--Additional Resin Orders and Deliveries

Continue to Support 20-Million Pound Cutlery Award –-

-- 100% Compostable Skittles® Bag Made with

Nodax® PHA Featured at NFL Game --

Danimer Scientific, Inc. (NYSE: DNMR) (“Danimer” or the

“Company”), a leading next generation bioplastics company focused

on the development and production of biodegradable materials,

announced today financial results for its third quarter ended

September 30, 2024.

Richard N. Altice, Interim Chief Executive Officer of Danimer,

commented, “We completed the third quarter in line with our

expectations considering the temporary impact of Starbucks’

reapportionment of their Nodax-based straw business between our

converter partners. We believe these headwinds are behind us, and

it is important to reiterate that we have retained 100% of this

business. We remain on track to continue to grow our PHA business

into fiscal 2025.

“Our significant cutlery award continues to progress as we work

toward the 20-million-pound annual run rate that we anticipate

reaching in mid-2025. Consistent with the end customer’s ramp plan,

we have received orders for over 250,000 pounds of cutlery resin

and film resin to date. The end customer has invested significant

capital in cutlery molds for each of our converter partners in

support of the program scale-up and testing is proceeding well.

“We are excited about the soft launch of 100% compostable

Skittles packaging made with our Nodax PHA resin. This packaging

was featured at a Seattle Seahawks NFL game in October 2024. This

long-standing development partnership with Mars Wrigley is a great

example of how our biodegradable resins can help combat the

end-of-life problem of petroleum-based plastics.

“While we remain focused on executing these commercial

opportunities, we are mindful of managing our indebtedness levels

and near-term constraints on liquidity as we enter our anticipated

significant commercial ramp over the next twelve months. We are

focused on preserving liquidity and analyzing a variety of

transactions to strengthen our capital structure.”

Third Quarter 2024 Financial Highlights:

- Revenues of $8.6 million in the third quarter of 2024 were down

by $2.3 million compared to revenue of $10.9 million in the third

quarter of 2023. PHA revenue of $6.6 million decreased by $1.8

million in the quarter as compared with the prior year quarter.

This was primarily due to the reapportionment of Starbucks’ straw

business which led to significant disruptions in order patterns of

the Company’s converter partners. PLA revenue of $1.3 million

decreased by $0.6 million quarter-over-quarter, primarily due to

decreased customer demand.

- Gross profit of $(7.3) million was in line with $(7.7) million

in the third quarter of 2023. Adjusted gross profit was $(2.3)

million compared to $(2.6) million in the third quarter of

2023.

- Net loss was $(21.8) million in the third quarter of 2024 which

improved as compared to $(40.2) million in the third quarter of

2023.

- Adjusted EBITDA was $(8.9) million in the third quarter of 2024

which improved as compared to $(9.3) million in the third quarter

of 2023.

Capital Structure

At September 30, 2024, the Company reported total debt

outstanding of $387.9 million, which included approximately $45.7

million of low-interest New Markets Tax Credit loans that the

Company expects will be forgiven beginning in 2026.

The Company has taken actions to reduce its operating costs

across all areas of the business, including reductions in

discretionary spending, reduced labor costs through employee

headcount rationalization, postponement of capital expenditures and

the temporary suspension of operations at the Danimer Catalytic

Technologies business. The Company has also heightened its focus on

collections of accounts receivable and has launched an initiative

to reduce on-hand inventory levels.

In light of the substantial leverage position, the Company

continues to analyze a variety of transactions and mechanisms

designed to reduce debt and/or provide additional liquidity.

Outlook

The Company reported third quarter results that were consistent

with its expectations including the impact of the reapportionment

related to the Starbucks straw resin business. As such, the Company

is providing the following guidance for the remainder of the fiscal

year:

- Adjusted EBITDA through the third quarter is ($27.4) million.

