false

0001167419

0001167419

2024-12-09

2024-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 9, 2024

Riot Platforms, Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

001-33675 |

|

84-1553387 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| 3855 Ambrosia Street, Suite 301 |

80109 |

| Castle Rock, CO |

|

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (303) 794-2000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

Common

Stock, no par value per share |

RIOT |

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

Riot Platforms, Inc. (the “Company”)

is providing the disclosure below which the Company included in the preliminary offering memorandum, dated December 9, 2024, relating

to the Convertible Notes Offering (as defined in Item 8.01 of this Current Report on Form 8-K):

Recent Developments

As of November 30, 2024, the Company

held 11,425 Bitcoin with a fair value of approximately $1.102 billion, as determined using the closing price of Bitcoin on the Company’s

principal market, Coinbase (the “Principal Market”), as of November 30, 2024. All of the Company’s Bitcoin

held as of November 30, 2024 were produced from the Company’s Bitcoin Mining operations.

The Company’s Bitcoin is recorded

at fair value in the Company’s consolidated financial statements, as determined using the period-end closing price of Bitcoin on

the Principal Market, and changes in fair value are recognized in Change in fair value of Bitcoin, in Operating income (loss) on the Company’s

Consolidated Statements of Operations.

Each of the number of Bitcoin held and

the fair value of the Company’s Bitcoin held as of November 30, 2024 is preliminary and unaudited, and is not necessarily indicative

of the number of Bitcoin held or fair value thereof to be achieved in any future period. Accordingly, these unaudited estimates are not

comprehensive statements or estimates of the Company’s financial results or financial condition as of November 30, 2024, December 31,

2024 or any other future period.

The number and fair value of the Company’s

Bitcoin held as of November 30, 2024 has been prepared by, and is the responsibility of, the Company’s management. In addition,

Deloitte & Touche LLP, the Company’s independent registered public accounting firm, has not audited, reviewed, examined,

compiled, nor applied agreed-upon procedures with respect to such information. Accordingly, Deloitte & Touche LLP does not express

an opinion or any other form of assurance with respect thereto. This information should not be viewed as a substitute for financial statements

prepared in accordance with generally accepted accounting principles in the United States. Additional information and disclosure is required

for a more complete understanding of the Company’s financial position and results of operations as of November 30, 2024. Accordingly,

investors should not place undue reliance on this information. This information should be read together with the sections titled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements,” and under similar headings included in the Company’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, and the other filings the Company makes

with the U.S. Securities and Exchange Commission (“SEC”), copies of which may be obtained from the SEC’s website,

www.sec.gov.

The information in this Item 7.01 is being furnished

and shall not be treated as “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”).

On December 9, 2024, the Company issued a

press release announcing its intention to offer (the “Convertible Notes Offering”), subject to market conditions and

other factors, $500 million aggregate principal amount of its convertible senior notes due 2030 in a private offering to persons

reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”), and to grant to the initial purchasers of the notes an option to purchase, within a three-day period

beginning on, and including, the date on which the notes are first issued, up to an additional $75 million aggregate principal amount

of the notes.

A copy of the press release announcing the offering

is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 8.01 of this

Current Report on Form 8-K shall not constitute an offer to sell, or a solicitation of an offer to buy the notes, nor shall there

be any sale of, the notes in any state or jurisdiction in which such offer, solicitation or sale would be unlawful under the securities

laws of any such state or jurisdiction.

Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report on Form 8-K

and the exhibit attached hereto that are not historical facts are forward-looking statements that reflect management’s current expectations,

assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A

of the Securities Act and Section 21E of the Exchange Act. Because such statements are subject to risks and uncertainties, actual

results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,”

“believes,” “plans,” “expects,” “intends,” “will,” “potential,”

“hope,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements may

include, but are not limited to, statements about uncertainties related to market conditions and the completion of the offering on the

anticipated terms or at all. Detailed information regarding the factors identified by the Company’s management which they believe

may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this Current Report

on Form 8-K may be found in the Company’s filings with the SEC, including the risks, uncertainties and other factors discussed

under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Company’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, and the other filings the Company makes

with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements included in this

Current Report on Form 8-K are made only as of the date hereof, and the Company disclaims any intention or obligation to update or

revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter

becomes aware, except as required by law. Persons reading this Current Report on Form 8-K are cautioned not to place undue reliance

on such forward-looking statements.

| Item 9.01 |

Financial Statements and Exhibits |

| 104 | Cover Page Interactive Data File (embedded within the Inline

XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RIOT PLATFORMS, INC. |

| |

|

|

| December 9, 2024 |

By: |

/s/ Colin Yee |

| |

|

Colin Yee |

| |

|

Chief Financial Officer |

Exhibit 99.1

Riot Platforms Announces Proposed Private Offering

of

$500 Million of Convertible Senior Notes

CASTLE ROCK, Colo., December 9, 2024 — Riot Platforms, Inc.

