UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

| Date of Report (Date of earliest event reported): February 27, 2025 |

BlackRock

TCP Capital Corp.

(Exact name of Registrant as Specified in

Its Charter)

| Delaware | 814-00899 | 56-2594706 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | |

| 2951 28th Street, Suite 1000 | |

| Santa Monica, California | | 90405 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| Registrant’s Telephone Number, Including Area Code: (310) 566-1000 |

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

Title of each class | | Trading

Symbol(s) | |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | TCPC | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Explanatory Note.

On February 27, 2024, BlackRock TCP

Capital Corp. (the “Company”) filed a Current Report on Form 8-K (the “Original 8-K”) announcing its

financial results for the fourth quarter and year ended December 31, 2024. This amended Current Report on Form 8-K/A amends

the Original 8-K to correct a typographical error in the press release included as Exhibit 99.1 to the Original 8-K, for which a

corrected and replaced press release has been issued by the Company. The corrected and replaced press release is included as

Exhibit 99.1 to this Form 8-K/A. In the press release, Consolidated Results of Operations, third paragraph, third sentence, should

have read: Net unrealized losses for the three months ended December 31, 2024 were $72.3 million, or $0.85 per share (instead

of Net unrealized gains for the three months ended December 31, 2024 were $72.3 million, or $0.85 per share).

This amended Current Report on Form 8-K/A is

being filed solely to correct such typographical errors referenced herein and does not amend, in any way, and does not modify

or update any other disclosures contained in the Original 8-K. Accordingly, this amended Current Report on Form 8-K/A should be read

in conjunction with the Original 8-K.

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2025, the registrant issued a

press release announcing its financial results for the fourth quarter and year ended December 31, 2024. The text of the press release

is included as Exhibit 99.1 to this Form 8-K.

The information disclosed under this Item 2.02,

including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except

as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On February 27, 2025, the registrant issued

a press release, included herewith as Exhibit 99.1, announcing the declaration of a first quarter regular dividend of $0.25

per share and a special dividend of $0.04 per share, both payable on March 31, 2025 to stockholders of record as of the close of business

on March 17, 2025. The Company intends to declare a special dividend of at least $0.02 per

share of common stock in each of the second and third quarters of 2025, subject to Board approval. In addition, on February 25, 2025,

the Adviser voluntarily agreed to waive one-third of its base management fee with respect to the Company for three calendar quarters

beginning on January 1, 2025 and ending on September 30, 2025.

The information disclosed under this Item 7.01,

including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except as expressly

set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

BlackRock TCP Capital Corp. |

| |

|

|

|

| Date: |

February 27, 2025 |

By: |

/s/ Erik L. Cuellar |

| |

|

Name:

Title |

Erik L. Cuellar

Chief Financial Officer |

0001370755

false

0001370755

2025-02-27

2025-02-27

Exhibit 99.1

CORRECTING and REPLACING BLACKROCK TCP

CAPITAL CORP. ANNOUNCES 2024 FINANCIAL RESULTS INCLUDING FOURTH QUARTER NET INVESTMENT INCOME OF $0.40 PER SHARE; DECLARES FIRST QUARTER

DIVIDEND OF $0.25 PER SHARE AND A SPECIAL DIVIDEND OF $0.04 PER SHARE

SANTA MONICA, Calif., February 27,

2025 – Consolidated Results of Operations section, third paragraph, third sentence, should read: Net

unrealized losses for the three months ended December 31, 2024 were $72.3 million, or $0.85 per share (instead of Net

unrealized gains for the three months ended December 31, 2024 were $72.3 million, or $0.85 per share).

The updated release reads:

BLACKROCK TCP CAPITAL CORP. ANNOUNCES

2024 FINANCIAL RESULTS INCLUDING FOURTH QUARTER NET INVESTMENT INCOME OF $0.40 PER SHARE; DECLARES FIRST QUARTER DIVIDEND OF $0.25 PER

SHARE AND A SPECIAL DIVIDEND OF $0.04 PER SHARE

BlackRock TCP Capital Corp. (“we,” “us,” “our,” “TCPC” or the “Company”),

a business development company (NASDAQ: TCPC), today announced its financial results for the fourth quarter and year ended December 31,

2024 and filed its Form 10-K with the U.S. Securities and Exchange Commission.

