UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

GRUPO AEROPORTUARIO DEL SURESTE, S.A.B. de C.V.

(SOUTHEAST AIRPORT GROUP)

(Translation of Registrant’s Name Into English)

México

(Jurisdiction of incorporation or organization)

Bosque de Alisos No. 47A– 4th Floor

Bosques de las Lomas

05120 México, D.F.

(Address of principal executive offices)

(Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant

by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- .)

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Grupo Aeroportuario del

Sureste, S.A.B. de C.V. |

|

| |

|

|

| |

By: |

/s/ ADOLFO CASTRO RIVAS |

|

| |

|

Adolfo Castro Rivas |

|

| |

|

Chief Executive Officer |

|

Date: July 23, 2024

Exhibit 99.1

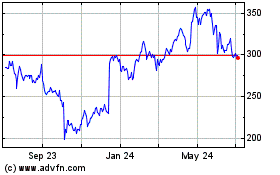

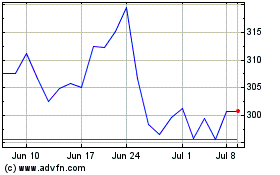

ASUR

ANNOUNCES 2Q24 RESULTS

Passenger Traffic Increased

2.8% YoY

Mexico City, July 23, 2024 - Grupo

Aeroportuario del Sureste, S.A.B. de C.V. (NYSE: ASR; BMV: ASUR) (ASUR), a leading international

airport group with operations in Mexico, the U.S., and Colombia, today announced results for the three-and

six-month periods ended June 30, 2024.

2Q24 Highlights1

| · | Total passenger traffic increased

2.8% year-over-year (“YoY”). By country of operations, passenger traffic presented the following YoY variations: |

| · | Mexico: declined 4.7%, reflecting

decreases of 2.5% in international traffic and 7.0% in domestic traffic. |

| · | Puerto Rico (Aerostar): increased

8.5%, driven by growth of 7.8% and 13.9% in domestic and in international traffic, respectively. |

| · | Colombia (Airplan): increased

20.9%, resulting from increases of 29.6% in international traffic and 18.8% in domestic traffic. |

| · | Revenues increased 20.1% YoY to

Ps.7,394.0 million. Excluding construction services, revenues increased 17.7% during the period. |

| · | Consolidated revenues per Passenger

increased 4.6% to Ps.127.9. |

| · | Consolidated EBITDA increased 18.0% YoY to Ps.4,909.9 million. |

| Table 1: Financial and Operating Highlights1 |

| |

|

|

|

| |

Second Quarter |

%

Chg. |

| |

2023 |

2024 |

| Financial

Highlights |

|

|

|

| Total

Revenue |

6,156,443 |

7,394,010 |

20.1 |

| Mexico |

4,541,133 |

5,428,666 |

19.5 |

| San

Juan |

1,036,616 |

1,182,580 |

14.1 |

| Colombia |

578,694 |

782,764 |

35.3 |

| Commercial

Revenues per PAX |

122.3 |

127.9 |

4.6 |

| Mexico |

141.7 |

154.5 |

9.1 |

| San

Juan |

146.4 |

147.2 |

0.6 |

| Colombia |

40.7 |

47.3 |

16.2 |

| EBITDA |

4,160,306 |

4,909,874 |

18.0 |

| Net

Income |

2,649,413 |

3,779,413 |

42.7 |

| Majority

Net Income |

2,444,711 |

3,673,567 |

50.3 |

| Earnings

per Share (in pesos) |

8.1490 |

12.2452 |

50.3 |

| Earnings

per ADS (in US$) |

4.4658 |

6.7105 |

50.3 |

| Capex |

152,927 |

636,780 |

316.4 |

| Cash

& Cash Equivalents |

14,474,035 |

14,996,995 |

3.6 |

| Net

Debt |

(1,326,708) |

(2,842,542) |

114.3 |

| Net

Debt/ LTM EBITDA |

(0.1) |

(0.2) |

100.1 |

| Operational

Highlights |

|

|

|

| Passenger

Traffic |

|

|

|

| Mexico |

10,697,831 |

10,193,640 |

(4.7) |

| San

Juan |

3,198,859 |

3,469,364 |

8.5 |

| Colombia |

3,389,611 |

4,099,011 |

20.9 |

| · | Adjusted EBITDA Margin (excluding IFRIC12) reached 69.2% compared

to 69.1% in 2Q23. |

| · | Closed 2Q24 with a cash position

of Ps.14,997.0 million and Debt to LTM Adjusted EBITDA of negative 0.2x. |

2Q24 Earnings Call

Day: Wednesday, July 24, 2024, at 10:00 AM

ET; 8:00 AM Mexico City time

Dial-in: 1-877-407-4018 (Toll-Free) and 1-201-689-8471 (International)

Access Code: 13747378

Replay: Wednesday, July 24, 2024, at 2:00 PM ET, ending at 11:59

PM ET on Wednesday, July 31, 2024. Dial-in: 1-844-512-2921 (Toll-Free); 1-412-317-6671 (International). Access Code: 13747378

1 Unless otherwise stated, all financial figures discussed

in this press release are unaudited, prepared in accordance with International Financial Reporting Standards (IFRS), and represent comparisons

between the three- and six-month periods ended June 30, 2024, and the equivalent three- and six-month periods ended June 30, 2023. All

figures in this report are expressed in Mexican pesos, unless otherwise noted. Tables state figures in thousands of Mexican pesos, unless

otherwise noted. Passenger figures for Mexico and Colombia exclude transit and general aviation passengers, unless otherwise noted. Commercial

revenues include revenues from non-permanent ground transportation and parking lots. All U.S. dollar figures are calculated at the exchange

rate of US$1.00 = Mexican Ps. 18.2478 (source: Diario Oficial de la Federación de México), while Colombian peso figures

are calculated at the exchange rate of COP.226.1200 = Mexican Ps.1.00 (source: Investing). Definitions for EBITDA, Adjusted EBITDA Margin,

Majority Net Income can be found on page 17 of this report.

Passenger Traffic

ASUR's total passenger traffic increased 2.8% YoY to

17.8 million in 2Q24.

In Mexico, total passenger traffic declined 4.7% YoY

to 10.2 million in 2Q24, driven by decreases of 2.5% in international traffic and 7.0% in domestic traffic.

In Puerto Rico, total passenger traffic increased 8.5%

YoY to 3.5 million in 2Q24, mainly driven by increases of 7.8% in domestic traffic and 13.9% in international traffic.

Total passenger traffic in Colombia for 2Q24 increased

20.9% YoY to 4.1 million passengers, driven by growth of 29.6% and 18.8% in domestic and international traffic, respectively.

On page 20 of this report, you will find the tables

with detailed information on passenger traffic for each airport.

| Table 2: Passenger Traffic Summary |

| |

|

|

|

|

|

|

|

| |

Second Quarter |

% Chg. |

|

Six-Months |

% Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Total México |

10,697,831 |

10,193,640 |

(4.7) |

|

21,771,122 |

21,690,050 |

(0.4) |

| - Cancun |

8,153,866 |

7,508,459 |

(7.9) |

|

16,638,564 |

16,238,550 |

(2.4) |

| - 8 Other Airports |

2,543,965 |

2,685,181 |

5.6 |

|

5,132,558 |

5,451,500 |

6.2 |

| Domestic Traffic |

5,265,236 |

4,897,005 |

(7.0) |

|

10,049,424 |

9,512,090 |

(5.3) |

| - Cancun |

3,006,582 |

2,545,231 |

(15.3) |

|

5,603,062 |

4,864,912 |

(13.2) |

| - 8 Other Airports |

2,258,654 |

2,351,774 |

4.1 |

|

4,446,362 |

4,647,178 |

4.5 |

| International Traffic |

5,432,595 |

5,296,635 |

(2.5) |

|

11,721,698 |

12,177,960 |

3.9 |

| - Cancun |

5,147,284 |

4,963,228 |

(3.6) |

|

11,035,502 |

11,373,638 |

3.1 |

| - 8 Other Airports |

285,311 |

333,407 |

16.9 |

|

686,196 |

804,322 |

17.2 |

| Total San Juan, Puerto Rico |

3,198,859 |

3,469,364 |

8.5 |

|

6,105,897 |

6,731,260 |

10.2 |

| Domestic Traffic |

2,850,826 |

3,072,984 |

7.8 |

|

5,492,755 |

6,008,924 |

9.4 |

| International Traffic |

348,033 |

396,380 |

13.9 |

|

613,142 |

722,336 |

17.8 |

| Total Colombia |

3,389,611 |

4,099,011 |

20.9 |

|

7,274,928 |

7,903,243 |

8.6 |

| Domestic Traffic |

2,723,025 |

3,235,205 |

18.8 |

|

5,899,180 |

6,198,665 |

5.1 |

| International Traffic |

666,586 |

863,806 |

29.6 |

|

1,375,748 |

1,704,578 |

23.9 |

| Total Traffic |

17,286,301 |

17,762,015 |

2.8 |

|

35,151,947 |

36,324,553 |

3.3 |

| Domestic Traffic |

10,839,087 |

11,205,194 |

3.4 |

|

21,441,359 |

21,719,679 |

1.3 |

| International Traffic |

6,447,214 |

6,556,821 |

1.7 |

|

13,710,588 |

14,604,874 |

6.5 |

| Note: Passenger figures for Mexico and Colombia exclude transit and general aviation passengers, while Puerto Rico includes transit passengers and general aviation. |

