Total passenger traffic down 2.7% YoY, or 0.2%

YoY ex-Natal

International passenger traffic up 6.6% YoY; up

10.3% YoY in Argentina

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP”

or the “Company”), one of the leading private airport operators in

the world, reported today a 2.7% year-on-year (YoY) decrease in

passenger traffic in November 2024. Excluding Natal for comparison

purposes, total traffic in November decreased by 0.2% YoY.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241217819655/en/

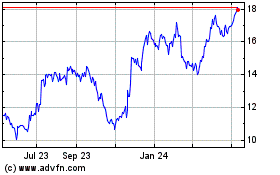

Monthly Passenger Traffic Performance (In

million PAX) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and

Aircraft Movements Highlights (2024 vs. 2023)

Statistics

Nov'24

Nov'23

% Var.

YTD’24

YTD'23

% Var.

Domestic Passengers (thousands)

3,663

3,927

-6.7%

37,224

41,826

-11.0%

International Passengers (thousands)

2,355

2,209

6.6%

28,203

26,068

8.2%

Transit Passengers (thousands)

558

626

-10.9%

6,588

6,506

1.3%

Total Passengers (thousands)1

6,576

6,761

-2.7%

72,015

74,400

-3.2%

Cargo Volume (thousand tons)

40.0

32.5

23.2%

358.6

334.1

7.3%

Total Aircraft Movements

(thousands)

68.6

64.1

7.0%

750.4

778.0

-3.5%

1 Excluding Natal for comparison purposes, total passenger traffic

was down 0.2% in November and 1.0% YTD.

Passenger Traffic

Overview

Total passenger traffic declined by 2.7% in November

compared to the same month in 2023, or 0.2% when adjusting for the

discontinuation of Natal airport. Domestic passenger traffic

decreased by 6.7% YoY, or 2.6% when excluding Natal, primarily due

to weaker YoY domestic traffic performance in Argentina.

International traffic increased by 6.6%, mainly driven by growth in

Argentina and Italy.

In Argentina, total passenger traffic declined by 3.3%

YoY, an improvement compared to the 7.8% YoY decline recorded in

October. This result was primarily driven by weaker performance in

domestic traffic, which fell by 7.2% YoY. Last year, domestic

traffic benefited from incentives provided by a government program

called "Previaje" to boost domestic tourism; however, it continued

to be impacted by the ongoing recession in the country. JetSMART

has continued to gain market share since initiating its growth

strategy a few months ago, while Flybondi increased its operational

capacity by 13% with the addition of two more aircraft.

International passenger traffic increased by 10.3% YoY, up from the

7.0% YoY increase recorded in October. Among other developments,

Avianca inaugurated its Guayaquil–Ezeiza route with three weekly

flights, and Paranair launched the Jujuy–Asunción route.

Additionally, Emirates, Iberia, and United increased their flight

frequencies during the month. International passenger traffic in

November also benefited from the final game of the Libertadores

Cup, with Azul, Gol, JetSMART, and Flybondi scheduling charter

flights for the event.

In Italy, passenger traffic grew by 15.3% compared to the

same month in 2023. International passenger traffic, which

accounted for almost 75% of the total traffic, increased by 10.7%

YoY, driven by a 13.7% increase at Florence airport and an 8.1%

increase at Pisa airport. Domestic passenger traffic increased by a

strong 30.6% YoY, with strong performances at both Pisa and

Florence airports.

In Brazil, total passenger traffic decreased by 8.8% YoY,

or increased by 4.0% YoY when adjusting for the discontinuation of

Natal Airport. These results reflect an improvement in traffic

trends despite the still challenging aviation context and aircraft

constraints in the country, along with the positive impact of the

temporary closure of Porto Alegre airport. Domestic traffic, which

accounted for 60% of the total traffic, was down 10.7% YoY, or up

10.3% when excluding Natal, while transit passengers were down 7.1%

YoY. As a reminder, following the friendly termination process

concluded in February 2024, CAAP no longer operates Natal Airport,

effective February 19, 2024. Therefore, statistics for Natal are

available up to February 18, 2024.

In Uruguay, total passenger traffic, predominantly

international, continued to recover, increasing by 4.4% YoY.

American Airlines resumed its Montevideo–Miami route with three

weekly flights, which will increase to daily service during the

high season. At Punta del Este Airport, the company is inaugurating

the summer season with the first direct flight from Santiago de

Chile to Punta del Este. From November to March, LATAM will offer

three weekly flights to connect these two destinations.

