0001836981false00018369812025-01-152025-01-150001836981us-gaap:CommonStockMember2025-01-152025-01-150001836981bbai:RedeemableWarrantsMember2025-01-152025-01-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 15, 2025

________________________________________________________

BigBear.ai Holdings, Inc.

(Exact name of Registrant as Specified in Charter)

________________________________________________________

| | | | | | | | |

Delaware | 001-40031 | 85-4164597 |

| (State or Other Jurisdiction of | (Commission | (IRS Employer |

| Incorporation or Organization) | File Number) | Identification Number) |

| | |

6811 Benjamin Franklin Drive, Suite 200 |

Columbia, MD 21046 |

(Address of principal executive offices, including Zip Code) |

(410) 312-0885 |

(Registrant's telephone number, including area code) |

________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | Trading | | Name of each exchange |

Title of each class | | Symbols | | on which registered |

| Common stock, $0.0001 par value | | BBAI | | New York Stock Exchange |

| Redeemable warrants, each full warrant exercisable for one share of common stock at an exercise price of $11.50 per share | | BBAI.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 15, 2025, BigBear.ai Holdings, Inc. (the “Company”) announced that it has appointed Kevin McAleenan as Chief Executive Officer and member of the Board of Directors. Amanda Long will step down as Chief Executive Officer and from the Board of Directors, transitioning to serve as a Company advisor. The Company thanks Mrs. Long for her dedication and service to the Company and its stockholders.

Mr. McAleenan, 53, currently serves as the Company’s President. Mr. McAleenan co-founded Pangiam, and served as Chairman and Chief Executive Officer from January 2020 until Pangiam was acquired by BigBear.ai in 2024. Pangiam developed and delivered identity and risk management software solutions for both government and commercial customers. Prior to founding Pangiam, Mr. McAleenan spent almost two decades in government, focusing on counterterrorism, border and immigration security, and trade and travel security and facilitation. After serving as a career professional at U.S. Customs and Border Protection from 2001 through 2018, Mr. McAleenan was confirmed by the Senate in 2018 as Commissioner, U.S. Customs and Border Protection, and then served as Acting Secretary, Department of Homeland Security under appointment by President Donald J. Trump in 2019. Mr. McAleenan earned a Bachelor of Arts in Political Science from Amherst College and a Juris Doctorate from the University of Chicago Law School.

Mr. McAleenan will serve on the Board as a Class II Director for a term expiring at the Company’s annual meeting of stockholders in 2026 and until his successor has been duly elected and qualified or until his earlier resignation or removal.

There are no arrangements or understandings between Mr. McAleenan and any other person pursuant to which Mr. McAleenan was appointed as Chief Executive Officer. There are no family relationships among any of the Company’s directors or executive officers and Mr. McAleenan.

In connection with his appointment as Chief Executive Officer and pursuant to an offer letter, dated as of January 15, 2025 (the “Offer Letter”), Mr. McAleenan will be entitled to the following compensation: (i) an annualized base salary of $500,000; (ii) eligibility to participate in the Company’s short-term incentive program with an annual bonus target of 125% of his annual base compensation based upon mutually developed performance objectives, to be paid in either cash or performance units, less applicable payroll deductions and withholdings; (iii) an initial award with a value of $4,000,000, to be awarded in the form of 50% restricted stock units and 50% stock options; (iv) beginning in 2025 and subject to Compensation Committee approval, a recurring annual grant estimated to be valued at 200% of base compensation and split (at the Compensation Committee’s discretion) between restricted stock units, performance stock units, stock options and other long-term incentive vehicles; and (v) eligibility to participate in the Company’s employee benefit plans and programs in accordance with the terms and conditions of the applicable plans and programs. In connection with his appointment, the Company will also enter into its standard form of indemnification agreement (the “Standard Indemnification Agreement”) with Mr. McAleenan.

As part of Mrs. Long’s departure and pursuant to the BigBear.ai LLC Executive Severance Program (the “ESP”), Mrs. Long will be entitled to receive the following payments and benefits, in each case, less all applicable taxes, withholdings and authorized or required deductions, subject to her timely execution of a separation agreement and general release (the “Separation and Release Agreement”): (i) a payment of $1,125,000, which is equivalent to Mrs. Long’s base salary for a period of twelve months plus one times her Target Annual Bonus as defined in the ESP, paid as salary continuation on the Company’s regular payroll schedule, and (ii) a lump sum payment of approximately $170,298.96, which is equivalent to twelve months of the employer share of health and welfare premiums for plans in which Mrs. Long was enrolled as of the separation date (collectively, the “Severance Benefits”). In exchange for the Severance Benefits, Mrs. Long will agree to a release of claims in favor of the Company and reaffirmation of her commitment to comply with her existing restrictive covenant obligations. Mrs. Long will provide certain services to the Company for specific projects that are mutually agreed upon from time to time at a rate not to exceed $550 per hour.