|

Table

3: % YoY Change in Passenger Traffic 2024 & 2023

| Region |

January |

February |

March |

April |

May |

June |

Total |

| Mexico |

2.6% |

5.7% |

3.4% |

(5.6%) |

(3.0%) |

(5.5%) |

(0.4%) |

| Domestic Traffic |

(2.2%) |

(1.3%) |

(6.8%) |

(10.7%) |

(4.6%) |

(5.7%) |

(5.3%) |

| International Traffic |

6.3% |

10.9% |

11.1% |

(1.0%) |

(1.3%) |

(5.2%) |

3.9% |

| Puerto Rico |

8.2% |

12.6% |

16.0% |

9.4% |

4.3% |

11.6% |

10.2% |

| Domestic Traffic |

6.7% |

12.0% |

14.9% |

9.4% |

3.1% |

10.9% |

9.4% |

| International Traffic |

23.1% |

17.9% |

27.1% |

9.2% |

15.4% |

16.1% |

17.8% |

| Colombia |

(10.1%) |

(3.4%) |

9.4% |

17.9% |

20.2% |

24.5% |

8.6% |

| Domestic Traffic |

(14.1%) |

(7.8%) |

3.6% |

16.2% |

17.8% |

22.3% |

5.1% |

| International Traffic |

6.6% |

16.9% |

37.7% |

25.3% |

30.1% |

33.1% |

23.9% |

| Total |

0.5% |

4.8% |

6.6% |

1.3% |

3.1% |

3.8% |

3.3% |

| Domestic Traffic |

(3.7%) |

(0.1%) |

1.6% |

0.9% |

3.1% |

6.0% |

1.3% |

| International Traffic |

6.9% |

11.7% |

13.9% |

1.9% |

3.0% |

0.2% |

6.5% |

Review of Consolidated

Results

| Table 4: Summary of Consolidated Results |

| |

|

|

|

|

|

|

|

| |

Second Quarter |

% Chg. |

|

Six-Months |

% Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Total Revenues |

6,156,443 |

7,394,010 |

20.1 |

|

12,605,852 |

14,828,917 |

17.6 |

| Aeronautical Services |

3,710,976 |

4,613,942 |

24.3 |

|

7,588,394 |

9,257,579 |

22.0 |

| Non-Aeronautical Services |

2,313,978 |

2,480,028 |

7.2 |

|

4,736,590 |

5,014,865 |

5.9 |

| Total Revenues Excluding Construction Revenues |

6,024,954 |

7,093,970 |

17.7 |

|

12,324,984 |

14,272,444 |

15.8 |

| Construction Revenues |

131,489 |

300,040 |

128.2 |

|

280,868 |

556,473 |

98.1 |

| Total Operating Costs & Expenses |

2,252,366 |

3,051,086 |

35.5 |

|

4,688,124 |

5,906,770 |

26.0 |

| Other Revenues |

- |

- |

0.0 |

|

- |

- |

0.0 |

| Operating Profit |

3,904,077 |

4,342,924 |

11.2 |

|

7,917,728 |

8,922,147 |

12.7 |

| Operating Margin |

63.4% |

58.7% |

(468 bps) |

|

62.8% |

60.2% |

(264 bps) |

| Adjusted Operating Margin 1 |

64.8% |

61.2% |

(358 bps) |

|

64.2% |

62.5% |

(173 bps) |

| EBITDA |

4,160,306 |

4,909,874 |

18.0 |

|

8,690,708 |

10,032,814 |

15.4 |

| EBITDA Margin |

67.6% |

66.4% |

(117 bps) |

|

68.9% |

67.7% |

(128 bps) |

| Adjusted EBITDA Margin 2 |

69.1% |

69.2% |

16 bps |

|

70.5% |

70.3% |

(22 bps) |

| Net income |

2,649,413 |

3,779,413 |

42.7 |

|

5,251,658 |

6,966,167 |

32.6 |

| Net income majority |

2,444,711 |

3,673,567 |

50.3 |

|

4,957,073 |

6,755,658 |

36.3 |

| Earnings per Share |

8.1490 |

12.2452 |

50.3 |

|

16.5236 |

22.5189 |

36.3 |

| Earnings per ADS in US$ |

4.4658 |

6.7105 |

50.3 |

|

9.0551 |

12.3406 |

36.3 |

| |

|

|

|

|

|

|

|

| Total Commercial Revenues per Passenger 3 |

122.3 |

127.9 |

4.6 |

|

122.8 |

126.4 |

2.9 |

| Commercial Revenues |

2,135,266 |

2,293,840 |

7.4 |

|

4,363,641 |

4,630,274 |

6.1 |

| Commercial Revenues from Direct Operations per Passenger 4 |

23.2 |

22.0 |

(5.6) |

|

23.7 |

22.9 |

(3.2) |

| Commercial Revenues Excl. Direct Operations per Passenger |

99.1 |

106.0 |

6.9 |

|

99.1 |

103.5 |

4.4 |

1 Adjusted operating margin excludes the effect of IFRIC12 with

respect to the construction or improvements to concessioned assets in Mexico, Puerto Rico and Colombia and is equal to operating income

divided by total revenues minus revenues from construction services.

2 Adjusted EBITDA Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets

in Mexico, Puerto Rico and Colombia, and is calculated by dividing EBITDA by total revenues less construction services revenues.

3 Passenger figures include transit and general aviation passengers Mexico, Puerto Rico and Colombia.

4 Represents ASUR´s operations in convenience stores.

Consolidated Revenues

Consolidated Revenues increased 20.1% YoY, or

Ps.1,237.6 million, to Ps.7,394.0 million, mainly due to the following increases:

| · | 128.2%, or Ps.168.5 million, YoY increase in construction

services revenues to Ps.300.0 million, principally in Mexico, |

| · | 24.3%, or Ps.903.0 million in

aeronautical services revenues to Ps.4,613.9 million. Mexico contributed Ps.3,513.7 million, while Puerto Rico and Colombia accounted

for Ps.518.3 million and Ps.581.9 million, respectively; and |

| · | 7.2%, or Ps.166.0 million non-aeronautical

services revenues to Ps.2,480.0 million. Mexico contributed Ps.1,767.0 million, while Puerto Rico and Colombia accounted for Ps.513.5

million and Ps.199.5 million, respectively. |

Excluding Revenues from Construction Services,

for which an equivalent expense is recorded under IFRS accounting standards, total revenues would have increased 17.7% YoY to Ps.7,094.0

million.

Excluding revenues from construction services, Mexico

represented 74.4% of ASUR´s total revenues in 2Q24, while Puerto Rico and Colombia accounted for 14.5% and 11.1%, respectively.

Commercial Revenues in 2Q24 increased 7.4% YoY

to Ps.2,293.8 million, mainly reflecting the 2.7% increase in passenger traffic (including transit and general aviation passengers). Commercial

revenue growth was driven by increases of 3.9% to Ps.1,583.9 million in Mexico, 9.1% to Ps.510.8 million in Puerto Rico and 40.1% to Ps.199.1

million in Colombia.

Commercial Revenues per Passenger increased 4.6%

YoY to Ps.127.9 in 2Q24, from Ps.122.3 in 2Q23.

Consolidated Operating Costs and Expenses

Consolidated Operating Costs and Expenses, including

construction costs, increased 35.5% YoY, or Ps.798.7 million, to Ps.3,051.1 million in 2Q24.

Excluding construction costs, operating costs and expenses

increased 29.7%, or Ps.630.2 million, due to the following factors:

| · | Mexico: increased 18.1%,

or Ps.254.7 million, mainly due to higher costs in connection to personnel, concession fees, security and cleaning services, and maintenance

and conservation. |

| · | Puerto Rico: increased

86.8%, or Ps.306.2 million, mainly due to the recovery of expenses under the CRRSAA Act for an amount of Ps.252.3 million in 2Q23. On

a comparable basis and excluding this benefit in 2Q23, operating costs and expenses increased 8.9%, or Ps.53.8 million, mainly due to

increases in personnel costs, electric energy, insurance and surety bonds, professional fees, security and depreciation and amortization. |

| · | Colombia: increased 19.2%,

or Ps.69.2 million, mainly due to increases in maintenance and conservation, personnel costs, taxes and duties, security and cleaning

services, insurance and surety bonds, concession fees, energy costs and depreciation and amortization. |

Cost of Services increased 37.0%, or Ps.368.4

million, YoY mainly due to increases in personnel costs, surveillance and cleaning services, maintenance and conservation, professional

fees, insurance and bonds, electric energy, and taxes and duties.

