Atlas Energy Solutions Inc. (NYSE: AESI) (“Atlas” or the

“Company”) today announced that it has entered into a definitive

agreement to acquire all of the outstanding capital stock of Moser

Acquisition, Inc. (“Moser Energy Systems” or “Moser”), a leading

provider of distributed power solutions, in a transaction valued at

$220 million (the “Moser Acquisition”).

The transaction consideration includes $180 million of cash and

approximately 1.7 million shares (the “Stock Consideration”) of the

Company’s common stock, par value $0.01 per share, which are valued

at $40.0 million based on the 20-day trailing volume-weighted

average price ending at the close of trading on Friday, January 24,

2025. Atlas has the ability to elect to pay the aggregate

transaction consideration in cash in lieu of Atlas’s issuance of

the Stock Consideration (the “Cash Option”). The final

consideration mix will be determined at closing and the Stock

Consideration is subject to revision for customary post-closing

adjustments. Following closing, if the Cash Option has not been

exercised, all or any portion of the Stock Consideration will be

subject to redemption at the option of Atlas, with any such

redemption to be paid in cash.

Acquisition Highlights

- The combination of Atlas’s completion platform and Moser’s

distributed power platform creates an innovative, diversified

energy solutions provider with a leading portfolio of proppant,

logistics (including the Dune Express) and distributed power

solutions.

- Dynamic fleet of natural gas-powered assets (~212MWs) expands

Atlas’s current operations into production and distributed power

end markets supported by strong macro tailwinds expected to reduce

through-cycle volatility associated with completions

operations.

- Moser’s strong EBITDA(1) margin profile of 50%+ and robust cash

flow generation is expected to enhance Atlas’s pro forma cash flow

generation and shareholder returns.

- Adds critical, differentiated in-house manufacturing and

remanufacturing capabilities driving best-in-class quality and

reliability while reducing through-cycle maintenance and equipment

replacement costs.

- Increases Atlas’s customer reach with a vital power service

offering in Atlas’s core geography, the Permian Basin, while

providing geographic diversity with operating locations in key oil

and gas basins across the central United States.

- Estimated to be immediately accretive.

- Assuming 10-months of contribution, we expect the acquired

assets to generate $40-45 million in Adjusted EBITDA(1) in 2025,

which implies on a full run-rate basis a valuation of approximately

4.3x 2025 Adjusted EBITDA(1).

- The transaction is expected to close before the end of the

first quarter of 2025.

John Turner, President and Chief Executive Officer of Atlas,

commented, “Today marks yet another exciting milestone for Atlas.

This acquisition diversifies the Company into attractive

high-growth end markets in both production and distributed power

while strengthening Atlas’s current market position as a leading

provider of energy solutions within the oil and gas sector across

North America. This transaction highlights our continued commitment

to evolve our organization by deploying innovative and

differentiated solutions to return value to our shareholders. We

are looking forward to continuing to invest in our current

operations and expand the capabilities of our distributed power

platform.”

“When we made our original investment in Moser, we saw a company

with tremendous potential and a rich legacy of customer service and

excellence that Randy Moser and his family had built over the

previous 40 years. We have worked hard to be good caretakers of

that legacy as we have grown the business, and we view Atlas Energy

as the perfect company to further build upon that legacy,” said

Mark Plunkett, Managing Partner of Hilltop Opportunity Partners.

“We have greatly valued the partnership we have had with the Moser

team over the last several years and look forward to watching them

thrive as they lead Moser into this next chapter with Atlas.”

Transaction Financing

At closing, Atlas will fund $180 million of cash and 1.7 million

shares of Atlas common stock, subject to the Cash Option, to

Moser’s sole shareholder. Atlas has secured funding for the cash

portion of the consideration, including the Cash Option, if

exercised, through an upsizing amendment to its existing delayed

draw term loan facility.

Transaction Timing and Approvals

Atlas’s Board of Directors has approved the Moser Acquisition.

The transaction is subject to customary closing conditions and the

Company expects the transaction to close by the end of the first

quarter of 2025.

