0001690820false00016908202025-01-032025-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 3, 2025

CARVANA CO.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-38073 | | 81-4549921 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

| | 300 E. Rio Salado Parkway | | |

| Tempe | Arizona | 85281 | |

| | (Address of principal executive offices, including zip code) | | |

(602) 922-9866

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, Par Value $0.001 Per Share | CVNA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 3, 2025, a subsidiary of Carvana Co., Ally Bank, and Ally Financial Inc. (together, the "Ally Parties") amended the Second Amended and Restated Master Purchase and Sale Agreement to, among other things, reestablish a commitment by the Ally Parties to purchase up to $4.0 billion of automotive finance receivables between January 3, 2025 and January 2, 2026.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| |

|

|

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Certain portions of this exhibit have been omitted in accordance with Item 601(b)(10)(iv) of Regulation S-K. The registrant agrees to furnish supplementally an unredacted copy of this exhibit to the Securities and Exchange Commission upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Date: | January 6, 2025 | | | CARVANA CO. | |

| | | | | | |

| | | | | By: | /s/ Paul Breaux | |

| | | | | Name: | Paul Breaux | |

| | | | | Title: | Vice President, General Counsel, and Secretary | |

| | | | | | | |

SIXTH AMENDMENT

(MASTER PURCHASE AND SALE AGREEMENT)

SIXTH AMENDMENT, dated as of January 3, 2025 (this “Amendment”) to the Second Amended and Restated Master Purchase and Sale Agreement, dated as of November 1, 2022, as amended by the First Amendment, dated as of January 13, 2023, as amended by the Second Amendment, dated as of January 20, 2023, as amended by the Third Amendment, dated as of March 24, 2023, as amended by the Fourth Amendment, dated as of April 17, 2023 and as amended by the Fifth Amendment, dated as of January 11, 2024 (as further amended, supplemented, restated or otherwise modified to the date hereof, the “Master Purchase and Sale Agreement”), among CARVANA AUTO RECEIVABLES 2016-1 LLC, a Delaware limited liability company, as Transferor (the “Transferor”), ALLY BANK, a Utah chartered bank, as a Purchaser (in such capacity, a “Purchaser”), and ALLY FINANCIAL INC., a Delaware corporation, as a Purchaser (in such capacity, a “Purchaser” and, together with Ally Bank, the “Purchasers”).

RECITALS:

WHEREAS, the Transferors and the Purchasers are parties to the Master Purchase and Sale Agreement pursuant to which the Purchasers have agreed to purchase specified portfolios of receivables and related property from the Transferor; and

WHEREAS, the parties wish to amend the Master Purchase and Sale Agreement in certain respects;

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

Section 1.01 Defined Terms. Unless otherwise defined herein, capitalized terms used in the above recitals and in this Amendment are defined in and shall have the respective meanings assigned to them in (or by reference in) Appendix A to the Master Purchase and Sale Agreement.

ARTICLE II

AMENDMENTS

Section 2.01 Amendments to Appendix A (Definitions). Appendix A to the Master Purchase and Sale Agreement is hereby amended as follows:

Certain information has been excluded because it is both (i) not material and (ii) the type that the registrant treats as private or confidential.

(a) Clauses (xxxii), (xxxiii) and (xlii) of the “Eligible Receivable” definition are deleted in their entirety and replaced with the following:

(xxxii) (A) for Receivables with a related Cutoff Date prior to January 1, 2024, the original term of such Receivable is not more than seventy-five (75) months (B) for Receivables with a related Cutoff Date on or after January 1, 2024 and prior to January 1, 2025, the original term of such Receivable is not more than seventy-eight (78) months and (C) for Receivables with a related Cutoff Date on or after January 1, 2025, the original term of such Receivable is not more than eighty-four (84) months;

