false

0001178697

0001178697

2024-08-09

2024-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 9, 2024

Sonim

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38907 |

|

94-3336783 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

4445

Eastgate Mall, Suite 200,

San

Diego, CA 92121

(Address

of principal executive offices, including Zip Code)

(650)

378-8100

(Registrant’s

telephone number, including area code)

Not

applicable.

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

SONM |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

2.02 |

Results

of Operations and Financial Condition. |

On

August 9, 2024, Sonim Technologies, Inc. issued a press release announcing its financial results for its fiscal quarter ended June 30,

2024 (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

Exhibit

Number |

|

Description |

| |

|

|

| 99.1 |

|

Press Release |

| |

|

|

| 104 |

|

Cover

Page Interactive Data file (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SONIM

TECHNOLOGIES, INC. |

| |

|

|

| Date:

August 9, 2024 |

By: |

/s/

Clay Crolius |

| |

Name: |

Clay

Crolius |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Sonim

Reports Second Quarter 2024 Results, Begins New Product Releases into Large New Addressable Markets

Commences

launch of new connected solution and rugged smartphone portfolio with tier-one carriers in North America

Expands

European market presence and development with leading carriers and distributors

Expects

return to sequential growth in Q3 and Q4 driven by additional carrier launches

San

Diego, California – August 9, 2024 – Sonim Technologies, Inc. (Nasdaq: SONM), a leading provider of mobility solutions

that include ultra-rugged and rugged phones, connected devices and accessories designed to provide extra protection for users that demand

more durability in their work and everyday lives, reported financial results for the quarter ended June 30, 2024.

Second

Quarter 2024 and Recent Highlights

| |

● |

Net

revenues were $11.5 million, compared to $16.8 million in the first quarter. |

| |

● |

GAAP

net loss for the quarter was $6.6 million, including a $3.2 million impairment charge, compared to $2.9 million in the first quarter.

|

| |

● |

Adjusted

EBITDA* was negative $2.0 million, compared to negative $1.6 million in the first quarter 2024. |

| |

● |

Ended

the quarter with cash and cash equivalents totaling $9.6 million, trade accounts receivable of $10.8 million, and inventory valued

at $7.0 million. |

| |

● |

Raised

$3.85 million in an equity transaction with each unit priced 126% above the closing price of the Company’s common stock on

April 26, 2024. |

| |

● |

Commenced

launches for two of the 14 new product awards Sonim has secured to date with carriers in North America, Europe and Australia for

Sonim’s new portfolio of connected solutions and next-generation rugged devices. |

| |

● |

Secured

a new product award for the 5G variant of the Sonim XP3plus flip phone with a tier-one carrier in the U.S. |

| |

● |

Advanced

European market entry plans with an expanded sales, marketing and customer service team driving carrier and regulatory qualification

of Sonim’s devices, customer engagement and establishment of local distribution channels. |

| |

● |

Secured

a new product award for a new mobile hotspot from the connected solutions portfolio with a tier-one carrier in the Nordics, scheduled

to launch in the second half 2024. |

Peter

Liu, Sonim’s Chief Executive Officer, said: “We are excited to initiate the first commercial launches from our expanding

portfolio of new rugged mobile and connected solutions devices. As a result of these new products and broad-based distribution, we expect

sequential sales growth in both the third and fourth quarters. Our design awards with all tier-one carriers in the United States and

Canada position us to significantly broaden our market reach. This expansion will elevate Sonim’s addressable market from a legacy market

of approximately $400 million to a diverse global market valued at over $50 billion annually.”

* Non-GAAP

financial measure. An explanation and reconciliation of non-GAAP financial measures are presented at the end of this press

release.

“In

line with our global expansion strategy, Europe is becoming an important part of our commercial outlook. The departure of a major rugged

device provider has created an urgent need for a trusted global brand to take over key distribution channels and engage customers. Our

investment in the expanded European team is rapidly advancing our progress and adoption in these robust markets.”

Second

Quarter 2024 Financial Results

Revenue

for the second quarter of 2024 was $11.5 million, decreased from $16.8 million in the first quarter of 2024. Revenue reflected a discontinuation

of the Company’s lower margin white-label business as Sonim transitions its full focus to the new rugged phone and connected solution

product lines now launching with major carriers. The Company expects further sequential revenue growth in the second half of 2024 as

these launches continue.

Gross

profit for the second quarter of 2024 was $3.0 million, or 26% of revenues, compared with first quarter of 2024 gross profit of $2.9

million, or 17% of revenues. Gross margin increased in the second quarter of 2024 because we did not sell any lower margin white-label

products.

