0000076605false00000766052025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 OR 15(d) Of The Securities Exchange Act Of 1934

| | | | | |

Date of report (Date of earliest event reported) | February 6, 2025 |

| |

| PATRICK INDUSTRIES, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Indiana | | 000-03922 | | 35-1057796 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | | | | | | | | | | | | | | | | |

| 107 W. Franklin Street | | | | | |

| Elkhart, | Indiana | | 46516 | | (574) | 294-7511 |

| (Address of Principal Executive Offices) | | (Zip Code) | | Registrant's Telephone Number, including area code |

| | |

|

| (Former name or former address if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, no par value | PATK | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On February 6, 2025, the Company issued a press release announcing operating results for the fourth quarter ended December 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

The information referenced in this Form 8-K is furnished pursuant to Item 7.01, “Regulation FD Disclosure.” Such information, including the Exhibit attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

(a) Slides for Earnings Presentation as contained in Exhibit 99.2

Item 8.01 Other Events

On February 3, 2025, the Board of Directors of Patrick Industries, Inc. declared a quarterly cash dividend of $0.40 per share of common stock, which will be payable on March 3, 2025, to shareholders of record at the close of business on February 18, 2025.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 104 - Cover Page Interactive Date File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PATRICK INDUSTRIES, INC. |

| (Registrant) |

| | | | | | | | |

| Date: February 6, 2025 | By: | /s/ Andrew C. Roeder |

| Andrew C. Roeder |

| Executive Vice President - Finance, Chief Financial Officer, and Treasurer |

News Release

News Release Patrick Industries, Inc. Reports Fourth Quarter and Full Year 2024 Financial Results and Declares Quarterly Cash Dividend

Fourth Quarter and Full Year 2024 Highlights (compared to Fourth Quarter and Full Year 2023 unless otherwise noted)

•Net sales for the fourth quarter and full year increased 8% to $846 million and 7% to $3.7 billion, respectively, reflecting the contribution of acquisitions, and higher revenue from our Housing and RV end markets.

•Operating margin for the fourth quarter and full year was 4.7% and 6.9%, respectively. Adjusted operating margin1 for the fourth quarter and full year was 5.2% and 7.2%, respectively.

•Diluted earnings per share (EPS) for the fourth quarter and full year 2024 was $0.42 and $4.11, respectively. Adjusted diluted EPS1 for the fourth quarter and full year 2024 was $0.52 and $4.34, respectively.

•Reported and adjusted diluted EPS1 for the fourth quarter and full year 2024 included an estimated $0.02 per share and $0.10 per share, respectively, related to the dilutive impact of our convertible notes and related warrants in the periods.

•Full year 2024 adjusted EBITDA1 of $452 million increased 6% and full year 2024 adjusted EBITDA margin1 decreased 10 basis points to 12.2%.

•Free cash flow1 for 2024 was $251 million. Patrick returned $55 million to shareholders in 2024 in the form of dividends and share repurchases.

•During 2024, Patrick strengthened its Powersports platform through the acquisition of Sportech, LLC in January, and significantly expanded its Outdoor Enthusiast aftermarket presence with the September acquisition of RecPro.

•In the fourth quarter, the Company amended and extended the maturity of its senior credit facility and issued $500 million aggregate principal amount of 6.375% Senior Notes due 2032. The Company redeemed its $300 million 7.50% Senior Notes due 2027 with a portion of the proceeds.

•In November, the Company increased its share repurchase authorization to $200 million and quarterly cash dividend by 9%. Patrick executed a three-for-two stock split in December.

ELKHART, IN, February 6, 2025 – Patrick Industries, Inc. (NASDAQ: PATK) ("Patrick" or the "Company"), a leading component solutions provider for the Outdoor Enthusiast and Housing markets, today reported financial results for the fourth quarter and year ended December 31, 2024.

Fourth quarter net sales increased 8% to $846 million compared to $781 million in the fourth quarter of 2023. The improvement in sales reflected the contribution of acquisitions completed during the year, a 12% improvement in Housing end market revenue and market share gains. The improvement in sales was partially offset by lower revenue from our Marine end market due to lower marine industry wholesale shipments.

Operating income of $40 million decreased $17 million, or 31%, compared to the fourth quarter of 2023. Operating margin decreased 260 basis points to 4.7%, reflecting higher amortization related to acquisitions and our strategic decision to maintain production capacity to enhance our ability to serve customers as they prepare for the upcoming selling season. On an adjusted basis1, operating margin was 5.2%.

Net income was $15 million or $0.42 per diluted share in the fourth quarter of 2024 compared to $31 million or $0.94 per diluted share in the same period last year. On an adjusted basis1, net income was $18 million or $0.52 per diluted share in the fourth quarter of 2024. Adjusted diluted EPS1 includes the dilutive impact of our convertible notes and related warrants, or an estimated $0.02 per share. Adjusted EBITDA1 was $89 million and adjusted EBITDA margin1 was 10.6% in the fourth quarter of 2024 compared to adjusted EBITDA1 of $100 million and adjusted EBITDA margin1 of 12.8% in the same period last year.

"Our team continued to execute in 2024 with a steadfast commitment to excellence and innovation, addressing evolving customer needs while advancing our long-term strategic objectives," said Andy Nemeth, Chief Executive Officer. "As we navigated dynamic markets facing demand and interest rate pressures, we prioritized optimizing our operations and elevating our customer first expectations, presence and capabilities. Last year was strategically significant, as we completed two key acquisitions: Sportech, which solidifies our platform in the Powersports market, and RecPro, which meaningfully expands our presence in the Outdoor Enthusiast aftermarket space. We also bolstered our liquidity and financial flexibility by expanding and extending our credit facility and by refinancing a portion of our debt, which extended our maturity horizon and reduced the average interest rate of our fixed rate debt, supporting our strong foundation to capitalize on future opportunities and drive shareholder value in 2025 and beyond."

