false

0001690820

0001690820

2025-02-19

2025-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 19, 2025

CARVANA

CO.

(Exact name of registrant as specified in its charter)

| Delaware |

001-38073 |

81-4549921 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

| |

300 E. Rio Salado Parkway |

|

| Tempe |

Arizona |

85281 |

| |

(Address of principal executive offices, including zip code) |

|

(602) 922-9866

(Registrant's telephone number, including area

code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.

below):

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Class A Common Stock, Par Value $0.001 Per Share |

CVNA |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

As previously announced by Carvana Co. (the

“Company”) in its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, on February 19, 2025, the

Company entered into a Second Amended and Restated Distribution Agreement with Barclays Capital Inc., Citigroup Global Markets Inc.

and Virtu Americas LLC to further refresh its “at-the-market offering” program (the “ATM Program”). The

offering of shares of the Company’s Class A Common Stock pursuant to the ATM Program (the “ATM Shares”) will be

made from time to time pursuant to a shelf registration statement on Form S-3ASR (File No. 333-285061), including the prospectus

dated February 19, 2025 contained therein, and the prospectus supplement filed on February 19, 2025.

A copy of the opinion of Kirkland & Ellis LLP, relating to the

validity of the issuance and sale of the ATM Shares, is filed with this Current Report on Form 8-K as Exhibit 5.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 19, 2025 |

CARVANA CO. |

| |

|

| |

By: |

/s/ Paul Breaux |

| |

Name: |

Paul Breaux |

| |

Title: |

Vice President, General Counsel, and Secretary |

Exhibit 5.1

333 West Wolf Point Plaza

Chicago, IL 60654

United States

| |

+1 312 862 2000 |

+1 312 862 2200 |

www.kirkland.com

February 19, 2025

Carvana Co.

300 E. Rio Salado Parkway

Tempe, Arizona 85281

Re: Offering of Shares of Class A Common Stock, par value $0.001

per share, by Carvana Co.

Ladies and Gentlemen:

We are acting as counsel to

Carvana Co., a Delaware corporation (the “Company”), in connection with the registration under the Securities Act of 1933,

as amended (the “Securities Act”), of the offer and sale of the Company’s Class A common stock, $0.001 par value per

share (“Class A Common Stock”), of up to the greater of (i) shares of Class A Common Stock representing an aggregate offering

price of $1,000,000,000, or (ii) an aggregate number of 21,016,898 shares of Class A Common Stock (the greater of (i) and (ii), the “ATM

Shares”), from time to time in “at the market offerings,” as defined in Rule 415 promulgated under the Securities Act,

pursuant to the terms of that certain Second Amended and Restated Distribution Agreement, dated February 19, 2025, amending that certain

distribution agreement, dated as of July 19, 2023, as subsequently amended by that certain amended and restated distribution agreement,

dated as of July 31, 2024 (as it may be amended, restated or otherwise modified, the “Distribution Agreement”), among the

Company, Carvana Group, LLC, Barclays Capital Inc., Citigroup Global Markets, Inc. and Virtu Americas LLC, as

sales agents.

The ATM Shares are being

offered and sold by the Company under a registration statement on Form S-3 filed with the Securities and Exchange Commission (the

“Commission”) on February 19, 2025 (Registration No. 333-285061) (the “Registration Statement”), including a base

prospectus dated February 19, 2025 (the “Base Prospectus”), as supplemented by a prospectus supplement, dated February

19, 2025 (together with the Base Prospectus, the “Prospectus”).

In connection with the registration

of the ATM Shares, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate

records and other instruments as we have deemed necessary for the purposes of this opinion, including (i) the organizational documents

of the Company, (ii) minutes and records of the corporate proceedings of the Company, (iii) the Registration Statement and the exhibits

thereto, (iv) the Prospectus, and (v) the Distribution Agreement.

Austin Bay Area Beijing Boston Brussels Dallas Hong Kong Houston London Los Angeles Miami Munich New York Paris Riyadh Salt Lake City

Shanghai Washington, D.C.

Carvana Co.

February 19, 2025

Page 2

For purposes of this opinion,

we have assumed the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted

to us as copies and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal capacity

of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion is rendered,

the authority of such persons signing on behalf of the parties thereto other than the Company and the due authorization, execution and

delivery of all documents by the parties thereto other than the Company. We have not independently established or verified any facts relevant

to the opinions expressed herein, but have relied upon statements and representations of the officers and other representatives of the

Company.

Based upon and subject to

the foregoing qualifications, assumptions and limitations and the further limitations set forth below, we are of the opinion that the

ATM Shares have been duly authorized, and when issued, delivered and paid for in accordance with the Distribution Agreement, will be validly

issued, fully paid and non-assessable.

Our opinion expressed above

is subject to the qualifications that we express no opinion as to the applicability of, compliance with, or effect of any laws except

the laws of the State of New York and the General Corporation Law of the State of Delaware (the “DGCL”), including the applicable

provisions of the Delaware constitution and reported judicial decisions interpreting these laws.

We hereby consent to the filing

of this opinion with the Commission as Exhibit 5.1 to the Company’s Current Report on Form 8-K and to its incorporation by reference

into the Registration Statement. We also consent to the reference to our firm under the heading “Legal Matters” in the Prospectus

constituting part of the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons

whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

We do not find it necessary

for the purposes of this opinion, and accordingly we do not purport to cover herein, the application of the securities or “Blue

Sky” laws of the various states to the sale of the ATM Shares.

This opinion is limited to

the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. The ATM Shares may

be sold from time to time, and this opinion is limited to the laws, including the rules and regulations, as in effect on the date hereof,

which laws are subject to change with possible retroactive effect. We assume no obligation should the present federal securities laws

of the United States, laws of the State of New York or the DGCL be changed by legislative action, judicial decision or otherwise.

Carvana Co.

February 19, 2025

Page 3

This opinion is furnished

to you in connection with the filing of the Company’s Current Report on Form 8-K, which is incorporated by reference into the Registration

Statement, and is not to be used, circulated, quoted or otherwise relied upon for any other purpose.

| |

Very truly yours, |

| |

|

| |

/s/ Kirkland & Ellis LLP |

| |

|

| |

Kirkland & Ellis LLP |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

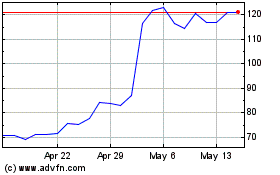

Carvana (NYSE:CVNA)

Historical Stock Chart

From Jan 2025 to Feb 2025

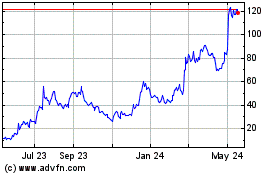

Carvana (NYSE:CVNA)

Historical Stock Chart

From Feb 2024 to Feb 2025