UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20546

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month

of October, 2024

Commission File Number: 333-221916

Corporación América Airports

S.A.

(Name of Registrant)

128, Boulevard de la Pétrusse

L-2330 Luxembourg

Tel: +35226258274

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 16, 2024

| |

Corporación America Airports S.A. |

| |

|

| |

By: |

/s/ Andres Zenarruza |

| |

Name: |

Andres Zenarruza |

| |

Title: |

Head of Legal & Compliance |

| |

By: |

/s/ Jorge Arruda |

| |

Name: |

Jorge Arruda |

| |

Title: |

Chief Financial Officer |

Exhibit Index

Exhibit 99.1

Corporación América

Airports S.A. Reports September 2024 Passenger Traffic

Total passenger

traffic down 3.6% YoY, or 1.2% YoY ex-Natal

International passenger

traffic up 5.4% YoY

Luxembourg, October 16, 2024— Corporación

América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators

in the world, reported today a 3.6% year-on-year (YoY) decrease in passenger traffic in September 2024. Excluding Natal for comparison

purposes, total traffic in September decreased by 1.2% YoY.

| Passenger Traffic, Cargo

Volume and Aircraft Movements Highlights (2024 vs. 2023) |

|

|

|

|

|

|

|

| Statistics |

Sep'24 |

Sep'23 |

% Var. |

|

YTD’24 |

YTD'23 |

% Var. |

| Domestic Passengers (thousands) |

3,376 |

3,844 |

-12.2% |

|

29,965 |

33,856 |

-11.5% |

| International Passengers (thousands) |

2,752 |

2,612 |

5.4% |

|

23,164 |

21,273 |

8.9% |

| Transit Passengers (thousands) |

659 |

585 |

12.6% |

|

5,384 |

5,298 |

1.6% |

| Total Passengers (thousands)1 |

6,787 |

7,042 |

-3.6% |

|

58,513 |

60,426 |

-3.2% |

| Cargo Volume (thousand tons) |

33.9 |

30.9 |

9.7% |

|

279.8 |

268.6 |

4.2% |

| Total Aircraft Movements (thousands) |

69.3 |

71.9 |

-3.7% |

|

610.1 |

639.9 |

-4.7% |

1 Excluding

Natal for comparison purposes, total passenger traffic was down 1.2% in September and 1.0% YTD.

Monthly Passenger Traffic Performance

(In million PAX)

Passenger Traffic Overview

Total passenger traffic declined by 3.6%

in September compared to the same month in 2023, or 1.2% when adjusting for the discontinuation of Natal airport. This represents a sequential

improvement compared to the YoY decline of 3.8%, or 1.5% excluding Natal, reported in August. Domestic passenger traffic decreased by

12.2% YoY, or 8.4% when excluding Natal, primarily due to weaker YoY domestic traffic performance in Argentina. International traffic

increased by 5.4%, mainly driven by growth in Italy, Uruguay and Argentina.

In Argentina, total passenger traffic declined

by 7.2% YoY, driven by a weaker performance in domestic traffic, which fell by 12.1% YoY. Last year, domestic traffic benefited from incentives

provided by a government program called "Previaje" to boost domestic tourism, but it continued to be impacted by the ongoing

recession in the country. Nevertheless, certain destinations, such as Córdoba, Salta, Tucumán, and Mendoza, showed strong

performance, with increased load factors. International passenger traffic rose by 6.7% YoY. Aerolíneas Argentinas inaugurated a

new Córdoba–Punta Cana route and suspended its Ezeiza–JFK route, while JetSmart suspended its Aeroparque–Montevideo

and Ezeiza–Curitiba routes. European routes, including Madrid, Rome, Frankfurt, and Amsterdam, performed well, with increased load

factors. Passenger traffic in September was also affected by strikes organized by the aeronautical union.

In Italy, passenger traffic grew by 5.9%

compared to the same month in 2023. International passenger traffic, which accounted for over 80% of the total traffic, increased by 7.0%

YoY, with strong performances at both Pisa and Florence airports. Domestic passenger traffic increased by 1.9% YoY, driven by a 4.2% increase

at Pisa airport which was partially offset by a decline of 3.2% at Florence airport.

In Brazil, total passenger traffic decreased

by 2.4% YoY, or increased by 11.3% YoY when adjusting for the discontinuation of Natal Airport, up from the 4.3% YoY increase reported

in August. These results reflect an improvement in traffic trends despite the still challenging aviation context and aircraft constraints

in the country, along with the positive impact of the temporary closure of Porto Alegre airport. Domestic traffic, which accounted for

55% of the total traffic, was down 15.1% YoY, or up 4.2% when excluding Natal, while transit passengers were up 20.1% YoY, or 20.4% ex-Natal.

As a reminder, following the friendly termination process concluded in February 2024, CAAP no longer operates Natal Airport, effective

February 19, 2024. Therefore, statistics for Natal are available up to February 18, 2024.

In Uruguay, total passenger traffic, predominantly

international, continued its recovery, increasing by a solid 15.7% YoY. In August, both SKY and LATAM Airlines announced they would resume

their routes, Montevideo–Rio de Janeiro and Punta del Este–Santiago de Chile, respectively, for the summer season. In September,

American Airlines announced the resumption of its Montevideo–Miami route, with three weekly flights starting in November.