FINANCIAL HIGHLIGHTS

| • | On

a GAAP basis, net investment income for the quarter ended December 31, 2024 was $33.8

million, or $0.40 per share on a diluted basis, which exceeded the regular dividend of $0.34

per share paid on December 31, 2024. Excluding amortization of purchase discount recorded

in connection with the Merger(1), adjusted net investment income(1)

for the quarter ended December 31, 2024 was $30.8 million, or $0.36 per share on a diluted

basis. Adjusted net investment income(1) for the year ended December 31,

2024 was $121.5 million, or $1.52 per share on a diluted basis. |

| • | Net

asset value per share was $9.23 as of December 31, 2024 compared to $10.11 as of September 30,

2024. |

| • | Net

decrease in net assets from operations on a GAAP basis for the quarter ended December 31,

2024 was $38.6 million, or $0.45 per share, compared to a $21.6 million, or $0.25 per share,

net decrease in net assets from operations for the quarter ended September 30, 2024. |

| • | Total

acquisitions during the quarter ended December 31, 2024 were approximately $120.7 million

and total investment dispositions were $168.6 million during the three months ended December 31,

2024. |

| • | As

of December 31, 2024, net leverage was 1.14x compared to 1.08x at September 30,

2024. |

| • | As

of December 31, 2024, debt investments on non-accrual status represented 5.6% of the

portfolio at fair value and 14.4% at cost, compared to 3.8% of the portfolio at fair value

and 9.3% at cost as of September 30, 2024. |

| • | On

February 25, 2025, the Adviser voluntarily agreed to waive one-third of its base management

fee with respect to the Company for three calendar quarters beginning on January 1, 2025

and ending on September 30, 2025. |

| • | On

February 27, 2025, our Board of Directors declared a first quarter dividend of $0.25

per share and a special dividend of $0.04 per share, both payable on March 31, 2025 to stockholders

of record as of the close of business on March 17, 2025.

The Company intends to declare a special dividend of at least $0.02 per share of common stock

in each of the second and third quarters of 2025, subject to Board approval. |

“We delivered adjusted net investment

income of $1.52 per share in 2024, reflecting higher non-accruals as well as the impact of lower base rates and higher expenses. While

the vast majority of our portfolio continued to perform well, we are working closely with our borrowers and sponsors to resolve the portfolio

issues that impacted our results in recent quarters.

TCPC’s new management team remains

optimistic about our future prospects and is confident we have the right plan in place to effectively navigate the challenges presented

during 2024 and to return the portfolio performance to historical levels, said Phil Tseng, Chairman and CEO of BlackRock TCP Capital

Corp.

Given our recent performance, our board

declared a regular dividend of $0.25 per share for the first quarter 2025, which we believe is a sustainable level. In addition, our

board declared a $0.04 special dividend for the first quarter. We intend to declare a special dividend of at least $0.02 in each of the

second and third quarters of 2025, subject to Board approval. We appreciate our shareholders’ support and have taken additional

steps to further align our interests,” Tseng concluded.

SELECTED FINANCIAL HIGHLIGHTS(1)

| |

Year

ended December 31, |

|

| |

2024 |

|

|

2023 |

|

| |

Amount |

|

|

Per

Share |

|

|

Amount |

|

|

Per

Share |

|

| Net investment income |

$ |

131,757,870 |

|

|

|

1.65 |

|

|

$ |

106,556,758 |

|

|

|

1.84 |

|

| Less: Purchase accounting

discount amortization |

|

10,303,754 |

|

|

|

0.13 |

|

|

|

— |

|

|

|

— |

|

| Adjusted net investment income |

$ |

121,454,116 |

|

|

|

1.52 |

|

|

$ |

106,556,758 |

|

|

|

1.84 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net realized and unrealized gain

(loss) |

$ |

(194,895,042 |

) |

|

|

(2.45 |

) |

|

$ |

(68,082,326 |

) |

|

|

(1.18 |

) |

| Less: Realized gain

(loss) due to the allocation of purchase discount |

|

9,798,978 |

|

|

|

0.12 |

|

|

|

— |

|

|

|

— |

|

| Less: Net change

in unrealized appreciation (depreciation) due to the allocation of purchase discount |

|

1,784,116 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

— |

|

| Adjusted net realized and unrealized

gain (loss) |

$ |

(206,478,136 |

) |

|

|

(2.59 |

) |

|

$ |

(68,082,326 |

) |

|

|

(1.18 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in net assets

resulting from operations |

$ |

(63,137,172 |

) |

|

|

(0.79 |

) |

|

$ |

38,474,432 |

|

|

|

0.67 |

|

| Less: Purchase accounting

discount amortization |

|

10,303,754 |

|

|

|

0.13 |

|

|

|

— |

|

|

|

— |

|

| Less: Realized gain

(loss) due to the allocation of purchase discount |

|

9,798,978 |

|

|

|

0.12 |

|

|

|

— |

|

|

|

— |

|

| Less: Net change

in unrealized appreciation (depreciation) due to the allocation of purchase discount |

|

1,784,116 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

— |

|

| Adjusted net increase (decrease)

in assets resulting from operations |

$ |

(85,024,020 |

) |

|

|

(1.06 |

) |

|

$ |

38,474,432 |

|

|

|

0.67 |

|

(1) On March 18, 2024, the Company completed

its previously announced merger with BlackRock Capital Investment Corporation (“Merger”). The Merger has been accounted for

as an asset acquisition of BlackRock Capital Investment Corporation (“BCIC”) by the Company in accordance with the asset acquisition

method of accounting as detailed in ASC 805-50 (“ASC 805”), Business Combinations-Related Issues. The Company determined

the fair value of the shares of the Company’s common stock that were issued to former BCIC shareholders pursuant to the Merger Agreement

plus transaction costs to be the consideration paid in connection with the Merger under ASC 805. The consideration paid to BCIC shareholders

was less than the aggregate fair values of the BCIC assets acquired and liabilities assumed, which resulted in a purchase discount (the

