false

0001716166

0001716166

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 14, 2024

Vivos

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39796 |

|

81-3224056 |

| (State

or other jurisdiction |

|

(Commission

|

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

7921

Southpark Plaza, Suite 210

Littleton,

Colorado 80120

(Address

of principal executive offices) (Zip Code)

(844)

672-4357

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

VVOS |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

On

November 14, 2024, Vivos Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the

third quarter ended September 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K and is incorporated herein by reference.

The

information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VIVOS

THERAPEUTICS, INC. |

| |

|

| Dated:

November 14, 2024 |

By: |

/s/

Bradford Amman |

| |

Name: |

Bradford

Amman |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Vivos

Therapeutics Reports Third Quarter 2024 Financial Results and Provides Operational Update

Revenue

Increased 17% Quarter over Quarter

Operating

Loss Decreased 27%

Management

to Host Conference Call Today at 5:00 pm ET

LITTLETON,

Colo., November 14, 2024 – Vivos Therapeutics, Inc. (“Vivos” or the “Company’’)

(NASDAQ: VVOS), a leading medical device and technology company specializing in the development and commercialization of highly effective

proprietary treatments for sleep-related breathing disorders (including all severities of obstructive sleep apnea (OSA) and snoring in

adults and moderate to severe OSA in children ages 6 – 17), today reported financial results and operating highlights for the third

quarter and nine months ended September 30, 2024.

Third

Quarter 2024 Financial and Operating Summary

| |

● |

Revenue

was $3.9 million for the third quarter of 2024 and $11.3 million for the nine months ended September 30, 2024, compared to $3.3 million

and $10.6 million for the three and nine months ended September 30, 2023, respectively, mainly due to increased revenue from higher

product sales and lower discounts of Vivos appliances coupled with higher service revenue primarily from early recognition of deferred

enrollment revenue, sponsorships and seminars, offset by lower myofunctional therapy revenues. |

| |

|

|

| |

● |

Gross

profit was $2.3 million for the third quarter of 2024 and $6.9 million for the nine months ended September 30, 2024, compared to

$1.7 million and $6.2 million for the comparable periods in 2023, primarily attributable to the increase in revenue. |

| |

|

|

| |

● |

Gross

margin increased to 60% for the third quarter of 2024, compared to 53% for the third quarter of 2023 due primarily to the revenue

increase. Gross margin for the nine months ended September 30, 2024 was 61%, compared with 59% during the same period in 2023. |

| |

|

|

| |

● |

Operating

expenses for the third quarter of 2024 decreased by $0.4 million, or 8% versus the third quarter of 2023, reflecting the success

of Vivos’ continuing cost-cutting initiatives, resulting in the ninth consecutive quarter of year over year reductions in operating

expenditures. For the nine months ended September 30, 2024 operating expenses decreased by $4.1 million or 21%, compared to the same

period in 2023. |

| |

|

|

| |

● |

Vivos’

cost-cutting initiatives also led to a $1 million or 27% year-over-year reduction in operating loss, versus the third quarter of

2023. For the nine months ended September 30, 2024 operating loss decreased by $4.8 million or 36%, compared to the same period in

2023. Vivos anticipates attaining positive cash flow from operations by mid-2025. |

| |

|

|

| |

● |

In

September, Vivos announced the closing of a $4.3 million registered direct equity offering, improving cash on hand, working capital

and stockholders’ equity. As of September 30, 2024, cash and cash equivalents were $6.3 million while stockholders’ equity

was $7.7 million. |

| |

|

|

| |

● |

As

of September 30, 2024, patients treated with Vivos’ patented oral appliances totaled over 47,000 worldwide, compared to over

40,000 as of September 30, 2023. Vivos has also trained more than 2,000 dentists in the use of The Vivos Method and Vivos’ related value-added services, compared to approximately 1,850 as of September 30, 2023. |

| |

● |

In

September, Vivos announced receipt of the first ever U.S. Food and Drug Administration (FDA) 510(k) clearance to treat moderate to

severe OSA and snoring in children ages 6 to 17 using Vivos’ proprietary flagship oral medical device. This milestone creates

the potential to address this important market and increase revenue. |

| |

|

|

| |

● |

In

October 2024, the American Medical Association (AMA) issued new CPT® medical codes applicable to all Vivos CARE oral

medical devices, which will become effective January 1, 2025. This achievement creates the potential for wider adoption of