Preliminary Fourth Quarter and Year-End 2024 Results

Set forth below are certain estimated preliminary unaudited

financial results and other data for the fourth quarter ended

December 31, 2024 and the corresponding period of the prior fiscal

year, as well as fiscal year ended December 31, 2024 and the

corresponding period of the prior fiscal year. Our unaudited

interim consolidated financial statements for the fourth quarter

ended December 31, 2024 and fiscal year ended December 31, 2024 are

not yet available. These ranges are based on the information

available to us as of the date of this release. These are

forward-looking statements and may differ from actual results. We

have provided ranges, rather than specific amounts, because these

results are preliminary and subject to change. Our actual results

may vary from the estimated preliminary results presented below due

to the completion of our financial closing and other operational

procedures, final adjustments and other developments that may arise

between now and the time the financial results for the fourth

quarter ended December 31, 2024 and fiscal year ended December 31,

2024 are finalized.

These estimates should not be viewed as a substitute for our

full interim or annual audited financial statements prepared in

accordance with U.S. generally accepted accounting principles

(“GAAP”). Accordingly, you should not place undue reliance on this

preliminary data. See “Cautionary Statement Regarding

Forward-Looking Statements” below for additional information

regarding factors that could result in differences between the

preliminary estimated ranges of our financial and other data

presented below and the actual financial and other data we will

report for the fourth quarter ended December 31, 2024 and fiscal

year ended December 31, 2024.

The estimated preliminary financial results for the fourth

quarter ended December 31, 2024 and fiscal year ended December 31,

2024 have been prepared by, and are the responsibility of,

management. Our independent registered public accounting firm,

Ernst & Young LLP, has not audited, reviewed, compiled or

performed any procedures with respect to the estimated preliminary

financial results. Accordingly, Ernst & Young LLP does not

express an opinion or any other form of assurance with respect

thereto.

For the fourth quarter ended December 31, 2024, we expect:

- Revenue to be between $270.0 million and $272.0 million, as

compared to revenue of approximately $141.1 million for the fourth

quarter ended December 31, 2023, an increase of approximately 92%

at the midpoint.

- Gross profit to be between $49.0 million and $51.0 million, as

compared to gross profit of $62.9 million for the fourth quarter

ended December 31, 2023, a decrease of approximately 21% at the

midpoint.

- Adjusted EBITDA(1) to be between $62.2 million and $64.2

million, as compared to Adjusted EBITDA(1) of $68.7 million for the

fourth quarter ended December 31, 2023, a decrease of approximately

8% at the midpoint.

For the fiscal year ended December 31, 2024, we expect:

- Revenue to be between $1,055.0 million and $1,057.0 million, as

compared to revenue of $614.0 million for the fiscal year ended

December 31, 2023, an increase of approximately 72% at the

midpoint.

- Gross profit to be between $231.0 million and $233.0 million,

as compared to gross profit of $313.8 million for the fiscal year

ended December 31, 2023, a decrease of approximately 26% at the

midpoint.

- Adjusted EBITDA(1) to be between $287.9 million and $289.9

million, as compared to Adjusted EBITDA(1) of $329.7 million for

the fiscal year ended December 31, 2023, a decrease of

approximately 12% at the midpoint.

- Cash and cash equivalents to total approximately $71.7 million,

as compared to cash and cash equivalents of $210.2 million at

December 31, 2023, a decrease of approximately 66%.

(1) EBITDA and Adjusted EBITDA are non-GAAP financial measures.

See Non-GAAP Financial Measures for a discussion of these measures

and a reconciliation of estimated 2024 Adjusted EBITDA to our most

directly comparable financial measures calculated and presented in

accordance with GAAP.

Advisors

Piper Sandler & Co. is serving as exclusive financial

advisor to Atlas. Vinson & Elkins L.L.P. is serving as legal

advisor to Atlas in association with the transaction.

TPH&Co., the energy business of Perella Weinberg Partners,

is serving as exclusive financial advisor to Moser. Katten Muchin

Rosenman LLP is serving as legal advisor in association with the

transaction.

Conference Call

The Company will host a conference call to discuss the

transaction on January 27, 2025 at 9:00am Central Time (10:00am

Eastern Time). Individuals wishing to participate in the conference

call should dial (877) 407-4133. A live webcast will be available

at https://ir.atlas.energy/. Please access the webcast or dial in

for the call at least 10 minutes ahead of the start time to ensure

a proper connection. An archived version of the conference call

will be available on the Company’s website shortly after the

conclusion of the call.

