Raises 2024 guidance 22% volume

growth accelerates for a sixth consecutive quarter, reflecting

consistent execution 40% B2B volume growth driving continued SMB

take rate expansion Expands into global workforce management

services for SMBs with the acquisition of Skuad

Payoneer Global Inc. (“Payoneer” or the “Company”) (NASDAQ:

PAYO), the financial technology company empowering the world’s

small and medium-sized businesses to transact, do business and grow

globally, today reported financial results for its second quarter

ended June 30, 2024.

Second Quarter 2024 Financial

Highlights

($ in mm)

2Q

2023

3Q

2023

4Q

2023

1Q

2024

2Q

2024

YoY Change

Revenue ex. interest income

$151.4

$147.6

$159.4

$162.9

$173.7

15%

Interest income

55.3

60.4

64.9

65.3

65.8

19%

Revenue

$206.7

$208.0

$224.3

$228.2

$239.5

16%

Transaction costs as a % of revenue

13.8%

14.6%

16.2%

14.9%

15.4%

160 bps

Net income

$45.5

$12.8

$27.0

$29.0

$32.4

-29%

Adjusted EBITDA

56.0

58.2

52.2

65.2

72.8

30%

Operational Metrics

Volume ($bn)

$15.3

$16.3

$19.0

$18.5

$18.7

22%

Active Ideal Customer Profiles (ICPs) ('000s)1

495

502

516

530

547

10%

Revenue as a % of volume ("Take Rate")

135 bps

127 bps

118 bps

124 bps

128 bps

-7 bps

SMB customer take rate2

110 bps

107 bps

100 bps

108 bps

111 bps

1 bps

1.

Active ICPs are defined as customers with

a Payoneer Account that have on average over $500 per month in

volume and were active over the trailing twelve-month period.

2.

SMB customer take rate represents revenue

from SMBs who sell on marketplaces, B2B SMBs, and Merchant

Services, divided by the associated volume from each respective

channel.

“Payoneer delivered another consecutive quarter of record revenue,

accelerating volume and ICP growth, and significant profitability.

We are steadily executing to capture a massive opportunity and our

results are a validation that our strategy is working: we grew ICPs

by 10%, increased ARPU by 27%, and continued to expand our SMB take

rate while driving more leverage across the business.

More and more cross-border SMBs with

global operations are using Payoneer’s financial stack. To

accelerate our evolution and B2B momentum, we are excited to

announce the acquisition of Skuad and welcome to Payoneer the

talented entrepreneurs who share our vision of supporting global

SMBs. We are combining the strength and reach of Payoneer with

Skuad’s comprehensive global workforce and payroll solutions to

create a powerful platform that will enhance our customers’ ability

to expand their teams worldwide and grow globally.”

John Caplan, Chief Executive

Officer

Transaction Details

On August 5, Payoneer acquired Skuad, a global workforce and

payroll management company headquartered in Singapore. The

acquisition accelerates Payoneer’s strategy to deliver a

comprehensive and integrated financial stack for SMBs that operate

internationally.

Payoneer acquired Skuad for $61 million cash, subject to

adjustments and funded with cash on hand, and up to an additional

$20 million of future payments in cash and equity that are

contingent upon reaching certain performance and tenure

milestones.

Second Quarter 2024 Business

Highlights

- 10% active ICP growth, including 7% growth in larger ICPs who

have on average over $10,000 per month in volume. Both volume and

revenue from $10K+ ICPs increased more than 20% year-over-year as

we acquire larger customers

- 22% volume growth year-over-year reflects:

- B2B volume of $2.5 billion increased 40% year-over-year, driven

by strong growth of new cohorts added in the past year and

continued strong customer acquisition

- Marketplace volume of $11.4 billion increased 15%

year-over-year led by acquisition of large customers in China and

continued strength from large ecommerce platforms

- Merchant Services (Checkout) volume of $119 million increased

192% year-over-year as we doubled the number of $10K+ customers

using Checkout from a year ago

- Enterprise payouts volume of $4.7 billion increased 31%

year-over-year, led by the travel vertical where we increased the

number of countries we serve compared to a year ago

- $1.2 billion of spend on Payoneer cards, up 33% year-over-year,

as we continue to improve our card capabilities. We launched

additional integrations with accounting ERP platforms, which

enables customers to more easily track their spend on Payoneer

cards directly within their preferred accounting solution

- Payoneer continues to expand its ecosystem to enable more

interoperability for customers. We are now integrated with Xero,

QuickBooks, and Zoho Books, which represent the top global

accounting platforms used by SMBs

- $6.0 billion of customer funds as of June 30, 2024, up 9%

year-over-year

- $47 million of share repurchases at a weighted average price of

$5.33

2024 Guidance

“Payoneer is driving accelerating growth

across our entire SMB customer business. We delivered a second

consecutive quarter of 21% growth in revenue excluding interest

income and $7.5 million of certain non-volume fees earned in the

prior year period.

We are raising our 2024 guidance to

reflect our significant outperformance in the second quarter and

our momentum heading into the second half of 2024. We continue to

innovate our product offerings, are accelerating the evolution of

our financial stack with our acquisition of Skuad and continue to

strengthen our position as the dedicated partner of choice for SMBs

with global, cross-border operations.”

Bea Ordonez, Chief Financial

Officer

2024 guidance is as follows:

Revenue

$920 million - $930 million

Transaction costs

~16.5% of revenue

Adjusted EBITDA (1)

$225 million to $235 million

(1) Guidance for fiscal year, where

adjusted, is provided on a non-GAAP basis, which Payoneer will

continue to identify as it reports its future financial results.

The Company cannot reconcile its expected adjusted EBITDA to

expected net income under “2024 Guidance” without unreasonable

effort because certain items that impact net income and other

reconciling metrics are out of the Company's control and/or cannot

be reasonably predicted at this time, which unavailable information

could have a significant impact on the Company’s GAAP financial

results. Please refer to “Financial Information; Non-GAAP Financial

Measures” below for a description of the calculation of adjusted

EBITDA.

Webcast

Payoneer will host a live webcast of its earnings on a

conference call with the investment community beginning at 8:30

a.m. ET today, August 7, 2024. To access the webcast, go to the

investor relations section of the Company’s website at

https://investor.payoneer.com. A replay will be available on the

investor relations website following the call.

About Payoneer

Payoneer is the financial technology company empowering the

world’s small and medium-sized businesses to transact, do business,

and grow globally. Payoneer was founded in 2005 with the belief

that talent is equally distributed, but opportunity is not. It is

our mission to enable any entrepreneur and business anywhere to

participate and succeed in an increasingly digital global economy.

Since our founding, we have built a global financial stack that

removes barriers and simplifies cross-border commerce. We make it

easier for millions of SMBs, particularly in emerging markets, to

connect to the global economy, pay and get paid, manage their funds

across multiple currencies, and grow their businesses.

Forward-Looking

Statements

This press release includes, and oral statements made from time

to time by representatives of Payoneer, may be considered

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

relate to future events or Payoneer’s future financial or operating

performance. For example, the impact from our acquisition of Skuad

and projections of future revenue, transaction cost and adjusted

EBITDA are forward-looking statements. In some cases, you can

identify forward-looking statements by terminology such as “may,”

“should,” “expect,” “intend,” “plan,” “will,” “estimate,”

“anticipate,” “believe,” “predict,” “potential” or “continue,” or

the negatives of these terms or variations of them or similar

terminology. Such forward-looking statements are subject to risks,

uncertainties, and other factors which could cause actual results

to differ materially from those expressed or implied by such

forward looking statements. These forward-looking statements are

based upon estimates and assumptions that, while considered

reasonable by Payoneer and its management, as the case may be, are

inherently uncertain. Factors that may cause actual results to

differ materially from current expectations include, but are not

limited to: (1) changes in applicable laws or regulations; (2) the

possibility that Payoneer may be adversely affected by geopolitical

events and conflicts, such as the current conflict between Israel

and Hamas, and other economic, business and/or competitive factors;