Vivos devices and the resulting potential for increased revenue. |

Kirk

Huntsman, Vivos’ Chairman and Chief Executive Officer, stated, “Today, we reported a 17% increase in third-quarter topline

revenue as we leverage our proprietary technology and treatment protocols, which offer highly effective treatment alternatives for OSA

patients. Our third-quarter results mark the ninth consecutive quarter of year-over-year decreases in operating expenses as we continue

to focus on costs as we seek to grow revenue. During the quarter and more recently, we also achieved important milestones to strengthen

the foundation for future growth, notably a key FDA clearance for use of our devices in children and the issuance of new insurance codes

covering our devices.”

“Our

new marketing and distribution model announced in June, which leverages contractual alliances with medical sleep specialists, continues

to show promise in its early stages. As we previously anticipated, revenues from this new model were not material in the third quarter,

although we have seen enough to date to warrant expanding the program to two additional locations in Colorado, which we expect to have

operational by the end of 2024 or very early in 2025. We are also in discussions to expand the model through similar alliances with other

medical sleep providers, and we expect to continue to refine the model as it rolls out based on our experiences. As we continue to move

more directly and vertically into affiliations and collaborations with medical specialists, functional medicine doctors, and other sleep-related

healthcare practitioners, we expect this to positively impact our new case starts, revenue growth and gross profit in 2025”, Mr.

Huntsman concluded.

Vivos

encourages investors and other interested parties to join its conference call today at 5:00 p.m. Eastern time (details below), where

management will further discuss the financial and operating results of the third quarter of 2024.

In

addition, further information on Vivos’ financial results is included in the attached unaudited condensed consolidated balance

sheets and statements of operations. Additional explanations of Vivos’ financial performance are provided in the Vivos’ Quarterly

Report on Form 10-Q for the three and nine months ended September 30, 2024, which will be filed with the Securities and Exchange Commission

(“SEC”). The full 10-Q report will be available on the SEC Filings section of the Investor Relations section of Vivos’

website at https://vivos.com/investor-relations.

Conference

Call

To

access Vivos’ investor conference call, please dial (800) 717-1738 or (646) 307-1865 for international callers. Participants can

use the Guest dial-in numbers above and be answered by an operator, or they can click the Call me™ link https://emportal.ink/3NzntGx

for instant telephone access to the event. Call me™ link will be made active 15 minutes prior to the scheduled start time.

A replay will be available shortly after the call and can be accessed by dialing (844) 512-2921 or (412) 317-6671 for international callers.

The replay will be available until November 29, 2024.

The

live conference call webcast can be accessed on Vivos’ website at https://vivos.com/investor-relations. The company will

also post an online archive of the webcast on its website for 30 days after the call.

About

Vivos Therapeutics, Inc.

Vivos

Therapeutics, Inc. (NASDAQ: VVOS) is a medical technology company focused on developing and commercializing innovative diagnostic and

treatment methods for patients suffering from breathing and sleep issues arising from certain dentofacial abnormalities such as obstructive

sleep apnea (OSA) and snoring in adults and children. The Vivos Method represents the first clinically effective nonsurgical, noninvasive,

nonpharmaceutical, and cost-effective solution for treating mild to severe OSA in adults and moderate to severe OSA in children. It has

proven effective in over 47,000 patients treated worldwide by more than 2,000 trained dentists.