The Company will also post an updated investor presentation

titled “Moser Acquisition Presentation” at https://ir.atlas.energy/

in the “Presentations” section under “News & Events” tab on the

Company’s Investor Relations webpage prior to the conference

call.

About Atlas Energy Solutions

Atlas Energy Solutions Inc. is a leading proppant producer and

proppant logistics provider, serving primarily the Permian Basin of

West Texas and New Mexico. We operate 14 proppant production

facilities across the Permian Basin with a combined annual

production capacity of 29 million tons, including both large-scale

in-basin facilities and smaller distributed mining units. We manage

a portfolio of leading-edge logistics assets, which includes our

42-mile Dune Express conveyor system. In addition to our conveyor

infrastructure, we manage a fleet of over 120 trucks, which are

capable of delivering expanded payloads due to our

custom-manufactured trailers and patented drop-depot process. Our

approach to managing both our proppant production and proppant

logistics operations is intently focused on leveraging technology,

automation and remote operations to drive efficiencies.

We are a low-cost producer of various high-quality, locally

sourced proppants used during the well completion process. We offer

both dry and damp sand, and carry various mesh sizes including 100

mesh and 40/70 mesh. Proppant is a key component necessary to

facilitate the recovery of hydrocarbons from oil and natural gas

wells.

Our logistics platform is designed to increase the efficiency,

safety and sustainability of the oil and natural gas industry

within the Permian Basin. Proppant logistics is increasingly a

differentiating factor affecting customer choice among proppant

producers. The cost of delivering sand, even short distances, can

be a significant component of customer spending on their well

completions given the substantial volumes that are utilized in

modern well designs.

We continue to invest in and pursue leading-edge technologies,

including autonomous trucking, digital infrastructure, and

artificial intelligence, to support opportunities to gain

efficiencies in our operations. These technology-focused

investments aim to improve our cost structure and also combine to

produce beneficial environmental and community impacts.

While our core business is fundamentally aligned with a lower

emissions economy, our core obligation has been, and will always

be, to our stockholders. We recognize that maximizing value for our

stockholders requires that we optimize the outcomes for our broader

stakeholders, including our employees and the communities in which

we operate. We are proud of the fact that our approach to

innovation in the hydrocarbon industry while operating in an

environmentally responsible manner creates immense value. Since our

founding in 2017, our core mission has been to improve human

beings’ access to the hydrocarbons that power our lives while also

delivering differentiated social and environmental progress. Our

Atlas team has driven innovation and has produced industry-leading

environmental benefits by reducing energy consumption, emissions,

and our aerial footprint. We call this Sustainable Environmental

and Social Progress.

We were founded in 2017 by Ben M. “Bud” Brigham, our Executive

Chairman, and are led by an entrepreneurial team with a history of

constructive disruption bringing significant and complementary

experience to this enterprise, including the perspective of

longtime E&P operators, which provides for an elevated

understanding of the end users of our products and services. Our

executive management team has a proven track record with a history

of generating positive returns and value creation. Our experience

as E&P operators was instrumental to our understanding of the

opportunity created by in-basin sand production and supply in the

Permian Basin, which we view as North America’s premier shale

resource and which we believe will remain its most active through

economic cycles.

About Moser Energy Systems

Moser Energy Systems is a world-class provider of innovative,

low-emission, grid interactive distributed energy solutions for

Oilfield Services, Commercial, Industrial, and Military

applications.

Since 1973, Moser has been at the forefront of advances in

distributed energy solutions. Moser’s cutting-edge technologies

include industry-leading development of proprietary oilfield

generator systems utilizing raw wellhead gas. These innovations

substantially reduce flaring and offer customers significant

reductions in operating expenses. The company’s products and

commitment to customers are recognized throughout the industry as

the gold standard for low-emissions, reliable, and durable natural

gas generators and hybrid generator systems.

