Brightmark Fund Holdings is now one of the

leading dairy RNG solution providers in the U.S. as it expands its

portfolio with new operational projects in Iowa, Michigan, South

Dakota, Wisconsin, and Ohio

Brightmark RNG Holdings LLC announced today that it has

delivered first gas at 10 renewable natural gas (RNG) projects

across the Midwest. Brightmark RNG Holdings LLC is a joint venture

between Chevron U.S.A. Inc., a subsidiary of Chevron Corporation

(NYSE: CVX), and Brightmark Fund Holdings LLC, a subsidiary of

Brightmark LLC.

With today's announcement, the Brightmark RNG Holdings LLC joint

venture now owns and operates 15 RNG projects in the Midwest, a

region that generates nearly 43 percent of the nation’s

agricultural products.

This milestone makes Brightmark one of the leading dairy RNG

providers in the United States. To date, Brightmark has reduced

emissions by more than 1.2 million tons of CO₂eq through its RNG

circularity centers, equivalent to the amount of carbon sequestered

by planting and growing nearly 20 million trees for 10 years.

“We’re extremely excited to see these projects come online and

begin reducing methane emissions while driving economic development

in local communities,” said Bob Powell, founder and Chief Executive

Officer of Brightmark. “This milestone demonstrates the scalability

of these solutions and determination from farmers to reduce methane

emissions in one of the nation’s largest agricultural regions.”

Brightmark’s process for reducing methane emissions involves

collaborating with farmers to produce RNG through anaerobic

digestion. This process collects organic waste, digests it to

extract methane, and upgrades it into RNG for use as transportation

fuel.

“Delivering first gas at 10 farms is a significant milestone,”

said Nuray Elci, Vice President, Renewables, Chevron.

"Transitioning to a lower carbon intensity energy economy demands,

among other things, ambitious goals, innovation, and practical

solutions. This success highlights renewable natural gas' potential

and fosters new opportunities for transport, industry, and

consumers."

“We’re thrilled to implement these innovations on our farm,”

said Jeremy VanEss of VanEss and Legacy Dairies. "Lower carbon is

important to us, and it's exciting to see this technology become

operational and help put our organic waste to use while striving to

reduce our carbon footprint."

“Implementing anaerobic digestion at our farm is not only

environmentally sound but also economically beneficial,” said Lynn

Boadwine of Boadwine Dairy Inc. “Additional revenue generated from

the RNG we produce provides a viable and economic solution to

address recurring waste and makes the transition toward a lower

carbon intensity agriculture more attainable. It’s a win-win.”

For more information:

Visit https://www.brightmark.com/renewable-natural-gas/projects

for more details on their renewable natural gas projects.

About Brightmark RNG

Holdings

Brightmark RNG Holdings LLC is a joint venture between Chevron

U.S.A. Inc., a subsidiary of Chevron Corporation (NYSE: CVX), and

Brightmark Fund Holdings LLC, a subsidiary of Brightmark LLC. The

Chevron-Brightmark renewable natural gas joint venture operates a

nationwide system of RNG projects, capturing methane from dairy

operations for beneficial use as pipeline fuel.

For more information on Brightmark RNG Holding LLC's renewable

natural gas projects, please visit Brightmark.com.

About Brightmark LLC

Brightmark, LLC is a circular innovations company with a mission

to Reimagine Waste, developing solutions that make a positive

environmental impact on the world and communities where it

operates. Brightmark's established anaerobic digestion and

proprietary Plastics Renewal® technologies make the company a

veteran in a burgeoning marketplace. The company works across

sectors, including agriculture, healthcare, manufacturing, and

transportation, to decarbonize operations, displace reliance on

virgin fossil fuels, and solve circularity challenges at scale.

Committed to systems change in waste, Brightmark works

collaboratively to address gaps where traditional methods fall

short through its innovative closed-loop approach to recycling and

renewables. To date, Brightmark has repurposed nearly 10 million

pounds of landfill-bound plastics and reduced more than one million

tons of CO2eq from entering the atmosphere through anaerobic

digestion. The company is also deeply committed to conservation,

education, and sustainability career training by partnering with

local and national organizations that help protect land and oceans.

For more information, visit www.brightmark.com.

About Chevron

Chevron is one of the world’s leading integrated energy

companies. We believe affordable, reliable and ever-cleaner energy

is essential to enabling human progress. Chevron produces crude oil

and natural gas; manufactures transportation fuels, lubricants,

petrochemicals and additives; and develops technologies that

enhance our business and the industry. We aim to grow our oil and

gas business, lower the carbon intensity of our operations and grow

lower carbon businesses in renewable fuels, carbon capture and

offsets, hydrogen and other emerging technologies. More information

about Chevron is available at www.chevron.com.

NOTICE

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE

SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements relating

to Chevron’s operations and lower carbon strategy that are based on

management’s current expectations, estimates, and projections about

the petroleum, chemicals, and other energy-related industries.

