--12-31

false

0000022701

0000022701

2024-10-15

2024-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (date of earliest event reported): October 15, 2024

Pineapple Energy Inc.

| |

(Exact

name of Registrant as Specified in its Charter) |

|

Minnesota

| |

(State Or Other Jurisdiction

Of Incorporation) |

|

| 001-31588 |

|

41-0957999 |

| (Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

10900

Red Circle Drive

Minnetonka,

MN

|

|

55343 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(952) 996-1674

| |

Registrant’s Telephone

Number, Including Area Code |

|

Securities

registered pursuant to Section 12(b) of the Act

| Title

of Each Class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common

Stock, par value, $.05 per share |

PEGY |

The

Nasdaq Stock Market, LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425

under the Securities Act |

| |

☐ |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

As previously disclosed, Pineapple Energy Inc. (the “Company”) had entered into an operating lease on June 10, 2022 for 8,590 square feet of office space for its corporate office location, located at 10900 Red Circle Drive, Minnetonka, MN 55343 (the “Lease”). Effective October 14, 2024, the Company has terminated the Lease for its principal corporate office.

The termination of the lease, which was set to expire in 2027, is expected to save the Company approximately $17,500 per month, or $210,000 a year, in associated rent expenditures. In connection with the Lease termination, there is a one-time buyout fee in the amount of $189,000 associated with the lease termination agreement, which the Company will pay in fourteen (14) equal monthly installments, as well as the Company waiving its right to its original security deposit provided at entry into the original lease in the amount of $35,434.

Taking into account the remaining years on the now terminated lease, other related costs, and the effect of the buyout fee, total savings are estimated at approximately $480,000.

| Item 3.03 |

Material Modification to Rights of Security Holders. |

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 herein is incorporated by reference into this Item 3.03.

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Effective October 17, 2024, the Company amended its Fourth Amended and Restated Articles of Incorporation (“Articles of Amendment”) to implement a one-for-fifty reverse stock split. The Company’s common stock began trading on a split-adjusted basis when the market opened on October 17, 2024 (the “Effective Date”). The Board of Directors of the Company approved the amendment to the Company’s Articles of Incorporation to meet the share bid price requirements of the NASDAQ Capital Market. The Company’s stockholders approved the Articles of Amendment at its annual meeting held on July 19, 2024.

As a result of the reverse stock split, at 12:01 a.m. Central Time on the Effective Date, every 50 shares of common stock then issued and outstanding automatically were combined into one share of common stock, with no change in par value per share. No fractional shares were outstanding following the reverse stock split, and any fractional shares that would have resulted from the reverse stock split will be settled in cash. The total number of shares authorized for issuance was reduced to 2,666,667 in proportion to the reverse stock split. The text of the Articles of Amendment of the Fourth Amended and Restated Articles of Incorporation of the Company that effected the foregoing actions is attached hereto as Exhibit 3.1 and incorporated herein by reference.

The trading symbol for the Company’s common stock will remain “PEGY.” The Company was assigned a new CUSIP number (72303P404) in connection with the reverse split. All options, warrants and other convertible securities of the Company outstanding immediately prior to the effectiveness of the Certificate of Amendment will be adjusted in accordance with the terms of the plans, agreements or arrangements governing such options, warrants and other convertible securities and subject to rounding to the nearest whole share.

| Item 7.01 |

Regulation FD Disclosure |

On October 15, 2024, the Company issued a press release announcing the reverse stock split. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended or the Exchange Act, except as otherwise expressly stated in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATUREs

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

PINEAPPLE ENERGY INC. |

| |

|

| |

By: |

/s/ James Brennan |

| |

|

James Brennan

Chief Operating Officer |

| |

|

|

| Date: October 17, 2024 |

|

|

Exhibit 3.1

ARTICLES OF AMENDMENT OF THE

FOURTH AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF PINEAPPLE ENERGY INC.

The undersigned, Interim

Chief Executive Officer of Pineapple Energy Inc., a Minnesota corporation (the “Corporation”), hereby certifies that the following

Articles of Amendment have been duly adopted by the Corporation’s Board of Directors and shareholders pursuant to the provisions

of the Minnesota Business Corporation Act (the “Act”):

1. The name of the Corporation is: Pineapple Energy

Inc.

2. The first sentence of Article V (Capital Stock)

of the Corporation’s Fourth Amended and Restated Articles of Incorporation, is hereby amended to read in its entirety as follows:

The authorized capital stock of this

corporation shall be two million six hundred sixty six thousand six hundred and sixty seven (2,666,667) shares of common stock of the

par value of five cents ($.05) per share (the “Common Stock”) and three million (3,000,000) shares of Preferred Stock of the

par value of one dollar ($1.00) per share (the “Preferred Stock”).

