.bank.

About Penns Woods Bancorp,

Inc.

Penns Woods Bancorp, Inc. is the bank holding

company for Jersey Shore State Bank and Luzerne Bank. The banks

serve customers in North Central and Northeastern Pennsylvania

through their retail banking, commercial banking, mortgage

services, and financial services divisions. Penns Woods Bancorp,

Inc. stock is listed on the NASDAQ Global Select Market under the

symbol PWOD. Previous press releases and additional information can

be obtained from the company’s website at www.pwod.com.

Forward-Looking Statements

The statements in this press release that are

not historical facts, in particular the statements with respect to

the expected timing of and benefits of the proposed merger between

Northwest and Penns Woods, the parties’ plans, obligations,

expectations, and intentions, and the statements with respect to

accretion and earn-back of tangible book value dilution, constitute

forward-looking statements as defined by federal securities laws.

Such statements are subject to numerous assumptions, risks, and

uncertainties. Actual results could differ materially from those

contained or implied by such statements for a variety of factors

including: the businesses of Northwest and Penns Woods may not be

integrated successfully or such integration may take longer to

accomplish than expected; the expected cost savings and any revenue

synergies from the proposed merger may not be fully realized within

the expected timeframes; disruption from the proposed merger may

make it more difficult to maintain relationships with clients,

associates, or suppliers; the required governmental approvals of

the proposed merger may not be obtained on the expected terms and

schedule; Penns Woods’ shareholders may not approve the proposed

merger and the Agreement; and changes in economic conditions;

movements in interest rates; competitive pressures on product

pricing and services; success and timing of other business

strategies; the nature, extent, and timing of governmental actions

and reforms; and extended disruption of vital infrastructure; and

other factors described in Northwest’s 2023 Annual Report on Form

10-K, Penns Woods’s 2023 Annual Report on Form 10-K, and documents

subsequently filed by Northwest and Penns Woods with the Securities

and Exchange Commission (SEC). Annualized, pro forma, projected and

estimated numbers are used for illustrative purposes only, are not

forecasts and may not reflect actual results. All forward-looking

statements included herein are based on information available at

the time of the release. Neither Northwest nor Penns Woods assumes

any obligation to update any forward-looking statement.

Additional Information about the Merger

and Where to Find It

This news release does not constitute an offer

to sell or the solicitation of an offer to buy securities of

Northwest. In connection with the proposed merger, Northwest will

file with the SEC a Registration Statement on Form S-4 that will

include a proxy statement of Penns Woods, and a prospectus of

Northwest, as well as other relevant documents concerning the

proposed transaction. INVESTORS AND SHAREHOLDERS OF PENNS

WOODS, AND OTHER INTERESTED PARTIES ARE URGED TO READ THE

REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING

THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. The Proxy Statement/Prospectus will be mailed

to shareholders of Penns Woods prior to the shareholder meeting,

which has not yet been scheduled. In addition, when the

Registration Statement on Form S-4, which will include the Proxy

Statement/Prospectus, and other related documents are filed by

Northwest with the SEC, it may be obtained for free at the SEC’s

website at www.sec.gov, and from either Northwest’s website at

www.northwest.bank or Penns Woods’ website at www.pwod.com.

Participants in the

Solicitation

Northwest, Penns Woods, and their respective

executive officers and directors may be deemed to be participants

in the solicitation of proxies from the shareholders of Northwest

and Penns Woods in connection with the proposed merger. Information

about the directors and executive officers of Northwest is set

forth in the proxy statement for Northwest’s 2024 annual meeting of

shareholders, as filed with the SEC on March 8, 2024. Information

about the directors and executive officers of Penns Woods is set

forth in the proxy statement for Penns Woods’s 2024 annual meeting

of shareholders, as filed with the SEC on March 26, 2024.

Information about any other persons who may, under the rules of the

SEC, be considered participants in the solicitation of shareholders

of Penns Woods in connection with the proposed merger will be

included in the Proxy Statement/Prospectus. You can obtain free

copies of these documents from the SEC, Northwest, or Penns Woods

using the website information above. This communication does not

constitute an offer to sell or the solicitation of an offer to buy

any securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

PENNS WOODS SHAREHOLDERS AND INVESTORS

ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN IT

BECOMES AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS

WITH RESPECT TO THE PROPOSED MERGER.

SOURCE: Northwest Bancshares, Inc. and Penns

Woods Bancorp, Inc.

Northwest Company Contact:

Devin T. CygnarExecutive Vice President, Chief

Marketing & Communications Officer3 Easton Oval, Suite

500Columbus, OH 43219(614) 934-2797

Penns Woods Company

Contact:

Richard A. Grafmyre, Chief Executive Officer300

Market StreetWilliamsport, PA, 17701(570) 322-1111(888)

412-5772

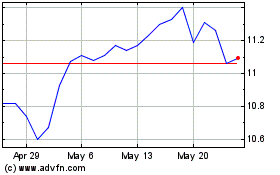

Northwest Bancshares (NASDAQ:NWBI)

Historical Stock Chart

From Nov 2024 to Dec 2024

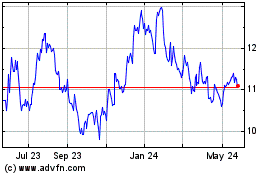

Northwest Bancshares (NASDAQ:NWBI)

Historical Stock Chart

From Dec 2023 to Dec 2024