The foregoing descriptions of the Offer Letter and the Standard Indemnification Agreement are qualified in their entirety by reference to the complete text of the Offer Letter and the Standard Indemnification Agreement, which are filed as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On January 15, 2025, the Company issued a press release with respect to the management changes described in Item 5.02 of this Current Report on Form 8-K. The press release is included in this report as Exhibit 99.1 and is incorporated herein by reference. This information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

By: | /s/ Sean Ricker |

Name: | Sean Ricker |

Title: | Chief Accounting Officer |

Exhibit 10.1

Exhibit 10.1

January 15, 2025

Kevin McAleenan

via email

Dear Kevin,

On behalf of BigBear.ai, I am pleased to extend an offer of employment to you for the position of Chief Executive Officer. The details of the offer are as follows:

Job Title: Chief Executive Officer (a Section 16 Officer)

Direct Supervisor: the BigBear.ai Holdings, Inc. Board of Directors

Work Location: Tysons Corner, Virginia, travel as appropriate

Compensation:

Salary: As a full-time, exempt employee, your base salary will be paid at the rate of $500,000.00/annually, less applicable payroll deductions and withholdings. You will be paid semi-monthly in accordance with BigBear.ai’s standard payroll policies and practices.

Short-Term Incentive (STI) / Annual Bonus Plan: In addition to your base compensation, you will be eligible for an annual bonus of up to 125% of your annual base compensation (“Annual Target Bonus”), on the same terms and conditions as other similarly situated executives based upon mutually developed performance objectives at the start of each year. Your Annual Target Bonus will be paid through a combination of cash and Performance Stock Units (PSUs) based on the achievement of Company goals and personal goals. The STI program and your participation in the plan are subject to annual approval/renewal by the BigBear.ai Compensation Committee.

Long-Term Incentive (LTI) / Equity Bonus Plan: As a key executive, you will be eligible to participate in the BigBear.ai equity incentive plan, comprised of a mix of Restricted Stock Units (RSUs), stock options, and PSUs. LTI awards vest on a four-year ratable schedule from the grant date, unless otherwise specified, and specific terms and conditions will be included in each LTI grant agreement.

Your LTI plan consists of two components:

1.An initial award with a target value at grant date of $4,000,000.00. This award will be delivered in the form of 50% RSUs and 50% stock options. The actual number of RSUs and options are dependent upon the price of BigBear.ai’s stock at the time of the award.

2.Starting in 2025, a recurring annual grant estimated to be valued at 200% of your base compensation, subject to Compensation Committee approval (split between stock options, RSUs, PSUs and/or other long-term incentive vehicles at the discretion of the BigBear.ai Compensation Committee (the “Compensation Committee”)).

Unvested awards will be canceled in the event of a termination, voluntary or involuntary.

The LTI program is subject to annual approval/renewal by the Compensation Committee. In the event that the LTI program is discontinued, BigBear.ai agrees to work in good faith with you to come to an agreeable replacement program or compensation arrangement.

Annual Leave: You will receive 25 days of paid time off accrued on a semi-monthly basis upon your Start Date and 11 paid holidays, both pro-rated based on your Start Date.

Benefits: As a full-time employee, you will be eligible to participate in BigBear.ai’s comprehensive benefit program in accordance with our policies and after meeting the applicable eligibility requirements, if any.

Severance: As CEO, you are eligible to participate in the BigBear.ai Executive Severance Plan (the “ESP Plan”) at the Tier 1 level. The ESP Plan can be found at:

(https://www.sec.gov/Archives/edgar/data/1836981/000119312522289531/423944dex101.htm).

Medical Insurance Offset: If you elect to waive BigBear.ai’s medical insurance coverage in 2025, you will receive a payment of $3,000.00 annually, in addition to your base salary. You will still be eligible to participate in all other benefits offered. Should you elect BigBear.ai’s medical insurance in the future, you will no longer receive the offset, effective the date coverage begins.

