Dole plc (NYSE: DOLE) ("Dole" or the "Group" or the "Company")

today released its financial results for the three months and year

ended December 31, 2024.

Highlights for the quarter ended December 31, 2024:

- Strong fourth quarter operational performance for the

Group

- Revenue of $2.2 billion, an increase of 4.6% (an increase of

10.1% on a like-for-like basis1)

- Net Loss of $31.6 million, primarily due to a non-cash

write-down of the carrying value of the Fresh Vegetables division

of $78.2 million

- Adjusted EBITDA2 of $74.6 million, a decrease of 2.9% (an

increase of 3.7% on a like-for-like basis)

- Adjusted Net Income2 of $15.3 million and Adjusted Diluted EPS2

of $0.16

Highlights for the year ended December 31, 2024:

- Very strong full year results achieved following a year of good

momentum for the Group

- Revenue of $8.5 billion, an increase of 2.8% (an increase of

6.7% on a like-for-like basis)

- Net Income decreased to $143.4 million, primarily due to the

non-cash write down of the carrying value of the Fresh Vegetables

division in the fourth quarter, offset significantly by the strong

operational performance of the Group

- Diluted EPS was $1.32, an increase from $1.30

- Adjusted EBITDA of $392.2 million, an increase of 1.8% (an

increase of 6.7% on a like-for-like basis)

- Adjusted Net Income increased 2.4% to $120.9 million and

Adjusted Diluted EPS increased 2.4% to $1.27

- Free Cash Flow from Continuing Operations2 of $180.3

million

- Net Debt2 of $637.1 million, a reduction of $181.1 million, and

Net Leverage2 of 1.6x

_______________________

1

Like-for-like basis refers to the measure

excluding the impact of foreign currency translation movements and

acquisitions and divestitures. Refer to the Appendix and

"Supplemental Reconciliation of Prior Year Segment Results to

Current Year Segment Results" for further detail on these impacts

and the calculation of like-for-like basis variances.

2

Dole plc reports its financial results in

accordance with U.S. Generally Accepted Accounting Principles

("GAAP"). See full GAAP financial results in the appendix. Adjusted

EBIT, Adjusted EBITDA, Adjusted Net Income, Adjusted Earnings Per

Share, Net Debt, Net Leverage and Free Cash Flow from Continuing

Operations are non-GAAP financial measures. Refer to the appendix

of this release for an explanation and reconciliation of these and

other non-GAAP financial measures used in this release to

comparable GAAP financial measures.

Financial Highlights -

Unaudited

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(U.S. Dollars in millions, except

per share amounts)

Revenue

2,167

2,072

8,475

8,245

Income from Continuing Operations3

29.6

23.1

172.3

177.5

Net (Loss) Income

(31.6

)

28.9

143.4

155.7

Net (Loss) Income attributable to Dole

plc

(39.1

)

22.3

125.5

124.1

Diluted EPS from Continuing Operations

0.23

0.17

1.62

1.53

Diluted EPS

(0.41

)

0.23

1.32

1.30

Adjusted EBITDA2

74.6

76.9

392.2

385.1

Adjusted Net Income2

15.3

14.8

120.9

118.1

Adjusted Diluted EPS2

0.16

0.16

1.27

1.24

Commenting on the results, Carl McCann, Executive Chairman,

said:

“We are pleased to report another strong result in the fourth

quarter, rounding out a year of positive progress and development

for the Group. Adjusted EBITDA increased 6.7% on a like-for-like

basis, a result which was ahead of our latest guidance.

We finished the year in a strong financial position, with net

leverage reducing to 1.6x, as we prioritized capital allocation and

maximizing cash flow generation.

For the current financial year, although there is increased

uncertainty due to the evolving geopolitical environment, we

believe our business is well positioned to deliver another good

result. At this early stage of the financial year, we are targeting

full year Adjusted EBITDA in the range of $370 - $380 million.

Finally, we would like to extend thanks to all our dedicated

people for their contributions and focus throughout the year,

helping to drive our Group forward and delivering our strong 2024

financial result.”

_______________________

3

Fresh Vegetables results are reported

separately as discontinued operations, net of income taxes, in our

consolidated statements of operations, its assets and liabilities

are separately presented in our consolidated balance sheets, and

its cash flows are presented separately in our consolidated

statements of cash flows for all periods presented. Unless

otherwise noted, our discussion of our results included herein,

outlook and all supplementary tables, including non-GAAP financial

measures, are presented on a continuing operations basis.