We expect fourth quarter Adjusted EBITDA to be in the range of

($7.0) million to ($7.5) million resulting in a full year Adjusted

EBITDA total of ($34.4) million to ($34.9) million which is within

the previously disclosed guidance range of $(30) million to $(35)

million.

- We expect full-year capital expenditures will be between $8

million and $9 million, within the previously disclosed guidance

range of $8 million to $10 million. This range will support

existing commitments related to the Bainbridge greenfield facility,

maintenance expenditures and other capital projects.

- Given ongoing efforts to analyze a variety of transactions and

mechanisms designed to provide additional liquidity, the Company is

not providing a year-end liquidity outlook at this time.

Webcast, Conference Call and 10-Q Filing

The Company will host a webcast and conference call today,

Tuesday November 19, 2024, at 10:00 AM Eastern time to review third

quarter 2024 results and discuss recent events. The live webcast of

the conference call can be accessed on the Investor Relations

section of the Company’s website at

https://ir.danimerscientific.com. For those unable to access

the webcast, the conference call will be accessible domestically or

internationally, by dialing 1-800-445-7795 or 1-785-424-1699,

respectively. Please use Conference ID: DSQ324 for entrance into

the meeting. Upon dialing in, please request to join the Danimer

Scientific Third Quarter 2024 Earnings Conference Call. The

archived webcast will be available for replay on the Company's

website after the call.

About Danimer Scientific

Danimer is a pioneer in creating more sustainable, more natural

ways to make plastic products. For more than a decade, its

renewable and sustainable biopolymers have helped create plastic

products that are biodegradable and compostable and return to

nature instead of polluting our lands and waters. Danimer’s

technology can be found in a vast array of plastic end products

that people use every day. Applications for its biopolymers include

additives, aqueous coatings, fibers, filaments, films and

injection-molded articles, among others. Danimer holds more than

480 granted patents and pending patent applications in more than 20

countries for a range of manufacturing processes and biopolymer

formulations. For more information, visit

https://danimerscientific.com.

Forward Looking Statements

Please note that this press release may use words such as

“appears,” “anticipates,” “believes,” “plans,” “expects,”

“intends,” “future,” and similar expressions which constitute

forward-looking statements within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, without limitation, statements

regarding expectations for the full year 2024 capital expenditures,

Adjusted EBITDA and liquidity, and statements regarding expected

PHA revenue growth. Forward-looking statements are made based on

expectations and beliefs concerning future events impacting the

Company and therefore involve a number of risks and uncertainties.

The Company cautions that forward-looking statements are not

guarantees and that actual results could differ materially from

those expressed or implied in the forward-looking statements.

Potential risks and uncertainties that could cause the actual

results of operations or financial condition of the Company to

differ materially from those expressed or implied by

forward-looking statements in this release include, but are not

limited to, the overall level of consumer demand on our products;

our ability to maintain sufficient liquidity by realizing near-term

revenue growth and related cash returns and preserving cash until

such cash returns, if any are obtained; the effect on our borrowing

facilities of an event of default, including if an Annual Report on

Form 10-K contains a Report of Independent Registered Public

Accounting Firm that includes disclosure regarding going concern;