Words or phrases such as “anticipates,” “expects,” “intends,”

“plans,” “targets,” “advances,” “commits,” “drives,” “aims,”

“forecasts,” “projects,” “believes,” “approaches,” “seeks,”

“schedules,” “estimates,” “positions,” “pursues,” “progress,”

“may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,”

“trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,”

“strategies,” “opportunities,” “poised,” “potential,” “ambitions,”

“aspires” and similar expressions, and variations or negatives of

these words, are intended to identify such forward-looking

statements, but not all forward-looking statements include such

words. These statements are not guarantees of future performance

and are subject to numerous risks, uncertainties and other factors,

many of which are beyond the company’s control and are difficult to

predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements. The reader should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this report. Unless legally required, Chevron

undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Among the important factors that could cause actual results to

differ materially from those in the forward-looking statements are:

changing crude oil and natural gas prices and demand for the

company’s products, and production curtailments due to market

conditions; crude oil production quotas or other actions that might

be imposed by the Organization of Petroleum Exporting Countries and

other producing countries; technological advancements; changes to

government policies in the countries in which the company operates;

public health crises, such as pandemics and epidemics, and any

related government policies and actions; disruptions in the

company’s global supply chain, including supply chain constraints

and escalation of the cost of goods and services; changing

economic, regulatory and political environments in the various

countries in which the company operates; general domestic and

international economic, market and political conditions, including

the military conflict between Russia and Ukraine, the conflict in

Israel and the global response to these hostilities; changing

refining, marketing and chemicals margins; the company’s ability to

realize anticipated cost savings and efficiencies associated with

enterprise structural cost reduction initiatives; the potential for

gains and losses from asset dispositions or impairments; the

possibility that future charges related to enterprise structural

cost reduction initiatives, impairments and other obligations may

be greater or different than anticipated, including as a result of

unexpected or changed facts, circumstances and assumptions; actions

of competitors or regulators; timing of exploration expenses;

timing of crude oil liftings; the competitiveness of

alternate-energy sources or product substitutes; development of

large carbon capture and offset markets; the results of operations

and financial condition of the company’s suppliers, vendors,

partners and equity affiliates; the inability or failure of the

company’s joint-venture partners to fund their share of operations

and development activities; the potential failure to achieve

expected net production from existing and future crude oil and

natural gas development projects; potential delays in the

development, construction or start-up of planned projects; the

potential disruption or interruption of the company’s operations

due to war, accidents, political events, civil unrest, severe

weather, cyber threats, terrorist acts, or other natural or human

causes beyond the company’s control; the potential liability for

remedial actions or assessments under existing or future

environmental regulations and litigation; significant operational,

investment or product changes undertaken or required by existing or

future environmental statutes and regulations, including

international agreements and national or regional legislation and

regulatory measures related to greenhouse gas emissions and climate

change; the potential liability resulting from pending or future

litigation; the risk that regulatory approvals and clearances

related to the Hess Corporation (Hess) transaction are not obtained

or are obtained subject to conditions that are not anticipated by

the company and Hess; potential delays in consummating the Hess

transaction, including as a result of the ongoing arbitration

proceedings regarding preemptive rights in the Stabroek Block joint

operating agreement; risks that such ongoing arbitration is not

satisfactorily resolved and the potential transaction fails to be

consummated; uncertainties as to whether the potential transaction,

if consummated, will achieve its anticipated economic benefits,

including as a result of risks associated with third party

contracts containing material consent, anti-assignment, transfer or

other provisions that may be related to the potential transaction

that are not waived or otherwise satisfactorily resolved; the

company’s ability to integrate Hess’ operations in a successful

manner and in the expected time period; the possibility that any of

the anticipated benefits and projected synergies of the potential

transaction will not be realized or will not be realized within the

expected time period; the company’s future acquisitions or

dispositions of assets or shares or the delay or failure of such

transactions to close based on required closing conditions;

government mandated sales, divestitures, recapitalizations, taxes

and tax audits, tariffs, sanctions, changes in fiscal terms or

restrictions on scope of company operations; foreign currency

movements compared with the U.S. dollar; higher inflation and

related impacts; material reductions in corporate liquidity and

access to debt markets; changes to the company’s capital allocation

strategies; the effects of changed accounting rules under generally

accepted accounting principles promulgated by rule-setting bodies;

the company’s ability to identify and mitigate the risks and

hazards inherent in operating in the global energy industry; and

the factors set forth under the heading “Risk Factors” on pages 20

through 26 of the company’s 2023 Annual Report on Form 10-K and in

subsequent filings with the U.S. Securities and Exchange

Commission. Other unpredictable or unknown factors not discussed in

this report could also have material adverse effects on

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116134554/en/

Chevron Media Contact: Allison Cook, Chevron

acook@chevron.com

Brightmark Media Contact: Max Madden

mmadden@apcoworldwide.com

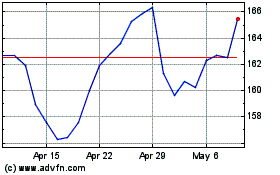

Chevron (NYSE:CVX)

Historical Stock Chart

From Dec 2024 to Jan 2025

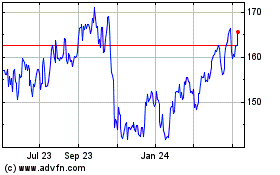

Chevron (NYSE:CVX)

Historical Stock Chart

From Jan 2024 to Jan 2025