Moser continues to build on its commitment to excellence and its

legacy of industry-leading innovation in pursuit of a lower

emissions future powered by flexible, smart energy applications

with integrated grid services and active load management. With a

dynamic vision, dedication to responsible business practices, and

cleaner, more efficient products, Moser is transforming power for

the future.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). Statements

that are predictive or prospective in nature, that depend upon or

refer to future events or conditions or that include the words

“may,” “assume,” “forecast,” “position,” “strategy,” “potential,”

“continue,” “could,” “will,” “plan,” “project,” “budget,”

“predict,” “pursue,” “target,” “seek,” “objective,” “believe,”

“expect,” “anticipate,” “intend,” “estimate” and other expressions

that are predictions of or indicate future events and trends and

that do not relate to historical matters identify forward-looking

statements. Examples of forward-looking statements include, but are

not limited to, statements regarding Atlas’s plans to finance the

Moser Acquisition; the anticipated financial performance of Atlas

following the Moser Acquisition; expected accretion to Adjusted

EBITDA; expectations regarding the leverage and dividend profile of

Atlas following the Moser Acquisition; the expected synergies and

efficiencies to be achieved as a result of the Moser Acquisition;

expansion and growth of Atlas’s business; Atlas’s plans to finance

the Moser Acquisition; the receipt of all necessary approvals to

close the Moser Acquisition and the timing associated therewith;

our business strategy, industry, future operations and

profitability, expected capital expenditures and the impact of such

expenditures on our performance, statements about our financial

position, production, revenues and losses, our capital programs,

management changes, current and potential future long-term

contracts and our future business and financial performance.

Although forward-looking statements reflect our good faith

beliefs at the time they are made, we caution you that these

forward-looking statements are subject to a number of risks and

uncertainties, most of which are difficult to predict and many of

which are beyond our control. These risks include but are not

limited to: the completion of the Moser Acquisition on anticipated

terms and timing or at all, including obtaining any required

governmental or regulatory approval and satisfying other conditions

to the completion of the Moser Acquisition; uncertainties as to

whether the Moser Acquisition, if consummated, will achieve its

anticipated benefits and projected synergies within the expected

time period or at all; Atlas’s ability to integrate Moser’s

operations in a successful manner and in the expected time period;

the occurrence of any event, change, or other circumstance that

could give rise to the termination of the Moser Acquisition; risks

that the anticipated tax treatment of the Moser Acquisition is not

obtained; unforeseen or unknown liabilities; potential litigation

relating to the Moser Acquisition; the possibility that the Moser

Acquisition may be more expensive to complete than anticipated,

including as a result of unexpected factors or events; the effect

of the announcement, pendency or completion of the Moser

Acquisition on the parties’ business relationships and business

generally; risks that the Moser Acquisition disrupts current plans

and operations of Atlas or Moser and their respective management

teams and potential difficulties in retaining employees as a result

of the Moser Acquisition; the risks related to Atlas’s financing of

the Moser Acquisition; potential negative effects of this

announcement and the pendency or completion of the Moser

Acquisition on the market price of Atlas’s common stock or

operating results; unexpected future capital expenditures; our

ability to successfully execute our stock repurchase program or

implement future stock repurchase programs; commodity price

volatility, including volatility stemming from the ongoing armed

conflicts between Russia and Ukraine and Israel and Hamas;

increasing hostilities and instability in the Middle East; adverse

developments affecting the financial services industry; our ability

to complete growth projects on time and on budget; the risk that

stockholder litigation in connection with our recent corporate

reorganization may result in significant costs of defense,

indemnification and liability; changes in general economic,

business and political conditions, including changes in the

financial markets; transaction costs; actions of OPEC+ to set and

maintain oil production levels; the level of production of crude

oil, natural gas and other hydrocarbons and the resultant market

prices of crude oil; inflation; environmental risks; operating

risks; regulatory changes; lack of demand; market share growth; the

uncertainty inherent in projecting future rates of reserves;

production; cash flow; access to capital; the timing of development

expenditures; the ability of our customers to meet their

obligations to us; our ability to maintain effective internal

controls; and other factors discussed or referenced in our filings

made from time to time with the U.S. Securities and Exchange

Commission (“SEC”), including those discussed under the heading

“Risk Factors” in our Annual Report on Form 10-K, filed with the

SEC on February 27, 2024, and any subsequently filed Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. Readers are

cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date hereof. Factors or

events that could cause our actual results to differ may emerge

from time to time, and it is not possible for us to predict all of

them. We undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by

law.