Construction Costs increased 128.2% YoY, or Ps.168.5

million. This was mainly driven by a YoY increases of 100.5%, or Ps.74.2 million, in construction costs in Mexico, and 164.5%, or Ps.93.7

million, in Puerto Rico, and 89.6%, or Ps.0.6 million, in construction costs in Colombia.

Administrative Expenses that reflect administrative

costs in Mexico increased 5.8% YoY.

Consolidated Technical Assistance Costs decreased

by 42.5% YoY, as the technical assistance fee in Mexico decreased from 5% to 2.5% as of January 1, 2024.

Concession Fees increased 74.6% YoY, on a consolidated

basis, principally due to increases of 115.4% in Mexico due to an increase in the concession fee from 5% to 9% as of January 1, 2024,

together with increases of 30.2% in Colombia and 4.2% in Puerto Rico as a result of higher regulated and unregulated revenues.

Depreciation and Amortization increased 11.5%

YoY, or Ps.58.6 million, principally due to an increase of 12.7%, or Ps.33.1 million in Mexico, 16.6%, or Ps.14.6 million in Colombia

and 6.8%, or Ps.10.9 million, in Puerto Rico.

Consolidated Operating Profit and EBITDA

ASUR reported a Consolidated Operating Profit of

Ps.4,342.9 million in 2Q24, with an operating margin of 58.7%, compared to Ps.3,904.1 million and an operating margin of 63.4% in 2Q23.

Adjusted Operating Margin was 61.2% in 2Q24 compared

to 64.8% in 2Q23. Adjusted Operating Margin excludes the effect of IFRIC 12 with respect to the construction of or improvements to concessioned

assets in Mexico, Colombia, and Puerto Rico, which is calculated as operating profit or loss divided by total revenue minus revenue from

construction services.

EBITDA increased 18.0%, or Ps.749.6 million,

to Ps.4,909.9 million in 2Q24, from Ps.4,160.3 million in 2Q23. By country of operations, EBITDA increased by 17.8%, or Ps.591.6 million

to Ps.3,914.0 million in Mexico, and 1.7%, or Ps.9.3 million, to Ps.543.0 million in Puerto Rico and 48.9%, or Ps.148.7 million, to Ps.452.9

million in Colombia.

Consolidated EBITDA margin in 2Q24 was

66.4% compared to 67.6% in 2Q23.

Adjusted EBITDA Margin, which excludes

the effect of IFRIC 12 with respect to the construction of or improvements to concessioned assets in Mexico, Puerto Rico, and Colombia,

was 69.2% in 2Q24, compared to 69.1% in 2Q23.

Comprehensive Financing Gain (Loss)

| Table 5: Consolidated Comprehensive Financing Gain (Loss) |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Second Quarter |

% Chg. |

|

Six-Months |

% Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Interest Income |

296,670 |

372,072 |

25.4 |

|

561,730 |

781,797 |

39.2 |

| Interest Expense |

(281,678) |

(106,097) |

(62.3) |

|

(587,670) |

(361,499) |

(38.5) |

| Foreign Exchange Gain (Loss), Net |

(344,984) |

941,963 |

n/a |

|

(831,892) |

745,598 |

n/a |

| Total |

(329,992) |

1,207,938 |

n/a |

|

(857,832) |

1,165,896 |

n/a |

In 2Q24 ASUR reported a Ps.1,207.9 million Consolidated

Comprehensive Financing Gain, compared to a Ps.330.0 million loss in 2Q23. This variation is mainly attributed to a foreign exchange

gain of Ps.942.0 million in 2Q24 compared to a foreign exchange loss of Ps.345.0 million in 2Q23.

The foreign exchange gain in 2Q24 resulted from the

10.4% quarter-end depreciation of the Mexican peso against the U.S. dollar on a U.S. dollar net asset position (4.4% average depreciation)

during the covered period. The foreign exchange loss in 2Q23 resulted from the 5.0% quarter-end appreciation of the Mexican peso against

the U.S. dollar on a U.S. dollar net asset position (1.9% average appreciation) during the covered period.

Interest income increased 25.4%, or Ps.75.4 million

reflecting a higher cash balance position, while interest expenses declined 62.3%, or Ps.175.6 million resulting from principal payments

in Mexico and Puerto Rico.

Income Taxes

Income Taxes for 2Q24 increased Ps.844.9 million

YoY, principally due to the following variations:

| · | A Ps.654.2 million increase in

income taxes, mainly due to a higher taxable income base in Mexico and Colombia. |

| · | A Ps.190.7 million increase in deferred income taxes, mainly

in Mexico, resulting from the initial recognition of deferred income tax on untaxed accumulated profits from investments in Puerto Rico

and Colombia. |

Net Majority Income

ASUR reported Majority Net Income of Ps.3,673.6

million in 2Q24, compared to Ps.2,444.7 million in 2Q23. This resulted in earnings per common share in 2Q24 of Ps.12.2452, or earnings

per ADS of US$6.7105 (one ADS represents ten series B common shares). This compared to earnings per share of Ps.8.1490, or earnings per

ADS of US$4.4658 for 2Q23.

Net Income

ASUR reported Net Income of Ps.3,779.4 million

in 2Q24, an increase of 42.7%, or Ps.1,130.0 million, from Ps.2,649.4 million in 2Q23.

Consolidated Financial Position

Airport concessions represented 69.5% of ASUR´s

total assets as of June 30, 2024, with current assets representing 28.0% and other assets 2.5%.

As of June 30, 2024, cash and cash equivalents amounted

to Ps.14,997.0 million, an 8.1% increase from Ps.13,872.9 million as of December 31 2023. Cash and cash equivalents in México,

Colombia and Puerto Rico amounted to Ps.10,911.7 million, Ps.2,193.6 million and Ps.1,891.7 million, respectively.

As of June 30, 2024, the valuation of ASUR’s investment

in Aerostar in accordance with IFRS 3 "Business Combinations," had the following effects on its balance sheet: (i) the recognition

of a net intangible asset of Ps.4,770.1 million, (ii) goodwill of Ps.871.8 million (net of an impairment of Ps.4,719.1 million), (iii)

deferred taxes of Ps.477.0 million, and (iv) a minority interest of Ps.4,912.4 million in stockholders' equity.

The valuation of ASUR’s investment in Airplan,

in accordance with IFRS 3 “Business Combinations”, resulted in the following effects on the balance sheet as of June 30,

2024: (i) the recognition of a net intangible asset of Ps.793.1 million, (ii) goodwill of Ps.1,431.5 million, (iii) deferred taxes of

Ps.245.4 million, and (iv) a Ps.91.8 million recognition of bank loans at fair value.

As of June 30, 2024, Stockholders’ equity was

Ps. Ps.53,207.0 million and total liabilities were Ps.19,467.0, representing 73.2% and 26.8% of ASUR’s total assets, respectively.

Deferred liabilities represented 17.6% of ASUR’s total liabilities.

As of June 30, 2024, Total Debt declined 0.6% to Ps.12,154.4

million from Ps. 12,224.8 million as of December 31, 2023, mainly reflecting: (i) the FX conversion impact of the Mexican peso depreciation

against the U.S. dollar and the Colombian peso, and (ii) payment of principal amounts of outstanding debt of Ps.50.0 million in Mexico

and Ps.438.7 million in Colombia.

As of June 30, 2024, 20.0% of ASUR’s Total Debt

was denominated in Mexican pesos, 76.8% in U.S. Dollars (at Aerostar in Puerto Rico) and 3.2% in Colombian pesos (debt at Airplan in Colombia).

In July 2022, Aerostar in Puerto Rico issued US$200

million principal amount of 4.92% senior secured notes due March 22, 2035. In May 2022, Aerostar renegotiated the terms of its US$50 million

principal amount of 6.75% senior secured notes originally due on June 24, 2015, and extended their maturity through March 22, 2035. All

long-term debt is collateralized by Aerostar’s assets.

On November 15, 2023, Aerostar renewed the US$20.0

million revolving credit facility with Banco Popular de Puerto Rico, with a maturity date of December 29, 2026. As of June 30, 2024, no

such credit line has been drawn.

In April 2023, Banco Popular transferred to the Bank

of Bogotá its interests under the syndicated loan entered into with Airplan by issuing promissory notes under the same terms and

conditions than the original loan.