(3) changes in the assumptions underlying our financial estimates;

(4) the outcome of any known and/or unknown legal or regulatory

proceedings; and (5) other risks and uncertainties set forth in

Payoneer’s Annual Report on Form 10-K for the period ended December

31, 2023 and future reports that Payoneer may file with the SEC

from time to time. Nothing in this press release should be regarded

as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. Payoneer

does not undertake any duty to update these forward-looking

statements.

Financial Information; Non-GAAP

Financial Measures

Some of the financial information and data contained in this

press release, such as adjusted EBITDA, have not been prepared in

accordance with United States generally accepted accounting

principles (“GAAP”). Payoneer uses these non-GAAP measures to

compare Payoneer’s performance to that of prior periods for

budgeting and planning purposes. Payoneer believes these non-GAAP

measures of financial results provide useful information to

management and investors regarding certain financial and business

trends relating to Payoneer’s results of operations. Payoneer's

method of determining these non-GAAP measures may be different from

other companies' methods and, therefore, may not be comparable to

those used by other companies and Payoneer does not recommend the

sole use of these non-GAAP measures to assess its financial

performance. Payoneer management does not consider these non-GAAP

measures in isolation or as an alternative to financial measures

determined in accordance with GAAP. The principal limitation of

these non-GAAP financial measures is that they exclude significant

expenses and income that are required by GAAP to be recorded in

Payoneer’s financial statements. In addition, they are subject to

inherent limitations as they reflect the exercise of judgments by

management about which expense and income are excluded or included

in determining these non-GAAP financial measures. In order to

compensate for these limitations, management presents non-GAAP

financial measures in connection with GAAP results. You should

review Payoneer’s financial statements, which are included in

Payoneer’s Annual Report on Form 10-K for the year ended December

31, 2023 and its subsequent Quarterly Reports on Form 10-Q, and not

rely on any single financial measure to evaluate Payoneer’s

business.

Non-GAAP measures include the following item:

Adjusted EBITDA: We provide

adjusted EBITDA, a non-GAAP financial measure that represents our

net income (loss) adjusted to exclude, as applicable: M&A

related expense (income), stock-based compensation expenses,

restructuring charges, share in losses (gain) of associated

company, loss (gain) from change in fair value of warrants, other

financial expense (income), net, taxes on income, and depreciation

and amortization.

Other companies may calculate the above measure differently, and

therefore Payoneer’s measures may not be directly comparable to

similarly titled measures of other companies.

In addition, in this earnings release, we reference volume,

which is an operational metric. Volume refers to the total dollar

value of transactions successfully completed or enabled by our

platform, not including orchestration transactions. For a customer

that both receives and later sends payments, we count the volume

only once. We also reference ARPU (Average Revenue Per User), which

is defined as the Revenue from Active Customers divided by the

number of Active Customers over the period in which the Revenue was

earned. Active Customers for these purposes are defined as Payoneer

accountholders with at least 1 financial transaction over the

period. Revenue from Active Customers represents revenue attributed

to Active Customers based on their use of the Payoneer platform,

including interest income earned from their balances, and excluding

revenues unrelated to their activities.