In Ecuador, passenger traffic decreased

by 5.1% YoY, following a strong recovery in 2023. International passenger traffic increased by 3.5% YoY, while domestic traffic decreased

by 13.0% YoY, mainly due to the exit of the local airline Equair in October 2023 and high airfare prices affecting travel demand.

In Armenia, passenger traffic decreased

by 2.5% YoY, consistent with last month's performance and following a strong recovery in 2023, which benefited from the introduction of

new airlines and routes, as well as an increase in flight frequencies. The introduction of new routes has continued into 2024.

Cargo Volume and Aircraft Movements

Cargo volume increased by 9.7% compared

to the same month in 2023, with positive YoY contributions from Argentina (+11.7%), Uruguay (+20.1%), Armenia (+17.9%), and Italy (+25.6%),

partially offset by YoY declines in Ecuador (-6.6%) and Brazil (-1.2%). Argentina, Brazil, and Armenia together accounted for 80% of the

total cargo volume in September.

Aircraft movements decreased by 3.7% YoY,

with negative YoY contributions from Armenia (-10.9%), Brazil (-4.0%), Argentina (-4.0%) and Ecuador (-9.5%), which were partially offset

by positive YoY variances in Uruguay (+13.6%) and Italy (+2.6%). Argentina, Brazil, and Italy accounted for more than 80% of total aircraft

movements in September.

Summary Passenger Traffic, Cargo Volume and Aircraft

Movements (2024 vs. 2023)

| |

Sep'24 |

Sep'23 |

% Var. |

|

YTD'24 |

YTD'23 |

% Var. |

| Passenger Traffic (thousands) |

|

|

|

|

|

|

|

| Argentina |

3,419 |

3,684 |

-7.2% |

|

30,645 |

32,010 |

-4.3% |

| Italy |

928 |

876 |

5.9% |

|

7,046 |

6,368 |

10.6% |

| Brazil (1) |

1,345 |

1,378 |

-2.4% |

|

11,510 |

12,770 |

-9.9% |

| Uruguay |

191 |

165 |

15.7% |

|

1,681 |

1,418 |

18.5% |

| Ecuador |

377 |

398 |

-5.1% |

|

3,526 |

3,673 |

-4.0% |

| Armenia |

527 |

540 |

-2.5% |

|

4,104 |

4,187 |

-2.0% |

| TOTAL |

6,787 |

7,042 |

-3.6% |

|

58,513 |

60,426 |

-3.2% |

(1)

Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are

available up to February 18, 2024.

| Cargo Volume (tons) |

|

|

|

|

|

|

|

| Argentina |

17,966 |

16,078 |

11.7% |

|

144,149 |

138,565 |

4.0% |

| Italy |

1,075 |

856 |

25.6% |

|

9,431 |

9,479 |

-0.5% |

| Brazil |

5,376 |

5,443 |

-1.2% |

|

47,360 |

48,430 |

-2.2% |

| Uruguay |

2,897 |

2,413 |

20.1% |

|

23,010 |

23,343 |

-1.4% |

| Ecuador |

2,420 |

2,591 |

-6.6% |

|

27,781 |

24,331 |

14.2% |

| Armenia |

4,158 |

3,526 |

17.9% |

|

28,070 |

24,475 |

14.7% |

| TOTAL |

33,892 |

30,907 |

9.7% |

|

279,801 |

268,623 |

4.2% |

| Aircraft Movements |

|

|

|

|

|

|

|

| Argentina |

36,559 |

38,091 |

-4.0% |

|

328,205 |

343,034 |

-4.3% |

| Italy |

8,175 |

7,965 |

2.6% |

|

64,013 |

60,452 |

5.9% |

| Brazil |

12,348 |

12,860 |

-4.0% |

|

107,362 |

119,404 |

-10.1% |

| Uruguay |

2,441 |

2,148 |

13.6% |

|

23,559 |

23,143 |

1.8% |

| Ecuador |

5,957 |

6,581 |

-9.5% |

|

56,920 |

59,688 |

-4.6% |

| Armenia |

3,805 |

4,272 |

-10.9% |

|

30,070 |

34,220 |

-12.1% |

| TOTAL |

69,285 |

71,917 |

-3.7% |

|

610,129 |

639,941 |

-4.7% |

About Corporación América Airports

Corporación

América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries

across Latin America and Europe (Argentina, Brazil, Uruguay, Ecuador, Armenia and Italy). In 2023, Corporación América Airports

served 81.1 million passengers, 23.7% above the 65.6 million passengers served in 2022 and 3.6% below the 84.2 million served in 2019.

The Company is listed on the New York Stock Exchange where it trades under the ticker “CAAP”. For more information, visit

http://investors.corporacionamericaairports.com.

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

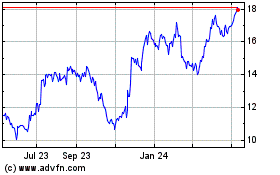

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

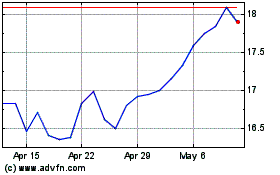

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Nov 2023 to Nov 2024