Payoneer Global Inc. (“Payoneer” or the “Company”)

(Nasdaq: PAYO) today announced the expiration of its offer to

purchase (the “Offer”) all of its outstanding Warrants (as

defined below) at a purchase price of $0.78 per Warrant in cash,

without interest. Completion of the Offer, when combined with the

contemplated redemption of untendered Warrants (as described

below), will lead to a simplified capital structure.

Payoneer’s offer to purchase 25,158,086 publicly traded warrants

which were publicly issued and sold as part of the units in the

initial public offering of FTAC Olympus Acquisition Corp.

(“FTOC”) on August 25, 2020 (the “FTOC IPO”), and

assumed by the Company on June 25, 2021, and which entitle such

warrant holders to purchase one share of Payoneer’s common stock,

par value $0.01 per share, at an exercise price of $11.50, subject

to certain adjustments (the “Warrants”), expired at 12:00

midnight, Eastern Time, at the end of the day on September 9, 2024

(the “Expiration Date”).

Payoneer has been advised that, as of the Expiration Date,

24,030,937 Warrants (including 7,267 Warrants tendered pursuant to

the notice of guaranteed delivery procedures of the Offer) had been

validly tendered and not validly withdrawn, representing

approximately 95.5% of the outstanding Warrants. The Company

expects to accept all validly tendered Warrants for purchase and

expects to settle such purchase promptly. Pursuant to the terms of

the Offer, holders of Warrants that were validly tendered and not

validly withdrawn prior to the Expiration Date will receive $0.78

per share for each Warrant tendered. The Company expects to pay an

aggregate of approximately $18.7 million in cash in exchange for

all validly tendered Warrants.

Payoneer also solicited consents (the “Consent

Solicitation”) to amend the Warrant Agreement, dated August 25,

2020, by and between FTOC and Continental Stock Transfer &

Trust Company (“Continental”), as amended by the Assignment,

Assumption and Amendment Agreement, dated June 25, 2021, by and

between the Company, FTOC and Continental (as amended, the

“Warrant Agreement”), which governs all of the Warrants, to

permit Payoneer to redeem each outstanding Warrant not tendered in

the Offer for $0.70 in cash, without interest, which is

approximately 10% less than the price applicable to the Offer (such

amendment, the “Warrant Amendment”). Pursuant to the terms

of the Warrant Agreement, the adoption of the Warrant Amendment

required the consent of holders of at least 65% of the then

outstanding Warrants.

As of the Expiration Date, parties representing holders of

approximately 95.5% of the outstanding Warrants consented to the

Warrant Amendment in the Consent Solicitation. Accordingly, because

holders of more than 65% of the outstanding Warrants have agreed to

consent to the Warrant Amendment in the Consent Solicitation, the

Warrant Amendment was adopted. The Warrant Amendment was executed

and the Company will exercise its right, in accordance with the

terms of the Warrant Amendment, to redeem all remaining Warrants

not tendered in the Offer in exchange for $0.70 per Warrant,

without interest (unless exercised prior to the redemption date),

and has fixed September 25, 2024 as the redemption date, following

which no Warrants will remain outstanding.

The Offer and Consent Solicitation were made pursuant to an

Offer to Purchase, initially dated August 12, 2024, and joint

Schedule TO/Schedule 13e-3 (the “Schedule TO”), initially

dated August 12, 2024, each as amended and supplemented from time

to time, and each of which have been filed with the U.S. Securities

and Exchange Commission (“SEC”) and more fully set forth in

the terms and conditions of the Offer and Consent Solicitation.

Payoneer will file a final amendment to its Schedule TO to disclose

the final results of the Offer.

The Company’s common stock and Warrants are listed on The Nasdaq

Stock Market LLC under the symbols “PAYO” and “PAYOW,”

respectively.

Citigroup Global Markets Inc. was the Dealer Manager for the

Offer and Consent Solicitation. Sodali & Co. (“Sodali”) was the

Information Agent for the Offer and Consent Solicitation, and

Continental was the Warrant Agent for the Offer and Consent

Solicitation. All questions concerning tender procedures and

requests for additional copies of the offer materials, including

the letter of transmittal and consent, should be directed to Sodali

at (800) 662-5200 (toll free).

Disclaimer

This announcement is for informational purposes only and shall

not constitute an offer to purchase or a solicitation of an offer

to sell the Warrants. The Offer and Consent Solicitation were made

only through the Schedule TO and Offer to Purchase, and the

complete terms and conditions of the Offer and Consent Solicitation

are set forth in the Schedule TO and Offer to Purchase. This

announcement does not constitute a notice of redemption with

respect to the Warrants that remain outstanding after the

settlement.

About Payoneer:

Payoneer is the financial technology company empowering the

world’s small and medium-sized businesses to transact, do business,

and grow globally. Payoneer was founded in 2005 with the belief

that talent is equally distributed, but opportunity is not. It is

our mission to enable any entrepreneur and business anywhere to

participate and succeed in an increasingly digital global economy.

Since our founding, we have built a global financial stack that

removes barriers and simplifies cross-border commerce. We make it

easier for millions of SMBs, particularly in emerging markets, to

connect to the global economy, pay and get paid, manage their funds

across multiple currencies, and grow their businesses.

Forward-Looking Statements:

This press release includes “forward-looking statements”,

including statements about the expiration date for the Offer and

Consent Solicitation and the effects of the Offer and Consent

Solicitation on our capital structure. Forward-looking statements

generally relate to future events or Payoneer’s future financial or

operating performance. In some cases, you can identify

forward-looking statements by terminology such as “may,” “should,”

“expect,” “intend,” “plan,” “will,” “estimate,” “anticipate,”

“believe,” “predict,” “potential” or “continue,” or the negatives

of these terms or variations of them or similar terminology. Such

forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially

from those expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Payoneer and its

management, as the case may be, are inherently uncertain. Factors

that may cause actual results to differ materially from current

expectations include, but are not limited to: (1) changes in

applicable laws or regulations; (2) the possibility that Payoneer

may be adversely affected by geopolitical events and conflicts,

such as the current conflict between Israel and Hamas, and other

economic, business and/or competitive factors; (3) changes in the

assumptions underlying our financial estimates; (4) the outcome of

any known and/or unknown legal or regulatory proceedings; and (5)

other risks and uncertainties set forth in Payoneer’s Annual Report

on Form 10-K for the period ended December 31, 2023 and future

reports that Payoneer may file with the SEC from time to time.

Nothing in this press release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Payoneer does not

undertake any duty to update these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910237111/en/

Investor Contact: Michelle Wang investor@payoneer.com

Media Contact: Alison Dahlman PR@payoneer.com

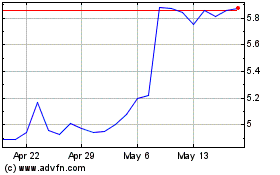

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Oct 2024 to Nov 2024

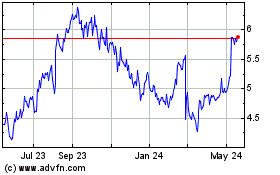

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Nov 2023 to Nov 2024