Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

December 11 2024 - 3:41PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a

-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a -12

|

Patterson Companies, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0 -11. |

Customer Communications Toolkit

To be distributed to customer-facing Patterson employees for their use as instructed below.

READ FIRST: HOW TO USE THIS TOOLKIT.

Overview

Patterson Companies announced that it has agreed to be acquired by Patient Square Capital.

Your Role & Instructions

Customers may reach

out to you with questions about this news. Please refer to the below Talking Points and FAQs when responding to questions from your customers. The Talking Points and FAQs are for your use only and may not be distributed or forwarded.

Communication Protocols

It is critical that we speak

with one voice. Please do not speculate, make assumptions, address rumors, or discuss any details not provided in this document. If you are asked a question that is not covered in this document, please do not speculate or make up an

answer. Instead, take note of the question and respond with the following:

“I am not sure how to answer your question, and I don’t

want to provide any information that may not be accurate. I am happy to pass your question along and get back to you if there is any information to share.”

Refer any questions that you are unable to answer to Patterson Legal.

Customer Talking Points – FOR YOUR REACTIVE USE ONLY

| |

• |

|

Thank you for reaching out to me about Patterson’s recent news. We are excited about what the sale to

Patient Square Capital means for Patterson and our customers. Please see the press release Patterson issued for more information. |

| |

• |

|

Patient Square Capital is a dedicated health care investment firm that aims to achieve strong investment returns

by partnering with growth-oriented companies and top-tier management teams whose products, services, and technologies improve health. Patient Square utilizes deep industry expertise, a broad network of

relationships, and a partnership approach to make investments in companies that will grow and thrive. Patient Square invests in businesses that strive to improve patient lives, strengthen communities, and create a healthier world. For more

information, visit www.patientsquarecapital.com. |

| |

• |

|

While this transaction will mark the beginning of an exciting new chapter for Patterson, I want to emphasize that

this announcement does not impact our day-to-day operations or your relationship with Patterson. |

| |

• |

|

I remain your go-to contact here, and nothing about our business

relationship, or product and service offering changes. We expect to complete the transaction during our 2025 fiscal fourth quarter. |

| |

• |

|

As always, thank you for your trust and support of Patterson. We are excited about the opportunities ahead and

look forward to continuing to serve you in this next phase of our journey. |

Customer FAQs – FOR YOUR REACTIVE USE ONLY

Q&A

| 1. |

What happens between now and closing? |

| |

• |

|

Until the transaction is complete, Patterson remains an independent, publicly-traded company, and it is business

as usual. We expect the transaction to close in our fiscal fourth quarter of 2025. |

| 2. |

How will this impact me? |

| |

• |

|

We are excited about what this means for Patterson and our customers. |

| |

• |

|

While this transaction will mark the beginning of an exciting new chapter for Patterson, I want to emphasize that

this announcement does not impact our day-to-day operations or your relationship with Patterson. |

| |

• |

|

Please see the press release Patterson issued for more information. |

| 3. |

Will there be a change in pricing? |

| |

• |

|

We don’t anticipate any changes in our pricing as a result of this news. As always, Patterson regularly

evaluates our pricing levels and adjusts as appropriate based on market conditions and other factors. |

| 4. |

Will my point of contact at Patterson change? |

| |

• |

|

No. It is business as usual. Please continue to reach out to me. |

Vendor Communications Toolkit

To be distributed to vendor-facing Patterson employees for their use as instructed below.

READ FIRST: HOW TO USE THIS TOOLKIT.

Overview

Patterson Companies announced that it has agreed to be acquired by Patient Square Capital.

Your Role & Instructions

Vendors may reach out

to you with questions about this news. Please refer to the below Talking Points and FAQs when responding to questions from vendors. The Talking Points and FAQs are for your use only and may not be distributed or forwarded.

Communication Protocols

It is critical that we speak

with one voice. Please do not speculate, make assumptions, address rumors, or discuss any details not provided in this document. If you are asked a question that is not covered in this document, please do not speculate or make up an

answer. Instead, take note of the question and respond with the following:

“I am not sure how to answer your question, and I don’t

want to provide any information that may not be accurate. I am happy to pass your question along and get back to you.”

Refer any

questions that you are unable to answer to Patterson Legal.