TABLE - 1 PAYONEER GLOBAL INC. CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED) (U.S. dollars in

thousands, except share and per share data)

(Unaudited)

Three months ended

June 30,

2024

2023

Revenues $

239,520

$

206,734

Transaction costs (Exclusive of depreciation and

amortization shown separately below and inclusive of $375 and $436

in interest expense and fees associated with related party

transactions during the three months ended June 30, 2024 and 2023,

respectively)

36,961

28,497

Other operating expenses

41,242

40,527

Research and development expenses

27,580

27,995

Sales and marketing expenses

50,614

48,402

General and administrative expenses

26,102

22,012

Depreciation and amortization

10,712

5,909

Total operating expenses

193,211

173,342

Operating income

46,309

33,392

Financial income: Gain from change in fair value of

Warrants

1,006

13,586

Other financial income, net

976

4,318

Financial income, net

1,982

17,904

Income before taxes on income

48,291

51,296

Taxes on income

15,866

5,747

Net income $

32,425

$

45,549

Other comprehensive income (loss) Unrealized gain on

available-for-sale debt securities, net

872

-

Unrealized loss on cash flow hedges, net

(699

)

-

Tax benefit on unrealized losses on cash flow hedges, net

126

-

Other comprehensive income, net of tax

299

-

Comprehensive income $

32,724

$

45,549

Per Share Data Net income per share attributable to

common stockholders — Basic earnings per share $

0.09

$

0.12

— Diluted earnings per share $

0.09

$

0.12

Weighted average common shares outstanding — Basic

356,315,658

365,000,974

Weighted average common shares outstanding — Diluted

373,368,383

387,623,679

Disaggregation of revenue

The following table presents revenue recognized from contracts

with customers as well as revenue from other sources:

Three months ended June

30,

2024

2023

Revenue recognized at a point in time $

170,751

$

141,231

Revenue recognized over time

492

7,884

Revenue from contracts with customers $

171,243

$

149,115

Interest income on customer balances $

65,821

$

55,293

Capital advance income

2,456

2,326

Revenue from other sources $

68,277

$

57,619

Total revenues $

239,520

$

206,734

The following table presents the Company’s revenue disaggregated

by primary regional market, with revenues being attributed to the

country (in the region) in which the billing address of the

transacting customer is located, with the exception of global bank

transfer revenues, where revenues are disaggregated based on the

billing address of the transaction funds source.

Three months ended June

30,

2024

2023

Primary regional markets Greater China(1) $

84,439

$

71,227

Europe(2)

45,609

41,699

Asia-Pacific(2)

36,225

27,385

North America(3)

22,798

26,041

South Asia, Middle East and North Africa(2)

25,914

21,711

Latin America(2)

24,535

18,671

Total revenues $

239,520

$

206,734

1.

Greater China is inclusive of mainland

China, Hong Kong, Macao and Taiwan.

2.

No single country included in any of these

regions generated more than 10% of total revenue.

3.

The United States is the Company’s country

of domicile. Of North America revenues, the US represents $21,645

and $24,995 during the three months ended June 30, 2024 and 2023,

respectively.

TABLE - 2 PAYONEER GLOBAL INC. RECONCILIATION OF

NET INCOME TO ADJUSTED EBITDA (UNAUDITED) (U.S. dollars in

thousands)

Three months ended

June 30,

2024

2023

Net income $

32,425

$

45,549

Depreciation and amortization

10,712

5,909

Taxes on income

15,866

5,747

Other financial income, net

(976

)

(4,318

)

EBITDA

58,027

52,887

Stock based compensation expenses(1)

13,666

16,173

M&A related expense(2)

2,091

498

Gain from change in fair value of Warrants(3)

(1,006

)

(13,586

)

Adjusted EBITDA $

72,778

$

55,972

Three months ended, June 30, 2023 Sept. 30,

2023 Dec. 31, 2023 Mar. 31, 2024 June 30,

2024 Net income $

45,549

$

12,825

$

27,021

$

28,974

$

32,425

Depreciation and amortization

5,909

7,116

8,750

9,408

10,712

Taxes on income

5,747

10,012

14,272

13,910

15,866

Other financial income, net

(4,318

)

(1,137

)

(3,763

)

(2,747

)

(976

)

EBITDA

52,887

28,816

46,280

49,545

58,027

Stock based compensation expenses(1)

16,173

15,330

17,338

15,077

13,666

M&A related expense(2)

498

1,745

451

2,375

2,091

Loss (gain) from change in fair value of Warrants(3)

(13,586

)

7,799

(11,824

)

(1,761

)

(1,006

)

Restructuring charges(4)

—

4,488

—

—

—

Adjusted EBITDA $

55,972

$

58,178

$

52,245

$

65,236

$

72,778

1.