LTM Net Debt-to-LTM EBITDA stood at negative 0.2x at

the close of 2Q24, while the Interest Coverage Ratio was 12.2x. This compared with LTM Net Debt-to-LTM EBITDA of negative 0.1x and an

Interest Coverage Ratio of 11.5x as of June 30, 2023, respectively.

| Table

6: Consolidated Debt Indicators |

|

|

|

| |

|

|

|

| |

June

30, 2023 |

December

31, 2023 |

June

30, 2024 |

| Apalancamiento |

|

|

|

| Total

Debt/ LTM EBITDA (Times) 1 |

0.8 |

0.7 |

0.7 |

| Total

Net Debt/ LTM EBITDA (Times) 2 |

(0.1) |

(0.3) |

(0.2) |

| Interest

Coverage Ratio 3 |

11.5 |

11.4 |

12.2 |

| Total

Debt |

13,147,327 |

12,224,770 |

12,154,453 |

| Short-term

Debt |

1,881,660 |

1,233,639 |

1,291,986 |

| Long-term

Debt |

11,265,667 |

10,991,131 |

10,862,467 |

| Cash

& Cash Equivalents |

14,474,035 |

16,917,191 |

14,996,995 |

| Total

Net Debt 4 |

(1,326,708) |

(4,692,421) |

(2,842,542) |

| 1

The Total Debt to EBITDA Ratio is calculated as ASUR’s interest-bearing liabilities divided by its EBITDA. |

| 2

Total Net Debt to EBITDA Ratio is calculated as ASUR’s interest-bearing liabilities minus Cash & Cash Equivalents,

divided by EBITDA. |

| 3

The Interest Coverage Ratio for Mexico is calculated as ASUR’s LTM EBIDA divided by its LTM interest expenses. For Puerto

Rico, it is calculated as LTM Cash Flow Generation divided LTM debt service, and for Colombia as LTM EBITDA minus LTM taxes divided

by LTM debt service. |

4

Total net debt is calculated as Asur´s total debt without cash & cash Equivalents.

|

| Table

7: Consolidated Debt (million) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Aerostar

Dls |

Cancun

Airport M´Mxp $ |

Airplan

M Col Ps |

| Original

Amount |

350´M

|

200´M

|

50´M |

BBVA 2,000 |

Santander

2,650 |

Syindicated

Loan

440,000 |

| Interest

Rate |

5.75% |

4.92% |

6.75% |

TIIE

+ 1.4 pp |

TIIE

+1.5 pp |

DTF

+ 4pp |

Principal Balance as of June 30,

2024 |

271.3 |

200.0 |

42.0 |

1,750.0 |

675.0 |

67,897.2 |

| 2024 |

6.5 |

-

|

-

|

100.0 |

|

|

| 2025 |

13.6 |

-

|

-

|

275.0 |

675.0 |

-

|

| 2026 |

15.0 |

-

|

-

|

375.0 |

-

|

30,499.7 |

| 2027 |

16.6 |

-

|

-

|

475.0 |

-

|

37,397.5 |

| 2028 |

16.2 |

-

|

-

|

525.0 |

-

|

-

|

| 2029 |

17.3 |

-

|

-

|

-

|

-

|

-

|

| 2030 |

20.9 |

-

|

-

|

-

|

-

|

-

|

| 2031 |

27.0 |

-

|

-

|

-

|

-

|

-

|

| 2032 |

34.4 |

-

|

-

|

-

|

-

|

-

|

| 2033 |

38.5 |

-

|

-

|

-

|

-

|

-

|

| 2034 |

42.6 |

-

|

-

|

-

|

-

|

-

|

| 2035 |

22.6 |

200.0 |

42.0 |

-

|

-

|

-

|

| |

1 DTF is an average 90-day rate

to which the credit facilities in Colombia are pegged.

The loans from Mexico were made in October

2017, with Bancomer and Santander. The bonds from Puerto Rico were issued in March 2013 and June 2015 (in May 2022 the payment date

at maturity was modified to 2035). The syndicated loan from Colombia was obtained in June 2015, with a grace period of three years.

In April 2022, Airplan made capital payments for Cop. 100,000 million, and its next principal payment is due in September 2026. In

July 2022, Aerostar issued senior secured notes for US$200,000 million due March 22, 2035. On November 30, 2022, March 29, 2023,

and September 29, 2023 Cancun Airport prepaid Ps.650 million, Ps.662.5 million and Ps.662.5 million of the loan with Santander, respectively.

Cancún Airport made capital payments of Ps.50 million of the BBVA loan on each of the following dates: April 14, 2023, July

14, 2023, October 13, 2023, January 15, 2024 and 15 April 2024.

*Expressed in the original currency of

each loan. |

|

| |

|

|

|

|

|

|

|

Strong Liquidity Position and Healthy

Debt Maturity Profile

ASUR closed 2Q24 with a solid financial position, with

cash and cash equivalents totaling Ps.14,997.0 million and Ps.12,154.4 million in Total Debt. A total of Ps.168.0 million in principal

amount of outstanding debt payments is due in 3Q24.

The following table shows the liquidity position for each of ASUR’s

regions of operations:

|

Table 8: Liquidity

Position as of June 30, 3024 |

|

|

|

| Figures

in thousands of Mexican Pesos |

|

|

|

| Region

of Operation |

Cash

&

Equivalents |

Total

Debt |

Short-term

Debt |

Long-term

Debt |

Principal

Payments

(July - October

2024) |

| Mexico |

10,911,734 |

2,425,149 |

909,257 |

1,515,892 |

50,000 |

| Puerto

Rico |

1,891,659 |

9,335,025 |

380,515 |

8,954,510 |

117,963 |

| Colombia |

2,193,602 |

394,279 |

2,214 |

392,065 |

0 |

| Total |

14,996,995 |

12,154,453 |

1,291,986 |

10,862,467 |

167,963 |

|

|

|

|

|

|

| Table

9: Debt Maturity Profile as of June 30, 2024 |

| Figures

in thousands of Mexican Pesos |

|

|

|

|

| Region

of Operation |

2024 |

2025 |

2026 |

2027/2035 |

| Mexico |

100,000 |

950,000 |

375,000 |

1,000,000 |

| Puerto

Rico |

117,963 |

248,207 |

273,604 |

8,725,259 |

| Colombia |

0 |

0 |

134,883 |

165,388 |

| Total |

217,963 |

1,198,207 |

783,487 |

9,890,646 |

| 1

Figures in pesos converted at the exchange rate at the close of the quarter Ps.18.2478=US$1.00 |

| 2

Figures in pesos converted at the exchange rate at the close of the quarter of COP 226.12=Ps.1.00 |

| Note:

Figures only reflect principal payments. |

|

|

|

|

| Table

10: Debt Ratios at June 30, 2024 |

| |

LTM EBITDA and interest expense figures in thousands of Mexican Pesos

|

| Region |

LTM

EBITDA |

LTM

Interest

Expenses |

Debt

Coverage Ratio |

Minimum

Coverage

Requirement as per

Agreements |

| Mexico

1 |

14,714,478 |

349,947 |

42.0 |

3.0 |

| Puerto

Rico 2 |

1,474,506 |

738,592 |

2.0 |

1.1 |

| Colombia

3 |

1,261,408 |

345,552 |

3.7 |

1.2 |

| Total |

17,450,392 |

1,434,091 |

12.2 |

|

| 1

Per the applicable debt agreement, the formula for the Interest Coverage ratio is: LTM EBITDA/ LTM Interest Expense. |

| 2

Per the applicable debt agreement, the formula for the Debt Coverage ratio is: LTM Cash Flow Generation / LTM Debt Service.

LTM Cash Flow Generation for the period was Ps.1,474,5 million and LTM Debt Service was Ps.738,6 million. |

| 3

Per the applicable debt agreement, the formula for the Debt Coverage ratio is: (LTM EBITDA minus LTM Taxes)/ LTM Debt Service.

EBITDA minus Taxes for the period amounted to Ps.1,261.4 million and Debt Service was Ps.345.6 million. |

Accounts Receivables

Accounts receivables increased 28.5% YoY in 2Q24, mainly

driven by increased activity in Mexico and Colombia.