The

Vivos Method includes treatment regimens that employ proprietary CARE appliance therapy and other modalities that alter the size, shape,

and position of the jaw and soft tissues that comprise a patient’s upper airway and/or palate. The Vivos Method opens airway space

and may significantly reduce symptoms and conditions associated with mild-to-severe OSA in adults and moderate-to-severe OSA in children

ages 6 to 17, such as lowering Apnea Hypopnea Index scores. Vivos also markets and distributes SleepImage diagnostic technology under

its VivoScore program for home sleep testing in adults and children. The Vivos Integrated Practice (VIP) program offers dentists training

and other value-added services in connection with using The Vivos Method. Vivos also employs a marketing and distribution model where

it collaborates with sleep-treatment providers to offer patients OSA treatment options and help promote sales of its appliances.

For

more information, visit www.vivos.com.

Cautionary

Note Regarding Forward-Looking Statements

This

press release, the conference call referred to herein, and statements of the Company’s management made in connection therewith

contain “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended) concerning future events. Words such as “may”, “should”,

“expects”, “projects,” “intends”, “plans”, “believes”, “anticipates”,

“hopes”, “estimates”, “goal” and variations of such words and similar expressions are intended to

identify forward-looking statements. These statements involve significant known and unknown risks and are based upon several assumptions

and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond Vivos’ control.

Actual results (including the actual future impact of the initiatives and corporate achievements described herein on Vivos’ future

revenues and results of operations and the anticipated benefits of the Company’s new marketing and distribution model described

herein) may differ materially and adversely from those expressed or implied by such forward-looking statements. Factors that could cause

actual results to differ materially include, but are not limited to: (i) the risk that Vivos may be unable to implement revenue, sales

and marketing strategies that increase revenues, (ii) the risk that some patients may not achieve the desired results from using Vivos’

products, (iii) risks associated with regulatory scrutiny of and adverse publicity in the sleep apnea treatment sector; (iv) the risk

that Vivos may be unable to secure additional financings on reasonable terms when needed, if at all or maintain its Nasdaq listing and

(v) other risk factors described in Vivos’ filings with the Securities and Exchange Commission (“SEC”). Vivos’

filings can be obtained free of charge on the SEC’s website at www.sec.gov. Except to the extent required by law, Vivos expressly

disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein

to reflect any change in Vivos’ expectations with respect thereto or any change in events, conditions, or circumstances on which

any statement is based.

Vivos

Investor Relations and Media Contact:

Bradford

Amman, CFO

investors@vivoslife.com

-Tables

Follow-

VIVOS

THERAPEUTICS INC.

Unaudited

Condensed Consolidated Balance Sheets

(In

Thousands, Except Per Share Amounts)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 6,311 | | |

$ | 1,643 | |

| Accounts receivable, net of allowance of $262 and $250, respectively | |

| 454 | | |

| 202 | |

| Prepaid expenses and other current assets | |

| 634 | | |

| 616 | |

| | |

| | | |

| | |

| Total current assets | |

| 7,399 | | |

| 2,461 | |

| | |

| | | |

| | |

| Long-term assets | |

| | | |

| | |

| Goodwill | |

| 2,843 | | |

| 2,843 | |

| Property and equipment, net | |

| 3,317 | | |

| 3,314 | |

| Operating lease right-of-use asset | |

| 1,129 | | |

| 1,385 | |

| Intangible assets, net | |

| 383 | | |

| 420 | |

| Deposits and other | |

| 276 | | |

| 307 | |

| | |

| | | |

| | |

| Total assets | |

$ | 15,347 | | |

$ | 10,730 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,075 | | |

$ | 2,145 | |

| Accrued expenses | |

| 2,054 | | |

| 2,334 | |

| Current portion of contract liabilities | |

| 1,313 | | |

| 2,138 | |

| Current portion of operating lease liability | |

| 485 | | |

| 474 | |

| Other current liabilities | |

| 199 | | |

| 198 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 5,126 | | |

| 7,289 | |

| | |

| | | |

| | |

| Long-term liabilities | |

| | | |

| | |

| Contract liabilities, net of current portion | |

| 178 | | |

| 289 | |

| Employee retention credit liability | |

| 1,220 | | |

| 1,220 | |

| Operating lease liability, net of current portion | |

| 1,158 | | |

| 1,521 | |

| | |

| | | |

| | |

| Total liabilities | |

| 7,682 | | |

| 10,319 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred Stock, $0.0001 par value per share. Authorized 50,000,000 shares; no shares issued and outstanding | |