Operating

expenses for the second quarter of 2024 were $9.4 million, increased from $5.6 million in the preceding quarter. The 2024 second quarter

included a charge of $3.2 million for impairment of contract fulfillment assets, as well as R&D expenses for Sonim’s new line

of mobile hotspots, rugged phones and consumer durable phone, but under a more cost-efficient product development strategy than in prior

years. Sales and marketing expenses increased as the Company began to support the launch of the Company’s new connected solutions

and international strategies in Australia, Europe, the Middle East and Africa.

Net

loss in the second quarter of 2024 was $6.6 million, compared with a net loss of $2.9 million in the first quarter of 2023. Adjusted

EBITDA* was negative $2.0 million for the second quarter of 2024, compared to negative $1.6 million for the first quarter of 2024.

“The

second quarter marks our strategic exit from the non-core and lower margin ODM business that accounted for approximately half of our

revenue in 2023. We expect to resume sequential quarterly growth through the rest of 2024 as we roll out our higher margin rugged products

and connected solutions to fulfill our growing list of major carrier design awards. Furthermore, we are also making a calculated investment

to penetrate the European market.,” said Clay Crolius, Chief Financial Officer of Sonim.

Balance

Sheet and Working Capital

Sonim

ended the second quarter of 2024 with $9.6 million in cash and equivalents and remained essentially debt free. Trade accounts receivable

was $10.8 million and inventory was $7.0 million.

On

April 29, 2024, the Company announced a $3.85 million equity capital transaction of stock and warrants with a single investor. The transaction

was priced above market at $11.00 per unit (as adjusted to reflect the 1-for-10 reverse stock split that became effective on July 17,

2024), which includes of one share of common stock and one warrant. The transaction proceeds will further Sonim’s growth strategies

with both new products and new geographies, underway now.

About

Sonim Technologies, Inc.

Sonim

Technologies is a leading U.S. provider of ultra-rugged and rugged mobile devices, including phones, wireless internet data devices,

and accessories designed to provide extra protection for users that demand more durability in their work and everyday lives. We currently

sell our ruggedized mobility solutions to several of the largest wireless carriers in the United States—including AT&T, T-Mobile

and Verizon—as well as the three largest wireless carriers in Canada-Bell, Rogers and TELUS Mobility. Our ruggedized phones and

accessories are also sold through distributors in North America and Europe. Sonim devices and accessories connect users with voice, data,

workflow and lifestyle applications that enhance the user experience while providing an extra level of protection. For more information,

visit www.sonimtech.com.

Important

Cautions Regarding Forward-Looking Statements

This

release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These

statements relate to, among other things, the projected revenue growth, the declaring and reaffirming of Sonim’s business strategy and

objectives, the timing of the availability of the new products, the successful expansion of Sonim’s products in new markets, the impact

of certain events on Sonim’s business, and Sonim’s ability to grow and to capitalize the market opportunity. These forward-looking statements

are based on Sonim’s current expectations, estimates and projections about its business and industry, management’s beliefs and certain

assumptions made by Sonim, all of which are subject to change. Forward-looking statements generally can be identified by the use of forward-looking

terminology such as “achieve,” “aim,” “ambitions,” “anticipate,” “believe,” “committed,”

“continue,” “could,” “designed,” “estimate,” “expect,” “forecast,” “future,”

“goals,” “grow,” “guidance,” “intend,” “likely,” “may,” “milestone,”

“objective,” “on track,” “opportunity,” “outlook,” “pending,” “plan,” “position,”

“possible,” “potential,” “predict,” “progress,” “promises,” “roadmap,” “seek,”

“should,” “strive,” “targets,” “to be,” “upcoming,” “will,” “would,”

and variations of such words and similar expressions or the negative of those terms or expressions. Such statements involve risks and

uncertainties, which could cause actual results to vary materially from those expressed in or indicated by the forward-looking statements.

Factors that may cause actual results to differ materially include, but are not limited to, the following: the availability of cash on

hand; potential material delays in realizing projected timelines; Sonim’s material dependence on its relationship with a small number

of customers who account for a significant portion of Sonim’s revenue; Sonim’s entry into the data device sector could divert our management

team’s attention from existing products; risks related to Sonim’s ability to comply with the continued listing standards of the Nasdaq

Stock Market and the potential delisting of Sonim’s common stock; Sonim’s ability to continue to develop solutions to address user needs

effectively, including its next-generation products; Sonim’s reliance on third-party contract manufacturers and partners; Sonim’s ability

to stay ahead of the competition; Sonim’s ongoing transformation of its business; the variation of Sonim’s quarterly results; the lengthy

customization and certification processes for Sonim’s wireless carries customers; various economic, political, environmental, social,

and market events beyond Sonim’s control, as well as the other risk factors described under “Risk Factors” included in Sonim’s

most recent Annual Report on Form 10-K and any subsequent quarterly filings on Form 10-Q filed with the Securities and Exchange Commission

(available at www.sec.gov). Sonim cautions you not to place undue reliance on forward-looking statements, which speak only as of the

date hereof. Sonim assumes no obligation to update any forward-looking statements in order to reflect events or circumstances that may

arise after the date of this release, except as required by law.