Group Results - Fourth Quarter

Revenue increased 4.6%, or $95.2 million, primarily due to

positive operational performance across all segments, offset

partially by an unfavorable impact from foreign currency

translation of $2.5 million and a net negative impact from

acquisitions and divestitures of $111.2 million, particularly in

the Diversified Fresh Produce - Americas & ROW segment as a

result of the disposal of the Progressive Produce business in

mid-March 2024. On a like-for-like basis, group revenue increased

10.1%, or $208.9 million.

Net loss was $31.6 million, a decrease from net income of $28.9

million in the prior year. This decrease was due to a loss of $61.2

million in discontinued operations (Fresh Vegetables) compared to

income of $5.8 million in the prior year with improved operating

results offset by a non-cash held for sale fair value loss of

$104.9 million ($78.2 million, net of tax), which adjusted the

carrying value of the Fresh Vegetables division to its estimated

fair value. This loss was primarily due to $78.1 million of

unrecorded depreciation and amortization from March 31, 2023 in

accordance with held for sale guidance.

Adjusted EBITDA decreased 2.9%, or $2.2 million, primarily

driven by a net negative impact from acquisitions and divestitures

of $4.9 million, particularly in the Diversified Fresh Produce -

Americas & ROW segment as a result of the disposal of the

Progressive Produce business. These decreases were partially offset

by good performance in the Fresh Fruit segment. On a like-for-like

basis, Adjusted EBITDA increased 3.7%, or $2.8 million.

Adjusted Net Income increased 3.0%, or $0.5 million,

predominantly due to lower interest expense, as well as lower

depreciation, interest and tax expense recorded within our equity

method investments, offset partially by the decreases in Adjusted

EBITDA as noted above. Adjusted Diluted EPS was $0.16 in each

year.

Group Results - Full Year

Revenue increased 2.8%, or $230.1 million, predominantly due to

strong operational performances across all segments and a favorable

impact from foreign currency translation of $13.4 million. These

positive impacts were partially offset by a net negative impact

from acquisitions and divestitures of $335.6 million, particularly

in the Diversified Fresh Produce - Americas & ROW segment as a

result of the disposal of the Progressive Produce business. On a

like-for-like basis, revenue increased 6.7%, or $552.2 million.

Net income of $143.4 million was $12.3 million lower than the

prior year. The decrease was primarily due to the non-cash held for

sale fair value loss of $78.2 million, net of tax, in the fourth

quarter within discontinued operations as described above, as well

as higher tax expense. These decreases were partially offset by

higher operating income due to strong underlying performance across

the Group, higher other income, primarily related to fair value

adjustments of financial instruments, and lower interest

expense.

Adjusted EBITDA increased 1.8%, or $7.1 million, primarily due

to good performance in the Fresh Fruit and Diversified Fresh

Produce - Americas & ROW segments, partially offset by a lower

result in the Diversified Fresh Produce - EMEA segment and a net

negative impact from acquisitions and divestitures of $18.8

million. The impact of foreign currency translation was not

material. On a like-for-like basis, Adjusted EBITDA increased 6.7%,

or $25.7 million.

Adjusted Net Income increased 2.4%, or $2.8 million,

predominantly due to the increases in Adjusted EBITDA as noted

above, as well as lower interest and depreciation expense,

partially offset by higher tax expense. Adjusted Diluted EPS for

the year ended December 31, 2024 was $1.27 compared to $1.24 in the

prior year.

Selected Segmental Financial

Information (Unaudited)

Three Months Ended

December 31, 2024

December 31, 2023

(U.S. Dollars in thousands)

Revenue

Adjusted EBITDA

Revenue

Adjusted EBITDA

Fresh Fruit

$

819,066

$

31,890

$

748,703

$

28,792

Diversified Fresh Produce - EMEA

910,604

32,487

862,865

32,638

Diversified Fresh Produce - Americas &

ROW

463,285

10,234

489,761

15,427

Intersegment

(25,491

)

—

(29,074

)

—

Total

$

2,167,464

$

74,611

$

2,072,255

$

76,857

Year Ended

December 31, 2024

December 31, 2023

(U.S. Dollars in thousands)

Revenue

Adjusted EBITDA

Revenue

Adjusted EBITDA

Fresh Fruit

$

3,293,527

$

214,848

$

3,135,866

$

208,930

Diversified Fresh Produce - EMEA

3,608,692

131,504

3,432,945

133,570

Diversified Fresh Produce - Americas &

ROW

1,686,281

45,851

1,800,168

42,618

Intersegment

(113,157

)

—

(123,711

)

—

Total

$

8,475,343

$

392,203

$

8,245,268

$

385,118

Fourth Quarter Commentary

Fresh Fruit

Revenue increased 9.4%, or $70.4 million, primarily due to

higher worldwide volumes of bananas sold, higher worldwide pricing

of pineapples and higher pricing and volume for plantains in North

America. These increases were partially offset by lower worldwide

volumes of pineapples sold, lower worldwide pricing for bananas and

lower pricing and volume for plantains in Europe.