“purchase discount”). The consideration paid was allocated to the individual BCIC assets acquired and liabilities assumed

based on the relative fair values of net identifiable assets acquired other than “non-qualifying” assets and liabilities

(for example, cash) and did not give rise to goodwill. As a result, the purchase discount was allocated to the cost basis of the BCIC

investments acquired by the Company on a pro-rata basis based on their relative fair values as of the effective time of the Merger. Immediately

following the Merger, the investments were marked to their respective fair values in

accordance with ASC 820 which resulted in immediate

recognition of net unrealized appreciation in the Consolidated Statement of Operations as a result of the Merger. The purchase discount

allocated to the BCIC debt investments acquired will amortize over the remaining life of each respective debt investment through interest

income, with a corresponding adjustment recorded to unrealized appreciation or depreciation on such investment acquired through its ultimate

disposition. The purchase discount allocated to BCIC equity investments acquired will not amortize over the life of such investments

through interest income and, assuming no subsequent change to the fair value of the equity investments acquired and disposition of such

equity investments at fair value, the Company may recognize a realized gain or loss with a corresponding reversal of the unrealized appreciation

on disposition of such equity investments acquired.

As a supplement to the Company’s reported

GAAP financial measures, we have provided the following non-GAAP financial measures that we believe are useful:

| • | “Adjusted

net investment income” – excludes the amortization of purchase accounting discount

from net investment income calculated in accordance with GAAP; |

| • | “Adjusted

net realized and unrealized gain (loss)” – excludes the unrealized appreciation

resulting from the purchase discount and the corresponding reversal of the unrealized appreciation

from the amortization of the purchase discount from the determination of net realized and

unrealized gain (loss) determined in accordance with GAAP; and |

| • | “Adjusted

net increase (decrease) in net assets resulting from operations” – calculates

net increase (decrease) in net assets resulting from operations based on Adjusted net investment

income and Adjusted net realized and unrealized gain (loss). |

We believe that the adjustment to exclude

the full effect of purchase discount accounting under ASC 805 from these financial measures is meaningful because of the potential impact

on the comparability of these financial measures that we and investors use to assess our financial condition and results of operations

period over period. Although these non-GAAP financial measures are intended to enhance investors’ understanding of our business

and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The aforementioned non-GAAP financial

measures may not be comparable to similar non-GAAP financial measures used by other companies.

PORTFOLIO AND INVESTMENT ACTIVITY

As of December 31, 2024, our consolidated

investment portfolio consisted of debt and equity positions in 154 portfolio companies with a total fair value of approximately $1.8

billion, of which 91.2% was in senior secured debt. 83.6% of the total portfolio was first lien. Equity positions, which include equity

interests in diversified portfolios of debt, represented approximately 8.5% of the portfolio. 94.5% of our debt investments were floating

rate, 97.5% of which had interest rate floors.

As of December 31, 2024, the weighted

average annual effective yield of our debt portfolio was approximately 12.4%(1) and the weighted average annual effective

yield of our total portfolio was approximately 11.1%, compared with 13.4% and 11.9%, respectively, as of September 30, 2024. Debt

investments in twelve portfolio companies were on non-accrual status as of December 31, 2024, representing 5.6% of the consolidated

portfolio at fair value and 14.4% at cost.

During the three months ended December 31,

2024, we invested approximately $120.7 million, primarily in 9 investments, comprised of 9 new and 9 existing portfolio companies. Of

these investments, $119.3 million, or 98.8% of total acquisitions, were in senior secured loans. The remaining $1.4 million, or 1.2%

of total acquisitions, were comprised of equity investments. Additionally, we received approximately $168.6 million in proceeds from

sales or repayments of investments during the three months ended December 31, 2024. New investments during the quarter had a weighted

average effective yield of 10.8%. Investments we exited had a weighted average effective yield of 14.0%.

As of December 31, 2024, total assets

were $1.9 billion, net assets were $785.1 million and net asset value per share was $9.23, as compared to $2.0 billion, $865.6 million,

and $10.11 per share, respectively, as of September 30, 2024.

