false000198406000019840602024-08-222024-08-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 22, 2024 |

Atlas Energy Solutions Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41828 |

93-2154509 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

5918 W. Courtyard Drive Suite 500 |

|

Austin, Texas |

|

78730 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (512) 220-1200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 per share |

|

AESI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 22, 2024, the Board of Directors (the “Board”) of Atlas Energy Solutions Inc. (the “Company”) increased the size of the Board from eight members to nine and elected John Turner, the Company’s current Chief Executive Officer, to the Board effective immediately.

Mr. Turner, age 52, has served as our Chief Executive Officer since March 2024, served as our President and Chief Financial Officer from November 2022 to March 2024, and served as our Chief Financial Officer from April 2017 to November 2022. Mr. Turner has over 20 years of oil and natural gas industry experience. Prior to joining the Company, Mr. Turner worked in various capacities for both public and private entities, with a focus on corporate finance, business development and strategic planning, including as Chief Financial Officer of Brigham Exploration LLC, Chief Financial Officer of Mediterranean Resources, LLC and Vice President of Brigham Exploration. Mr. Turner received a Bachelor of Business Administration and a Master of Business Administration from the McCombs School of Business at the University of Texas at Austin.

As an executive officer of the Company, Mr. Turner will not serve on any committees of the Board, nor will he receive any additional compensation for service as a director of the Company. There is no arrangement or understanding between Mr. Turner and any other person pursuant to which Mr. Turner was selected to serve as a director of the Company. There are no family relationships between Mr. Turner and any of our directors or executive officers. Mr. Turner has not had an interest in any transaction since the beginning of the Company’s last fiscal year, or any currently proposed transaction, that requires disclosure pursuant to Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure.

On August 26, 2024, the Company issued a press release announcing the election of Mr. Turner to the Company’s Board effective immediately. A copy of the press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction B.2. of Form 8-K, the information contained in this Item 7.01 and the accompanying Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ATLAS ENERGY SOLUTIONS INC. |

|

|

|

|

Date: |

August 26, 2024 |

By: |

/s/ Dathan Voelter |

|

|

|

Name: Dathan Voelter

Title: General Counsel and Secretary |

Atlas Energy Solutions Announces Election of CEO John Turner to Board of Directors

AUSTIN, Texas – (BUSINESS WIRE) – Atlas Energy Solutions Inc. (NYSE: AESI) (“Atlas” or the “Company”) today announced that on August 22, 2024, the Company’s Board of Directors (the “Board”) increased the size of the Board from eight members to nine and elected John Turner, the Company’s current Chief Executive Officer, to the Board, effective immediately.

“John will bring an invaluable perspective to the Board through his extensive experience as an executive in the oil and gas industry,” said Ben M. “Bud” Brigham, Executive Chairman of the Board. “He has been a remarkable leader for Atlas since our founding, and his knowledge and decades of operational and financial leadership in the industry will benefit the Board and add valuable insight as we continue to focus on operational excellence and generating returns for our stockholders.”

Mr. Turner has served as our Chief Executive Officer since March 2024 and before that as our Chief Financial Officer and President since November 2022. Prior to that, Mr. Turner served as Chief Financial Officer since our founding in 2017. Mr. Turner has over 20 years of oil and natural gas industry experience. Prior to joining Atlas, Mr. Turner worked in various capacities for both public and private entities, with a focus on corporate finance, business development and strategic planning, including as Chief Financial Officer of Brigham Exploration Company, LLC (the second entity founded by Mr. Brigham with such name), Chief Financial Officer of Mediterranean Resources, LLC and Vice President of Brigham Exploration Company (NASDAQ: BEXP). Mr. Turner received a Bachelor of Business Administration and a Master of Business Administration from the McCombs School of Business at the University of Texas at Austin.

About Atlas Energy Solutions

Atlas Energy Solutions Inc. is a leading proppant producer and proppant logistics provider, serving primarily the Permian Basin of West Texas and New Mexico. We operate 12 proppant production facilities across the Permian Basin with a combined annual production capacity of 28 million tons, including both large-scale in-basin facilities and smaller distributed mining units. We manage a portfolio of leading-edge logistics assets, which includes our 42-mile Dune Express conveyor system, which is currently under construction and is scheduled to come online in the fourth quarter of 2024. In addition to our conveyor infrastructure, we manage a fleet of 120 trucks, which are capable of delivering expanded payloads due to our custom-manufactured trailers and patented drop-depot process. Our approach to managing both our proppant production and proppant logistics operations is intently focused on leveraging technology, automation and remote operations to drive efficiencies.

We are a low-cost producer of various high-quality, locally sourced proppants used during the well completion process. We offer both dry and damp sand, and carry various mesh sizes including 100 mesh and 40/70 mesh. Proppant is a key component necessary to facilitate the recovery of hydrocarbons from oil and natural gas wells.