(xxxiii) (A) for Receivables with a related Cutoff Date on or after February 24, 2019 and on or prior to March 19, 2020, the LTV at origination did not exceed [***]% and (B) for Receivables with a related Cutoff Date after March 19, 2020 and prior to January 1, 2024, where the Obligor has a FICO score (i) greater than or equal to [***] (or if the related Receivable has more than one Obligor, at least one Obligor must have a FICO Score greater than or equal to [***]), then the LTV at origination is less than or equal to [***]%; (ii) greater than or equal to [***] and less than [***] (or if the related Receivable has more than one Obligor, at least one Obligor must have a FICO Score greater than or equal to [***] and less than [***]), then the LTV at origination is less than or equal to [***]%, (iii) greater than or equal to [***] and less than [***] (or if the related Receivable has more than one Obligor, at least one Obligor must have a FICO Score greater than or equal to [***] and less than [***]), then the LTV at origination is less than or equal to [***]%; and (iv) less than [***] (or if the related Receivable has more than one Obligor, both Obligors must have a FICO Score less than [***]), then the LTV at origination is less than or equal to [***]%, and (C) for Receivables with a related Cutoff Date on or after January 1, 2024 and prior to January 1, 2025, (i) and an original term of less than seventy-six (76) months, the LTV at origination did not exceed [***]% and (ii) an original term of seventy-six (76) months or more, the LTV at origination did not exceed [***]% and (D) for Receivables with a related Cutoff Date on or after January 1, 2025, (i) and an original term of less than seventy-six (76) months, the LTV at origination did not exceed [***]% and (ii) an original term of seventy-six (76) months or more, the LTV at origination did not exceed [***]%;

(xlii) (A) for Receivables with a related Cutoff Date on or after January 1, 2024 and prior to January 1, 2025, and an original term of seventy-six (76) months or more, the Original Amount Financed is not less than $[***] and not more than $[***] and (B) for Receivables

2

[***] Redacted for confidentiality purposes

with a related Cutoff Date on or after January 1, 2025 and an original term of seventy-six (76) months or more, the Original Amount Financed is not less than $[***] and not more than $[***].

(b) the “Commitment Period”, “Letter Agreement” and “Scheduled Commitment Termination Date” definitions are deleted in their entirety and replaced with the following:

“Commitment Period” means the period from the Ninth Extension Amendment Effective Date to the earliest of (i) the Scheduled Commitment Termination Date, (ii) the occurrence of a Commitment Termination Event and (iii) the purchase by the Purchasers of Receivables Pools with a total Cutoff Date Aggregate Outstanding Principal Balance in an amount equal to the Commitment Amount.

“Letter Agreement” means the twenty-second amended and restated letter agreement, dated as of January 3, 2025, among the Purchasers, the Seller, the Transferor and the Servicer, as the same may be amended, restated, supplemented or otherwise modified from time to time.

“Scheduled Commitment Termination Date” means January 2, 2026.

(c) the following definition of the “Ninth Extension Amendment Effective Date” is added to Appendix A to the Master Purchase and Sale Agreement in the appropriate alphabetical order:

“Ninth Extension Amendment Effective Date” means January 3, 2025.

and

(d) the “Eighth Extension Amendment Effective Date” definition is deleted in its entirety.

ARTICLE III

MISCELLANEOUS

Section 3.01 Conditions to Effectiveness. This Amendment shall become effective as of the date first written above (the “Effective Date”) upon receipt of the following:

(i) the receipt by the parties hereto of a signed counterpart to this Amendment duly executed and delivered by each of the parties hereto,

3

[***] Redacted for confidentiality purposes

(ii) a signed copy of the Fourth Amendment to Master Servicing Agreement, dated as of the date hereof, shall have been duly executed and delivered by Carvana, the Transferor, the Servicer, the Purchasers and the Performance Guarantor, and

(iii) a signed copy of the Twenty-Second Amended and Restated Letter Agreement, dated as of the date hereof, shall have been duly executed and delivered by Carvana, the Transferor, Ally Financial, Ally Bank, and the Servicer.

Section 3.02 Continuing Effect of the Master Purchase and Sale Agreement. Except as specifically amended and modified above, the Master Purchase and Sale Agreement is and shall continue to be in full force and effect and is hereby in all respects ratified and confirmed. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Purchasers under the Master Purchase and Sale Agreement, nor constitute a waiver of any provision of the Master Purchase and Sale Agreement.

Section 3.03 Representations and Warranties. The representations and warranties of the Seller and the Transferor contained in the Basic Documents shall be true and correct in all material respects as of the effective date of this Amendment.

Section 3.04 Binding Effect. This Amendment shall be binding upon and inure to the benefit of the Purchasers, the Servicer and their respective successors and permitted assigns.