(1) Weighted average annual effective

yield includes amortization of deferred debt origination and accretion of original issue discount, but excludes market discount and any

prepayment and make-whole fee income. The weighted average effective yield on our debt portfolio excludes non-accrual

and non-income producing loans.

CONSOLIDATED

RESULTS OF OPERATIONS

Total investment income for the three months

ended December 31, 2024 was approximately $61.2 million, or $0.72 per share. Investment income for the three months ended December 31,

2024 included $0.06 per share from prepayment premiums and related accelerated original issue discount

and exit fee amortization, $0.04 per share from recurring portfolio investment original issue discount and exit fee amortization, $0.08

per share from interest income paid in kind and $0.03 per share in dividend income. This reflects our policy of recording interest

income, adjusted for amortization of portfolio investment premiums and discounts, on an accrual basis. Origination, structuring, closing,

commitment, and similar upfront fees received in connection with the outlay of capital are generally amortized into interest income over

the life of the respective debt investment.

Total operating expenses for the three

months ended December 31, 2024 were approximately $26.9 million, or $0.32 per share, including interest and other debt expenses

of $18.0 million, or $0.21 per share. As of December 31, 2024, the Company’s cumulative total return did not exceed the total return

hurdle, and as a result, no incentive compensation was accrued for the three months ended December 31, 2024. Excluding interest and other

debt expenses, annualized third quarter expenses were 4.2% of average net assets.

Net investment income for the three months

ended December 31, 2024 was approximately $33.8 million, or $0.40 per share. Net realized losses for the three months ended December 31,

2024 were $0.0 million, or $0.00 per share. Net unrealized losses for the three months ended December 31,

2024 were $72.3 million, or $0.85 per share. Net unrealized losses for the three months ended December 31, 2024 primarily reflects

a $50.3 million unrealized loss on our investment in Razor, a $7.3 million unrealized loss on our investment in Securus, a $6.5 million

unrealized loss on our investment in Astra, a $4.9 million unrealized loss on our investment in Homerenew Buyer, a $4.1 million unrealized

loss on our investment in Pluralsight, a $3.1 million unrealized loss on our investment in Fishbowl and a $3.0 million unrealized loss

on our investment in InMoment, partially offset by a $14.8 million reversals of previous unrealized losses of

our investment in SellerX. Net decrease in net assets resulting from operations for the three months ended December 31, 2024 was

$38.6 million, or $0.45 per share.

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2024, available

liquidity was approximately $615.3 million, comprised of approximately $519.3 million in available capacity under our leverage program,

$91.6 million in cash and cash equivalents and $4.5 million in receivable for investments sold, offset by $0.1 million in payable for

investments purchased.

The combined weighted-average interest

rate on debt outstanding at December 31, 2024 was 5.19%.

Total debt outstanding at December 31,

2024, including debt assumed as a result of the Merger, was as follows:

| |

|

Maturity |

|

Rate |

|

|

Carrying

Value (1) |

|

|

Available |

|

|

Total

Capacity |

|

| Operating Facility |

|

2029 |

|

SOFR+2.00% |

(2) |

|

$ |

120,670,788 |

|

|

$ |

179,329,212 |

|

|

$ |

300,000,000 |

(3) |

| Funding Facility II |

|

2027 |

|

SOFR+2.05% |

(4) |

|

|

75,000,000 |

|

|

|

125,000,000 |

|

|

|

200,000,000 |

(5) |

| Merger Sub Facility(6) |

|

2028 |

|

SOFR+2.00% |

(7) |

|

|

60,000,000 |

|

|

|

205,000,000 |

|

|

|

265,000,000 |

(8) |

| SBA Debentures |

|

2025−2031 |

|

2.45% |

(9) |

|

|

131,500,000 |

|

|

|

10,000,000 |

|

|

|

141,500,000 |

|

| 2025 Notes ($92 million par)(6) |

|

2025 |

|

Fixed/Variable |

(10) |

|

|

92,000,000 |

|

|

|

— |

|

|

|

92,000,000 |

|

| 2026 Notes ($325 million par) |

|

2026 |

|

2.85% |

|

|

|

325,398,402 |

|

|

|

— |

|

|

|

325,398,402 |

|

| 2029 Notes ($325 million par) |

|

2029 |

|

6.95% |

|

|

|

321,745,636 |

|

|

|

— |

|

|

|

321,745,636 |

|

| Total leverage |

|

|

|

|

|

|

|

1,126,314,826 |

|

|

$ |

519,329,212 |

|

|

$ |

1,645,644,038 |

|

| Unamortized issuance costs |

|

|

|

|

|

|

|

(7,974,601 |

) |

|

|

|

|

|

|

| Debt, net of unamortized issuance

costs |

|

|

|

|

|

|

$ |

1,118,340,225 |

|

|

|

|

|

|

|

| (1) | Except

for the 2026 Notes and 2029 Notes, all carrying values are the same as the principal amounts