Jeff Rodino, President – RV, said, "Last year, we continued to see diligent dealer inventory management due to high floorplan costs and uncertain consumer demand. Looking at 2025, we believe there are promising trends occurring in our RV market as the industry prepares for the upcoming selling season. While our experience suggests that RV tends to be the first of our Outdoor Enthusiast markets to improve after a down cycle, we will closely monitor the impact of interest rates and consumer confidence on all of our end markets and continue to drive our business for long-term profitable growth."

Fourth Quarter 2024 Revenue by Market Sector (compared to Fourth Quarter 2023 unless otherwise noted)

RV (42% of Revenue)

•Revenue of $358 million increased 1% while wholesale RV industry unit shipments increased 3%.

•Full year content per wholesale RV unit increased 1% to $4,870. Compared to the trailing twelve-month period through the third quarter of 2024, content per wholesale RV unit was flat.

Marine (14% of Revenue)

•Revenue of $122 million decreased 17% while estimated wholesale powerboat industry unit shipments decreased 20%. Our Marine end market revenue previously included Powersports revenue, which we began to report separately following the Sportech acquisition. End market revenue and content per unit have been adjusted to reflect this change for the relevant periods.

•Full year estimated content per wholesale powerboat unit decreased 3% to $3,967. Compared to the trailing twelve-month period through the third quarter of 2024, content per wholesale powerboat unit increased 1%.

Powersports (9% of Revenue)

•Revenue of $78 million increased 228%, driven primarily by the acquisition of Sportech.

Housing (35% of Revenue, comprised of Manufactured Housing ("MH") and Industrial)

•Revenue of $288 million increased 12%; wholesale MH industry unit shipments increased 15%; total housing starts decreased 6%, with single-family housing starts decreasing 5% and multifamily housing starts decreasing 9%.

•Full year content per wholesale MH unit increased 4% to $6,604. Compared to the trailing twelve-month period through the third quarter of 2024, content per wholesale MH unit increased 1%.

Full Year 2024 Results

Net sales of $3.7 billion increased 7% compared to 2023 as a result of strategic acquisitions completed during the year and higher revenue from our Housing and RV end markets, partially offset by lower Marine end market revenue.

Operating income of $258 million decreased 1% compared to 2023 and GAAP reported operating margin was 6.9%. Adjusted operating margin1 was 7.2%, a decrease of 30 basis points compared to 2023.

Net income of $138 million decreased 3% in 2024 compared to $143 million in 2023, while diluted earnings per share decreased 5% to $4.11 compared to $4.33 in the prior year. Adjusted net income1 was $146 million and adjusted diluted EPS1 was $4.34. Adjusted diluted EPS1 included an estimated $0.10 per share related to the dilutive impact of our convertible notes and related warrants in the period. Adjusted EBITDA1 for 2024 was $452 million, an increase of 6% compared to 2023.

Balance Sheet, Cash Flow and Capital Allocation

Cash provided by operations for full year 2024 was $327 million compared to $409 million in 2023, primarily due to increasing our inventories in the fourth quarter of 2024 to ensure we are in the best position to support our customer’s needs in anticipation of a RV demand recovery in 2025. Purchases of property, plant and equipment for full year 2024 totaled $76 million, up from $59 million in 2023, reflecting continued investments in automation and technology initiatives. For the full year 2024, business acquisitions totaled $412 million, primarily related to the acquisition of Sportech in the first quarter and RecPro during the third quarter. Free cash flow1 in 2024 was $251 million compared to $350 million in 2023.

In alignment with our capital allocation strategy, we returned $18 million to shareholders in the fourth quarter of 2024, consisting of $5 million in opportunistic repurchases of approximately 60,000 shares and $13 million in cash dividends. For the full year, we returned $55 million to shareholders including $50 million in cash dividends to our shareholders and $5 million in opportunistic share repurchases.

Our total debt at the end of the fourth quarter of 2024 was approximately $1.3 billion, resulting in a total net leverage ratio of 2.7x (as calculated in accordance with our credit agreement). Available liquidity, comprised of borrowing availability under our senior credit facility and cash on hand, was approximately $804 million.

Business Outlook and Summary

"We see significant opportunity across the Outdoor Enthusiast space and are optimistic about the long-term growth potential of our company and the markets we serve," continued Mr. Nemeth. "We have continued to make strategic investments in our business, including our automation initiatives and the creation of our Advanced Product Group, which highlights our commitment to forward-looking innovation and delivering cutting-edge product solutions to our customers. As we enter 2025, we remain nimble and well-positioned to support our markets and the scalability needs of our customers. We have utilized our cash flows to invest in inventory in anticipation of potential increased production levels in our RV markets, and have also focused on retaining key talent and resources in anticipation of our end markets improving. Looking ahead, we are optimistic about our end markets, favorable demographic trends, the earnings power of our business, our strong balance sheet and cash flow, and the unwavering commitment of our team members who are key to our continued momentum in 2025."

1 See additional information at the end of this release regarding non-GAAP financial measures.

Quarterly Cash Dividend

On February 3, 2025, the Company's Board of Directors declared a quarterly cash dividend of $0.40 per share of common stock. The dividend is payable on March 3, 2025, to shareholders of record at the close of business on February 18, 2025.

Conference Call Webcast

As previously announced, Patrick Industries will host an online webcast of its fourth quarter 2024 earnings conference call that can be accessed on the Company’s website, www.patrickind.com, under “For Investors,” on Thursday, February 6, 2025 at 10:00 a.m. Eastern time. In addition, a supplemental earnings presentation can be accessed on the Company’s website, www.patrickind.com under “For Investors.”