Vendor Talking Points – FOR YOUR REACTIVE USE ONLY

| |

• |

|

Thank you for reaching out to me about Patterson’s recent news. We are excited about what the sale to

Patient Square Capital means for Patterson and our partners. Please see the press release Patterson issued for more information. |

| |

• |

|

Patient Square Capital is a dedicated health care investment firm that aims to achieve strong investment returns

by partnering with growth-oriented companies and top-tier management teams whose products, services, and technologies improve health. Patient Square utilizes deep industry expertise, a broad network of

relationships, and a partnership approach to make investments in companies that will grow and thrive. Patient Square invests in businesses that strive to improve patient lives, strengthen communities, and create a healthier world. For more

information, visit www.patientsquarecapital.com. |

| |

• |

|

While this transaction will mark the beginning of an exciting new chapter for Patterson, I want to emphasize that

this announcement does not impact our day-to-day operations or your relationship with Patterson. |

| |

• |

|

I remain your go-to contact here, and nothing about our business

relationship, or product and service offering changes. |

| |

• |

|

We expect to complete the transaction during our 2025 fiscal fourth quarter. |

| |

• |

|

As always, thank you for your partnership and continued collaboration with Patterson. We are excited about the

opportunities ahead and look forward to working together in this next phase of our journey. |

Vendor FAQs – FOR YOUR REACTIVE USE

ONLY

Q&A

| 1. |

What happens between now and closing? |

| |

• |

|

Until the transaction is complete, Patterson remains an independent, publicly-traded company, and it is business

as usual. We expect the transaction to close in our fiscal fourth quarter of 2025. |

| 2. |

How will this impact me? |

| |

• |

|

We are excited about what this means for Patterson and our partners. |

| |

• |

|

While this transaction will mark the beginning of an exciting new chapter for Patterson, I want to emphasize that

this announcement does not impact our day-to-day operations or your relationship with Patterson. |

| |

• |

|

Please see the press release Patterson issued for more information. |

| 3. |

Will my point of contact at Patterson change? |

| |

• |

|

No. It is business as usual. Please continue to reach out to me. |

Forward-Looking Statements

This communication contains

statements that are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include information concerning the proposed merger (“Merger”) with Paradigm Parent, LLC, a Delaware limited

liability company (“Parent”), and Paradigm Merger Sub, Inc., a Minnesota corporation and a wholly owned subsidiary of Parent (“Merger Sub”) and the ability to consummate the proposed Merger, our liquidity and our possible or

assumed future results of operations, including descriptions of our business strategies. These statements often include words such as “believe,” “expect,” “project,” “potential,” “anticipate,”

“intend,” “plan,” “estimate,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts” or similar words. These statements are based on certain

assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. We

believe these assumptions are reasonable, but you should understand that these statements are not guarantees of performance or results, and our actual results could differ materially from those expressed in the forward-looking statements due to a

variety of important factors, both positive and negative, that may be revised or supplemented in subsequent releases or reports. These statements involve risks, estimates, assumptions, and uncertainties that could cause actual results to differ

materially from those expressed in these statements and elsewhere in this communication. These uncertainties include, but are not limited to, the inability to consummate the Merger within the anticipated time period, or at all, due to any reason,

including the failure to obtain required regulatory or shareholder approvals, satisfy the other conditions to the consummation of the Merger or complete necessary financing arrangements; the risk that the Merger disrupts our current plans and

operations or diverts management’s attention from its ongoing business; the effects of the Merger on

our business, operating results, and ability to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom we do business; the risk that our stock

price may decline significantly if the Merger is not consummated; the nature, cost and outcome of any legal proceedings related to the Merger; our dependence on suppliers to manufacture and supply substantially all of the products we sell; potential

disruption of distribution capabilities, including service issues with third-party shippers; our dependence on relationships with sales representatives and service technicians to retain customers and develop business; risks of selling private label

products, including the risk of adversely affecting our relationships with suppliers; adverse changes in supplier rebates or other purchasing incentives; the risk of technological and market obsolescence for the products we sell; the risk of failing

to innovate and develop new and enhanced software and e-services products; our dependence on positive perceptions of Patterson’s reputation; risks associated with illicit human use of pharmaceutical

products we distribute; risks inherent in acquiring and disposing of assets or other businesses and risks inherent in integrating acquired businesses; turnover or loss of key personnel or highly skilled employees; risks associated with information

