Total passenger traffic down 3.6% YoY, or 1.2%

YoY ex-Natal

International passenger traffic up 5.4% YoY

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP”

or the “Company”), one of the leading private airport operators in

the world, reported today a 3.6% year-on-year (YoY) decrease in

passenger traffic in September 2024. Excluding Natal for comparison

purposes, total traffic in September decreased by 1.2% YoY.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241016585699/en/

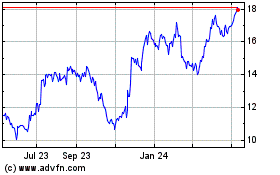

Monthly Passenger Traffic Performance (In

million PAX) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and

Aircraft Movements Highlights (2024 vs. 2023)

Statistics

Sep'24

Sep'23

% Var.

YTD’24

YTD'23

% Var.

Domestic Passengers (thousands)

3,376

3,844

-12.2

%

29,965

33,856

-11.5

%

International Passengers (thousands)

2,752

2,612

5.4

%

23,164

21,273

8.9

%

Transit Passengers (thousands)

659

585

12.6

%

5,384

5,298

1.6

%

Total Passengers (thousands)1

6,787

7,042

-3.6

%

58,513

60,426

-3.2

%

Cargo Volume (thousand tons)

33.9

30.9

9.7

%

279.8

268.6

4.2

%

Total Aircraft Movements

(thousands)

69.3

71.9

-3.7

%

610.1

639.9

-4.7

%

1 Excluding Natal for comparison purposes,

total passenger traffic was down 1.2% in September and 1.0%

YTD.

Passenger Traffic

Overview

Total passenger traffic declined by 3.6% in September

compared to the same month in 2023, or 1.2% when adjusting for the

discontinuation of Natal airport. This represents a sequential

improvement compared to the YoY decline of 3.8%, or 1.5% excluding

Natal, reported in August. Domestic passenger traffic decreased by

12.2% YoY, or 8.4% when excluding Natal, primarily due to weaker

YoY domestic traffic performance in Argentina. International

traffic increased by 5.4%, mainly driven by growth in Italy,

Uruguay and Argentina.

In Argentina, total passenger traffic declined by 7.2%

YoY, driven by a weaker performance in domestic traffic, which fell

by 12.1% YoY. Last year, domestic traffic benefited from incentives

provided by a government program called "Previaje" to boost

domestic tourism, but it continued to be impacted by the ongoing

recession in the country. Nevertheless, certain destinations, such

as Córdoba, Salta, Tucumán, and Mendoza, showed strong performance,

with increased load factors. International passenger traffic rose

by 6.7% YoY. Aerolíneas Argentinas inaugurated a new Córdoba–Punta

Cana route and suspended its Ezeiza–JFK route, while JetSmart

suspended its Aeroparque–Montevideo and Ezeiza–Curitiba routes.

European routes, including Madrid, Rome, Frankfurt, and Amsterdam,

performed well, with increased load factors. Passenger traffic in

September was also affected by strikes organized by the

aeronautical union.

In Italy, passenger traffic grew by 5.9% compared to the

same month in 2023. International passenger traffic, which

accounted for over 80% of the total traffic, increased by 7.0% YoY,

with strong performances at both Pisa and Florence airports.

Domestic passenger traffic increased by 1.9% YoY, driven by a 4.2%

increase at Pisa airport which was partially offset by a decline of

3.2% at Florence airport.

In Brazil, total passenger traffic decreased by 2.4% YoY,

or increased by 11.3% YoY when adjusting for the discontinuation of

Natal Airport, up from the 4.3% YoY increase reported in August.

These results reflect an improvement in traffic trends despite the

still challenging aviation context and aircraft constraints in the

country, along with the positive impact of the temporary closure of

Porto Alegre airport. Domestic traffic, which accounted for 55% of

the total traffic, was down 15.1% YoY, or up 4.2% when excluding

Natal, while transit passengers were up 20.1% YoY, or 20.4%

ex-Natal. As a reminder, following the friendly termination process

concluded in February 2024, CAAP no longer operates Natal Airport,

effective February 19, 2024. Therefore, statistics for Natal are

available up to February 18, 2024.

In Uruguay, total passenger traffic, predominantly

international, continued its recovery, increasing by a solid 15.7%

YoY. In August, both SKY and LATAM Airlines announced they would

resume their routes, Montevideo–Rio de Janeiro and Punta del

Este–Santiago de Chile, respectively, for the summer season. In

September, American Airlines announced the resumption of its

Montevideo–Miami route, with three weekly flights starting in

November.