Section 3.05 Counterparts. This Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same agreement. The words “execution”, “signed”, “signature”, and words of like import in any such amendment, waiver, certificate, agreement or document related to this Amendment shall include images of manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf”, “tif” or “jpg”) and other electronic signatures (including, without limitation, DocuSign and AdobeSign). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the UCC. In case any provision in or obligation under this Amendment shall be invalid, illegal or unenforceable in any jurisdiction, the validity, legality and enforceability of the remaining provisions or obligations, or of such provision or obligation in any other jurisdiction, shall not in any way be affected or impaired thereby. This Amendment contains the final and complete integration of all prior expressions by the parties hereto with respect to the subject matter hereof and shall constitute the entire agreement among the parties hereto with respect to the subject matter hereof, superseding all prior oral or written understandings other than any fee letter contemplated hereby.

Section 3.06 GOVERNING LAW. SUBMISSION TO JURISDICTION, ETC.

(a) THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS OF THE STATE OF NEW YORK, WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS OF LAWS THEREOF OR OF ANY OTHER JURISDICTION OTHER THAN SECTION 5-1401 AND SECTION 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW, AND THE OBLIGATIONS, RIGHTS AND REMEDIES OF THE PARTIES UNDER THIS AMENDMENT SHALL BE DETERMINED IN ACCORDANCE WITH SUCH LAWS.

(b) THE TRANSFEROR AND THE PURCHASERS HEREBY MUTUALLY AGREE TO SUBMIT TO THE NONEXCLUSIVE JURISDICTION OF THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK AND OF ANY NEW YORK STATE COURT SITTING IN THE CITY OF NEW YORK FOR PURPOSES OF ALL LEGAL PROCEEDINGS ARISING OUT OF OR RELATING TO THIS AMENDMENT, ANY OTHER BASIC DOCUMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY. EACH OF THE TRANSFEROR AND THE PURCHASERS HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT IT MAY EFFECTIVELY DO SO, ANY OBJECTION WHICH IT MAY NOW OR HEREAFTER HAVE TO THE LAYING OF THE VENUE OF ANY SUCH PROCEEDING BROUGHT IN SUCH A COURT AND ANY CLAIM THAT ANY SUCH PROCEEDING BROUGHT IN SUCH A COURT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM.

(c) THE TRANSFEROR AND THE PURCHASERS EACH HEREBY WAIVES (TO EXTENT THAT IT MAY LAWFULLY DO SO) ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT, OR OTHERWISE ARISING OUT OF, CONNECTED WITH, RELATED TO, OR IN CONNECTION WITH THIS AMENDMENT. INSTEAD, ANY DISPUTE RESOLVED IN COURT WILL BE RESOLVED IN A BENCH TRIAL WITHOUT A JURY.

Section 3.07 Effect of Headings. The section headings herein are for convenience only and shall not affect the construction hereof.

[remainder of the page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered by their proper and duly authorized officers as of the day and year first above written.

| | | | | | | | |

| CARVANA AUTO RECEIVABLES 2016-1 LLC, |

| as Transferor |

| | |

| By: | /s/ Paul Breaux |

| Name: | Paul Breaux |

| Title: | Vice President |

| | |

| | |

| ALLY BANK, |

| as Purchaser |

| | |

| By: | /s/ Scott M. Brobecker |

| Name: | Scott M. Brobecker |

| Title: | Authorized Representative |

| | |

| | |

| ALLY FINANCIAL INC., |

| as Purchaser |

| | |

| By: | /s/ Thomas E. Elkins |

| Name: | Thomas E. Elkins |

| Title: | Authorized Representative |

[SIGNATURES CONTINUE]

[Signature page to Sixth Amendment to Second Amended and Restated Master Purchase and Sale Agreement]

Agreed to and accepted by:

| | | | | | | | |

| CARVANA, LLC, |

| as Seller | |

| | |

| By: | /s/ Paul Breaux |

| Name: | Paul Breaux |

| Title: | Vice President |

[Signature page to Sixth Amendment to Second Amended and Restated Master Purchase and Sale Agreement]

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

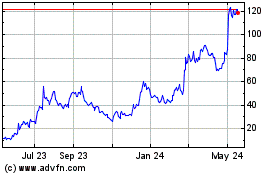

Carvana (NYSE:CVNA)

Historical Stock Chart

From Dec 2024 to Jan 2025

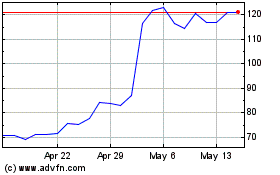

Carvana (NYSE:CVNA)

Historical Stock Chart

From Jan 2024 to Jan 2025