Filed pursuant

to Rule 424(b)(5)

Registration No. 333-267066

PROSPECTUS SUPPLEMENT

(To Prospectus dated September 2, 2022)

$10,000,000

of Common Stock

We have

entered into a Sales Agreement (the “Sales Agreement”), dated October 21, 2024, with Roth Capital Partners, LLC (the

“Sales Agent”), relating to the shares of our Common Stock, par value $0.05 per share (the “Common Stock”),

offered by this prospectus supplement. In accordance with the terms of the Sales Agreement, we may offer and sell shares of our

Common Stock having an aggregate offering price of up to $10,000,000 from time to time through or to the Sales Agent, as agent

or principal.

Sales of

Common Stock, if any, under this prospectus supplement and the accompanying prospectus may be made in transactions that are deemed

to be “at-the-market offerings” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities

Act”). The Sales Agent is not required to sell any specific number or dollar amount of shares, but will act as sales agent

on a commercially reasonable efforts basis consistent with its normal trading and sales practices. There is no arrangement for

funds to be received in any escrow, trust or similar arrangement.

We will

pay the Sales Agent a fixed commission, in an amount up to 3.0% of the gross sales price per share of Common Stock issued by us

and sold through them as our Sales Agent under the Sales Agreement. In connection with the sale of Common Stock on our behalf,

the Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation

to the Sales Agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification

and contribution to the Sales Agent with respect to certain liabilities, including liabilities under the Securities Act.

As of October

17, 2024, we had 1,210,471 authorized but unissued shares of Common Stock available for issuance (after deducting the number of

shares outstanding and reserved for issuance and (i) giving effect to the 1-for-50 reverse stock split, which became effective

as of October 17, 2024, and (ii) giving effect to an aggregate of 110,982 shares of common stock issuable upon the exercise of

any outstanding shares of preferred stock, equity incentive plan, equity stock purchase plans, SUNation inducement shares and

convertible debt. Based on 1,210,471 authorized shares of Common Stock available for issuance and an assumed offering price of

$5.51 per share, which was the last reported sale price of our Common Stock on the Nasdaq Capital Market on October 17, 2024,

we would be able to issue and sell shares under the Sales Agreement for a maximum of approximately $6.67 million, notwithstanding

the $10,000,000 maximum aggregate offering amount set forth in this prospectus supplement. In no event will we sell, pursuant

to the registration statement of which this prospectus supplement forms a part, more shares than we have available and authorized

for issuance.

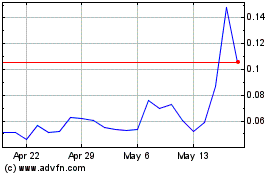

Our shares

of Common Stock are traded on the Nasdaq Capital Market under the symbol “PEGY”.

Investment

in our Common Stock involves risks. See the section entitled “Risk Factors” on page S-10 of this prospectus supplement

and the risk factors contained in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus

for a discussion of certain factors which should be considered before investing in our Common Stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Roth Capital

Partners

The date

of this prospectus supplement is October 21, 2024.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

No dealer,

salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement

or the accompanying prospectus. You must not rely on any unauthorized information or representations. This prospectus supplement

and the accompanying prospectus are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. The information contained in this prospectus supplement and the accompanying prospectus is current

only as of their respective dates.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities

and Exchange Commission, or SEC, utilizing a “shelf” registration process. This document is in two parts. The first

part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying

prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of

this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and

the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the

date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date-for example, a document incorporated

by reference in the accompanying prospectus-the statement in the document having the later date modifies or supersedes the earlier

statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state

of our affairs.

You

should rely only on the information contained in this prospectus supplement or the accompanying prospectus or incorporated by

reference herein. We have not authorized anyone to provide you with information that is different. The information contained in

this prospectus supplement or the accompanying prospectus or incorporated by reference herein or therein is accurate only as of

the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus

or of any sale of our Common Stock. It is important for you to read and consider all information contained in this prospectus

supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your

investment decision. This prospectus supplement contains summaries of certain provisions contained in some of the documents described

herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety

by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated

by reference as exhibits to the registration statement of which this prospectus supplement is a part, and you may obtain copies

of those documents as described below under the heading “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus supplement and in the accompanying prospectus, respectively.

We

are offering to sell, and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where

offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering

of the securities offered by this prospectus supplement in certain jurisdictions may be restricted by law. For investors outside

of the United States: neither we nor the Sales Agent have done anything that would permit this offering or possession or distribution

of this prospectus supplement and accompanying prospectus in any jurisdiction where action for that purpose is required, other

than in the United States. Persons outside the United States who come into possession of this prospectus supplement and the accompanying

prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Common Stock and the distribution

of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying

prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy,

any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which

it is unlawful for such person to make such an offer or solicitation.

When

used herein, unless the context requires otherwise, references to the “Company,” “we,” “our”

and “us” refer to Pineapple Energy Inc., a Minnesota corporation.

All

trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience,

the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references

should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable

law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a

relationship with, or endorsement or sponsorship of us by, any other companies.

Except

as otherwise indicated, all information in this prospectus supplement gives effect to a 1-for-50 reverse stock split of our Common

Stock, which became effective as of October 17, 2024. However, share and per share amounts in the accompanying prospectus and

certain of the documents incorporated by reference herein prior to October 17, 2024, have not been adjusted to give effect to

the reverse stock split.

CAUTIONARY

NOTE ON FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the documents incorporated by reference in this prospectus supplement contain, and our officers and

representatives may from time to time make, “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

which include information relating to future events, future financial performance, financial projections, strategies, expectations,

competitive environment and regulation. Words such as “may,” “should,” “could,” “would,”

“predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates,” “goal,” “seek,”

“project,” “strategy,” “likely,” and similar expressions, as well as statements in future

tense, identify forward-looking statements. Forward-looking statements are neither historical facts, nor should they be read as

a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved.