Investor

Contact

Matt

Kreps

Darrow

Associates Investor Relations

mkreps@darrowir.com

M:

214-597-8200

Media

Contact

Anette

Gaven

Sonim

Technologies

M:

619-993-3058

pr@sonimtech.com

SONIM

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(IN

THOUSANDS EXCEPT SHARE AND

PER

SHARE AMOUNTS)

| | |

June 30, 2024 | | |

December 31,

2023 | |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 9,600 | | |

$ | 9,397 | |

| Accounts receivable, net | |

| 10,781 | | |

| 25,304 | |

| Non-trade receivable | |

| 2,198 | | |

| 961 | |

| Inventory | |

| 7,020 | | |

| 6,517 | |

| Prepaid expenses and other current assets | |

| 2,986 | | |

| 1,608 | |

| Total current assets | |

| 32,585 | | |

| 43,787 | |

| Property and equipment, net | |

| 120 | | |

| 71 | |

| Right-of-use assets | |

| — | | |

| 55 | |

| Contract fulfillment assets | |

| 10,155 | | |

| 9,232 | |

| Other assets | |

| 3,011 | | |

| 2,898 | |

| Total assets | |

$ | 45,871 | | |

$ | 56,043 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Accounts payable | |

$ | 9,164 | | |

$ | 19,847 | |

| Accrued liabilities | |

| 17,714 | | |

| 12,233 | |

| Current portion of lease liability | |

| — | | |

| 55 | |

| Deferred revenue | |

| 12 | | |

| 12 | |

| Total current liabilities | |

| 26,890 | | |

| 32,147 | |

| Income tax payable | |

| 1,507 | | |

| 1,528 | |

| Total liabilities | |

| 28,397 | | |

| 33,675 | |

| Commitments and contingencies (Note 9) | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock, $0.001 par value per share; 100,000,000 shares authorized: and 4,827,092 and 4,426,867 shares issued and outstanding at June 30, 2024, and December 31, 2023, respectively (*) | |

| 5 | | |

| 4 | |

| Preferred stock, $0.001 par value per share, 5,000,000 shares authorized, and no shares issued and outstanding at June 30, 2024, and December 31, 2023, respectively | |

| — | | |

| — | |

| Additional paid-in capital (*) | |

| 276,951 | | |

| 272,324 | |

| Accumulated deficit | |

| (259,482 | ) | |

| (249,960 | ) |

| Total stockholders’ equity | |

| 17,474 | | |

| 22,368 | |

| Total liabilities and stockholders’ equity | |

$ | 45,871 | | |

$ | 56,043 | |

(*)

Adjusted retroactively to reflect the 1-for-10 reverse stock split that became effective on July 17, 2024.

SONIM

TECHNOLOGIES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(IN

THOUSANDS EXCEPT SHARE AND PER SHARE AMOUNTS)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net revenues | |