About Patrick Industries, Inc.

Patrick (NASDAQ: PATK) is a leading component solutions provider serving the RV, Marine, Powersports and Housing markets. Since 1959, Patrick has empowered manufacturers and outdoor enthusiasts to achieve next-level recreation experiences. Our customer-focused approach brings together design, manufacturing, distribution, and transportation in a full solutions model that defines us as a trusted partner. Patrick is home to more than 85 leading brands, all united by a commitment to quality, customer service, and innovation. Headquartered in Elkhart, IN, Patrick employs approximately 10,000 skilled team members throughout the United States. For more information on Patrick, our brands, and products, please visit www.patrickind.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Potential factors that could impact results include: the effects of external macroeconomic factors, including adverse developments in world financial markets, disruptions related to tariffs and other trade issues, and global supply chain interruptions; adverse economic and business conditions, including inflationary pressures, cyclicality and seasonality in the industries we sell our products; the effects of interest rate changes and other monetary and market fluctuations; the deterioration of the financial condition of our customers or suppliers; the ability to adjust our production schedules up or down quickly in response to rapid changes in demand; the loss of a significant customer; changes in consumer preferences; pricing pressures due to competition; conditions in the credit market limiting the ability of consumers and wholesale customers to obtain retail and wholesale financing for RVs, manufactured homes, and marine products; public health emergencies or pandemics, such as the COVID-19 pandemic; the imposition of, or changes in, restrictions and taxes on imports of raw materials and components used in our products; information technology performance and security, including our ability to deter cyberattacks or other information security incidents; any increased cost or limited availability of certain raw materials; the impact of governmental and environmental regulations, and our inability to comply with them; our level of indebtedness; the ability to remain in compliance with our credit agreement covenants; the availability and costs of labor and production facilities and the impact of labor shortages; inventory levels of retailers and manufacturers; the ability to manage working capital, including inventory and inventory obsolescence; the ability to generate cash flow or obtain financing to fund growth; future growth rates in the Company's core businesses; realization and impact of efficiency improvements and cost reductions; the successful integration of acquisitions and other growth initiatives; increases in interest rates and oil and gasoline prices; the ability to retain key executive and management personnel; the impact on our business resulting from wars and military conflicts such as war in Ukraine and evolving conflict in the Middle East; natural disasters or other unforeseen events, and adverse weather conditions.

There can be no assurance that any forward-looking statement will be realized or that actual results will not be significantly different from that set forth in such forward-looking statement. Information about certain risks that could affect our business and cause actual results to differ from those expressed or implied in the forward-looking statements are contained in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company's Forms 10-Q for subsequent quarterly periods, which are filed with the Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. In addition, future dividends are subject to Board approval. Each forward-looking statement speaks only as of the date of this press release, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made.

Contact:

Steve O'Hara

Vice President of Investor Relations

oharas@patrickind.com

574.294.7511

| | | | | | | | | | | | | | | | | | | | | | | |

| PATRICK INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

| | | | | | | |

| Fourth Quarter Ended | | Year Ended |

| ($ and shares in thousands, except per share data) | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| NET SALES | $ | 846,123 | | | $ | 781,187 | | | $ | 3,715,683 | | | $ | 3,468,045 | |

| Cost of goods sold | 658,896 | | | 602,285 | | | 2,879,793 | | | 2,685,812 | |

| GROSS PROFIT | 187,227 | | | 178,902 | | | 835,890 | | | 782,233 | |

| | | | | | | |

| Operating Expenses: | | | | | | | |

| Warehouse and delivery | 41,768 | | | 34,381 | | | 155,821 | | | 143,921 | |

| Selling, general and administrative | 81,137 | | | 67,604 | | | 325,754 | | | 299,418 | |

| Amortization of intangible assets | 24,730 | | | 19,601 | | | 96,275 | | | 78,694 | |

| Total operating expenses | 147,635 | | | 121,586 | | | 577,850 | | | 522,033 | |

| OPERATING INCOME | 39,592 | | | 57,316 | | | 258,040 | | | 260,200 | |

| Interest expense, net | 18,987 | | | 15,319 | | | 79,470 | | | 68,942 | |

| Income before income taxes | 20,605 | | | 41,997 | | | 178,570 | | | 191,258 | |

| Income taxes | 6,047 | | | 11,180 | | | 40,169 | | | 48,361 | |

| NET INCOME | $ | 14,558 | | | $ | 30,817 | | | $ | 138,401 | | | $ | 142,897 | |

| | | | | | | |

BASIC EARNINGS PER COMMON SHARE (1) | $ | 0.45 | | | $ | 0.96 | | | $ | 4.25 | | | $ | 4.43 | |

DILUTED EARNINGS PER COMMON SHARE (1) | $ | 0.42 | | | $ | 0.94 | | | $ | 4.11 | | | $ | 4.33 | |

| | | | | | | |

Weighted average shares outstanding - Basic (1) | 32,597 | | | 32,177 | | | 32,568 | | | 32,278 | |

Weighted average shares outstanding - Diluted (1) | 34,447 | | | 32,871 | | | 33,699 | | | 33,038 | |

(1)Prior year periods reflect the impact of the three-for-two stock-split paid on December 13, 2024.