Forward-looking statements are based on information we have when those statements are made or management’s good faith belief

as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance

or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that

could cause such differences include, but are not limited to:

| |

● |

our growth strategy

depends on the continued origination of solar installation agreements; |

| |

● |

if we fail to manage

our operations and growth effectively, we may be unable to execute our business plan, maintain high levels of customer service

or adequately address competitive challenges; |

| |

● |

we need to raise

additional capital to fund our operations and repay our obligations, which funding may not be available on favorable terms

or at all and may lead to substantial dilution to our existing shareholders. Further, there is substantial doubt about our

ability to continue as a going concern, which conditions may adversely affect our stock price and our ability to raise capital; |

| |

● |

our Common Stock

may be delisted from The Nasdaq Capital Market if we cannot increase the share price within the time period and for the duration

as required by The Nasdaq Capital Market; |

| |

● |

we may face claims

for monetary damages, penalties, and other significant items pursuant to existing contractual arrangements, as well as litigation

or threatened litigations, which, if material, may strain our cashflow and operations, as well as take away substantial time

and attention from management that is necessary to for business operations and potential growth opportunities; |

| |

● |

we depend on a limited

number of suppliers of solar energy system components and technologies to adequately meet demand for our solar energy systems; |

| |

● |

increases in the

cost of our solar energy systems due to tariffs and other trade restrictions imposed by the U.S. government could have a material

adverse effect on our business, financial condition and results of operations; |

| |

● |

our operating results

and our ability to grow may fluctuate from quarter to quarter and year to year, which could make our future performance difficult

to predict and could cause our operating results for a particular period to fall below expectations; |

| |

● |

we may have difficulty

integrating any new businesses we may acquire with our existing operations or otherwise obtaining the strategic benefits of

the acquisition; |

| |

● |

if we are unable

to make acquisitions on economically acceptable terms, our future growth would be limited, and any acquisitions we may make

could reduce, rather than increase, our cash flows; |

| |

● |

product liability

and property damage claims against us or accidents could result in adverse publicity and potentially significant monetary

damages; |

| |

● |

we will not be able

to insure against all potential risks and we may become subject to higher insurance premiums; |

| |

● |

damage to our brand

and reputation or change or loss of use of our brand could harm our business and results of operations; |

| |

● |

the loss of one

or more members of our senior management or key employees may adversely affect our ability to implement our strategy; |

| |

● |

our inability to

protect our intellectual property could adversely affect our business. We may also be subject to intellectual property rights

claims by third parties, which are extremely costly to defend, could require us to pay significant damages and could limit

our ability to use certain technologies; |

| |

● |

we may be subject

to interruptions or failures in our information technology systems; |

| |

● |

our information

technology systems may be exposed to various cybersecurity risks and other disruptions that could impair our ability to operate,

adversely affect our business, and damage our brand and reputation; |

| |

● |

our failure to hire

and retain a sufficient number of key employees, such as installers and electricians, would constrain our growth and our ability

to timely complete projects; |

| |

● |

our business is

concentrated in certain markets, putting us at risk of region-specific disruptions; |

| |

● |

if sufficient additional

demand for residential solar energy systems does not develop or takes longer to develop than we anticipate, our ability to

originate solar installation agreements may decrease; |

| |

● |

our business prospects

are dependent in part on a continuing decline in the cost of solar energy system components and our business may be adversely

affected to the extent the cost of these components stabilize or increase in the future; |

| |

● |

we face competition

from centralized electric utilities, retail electric providers, independent power producers and renewable energy companies; |

| |

● |

developments in

technology or improvements in distributed solar energy generation and related technologies or components may materially adversely

affect demand for our offerings; |

| |

● |

a material reduction

in the retail price of electricity charged by electric utilities or other retail electricity providers could harm our business,

financial condition and results of operations; |

| |

● |

terrorist or cyberattacks

against centralized utilities could adversely affect our business; |

| |

● |

climate change may

have long-term impacts on our business, industry, and the global economy; |

| |

● |

increases in the

cost of our solar energy systems due to tariffs imposed by the U.S. government could have a material adverse effect on our

business, financial condition and results of operations; |

| |

● |

we are not currently

regulated as an electric public utility under applicable law, but may be subject to regulation as an electric utility in the

future; |

| |

● |

electric utility

policies and regulations, including those affecting electric rates, may present regulatory and economic barriers to the purchase

and use of solar energy systems that may significantly reduce demand for our solar energy systems and adversely impact our

ability to originate new solar installation agreements; |

| |

● |

we rely on net metering

and related policies to sell solar systems to our customers in most of our current markets, and changes to policies governing

net metering may significantly reduce demand for electricity from residential solar energy systems and thus for our installation

services; |

| |

● |

a customer’s

decision to procure installation services from us depends in part on the availability of rebates, tax credits and other financial

incentives. The expiration, elimination or reduction of these rebates, credits or incentives or our ability to monetize them

could adversely impact our business; |

| |

● |

technical

and regulatory limitations regarding the interconnection of solar energy systems to the electrical grid may significantly

delay interconnections and customer in-service dates, harming our growth rate and customer satisfaction; and |

| |

● |

compliance

with occupational safety and health requirements and best practices can be costly, and noncompliance with such requirements

may result in potentially significant monetary penalties, operational delays and adverse publicity. |

While

we believe these expectations, assumptions, beliefs, estimates, projections, intentions and strategies are reasonable, such forward-looking

statements are only predictions and involve known and unknown risks and uncertainties, most of which are difficult to predict

and many of which are beyond our control. Actual results and timing of certain events may differ materially from those anticipated

in these forward-looking statements as a result of various factors. You should consider these factors carefully in evaluating

forward-looking statements contained in this prospectus supplement and the documents incorporated by reference into this prospectus

supplement and are cautioned not to place undue reliance on such statements, which speak only as of the date of this prospectus

supplement.

We undertake

no obligation to update forward-looking statements except as may be required under applicable securities laws. See an additional

discussion under the heading “Risk Factors” in this prospectus supplement, any related free writing prospectus, and

in our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement,

in the accompanying prospectus and in the documents incorporated by reference herein and therein. This summary is not complete

and does not contain all the information you should consider before investing in our securities pursuant to this prospectus supplement

and the accompanying prospectus. Before making an investment decision, to fully understand this offering and its consequences

to you, you should carefully read this entire prospectus supplement and the accompanying prospectus, including “Risk Factors,”

the financial statements, and related notes, and the other information incorporated by reference herein and therein. When used

herein, unless the context requires otherwise, references to the “Company,” “we,” “our” and

“us” refer to Pineapple Energy Inc., a Minnesota corporation.

Company

Overview

Our vision

is to power the energy transition through grass-roots growth of solar electricity paired with battery storage. We are a growing

domestic operator and consolidator of residential and commercial solar, battery storage, and grid services solutions. Our strategy

is focused on acquiring, integrating, and growing leading local and regional solar, storage, and energy services companies nationwide.

Today,

we are primarily engaged in the sale, design, and installation of photovoltaic solar energy systems and battery storage systems

through our Hawaii-based Hawaii Energy Connection (“HEC”) and New York-based SUNation (as defined below) entities.

We install systems that provide clean, reliable solar energy typically at savings relative to traditional utility offerings. Our

primary customers are residential homeowners, commercial owners, municipal and institutional customers, as well as owners of pre-existing

photovoltaic and energy storage systems that are in need of service.