In Ecuador, passenger traffic decreased by 5.1% YoY,

following a strong recovery in 2023. International passenger

traffic increased by 3.5% YoY, while domestic traffic decreased by

13.0% YoY, mainly due to the exit of the local airline Equair in

October 2023 and high airfare prices affecting travel demand.

In Armenia, passenger traffic decreased by 2.5% YoY,

consistent with last month's performance and following a strong

recovery in 2023, which benefited from the introduction of new

airlines and routes, as well as an increase in flight frequencies.

The introduction of new routes has continued into 2024.

Cargo Volume and Aircraft

Movements

Cargo volume increased by 9.7% compared to the same month

in 2023, with positive YoY contributions from Argentina (+11.7%),

Uruguay (+20.1%), Armenia (+17.9%), and Italy (+25.6%), partially

offset by YoY declines in Ecuador (-6.6%) and Brazil (-1.2%).

Argentina, Brazil, and Armenia together accounted for 80% of the

total cargo volume in September.

Aircraft movements decreased by 3.7% YoY, with negative

YoY contributions from Armenia (-10.9%), Brazil (-4.0%), Argentina

(-4.0%) and Ecuador (-9.5%), which were partially offset by

positive YoY variances in Uruguay (+13.6%) and Italy (+2.6%).

Argentina, Brazil, and Italy accounted for more than 80% of total

aircraft movements in September.

Summary Passenger Traffic, Cargo Volume

and Aircraft Movements (2024 vs. 2023)

Sep'24

Sep'23

% Var.

YTD'24

YTD'23

% Var.

Passenger Traffic (thousands)

Argentina

3,419

3,684

-7.2

%

30,645

32,010

-4.3

%

Italy

928

876

5.9

%

7,046

6,368

10.6

%

Brazil (1)

1,345

1,378

-2.4

%

11,510

12,770

-9.9

%

Uruguay

191

165

15.7

%

1,681

1,418

18.5

%

Ecuador

377

398

-5.1

%

3,526

3,673

-4.0

%

Armenia

527

540

-2.5

%

4,104

4,187

-2.0

%

TOTAL

6,787

7,042

-3.6

%

58,513

60,426

-3.2

%

(1) Following the friendly termination

process concluded in February 2024, CAAP no longer operates Natal

airport. Statistics for Natal are available up to February 18,

2024.

Cargo Volume (tons)

Argentina

17,966

16,078

11.7

%

144,149

138,565

4.0

%

Italy

1,075

856

25.6

%

9,431

9,479

-0.5

%

Brazil

5,376

5,443

-1.2

%

47,360

48,430

-2.2

%

Uruguay

2,897

2,413

20.1

%

23,010

23,343

-1.4

%

Ecuador

2,420

2,591

-6.6

%

27,781

24,331

14.2

%

Armenia

4,158

3,526

17.9

%

28,070

24,475

14.7

%

TOTAL

33,892

30,907

9.7

%

279,801

268,623

4.2

%

Aircraft Movements

Argentina

36,559

38,091

-4.0

%

328,205

343,034

-4.3

%

Italy

8,175

7,965

2.6

%

64,013

60,452

5.9

%

Brazil

12,348

12,860

-4.0

%

107,362

119,404

-10.1

%

Uruguay

2,441

2,148

13.6

%

23,559

23,143

1.8

%

Ecuador

5,957

6,581

-9.5

%

56,920

59,688

-4.6

%

Armenia

3,805

4,272

-10.9

%

30,070

34,220

-12.1

%

TOTAL

69,285

71,917

-3.7

%

610,129

639,941

-4.7

%

About Corporación América Airports

Corporación América Airports acquires, develops and operates

airport concessions. Currently, the Company operates 52 airports in

6 countries across Latin America and Europe (Argentina, Brazil,

Uruguay, Ecuador, Armenia and Italy). In 2023, Corporación América

Airports served 81.1 million passengers, 23.7% above the 65.6

million passengers served in 2022 and 3.6% below the 84.2 million

served in 2019. The Company is listed on the New York Stock

Exchange where it trades under the ticker “CAAP”. For more

information, visit

http://investors.corporacionamericaairports.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016585699/en/

Investor Relations Contact Patricio Iñaki Esnaola Email:

patricio.esnaola@caairports.com Phone: +5411 4899-6716

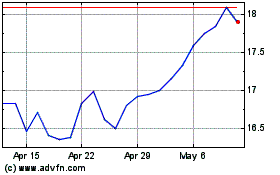

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Dec 2023 to Dec 2024