Adjusted EBITDA increased by 10.8%, or $3.1 million, primarily

driven by higher revenue in bananas in particular, as well as lower

fruit sourcing and shipping costs in Europe, partially offset by

higher shipping costs in North America due to scheduled dry

dockings.

Diversified Fresh Produce – EMEA

Revenue increased 5.5%, or $47.7 million, primarily driven by

strong performance in the U.K., Spain and the Nordics, partially

offset by a net negative impact from acquisitions and divestitures

of $7.4 million. On a like-for-like basis, revenue increased 6.5%,

or $56.1 million.

Adjusted EBITDA decreased 0.5%, or $0.2 million, primarily due

to decreases in the Czech Republic, South Africa and Ireland as

well as an unfavorable impact from foreign currency translation of

$0.2 million, partially offset by stronger performance in Spain and

the U.K. On a like-for-like basis, Adjusted EBITDA increased 0.3%,

or $0.1 million.

Diversified Fresh Produce – Americas & ROW

Revenue decreased 5.4%, or $26.5 million, primarily due to the

disposal of the Progressive Produce business in mid-March 2024. On

a like-for-like basis, revenue increased 16.1%, or $78.8 million,

primarily due to higher export volumes in cherries and grapes as

well as strong trading performance across commodities in the North

American market.

Adjusted EBITDA decreased 33.7%, or $5.2 million, primarily due

to the disposal of the Progressive Produce business. On a

like-for-like basis, Adjusted EBITDA decreased 2.2%, or $0.3

million, primarily due to a lower profitability in the Chilean

cherry business, partially offset by continued good performance in

North America, particularly in kiwi, grapes and avocados.

Full Year Commentary

Fresh Fruit

Revenue increased 5.0%, or $157.7 million, predominantly driven

by higher worldwide volumes of bananas sold, higher worldwide

pricing of pineapples, higher pricing of bananas in North America

and higher pricing and volume for plantains in North America. These

increases were partially offset by lower pricing for bananas in

Europe, lower volumes of pineapples sold on a worldwide basis,

lower pricing for plantains in Europe and lower commercial cargo

revenue.

Adjusted EBITDA increased 2.8%, or $5.9 million, primarily

driven by higher revenue in bananas in particular, as well as lower

fruit sourcing and shipping costs in Europe, partially offset by

higher shipping costs in North America due to scheduled dry

dockings and a decrease in commercial cargo profitability.

Diversified Fresh Produce – EMEA

Revenue increased 5.1%, or $175.7 million, primarily driven by

strong performance in Ireland and the U.K., a favorable impact from

foreign currency translation of $16.7 million, as a result of the

strengthening of the British pound sterling and Swedish krona

against the U.S. Dollar, and a net positive impact from

acquisitions and divestitures of $8.3 million. On a like-for-like

basis, revenue increased 4.4%, or $150.8 million.

Adjusted EBITDA decreased 1.5%, or $2.1 million, primarily

driven by decreases in the Netherlands and the Czech Republic.

These decreases were partially offset by strong performance in the

Nordics, Spain and South Africa, as well as a favorable impact from

foreign currency translation of $0.3 million. On a like-for-like

basis, Adjusted EBITDA decreased 1.9%, or $2.5 million.

Diversified Fresh Produce – Americas & ROW

Revenue decreased 6.3%, or $113.9 million, primarily due to the

disposal of the Progressive Produce business in mid-March 2024. On

a like-for-like basis, revenue increased 13.0%, or $233.3 million,

primarily due to significantly higher export volumes of cherries,

accentuated by important seasonal timing differences in 2024, as

well as good developments in most other export products. In

addition, the segment also saw strong growth in the North American

marketplace, driven by increases in kiwis, avocados and grapes, in

particular, partially offset by decreases in berries.