Outside Counsel and Compensation Consultant Fees: BigBear.ai shall timely pay all reasonable attorney and consulting fees incurred as part of your and your outside counsel’s and consultant’s review and negotiation of the initial terms of your employment as set forth herein, and any supplemental agreements required or proposed by BigBear.ai (e.g., the Employee Nondisclosure and Intellectual Property Assignment Agreement, the Non-Solicitation Agreement, and Executive Severance Plan).

Start Date: Your start date will be January 15, 2025.

This is an offer of at-will employment and is not a contract guaranteeing employment for any specific duration. As an at-will employee, both you and BigBear.ai have the right to terminate this arrangement and subsequent employment at any time with or without cause or notice. By accepting this offer you agree to provide the Company’s security officer with sufficient information to properly verify security information, as applicable for the role. This offer is also contingent upon your agreement to the Company policies including but not limited to the following: BBAI Policies and Procedures, Insider Trading Policy, Employee NDA and IP Assignment, Non-Solicitation Agreement and Code of Conduct and Ethics, as well as verification of your right to work in the United States, as demonstrated by your completion of an I-9 form upon hire and your submission of acceptable documentation (as noted on the I-9 form) verifying your identity and work authorization within three days of your Start Date.

Please indicate your acceptance of this offer by signing and returning by January 15, 2025.

Sincerely,

Peter Cannito

Chairman, Board of Directors, BigBear.ai Holdings, Inc.

Acceptance of Offer

I have read and understood, and I accept all the terms of the offer of employment as set forth in the foregoing letter. I have not relied on any agreements or representations, express or implied, that are not set forth expressly in the foregoing letter, and this letter supersedes all prior and contemporaneous understandings, communications, agreements, representations and warranties, both written and oral, with respect to the subject matter of this letter.

Signed .....................................................

Date ........................................................

January 15, 2025

Kevin McAleenan Appointed CEO of BigBear.ai

TYSONS CORNER, Va.--(BUSINESS WIRE)-- BigBear.ai (NYSE: BBAI) today announced that the Board of Directors has appointed Kevin McAleenan as Chief Executive Officer and member of the Board of Directors, effective January 15, 2025, succeeding Mandy Long.

Mandy Long will step down as Chief Executive Officer and from the Board of Directors, transitioning to serve as a Company advisor.

McAleenan currently serves as BigBear.ai’s President and has deep government and business experience working with U.S. national security agencies, including serving as Acting Secretary of the U.S. Department of Homeland Security (DHS) during the first Trump administration before founding Pangiam, which was subsequently bought by BigBear.ai in 2024.

Prior to Pangiam, McAleenan was Commissioner of U.S. Customs and Border Protection, where he focused on counterterrorism, border security and immigration enforcement, following almost two decades as a career official.

“Today marks an important next step for the business,” said Peter Cannito, Chair of the Board of Directors of BigBear.ai.

“The demand for differentiated artificial intelligence solutions to provide strategic advantage in government and business is strong and the combination of recent technological achievements and strategic contract awards have positioned BigBear.ai as a leading AI solutions provider focused on national security imperatives.

“Kevin is a proven leader with a track record of driving success through mission focus, technology and process innovation, and operational excellence. Having served at the highest levels of government, Kevin brings an intimate understanding of current national security priorities and the challenges faced by our mission partners, providing BigBear.ai with a deep understanding of how artificial intelligence can be most effectively leveraged to maximize impact. We are thrilled to welcome Kevin as CEO and confident in his ability to drive the company’s next phase of growth.

“All this would not have been possible without Mandy’s efforts over recent years in bringing innovative, cutting-edge AI technologies to market. The BigBear.ai product portfolio and financial position has been significantly enhanced as a direct result of her efforts. The Board is grateful for her contributions and the role she has played in shaping our strategy,” he concluded.

“It is an honor to step into the role of CEO at BigBear.ai,” said McAleenan. “The success of our customers depends on their ability to navigate complexity and act decisively in the most

high-stakes environments. BigBear.ai is uniquely positioned to support these objectives with our domain expertise, and our cutting-edge technology. I look forward to working with this exceptional team to build on our successes and expand our ability to deliver AI-powered solutions in ways that make a meaningful impact for our customers, partners, and stakeholders.”

“It has been a privilege to lead such a talented and dedicated team of professionals over the past two and a half years. The future is bright for BigBear.ai and its mission to deliver clarity for the world’s most complex decisions,” said Mandy Long.

