Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

November 06 2024 - 3:15PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(RULE

14a-101)

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☒ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under Rule 14a-12 |

| VIVOS

THERAPEUTICS, INC. |

| (Name

of Registrant as Specified In Its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

| ☐ |

Fee

paid previously with preliminary materials. |

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its

filing. |

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

Vivos

Therapeutics, Inc.

Supplemental

Proxy Materials

For the Annual Meeting of Stockholders on November 26, 2024

November

6, 2024

Dear

Fellow Vivos Stockholders,

As

we approach the Vivos Therapeutics, Inc. 2024 Annual Meeting of Stockholders on November 26, 2024 at 10:00 a.m. Mountain time,

I am pleased to report the progress we have made over the past 12 months to expand our regulatory approvals, enhance our prospects for

top line revenue, and bolster our balance sheet. Of note:

| ● | our

first provider alliance marketing and distribution model in Colorado is making steady progress,

and patient conversion rates are hitting our forecasts, which we expect will significantly

impact our revenues over the next year as we extend the model to two additional locations,

with others being planned; |

| | | |

| ● | we

received two groundbreaking FDA clearances for our CARE oral medical devices, including the

first ever FDA 510(k) clearance to treat severe OSA in adults (November 2023) and then just

recently another clearance for our CARE DNA appliance

to reduce snoring and treat moderate to severe OSA in children aged 6 to 17. In addition,

certain Vivos CARE devices are now Medicare eligible, and we recently received new CPT®

medical codes applicable to all Vivos CARE devices from the American Medical Association,

which will become effective January 1, 2025; |

| | | |

| ● | we

secured $11.8 million in new investor capital during this year, including equity capital

from a leading private equity sponsor, which has extended our cash runway and strengthened

our stockholders’ equity; and |

| | | |

| ● | we

also marked 8 consecutive quarters of operating cost reductions as we continue to push toward

becoming cash flow positive. |

We

believe more than ever that Vivos has the right vision to address the national crisis of sleep apnea and related conditions arising from

certain dentofacial abnormalities. Which is why we are asking again for your support at our 2024 Annual Meeting. On October 15,

2024, we mailed you our 2024 Annual Meeting proxy statement describing several proposals to be considered at the annual meeting Your

vote is extremely important, so if you haven’t done so already, please take the time to vote today. We have retained Lioness

Consulting LLC as our proxy solicitor for this meeting. You may receive a call to assist you with your vote or you can also call 888-406-3117

or email: info@lionessconsultingllc.com.

To

continue our momentum, we urge all our stockholders to vote “FOR” for each of the following proposals:

Proposal

1 - Election of Our Existing Six Directors

Proposal

2 - Approval of Vivos’ proposed 2024 Omnibus Equity Incentive Plan and Contingent Awards

Proposal

3 - Ratification of Our Auditors

To

register for the virtual meeting, please visit here. To review the full proxy statement please visit here.

I

wish to thank all of our stockholders for your continued support and look forward to the remainder of 2024 and beyond as we seek to fulfill

our mission and drive value for our investors.

Sincerely,

| /s/

R. Kirk Huntsman |

|

| R.

Kirk Huntsman |

|

| Chairman

and CEO |

|

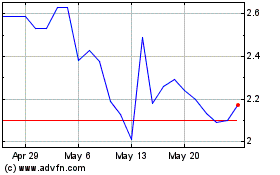

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Jan 2024 to Jan 2025