outstanding. |

| (2) | As

of December 31, 2024, $113.0 million of the outstanding amount was subject to a SOFR

credit adjustment of 0.10%. $7.7 million of the outstanding amount bore interest at a rate

of EURIBOR + 2.00%. |

| (3) | Operating

Facility includes a $100.0 million accordion which allows for expansion of the facility to

up to $400.0 million subject to consent from the lender and other customary conditions. |

| (4) | Subject

to certain funding requirements and a SOFR credit adjustment of 0.15%. |

| (5) | Funding

Facility II includes a $50.0 million accordion which allows for expansion of the facility

to up to $250.0 million subject to consent from the lender and other customary conditions. |

| (6) | Debt

assumed by the Company as a result of the Merger with BCIC. |

| (7) | The

applicable margin for SOFR-based borrowings could be either 1.75% or 2.00% depending on a

ratio of the borrowing base to certain committed indebtedness, and is also subject to a credit

spread adjustment of 0.10%. If Merger Sub elects to borrow based on the alternate base rate,

the applicable margin could be either 0.75% or 1.00% depending on a ratio of the borrowing

base to certain committed indebtedness. |

| (8) | Merger

Sub Facility includes a $60.0 million accordion which allows for expansion of the facility

to up to $325.0 million subject to consent from the lender and other customary conditions. |

| (9) | Weighted-average

interest rate, excluding fees of 0.35% or 0.36%. |

| (10) | The

2025 Notes consist of two tranches: $35.0 million aggregate principal amount with a fixed

interest rate of 6.85% and $57.0 million aggregate principal amount bearing interest at a

rate equal to SOFR plus 3.14%. |

On February 27, 2024, the Board of Directors

approved a new dividend reinvestment plan (the “DRIP”) for the Company. The DRIP was effective as of, and will apply to the

reinvestment of cash distributions with a record date after March 18, 2024. Under the DRIP, shareholders will automatically receive cash

dividends and distributions unless they “opt in” to the DRIP and elect to have their dividends and distributions reinvested

in additional shares of the Company’s common stock. Notwithstanding the foregoing, the former shareholders of BCIC that participated

in the BCIC dividend reinvestment plan at the time of the Merger have been automatically enrolled in the Company’s DRIP and will

have their shares reinvested in additional shares of the Company’s common stock on future distributions, unless they “opt

out” of the DRIP. For the three months ended December 31, 2024, approximately $2.3 million of cash distributions were reinvested

for electing Participants through purchase of shares in the open market in accordance with the terms of the DRIP.

The Company Repurchase Plan was re-approved

on April 24, 2024, to be in effect through the earlier of April 30, 2025, unless further extended or terminated by the Company’s

Board of Directors, or such time as the approved $50.0 million repurchase amount has been fully utilized, subject to certain conditions.

The following table summarizes the total

shares repurchased and amounts paid by the Company under the Company Repurchase Plan, including broker fees, for the year ended December 31,

2024:

| |

|

Shares

Repurchased |

|

|

Price

Per Share* |

|

|

Total

Cost |

|

| Company

Repurchase Plan |

|

|

510,687 |

|

|

$ |

8.86 |

|

|

$ |

4,524,639 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

RECENT DEVELOPMENTS

On

February 25, 2025, the Adviser voluntarily agreed to waive one-third of its base management fee with respect to the Company for three

calendar quarters beginning on January 1, 2025 and ending on September 30, 2025.

On February 27, 2025, our Board of Directors

declared a first quarter regular dividend of $0.25 per share and a special dividend of $0.04 per

share, both payable on March 31, 2025 to stockholders of record as of the close of business on March 17, 2025.

The Company intends to declare a special dividend of at least $0.02 per share of common stock in each of the second and third quarters

of 2025, subject to Board approval.

CONFERENCE CALL AND WEBCAST

BlackRock TCP Capital Corp. will host a

conference call on Thursday February 27, 2025 at 1:00 p.m. Eastern Time (10:00 a.m. Pacific Time)

to discuss its financial results. All interested parties are invited to participate in the conference call by dialing (833) 470-1428;

international callers should dial (404) 975-4839. All participants should reference the access code 840439. For a slide presentation

that we intend to refer to on the earnings conference call, please visit the Investor Relations section of our website (www.tcpcapital.com)

and click on the Fourth Quarter 2024 Investor Presentation under Events and Presentations. The conference call will be webcast simultaneously

in the investor relations section of our website at http://investors.tcpcapital.com/. An archived replay of the call will be available

approximately two hours after the live call, through Wednesday, March 6, 2025. For the replay, please visit https://investors.tcpcapital.com/events-and-presentations

or dial (866) 813-9403. For international replay, please dial (929) 458-6194. For all replays, please reference access code 715819.