On February 28 and March 29, 2023 Viva Colombia and

Ultra Air in Colombia suspended operations. At the close of 2Q24, these two companies owed ASUR Ps.14.5 million and Ps.10.2 million, respectively

and have been provisioned.

| Table

11: Accounts Receivables at June 30, 2024 |

|

|

|

| Figures

in thousands of Mexican Pesos |

|

|

|

| Region |

2Q23 |

2Q24 |

%

Chg. |

| Mexico |

1,741,418 |

2,267,510 |

30.2 |

| Puerto

Rico |

156,871 |

138,474 |

(11.7) |

| Colombia |

52,180 |

100,682 |

93.0 |

| Total |

1,950,469 |

2,506,666 |

28.5 |

| Note:

Net of allowance for bad debts. |

Capital Expenditures

ASUR made capital expenditures of Ps.646.8 million in

2Q24. Of this amount, Ps.461.6 million were allocated to modernizing the Company´s Mexican airports pursuant to its master development

plans, Ps.173.7 million were invested by Aerostar in Puerto Rico and Ps.1.5 million were invested by Airplan in Colombia. This compared

to Ps.152.9 million invested in 2Q23, of which Ps.81.3 million were invested in Mexico, Ps.70.9 million in Puerto Rico and Ps.0.7 million

in Colombia. On an accumulated basis, ASUR made capital expenses for a total of Ps.819.4 million in 6M24, of which Ps.567.8 million, were

allocated to its Mexican airports, Ps.246.1 million invested by Aerostar in Puerto Rico and Ps.5.5 million invested by Airplan in Colombia.

This compares to a total of Ps.295.9 million invested in 6M23, of which Ps.151.6 million were allocated to its Mexican airports, Ps.137.6

million in Puerto Rico and Ps.6.7 million in Colombia.

Review of Mexico

Operations

| Table

12: Mexico Revenues & Commercial Revenues Per Passenger |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Total

Passenger |

10,764 |

10,249 |

(4.8) |

|

21,899 |

21,803 |

(0.4) |

| |

|

|

|

|

|

|

|

| Total

Revenues |

4,541,133 |

5,428,666 |

19.5 |

|

9,316,279 |

11,074,778 |

18.9 |

| Aeronautical

Services |

2,766,378 |

3,513,751 |

27.0 |

|

5,631,981 |

7,099,255 |

26.1 |

| Non-Aeronautical

Services |

1,700,963 |

1,766,963 |

3.9 |

|

3,527,025 |

3,641,091 |

3.2 |

| Construction

Revenues |

73,792 |

147,952 |

100.5 |

|

157,273 |

334,432 |

112.6 |

| Total

Revenues Excluding Construction Revenues |

4,467,341 |

5,280,714 |

18.2 |

|

9,159,006 |

10,740,346 |

17.3 |

| |

|

|

|

|

|

|

|

| Total

Commercial Revenues |

1,524,765 |

1,583,901 |

3.9 |

|

3,161,011 |

3,262,322 |

3.2 |

| Commercial

Revenues from Direct Operations |

296,822 |

283,176 |

(4.6) |

|

631,422 |

620,680 |

(1.7) |

| Commercial

Revenues Excluding Direct Operations |

1,227,943 |

1,300,725 |

5.9 |

|

2,529,589 |

2,641,642 |

4.4 |

| |

|

|

|

|

|

|

|

| Total

Commercial Revenues per Passenger |

141.6 |

154.5 |

9.1 |

|

144.3 |

149.6 |

3.7 |

| Commercial

Revenues from Direct Operations per Passenger 1 |

27.6 |

27.6 |

0.2 |

|

28.8 |

28.5 |

(1.3) |

| Commercial

Revenues Excl. Direct Operations per Passenger |

114.1 |

126.9 |

11.3 |

|

115.5 |

121.2 |

4.9 |

| For the purposes of this table, approximately 66.6 and 55.0 thousand transit and general aviation passengers are included in 2Q23 and 2Q24 respectively, while 127.6 and 113.4 thousand transit and general aviation passengers are included in 6M23 and 6M24. |

| 1 Represents the operation of ASUR in its convenience stores in Mexico. |

Mexico Revenues

Mexico Revenues increased 19.5% YoY to Ps.5,429.0

million, mainly reflecting the new terms of the Master Development Plan published on December 13, 2023 and effective starting January

1, 2024.

Excluding construction, revenues increased 18.2%

YoY, mainly due to increases of 27.0% in revenues from aeronautical services and 3.9% in revenues from non-aeronautical services.

Commercial Revenues increased 3.9% YoY, as shown

in Table 12.

Commercial Revenues per Passenger for 2Q24 increased

to Ps.154.5 compared to Ps.141.6 in 2Q23.

ASUR classifies commercial revenues

as those derived from the following activities: duty-free stores, car rentals, retail operations, banking and currency exchange services,

advertising, teleservices, non-permanent ground transportation, food and beverage operations, parking lot fees, and other.

As shown in Table 14, during the last 12 months, ASUR

opened 17 new commercial spaces, 6 at Merida, 2 each at Tapachila and Veracruz airports, and 1 each at Cancun, Oaxaca, Huatulco, Cozumel,

Minatitlan, and Villahermosa airports. More details of these openings can be found on page 20 of this report.

| Table

13: Mexico Commercial Revenue Performance |

|

|

Table

14: Mexico Summary Retail and Other

Commercial

Space Opened since June 30, 2023 |

| |

|

|

|

| Business

Line |

YoY

Chg |

|

Type

of Commercial Space 1 |

#

Of Spaces Opened |

| 2Q24 |

6M24 |

|

| Car

rental |

30.0% |

26.6% |

|

Cancun |

1 |

| Car

parking |

9.9% |

6.6% |

|

Car

rental |

1 |

| Advertising |

9.8% |

12.8% |

|

8

Others airports |

16 |

| Ground

Transportation |

9.1% |

9.8% |

|

Retail |

2 |

| Retail |

5.9% |

0.8% |

|

Car

rental |

14 |

| Banks

and foreign exchange |

3.2% |

(8.3%) |

|

Mexico |

17 |

| Duty

Free |

0.8% |

2.4% |

|

|

|

| Other

Revenues |

(4.3%) |

(3.5%) |

|

|

|

| Teleservices |

(7.3%) |

(20.6%) |

|

1

Only includes new stores opened during the period and excludes remodelings or contract renewals. |

|

| Food

and Beverage |

(7.9%) |

(0.6%) |

|

|

|

| Total

Commercial Revenues |

3.9% |

3.2% |

|

|

|

Mexico Operating Costs and Expenses

| Table

15: Mexico Operating Costs & Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

|

2023 |

2024 |

|

| Cost

of Services |

689,629 |

744,473 |

8.0 |

|

1,312,734 |

1,433,606 |

9.2 |

| Administrative |

76,325 |

80,753 |

5.8 |

|

153,566 |

159,772 |

4.0 |

| Technical

Assistance |

174,434 |

100,279 |

(42.5) |

|

364,745 |

206,594 |

(43.4) |

| Concession

Fees |

204,826 |

441,248 |

115.4 |

|

411,827 |

891,511 |

116.5 |

| Depreciation

and Amortization |

261,444 |

294,588 |

12.7 |

|

517,681 |

583,772 |

12.8 |

| Operating

Costs and Expenses Excluding Construction Costs |

1,406,658 |

1,661,341 |

18.1 |

|

2,760,553 |

3,275,255 |

18.6 |

| Construction

Costs |

73,792 |

147,952 |

100.5 |

|

157,273 |

334,432 |

112.6 |

| Total

Operating Costs & Expenses |

1,480,450 |

1,809,293 |

22.2 |

|

2,917,826 |

3,609,687 |

23.7 |

Total Mexico Operating Costs and Expenses increased

22.2% YoY, or Ps.328.8 million. Excluding construction costs, operating costs and expenses increased 18.1%, or Ps.254.7 million, mainly

due to higher concession fees, personnel expenses, surveillance and cleaning services, and maintenance and conservation costs.

Cost of Services increased 8.0% YoY, primarily

due to increases in personnel, surveillance and cleaning services, maintenance, and conservation

Administrative Expenses increased 5.8% YoY.

The Technical Assistance fee

declined 42.5% YoY, principally due to the reduction in the technical assistance fees charged by ITA to 2.5% from 5.0% of the EBITDA generated

by ASUR´s Mexican operations starting January 1, 2024.

Concession Fees, which include fees paid to the

Mexican government, increased by 115.4%, principally due to the 80% increase in the concession fee rate and the increase in the calculation

base.

Depreciation and Amortization increased 12.7%

YoY, due to the recognition of investments made to date.

Mexico Consolidated Comprehensive

Financing Gain (Loss)

| Table

16: Mexico Comprehensive Financing Gain (Loss) |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Interest

Income |

216,770 |

286,652 |

32.2 |

|

401,189 |

595,297 |

48.4 |

| Interest

Expense |

(117,682) |

(88,349) |

(24.9) |

|

(253,060) |

(181,848) |

(28.1) |

| Foreign

Exchange Gain (Loss), Net |

(344,478) |

942,142 |

n/a |

|

(831,371) |

745,722 |

n/a |

| Total |

(245,390) |

1,140,445 |

n/a |

|

(683,242) |

1,159,171 |

n/a |

During 2Q24, ASUR’s Mexico operations reported

a Ps.1,140.4 million Comprehensive Financing Gain, compared to a Ps.245.4 million loss in 2Q23. This was mainly due to a Ps.942.1 million

foreign exchange gain reported in in 2Q24, resulting from the 10.4% quarter-end depreciation of the Mexican peso against the U.S. dollar

on a foreign currency net asset position (4.4% average depreciation). This compared to a Ps.344.5 million foreign exchange loss in 2Q23,

resulting from the 5.0% quarter-end appreciation of the Mexican peso during that period against the U.S. dollar on a foreign currency

net asset position (1.9% average appreciation).