In Ecuador, passenger traffic decreased by 2.6% YoY,

following a strong recovery in 2023. International passenger

traffic decreased by 1.9% YoY, while domestic traffic decreased by

3.7% YoY, impacted by high airfare prices affecting travel

demand.

In Armenia, passenger traffic decreased by 0.2% YoY,

consistent with last month's performance and following a strong

recovery in 2023, which benefited from the introduction of new

airlines and routes, as well as an increase in flight frequencies.

The introduction of new routes has continued into 2024.

Cargo Volume and Aircraft

Movements

Cargo volume increased by 23.2% compared to the same

month in 2023, with positive YoY contributions from all countries

of operation, except for Italy and Ecuador: Argentina (+28.2%),

Uruguay (+17.1%), Armenia (+80.3%), Brazil (+5.2%), Ecuador (-0.3%)

and Italy (-5.0%). Argentina, Brazil, and Armenia accounted for

more than 80% of the total cargo volume in November.

Aircraft movements increased by 7.0% YoY, with positive

YoY contributions from all countries of operation, except for

Brazil: Argentina (+14.6%), Uruguay (+3.6%), Armenia (+2.7%),

Ecuador (+3.6%), Italy (+5.6%), and Brazil (-9.8%). Argentina,

Brazil, and Ecuador accounted for more than 80% of total aircraft

movements in November.

Summary Passenger Traffic, Cargo Volume

and Aircraft Movements (2024 vs. 2023)

Nov'24

Nov'23

% Var.

YTD'24

YTD'23

% Var.

Passenger Traffic (thousands)

Argentina

3,793

3,923

-3.3%

38,051

39,850

-4.5%

Italy

554

480

15.3%

8,473

7,671

10.4%

Brazil (1)

1,303

1,429

-8.8%

14,210

15,614

-9.0%

Uruguay

176

169

4.4%

2,041

1,766

15.6%

Ecuador

381

391

-2.6%

4,294

4,458

-3.7%

Armenia

368

369

-0.2%

4,946

5,041

-1.9%

TOTAL

6,576

6,761

-2.7%

72,015

74,400

-3.2%

(1) Following the friendly termination process concluded in

February 2024, CAAP no longer operates Natal airport. Statistics

for Natal are available up to February 18, 2024.

Cargo Volume (tons)

Argentina

21,667

16,905

28.2%

186,287

172,970

7.7%

Italy

1,170

1,231

-5.0%

11,896

11,880

0.1%

Brazil

6,130

5,826

5.2%

59,963

60,193

-0.4%

Uruguay

3,269

2,792

17.1%

29,241

28,459

2.7%

Ecuador

3,131

3,139

-0.3%

34,024

30,245

12.5%

Armenia

4,611

2,558

80.3%

37,185

30,398

22.3%

TOTAL

39,977

32,451

23.2%

358,596

334,145

7.3%

Aircraft Movements

Argentina

39,873

34,788

14.6%

407,025

418,382

-2.7%

Italy

5,161

4,887

5.6%

77,074

73,133

5.4%

Brazil

11,490

12,732

-9.8%

131,326

145,151

-9.5%

Uruguay

2,687

2,594

3.6%

28,878

28,374

1.8%

Ecuador

6,387

6,165

3.6%

69,627

71,983

-3.3%

Armenia

2,984

2,905

2.7%

36,446

40,971

-11.0%

TOTAL

68,582

64,071

7.0%

750,376

777,994

-3.5%

About Corporación América Airports

Corporación América Airports acquires, develops and operates

airport concessions. Currently, the Company operates 52 airports in

6 countries across Latin America and Europe (Argentina, Brazil,

Uruguay, Ecuador, Armenia and Italy). In 2023, Corporación América

Airports served 81.1 million passengers, 23.7% above the 65.6

million passengers served in 2022 and 3.6% below the 84.2 million

served in 2019. The Company is listed on the New York Stock

Exchange where it trades under the ticker “CAAP”. For more

information, visit

http://investors.corporacionamericaairports.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217819655/en/

Investor Relations Contact Patricio Iñaki Esnaola Email:

patricio.esnaola@caairports.com Phone: +5411 4899-6716

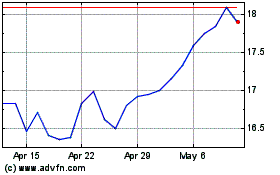

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Dec 2023 to Dec 2024