Fed Examined Amazon's Cloud in New Scrutiny for Tech -- Update

August 01 2019 - 6:49PM

Dow Jones News

By Liz Hoffman, Dana Mattioli and Ryan Tracy

The Federal Reserve conducted a formal examination this spring

of an Amazon.com Inc. facility in Virginia, the first of what is

expected to be ongoing oversight of giant cloud providers that have

become repositories of sensitive banking information, people

familiar with the matter said.

Around the same time, prosecutors allege, a 33-year-old hacker

in Seattle stole Capital One Financial Corp. data from Amazon's

cloud storage.

The federal examiners who visited Amazon in April are the same

ones who regulate Capital One. It doesn't appear they were aware of

the giant hack. A person familiar with the matter said the Fed was

told last week, a few days before Paige A. Thompson was charged

with stealing personal information of more than 100 million Capital

One card customers and applicants.

The examiners were greeted warily at the Amazon offices.

Chaperoned by an Amazon employee, they were allowed to review

certain documents on Amazon laptops, but not allowed to take

anything with them, some of the people said.

The examination points to a culture clash between government and

big tech, which has been far less regulated than the financial

sector. Antitrust investigations are under way into whether Amazon,

Facebook Inc. and other tech companies have used their size and

influence to stifle competition.

The examination, headed up by the Federal Reserve's Richmond

branch, also brings to the fore the question of where banks end and

where the vendors that power them begin.

The examiners in Virginia were focused on Amazon's resiliency

and backup systems, some of the people said, describing the visit

as the first of what is expected to be ongoing oversight of the

tech giant.

Technology companies such as Amazon are now a crucial player in

the U.S. banking system, whether they want to be or not.

They run the databases that hold customer credit scores and

social-security numbers. They analyze risk for banks' traders and

process payments. Cloud computing has made possible services that

customers now take for granted, like mobile access to their bank

accounts and split-second decisions on their efforts to buy and

sell securities.

Amazon is the biggest player, controlling nearly half of the

public cloud market in 2018, according to Gartner. Amazon Web

Services came out of a 2003 brainstorming session about ways to use

the company's extra data centers. It now contributes three-quarters

of the company's overall profits, helping to support its low-margin

retail business.

Goldman Sachs Group Inc., Nasdaq Inc. and payments company

Stripe Inc. all use Amazon. A competing cloud service from

Microsoft Corp. counts JPMorgan Chase & Co. and TD Bank among

its clients. Google, a smaller player, is also courting banks.

Most big banks use all three to some extent. Some, like Capital

One, have closed their proprietary data centers and moved much of

their digital footprint to the cloud, which makes Amazon and its

competitors crucial to day-to-day banking.

But Washington hasn't figured out yet how to regulate them.

Established bank vendors such as FiServ Inc. have been subject to

inquiries from financial regulators for years because they provide

the core software that runs banks' deposit and loan platforms.

Regulators have only limited power over nonbanks, and typically

rely on banks to vet their own vendors. A U.S. Treasury report last

year found that bank regulations hadn't "sufficiently modernized to

accommodate cloud and other innovative technologies."

Part of that modernization will require reckoning with a

cultural chasm between Silicon Valley's entrepreneurs and

Washington officials: After the meeting in Virginia, the Feds

sought more documents and information from Amazon, people familiar

with the matter said.

The company balked, demanding to first see details about how its

data would be stored and used, and who would have access and for

how long, some of the people said.

Tech giants have fought new oversight. When the government

weighed new cybersecurity standards in 2017, Amazon lobbied against

them. Cloud companies, it argued, simply sell a system and turn

over the job of running and securing it to their clients.

"Imposing additional cybersecurity requirements...could

unnecessarily lead to redundancy and increases in compliance costs,

while potentially leaving systemically important financial

institutions less secure," Amazon wrote to regulators in 2017. The

proposal was eventually dropped.

--Emily Glazer and Telis Demos contributed to this article.

Write to Liz Hoffman at liz.hoffman@wsj.com, Dana Mattioli at

dana.mattioli@wsj.com and Ryan Tracy at ryan.tracy@wsj.com

(END) Dow Jones Newswires

August 01, 2019 19:34 ET (23:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

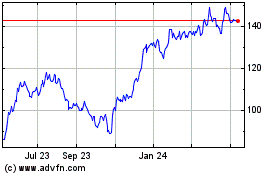

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

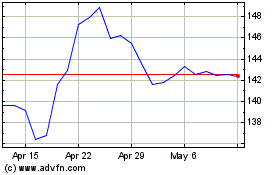

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024