Filed pursuant to Rule 424(b)(3)

Registration No. 333-252515

PROSPECTUS SUPPLEMENT NO. 46

(to Prospectus dated February 16, 2021)

Danimer Scientific, Inc.

Up to 32,435,961 Shares of Common Stock

Up to 16,279,253 Shares of Common Stock Issuable Upon Exercise of Warrants and Options

This prospectus supplement supplements the prospectus dated February 16, 2021 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-252515). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission on October 16, 2024 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement. The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of up to 16,279,253 shares of our Class A common stock, $0.0001 par value per share (“Common Stock”), which consists of (i) up to 6,000,000 shares of Common Stock that are issuable upon the exercise of 6,000,000 warrants (the “Private Warrants”) originally issued in a private placement in connection with the initial public offering of Live Oak Acquisition Corp., our predecessor company (“Live Oak”), (ii) up to 10,000,000 shares of Common Stock that are issuable upon the exercise of 10,000,000 warrants (the “Public Warrants” and, together with the Private Warrants, the “Warrants”) originally issued in the initial public offering of Live Oak and (iii) up to 279,253 shares of Common Stock issuable upon exercise of Non-Plan Legacy Danimer Options. We will receive the proceeds from any exercise of any Warrants for cash.

The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”), or their permitted transferees, of (i) up to 32,435,961 shares of Common Stock (including up to 6,000,000 shares of Common Stock that may be issued upon exercise of the Private Warrants) and (ii) up to 6,000,000 Private Warrants. We will not receive any proceeds from the sale of shares of Common Stock or the Private Warrants by the Selling Securityholders pursuant to the Prospectus and this prospectus supplement.

Our registration of the securities covered by the Prospectus and this prospectus supplement does not mean that the Selling Securityholders will offer or sell any of the shares. The Selling Securityholders may sell the shares of Common Stock covered by the Prospectus and this prospectus supplement in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the shares in the section entitled “Plan of Distribution.”

Our Common Stock is listed on The New York Stock Exchange under the symbol “DNMR”. On October 16, 2024, the closing price of our Common Stock was $0.41. Our Public Warrants were previously traded on The New York Stock Exchange under the symbol “DNMR WS”; however, the Public Warrants ceased trading on the New York Stock Exchange and were delisted following their redemption.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

See the section entitled “Risk Factors” beginning on page 4 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is October 18, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 14, 2024 |

DANIMER SCIENTIFIC, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39280 |

84-1924518 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

140 Industrial Boulevard |

|

Bainbridge, Georgia |

|

39817 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 229 243-7075 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common stock, $0.0001 par value per share |

|

DNMR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Transition of Chief Executive Officer

On October 15, 2024, Danimer Scientific, Inc. (the “Company”) announced that, effective as of October 14, 2024, Stephen Croskrey, who previously announced his intention to retire by the end of 2024 after more than eight years as Chief Executive Officer (“CEO”) of the Company, will no longer serve as CEO of the Company.

Pursuant to the terms of the previously disclosed Transition and Retirement Agreement between Mr. Croskrey and the Company, Mr. Croskrey has agreed to serve as a Special Advisor to the Company until the end of the year to further support the transition to a new CEO. Mr. Croskrey will continue to serve as a member of the Board of Directors (the “Board”) of the Company.

Appointment of Interim CEO

On October 15, 2024, the Company further announced that, effective immediately, Richard Altice, a current director of the Company has been named Interim Chief Executive Officer (“Interim CEO”) of the Company. Mr. Altice will continue to serve as a director of the Company, but in connection with and effective concurrently with his appointment as the Company’s Interim CEO, Mr. Altice ceased to serve as a member of the Nominating and Corporate Governance Committee of the Board. The Board is working to identify a new CEO and has formed an Executive Committee to lead the process. Mr. Altice will serve on the Executive Committee of the Board, replacing Mr. Croskrey.

In connection with his appointment as Interim CEO, the Company granted Mr. Altice 300,000 Stock Appreciation Rights pursuant to the Danimer Scientific, Inc. 2020 Long-Term Incentive Plan (as amended from time to time, the “LTIP”) with an exercise price set at 135% of the closing price of the Company’s Class A common stock as of October 14, 2024, which Stock Appreciation Rights will vest on the first anniversary of the date of grant, subject to Mr. Altice’s continued service as a director of the Company through such date. In addition, Mr. Altice will receive cash compensation of $25,000 a month during his service as Interim CEO and be eligible to participate in the Company’s standard benefit programs. Mr. Altice will not be eligible to participate in the Company’s Non-Employee Director Compensation Program during his tenure as Interim CEO.

Mr. Altice has been a member of the Board since April 2024. He most recently retired from NatureWorks, the world’s leading developer and manufacturer of biopolymers (polylactic acid), where he was President and CEO for five years. During his tenure as President and CEO, Mr. Altice led NatureWorks to significant revenue growth and profitability, leading to an expansion of its second manufacturing facility in Nahkon Sawan, Thailand. Prior to NatureWorks, Mr. Altice was the Senior Vice President and President of PolyOne’s Designed Structures and Solutions, a polymer and plastics converting and food packaging business, formerly known as Spartech. Mr. Altice led the turnaround of the business and subsequent divestiture to Arsenal Capital Partners in 2017. Additionally, Mr. Altice was Vice President of Hexion’s Global Specialty Epoxy resin business and was formerly the President of Solutia’s Technical Specialties division, responsible for the global rubber chemicals and specialty fluids businesses, including Therminol heat transfer fluid and Skydrol aviation hydraulic fluid. Mr. Altice graduated from the Missouri University of Science and Technology with a Bachelor of Science in Chemical Engineering.

Transition of Interim Executive Chairman to Independent Director

On October 15, 2024, the Company also announced that, in connection with the appointment of Mr. Altice as Interim CEO, Richard Hendrix would step down from his role as Interim Executive Chairman of the Board, effective as of October 20, 2024, and would continue serving on the Board as its independent Chairman of the Board.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

|

|

|

|

|

|

Exhibit No. |

|

Description |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Danimer Scientific, Inc |

|

|

|

|

Date: |

October 15, 2024 |

By: |

/s/ Stephen A. Martin |

|

|

|

Stephen A. Martin

Chief Legal Officer and Corporate Secretary |

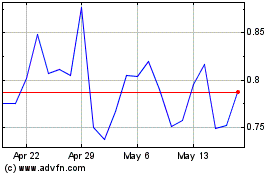

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Dec 2023 to Dec 2024