Adjusted EBITDA increased 7.6%, or $3.2 million, primarily due

to a strong export performance in Chilean cherries, accentuated by

seasonal timing differences in 2024, as well as a strong

performance on the export side of the business. In addition, there

was also a strong performance in North America, particularly in

kiwis, grapes and avocados. These positive impacts were

significantly offset by the disposal of the Progressive Produce

business. On a like-for-like basis, Adjusted EBITDA increased 52.3%

or $22.3 million.

Capital Expenditures

Capital expenditures for the year ended December 31, 2024 were

$82.4 million which included investments in shipping containers,

farming investments, efficiency projects in our warehouses and

ongoing investments in IT and logistics assets. Additions through

finance leases from continuing operations were $53.3 million for

the year ended December 31, 2024. These additions were primarily

related to $41.1 million of investments in two vessels made during

the three months ended September 30, 2024 that we had previously

chartered; the vessels were subsequently purchased in February of

2025. Total capital additions from continuing operations, including

additions through finance leases, were $135.7 million.

Free Cash Flow from Continuing Operations, Net Debt and Net

Leverage

Free cash flow from continuing operations was $180.3 million for

the year ended December 31, 2024. Free cash flow was driven by

normal seasonal impacts. There were higher outflows from

receivables based on higher revenues (excluding the impacts of

divestitures) and timing of collections and higher outflows from

inventories, partly offset by inflows from accounts payables,

accrued liabilities and other liabilities. At the end of the year,

Net Debt was $637.1 million, a reduction from $818.3 million as of

December 31, 2023. Net Leverage, which is calculated by dividing

Net Debt with Adjusted EBITDA, decreased to 1.6x as of December 31,

2024 from 2.1x as of December 31, 2023.

Outlook for Fiscal Year 2025 (forward-looking

statement)

We are very pleased with the group's strong performance in 2024,

delivering $392.2 million of Adjusted EBITDA from continuing

operations. This result exceeded expectations and gives us a strong

platform to move forward into the 2025 financial year.

While we continue to see excellent opportunities for our

business in 2025, we will also face challenges and uncertainties

this year. The evolving geopolitical environment is adding

increased uncertainty in areas including regulation, foreign

exchange rates and the potential impact of any tariffs on sourcing

costs and supply chains.

Our management teams are keenly focused on preparing for any

eventualities while also continuing to promote the critical

benefits of the fresh produce industry in supporting shared global

goals toward enhancing health and wellness.

For our own operations, we will face a known short-term headwind

in 2025 following the impact of Tropical Storm Sara on our Honduran

operations in November 2024. Factoring in this and given our

excellent finish to the 2024 financial year, which exceeded

expectations, at this early stage of the financial year our target

is to deliver full year Adjusted EBITDA in a range of $370 - $380

million.

Dividend

On February 25, 2025, the Board of Directors of Dole plc

declared a cash dividend for the fourth quarter of 2024 of $0.08

per share, payable on April 3, 2025 to shareholders of record on

March 20, 2025. A cash dividend of $0.08 per share was paid on

January 3, 2025 for the third quarter of 2024.

About Dole plc

A global leader in fresh produce, Dole plc produces, markets,

and distributes an extensive variety of fresh fruits and vegetables

sourced locally and from around the world. Dedicated and passionate

in exceeding our customers’ requirements in over 85 countries, our

goal is to make the world a healthier and a more sustainable

place.

Webcast and Conference Call Information

Dole plc will host a conference call and simultaneous webcast at

08:00 a.m. Eastern Time today to discuss the fourth quarter and

full year 2024 financial results. The live webcast and a replay

after the event can be accessed at

www.doleplc.com/investor-relations or directly at

https://events.q4inc.com/attendee/264989893. The conference call

can be accessed by registering at

https://registrations.events/direct/Q4I604517.

Forward-looking information

Certain statements made in this press release that are not

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are based on management’s beliefs,

assumptions, and expectations of our future economic performance,

considering the information currently available to management.

These statements are not statements of historical fact. The words

“believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,”

“estimate,” “expect,” “intend,” “objective,” “seek,” “strive,”

“target” or similar words, or the negative of these words, identify

forward-looking statements. The inclusion of this forward-looking

information should not be regarded as a representation by us or any

other person that the future plans, estimates, or expectations

contemplated by us will be achieved. Such forward-looking

statements are subject to various risks and uncertainties and

assumptions relating to our operations, financial results,

financial condition, business prospects, growth strategy and

liquidity. Accordingly, there are, or will be, important factors

that could cause our actual results to differ materially from those

indicated in these statements. If one or more of these or other

risks or uncertainties materialize, or if our underlying

assumptions prove to be incorrect, our actual results may vary

materially from what we may have expressed or implied by these

forward-looking statements. We caution that you should not place

undue reliance on any of our forward-looking statements. Any

forward-looking statement speaks only as of the date on which such

statement is made, and we do not undertake any obligation to update

any forward-looking statement to reflect events or circumstances

after the date on which such statement is made except as required

by the federal securities laws.