Through

our E-Gear, LLC (“E-Gear”) business, we also develop, manufacture, and sell patented technologies related to edge-of-grid

energy management software and related hardware technology, such as energy management control devices. These products allow homeowners

to get the most out of their installed photovoltaic solar energy systems and utility grid support benefits. Our primary customers

for this technology are energy services companies and other utilities.

Corporate

Information

We are currently

a Minnesota corporation organized in 1969 that operates directly and through our subsidiaries located in the United States (“U.S.”).

On October 10, 2024, we filed a definitive proxy statement pursuant to which we have scheduled a special meeting of our shareholders

to be held on November 4, 2024. At this meeting, our shareholders will be voting on three proposals: a proposal to re-domesticate

the Company from Minnesota to Delaware, to change our Company name to SUNation Energy, Inc. and on an adjournment proposal, should

we need to postpone or adjourn this special shareholder meeting for any reason. If our re-domestication proposal is approved,

then we will no longer be a Minnesota corporation, and will instead be a Delaware corporation upon the filing of a certificate

of incorporation with the Secretary of State of the state of Delaware. Our second proposal involves a change to our Company’s

name which, if approved, will be SUNation Energy, Inc. For more information about these proposals, and other information related

thereto, please see our definitive proxy statement filed with the Securities and Exchange Commission, which can be found at www.sec.gov,

as well as any amendments that may be made thereto.

On March

28, 2022, we completed our previously announced merger transaction with Pineapple Energy LLC (“Pineapple Energy”)

in accordance with the terms of that certain Agreement and Plan of Merger dated March 1, 2021, as amended by an Amendment No.

1 to Merger Agreement dated December 16, 2021 (collectively the “merger agreement”), by and among us, Helios Merger

Co., a Delaware corporation and a wholly-owned subsidiary of ours (the “Merger Sub”), Pineapple Energy LLC, a Delaware

limited liability company, Lake Street Solar LLC as the Members’ Representative, and Randall D. Sampson as the Shareholders’

Representative, pursuant to which the Merger Sub merged with and into Pineapple Energy, with Pineapple Energy surviving the merger

as a wholly-owned subsidiary of ours (the “merger”). Following the closing of the merger, we changed our name from

Communications Systems, Inc. to Pineapple Holdings, Inc. and commenced doing business using the Pineapple name, and subsequently,

on April 13, 2022, changed our name to Pineapple Energy Inc.

In addition,

on March 28, 2022 and immediately prior to the closing of the merger, Pineapple Energy completed its acquisition of substantially

all of the assets of two Hawaii-based solar energy companies, HEC and E-Gear. On November 9, 2022, we purchased the equity of

New York-based SUNation Solar Systems, Inc. and five of its affiliated entities (collectively “SUNation”).

Recent

Developments

Minnesota

Lease Termination

On

October 14, 2024, the Company entered into a lease termination agreement with our Minnesota office landlord for the property located

at 10900 Red Circle Drive, Minnetonka, MN 55343, pursuant to which we will pay a termination fee totaling $189,000 to be paid

at $13,500 per month for a period of fourteen (14) months from entry into this lease termination, as well as the Company waiving

its right to its original security deposit provided at entry into the original lease in the amount of $35,434. This lease termination

will result in a net cost savings to the Company of approximately $480,000 over the course of the lease agreement.

Principal

Place of Business

As part

of, and consistent with, our proposed re-domestication of the Company from Minnesota to Delaware, and with the changes in executive

management that have taken place over the course of the past few months, we are in the process of transitioning our principal

place of business from Minnesota to our New York office location located at 171 Remington Boulevard, Ronkonkoma, NY 11779.

Reverse

Stock Split

On July

19, 2024, the Company’s shareholders approved a reverse stock split of the Company’s common stock at a ratio within

a range of 1-for-2 and 1-for-200 and granted the Company’s board of directors the discretion to determine the timing and

ratio of the split within such range.

On October

2, 2024, the Company’s board of directors determined to effectuate the reverse stock split of the common stock at a 1-for-50

ratio (the “Reverse Stock Split”) and approved an amendment (“Reverse Stock Split Amendment”) to the Fourth

Amended and Restated Articles of Incorporation of the Company to effectuate the Reverse Stock Split. Effective October 17, 2024,

the Company amended its Fourth Amended and Restated Articles of Incorporation to implement the Reverse Stock Split. The Company’s

common stock began trading on a split-adjusted basis when the market opened on October 17, 2024 (the “Effective Date”).

The trading symbol for the Company’s common stock will remain “PEGY.” The Company was assigned a new CUSIP number

(72303P404) in connection with the reverse split.

As a result

of the Reverse Stock Split, at 12:01 a.m. Central Time on the Effective Date, every 50 shares of common stock then issued and

outstanding automatically were combined into one share of common stock, with no change in par value per share. No fractional shares

were outstanding following the Reverse Stock Split, and any fractional shares that would have resulted from the Reverse Stock

Split were settled in cash. The number of shares of common stock outstanding was reduced from 67,260,696 to 1,345,214. The total

number of shares authorized for issuance was reduced to 2,666,667 in proportion to the Reverse Stock Split ratio.

Effective

as of the same time as the Reverse Stock Split, the number of shares of common stock available for issuance under the Company’s

equity compensation and incentive plans, shares of common stock issuable upon exercise or vesting of equity awards, exercise of

any outstanding warrants, any outstanding shares of preferred stock, SUNation inducement shares and applicable portions of convertible

debt were automatically reduced in proportion to the Reverse Stock Split ratio and caused a proportionate increase in exercise

price or share-based performance criteria, if any, applicable to such awards, convertible or exercisable securities.

As more

fully described on our Current Report on Form 8-K, dated October 4, 2024, we received a notification from Nasdaq’s Listing

Qualifications Department (the “Staff”) of The Nasdaq Stock Market informing us that for the 30 consecutive business

days through September 30, 2024, the Company’s common stock had not maintained a minimum closing bid price of $1.00 per

share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (“Minimum Bid

Price Requirement”). Accordingly, in response to and in compliance with the October 1, 2024 Staff letter, we have filed

an appeal on October 8, 2024 with the Nasdaq hearing panel, which automatically stays any suspension or delisting action pending

the hearing.

In relevant

part, to this end, the board of directors of the Company determined to effectuate the stockholder approved stock split (noted

above) on a 1-50 ratio, which has increased our price per common share above the Minimum Bid Price Requirement in the immediate

term. In the event that the Company regains compliance with the Minimum Bid Price Requirement for a sufficient period of time

prior to any scheduled hearing date, then a hearing may not be necessary, as the Company may be mooted out of the hearings process

altogether.