| | | | | | | | | | | |

| PATRICK INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

| | | |

| As of December 31, |

| ($ in thousands) | 2024 | | 2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 33,561 | | | $ | 11,409 | |

| Trade and other receivables, net | 178,206 | | | 163,838 | |

| Inventories | 551,617 | | | 510,133 | |

| Prepaid expenses and other | 59,233 | | | 49,251 | |

| Total current assets | 822,617 | | | 734,631 | |

| Property, plant and equipment, net | 384,903 | | | 353,625 | |

| Operating lease right-of-use assets | 200,697 | | | 177,717 | |

| Goodwill and intangible assets, net | 1,600,125 | | | 1,288,546 | |

| Other non-current assets | 12,612 | | | 7,929 | |

| TOTAL ASSETS | $ | 3,020,954 | | | $ | 2,562,448 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current Liabilities: | | | |

| Current maturities of long-term debt | $ | 6,250 | | | $ | 7,500 | |

| Current operating lease liabilities | 53,697 | | | 48,761 | |

| Accounts payable | 187,915 | | | 140,524 | |

| Accrued liabilities | 105,753 | | | 111,711 | |

| Total current liabilities | 353,615 | | | 308,496 | |

| Long-term debt, less current maturities, net | 1,311,684 | | | 1,018,356 | |

| Long-term operating lease liabilities | 151,026 | | | 132,444 | |

| Deferred tax liabilities, net | 61,346 | | | 46,724 | |

| Other long-term liabilities | 14,917 | | | 11,091 | |

| TOTAL LIABILITIES | 1,892,588 | | | 1,517,111 | |

| | | |

| TOTAL SHAREHOLDERS’ EQUITY | 1,128,366 | | | 1,045,337 | |

| | | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 3,020,954 | | | $ | 2,562,448 | |

PATRICK INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| | | | | | | | | | | |

| Year Ended December 31, |

| ($ in thousands) | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income | $ | 138,401 | | | $ | 142,897 | |

| Depreciation and amortization | 166,545 | | | 144,543 | |

| Amortization of deferred debt financing costs | 3,270 | | | 3,239 | |

| Loss on extinguishment of debt | 2,549 | | | — | |

| Stock-based compensation expense | 16,775 | | | 19,429 | |

| Other adjustments to reconcile net income to net cash provided by operating activities | (6,342) | | | (331) | |

| Change in operating assets and liabilities, net of acquisitions of businesses | 5,643 | | | 98,895 | |

| Net cash provided by operating activities | 326,841 | | | 408,672 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchases of property, plant and equipment | (75,682) | | | (58,987) | |

| Business acquisitions and other investing activities | (437,167) | | | (27,558) | |

| Net cash used in investing activities | (512,849) | | | (86,545) | |

| NET CASH FLOWS PROVIDED BY (USED IN) FINANCING ACTIVITIES | 208,160 | | | (333,565) | |

| Net increase (decrease) in cash and cash equivalents | 22,152 | | | (11,438) | |

| Cash and cash equivalents at beginning of year | 11,409 | | | 22,847 | |

| Cash and cash equivalents at end of year | $ | 33,561 | | | $ | 11,409 | |

PATRICK INDUSTRIES, INC.

Earnings Per Common Share (Unaudited)

The table below illustrates the calculation for earnings per common and diluted shares:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter Ended | | Year Ended |

| ($ and shares in thousands, except per share data) | | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Numerator: | | | | | | | | |

| Earnings for basic earnings per common share calculation | | $ | 14,558 | | | $ | 30,817 | | | $ | 138,401 | | | $ | 142,897 | |

| Effect of interest on potentially dilutive convertible notes, net of tax | | — | | | — | | | — | | | 162 | |

| Earnings for diluted earnings per common share calculation | | $ | 14,558 | | | $ | 30,817 | | | $ | 138,401 | | | $ | 143,059 | |

Denominator: (1) | | | | | | | | |

| Weighted average common shares outstanding - basic | | 32,597 | | 32,177 | | 32,568 | | 32,278 |

| Weighted average impact of potentially dilutive convertible notes | | 1,039 | | — | | 644 | | 248 |

| Weighted average impact of potentially dilutive warrants | | 368 | | — | | 137 | | — |

| Weighted average impact of potentially dilutive securities | | 443 | | 694 | | 350 | | 512 |

| Weighted average common shares outstanding - diluted | | 34,447 | | 32,871 | | 33,699 | | 33,038 |

Earnings per common share: (1) | | | | | | | | |

| Basic earnings per common share | | $ | 0.45 | | | $ | 0.96 | | | $ | 4.25 | | | $ | 4.43 | |

| Diluted earnings per common share | | $ | 0.42 | | | $ | 0.94 | | | $ | 4.11 | | | $ | 4.33 | |

(1)Prior year periods reflect the impact of the three-for-two stock-split paid on December 13, 2024.

PATRICK INDUSTRIES, INC.

Non-GAAP Reconciliation (Unaudited)

Use of Non-GAAP Financial Metrics

In addition to reporting financial results in accordance with U.S. GAAP, the Company also provides financial metrics, such as net leverage ratio, content per unit, free cash flow, earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted EBITDA, adjusted net income, adjusted diluted earnings per share ("adjusted diluted EPS"), adjusted operating margin, adjusted EBITDA margin and available liquidity, which we believe are important measures of the Company's business performance. These metrics should not be considered alternatives to U.S. GAAP. Our computations of net leverage ratio, content per unit, free cash flow, EBITDA, adjusted EBITDA, adjusted net income, adjusted diluted EPS, adjusted operating margin, adjusted EBITDA margin and available liquidity may differ from similarly titled measures used by others. Content per unit metrics are generally calculated using our market sales divided by Company estimates based on third-party measures of industry volume. We calculate EBITDA by adding back depreciation and amortization, net interest expense, and income tax expense to net income. We calculate adjusted EBITDA by taking EBITDA and adding back stock-based compensation, loss on sale of property, plant and equipment, loss on extinguishment of debt, acquisition related transaction costs, acquisition related fair-value inventory step-up adjustments and subtracting out gain on sale of property, plant and equipment. Adjusted net income is calculated by removing the impact of acquisition related transaction costs, net of tax, acquisition related fair-value inventory step-up adjustments, net of tax and loss on extinguishment of debt, net of tax. Adjusted diluted EPS is calculated as adjusted net income divided by our weighted average shares outstanding. Adjusted operating margin is calculated by removing the impact of acquisition related transaction costs, acquisition related fair-value inventory step-up adjustments and loss on extinguishment of debt. We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from net cash provided by operating activities. RV wholesale unit shipments are provided by the RV Industry Association. Marine wholesale unit shipments are Company estimates based on data provided by the National Marine Manufacturers Association. MH wholesale unit shipments are provided by the Manufactured Housing Institute. Housing starts are provided by the U.S. Census Bureau. You should not consider these metrics in isolation or as substitutes for an analysis of our results as reported under U.S. GAAP.

