Albertsons Files Lawsuit Against Kroger for Breach of Merger Agreement

December 11 2024 - 7:35AM

Business Wire

Kroger refused to offer an adequate divesture

package and repeatedly ignored regulators’ concerns, causing the

merger with Albertsons to be blocked

Seeks billions of dollars in damages to account

for harm to Albertsons’ business, consumers, associates and

shareholders

Albertsons Companies, Inc. (NYSE: ACI) (“Albertsons”) today

filed a lawsuit against The Kroger Co. (NYSE: KR) (“Kroger”) in the

Delaware Court of Chancery, bringing claims for willful breach of

contract and breach of the covenant of good faith and fair dealing

arising from Kroger’s failure to exercise “best efforts” and to

take “any and all actions” to secure regulatory approval of the

companies’ agreed merger transaction, as was required of Kroger

under the terms of the merger agreement between the parties (the

“Merger Agreement”). Pursuant to the Court of Chancery rules,

Albertsons’ complaint against Kroger is temporarily under seal.

Kroger willfully breached the Merger Agreement in several key

ways, including by repeatedly refusing to divest assets necessary

for antitrust approval, ignoring regulators’ feedback, rejecting

stronger divestiture buyers and failing to cooperate with

Albertsons.

Tom Moriarty, Albertsons’ General Counsel and Chief Policy

Officer, said: “A successful merger between Albertsons and Kroger

would have delivered meaningful benefits for America's consumers,

Kroger’s and Albertsons’ associates, and communities across the

country. Rather than fulfill its contractual obligations to ensure

that the merger succeeded, Kroger acted in its own financial

self-interest, repeatedly providing insufficient divestiture

proposals that ignored regulators’ concerns. Kroger’s self-serving

conduct, taken at the expense of Albertsons and the agreed

transaction, has harmed Albertsons’ shareholders, associates and

consumers. We are disappointed that the opportunity to realize the

significant benefits of the merger has been lost on account of

Kroger’s willfully deficient approach to securing regulatory

clearance.”

Mr. Moriarty continued: “We are taking this action to enforce

and preserve Albertsons’ rights and to protect the interests of our

shareholders, associates and consumers. We believe strongly in the

merits of our case and look forward to presenting it to the Court

to hold Kroger responsible for the harm it has caused.”

Albertsons’ claims against Kroger are confirmed by the recent

rulings from the United States District Court for the District of

Oregon and the King County Superior Court for the State of

Washington, which granted regulators’ requests to block the merger.

Those results could have been avoided but for Kroger’s breaching

conduct.

Albertsons is seeking billions of dollars in damages from Kroger

to make Albertsons and its shareholders whole. Albertsons’

shareholders have been denied the multi-billion-dollar premium that

Kroger agreed to pay for Albertsons’ shares and have been subjected

to a decrease in shareholder value on account of Albertsons’

inability to pursue other business opportunities as it sought

approval for the transaction. Albertsons also seeks to recover for

the time, energy and resources it invested in good faith to try to

make the merger a success.

In light of the Oregon and Washington courts’ rulings enjoining

the company’s proposed merger with Kroger and Kroger’s failure to

close the merger before the contractual deadline to do so,

Albertsons has notified Kroger of its decision to terminate the

merger agreement. This termination entitles Albertsons to an

immediate $600 million termination fee and removes contractual

constraints on Albertsons’ ability to pursue other strategic

opportunities.

In addition to the $600 million termination fee, Albertsons is

entitled to relief reflecting the multiple years and hundreds of

millions of dollars it devoted to obtaining approval for the

merger, along with the extended period of unnecessary limbo

Albertsons endured as a result of Kroger’s actions. Albertsons

further seeks to recover certain expenses and costs.

About Albertsons Companies

Albertsons Companies is a leading food and drug retailer in the

United States. As of September 7, 2024, the Company operated 2,267

retail food and drug stores with 1,726 pharmacies, 405 associated

fuel centers, 22 dedicated distribution centers and 19

manufacturing facilities. The Company operates stores across 34

states and the District of Columbia under more than 20 well known

banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw's,

Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star

Market, Haggen, Carrs, Kings Food Markets and Balducci's Food

Lovers Market. The Company is committed to helping people across

the country live better lives by making a meaningful difference,

neighborhood by neighborhood. In 2023, along with the Albertsons

Companies Foundation, the Company contributed more than $350

million in food and financial support, including more than $35

million through our Nourishing Neighbors Program to ensure those

living in our communities and those impacted by disasters have

enough to eat.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211517822/en/

For Investor Relations, contact

investor-relations@albertsons.com

For Media Relations, contact media@albertsons.com or

Albertsons@fgsglobal.com

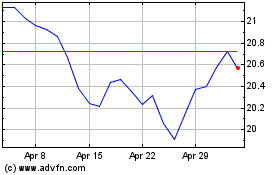

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Jan 2025 to Feb 2025

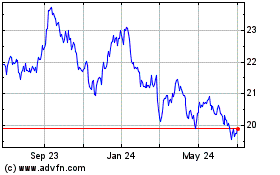

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Feb 2024 to Feb 2025