(NASDAQ: RIOT) (“Riot” or the “Company”) today announced that it intends to offer, subject to market conditions

and other factors, $500 million aggregate principal amount of its convertible senior notes due 2030 (the “notes”) in a private

offering to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of

1933, as amended (the “Securities Act”). Riot also expects to grant to the initial purchasers of the notes an option to purchase,

within a three-day period beginning on, and including, the date on which the notes are first issued, up to an additional $75 million aggregate

principal amount of the notes. The offering is subject to market and other conditions, and there can be no assurance as to whether, when

or on what terms the offering may be completed.

The notes will be unsecured, senior obligations of Riot. The notes

will mature on January 15, 2030, unless earlier repurchased, redeemed or converted in accordance with their terms. Subject to certain

conditions, on or after January 20, 2028, Riot may redeem for cash all or any portion of the notes. If Riot redeems fewer than all

the outstanding notes, at least $50 million aggregate principal amount of notes must be outstanding and not subject to redemption as of

the relevant redemption notice date. The notes will be convertible into cash, shares of Riot’s common stock, or a combination of

cash and shares of Riot’s common stock, at Riot’s election. Prior to July 15, 2029, the notes will be convertible only

upon the occurrence of certain events and during certain periods, and thereafter, at any time until the second scheduled trading day immediately

preceding the maturity date. The initial conversion rate and other terms of the notes will be determined at the time of pricing of the

offering. Riot expects that the reference price used to calculate the initial conversion price for the notes will be the U.S. composite

volume weighted average price of Riot’s common stock from 2:00 p.m. through and including

volume reported on the Market Center Official Close on the date of pricing.

Riot intends to use the net proceeds from this offering to acquire

additional bitcoin and for general corporate purposes.

The notes will be offered and sold to persons reasonably believed to

be qualified institutional buyers in accordance with Rule 144A under the Securities Act. The offer and sale of the notes and the

shares of Riot’s common stock issuable upon conversion of the notes, if any, have not been and will not be registered under the

Securities Act or the securities laws of any other jurisdiction, and the notes and any such shares may not be offered or sold in the United

States absent registration or an applicable exemption from such registration requirements. Any offer of the notes will be made only by

means of a private offering memorandum.

This press release shall not constitute an offer to sell, or a solicitation

of an offer to buy the notes, nor shall there be any sale of, the notes in any state or jurisdiction in which such offer, solicitation

or sale would be unlawful under the securities laws of any such state or jurisdiction. There can be no assurances that the offering of

the notes will be completed as described herein or at all.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading

Bitcoin-driven infrastructure platform.

Our mission is to positively impact the sectors, networks and communities

that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve

best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused

on a vertically integrated strategy. The Company has Bitcoin mining operations in central Texas and Kentucky, and electrical switchgear

engineering and fabrication operations in Denver, Colorado.

Forward-Looking Statements

Statements in this press release that are not historical facts are

forward-looking statements that reflect management’s current expectations, assumptions, and estimates of future performance and

economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act and Section 21E

of the Securities Exchange Act of 1934, as amended. Because such statements are subject to risks and uncertainties, actual results may

differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,”

“plans,” “expects,” “intends,” “will,” “potential,” “hope,” and

similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited

to, statements about uncertainties related to market conditions and the completion of the offering on the anticipated terms or at all.

Detailed information regarding the factors identified by the Company’s management which they believe may cause actual results to

differ materially from those expressed or implied by such forward-looking statements in this press release may be found in the Company’s

filings with the U.S. Securities and Exchange Commission (the “SEC”), including the risks, uncertainties and other factors

discussed under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements”

of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, and the other filings

the Company makes with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements

included in this press release are made only as of the date of this press release, and the Company disclaims any intention or obligation

to update or revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company

hereafter becomes aware, except as required by law. Persons reading this press release are cautioned not to place undue reliance on such

forward-looking statements.

For

further information, please contact:

Investor Contact:

Phil McPherson

IR@Riot.Inc

303-794-2000 ext. 110

Media Contact:

Alexis Brock

303-794-2000 ext. 118

PR@Riot.Inc

v3.24.3

Cover

|

Dec. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 09, 2024

|

| Entity File Number |

001-33675

|

| Entity Registrant Name |

Riot Platforms, Inc.

|

| Entity Central Index Key |

0001167419

|

| Entity Tax Identification Number |

84-1553387

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

3855 Ambrosia Street

|

| Entity Address, Address Line Two |

Suite 301

|

| Entity Address, City or Town |

Castle Rock

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80109

|

| City Area Code |

303

|

| Local Phone Number |

794-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, no par value per share

|

| Trading Symbol |

RIOT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

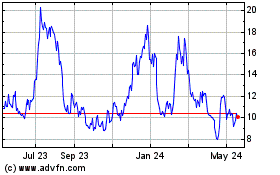

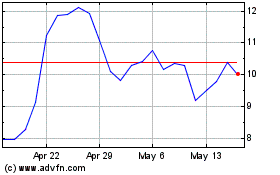

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Riot Platforms (NASDAQ:RIOT)

Historical Stock Chart

From Dec 2023 to Dec 2024