The following table reconciles net income to EBITDA and adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter Ended | | Year Ended |

| ($ in thousands) | | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Net income | | $ | 14,558 | | | $ | 30,817 | | | $ | 138,401 | | | $ | 142,897 | |

| + Depreciation & amortization | | 42,543 | | | 36,567 | | | 166,545 | | | 144,543 | |

| + Interest expense, net | | 18,987 | | | 15,319 | | | 79,470 | | | 68,942 | |

| + Income taxes | | 6,047 | | | 11,180 | | | 40,169 | | | 48,361 | |

| EBITDA | | 82,135 | | | 93,883 | | | 424,585 | | | 404,743 | |

| + Stock-based compensation | | 2,408 | | | 5,754 | | | 16,775 | | | 19,429 | |

| + Acquisition related transaction costs | | — | | | — | | | 4,998 | | | — | |

| + Acquisition related fair-value inventory step-up | | 2,166 | | | 87 | | | 2,988 | | | 697 | |

| + Loss on extinguishment of debt | | 2,549 | | | — | | | 2,549 | | | — | |

| + Loss (gain) on sale of property, plant and equipment | | 165 | | | 343 | | | (237) | | | 585 | |

| Adjusted EBITDA | | $ | 89,423 | | | $ | 100,067 | | | $ | 451,658 | | | $ | 425,454 | |

The following table reconciles full year cash flow from operations to free cash flow:

| | | | | | | | | | | | | | |

| | | Year Ended |

| ($ in thousands) | | December 31, 2024 | | December 31, 2023 |

| Net cash provided by operating activities | | $ | 326,841 | | | $ | 408,672 | |

| Less: purchases of property, plant and equipment | | (75,682) | | | (58,987) | |

| Free cash flow | | $ | 251,159 | | | $ | 349,685 | |

The following table reconciles operating margin to adjusted operating margin:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter Ended | | Year Ended | | |

| | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 | | | | |

| Operating margin | | 4.7 | % | | 7.3 | % | | 6.9 | % | | 7.5 | % | | | | |

| Acquisition related fair-value inventory step-up | | 0.2 | % | | — | % | | 0.1 | % | | — | % | | | | |

| Transaction costs | | — | % | | — | % | | 0.2 | % | | — | % | | | | |

| Loss on extinguishment of debt | | 0.3 | % | | — | % | | — | % | | — | % | | | | |

| Adjusted operating margin | | 5.2 | % | | 7.3 | % | | 7.2 | % | | 7.5 | % | | | | |

The following table reconciles net income to adjusted net income and diluted earnings per common share to adjusted diluted earnings per common share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter Ended | | Year Ended |

| ($ in thousands, except per share data) | | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Net income | | $ | 14,558 | | | $ | 30,817 | | | $ | 138,401 | | | $ | 142,897 | |

| + Acquisition related fair-value inventory step-up | | 2,166 | | | 87 | | | 2,988 | | | 697 | |

| + Transaction costs | | — | | | — | | | 4,998 | | | — | |

| + Loss on extinguishment of debt | | 2,549 | | | — | | | 2,549 | | | — | |

| - Tax impact of adjustments | | (1,206) | | | (22) | | | (2,694) | | | (176) | |

| Adjusted net income | | $ | 18,067 | | | $ | 30,882 | | | $ | 146,242 | | | $ | 143,418 | |

| | | | | | | | |

Diluted earnings per common share (per above) (1) | | $ | 0.42 | | | $ | 0.94 | | | $ | 4.11 | | | $ | 4.33 | |

Transaction costs, net of tax (1) | | — | | | — | | | 0.11 | | | — | |

Acquisition related fair-value inventory step-up, net of tax (1) | | 0.05 | | | — | | | 0.06 | | | 0.01 | |

Loss on extinguishment of debt, net of tax (1) | | 0.05 | | | — | | | 0.06 | | | — | |

Adjusted diluted earnings per common share (1) | | $ | 0.52 | | | $ | 0.94 | | | $ | 4.34 | | | $ | 4.34 | |

(1)Prior year periods reflect the impact of the three-for-two stock-split paid on December 13, 2024.

Q4 2024 Earnings Presentation February 6, 2025

Forward-looking statements 2 This presentation includes contains statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements are generally identified by words such as “estimates,” “guidance,” “expects,” ”anticipates,” “intends,” “plans,” “believes,” “seeks” and similar expressions. Forward-looking statements include information with respect to financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, industry projections, growth opportunities, acquisitions, plans and objectives of management, markets for the common stock and other matters. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, in addition to other matters described in this presentation, the impacts of future pandemics, geopolitical tensions or natural disaster, on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including risk factors that potentially could materially affect the Company’s financial results are discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on February 29, 2024. We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we disclaim any obligation or undertaking to disseminate any updates or revisions to any forward- looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. USE OF NON-GAAP FINANCIAL MEASURES This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability.