systems, software products and cyber-security attacks; risks inherent in our growing use of artificial intelligence systems to automate processes and analyze data; adverse impacts of wide-spread public health concerns as we experienced with the COVID-19 pandemic and may experience in the future; risks related to climate change; our ability to comply with restrictive covenants and other limits in our credit agreement; the risk that our governing documents

and Minnesota law may discourage takeovers and business combinations; the effects of the highly competitive dental and animal health supply markets in which we compete; the effects of consolidation within the dental and animal health supply markets;

risks from the formation or expansion of GPOs, provider networks and buying groups that may place us at a competitive disadvantage; exposure to the risks of the animal production business, including changing consumer demand, the cyclical livestock

market, weather conditions, the availability of natural resources and other factors outside our control, and the risks of the companion animal business, including the possibility of disease adversely affecting the pet population; exposure to the

risks of the health care industry, including changes in demand due to political, economic and regulatory influences and other factors outside our control; increases in

over-the-counter sales and e-commerce options; risks of litigation and government inquiries and investigations, including the

diversion of management’s attention, the cost of defending against such actions, the possibility of damage awards or settlements, fines or penalties, or equitable remedies (including but not limited to the revocation of or non-renewal of licenses) and inherent uncertainty; failure to comply with health care fraud or other laws and regulations; change and uncertainty in the health care industry; failure to comply with existing or

future U.S. or foreign laws and regulations including those governing the distribution of pharmaceuticals and controlled substances; failure to comply with evolving data privacy laws and regulations; tax legislation; risks inherent in international

operations, including currency fluctuations; and uncertain macro-economic conditions, including inflationary pressures. The foregoing review of important factors that could cause actual results to differ from expectations should not be construed as

exhaustive and should be read in conjunction with the information contained or incorporated by reference herein, including, but not limited to, our Annual Report on Form 10-K for the year ended April 27,

2024 filed with the SEC on June 18, 2024 and our definitive proxy statement for our 2024 annual meeting of shareholders filed with the SEC on August 2, 2024 and our recent Quarterly Reports on Form

10-Q and Current Reports on Form 8-K. The information contained in this communication is made only as of the date hereof, even if subsequently made available on our

website or otherwise.

Additional Information and Where to Find It

This communication relates to the proposed Merger of Parent and Merger Sub with and into Patterson. A special meeting of the shareholders of Patterson will be

announced as promptly as practicable to seek shareholder approval in connection with the proposed Merger. Patterson expects to file with the SEC a proxy statement and other relevant documents in connection with the proposed Merger. Shareholders of

Patterson are urged to read the definitive proxy statement and other relevant materials filed with the SEC

when they become available because they will contain important information about Patterson, Parent, Merger Sub and the Merger. Shareholders may obtain a free copy of these materials (when they

are available) and other documents filed by Patterson with the SEC at the SEC’s website at www.sec.gov, at Patterson’s website at www.pattersoncompanies.com or by sending a written request to our Corporate Secretary at our principal

executive offices at 1031 Mendota Heights Road, St. Paul, MN 55120.

Participants in the Solicitation

Patterson, its directors and certain of its executive officers and employees may be deemed to be participants in soliciting proxies from its shareholders in

connection with the Merger. Information regarding the Company’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and

“Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the year ended April 27, 2024 filed with the SEC

on June 18, 2024 (https://www.sec.gov/ix?doc=/Archives/edgar/data/891024/000089102424000008/pdco-20240427.htm) and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and

“Security Ownership of Certain Beneficial Owners” section of Patterson’s definitive proxy statement for its 2024 Annual Meeting of Shareholders (the “Annual Meeting Proxy Statement”) filed with the SEC on August 2, 2024

(https://www.sec.gov/ix?doc=/Archives/edgar/data/891024/000114036124035443/pdco-20240916.htm). To the extent that holdings of Patterson’s securities have changed since the amounts set forth in the Annual Meeting Proxy Statement, such changes

have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants in the solicitation of Patterson’s shareholders in connection with the

Merger, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the Merger when they are filed with the SEC. You may obtain free copies of these documents

using the sources indicated above in Additional Information and Where to Find It.

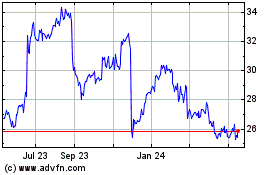

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

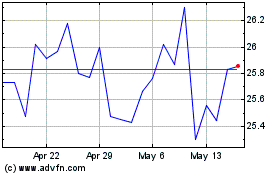

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Jan 2024 to Jan 2025