3. Section

3 of Article V (Capital Stock) of the Corporation’s Fourth Amended and Restated Articles of Incorporation is hereby amended and

restated in its entirety as follows:

SECTION 3. Reverse

Stock Split. Effective upon the filing of the Articles of Amendment approved by the shareholders of the Corporation (the “Effective

Time”), the issued and outstanding shares of common stock of the Corporation, as well as shares of common stock issuable upon exercise

or conversion of outstanding derivative securities as per the terms related thereto, shall be combined on a 1-for-50 basis such that,

at the Effective Time, every fifty (50) shares of common stock outstanding immediately prior to the Effective Time shall be combined into

one share of common stock. This reverse stock split will be effected through the exchange and replacement of certificates representing

issued and outstanding shares of common stock as of the Effective Time, together with immediate book-entry adjustments to the stock register

of the Corporation maintained in accordance with the Act. In the event that the reverse stock split would result in a shareholder being

entitled to receive less than a full share of common stock, the fractional share that would so result shall entitle such shareholder to

a cash payment in lieu thereof at a price equal to the fraction to which the shareholder would otherwise be entitled multiplied by the

closing price of the common stock on Nasdaq on the date of the Effective Time. The par value of each share of issued and outstanding common

stock shall not be affected by the reverse stock split.

4. That

such amendments shall be effective as of 12:01 a.m. Central time on October 17, 2024; and

5. That such amendments

will not adversely affect the rights or preferences of the holders of outstanding shares of any class or series of the Corporation, and

will not result in the percentage of authorized shares of any class or series that remains unissued after such combination exceeding the percentage of authorized shares of the same

class or series remaining unissued before the division.

IN WITNESS WHEREOF, the undersigned has set his

hand as of October 15, 2024.

| |

/s/ Scott Maskin |

|

| |

Scott Maskin, |

|

| |

Interim Chief Executive Officer |

|

Exhibit 99.1

Pineapple Energy Announces Previously Approved

Reverse Stock Split, Effective October 17, 2024

RONKONKOMA, NY, October 15, 2024 -- Pineapple Energy Inc. (the

“Company”) (NASDAQ: PEGY) announced today that effective at 12:01 a.m. Central Time on October 17, 2024, the Company will

implement a 1-for-50 reverse stock split of its outstanding common stock, which is within the range approved by stockholders at the annual

meeting of the Company’s shareholders held on July 19, 2024. The Company’s common stock will continue to trade under the symbol

“PEGY” and it is expected to open for trading on Nasdaq on October 17, 2024 on a post-split basis. The new CUSIP number for

the common stock following the reverse stock split will be 72303P404.

The reverse stock split is primarily intended to increase the market

price per share of the Company’s common stock to regain compliance with the minimum bid price required for continued listing on

The Nasdaq Capital Market.

Upon the effectiveness of the reverse stock

split, every 50 shares of issued and outstanding Company common stock at the close of business on October 16, 2024 will be automatically

combined into one issued and outstanding share of common stock, with no change in par value per share. Proportionate adjustments will

be made to the conversion and exercise prices of the Company’s outstanding stock purchase warrants, stock options, convertible notes

and to the number of shares issued and issuable under the Company’s equity incentive plans.

The reverse stock split proportionally reduces

the number of shares of the Company’s authorized common stock from 133,333,333 to 2,666,667. No fractional shares will be issued

as a result of the reverse stock split. Any fractional shares that would have resulted from the reverse stock split will be settled in

cash. The reverse stock split will affect all common shareholders uniformly and will not alter any shareholder’s percentage

interest in the Company’s common stock, except to the extent that the reverse stock split results in some shareholders experiencing

an adjustment of a fractional share as described above.

Shareholders holding their shares electronically

in book-entry form are not required to take any action to receive the post-split shares. Shareholders holding physical share certificates

will receive information from EQ Shareowner Services, the Company’s transfer agent, regarding the process for exchanging their shares

of common stock. Shareholders with questions may contact the Company’s transfer agent by calling 800-401-1957.

About Pineapple Energy

Pineapple is focused on growing leading local and regional solar, storage,

and energy services companies nationwide. Our vision is to power the energy transition through grass-roots growth of solar electricity

paired with battery storage. Our portfolio of brands (SUNation, Hawaii Energy Connection, E-Gear, Sungevity, and Horizon Solar Power)

provide homeowners and businesses of all sizes with an end-to-end product offering spanning solar, battery storage, and grid services.

Forward Looking Statements

This press release includes certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the Company’s current expectations

or beliefs and are subject to uncertainty and changes in circumstances, including the Company’s expectations regarding its ability

to effect the reverse stock split and regain compliance with Nasdaq’s continued listing standards. While the Company believes its

plans, intentions, and expectations reflected in those forward-looking statements are reasonable, these plans, intentions, or expectations

may not be achieved. For information about the factors that could cause such differences, please refer to the Company’s filings

with the Securities and Exchange Commission, including, without limitation, the statements

made under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and

in subsequent filings. The Company does not undertake any obligation to update or revise these forward-looking statements for any reason,

except as required by law.

Contacts:

|

|

Scott Maskin

Interim Chief Executive Officer

+1 (631) 823-7131

scott.maskin@pineappleenergy.com

Pineapple Investor Relations

+1 (952) 996-1674

IR@pineappleenergy.com

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

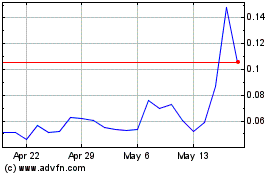

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Oct 2024 to Oct 2024

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Oct 2023 to Oct 2024