3 $ in millions, except per share data FY 2019 FY 2024 Δ Wholesale RV Shipments 406,070 333,733 (18)% Wholesale Marine Shipments 1 189,945 143,850 (24)% Total Net Sales $2,337 $3,716 +59% Total RV Revenue $1,287 $1,625 +26% Total Marine Revenue* $329 $571 +74% Total Housing Revenue $721 $1,168 +62% Total Powersports Revenue* - $352 NM Gross Margin 18.1% 22.5% +440 bps Adjusted Operating Margin 2 6.6% 7.2% +60 bps Adjusted Diluted EPS 2 $2.57 $4.34 +69% Adjusted EBITDA Margin 2 10.1% 12.2% +210 bps Free Cash Flow 2 $165 $251 +52% Diversification Journey Continues Entrepreneurial vision and investments driving long-term growth and improved resilience of model Strategic diversification reinforces business resilience, resulting in solid margin growth and free cash flow Marine and RV revenue significantly higher than 2019 despite sharply lower shipments Recent acquisitions of Sportech and RecPro, strengthen presence in Powersports and the Outdoor Enthusiast aftermarket 1 Company estimate | 2 Non-GAAP metric: Refer to appendix for reconciliation to closest GAAP metric | * In 2019 Powersports sales were included in Marine Sales

4 Highlights Q4 2024 Net sales grew 8% y/y as a result of acquisitions, a 12% increase in Housing revenue and market share gains • RV revenue improved 1% y/y in Q4 as dealers began to restock their lots for the upcoming selling season • Marine revenue declined 17% y/y as a result of softer demand in our key market categories • Powersports revenue grew primarily due to the January 2024 acquisition of Sportech • Housing revenue growth driven by a 4% increase in MH CPU1 and a 15% improvement in MH unit shipments Further strengthened capital structure and ability to deliver value to shareholders • Opportunistically refinanced high-yield notes and amended credit facility, extending maturities and lowering average cost of debt • Hosted inaugural Investor Day in New York City, highlighting Patrick leadership and solid foundation for future growth plans • Raised fourth quarter dividend by 9% and increased share repurchase authorization to $200M Strategically retained key resources in Q4 to support anticipated demand recovery 1CPU = Content per wholesale MH unit for the trailing twelve-month period

Performance by End Market Q4 2024

Our analysis suggests RV inventory is lean, which presents an opportunity for inventory restocking for the upcoming selling season. Retail demand continues to focus on smaller, more affordable units. We expect dealers to closely monitor the retail environment throughout the year and manage inventory accordingly. 6 $358M REVENUE % OF Q4 SALES 42% WHOLESALE SHIPMENTS 2 CPU 1 $4,870 77,300 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 CONTENT PER UNIT 1 1 CPU = Content per wholesale unit for the full year | 2 Data published by RVIA Q4 2024 MARINE POWERSPORTS HOUSINGRV MARKETS

$- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 CONTENT PER UNIT 1,2 7 $122M REVENUE % OF Q4 SALES 14% ESTIMATED WHOLESALE SHIPMENTS 2 ESTIMATED CPU 1,2 $3,967 31,300 1 CPU = Content per wholesale unit for the full year | 2 Company estimates based on data published by National Marine Manufacturers Association (NMMA) MARINE POWERSPORTS HOUSINGRV MARKETS Q4 2024 OEMs and dealers have worked collaboratively to improve and optimize the dealer inventory channel. Dealers remain cautious on adding inventory given the retail environment and high carrying costs. Sequential increase

In collaboration with dealers, OEMs targeted inventory reductions in an effort to keep product innovation and inventory updated. Utility and premium segments of the market outperformed the more discretionary recreation segment. 8 $78M REVENUE % OF Q4 SALES 9% SOLID POWERSPORTS PLATFORM Q4 2024 MARINE POWERSPORTS HOUSINGRV MARKETS $33 $36 $29 $24 $83 $104 $87 $78 QUARTERLY POWERSPORTS NET SALES ($ in millions)

$- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 CONTENT PER MH UNIT 1 Our Housing businesses remain a cornerstone of our resilient model and diversification strategy. The demand for affordable housing continues to outpace supply, and improved consumer confidence, among other factors, could help drive consumers’ purchasing decisions. 9 $288M REVENUE % OF Q4 SALES 35% MH WHOLESALE SHIPMENTS 2 MH CPU 1 $6,604 25,900 1CPU = Content per wholesale unit for the full year | 2 Data published by Manufactured Housing Institute (MHI) MARINE POWERSPORTS HOUSINGRV MARKETS Q4 2024 Sequential increase

Q4 2024 POWERSPORTS Disciplined OEM production has been instrumental toward the calibration of dealer inventory Supporting OEMs by engineering new products and solutions to drive consumer upgrades Utility segment of the market is continuing to show resilience compared to the recreation space MARINE Higher interest costs continue to limit consumer purchasing power and dealers’ willingness to bring on additional inventory Estimated weeks-on-hand is lower than historical norms, increasing need for a restock when demand recovers RV Inventory appears leaner as mix shift toward smaller, more entry-level units continues RecPro integration is progressing well, as we continue to add additional product lines to the site Encouraging commentary from early 2025 RV retail shows HOUSING Interest rate relief and improving consumer confidence should positively impact home buying decisions MH OEMs continue to innovate and improve accessibility while showcasing MH homes as an appealing solution for affordable housing 10 Market Sector Trends Outdoor Enthusiast Markets