$ | 11,516 | | |

$ | 26,835 | | |

$ | 28,292 | | |

$ | 52,636 | |

| Cost of revenues | |

| 8,547 | | |

| 22,409 | | |

| 22,421 | | |

| 44,035 | |

| Gross profit | |

| 2,969 | | |

| 4,426 | | |

| 5,871 | | |

| 8,601 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 557 | | |

| — | | |

| 1,013 | | |

| 105 | |

| Sales and marketing | |

| 3,219 | | |

| 1,827 | | |

| 5,711 | | |

| 3,584 | |

| General and administrative | |

| 2,446 | | |

| 1,852 | | |

| 5,089 | | |

| 3,832 | |

| Impairment of contract fulfillment assets | |

| 3,217 | | |

| — | | |

| 3,217 | | |

| — | |

| Total operating expenses | |

| 9,439 | | |

| 3,679 | | |

| 15,030 | | |

| 7,521 | |

| Income (loss) from operations | |

| (6,470 | ) | |

| 747 | | |

| (9,159 | ) | |

| 1,080 | |

| Interest expense, net | |

| (17 | ) | |

| (5 | ) | |

| (17 | ) | |

| (5 | ) |

| Other expense, net | |

| (92 | ) | |

| (161 | ) | |

| (184 | ) | |

| (154 | ) |

| Income (loss) before income taxes | |

| (6,579 | ) | |

| 581 | | |

| (9,360 | ) | |

| 921 | |

| Income tax expense | |

| (37 | ) | |

| (72 | ) | |

| (162 | ) | |

| (185 | ) |

| Net income (loss) | |

$ | (6,616 | ) | |

$ | 509 | | |

$ | (9,522 | ) | |

$ | 736 | |

| Net income (loss) per share: | |

| | | |

| | | |

| | | |

| | |

| Basic (*) | |

$ | (1.41 | ) | |

$ | 0.12 | | |

$ | (2.09 | ) | |

$ | 0.17 | |

| Diluted (*) | |

$ | (1.41 | ) | |

$ | 0.11 | | |

$ | (2.09 | ) | |

$ | 0.17 | |

| Weighted-average shares used in computing net income (loss) per share: | |

| | | |

| | | |

| | | |

| | |

| Basic (*) | |

| 4,685,352 | | |

| 4,222,699 | | |

| 4,561,741 | | |

| 4,216,118 | |

| Diluted (*) | |

| 4,685,352 | | |

| 4,458,577 | | |

| 4,561,741 | | |

| 4,309,121 | |

(*)

Adjusted retroactively to reflect the 1-for-10 reverse stock split that became effective on July 17, 2024.

Non-GAAP

Financial Measures

In

addition to our financial results determined in accordance with U.S. GAAP, we believe the following non-GAAP and operational measures

are useful in evaluating our performance-related metrics and present them as a supplemental measure of our performance.

Adjusted

EBITDA

We

define Adjusted EBITDA as net loss adjusted to exclude the impact of one-time non-cash asset impairment costs, stock-based compensation

expense, depreciation and amortization, interest expense, and income taxes. Adjusted EBITDA is a useful financial metric in assessing

our operating performance from period to period by excluding certain items that we believe are not representative of our core business,

such as certain material non-cash items and other adjustments, such as stock-based compensation.

We

believe that Adjusted EBITDA, viewed in addition to, and not in lieu of, our reported GAAP results, provides useful information to investors

regarding our performance and overall results of operations for various reasons, including: one-time non-cash asset impairment costs

as they do not reflect normal operations; non-cash equity grants made to employees at a certain price do not necessarily reflect the

performance of our business at such time, and as such, stock-based compensation expense is not a key measure of our operating performance;

and non-cash depreciation and amortization are not considered a key measure of our operating performance. We use Adjusted EBITDA: as

a measure of operating performance; for planning purposes, including the preparation of budgets and forecasts; to allocate resources

to enhance the financial performance of our business; to evaluate the effectiveness of our business strategies; in communications with

our board of directors concerning our financial performance; and as a consideration in determining compensation for certain key employees.

Adjusted

EBITDA has limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of our results

as reported under GAAP. Some of these limitations include: it does not reflect all cash expenditures, future requirements for capital

expenditures or contractual commitments; it does not reflect changes in, or cash requirements for, working capital needs; it does not

reflect interest expense on our debt or the cash requirements necessary to service interest or principal payments; and other companies

in our industry may define and/or calculate this metric differently than we do, limiting its usefulness as a comparative measure.

Set

forth below is a reconciliation from net loss to Adjusted EBITDA for the respective periods (in thousands):

| | |

Three Months Ended | |

| | |

June 30, 2024 | | |

March 31, 2024 | |

| Net loss | |

$ | (6,616 | ) | |

$ | (2,906 | ) |

| Impairment of contract fulfillment assets | |

| 3,217 | | |

| — | |

| Depreciation and amortization | |

| 845 | | |

| 880 | |

| Stock-based compensation | |

| 472 | | |

| 324 | |

| Interest expense | |

| 17 | | |

| — | |

| Income taxes | |

| 37 | | |

| 125 | |

| Adjusted EBITDA | |

$ | (2,028 | ) | |

$ | (1,577 | ) |

v3.24.2.u1

Cover

|

Aug. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 09, 2024

|

| Entity File Number |

001-38907

|

| Entity Registrant Name |

Sonim

Technologies, Inc.

|

| Entity Central Index Key |

0001178697

|

| Entity Tax Identification Number |

94-3336783

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4445

Eastgate Mall

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

San

Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

(650)

|

| Local Phone Number |

378-8100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

SONM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

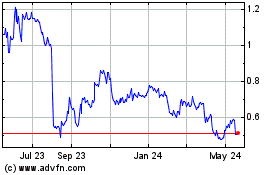

Sonim Technologies (NASDAQ:SONM)

Historical Stock Chart

From Nov 2024 to Dec 2024

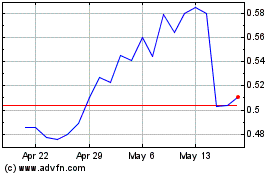

Sonim Technologies (NASDAQ:SONM)

Historical Stock Chart

From Dec 2023 to Dec 2024