our ability to maintain our exchange listing; general economic

conditions and other factors affecting consumer confidence,

preferences, and behavior; disruption and volatility in the global

currency, capital, and credit markets; the financial strength of

the Company's customers; the Company's ability to implement its

business strategy, including, but not limited to, its ability to

expand its production facilities and plants to meet customer demand

for its products and the timing thereof; risks relating to the

uncertainty of the projected financial information with respect to

the Company; the ability of the Company to execute and integrate

acquisitions; changes in governmental regulation, legislation or

public opinion relating to our products; the Company’s exposure to

product liability or product warranty claims and other loss

contingencies; the outcomes of any litigation matters; the impact

on our business, operations and financial results from the ongoing

conflicts in Ukraine and the Middle East; the impact that global

climate change trends may have on the Company and its suppliers and

customers; the Company's ability to protect patents, trademarks and

other intellectual property rights; any breaches of, or

interruptions in, our information systems; the ability of our

information technology systems or information security systems to

operate effectively, including as a result of security breaches,

viruses, hackers, malware, natural disasters, vendor business

interruptions or other causes; our ability to properly maintain,

protect, repair or upgrade our information technology systems or

information security systems, or problems with our transitioning to

upgraded or replacement systems; the impact of adverse publicity

about the Company and/or its brands, including without limitation,

through social media or in connection with brand damaging events

and/or public perception; fluctuations in the price, availability

and quality of raw materials and contracted products as well as

foreign currency fluctuations; our ability to utilize potential net

operating loss carryforwards; and changes in tax laws and

liabilities, tariffs, legal, regulatory, political and economic

risks. More information on potential factors that could affect the

Company's financial results is included from time to time in the

Company's public reports filed with the Securities and Exchange

Commission, including the Company's Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

All forward-looking statements included in this press release are

based upon information available to the Company as of the date of

this press release and speak only as of the date hereof. The

Company assumes no obligation to update any forward-looking

statements to reflect events or circumstances after the date of

this press release.

Danimer Scientific,

Inc.

Condensed Consolidated Balance

Sheets

September 30, December 31, (in thousands,

except share and per share data)

2024

2023

Assets: Current assets: Cash and cash equivalents

$

22,187

$

59,170

Accounts receivable, net

11,745

15,227

Other receivables, net

125

652

Inventories, net

26,043

25,270

Prepaid expenses and other current assets

5,395

4,714

Contract assets, net

4,377

3,005

Total current assets

69,872

108,038

Property, plant and equipment, net

430,231

445,153

Intangible assets, net

75,762

77,790

Right-of-use assets

19,163

19,160

Leverage loans receivable

31,446

31,446

Restricted cash

14,116

14,334

Other assets

3,180

2,210

Total assets

$

643,770

$

698,131

Liabilities and Stockholders' Equity: Current liabilities:

Accounts payable

$

4,542

$

5,292

Accrued liabilities

6,131

4,726

Unearned revenue and contract liabilities

914

1,000

Current portion of lease liability

3,724

3,337

Current portion of long-term debt, net

6,021

1,368

Total current liabilities

21,332

15,723

Long-term lease liability, net

21,418

21,927

Long-term debt, net

381,874

381,436

Warrant liability

6,315

5

Other long-term liabilities

1,238

1,020

Total liabilities

$

432,177

$

420,111

Stockholders' equity: Common stock, $0.0001 par value;

600,000,000 shares authorized: 120,771,640 and 102,832,103 shares

issued and outstanding at September 30, 2024 and December 31, 2023,

respectively

$

13

$

10

Additional paid-in capital

737,464

732,131

Accumulated deficit

(525,884

)

(454,121

)

Total stockholders’ equity

211,593

278,020

Total liabilities and stockholders’ equity

$

643,770

$

698,131

Danimer Scientific,

Inc.

Condensed Consolidated

Statements of Operations

Three Months Ended September 30, Nine Months Ended

September 30, (in thousands, except share and per share data)

2024

2023

2024

2023

Revenue: Products

$

7,972

$

10,454

$

25,173

$

33,724

Services

658

494

1,309

2,015

Total revenue

8,630

10,948

26,482

35,739

Costs and expenses: Cost of revenue

15,945

18,685

47,011

56,327

Selling, general and administrative

6,861

16,555

20,482

52,098

Research and development

4,580

6,883

15,031

21,667

Loss on sale of assets

65

64

630

234

Total costs and expenses

27,451

42,187

83,154

130,326

Loss from operations

(18,821

)

(31,239

)

(56,672

)

(94,587

)

Nonoperating income (expense) Gain (loss) on remeasurement of

warrants

(206

)

132

5,635

99

Interest, net

(9,631

)

(8,584

)

(27,541

)