Executive Bio

Kevin McAleenan, CEO, BigBear.ai

Kevin most recently served as President of BigBear.ai, where he led teams offering cutting edge computer vision, simulation and modeling, with digital identity tools to support customers critical security and operational decisions. Kevin co-founded and led Pangiam as CEO and Chair of the Board until its acquisition by BigBear.ai, developing cutting edge biometric and AI products for security applications, for both government agencies and commercial customers.

Kevin brings experience from almost two decades of leadership in the U.S. Government to his role. He was the first career civil servant to be appointed and confirmed as Commissioner of U.S. Customs and Border Protection (CBP) in 2018, and he served most recently as Acting Secretary of the U.S. Department of Homeland Security (DHS) under President Donald Trump, where he led over 240,000 employees and oversaw operations at CBP, the Transportation Security Administration (TSA), the U.S. Coast Guard, the Cybersecurity and Infrastructure Security Agency (CISA), Secret Service, and others.

His past experiences include implementing innovations to the U.S. international arrival and departure process, developing comprehensive counterterrorism and risk management strategies, and overseeing the implementation of the U.S. government’s single window for international trade, a project that spanned over 4-dozen agencies. Kevin received several awards for his service and leadership including a Presidential Rank Award—the nation’s highest civil service award, a Service to America Medal, and multiple awards from travel and trade industry groups.

About BigBear.ai

BigBear.ai is a leading provider of AI-powered decision intelligence solutions for national security, digital identity, and supply chain management. Customers and partners rely on BigBear.ai’s artificial intelligence and predictive analytics capabilities in highly complex, distributed, mission-based operating environments. BigBear.ai is a public company traded on the NYSE under the symbol BBAI. For more information, visit https://bigbear.ai and follow BigBear.ai on LinkedIn: @BigBear.ai, and X: @BigBearai. To receive email communications from BigBear.ai, register here.

Forward-Looking Statement

This press release contains “forward-looking statements.” Such statements include, but are

not limited to, statements regarding the intended use of proceeds from the private placement and may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words.

Forward-looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; risks related to the uncertainty of the projected financial information (including on a segment reporting basis); risks related to delays caused by factors outside of our control, including changes in fiscal or contracting policies or decreases in available government funding; changes in government programs or applicable requirements; budgetary constraints, including automatic reductions as a result of “sequestration” or similar measures and constraints imposed by any lapses in appropriations for the federal government or certain of its departments and agencies; influence by, or competition from, third parties with respect to pending, new, or existing contracts with government customers; our ability to successfully compete for and receive task orders and generate revenue under multiple award Indefinite Delivery Indefinite Quantity (IDIQ) contracts; potential delays or changes in the government appropriations or procurement processes, including as a result of events such as war, incidents of terrorism, natural disasters, and public health concerns or epidemics; and increased or unexpected costs or unanticipated delays caused by other factors outside of our control, such as performance failures of our subcontractors; risks related to the rollout of the business and the timing of expected business milestones; the effects of competition on our future business; our ability to issue equity or equity-linked securities in the future, and those factors discussed in the Company’s reports and other documents filed with the SEC, including under the heading “Risk Factors.” More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the SEC, including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250115839472/en/

General/Sales: info@bigbear.ai Investors: investors@bigbear.ai Media: media@bigbear.ai

Source: BigBear.ai

v3.24.4

Cover

|

Jan. 15, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 15, 2025

|

| Entity Registrant Name |

BigBear.ai Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40031

|

| Entity Tax Identification Number |

85-4164597

|

| Entity Address, Address Line One |

6811 Benjamin Franklin Drive

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Columbia

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

21046

|

| City Area Code |

410

|

| Local Phone Number |

312-0885

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001836981

|

| Amendment Flag |

false

|

| Common stock, $0.0001 par value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, $0.0001 par value

|

| Trading Symbol |

BBAI

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each full warrant exercisable for one share of common stock at an exercise price of $11.50 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, each full warrant exercisable for one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

BBAI.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bbai_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

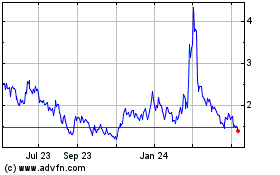

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Dec 2024 to Jan 2025

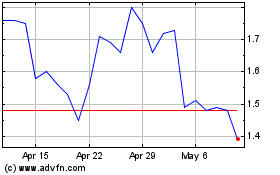

BigBear ai (NYSE:BBAI)

Historical Stock Chart

From Jan 2024 to Jan 2025