Non-GAAP Financial Measures

This press release includes or references certain

forward-looking financial measures not prepared in conformity with

generally accepted accounting principles (“GAAP”), including EBITDA

and Adjusted EBITDA. Because Atlas provides certain of these

measures on a forward-looking basis, it cannot reliably or

reasonably predict certain of the necessary components of the most

directly comparable forward-looking GAAP financial measures, such

as Gross Profit, Net Income, Operating Income, or any other measure

derived in accordance with GAAP. Accordingly, Atlas is unable to

present a quantitative reconciliation of such forward-looking,

non-GAAP financial measures to the respective most directly

comparable forward-looking GAAP financial measures. Atlas believes

that these forward-looking, non-GAAP measures may be a useful tool

for the investment community in comparing Atlas’s forecasted

financial performance to the forecasted financial performance of

other companies in the industry.

Atlas Energy Solutions – Reconciliation of

Adjusted EBITDA to Net Income (unaudited, in thousands)

Fourth Quarter Ended December

31,

2024 Estimated

(In thousands)

2023 Actual

Low

High

Net Income

$

36,050

$

12,850

$

14,250

Depreciation, depletion and accretion

expense

12,266

31,012

31,612

Amortization expense of acquired

intangible assets

—

3,943

3,543

Interest expense

4,731

12,357

12,157

Income tax expense

11,010

4,766

5,766

EBITDA

$

64,057

$

64,928

$

67,328

Stock and unit-based compensation

3,749

6,520

6,320

Insurance recovery (gain)

—

(10,098

)

(10,098

)

Other non-recurring costs

441

—

—

Other acquisition related costs

451

850

650

Adjusted EBITDA

$

68,698

$

62,200

$

64,200

Fiscal Year Ended December

31,

2024 Estimated

(In thousands)

2023 Actual

Low

High

Net Income

$

226,493

$

58,392

59,792

Depreciation, depletion and accretion

expense

41,634

101,877

102,477

Amortization expense of acquired

intangible assets

—

12,516

12,116

Interest expense

17,452

43,178

42,978

Income tax expense

31,378

16,182

17,182

EBITDA

$

316,957

$

232,145

$

234,545

Stock and unit-based compensation

7,409

22,481

22,281

Loss on disposal of assets

—

19,672

19,672

Insurance recovery (gain)

—

(20,098

)

(20,098

)

Other non-recurring costs

4,838

14,335

14,335

Other acquisition related costs

451

19,331

19,131

Adjusted EBITDA

$

329,655

$

287,866

$

289,866

Non-GAAP Measure Definitions

We define Adjusted EBITDA as net income before depreciation,

depletion and accretion, amortization expense of acquired

intangible assets, interest expense, income tax expense, stock and

unit-based compensation, loss on extinguishment of debt, loss on

disposal of assets, insurance recovery (gain), unrealized commodity

derivative gain (loss), other acquisition related costs, and other

non-recurring costs. Management believes Adjusted EBITDA is useful

because it allows management to more effectively evaluate the

Company’s operating performance and compare the results of its

operations from period to period and against our peers without

regard to financing method or capital structure. We exclude the

items listed above from net income in arriving at Adjusted EBITDA

because these amounts can vary substantially from company to

company within our industry depending upon accounting methods and

book values of assets, capital structures and the method by which

the assets were acquired.

We define EBITDA as net income before depreciation, depletion

and accretion expense, amortization expense of acquired intangible

assets, interest expense, and income tax expense.

No Offer or Solicitation

This press release is for informational purposes only and does

not constitute an offer to sell or the solicitation of an offer to

buy any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127929378/en/

Investor Contact Kyle Turlington 5918 W Courtyard Drive,

Suite #500 Austin, Texas 78730 United States T: 512-220-1200

IR@atlas.energy

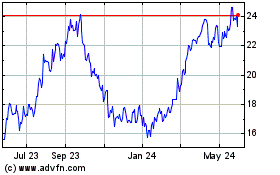

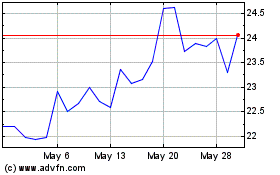

New Atlas Holdco (NYSE:AESI)

Historical Stock Chart

From Feb 2025 to Mar 2025

New Atlas Holdco (NYSE:AESI)

Historical Stock Chart

From Mar 2024 to Mar 2025