(21,132

)

(Gain) loss on loan extinguishment

6,821

-

6,821

(102

)

Total nonoperating expense:

(3,016

)

(8,452

)

(15,085

)

(21,135

)

Loss before income taxes

(21,837

)

(39,691

)

(71,757

)

(115,722

)

Income taxes

(2

)

(468

)

(6

)

(317

)

Net loss

$

(21,839

)

$

(40,159

)

$

(71,763

)

$

(116,039

)

Basic net loss per share

$

(0.18

)

$

(0.39

)

$

(0.63

)

$

(1.14

)

Weighted average shares outstanding

119,713,087

102,025,684

113,337,922

101,953,827

Danimer Scientific,

Inc.

Condensed Consolidated

Statements of Cash Flows

Nine Months Ended September 30, (in thousands)

2024

2023

Cash flows from operating activities: Net loss

$

(71,763

)

$

(116,039

)

Adjustments to reconcile net loss to net cash used in operating

activities: Depreciation and amortization

22,345

22,005

Gain on remeasurement of warrants

(5,635

)

(99

)

Amortization of debt issuance costs

8,951

6,209

Stock-based compensation

1,693

42,227

Warrant issuance costs

867

-

Loss on disposal of assets

630

234

Accounts receivable reserves

610

(1,462

)

Inventory reserves

513

540

Amortization of right-of-use assets and lease liability

(124

)

(278

)

(Gain) loss on loan extinguishment

(6,821

)

102

Deferred income taxes

-

(199

)

Other

-

941

Changes in operating assets and liabilities: Accounts receivable

2,873

7,029

Other receivables

528

555

Inventories, net

(1,287

)

5,475

Prepaid expenses and other current assets

(239

)

1,816

Contract assets

(759

)

(1,244

)

Other assets

76

(119

)

Accounts payable

(638

)

(2,061

)

Accrued liabilities

1,588

1,893

Other long-term liabilities

217

706

Unearned revenue and contract liabilities

(85

)

438

Net cash used in operating activities

(46,460

)

(31,331

)

Cash flows from investing activities: Purchases of property, plant

and equipment and intangible assets

(7,486

)

(25,722

)

Proceeds from disposals of property, plant and equipment

1,167

18

Net cash used in investing activities

(6,319

)

(25,704

)

Cash flows from financing activities: Proceeds from issuance of

warrants, net of issuance costs

8,888

-

Proceeds from issuance of common stock, net of issuance costs

4,517

-

Proceeds from long-term debt

20,716

130,000

Principal payments on long-term debt

(17,594

)

(12,437

)

Cash paid for debt issuance costs

(1,097

)

(33,296

)

Proceeds from employee stock purchase plan

176

282

Employee taxes related to stock-based compensation

(28

)

(61

)

Net cash provided by financing activities

15,578

84,488

Net (decrease) increase in cash and cash equivalents and restricted

cash

(37,201

)

27,453

Cash and cash equivalents and restricted cash-beginning of period

73,504

64,401

Cash and cash equivalents and restricted cash-end of period

$

36,303

$

91,854

Non-GAAP Financial Measures

This press release includes the non-GAAP financial measures

“Adjusted EBITDA”, “Adjusted gross profit” and "Adjusted gross

margin". Danimer management views these metrics as a useful way to

look at the performance of its operations between periods and to

exclude decisions on capital investment and financing that might

otherwise impact the review of profitability of the business based

on present market conditions.

Adjusted EBITDA is defined as net income or loss plus net

interest expense, income taxes, depreciation and amortization, as

adjusted to add back certain charges or gains that Danimer may

record each period such as remeasurement of warrants, stock-based

compensation expense, as well as non-recurring charges such as (i)

asset disposal gains or losses as well as other significant gains

or losses such as debt extinguishments and impairment of goodwill;

(ii) legal settlements; or (iii) other discrete non-recurring

items. Danimer believes these items are not considered an indicator

of ongoing performance. Adjusted EBITDA is not a measure of

performance defined in accordance with GAAP. The measure is used as

a supplement to GAAP results in evaluating certain aspects of

Danimer’s business, as described below.