Decathlon

and Hercules Loan Amendment

Effective

September 20, 2024, the Company entered into a third amendment to the Loan and Security Agreement, dated as of December 11, 2020,

by and between Pineapple Energy LLC as Borrower and Hercules Capital, Inc. (“Hercules”) as lender and agent (as amended,

the “Loan Agreement”) with Hercules (the “Third Amendment”). Pursuant to, and subject to the terms and

conditions of, the Third Amendment, Hercules waived the payment of outstanding principal due and payable on October 1, 2024 pursuant

to Section 2.1(c) of the Loan Agreement, effective September 20, 2024. Notwithstanding this waiver, Pineapple Energy LLC will

continue to make payment of monthly interest due and payable on October 1, 2024, and will resume making regular monthly payments

of principal on November 1, 2024, in each case, pursuant to Section 2.1(c) of the Loan Agreement.

Effective

September 12, 2024, Decathlon Growth Credit, LLC (as assignee of Decathlon Specialty Finance, LLC (“Decathlon”)) entered

into a Second Amendment (the “Second Amendment”) with respect to the Revenue Loan and Security Agreement dated June

1, 2023 among Decathlon (as lender), the Company (as borrower), and Pineapple Energy LLC, SUNation Solar Systems, Inc., SUNation

Commercial, Inc., SUNation Service, LLC, SUNation Roofing, LLC and SUNation Energy, LLC (as guarantors) (the “Decathlon

Agreement”) with the Company and the guarantors. Pursuant to the Second Amendment, Decathlon consented to the Company making

its monthly payment under the Decathlon Agreement that was originally due on September 15, 2024 by or before October 15, 2024,

which was made on September 30, 2024, and the payment due on October 15, 2024, may be made on or by October 31, 2024.

Conduit

Agreement

As previously

disclosed, on July 22, 2024, Pineapple Energy Inc. (the “Company”) obtained bridge loan financing for working capital

purposes from Conduit Capital U.S. Holdings LLC (“Conduit”), an unaffiliated lender. On such date, Conduit loaned

the principal sum of $500,000 to the Company on an original issue (“OID”) basis of 20% and accordingly, Conduit advanced

$400,000 to the Company (the “Initial Conduit Loan”). The Initial Conduit Loan will accrue interest on the unpaid

principal amount, without deduction for the OID, at an annual rate of 20%. Commencing on October 21, 2024 through and including

July 21, 2025 (the “Maturity Date”), the Company may request that Conduit provide additional advances for working

capital on identical terms, conditions and interest rate as the Initial Conduit Loan on an OID basis, up to an aggregate principal

sum of $500,000, and Conduit shall have the right, without commitment or obligation to make such requested loan(s) by advancing

80% of the principal thereof. All such loans are secured by a pledge of all of the Company’s assets. The agreement was evidenced

by the Secured Credit Agreement, dated July 22, 2024, between the Company and Conduit and the Secured Credit Note, dated July

22, 2024, between the Company and Conduit (the “Original Note”).

On September

9, 2024, the Company and Conduit entered into an Amended and Restated Convertible Secured Note (the “First Amended Note”)

which amended the Original Note, which provides for an additional principal advance of $120,000 (the “Second Advance”).

The First Amended Note also provides that Conduit may convert all or any portion of the Second Advance and all accrued but unpaid

interest thereon into a number of shares (the “Note Conversion Shares”) of the Company’s common stock, par value

$0.05 per share (the “Common Stock”), calculated as the total dollar amount to be converted divided by $22.50 (the

“Conversion Price”).

On September

23, 2024, the Company and Conduit entered into a further amended and restated convertible secured credit note (the “Second

Amended Note”), which amends and restates the First Amended Note. Under the terms of the Second Amended Note, Conduit loaned

an additional principal sum of $380,000 to the Company (the “Third Advance”) on an OID basis of 20%. Additionally,

pursuant to the Second Amended Note, Conduit was granted a demand registration right, which is in addition to the piggyback registration

rights set forth in the First Amended Note, which registration rights are inclusive of all convertible shares issuable for the

Second Advance and Third Advance, if converted; however, all out of pocket costs and expenses incurred in connection with this

demand registration right shall borne by Conduit. The Third Advance, together with all accrued but unpaid interest thereon, are

convertible into shares of Common Stock at the Conversion Price.

Share

Exchange

On

September 9, 2024, the Company entered into a Securities Exchange Agreement with the holders of the Series A Preferred Stock and

Warrants to cancel and retire the Series A Preferred Stock and the Warrants in exchange for shares of Series

C Convertible Preferred Stock of the Company (the “Series C Preferred Stock”), convertible

at the conversion price of $22.50 per share (post reverse split) for up to an aggregate of 1,246,262 shares (post reverse split)

of Common Stock (the “Exchange”). The Series C Preferred Stock does not contain any of the price resets set forth

in the Series A Preferred Stock, except in the case of stock splits, recapitalizations and similar transactions by the Company.

The Exchange transaction closed on September 10, 2024.

Quarterly

Financial Update

We have

not finalized our financial statements for the quarter ended September 30, 2024. Based upon our current preliminary estimates

and information available to us as of the date of this prospectus supplement, we expect to report that we generated net sales

of approximately $14.0-$15.0 million for the quarter ended September 30, 2024.

In addition,

we expect to report that we had net cash, cash equivalents and restricted cash of approximately $2.2 million as of September 30,

2024.

The estimates

of our net sales for the quarter ended September 30, 2024 and our cash and cash equivalents as of September 30, 2024 are preliminary

and actual amounts that we report will be subject to our financial closing procedures and any final adjustments that may be made

prior to the time that our financial results for the year ended September 30, 2024 are finalized and filed with the Securities

and Exchange Commission. The preliminary financial information included herein has been prepared by and is the responsibility

of our management. UHY LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary

financial information and does not express an opinion or any other form of assurance with respect thereto. As we complete our

financial closing procedures and finalize our financial results for the nine-months ended September 30, 2024, we will be required

to make significant judgments in a number of areas. While we are currently unaware of any items that would require us to make

adjustments to the financial information set forth above, it is possible that we may identify such items and that any resulting

changes could be material. Accordingly, undue reliance should not be placed on these preliminary estimates. These preliminary

estimates are not necessarily indicative of any future period and should be read together with “Risk Factors, and our financial

statements and related notes included elsewhere or incorporated by reference in this prospectus supplement and the accompanying

prospectus.