Represents non-cash charges associated

with stock-based compensation expense, which has been, and will

continue to be for the foreseeable future, a significant recurring

expense in our business and an important part of our compensation

strategy.

2.

Amounts relate to M&A-related

third-party fees, including related legal, consulting and other

expenditures.

3.

Changes in the estimated fair value of the

warrants are recognized as gain or loss on the condensed

consolidated statements of comprehensive income. The impact is

removed from EBITDA as it represents market conditions that are not

in our control.

4.

We initiated a plan to reduce our

workforce during the three months ended September 30, 2023, and had

non-recurring costs related to severance and other employee

termination benefits.

TABLE - 3 PAYONEER GLOBAL INC. EARNINGS PER SHARE

(UNAUDITED) (U.S. dollars in thousands, except share and per

share data)

(Unaudited)

Three months ended June

30,

2024

2023

Numerator: Net income $

32,425

$

45,549

Denominator: Weighted average common shares outstanding — Basic

356,315,658

365,000,974

Add: Dilutive impact of RSUs, ESPP and options to purchase common

stock

16,327,840

21,928,779

Dilutive impact of private Warrants

724,885

693,926

Weighted average common shares — diluted

373,368,383

387,623,679

Net income per share attributable to common stockholders — Basic

earnings per share $

0.09

$

0.12

Diluted earnings per share $

0.09

$

0.12

TABLE - 4 PAYONEER GLOBAL INC. CONSOLIDATED

BALANCE SHEETS (UNAUDITED) (U.S. dollars in thousands, except

share and per share data)

June 30,

December 31,

2024

2023

Assets: Current assets: Cash and cash equivalents $

575,730

$

617,022

Restricted cash

10,653

7,030

Customer funds

6,037,105

6,390,526

Accounts receivable (net of allowance of $352 at June 30, 2024 and

$385 at December 31, 2023)

6,567

7,980

Capital advance receivables (net of allowance of $5,445 at June 30,

2024 and $5,059 at December 31, 2023)

49,478

45,493

Other current assets

53,400

40,672

Total current assets

6,732,933

7,108,723

Non-current assets: Property, equipment and software, net

14,522

15,499

Goodwill

19,889

19,889

Intangible assets, net

88,597

76,266

Restricted cash

6,018

5,780

Deferred taxes

19,051

15,291

Severance pay fund

818

840

Operating lease right-of-use assets

23,078

24,854

Other assets

15,406

15,977

Total assets $

6,920,312

$

7,283,119

Liabilities and shareholders’ equity: Current

liabilities: Trade payables $

38,974

$

33,941

Outstanding operating balances

6,037,105

6,390,526

Short term debt from related party

14,984

—

Other payables

100,415

117,508

Total current liabilities

6,191,478

6,541,975

Non-current liabilities: Long-term debt from related party

—

18,411

Warrant liability

5,788

8,555

Other long-term liabilities

53,667

49,905

Total liabilities

6,250,933

6,618,846

Commitments and contingencies Shareholders’

equity: Preferred stock, $0.01 par value, 380,000,000 shares

authorized; no shares were issued and outstanding at June 30, 2024

and December 31, 2023.

—

—

Common stock, $0.01 par value, 3,800,000,000 and 3,800,000,000

shares authorized; 382,998,980 and 368,655,185 shares issued and

352,689,391 and 357,590,493 shares outstanding at June 30, 2024 and

December 31, 2023, respectively.

3,830

3,687

Treasury stock at cost, 30,309,589 and 11,064,692 shares as of June

30, 2024 and December 31, 2023, respectively.