BlackRock TCP Capital Corp.

Consolidated Statements of Assets and

Liabilities

| |

|

December 31,

2024 |

|

|

December 31,

2023 |

|

| Assets |

|

|

|

|

|

|

| Investments, at

fair value: |

|

|

|

|

|

|

| Non-controlled,

non-affiliated investments (cost of $1,737,804,418 and $1,389,865,889, respectively) |

|

$ |

1,565,603,755 |

|

|

$ |

1,317,691,543 |

|

| Non-controlled,

affiliated investments (cost of $59,606,472 and $63,188,613, respectively) |

|

|

49,444,693 |

|

|

|

65,422,375 |

|

| Controlled investments

(cost of $221,803,172 and $198,335,511, respectively) |

|

|

179,709,888 |

|

|

|

171,827,192 |

|

| Total investments

(cost of $2,019,214,062 and $1,651,390,013, respectively) |

|

|

1,794,758,336 |

|

|

|

1,554,941,110 |

|

| Cash and cash

equivalents |

|

|

91,589,702 |

|

|

|

112,241,946 |

|

| Interest, dividends

and fees receivable |

|

|

22,784,825 |

|

|

|

25,650,684 |

|

| Deferred debt

issuance costs |

|

|

6,235,009 |

|

|

|

3,671,727 |

|

| Receivable for

investments sold |

|

|

4,487,697 |

|

|

|

— |

|

| Due from broker |

|

|

817,969 |

|

|

|

— |

|

| Prepaid expenses

and other assets |

|

|

2,357,825 |

|

|

|

2,266,886 |

|

| Total assets |

|

|

1,923,031,363 |

|

|

|

1,698,772,353 |

|

| Liabilities |

|

|

|

|

|

|

| Debt (net of deferred

issuance costs of $7,974,601 and $3,355,221, respectively) |

|

|

1,118,340,225 |

|

|

|

985,200,609 |

|

| Interest and debt

related payables |

|

|

8,306,126 |

|

|

|

10,407,570 |

|

| Management fees

payable |

|

|

5,750,971 |

|

|

|

5,690,105 |

|

| Reimbursements

due to the Advisor |

|

|

932,224 |

|

|

|

844,664 |

|

| Interest Rate

Swap, at fair value |

|

|

731,830 |

|

|

|

— |

|

| Payable for investments

purchased |

|

|

99,494 |

|

|

|

960,000 |

|

| Incentive fees

payable |

|

|

— |

|

|

|

5,347,711 |

|

| Accrued expenses

and other liabilities |

|

|

3,746,826 |

|

|

|

2,720,148 |

|

| Total liabilities |

|

|

1,137,907,696 |

|

|

|

1,011,170,807 |

|

| Net assets |

|

$ |

785,123,667 |

|

|

$ |

687,601,546 |

|

| Composition of net assets applicable

to common shareholders |

|

|

|

|

|

|

| Common stock,

$0.001 par value; 200,000,000 shares authorized, 85,080,447 and 57,767,264 shares issued and outstanding as of December 31,

2024 and December 31, 2023, respectively |

|

$ |

85,080 |

|

|

$ |

57,767 |

|

| Paid-in capital

in excess of par |

|

|

1,611,236,587 |

|

|

|

967,643,255 |

|

| Distributable

earnings (loss) |

|

|

(826,198,000 |

) |

|

|

(280,099,476 |

) |

| Total net assets |

|

|

785,123,667 |

|

|

|

687,601,546 |

|

| Total liabilities

and net assets |

|

$ |

1,923,031,363 |

|

|

$ |

1,698,772,353 |

|

| Net assets

per share |

|

$ |

9.23 |

|

|

$ |

11.90 |

|

BlackRock TCP Capital Corp.