The foregoing

summary of recent developments is not complete and is not intended to be comprehensive. For additional material information about

the Company, our business, operations, board, management and risk factors and more, all of which are incorporated by reference

into this prospectus supplement, you should carefully review our annual report on Form 10-K, our quarterly reports on Form 10-Q,

our Current Reports on Form 8-K and our proxy statements filed on Form 14A, in each case as amended and supplemented. You may

obtain copies of those documents as described below under the heading “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus supplement.

THE OFFERING

| Issuer |

|

Pineapple

Energy Inc. |

| |

|

|

| Common

Stock offered by us |

|

Shares

of our Common Stock having an aggregate offering price of up to $10,000,000 |

| |

|

|

| Common

Stock to be outstanding after this Offering(1) |

|

Up

to 2,555,685 shares, after giving effect to the assumed sale of 1,210,471 shares of our Common Stock, which, at a price of

$5.51 per share, which was the closing price of our Common Stock on the Nasdaq Capital Market on October 17, 2024, would be

the maximum amount of shares of Common Stock available for issuance (after giving effect to the reservation of 1,456,196 shares

of Common Stock for issuance pursuant to outstanding securities, debt and equity incentive and compensation plans as of October

17, 2024 (as more set forth in the table below). The actual number of shares issuable in this Offering is limited by the number

of authorized shares of Common Stock under our Articles of Incorporation (2,666,667), unless and until our proposal to redomesticate

to the State of Delaware is approved by our stockholders in accordance with the definitive proxy statement, dated October

10, 2024, together with the Delaware certificate of incorporation included therein; and which will also depend on the price

at which shares are sold from time to time during this offering |

| |

|

|

| Form

of Offering |

|

At

the market offering” of our Common Stock that may be made from time to time through or to the Sales Agent, as agent

or principal. See “Plan of Distribution” on page S-16 of this

prospectus supplement |

| |

|

|

| Nasdaq

Capital Market symbol |

|

PEGY |

| |

|

|

| Use

of proceeds |

|

We

currently intend to use the net proceeds from this offering under this prospectus supplement for working capital and general

corporate purposes. See “Use of Proceeds” on page S-15 of this

prospectus supplement. |

| |

|

|

| Risk

Factors |

|

See

“Risk Factors” on page S-10 and the other information included

or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of certain factors

you should carefully consider before deciding to invest in shares of our Common. |

The

number of shares of Common Stock to be outstanding after this offering, as reflected above, is based on 1,345,214 shares of Common

Stock outstanding at October 17, 2024 (as adjusted for the reverse stock split which became effective on October 17, 2024) and

excludes the following:

| |

● |

75,521

shares of Common Stock issuable upon conversion of Series C Convertible Preferred Stock shares outstanding at a conversion

price of $22.50 per share |

| |

● |

12,719

shares of Common Stock issuable pursuant to our 2022 Equity Incentive Plan |

| |

● |

400

shares of Common Stock issuable pursuant to our 2022 Employee Stock Purchase Plan |

| |

● |

120

shares of Common Stock issuable pursuant to our SUNation Inducement Grants |

| |

● |

22,222

shares of Common Stock issuable pursuant to conversion of existing convertible debt |

Except as otherwise

indicated, all information in this prospectus supplement gives effect to a 1-for-50 reverse stock split of our Common Stock, which

became effective as of October 17, 2024. However, share and per share amounts in the accompanying prospectus and certain of the

documents incorporated by reference herein prior to October 17, 2024, have not been adjusted to give effect to the reverse stock

split.

RISK FACTORS

You

should carefully consider the risks described below before making an investment decision. The risks described below are not the

only ones we face, and are in addition to the risk factors set forth in our annual report on Form 10-K and in our quarterly reports

on Form 10-Q. Additional risks we are not presently aware of or that we currently believe are immaterial or very preliminary may

also impair our business operations, financial condition or results of operations. Our business, financial condition or results

of operations could be harmed by any of these risks. The trading price of our Common Stock could decline due to any of these risks,

and you may lose all or part of your investment. In assessing these risks, you should also refer to the risk factors and other

information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus, specifically

including the risk factors contained in our most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q, as filed

with the SEC, which are incorporated in this prospectus by reference in their entirety, as well as any amendment or updates to

our risk factors reflected in subsequent filings with the SEC, including any free writing prospectus that we may authorize for

use in connection with this offering.

Risks

Related to This Offering

Management

will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in

ways that do not improve our results of operations or enhance the value of our Common Stock. Our failure to apply these funds

effectively could have a material adverse effect on our business and cause the price of our Common Stock to decline.

The Common Stock offered

hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay

different prices.

Investors

who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes

in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares

sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result

of share sales made at prices lower than the prices they paid.

You

may experience future dilution as a result of future equity offerings and other issuances of our Common Stock or other securities,

including securities that are exercisable for or convertible into Common Stock. In addition, this offering and future equity offerings

and other issuances of our Common Stock or other securities may adversely affect our Common Stock price.

In

order to raise additional capital, we may in the future offer additional shares of our Common Stock or other securities convertible

into or exchangeable for our Common Stock at prices that may not be the same as the price per share in this offering. We may not

be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price

per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights

superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock or securities convertible

into Common Stock in future transactions may be higher or lower than the price per share in this offering. You will incur dilution

upon exercise of any outstanding stock options, warrants or upon the issuance of shares of Common Stock under our stock incentive

programs. In addition, the sale of shares in this offering and any future sales of a substantial number of shares of our Common

Stock in the public market, or the perception that such sales may occur, could adversely affect the price of our Common Stock.

We cannot predict the effect, if any, that market sales of those shares of Common Stock or the availability of those shares of

Common Stock for sale will have on the market price of our Common Stock.

You

may experience immediate and substantial dilution in the book value per share of the Common Stock you purchase.

Because

the price per share of our Common Stock being offered is substantially higher than the as adjusted net tangible book value per

share of our Common Stock, you may suffer immediate and substantial dilution with respect to the net tangible book value of the

Common Stock you purchase in this offering. After giving effect to the sale of 1,210,471 shares of Common Stock at an assumed

price of $5.51 per share, and after deducting the estimated offering-related expenses payable by us, our as adjusted net tangible

book value as of June 30, 2024 would have been approximately $(25.1) million, or $(18.53) per share. This amount represents an

immediate increase in the adjusted net tangible book value of $24.04 per share to investors purchasing shares of our Common Stock

in this offering. See “Dilution” for a more detailed discussion of the dilution you may incur in connection with this

offering.

Sales of a substantial

number of our shares of Common Stock in the public market could cause our stock price to fall.