Interest income increased 32.2% YoY, or Ps.69.9 million,

increase in interest income resulting from a higher cash balance, combined with a YoY decline of 24.9%, or Ps.29.3 million, in interest

expenses mainly due to principal payments in 2023 and 1Q24.

Mexico Operating Profit (Loss) and EBITDA

| Table 17: Mexico Profit & EBITDA |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Total

Revenue |

4,541,133 |

5,428,666 |

19.5 |

|

9,316,279 |

11,074,778 |

18.9 |

| Total

Revenues Excluding Construction Revenues |

4,467,341 |

5,280,714 |

18.2 |

|

9,159,006 |

10,740,346 |

17.3 |

| Operating

Profit |

3,060,683 |

3,619,373 |

18.3 |

|

6,398,453 |

7,465,091 |

16.7 |

| Operating

Margin |

67.4% |

66.7% |

(73

bps) |

|

68.7% |

67.4% |

(127

bps) |

| Adjusted

Operating Margin 1 |

68.5% |

68.5% |

3

bps |

|

69.9% |

69.5% |

(35

bps) |

| Net

Profit 2 |

1,978,141 |

3,189,436 |

61.2 |

|

4,128,265 |

5,854,406 |

41.8 |

| EBITDA |

3,322,367 |

3,913,960 |

17.8 |

|

6,916,382 |

8,048,862 |

16.4 |

| EBITDA

Margin |

73.2% |

72.1% |

(106

bps) |

|

74.2% |

72.7% |

(156

bps) |

| Adjusted

EBITDA Margin 3 |

74.4% |

74.1% |

(25

bps) |

|

75.5% |

74.9% |

(57

bps) |

| 1

Adjusted Operating Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets,

and is equal to operating profit divided by total revenues less construction services revenues. |

| 2

This result includes revenues from the participation of Aerostar Ps.183.3 million and 327.0 million in 2Q24 and 2Q23, respectively,

for Airplan Ps.221.1 million and Ps.142.3 million in 2Q24 and 2Q23, respectively. |

| 3

Adjusted EBITDA Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets,

and is calculated by dividing EBITDA by total revenues less construction services revenues. |

Mexico reported an Operating Gain of Ps.3,619.4

million and an Operating Margin of 66.7% in 2Q24. This compared to an Operating Gain of Ps.3,060.7 million and an Operating

Margin of 67.4% in 2Q23.

Adjusted Operating Margin remained unchanged

YoY at 68.5%. Adjusted Operating Margin excludes the effect of IFRIC 12 with respect to the construction of or improvements to concessioned

assets and is calculated as operating profit divided by total revenues excluding construction services revenues.

EBITDA increased 17.8%, or Ps.591.6 million,

to Ps.3,914.0 million in 2Q24, from Ps.3,322.4 million in 2Q23. EBITDA margin in 1Q24 was 72.1% compared to 73.2% in 2Q23.

Adjusted EBITDA Margin, which excludes the effect

of IFRIC 12 with respect to the construction of or improvements to concessioned assets, was 74.1% in 2Q24, compared to 74.4% in 2Q23.

Mexico Tariff Regulation

The Mexican Ministry of Communications and Transportation

regulates the majority of ASUR’s activities by setting maximum rates, which represent the maximum possible revenues allowed per

traffic unit at each airport.

ASUR’s accumulated regulated revenues at its Mexican

operations, as of June 30, 2024 totaled Ps.7,335.5 million, with an average tariff per workload unit of Ps.326.4 (December 2023 Mexican

pesos), representing approximately 68.3% of total income in Mexico (excluding construction revenues) for the period.

The Mexican Ministry

of Communications and Transportation reviews compliance with maximum rate regulations at the end of each year.

Mexico Capital Expenditures

During 2Q24 ASUR invested Ps.461.6 million in connection

with its plan to modernize its Mexican airports under its master development plans, compared to an investment of Ps.81.3 million in 2Q23.

On an accumulated basis, capital investments in Mexican operations totaled Ps.567.8 million, compared to Ps.151.6 million in 2Q23.

Review of Puerto Rico Operations

The following discussion compares Aerostar’s independent

results for the three and six-month periods ended June 30, 2023 and 2024.

As of June 30, 2024, the valuation of ASUR’s investment

in Aerostar in accordance with IFRS 3 "Business Combinations," had the following effects on its balance sheet: (i) the recognition

of a net intangible asset of Ps.4,770.1 million, (ii) goodwill of Ps.871.8 million (net of an impairment of Ps.4,719.1 million), (iii)

deferred taxes of Ps. 477.0 million, and (iv) a minority interest of Ps.4,912. million in stockholders' equity.

| Puerto

Rico Revenues & Commercial Revenues Per Passenger |

|

|

|

|

| Figures

in thousands of Mexican Pesos |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Total

Passenger |

3,199 |

3,469 |

8.5 |

|

6,106 |

6,731 |

10.2 |

| |

|

|

|

|

|

|

|

| Total

Revenues |

1,036,616 |

1,182,580 |

14.1 |

|

2,047,559 |

2,216,162 |

8.2 |

| Aeronautical

Services |

508,939 |

518,307 |

1.8 |

|

1,037,234 |

1,020,895 |

(1.6) |

| Non-Aeronautical

Services |

470,703 |

513,556 |

9.1 |

|

893,520 |

978,290 |

9.5 |

| Construction

Revenues |

56,974 |

150,717 |

164.5 |

|

116,805 |

216,977 |

85.8 |

| Total

Revenues Excluding Construction Revenues |

979,642 |

1,031,863 |

5.3 |

|

1,930,754 |

1,999,185 |

3.5 |

| |

|

|

|

|

|

|

|

| Total

Commercial Revenues |

468,358 |

510,794 |

9.1 |

|

889,014 |

973,438 |

9.5 |

| Commercial

Revenues from Direct Operations |

108,903 |

110,571 |

1.5 |

|

209,510 |

218,049 |

4.1 |

| Commercial

Revenues Excluding Direct Operations |

359,455 |

400,223 |

11.3 |

|

679,504 |

755,389 |

11.2 |

| |

|

|

|

|

|

|

|

| Total

Commercial Revenues per Passenger |

146.4 |

147.2 |

0.6 |

|

145.6 |

144.6 |

(0.7) |

| Commercial

Revenues from Direct Operations per Passenger 1 |

34.0 |

31.9 |

(6.4) |

|

34.3 |

32.4 |

(5.6) |

| Commercial

Revenues Excl. Direct Operations per Passenger |

112.4 |

115.4 |

2.7 |

|

111.3 |

112.2 |

0.8 |

| Figures

in pesos at the average exchange rate Ps.17.2558 = US. 1.00 for 2Q24 and for 6M24 the figures in pesos at the exchange rate of Ps.17.1113

= USD1.00 |

| 1

Represents ASUR´s operations in convenience stores in Puerto Rico. |

Puerto Rico Revenues

Total Puerto Rico Revenues increased 14.1% YoY

to Ps.1,182.6 million in 2Q24.

Excluding construction services, revenues increased

by 5.3% YoY, mainly due to increases of 9.1% in revenues from non-aeronautical services and 1.8% in revenues from aeronautical services.

Commercial Revenues per Passenger were Ps.147.2

in 2Q24, compared to Ps.146.4 in 2Q23.

Four commercial spaces were opened at Luis Muñoz

Marin (LMM) Airport over the last 12 months, as shown in Table 20. More details can be found on page 21 of this report.