(154,692

)

(56,936

)

Additional paid-in capital

773,888

732,894

Accumulated other comprehensive income (loss)

150

(176

)

Retained earnings (accumulated deficit)

46,203

(15,196

)

Total shareholders’ equity

669,379

664,273

Total liabilities and shareholders’ equity $

6,920,312

$

7,283,119

TABLE - 5 PAYONEER GLOBAL INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED) (U.S. dollars in

thousands)

Six months ended

June 30,

2024

2023

Cash Flows from Operating Activities Net income $

61,399

$

53,487

Adjustment to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

20,120

11,948

Deferred taxes

(3,640

)

(9,833

)

Stock-based compensation expenses

28,742

33,100

Gain from change in fair value of Warrants

(2,767

)

(13,334

)

Foreign currency re-measurement loss (gain)

2,311

(606

)

Changes in operating assets and liabilities: Other current

assets

(12,728

)

(1,621

)

Trade payables

4,606

(13,157

)

Deferred revenue

273

407

Accounts receivable, net

1,413

1,618

Capital advance extended to customers

(154,357

)

(138,900

)

Capital advance collected from customers

150,372

135,835

Other payables

(17,664

)

(5,259

)

Other long-term liabilities

1,168

(1,066

)

Operating lease right-of-use assets

4,370

5,053

Interest and amortization of discount on investments

(3,275

)

—

Other assets

571

2,247

Net cash provided by operating activities

80,914

59,919

Cash Flows from Investing Activities Purchase of

property, equipment and software

(2,802

)

(2,422

)

Capitalization of internal use software

(27,345

)

(12,921

)

Severance pay fund distributions, net

22

125

Customer funds in transit, net

(988

)

(54,188

)

Purchases of investments in available-for-sale debt securities

(739,185

)

—

Maturities and sales of investments in available-for-sale debt

securities

105,000

—

Net cash inflow from acquisition of remaining interest in joint

venture

—

5,953

Net cash used in investing activities

(665,298

)

(63,453

)

Cash Flows from Financing Activities Proceeds from

issuance of common stock in connection with stock-based

compensation plan, net of taxes paid related to settlement of

equity awards and proceeds from employee equity transactions to be

remitted to employees

12,027

12,091

Outstanding operating balances, net

(353,421

)

(309,911

)

Borrowings under related party facility

11,920

14,015

Repayments under related party facility

(15,347

)

(14,514

)

Common stock repurchased

(98,654

)

(17,125

)

Net cash used in financing activities

(443,475

)

(315,444

)

Effect of exchange rate changes on cash and cash

equivalents

(2,311

)

705

Net change in cash, cash equivalents, restricted cash and

customer funds

(1,030,170

)

(318,273

)

Cash, cash equivalents, restricted cash and customer funds at

beginning of period

7,018,367

6,386,720

Cash, cash equivalents, restricted cash and customer funds at

end of period $

5,988,197

$

6,068,447

Supplemental information of investing and financing activities

not involving cash flows: Property, equipment, and software

acquired but not paid $

1,237

$

870

Internal use software capitalized but not paid $

7,408

$

8,294

Common stock repurchased but not paid $

602

$

2,600

Right of use assets obtained in exchange for new operating lease

liabilities $

2,594

$

2,474

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807622293/en/

Investor Contact: Michelle Wang investor@payoneer.com

Media Contact: Alison Dahlman PR@payoneer.com

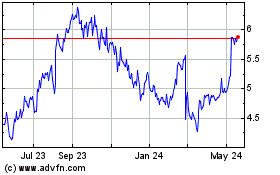

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Oct 2024 to Nov 2024

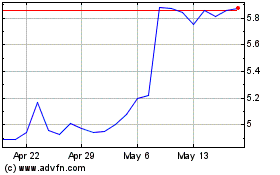

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Nov 2023 to Nov 2024