Our logistics platform is designed to increase the efficiency, safety and sustainability of the oil and natural gas industry within the Permian Basin. Proppant logistics is increasingly a differentiating factor affecting customer choice among proppant producers. The cost of delivering sand, even short distances, can be a significant component of customer spending on their well completions given the substantial volumes that are utilized in modern well designs.

We continue to invest in and pursue leading-edge technologies, including autonomous trucking, digital infrastructure, and artificial intelligence, to support opportunities to gain efficiencies in our operations. To this end, we have recently taken delivery of next-generation dredge mining assets to drive efficiencies in our proppant production operations. These technology-focused investments aim to improve our cost structure and also combine to produce beneficial environmental and community impacts.

While our core business is fundamentally aligned with a lower emissions economy, our core obligation has been, and will always be, to our stockholders. We recognize that maximizing value for our stockholders requires that we optimize the outcomes for our broader stakeholders, including our employees and the communities in which we operate. We are proud of the fact that our approach to innovation in the hydrocarbon industry while operating in an environmentally responsible manner creates immense value. Since our founding in 2017, our core mission has been to improve human beings’ access to the hydrocarbons that power our lives while also delivering differentiated social and environmental progress. Our Atlas team has driven innovation and has produced industry-leading environmental benefits by reducing energy consumption, emissions, and our aerial footprint. We call this Sustainable Environmental and Social Progress.

We were founded in 2017 by Ben M. “Bud” Brigham, our Executive Chairman, and are led by an entrepreneurial team with a history of constructive disruption bringing significant and complementary experience to this enterprise, including the perspective of longtime E&P operators, which provides for an elevated understanding of the end users of our products and services. Our executive management team has a proven track record with a history of generating positive returns and value creation. Our experience as E&P operators was instrumental to our understanding of the opportunity created by in-basin sand production and supply in the Permian Basin, which we view as North America’s premier shale resource and which we believe will remain its most active through economic cycles.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are predictive or prospective in nature, that depend upon or refer to future events or conditions or that include the words “may,” “assume,” “forecast,” “position,” “strategy,” “potential,” “continue,” “could,” “will,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, Mr. Turner’s expected continued contributions to the Company, and management’s plans to execute on the Company’s key objectives; our business strategy, industry, future operations and profitability, expected capital expenditures and the impact of such expenditures on our performance, statements about our financial position, production, revenues and losses, our capital programs, management changes, current and potential future long-term contracts and our future business and financial performance.

Although forward-looking statements reflect our good faith beliefs at the time they are made, we caution you that these forward-looking statements are subject to a number of risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include but are not limited to: uncertainties as to whether the Hi-Crush Acquisition will achieve its anticipated benefits and projected synergies within the expected time period or at all; Atlas’s ability to integrate Hi-Crush Inc.’s operations in a successful manner and in the expected time period; risks that the anticipated tax treatment of the Hi-Crush Acquisition is not obtained; unforeseen or unknown liabilities; unexpected future capital expenditures; potential litigation relating to the Hi-Crush Acquisition; the effect of the completion of the Hi-Crush Acquisition on Atlas’s business relationships and business generally; risks that the Hi-Crush Acquisition disrupts current plans and operations of Atlas and its management team and potential difficulties in retaining employees as a result of the Hi-Crush Acquisition; the risks related to Atlas’s financing of the Hi-Crush Acquisition; potential negative effects of the Hi-Crush Acquisition on the market price of Atlas’s common stock or operating results; commodity price volatility, including volatility stemming from the ongoing armed conflicts between Russia and Ukraine and Israel and Hamas; increasing hostilities and instability in the Middle East; adverse developments affecting the financial services industry; our ability to complete growth projects, including the Dune Express, on time and on budget; the risk that stockholder litigation in connection with our recent corporate reorganization may result in significant costs of defense, indemnification and liability; changes in general economic, business and political conditions, including changes in the financial markets; transaction costs; actions of OPEC+ to set and maintain oil production levels; the level of production of crude oil, natural gas and other hydrocarbons and the resultant market prices of crude oil; inflation; environmental risks; operating risks; regulatory changes; lack of demand; market share growth; the uncertainty inherent in projecting future rates of reserves; production; cash flow; access to capital; the timing of development expenditures; the ability of our customers to meet their obligations to us; our ability to maintain effective internal controls; and other factors discussed or referenced in our filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”), including those discussed under the heading “Risk Factors” in Annual Report on Form 10-K, filed with the SEC on February 27, 2024, and any subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Kyle Turlington

T: 512-220-1200

IR@atlas.energy

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

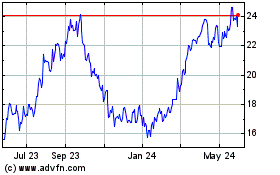

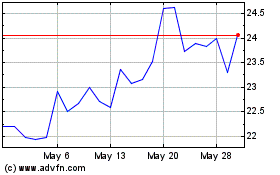

New Atlas Holdco (NYSE:AESI)

Historical Stock Chart

From Feb 2025 to Mar 2025

New Atlas Holdco (NYSE:AESI)

Historical Stock Chart

From Mar 2024 to Mar 2025