We may issue

and sell additional shares of Common Stock in the public markets, including during this offering. As a result, a substantial number

of shares of our Common Stock may be sold in the public market. Sales of a substantial number of shares of our Common Stock in

the public markets, including during this offering, or the perception that such sales could occur, could depress the market price

of our Common Stock and impair our ability to raise capital through the sale of additional equity securities.

An

active trading market for our Common Stock may not be sustained.

Although

our Common Stock is listed on The Nasdaq Capital Market, the market for our Common Stock has demonstrated varying levels of trading

activity. Furthermore, the current level of trading may not be sustained in the future. The lack of an active market for our Common

Stock may impair investors’ ability to sell their shares at the time they wish to sell them or at a price that they consider

reasonable, may reduce the fair market value of their shares and may impair our ability to raise capital to continue to fund operations

by selling shares and may impair our ability to acquire additional intellectual property assets by using our shares as consideration.

The exercise of our outstanding

options, warrants and settlement of our outstanding convertible notes will dilute stockholders and could decrease our stock price.

The exercise

of our outstanding options, warrants and the settlement of our outstanding convertible notes may adversely affect our stock price

due to sales of a large number of shares or the perception that such sales could occur. These factors also could make it more

difficult to raise funds through future offerings of our securities, and could adversely impact the terms under which we could

obtain additional equity capital. Exercise of outstanding options, warrants and the settlement of our outstanding convertible

notes or any future issuance of additional shares of Common Stock or other equity securities, including but not limited to options,

warrants, restricted stock units or other derivative securities convertible into our Common Stock, may result in significant dilution

to our stockholders and may decrease our stock price.

The actual number of shares

we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a sales notice

to the Sales Agent at any time throughout the term of the Sales Agreement. The number of shares that are sold by the Sales Agent

after delivery of a sales notice will fluctuate based on the market price of the Common Stock during the sales period and limits

we set with the Sales Agent. Because the price per share of each share sold will fluctuate based on the market price of our Common

Stock during the sales period, it is not possible at this stage to predict the number of shares that will ultimately be issued.

In addition, dependent upon our per share stock price, we may not have a sufficient number of authorized shares to sell up to

the maximum dollar amount under the Sales Agreement. If this were to occur, may be faced with limited options to finance certain

operations, to pay debt or expand operations or acquire entities in roll-up transactions involving our equity.

Our

stock price may be subject to substantial volatility, and stockholders may lose all or a substantial part of their investment.

Our

Common Stock currently trades on The Nasdaq Capital Market. There is limited public float, and trading volume historically has

been low and sporadic. As a result, the market price for our Common Stock may not necessarily be a reliable indicator of our fair

market value. The price at which our Common Stock trades may fluctuate as a result of a number of factors, including the number

of shares available for sale in the market, quarterly variations in our operating results, actual or anticipated announcements

of new releases by us or competitors, the gain or loss of significant customers, changes in the estimates of our operating performance,

market conditions in our industry and the economy as a whole.

Because

we do not anticipate paying any cash dividends on our Common Stock in the foreseeable future, capital appreciation, if any, will

be your sole source of gain.

We

have never paid or declared any cash dividends on our Common Stock. We currently intend to retain earnings, if any, to finance

the growth and development of our business and we do not anticipate paying any cash dividends in the foreseeable future. As a

result, only appreciation of the price of our Common Stock will provide a return to our stockholders.

Our

failure to maintain compliance with the Nasdaq Stock Market’s continued listing requirements could result in the delisting

of our common stock.

Our

common stock is currently listed on The Nasdaq Capital Market. In order to maintain this listing, we must satisfy minimum financial

and other requirements. On October 1, 2024, we received a letter (the “Minimum Bid Price Deficiency Letter”) from

the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market (“Nasdaq”) notifying the

Company that, for the 30 consecutive business day period from August 16 through September 30, 2024, the Company’s common

stock had not maintained a minimum closing bid price of $1.00 per share (the “Minimum Bid Price Requirement”) required

for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2).

Pursuant

to the previously disclosed Nasdaq hearing panel decision, dated July 18, 2024, the Company was subject to a mandatory panel monitor

(“Panel”) under Nasdaq’s listing Rule 5815(d)(4)(B) for a period of one year. Accordingly, due to the most recent

minimum bid price deficiency, the Staff notified the Company that it will not be afforded a 180-day cure period (as we had received

for our prior minimum bid price deficiency). Instead, the Company was offered an opportunity to appeal any deficiency related

to a delisting determination to Nasdaq by or before October 8, 2024, which appeal we timely filed on October 8, 2024.

The

hearing request automatically stays any suspension or delisting action pending the hearing and the expiration of any additional

extension period if granted by the Panel following the hearing. In the event that the Company regains compliance with the Minimum

Bid Price Requirement prior to any scheduled hearing date, then a hearing may not be necessary, as the Company may be mooted out

of the hearings process.

To

this end, the stockholders of the Company had approved a share consolidation on July 19, 2024, pursuant to which the board of

directors of the Company has effectuated a 1-50 reverse stock split on October 17, 2024 in relevant part to resolve the above

noted Nasdaq listing compliance deficiency prior to such hearing date. There can be no assurance that the Panel will grant the

Company an additional extension period or that the Company will ultimately regain compliance with all applicable requirements

for continued listing on The Nasdaq Capital Market.

The

perception among investors that we are at a heightened risk of delisting could negatively affect the market price and trading

volume of our common stock. If our common stock is delisted from Nasdaq, the delisting could: substantially decrease trading in

our common stock; adversely affect the market liquidity of our common stock as a result of the loss of market efficiencies associated

with Nasdaq and the loss of federal preemption of state securities laws; adversely affect our ability to issue additional securities

or obtain additional financing in the future on acceptable terms, if at all; result in the potential loss of confidence by investors,

suppliers, partners and employees and fewer business development opportunities; and result in limited analyst interest. Additionally,

the market price of our common stock may decline further, and shareholders may lose some or all of their investment.

Changes

in our business strategy or restructuring of our businesses may increase our costs or otherwise affect our businesses.

We

continually review our operations with a view toward reducing our cost structure, including, but not limited to, reducing our

labor cost-to-revenue ratio, improving process and system efficiencies and increasing our revenues and operating margins. Despite

these efforts, we have needed and may continue to need to adjust our business strategies to meet these changes, or we may otherwise

find it necessary to restructure our operations or particular businesses or assets. When these changes or events occur, we may

incur costs to change our business strategy and may need to write down the value of assets or sell certain assets. Additionally,

any of these events could result in disruptions or adversely impact our relationships with our workforce, suppliers and customers.