ASUR classifies commercial revenues as those derived

from the following activities: duty-free stores, car rentals, retail operations, advertising, non-permanent ground transportation, food

and beverage operations, parking lot fees, banking and currency exchange services, and others.

| Table

19: Puerto Rico Commercial Revenues Performance |

|

Table

20: Puerto Rico Summary Retail and Other Commercial Space Opened since June 30, 2023 |

| Business

Line |

YoY

Chg. |

|

Type

of Commercial Space 1 |

#

of Spaces

Opened |

| 2T24 |

6M24 |

|

| Ground

Transportation |

24.8% |

23.7% |

|

Food

and beverage |

2 |

| Advertising |

24.8% |

5.6% |

|

Retail |

2 |

| Food

and beverage |

24.5% |

21.0% |

|

Total

Commercial space |

4 |

| Others

revenues |

11.5% |

8.2% |

|

|

|

| Car

rentals |

9.9% |

13.8% |

|

|

|

| Car

parking |

7.6% |

4.0% |

|

1

Solo incluye nuevas tiendas abiertas durante el periodo y excluye remodelaciones o renovaciones a contratos. |

| Duty

Free |

6.6% |

(1.9%) |

|

|

|

| Retail |

3.0% |

4.9% |

|

|

|

| Banks

and foreign exchange |

0.4% |

(2.7%) |

|

|

|

| Total

Commercial Revenues |

9.1% |

9.5% |

|

|

|

Puerto Rico Costs & Expenses

| Table

21: Puerto Rico Operating Costs & Expenses |

|

|

|

|

|

|

| In

thousands of Mexican pesos |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Cost

of Services |

146,935 |

440,255 |

199.6 |

|

531,680 |

833,769 |

56.8 |

| Concession

Fees |

46,628 |

48,628 |

4.3 |

|

92,766 |

95,427 |

2.9 |

| Depreciation

and Amortization |

159,398 |

170,305 |

6.8 |

|

329,068 |

328,266 |

(0.2) |

| Operating

Costs and Expenses Excluding Construction Costs |

352,961 |

659,188 |

86.8 |

|

953,514 |

1,257,462 |

31.9 |

| Construction

Costs |

56,974 |

150,717 |

164.5 |

|

116,805 |

216,977 |

85.8 |

| Total

Operating Costs & Expenses |

409,935 |

809,905 |

97.6 |

|

1,070,319 |

1,474,439 |

37.8 |

| Figures

in pesos at the average exchange rate Ps.17.2558 = US. 1.00 for 2Q24 and for 6M24 the figures in pesos at the exchange rate of Ps.17.1113

= USD1.00 |

Total Operating Costs and Expenses for 2Q24 in

Puerto Rico increased 97.6% YoY to Ps.809.9 million. Construction costs increased 164.5%, to Ps.150.7 million in 2Q24 from Ps.57.0 million

in 2Q23.

Excluding construction costs, operating costs and

expenses increased 86.8% YoY, or Ps.306.2 million, mainly due the recovery of expenses under the CRRSAA Act for an amount of Ps.252.3

million in 2Q23. Excluding this benefit in 2Q23, operating costs and expenses increased 8.9%, or Ps.53.8 million, mainly due to increases

in personnel costs, together with higher energy insurance and surety bonds, professional fees, security costs and depreciation and amortization.

Cost of Services increased 199.6%, or Ps.293.3

million in 2Q24, principally reflecting the recovery of expenses under the ARPA law in 2Q23 for a total of Ps.252.3 million. Excluding

this impact, cost of services increased 10.3%, or Ps.40.9 million, mainly due to higher personnel and energy costs, insurance and surety

bonds, professional fees, and security services.

Concession Fees paid to the Puerto Rican government

in 2Q24 increased 4.3% YoY, or Ps.2.0 million.

Depreciation and Amortization declined 6.8% YoY,

or Ps.10.9 million, principally reflecting the foreign exchange translation impact.

Puerto Rico Comprehensive Financing

Gain (Loss)

| Table

22: Puerto Rico Comprehensive Financing Gain (Loss) |

| In

thousands of Mexican pesos |

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Interest

Income |

33,585 |

30,604 |

(8.9) |

|

64,928 |

61,163 |

(5.8) |

| Interest

Expense |

(138,462) |

(129,971) |

(6.1) |

|

(285,878) |

(258,792) |

(9.5) |

| Total |

(104,877) |

(99,367) |

(5.3) |

|

(220,950) |

(197,629) |

(10.6) |

| Figures

in pesos at the average exchange rate Ps.17.2558 = US. 1.00 for 2Q24 and for 6M24 the figures in pesos at the exchange rate of Ps.17.1113

= USD1.00io de Ps.17.2558 = USD1.00 para el 2T24 y para los 6M24 las cifras en pesos al tipo de cambio de Ps.17.1113 = USD1.00 |

During 2Q24, Puerto Rico reported a Ps.99.4 million

Comprehensive Financing Loss, compared to a Ps.104.9 million loss in 2Q23, mainly due to principal payments made on Aerostar’s

outstanding debt.

On March 22, 2013, Aerostar carried out a private bond

placement for a total of US$350.0 million to finance a portion of the Concession Agreement payment to the Puerto Rico Ports Authority,

and certain other costs and expenditures associated with it. On June 24, 2015, Aerostar carried out a private bond placement for a total

of US$50.0 million.

In December 2020, Aerostar entered into a three-year

revolving line of credit with Banco Popular de Puerto Rico for the amount of US$20.0 million, which as of June 30, 2024 has not been withdrawn.

In May 2022, Aerostar renegotiated the terms of its

US$50.0 million principal amount of 6.75% senior secured notes, extending the maturity to March 22, 2035.

In July 2022, Aerostar in Puerto Rico issued US$200.0

million principal amount of 4.92% senior secured notes due March 22, 2035.

On November 15, 2023, Aerostar extended the maturity

date of the revolving credit line with Banco Popular de Puerto Rico, now maturing December 29, 2026. As of June 30, 2024, this credit

line has not been drawn.

All long-term debt is collateralized by Aerostar’s

assets.

Puerto Rico Operating Profit and EBITDA

| Table

23: Puerto Rico Profit & EBITDA |

|

|

|

|

|

|

|

| In

thousands of Mexican pesos |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Total

Revenue |

1,036,616 |

1,182,580 |

14.1 |

|

2,047,559 |

2,216,162 |

8.2 |

| Total

Revenues Excluding Construction Revenues |

979,642 |

1,031,863 |

5.3 |

|

1,930,754 |

1,999,185 |

3.5 |

| Other

Revenues |

|

|

|

|

|

|

|

| Operating

Profit |

626,681 |

372,675 |

(40.5) |

|

977,240 |

741,723 |

(24.1) |

| Operating

Margin |

60.5% |

31.5% |

(2894

bps) |

|

47.7% |

33.5% |

(1426

bps) |

| Adjusted

Operating Margin1 |

64.0% |

36.1% |

(2785

bps) |

|

50.6% |

37.1% |

(1351

bps) |

| Net

Income |

511,751 |

264,615 |

(48.3) |

|

736,460 |

526,273 |

(28.5) |

| EBITDA |

533,715 |

542,982 |

1.7 |

|

1,053,944 |

1,069,990 |

1.5 |

| EBITDA

Margin |

51.5% |

45.9% |

(557

bps) |

|

51.5% |

48.3% |

(319

bps) |

| Adjusted

EBITDA Margin2 |

54.5% |

52.6% |

(186

bps) |

|

54.6% |

53.5% |

(107

bps) |

| Figures

in pesos at the average exchange rate Ps.17.2558 = US. 1.00 for 2Q24 and for 6M24 the figures in pesos at the exchange rate of Ps.17.1113

= USD1.00 |

| 1

Adjusted Operating Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets,

and is equal to operating profit divided by total revenues less construction services revenues. |

| 2

Adjusted EBITDA Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets,

and is calculated by dividing EBITDA by total revenues less construction services revenues. |

Operating Profit in Puerto Rico declined 40.5%

to Ps.372.7 million, resulting in an Operating Margin of 31.5%, compared to an operating profit of Ps.626.7 million and an Operating

Margin of 60.5% in 2Q23. This was mainly due to the recovery of expenses of Ps.252.4 million in 2Q23 under the CRRSAA Act in 2Q23.

EBITDA increased 1.7% to Ps.543.0 million in

2Q24 from Ps.533.7 million 2Q23. The EBITDA Margin declined to 45.9% in 2Q24 from 51.5% in 2Q23.

Adjusted EBITDA Margin (which excludes IFRIC

12) declined to 52.6% in 2Q24 from 54.5% in 2Q23.

Puerto Rico Capital Expenditures

During 2Q24, capital expenditures totaled Ps.173.6 million,

compared to capital expenditures of Ps.70.9 million in 2Q23. On an accumulated basis, total capital expenditures increased to Ps.246.1

million in 6M24, compared to Ps.137.6 million in 6M23.

Puerto Rico Tariff Regulation

The Airport Use Agreement entered into by and among

Aerostar, the airlines serving LMM Airport, and the Puerto Rico Ports Authority governs the relationship between Aerostar and the principal

airlines serving LMM Airport. The agreement entitles Aerostar to an annual contribution from the airlines of US$62.0 million during the

first five years of the term. From year six onwards, the total annual contribution for the prior year increases in accordance with an

adjusted consumer price index factor based on the U.S. non-core consumer price index. The annual fee is divided between the airlines that

operate at LMM Airport in accordance with the regulations and structure defined under the Airport Use Agreement to establish the contribution

of each airline for each particular year.