Consolidated Statements of Operations

| |

|

Year

Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2022 |

|

| Investment

income |

|

|

|

|

|

|

|

|

|

| Interest income

(excluding PIK): |

|

|

|

|

|

|

|

|

|

| Non-controlled,

non-affiliated investments |

|

$ |

223,638,775 |

|

|

$ |

183,528,944 |

|

|

$ |

157,012,042 |

|

| Non-controlled,

affiliated investments |

|

|

1,475,521 |

|

|

|

1,046,044 |

|

|

|

148,805 |

|

| Controlled investments |

|

|

10,469,100 |

|

|

|

10,061,227 |

|

|

|

7,710,565 |

|

| PIK interest income: |

|

|

|

|

|

|

|

|

|

| Non-controlled,

non-affiliated investments |

|

|

14,084,097 |

|

|

|

9,422,286 |

|

|

|

7,899,134 |

|

| Non-controlled,

affiliated investments |

|

|

89,620 |

|

|

|

410,074 |

|

|

|

— |

|

| Controlled investments |

|

|

1,653,364 |

|

|

|

651,700 |

|

|

|

— |

|

| Dividend income: |

|

|

|

|

|

|

|

|

|

| Non-controlled,

non-affiliated investments |

|

|

1,549,846 |

|

|

|

1,133,826 |

|

|

|

1,017,828 |

|

| Non-controlled,

affiliated investments |

|

|

3,725,827 |

|

|

|

2,652,918 |

|

|

|

2,357,066 |

|

| Controlled investments |

|

|

2,606,160 |

|

|

|

— |

|

|

|

3,794,889 |

|

| Other income: |

|

|

|

|

|

|

|

|

|

| Non-controlled,

non-affiliated investments |

|

|

145,080 |

|

|

|

376,214 |

|

|

|

881,611 |

|

| Non-controlled,

affiliated investments |

|

|

— |

|

|

|

45,650 |

|

|

|

180,520 |

|

| Total investment

income |

|

|

259,437,390 |

|

|

|

209,328,883 |

|

|

|

181,002,459 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

| Interest and other

debt expenses |

|

|

72,164,042 |

|

|

|

47,810,740 |

|

|

|

39,358,896 |

|

| Management fees |

|

|

24,541,027 |

|

|

|

24,020,766 |

|

|

|

26,259,584 |

|

| Incentive fees |

|

|

19,236,336 |

|

|

|

22,602,949 |

|

|

|

18,759,613 |

|

| Professional fees |

|

|

3,196,682 |

|

|

|

2,173,123 |

|

|

|

1,767,652 |

|

| Administrative

expenses |

|

|

2,389,479 |

|

|

|

1,532,284 |

|

|

|

1,760,905 |

|

| Director fees |

|

|

821,219 |

|

|

|

936,819 |

|

|

|

1,090,654 |

|

| Insurance expense |

|

|

783,631 |

|

|

|

558,020 |

|

|

|

638,006 |

|

| Custody fees |

|

|

380,582 |

|

|

|

365,107 |

|

|

|

339,886 |

|

| Other operating

expenses |

|

|

3,643,968 |

|

|

|

2,525,002 |

|

|

|

2,589,090 |

|

| Total operating

expenses |

|

|

127,156,966 |

|

|

|

102,524,810 |

|

|

|

92,564,286 |

|

| Net investment

income before taxes |

|

|

132,280,424 |

|

|

|

106,804,073 |

|

|

|

88,438,173 |

|

| Excise tax expense |

|

|

522,554 |

|

|

|

247,315 |

|

|

|

— |

|

| Net investment

income |

|

|

131,757,870 |

|

|

|

106,556,758 |

|

|

|

88,438,173 |

|

| Realized and

unrealized gain (loss) on investments and foreign currency |

|

|

|

|

|

|

|

|

|

| Net realized gain

(loss): |

|

|

|

|

|

|

|

|

|

| Non-controlled,

non-affiliated investments |

|

|

(54,300,808 |

) |

|

|

(31,648,232 |

) |

|

|

(29,278,589 |

) |

| Non-controlled,

affiliated investments |

|

|

(12,810,138 |

) |

|

|

— |

|

|

|

11,172,439 |

|

| Controlled investments |

|

|

— |

|

|

|

— |

|

|

|

(124,801 |

) |

| Net realized gain

(loss) |

|

|

(67,110,946 |

) |

|

|

(31,648,232 |

) |

|

|

(18,230,951 |

) |

Net change in

unrealized appreciation

(depreciation) (1): |

|

|

|

|

|

|

|

|

|

| Non-controlled,

non-affiliated investments |

|

|

(99,794,086 |

) |

|

|

(2,036,190 |

) |

|

|

(72,517,792 |

) |

| Non-controlled,

affiliated investments |

|

|

(12,395,543 |

) |

|

|

(28,656,798 |

) |

|

|

(27,307,855 |

) |

| Controlled investments |

|

|

(15,584,976 |

) |

|

|

(5,741,106 |

) |

|

|

20,393,093 |

|

| Interest Rate

Swap |

|

|

(9,491 |

) |

|

|

— |

|

|

|

— |

|

| Net change in

unrealized appreciation (depreciation) |

|

|

(127,784,096 |

) |

|

|

(36,434,094 |

) |

|

|

(79,432,554 |

) |

| Net realized and

unrealized gain (loss) |

|

|

(194,895,042 |

) |

|

|

(68,082,326 |

) |

|

|

(97,663,505 |

) |

Net increase (decrease)

in net assets resulting

from operations |

|

$ |

(63,137,172 |

) |

|

$ |

38,474,432 |

|

|

$ |

(9,225,332 |

) |

| Basic and diluted

earnings (loss) per share |

|

$ |

(0.79 |

) |

|

$ |

0.67 |

|

|

$ |

(0.16 |

) |

Basic and diluted

weighted average common

shares outstanding |

|

|

79,670,868 |

|

|

|

57,767,264 |

|

|

|

57,767,264 |

|

(1) Includes $21,347,357 change in unrealized appreciation from

application of Merger accounting under ASC 805 for the twelve months ended December 31, 2024.