| - | | |

| - | |

| Common Stock, $0.0001 par value per share. Authorized 200,000,000 shares; issued and outstanding 4,765,300 shares as of September 30, 2024 and 1,833,877 shares as December 31, 2023 | |

| - | | |

| - | |

| Additional paid-in capital | |

| 109,025 | | |

| 93,462 | |

| Accumulated deficit | |

| (101,360 | ) | |

| (93,051 | ) |

| Total stockholders’ equity | |

| 7,665 | | |

| 411 | |

| Total liabilities and stockholders’ equity | |

$ | 15,347 | | |

$ | 10,730 | |

VIVOS

THERAPEUTICS INC.

Unaudited

Condensed Consolidated Statements of Operations

(In

Thousands, Except Per Share Amounts)

| | |

Three

Months Ended

September

30, | | |

Nine

Months Ended

September

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Product revenue | |

$ | 1,958 | | |

$ | 1,466 | | |

$ | 5,608 | | |

$ | 4,783 | |

| Service revenue | |

| 1,902 | | |

| 1,835 | | |

| 5,725 | | |

| 5,770 | |

| Total revenue | |

| 3,860 | | |

| 3,301 | | |

| 11,333 | | |

| 10,553 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales (exclusive of depreciation and amortization shown separately below) | |

| 1,526 | | |

| 1,554 | | |

| 4,411 | | |

| 4,371 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 2,334 | | |

| 1,747 | | |

| 6,922 | | |

| 6,182 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 4,487 | | |

| 4,596 | | |

| 13,531 | | |

| 17,012 | |

| Sales and marketing | |

| 346 | | |

| 641 | | |

| 1,319 | | |

| 1,861 | |

| Depreciation and amortization | |

| 146 | | |

| 150 | | |

| 437 | | |

| 472 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 4,979 | | |

| 5,387 | | |

| 15,287 | | |

| 19,345 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (2,645 | ) | |

| (3,640 | ) | |

| (8,365 | ) | |

| (13,163 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating income (expense) | |

| | | |

| | | |

| | | |

| | |

| Other expense | |

| (18 | ) | |

| (53 | ) | |

| (42 | ) | |

| (198 | ) |

| Excess warrant fair value | |

| - | | |

| - | | |

| - | | |

| (6,453 | ) |

| Change in fair value of warrant liability, net of issuance costs of $645 | |

| - | | |

| 1,600 | | |

| - | | |

| 10,362 | |

| Other income | |

| 47 | | |

| - | | |

| 98 | | |

| 128 | |

| Loss before income taxes | |

| (2,616 | ) | |

| (2,093 | ) | |

| (8,309 | ) | |

| (9,324 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (2,616 | ) | |

$ | (2,093 | ) | |

$ | (8,309 | ) | |

$ | (9,324 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share (basic and diluted) | |

$ | (0.40 | ) | |

$ | (1.75 | ) | |

$ | (1.94 | ) | |

$ | (8.09 | ) |

| Weighted average number of shares of Common Stock outstanding (basic and diluted) | |

| 6,615,320 | | |

| 1,197,258 | | |

| 4,282,210 | | |

| 1,152,607 | |

v3.24.3

Cover

|

Nov. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 14, 2024

|

| Entity File Number |

001-39796

|

| Entity Registrant Name |

Vivos

Therapeutics, Inc.

|

| Entity Central Index Key |

0001716166

|

| Entity Tax Identification Number |

81-3224056

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7921

Southpark Plaza

|

| Entity Address, Address Line Two |

Suite 210

|

| Entity Address, City or Town |

Littleton

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80120

|

| City Area Code |

(844)

|

| Local Phone Number |

672-4357

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

VVOS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

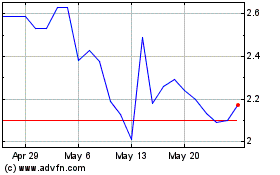

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Jan 2024 to Jan 2025