Financial Performance 11 Q4 2024 NET SALES & GROSS MARGIN $846$781 Q4 2023 Q4 2024 22.1%22.9% Powersports Housing Marine RV OPERATING INCOME & MARGIN 4.7%7.3% Q4 2023 Q4 2024 DILUTED EPS Q4 2023 Q4 2024 ADJUSTED DILUTED EPS 1 Q4 2023 Q4 2024 ($ in millions, except per share data) $0.52 $0.94 ADJUSTED OPERATING MARGIN 1 Q4 2023 Q4 2024 Net sales increased 8% as a result of strategic acquisitions, market share gains and higher Housing revenue, which more than offset lower revenue from Marine market Gross margin was 22.1%, down 80 basis points from the same period last year Operating margin was 4.7%, reflecting higher fixed costs related to acquisitions and our strategic decision to maintain production capacity to best serve customers Adjusted operating margin was 5.2%, excluding a fair-value inventory step-up and costs related to the extinguishment of debt Net income was $15M, or $0.42 per diluted share. Excluding a fair-value inventory step-up and costs related to the extinguishment of debt, adjusted earnings per diluted share was $0.52 For the full year, generated operating cash flow of $327M and free cash flow of $251M 5.2% 7.3% NET INCOME Q4 2023 Q4 2024 $15 $31 1 Non-GAAP metric: Refer to appendix for reconciliation to closest GAAP metric $40 $57 $0.42 $0.94

2024 Financial Performance 12 NET SALES & GROSS MARGIN $3,716$3,468 2023 2024 22.5%22.6% Powersports Housing Marine RV OPERATING INCOME & MARGIN 6.9%7.5% 2023 2024 DILUTED EPS 2023 2024 ADJUSTED DILUTED EPS 1 2023 2024 ($ in millions, except per share data) $4.34$4.34 ADJUSTED OPERATING MARGIN 1 2023 2024 7.2%7.5% NET INCOME 2023 2024 $138$143 1 Non-GAAP metric: Refer to appendix for reconciliation to closest GAAP metric $258$260 $4.11$4.33

Shipments and End Market Data RETAILWHOLESALE 63,600 77,300 +1% YoY +3% YoY RV RETAILWHOLESALE 18,600 31,300 (7)% YoY (20)% YoY MARINE WHOLESALE 25,900 +15% YoY MH MULTIFAMILYSINGLE FAMILY 101 239 (9)% YoY (5)% YoY HOUSING STARTS 75,000 62,900 38,900 20,000 22,500 227 Q4’23 Q4’24 Q4’23 Q4’24 Q4’23 Q4’24 Q4’23 Q4’24 Q4’23 Q4’24 Q4’23 Q4’24Q4’23 Q4’24 1 Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures | 2 Company estimates based on data published by RVIA, NMMA, MHI, and SSI | 3 U.S. Census Bureau Estimated Dealer Inventory Impact in Q4’24: + ~13,700 units Estimated Dealer Inventory Impact in Q4’24: + ~12,700 units (Units in thousands) 92 RETAILWHOLESALE 352,700333,700 (7)% YoY +7% YoY RV 313,200 380,700 2023 2024 2023 2024 Estimated Dealer Inventory Impact in 2024: (~19,000) units RETAILWHOLESALE 165,000 143,900 (8)% YoY (25)% YoY MARINE 192,300 179,500 2023 2024 2023 2024 Estimated Dealer Inventory Impact in 2024: (~21,100) units Full Year 2024Q4 2024 2 2 2 3 2 2 1

Balance Sheet and Liquidity 14 COVENANTS AND RATIOS1 DEBT STRUCTURE AND MATURITIES NET LEVERAGE1 ($ in millions) LIQUIDITY ($ in millions) • $125.0M Term Loan ($123.4M o/s), scheduled quarterly installments; balance due October 2029 • $875.0M ($100.0M o/s) Senior Secured Revolver, due October 2029 • $258.8M 1.750% Convertible Senior Notes, due December 2028 • $350.0M 4.750% Senior Notes, due May 2029 • $500.0M 6.375% Senior Notes, due November 2032 Total Debt Outstanding $ 1,332.2 Less: Cash and Debt Paid as Defined by the Credit Agreement (33.6) Net Debt $ 1,298.6 Pro Forma Adj. EBITDA $ 479.2 Net Debt to Pro Forma Adj. EBITDA 2.7x Total Revolver Credit Capacity $ 875.0 Less: Total Revolver Used (including outstanding letters of credit) (105.0) Unused Credit Capacity $ 770.0 Add: Cash on Hand 33.6 Total Available Liquidity $ 803.6 • Consolidated Net Leverage Ratio – 2.7x • Consolidated Secured Net Leverage Ratio – 0.40x versus 2.75x maximum • Consolidated Interest Coverage Ratio – 6.05x versus minimum 3.00x Strong balance sheet and favorable capital structure to support investments and pursue attractive growth opportunities 1 As defined by credit agreement Q4 2024 In the fourth quarter, we reduced our cost of debt and increased our liquidity position by issuing $500 million of 6.375% Senior Notes due 2032 and expanding the capacity of our credit facility to $1.0 billion, while extending the maturity date to October 2029. We used a portion of the proceeds from these transactions to redeem our $300 million 7.50% Senior Notes on November 7, 2024. Following these transactions, the Company's next major debt maturity will be in 2028.

Operating Margin 7.2% 2 Up 70 to 90 bps Unchanged Operating Cash Flows $327M $390M - $410M Unchanged Capital Expenditures $76M $75M - $85M Unchanged Free Cash Flow $251M $305M+ Unchanged RV Wholesale Unit Shipments (RVIA) 334K ~350K Unchanged RV Retail Unit Shipments3 353K Flat Unchanged Marine Wholesale Powerboat Unit Shipments3 144K Up 5% - 10% Unchanged Marine Retail Powerboat Unit Shipments3 165K Flat Unchanged Powersports Organic Content - Up MSD% Unchanged Powersports Wholesale Shipments - Down 10% Unchanged MH Wholesale Unit Shipments (MHI) 103K Up 10% - 15% Up 5% - 10% New Housing Starts (U.S. Census Bureau) 1.4M Flat to Up 5% Unchanged FY 2024 Actual FY 2025 Estimate 1 Fiscal Year 2025 Outlook 15 1 Company estimates | 2 2024 operating margin excludes acquisition transaction costs, purchase accounting adjustments and loss on extinguishment of debt | 3 Company estimates based on data published by NMMA and SSI Prior Estimate 2025 Assumptions • Modest interest rate relief • Flat industry retail environment • Moderate inflation • + Consumer confidence