ABOUT BLACKROCK TCP CAPITAL CORP.

BlackRock TCP Capital Corp. (NASDAQ: TCPC)

is a specialty finance company focused on direct lending to middle-market companies as well as small businesses. TCPC lends primarily

to companies with established market positions, strong regional or national operations, differentiated products and services and sustainable

competitive advantages, investing across industries in which it has significant knowledge and expertise. TCPC’s investment objective

is to achieve high total returns through current income and capital appreciation, with an emphasis on principal protection. TCPC is a

publicly-traded business development company, or BDC, regulated under the Investment Company Act of 1940 and is externally managed by

its advisor, a wholly-owned, indirect subsidiary of BlackRock, Inc. For more information, visit www.tcpcapital.com.

FORWARD-LOOKING STATEMENTS

Prospective investors considering an investment

in BlackRock TCP Capital Corp. should consider the investment objectives, risks and expenses of the company carefully before investing.

This information and other information about the company are available in the company’s filings with the Securities and Exchange

Commission (“SEC”). Copies are available on the SEC’s website at www.sec.gov and the company’s website at www.tcpcapital.com.

Prospective investors should read these materials carefully before investing.

This press release may contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on estimates,

projections, beliefs and assumptions of management of the company at the time of such statements and are not guarantees of future performance.

Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results could differ materially

from those projected in these forward-looking statements due to a variety of factors, including, without limitation, changes in general

economic conditions or changes in the conditions of the industries in which the company makes investments, risks associated with the

availability and terms of financing, changes in interest rates, availability of transactions, and regulatory changes. Certain factors

that could cause actual results to differ materially from those contained in the forward-looking statements are included in the “Risk

Factors” section of the company’s Form 10-K for the year ended December 31, 2023, and the company’s subsequent periodic

filings with the SEC. Certain factors could cause actual results and conditions to differ materially from those projected, including

the uncertainties associated with (i) the ability to realize the anticipated benefits of the Merger, including the expected accretion

to net investment income and the elimination or reduction of certain expenses and costs due to the Merger; (ii) risks related to diverting

management’s attention from ongoing business operations; (iii) risks related to the retention of the personnel of TCPC’s

advisor; (iv) changes in the economy, financial markets and political environment, including the impacts of inflation and rising interest

rates; (v) risks associated with possible disruption in the operations of TCPC or the economy generally due to terrorism, war or other

geopolitical conflict (including the current conflict between Russia and Ukraine and the conflict in the Middle East), natural disasters

or public health crises and epidemics; (vi) future changes in laws or regulations (including the interpretation of these laws and regulations

by regulatory authorities); (vii) conditions in TCPC’s operating areas, particularly with respect to business development companies

or regulated investment companies; and (viii) other considerations that may be disclosed from time to time in TCPC’s publicly disseminated

documents and filings. Copies are available on the SEC’s website at www.sec.gov and the Company’s website at www.tcpcapital.com.

Forward-looking statements are made as of the date of this press release and are subject to change without notice. The Company has no

duty and does not undertake any obligation to update or revise any forward-looking statements based on the occurrence of future events,

the receipt of new information, or otherwise.

SOURCE:

BlackRock TCP Capital Corp.

CONTACT

BlackRock TCP Capital Corp.

Michaela Murray

(310) 566-1094

investor.relations@tcpcapital.com

v3.25.0.1

Document And Entity Information

|

Feb. 27, 2025 |

| Document Information Line Items |

|

| Entity Central Index Key |

0001370755

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2025

|

| Entity Registrant Name |

BlackRock

TCP Capital Corp.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

814-00899

|

| Entity Tax Identification Number |

56-2594706

|

| Entity Address, Address Line One |

2951 28th Street, Suite 1000

|

| Entity Address, City or Town |

Santa Monica

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90405

|

| City Area Code |

(310)

|

| Local Phone Number |

566-1000

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TCPC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

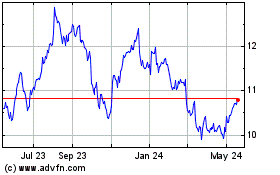

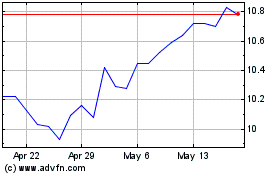

BlackRock TCP Capital (NASDAQ:TCPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

BlackRock TCP Capital (NASDAQ:TCPC)

Historical Stock Chart

From Mar 2024 to Mar 2025