In any of these events our costs may increase, and we may have significant charges or losses associated with the write-down or

divestiture of assets and our business may be materially and adversely affected.

We

may not fully realize the anticipated benefits from our restructuring efforts.

In

regard to our realigned strategy and exploration of strategic alternatives, we may not achieve the expected benefits of such activities.

Our ability to achieve the anticipated cost savings and other benefits from our restructuring, or other efforts within expected

time frames is subject to many estimates and assumptions, and may vary materially based on factors such as market conditions and

the effect of our efforts on our work force. These estimates and assumptions are subject to significant economic, competitive

and other uncertainties, some of which are beyond our control. There can be no assurance that we will fully realize the anticipated

positive impacts to our operations, liquidity or future financial results from our current or future efforts. If our estimates

and assumptions are incorrect or if other unforeseen events occur, we may not achieve the cost savings expected from such strategic

alternative efforts, and our business and results of operations could be adversely affected.

We

have significant obligations under payables and debt obligations and other contracts. Our ability to operate as a going concern

are contingent upon successfully obtaining additional financing and/or renegotiating terms of selected existing indebtedness in

the near future. Failure to do so could adversely affect our ability to continue or successfully grow our operations.

If

capital is not available or we are not able to agree on reasonable terms with our lenders or creditors, we may then need to scale

back or postpone our organic growth plans, reduce expenses, and/or curtail future acquisition plans to manage our liquidity and

capital resources. From time to time, we receive claims for significant monetary damages, penalties, or seeking additional securities.

Such claims, if material, and if accurate, can place significant pressure on our financials, cashflow, operations and place a

strain on management’s time and focus, each of which could result in a material adverse event in relation to our operations

and future prospects. Additionally, as a result of certain prior securities offerings involving convertible or exercisable securities

containing anti-dilution provisions that provided for significant per share price reset features, causing more shares to be issued

than initially anticipated, we have faced periods of time where we were ultimately required to seek shareholder approval to increase

our authorized share capital, in large measure to satisfy the conversion, exercise, exchange or delivery of such shares, which

is a time consuming and costly approval processes. While we have ultimately satisfied our delivery obligations, including the

issuance of shares under these securities, failing to satisfy or timely satisfy such contractual obligations could lead to material

financial claims, and if proven accurate, could subject us to substantial financial penalties and damages, potentially materially

impacting the Company’s financial stability, interrupt operations and cause reputational harm. For example, we have informally

received a financial claim alleging liquidated damages, which we have begun to investigate. If such preliminary claim is ultimately

found accurate or substantial, we may not be able timely pay, finance, refinance or otherwise extend or repay our past, current

or future obligations if and as they arise, which could materially impact our ability to continue to operate as a going concern.

We

need to obtain substantial additional financing arrangements to provide working capital and growth capital. If financing is not

available to us on acceptable terms when needed, our ability to continue to fund our operations and grow our business would be

materially adversely impacted.

Distributed

solar power is a capital-intensive business that relies heavily on the availability of debt and equity financing sources to fund

solar energy system purchase, design, engineering and other capital and operational expenditures. Our future success depends in

part on our ability to raise capital from third-party investors and commercial sources, such as banks and other lenders, on competitive

terms to help finance the deployment of our solar energy systems. We seek to minimize our cost of capital in order to improve

profitability and maintain the price competitiveness of the electricity produced by the payments for and the cost of our solar

energy systems. We rely on access to capital, including through equity financing, convertible notes, revenue loans and other forms

of debt facilities, asset-backed securities and loan-backed securities, to cover the costs related to bringing our solar energy

systems in service.

To

meet the capital and liquidity needs of our business, we will need to obtain additional debt or equity financing from current

and new investors. We have limited cash resources with which to operate our business and we may have difficulty in accessing financing

on a timely basis or at all. The contract terms in certain of our existing investment and securities documents contain various

conditions, penalty and liquidated damages clauses. If we are not able to satisfy such conditions due to events related to our

business, a specific investment fund, developments in our industry, including tax or regulatory changes, or otherwise, and as

a result, we are unable to draw on existing funding commitments or raise capital through equity, equity derivative or debt instruments,

we could experience a material adverse effect on our business, liquidity, financial condition, results of operations and prospects.

Any delays in accessing financing could have an adverse effect on our ability to pay our operational expenses, make capital expenditures,

repay loans and fund other general corporate purposes. Further, our flexibility in planning for and reacting to changes in our

business may be limited and our vulnerability to adverse changes in general economic, industry, regulatory and competitive conditions

may be increased.

If

any of our current debt or equity investors decide not to invest in us in the future for any reason or decide to invest at levels

inadequate to support our anticipated needs or materially change the terms under which they are willing to provide future financing,

we will need to identify new investors and financial institutions to provide financing and negotiate new financing terms. In addition,

our ability to obtain additional financing through the asset-backed securities market, loan-backed securities market or other

secured debt markets is subject to our having sufficient assets eligible for securitization as well as our ability to obtain appropriate

credit ratings. If we are unable to raise additional capital in a timely manner, our ability to meet our capital needs and fund

future growth and profitability may be limited.

Delays

in obtaining financing could cause delays in expansion in existing markets or entering into new markets and hiring additional

personnel. Any future delays in capital raising could similarly cause us to delay deployment of a substantial number of solar

energy systems for which we have signed solar service agreements with customers. Our future ability to obtain additional financing

depends on banks’ and other financing sources’ continued confidence in our business model and the renewable energy

industry as a whole. It could also be impacted by the liquidity needs of such financing sources themselves. We face intense competition

from a variety of other companies, technologies and financing structures for such limited investment capital. If we are unable

to continue to offer a competitive investment profile, we may lose access to these funds or they may only be available to us on

terms less favorable than those received by our competitors. Any inability to secure financing could lead us to cancel planned

installations, impair our ability to accept new customers or increase our borrowing costs, any of which could have a material

adverse effect on our business, financial condition and results of operations.

Litigation

brought by third parties claiming breach of contract, contractual defaults or other claims for may be costly and time consuming.

Although

we may, from time to time, be involved in litigation and government proceedings, as well as contractual financial claims arising

in the course of business, we are not a party to any litigation or governmental or other proceeding that we believe will have

a material adverse impact on our financial position, results of operations or liquidity. These claims have in the past, and may

in the future, arise from a wide variety of business practices and initiatives, including current or new product releases, significant

business transactions, securities offerings, convertible notes, warrants, loans, warranty or product claims, employment practices,

and regulation, among other matters. Adverse outcomes in some or all of these claims may result in significant monetary damages

or injunctive relief that could adversely affect our ability to conduct our business. Litigation threatened litigation and other

claims are subject to inherent uncertainties and management’s view of these matters may change in the future. A material

adverse impact in our consolidated financial statements could occur for the period in which the effect of an unfavorable outcome

becomes probable and reasonably estimable.