Adjusted gross profit is defined as gross profit plus

depreciation, stock-based compensation and other nonrecurring

items.

Adjusted gross margin is defined as adjusted gross profit

divided by total revenue.

Danimer believes that each of Adjusted EBITDA, Adjusted gross

profit and Adjusted gross margin is useful to investors in

evaluating the Company’s performance because each measure considers

the performance of the Company’s operations, excluding decisions

made with respect to capital investment, financing and other

non-recurring charges as outlined in the preceding paragraph.

Danimer believes these non-GAAP metrics offer additional financial

information that, when coupled with the GAAP results and the

reconciliation to GAAP results, provides a more complete

understanding of its results of operations and the factors and

trends affecting its business.

Adjusted EBITDA, Adjusted gross profit and Adjusted gross margin

should not be considered as an alternative to net income or loss as

an indicator of its performance or as alternatives to any other

measure prescribed by GAAP as there are limitations to using such

non-GAAP measures. Although Danimer believes that Adjusted EBITDA,

Adjusted gross profit and Adjusted gross margin may enhance an

evaluation of its operating performance based on recent revenue

generation and product/overhead cost control because it excludes

the impact of prior decisions made about capital investment,

financing and other expenses, (i) other companies in Danimer’s

industry may define Adjusted EBITDA, Adjusted gross profit and

Adjusted gross margin differently than Danimer does and, as a

result, they may not be comparable to similarly titled measures

used by other companies in its industry, and (ii) Adjusted EBITDA,

Adjusted gross profit and Adjusted gross margin exclude certain

financial information that some may consider important in

evaluating Danimer’s performance.

Danimer compensates for these limitations by providing

disclosure of the differences between Adjusted EBITDA, Adjusted

gross profit and Adjusted gross margin and GAAP results, including

providing a reconciliation to GAAP results, to enable investors to

perform their own analysis of Danimer’s operating results. Because

GAAP financial measures on a forward-looking basis are not

accessible, and reconciling information is not available without

unreasonable effort, reconciliations to GAAP financial measures are

not provided for forward-looking non-GAAP measures. For the same

reasons, the Company is unable to address the probable significance

of the unavailable information, which could be material to future

results.

Danimer Scientific,

Inc.

Reconciliation of Adjusted

EBITDA to Net Loss (Unaudited)

Three Months Ended September 30,

2024

2023

(in thousands)

Net loss

$

(21,839

)

$

(40,159

)

Interest, net

9,631

8,584

Depreciation and amortization

7,376

7,253

(Gain) loss on loan extinguishment

(6,821

)

-

Transaction and other related

1,197

-

Stock-based compensation

744

14,324

Strategic reorganization and related

522

382

Loss (gain) on remeasurement of warrants

206

(132

)

Litigation and other legal related

101

28

Income taxes

2

468

Adjusted EBITDA

$

(8,881

)

$

(9,252

)

Reconciliation of Adjusted

Gross Profit to Gross Profit (Unaudited)

Three Months Ended September 30,

2024

2023

(in thousands) Total revenue

$

8,630

$

10,948

Cost of revenue

15,945

18,685

Gross profit

(7,315

)

(7,737

)

Depreciation

5,049

5,086

Stock-based compensation

3

2

Adjusted gross profit

$

(2,263

)

$

(2,649

)

Adjusted gross margin

(26.2

%)

(24.2

%)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119474813/en/

Investor Relations and Media Blake Chamblee Phone:

770-337-6570 ir@danimer.com

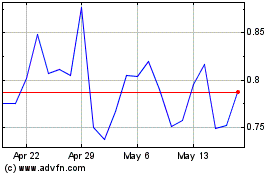

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

From Feb 2024 to Feb 2025