Review of Colombia

Operations

The following discussion compares Airplan's independent

results for the three- and six-month periods ended June 30, 2024 and 2023.

The valuation of ASUR’s investment in Airplan,

in accordance with IFRS 3 “Business Combinations”, resulted in the following effects on the balance sheet as of June 30,

2024: (i) the recognition of a net intangible asset of Ps.793.1 million, (ii) goodwill of Ps.1,431.5 million, (iii) deferred taxes of

Ps.245.4 million, and (iv) a Ps.91.8 million recognition of bank loans at fair value.

| Table

24: Colombia Revenues & Commercial Revenues Per Passenger |

|

|

|

|

| In

thousands of Mexican pesos |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Total

Passengers |

3,490 |

4,214 |

20.7 |

|

7,543 |

8,104 |

7.4 |

| |

|

|

|

|

|

|

|

| Total

Revenues |

578,694 |

782,764 |

35.3 |

|

1,242,014 |

1,537,977 |

23.8 |

| Aeronautical

Services |

435,659 |

581,884 |

33.6 |

|

919,179 |

1,137,429 |

23.7 |

| Non-Aeronautical

Services |

142,312 |

199,509 |

40.2 |

|

316,045 |

395,484 |

25.1 |

| Construction

Revenues 1 |

723 |

1,371 |

89.6 |

|

6,790 |

5,064 |

(25.4) |

| Total

Revenues Excluding Construction Revenues |

577,971 |

781,393 |

35.2 |

|

1,235,224 |

1,532,913 |

24.1 |

| |

|

|

|

|

|

|

|

| Total

Commercial Revenues |

142,143 |

199,145 |

40.1 |

|

313,616 |

394,514 |

25.8 |

| |

|

|

|

|

|

|

|

| Total

Commercial Revenues per Passenger |

40.7 |

47.3 |

16.2 |

|

41.6 |

48.7 |

17.1 |

| Figures

in Mexican pesos at an average exchange rate of COP.227.4957 = Ps.1.00 Mexican pesos for 2Q24 and COP.228.9373 = Ps.1.00 for 6M24. |

| For

the purposes of this table, approximately 100.6 and 115.3 thousand transit and general aviation passengers are included in 2Q23 and

2Q24 while 267.9 and 200.5 thousand transit and general aviation passengers are included in 6M23 and 6M24. |

Colombia Revenues

Total Revenues in Colombia increased 35.3%

YoY to Ps.782.8 million. Excluding construction services, revenues increased 35.2% YoY, principally reflecting the increase in international

traffic during the period.

Commercial Revenue per Passenger was Ps.47.3

compared to Ps.40.2 in 2Q23.

As shown in Table 26, during the past twelve-months

a total of 33 new commercial spaces were opened in Colombia: 16 in Rionegro, 11 in Olaya Herrera, and 2 each in Monteria, Quibdó,

and the Service Center. Further details of these openings can be found on page 21 of this report.

As shown in Table 26, during the past twelve-months

a total of 33 new commercial spaces were opened in Colombia: 16 in Rionegro, 11 in Olaya Herrera, and 2 each in Monteria, Quibdó,

and the Service Center. Further details of these openings can be found on page 21 of this report.

ASUR classifies commercial revenues as those derived from the following activities:

duty-free stores, car rentals, retail operations, advertising, non-permanent ground transportation, food and beverage operations, parking

lot fees, teleservices, banking and currency exchange services and other.

| Table

25: Colombia Commercial Revenue Performance |

|

|

|

Table

26: Colombia Summary Retail and Other Commercial Space Opened since June 30, 2023 |

| Bussines

Line |

YoY

Chg |

|

Type

of Commercial Space 1 |

#

of

Spaces

Opened |

| 2Q24 |

6M24 |

|

| Advertising |

188.8% |

63.8% |

|

Food

and beverage |

5 |

| Food

and beverage |

82.6% |

28.2% |

|

Retail |

1 |

| Duty

free |

45.3% |

40.5% |

|

Car

rental |

1 |

| Others

revenues |

32.5% |

26.1% |

|

Banks

and foreign exchange |

1 |

| Ground

Transportation |

32.4% |

(29.4%) |

|

Others

revenues |

25 |

| Banks

and foreign exchange |

32.0% |

22.2% |

|

Total

Commercial Spaces |

33 |

| Car

parking |

30.2% |

26.5% |

|

|

|

| Retail |

24.2% |

15.0% |

|

|

|

| Teleservices |

(8.3%) |

(7.0%) |

|

1

Only includes new stores opened during the period and excludes remodelings or contract renewals. |

| Car

rental |

(8.7%) |

(1.3%) |

|

| Total

Commercial Revenues |

40.1% |

25.8% |

|

|

|

Colombia Costs & Expenses

| Table

27: Colombia Costs & Expenses |

|

|

|

|

|

|

|

| In

thousands of Mexican pesos |

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Cost

of Services |

159,580 |

179,861 |

12.7 |

|

276,241 |

327,473 |

18.5 |

| Technical

Assistance |

|

|

|

|

|

|

|

| Concession

Fees |

114,166 |

148,600 |

30.2 |

|

238,600 |

291,478 |

22.2 |

| Depreciation

and Amortization |

87,512 |

102,056 |

16.6 |

|

178,348 |

198,629 |

11.4 |

| Operating

Costs and Expenses Excluding Construction Costs |

361,258 |

430,517 |

19.2 |

|

693,189 |

817,580 |

17.9 |

| Construction

Costs |

723 |

1,371 |

89.6 |

|

6,790 |

5,064 |

(25.4) |

| Total

Operating Costs & Expenses |

361,981 |

431,888 |

19.3 |

|

699,979 |

822,644 |

17.5 |

| Figures

in pesos at an average exchange rate of COP.230.3787 = Ps.1.00 Mexican pesos for 2Q24 and for 6M24 the figures in pesos at the Colombian

exchange rate of COP.228.9373 = Ps.1.00 Mexican pesos. |

Total Operating Costs

and Expenses in Colombia increased 19.3% YoY to Ps.431.9 million. Excluding construction costs, operating costs and expenses increased

19.2% YoY to Ps.430.5 million, principally due to increases in maintenance and conservation, personnel, taxes and duties, security and

cleaning, insurance and surety bond costs, concession fees and energy costs.

Cost of Services increased

12.7% YoY, or Ps.20.3 million, principally resulting from higher maintenance and conservation costs, personnel expenses, taxes and duties,

as well as security, cleaning surety bond costs end energy costs.

Construction Costs increased 89.6% YoY, or Ps.0.6

million.

Concession Fees, which include fees paid to the

Colombian government, increased 30.2% YoY, principally due to the increase in regulated and non-regulated revenues during the period.

Depreciation and Amortization increased 16.6%

YoY.

Colombia Comprehensive Financing Gain (Loss)

| Table

28: Colombia, Comprehensive Financing Gain (Loss) |

| In

thousands of Mexican pesos |

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

| |

2023 |

2024 |

|

2023 |

2024 |

| Interest

Income |

46,315 |

54,816 |

18.4 |

|

95,613 |

125,337 |

31.1 |

| Interest

Expense |

(25,534) |

112,223 |

n/a |

|

(48,732) |

79,141 |

n/a |

| Foreign

Exchange Gain (Loss), Net |

(506) |

(179) |

(64.6) |

|

(521) |

(124) |

(76.2) |

| Total |

20,275 |

166,860 |

723.0 |

|

46,360 |

204,354 |

340.8 |

| Figures

in pesos at an average exchange rate of COP.230.3787 = Ps.1.00 Mexican pesos for 2Q24 and for 6M24 the figures in pesos at the Colombian

exchange rate of COP.228.9373 = Ps.1.00 Mexican pesos. |

During 2Q24, Colombia reported a Ps.166.9 million

Comprehensive Financing Gain, compared to a Ps.20.3 million gain in 2Q23. Interest income increased 18.4% reflecting a higher cash

position and rates.

Interest expenses declined by Ps.137.8 million, mainly

due to the amortization at fair value of the loan originated in the acquisition of the business for Ps.135.2 million.

Colombia Operating Profit (Loss)

and EBITDA

| Table

29: Colombia Profit & EBITDA |

|

|

|

|

|

|

|

|

| In

thousands of Mexican pesos |

|

|

|

|

|

|

|

|

| |

Second

Quarter |

%

Chg. |

|

Six-Months |

%

Chg. |

|

| |

2023 |

2024 |

|

2023 |

2024 |

|

| Total

Revenues |

578,694 |

782,764 |

35.3 |

|

1,242,014 |

1,537,977 |

23.8 |

|

| Total

Revenues Excluding Construction Revenues |

577,971 |

781,393 |

35.2 |

|

1,235,224 |

1,532,913 |

24.1 |

|

| Operating

Profit |

216,713 |

350,876 |

61.9 |

|