If

we become involved in material litigation or a significant number of litigations, we may incur substantial expense defending these

claims and the proceedings may divert the attention of management, even if we prevail. An adverse outcome could have a material

adverse impact on our business, including causing us to seek protection under the bankruptcy laws, forcing us to reduce or discontinue

our operations entirely, subject us to significant liabilities, allow our competitors to market competitive products without a

license from us, prohibit us from marketing our products or require us to seek licenses from third parties that may not be available

on commercially reasonable terms, if at all. If a judgment is entered against us, and we are unable to satisfy the judgment, a

plaintiff may attempt to levy on our assets. We may be forced to sell material assets to satisfy such judgment, which may, in

turn, force us to reduce or discontinue our operations.

USE OF

PROCEEDS

We

may issue and sell shares of our Common Stock having an aggregate gross offering price of up to $10,000,000 from time to time

using this prospectus supplement. The amount of proceeds we will receive from this offering, if any, will depend upon the number

of shares of Common Stock sold and the market price at which they are sold. Because there is no minimum offering amount required

as a condition to this offering, the actual total offering amount, commissions and proceeds to us, if any, are not determinable

at this time. There can be no assurance that we will be able to sell any shares under or fully utilize the Sales Agreement with

the Sales Agent.

We

currently intend to use the net proceeds from the sale of the securities offered under this prospectus supplement for working

capital and general corporate purposes. Although we may use a portion of the net proceeds of this offering for the acquisition

or licensing, as the case may be, of additional technologies, other assets or businesses, to repay certain debt obligations, if

triggered, or for other strategic investments or opportunities, we have no current understandings, agreements or commitments to

do so.

Our

management will have broad discretion in the application of the net proceeds from this offering and could use them for purposes

other than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management

chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that

may not positively impact our results of operations or increase the market value of our Common Stock. Pending any use, as described

above, we plan to deposit the net proceeds in money market or similar interest-bearing accounts with our primary bank or otherwise

invest the net proceeds in high-quality, short-term, interest-bearing securities.

DILUTION

If

you invest in our common stock, your ownership interest will be diluted to the extent of the difference between the public offering

price per share and the as adjusted net tangible book value per share after this offering. The net tangible book value of our

common stock on June 30, 2024, was approximately $(29.4) million, or approximately $(202.88) per share of common stock on a post

1-for-50 reverse stock split adjusted basis. We calculate net tangible book value per share by dividing the net tangible book

value, which is tangible assets less total liabilities, by the number of outstanding shares of our common stock. Dilution with

respect to net tangible book value per share represents the difference between the amount per share paid by purchasers of shares

of common stock in this offering and the as adjusted net tangible book value per share of our common stock immediately after this

offering.

After

giving effect to an assumed sale of 544,465 shares of our common stock pursuant to this prospectus supplement and the accompanying

prospectus in the aggregate amount of approximately $3 million at an assumed price of $5.51 per share, and after deducting commissions

and estimated offering expenses payable by us (estimated at $300,000), our as adjusted net tangible book value as of June 30,

2024 would have been approximately $(26.7) million, or approximately $(38.72) per share on a post 1-for-50 reverse stock split

adjusted basis. This represents an immediate increase in net tangible book value of approximately $164.16 per share of common

stock to our existing stockholders and an immediate dilution in net tangible book value of approximately $44.23 per share to purchasers

of our common stock in this offering, as illustrated by the following table:

| Assumed Public offering price per share |

|

|

$5.51 |

| Historical net tangible book value per share as of June 30, 2024 |

|

$(202.88) |

|

| Increase in net tangible book value per share after giving effect to this offering |

|

$164.16 |

|

| As adjusted net tangible book value per share after this offering |

|

|

$(38.72) |

| Dilution per share to new investors in this offering |

|

|

$44.23 |

Based

on 144,865 shares of common stock outstanding as of June 30, 2024. This information

is supplied for illustrative purposes only, and will adjust based on the actual offering prices, the actual number of shares that

we offer and sell in this offering and other terms of each sale of shares in this offering.

Except

as otherwise indicated, all information in this Dilution section gives effect to the Company’s 1-for-50 reverse stock split

of its Common Stock, which became effective as of October 17, 2024.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our capital stock. We currently intend to retain any future earnings and do

not expect to pay any dividends in the foreseeable future. Any future determination to declare cash dividends will be made at

the discretion of our Board of Directors, subject to applicable laws, and will depend on a number of factors, including our financial

condition, results of operations, capital requirements, contractual restrictions, general business conditions, and other factors

that our Board of Directors may deem relevant. In addition, the terms of our revolving credit facility place certain limitations

on the amount of cash dividends we can pay, even if no amounts are currently outstanding.

PLAN OF

DISTRIBUTION

We previously

entered into the Sales Agreement with Roth Capital Partners, LLC, under which we may issue and sell shares of our Common Stock

having an aggregate offering price of up to $10,000,000 from time to time through or to the Sales Agent, as agent or principal.

The Sales

Agreement provides that sales of our Common Stock, if any, under this prospectus supplement may be made in sales deemed to be

“at the market offerings” as defined in Rule 415(a)(4) promulgated under the Securities Act.

The Sales

Agent will offer shares of our Common Stock at prevailing market prices subject to the terms and conditions of the Sales Agreement

as agreed upon by us and the Sales Agent. We will designate the number of shares which we desire to sell, the time period during

which sales are requested to be made, any limitation on the number of shares that may be sold in one day and any minimum price

below which sales may not be made. Subject to the terms and conditions of the Sales Agreement, the Sales Agent will use its commercially

reasonable efforts consistent with its normal trading and sales practices and applicable laws and regulations to sell on our behalf

all of the shares requested to be sold by us. We or the Sales Agent may suspend the offering of the shares of Common Stock being

made through the Sales Agent under the Sales Agreement at any time upon proper notice to the other party.

Settlement

for sales of Common Stock will occur on the first trading day, or any such shorter settlement cycle as may be in effect under

Exchange Act Rule 15c6-1 from time to time, following the date on which any sales are made, or on some other date that is agreed

upon by us and the Sales Agent in connection with a particular transaction, in return for payment of the net proceeds to us. Sales

of shares of our Common Stock as contemplated in this prospectus supplement and the accompanying base prospectus will be settled

through the facilities of The Depository Trust Company or by such other means as we and the Sales Agent may agree upon. There

is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will