Appendix

Quarterly Revenue by End Market – 2023 1 ($ in millions) Q1 2023 Q2 2023 Q3 2023 Q4 2023 2023 RV $367.0 $383.6 $400.1 $352.7 $1,503.3 Marine $238.0 $226.3 $171.7 $146.6 $782.6 Powersports $32.8 $36.5 $28.8 $23.9 $122.0 Housing $262.4 $274.3 $265.5 $258.0 $1,060.2 Total $900.1 $920.7 $866.1 $781.2 $3,468.0 17 CPU, excluding Powersports 2,3 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Marine $4,433 $4,367 $4,209 $4,069 1 Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures | 2 CPU = Content per wholesale unit for the trailing twelve-month period | 3 Company estimates based on data published by NMMA

Non-GAAP Reconciliation – Earnings before interest, taxes, depreciation and amortization (“EBITDA”), pro forma adjusted EBITDA, and net debt to pro forma adjusted EBITDA are non- GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. – We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. – We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to prior periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. – We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from net cash provided by operating activities. – Content per unit metrics are generally calculated using our market sales divided by Company estimates based on third-party measures of industry volume. – Figures may not sum due to rounding. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE RECONCILIATION OF ADJUSTED OPERATING MARGIN 2024 2023 2019 Diluted earnings per common share $4.11 $4.33 $2.57 Transaction costs, net of tax 0.11 - - Acquisition related fair-value inventory step- up, net of tax 0.06 0.01 - Loss on extinguishment of debt, net of tax 0.06 - - Adjusted diluted earnings per common share $4.34 $4.34 $2.57 2024 2023 2019 Operating margin 6.9% 7.5% 6.6% Acquisition related fair-value inventory step- up 0.1% - - Transaction costs 0.2% - - Loss on extinguishment of debt - - - Adjusted operating margin 7.2% 7.5% 6.6% CALCULATION OF FREE CASH FLOW RECONCILIATION OF FOURTH QUARTER ADJUSTED DILUTED EARNINGS PER SHARE RECONCILIATION OF FOURTH QUARTER ADJUSTED OPERATING MARGIN Q4 2024 Q4 2023 Diluted earnings per common share $0.42 $0.94 Transaction costs, net of tax - - Acquisition related fair-value inventory step-up, net of tax 0.05 - Loss on extinguishment of debt, net of tax 0.05 - Adjusted diluted earnings per common share $0.52 $0.94 Q4 2024 Q4 2023 Operating margin 4.7% 7.3% Acquisition related fair-value inventory step-up 0.2% - Transaction costs - - Loss on extinguishment of debt 0.3% - Adjusted operating margin 5.2% 7.3% ($ in millions) 2024 2019 Net cash provided by operating activities $326.8 $192.4 Less: purchases of property, plant and equipment (75.7) (27.7) Free Cash Flow $251.2 $164.7

($ in millions) 2024 2019 Net income $138 $90 + Interest expense 80 37 + Income Taxes 40 28 + Depreciation & amortization 167 63 EBITDA $425 $218 + Stock compensation 17 15 + Acquisition related transaction costs 5 - + Acquisition related fair-value inventory step-up 3 - + Loss on extinguishment of debt 2 - + Loss (gain) on sale of property, plant and equipment (0) 2 Adjusted EBITDA $452 $235 Net sales $3,716 $2,337 Adjusted EBITDA Margin 12.2% 10.1% Non-GAAP Reconciliation 19 RECONCILIATION OF NET INCOME TO EBITDA TO ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN RECONCILIATION OF NET INCOME TO EBITDA TO PRO FORMA ADJUSTED EBITDA ($ in millions) 12/31/2024 Net Income $138.4 + Depreciation and Amortization 166.5 + Interest Expense, net 79.5 + Income Taxes 40.2 EBITDA $424.6 + Stock Compensation Expense 16.8 +Acquisition Pro Forma, transaction-related expenses & other 37.8 Pro Forma Adjusted EBITDA $479.2 Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. – Earnings before interest, taxes, depreciation and amortization (“EBITDA”), pro forma adjusted EBITDA, and net debt to pro forma adjusted EBITDA are non- GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. – We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. – We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to prior periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. – We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from net cash provided by operating activities. – Content per unit metrics are generally calculated using our market sales divided by Company estimates based on third-party measures of industry volume. – Figures may not sum due to rounding.

v3.25.0.1

Cover Document

|

Feb. 06, 2025 |

| Document Entity Information [Abstract] |

|

| Entity Central Index Key |

0000076605

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Registrant Name |

PATRICK INDUSTRIES, INC.

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

000-03922

|

| Entity Tax Identification Number |

35-1057796

|

| Entity Address, Address Line One |

107 W. Franklin Street

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46516

|

| City Area Code |

(574)

|

| Local Phone Number |

294-7511

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

PATK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

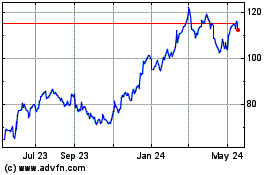

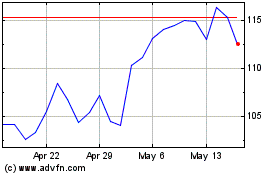

Patrick Industries (NASDAQ:PATK)

Historical Stock Chart

From Mar 2025 to Apr 2025

Patrick Industries (NASDAQ:PATK)

Historical Stock Chart

From Apr 2024 to Apr 2025