Category: Financial

Appendix

Consolidated Statements of Operations - Unaudited

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(U.S. Dollars and shares in

thousands, except per share amounts)

Revenue, net

$

2,167,464

$

2,072,255

$

8,475,343

$

8,245,268

Cost of sales

(2,009,045

)

(1,920,077

)

(7,757,622

)

(7,551,098

)

Gross profit

158,419

152,178

717,721

694,170

Selling, marketing, general and

administrative expenses

(122,675

)

(119,334

)

(474,058

)

(473,903

)

Gain on disposal of businesses

472

—

76,417

—

Gain on asset sales

747

10,666

2,648

54,108

Impairment of goodwill

—

—

(36,684

)

—

Impairment and asset write-downs of

property, plant and equipment

(2,154

)

(2,217

)

(5,480

)

(2,217

)

Operating income

34,809

41,293

280,564

272,158

Other income (expense), net

11,137

(2,922

)

20,595

4,799

Interest income

2,410

2,823

10,745

10,083

Interest expense

(18,055

)

(18,754

)

(72,264

)

(81,113

)

Income from continuing operations before

income taxes and equity earnings

30,301

22,440

239,640

205,927

Income tax expense

(264

)

(2,987

)

(75,649

)

(43,591

)

Equity method (loss) earnings

(403

)

3,683

8,308

15,191

Income from continuing operations

29,634

23,136

172,299

177,527

(Loss) income from discontinued

operations, net of income taxes

(61,231

)

5,798

(28,880

)

(21,818

)

Net (loss) income

(31,597

)

28,934

143,419

155,709

Less: Net income attributable to

noncontrolling interests

(7,552

)

(6,597

)

(17,906

)

(31,646

)

Net (loss) income attributable to Dole

plc

$

(39,149

)

$

22,337

$

125,513

$

124,063

Income (loss) per share - basic:

Continuing operations

$

0.23

$

0.18

$

1.63

$

1.54

Discontinued operations

(0.64

)

0.06

(0.31

)

(0.23

)

Net (loss) income per share attributable

to Dole plc - basic

$

(0.41

)

$

0.24

$

1.32

$

1.31

Income (loss) per share - diluted:

Continuing operations

$

0.23

$

0.17

$

1.62

$

1.53

Discontinued operations

(0.64

)

0.06

(0.30

)

(0.23

)

Net income per share attributable to Dole

plc - diluted

$

(0.41

)

$

0.23

$

1.32

$

1.30

Weighted-average shares:

Basic

95,019

94,929

94,967

94,917

Diluted

95,702

95,187

95,471

95,118

Consolidated Balance Sheets -

Unaudited

December 31, 2024

December 31, 2023

ASSETS

(U.S. Dollars and shares in

thousands)

Cash and cash equivalents

$

330,017

$

275,580

Short-term investments

6,019

5,899

Trade receivables, net of allowances for

credit losses of $19,493 and $18,360, respectively

473,511

538,177

Grower advance receivables, net of

allowances of $29,304 and $19,839, respectively

104,956

109,958

Other receivables, net of allowances of

$15,248 and $13,227, respectively

125,412

117,069

Inventories, net of allowances of $4,178

and $4,792, respectively

430,090

378,592

Prepaid expenses

66,136

61,724

Other current assets

15,111

17,401

Fresh Vegetables current assets held for

sale

332,042

414,457

Other assets held-for-sale

1,419

1,832

Total current assets

1,884,713

1,920,689

Long-term investments

14,630

15,970

Investments in unconsolidated

affiliates

129,322

131,704

Actively marketed property

45,778

13,781

Property, plant and equipment, net of

accumulated depreciation of $498,895 and $444,775, respectively

1,082,056

1,102,234

Operating lease right-of-use assets

337,468

340,458

Goodwill

429,590

513,312

DOLE brand

306,280

306,280

Other intangible assets, net of

accumulated amortization of $118,956 and $134,420, respectively

25,238

41,232

Other assets

108,804

109,048

Deferred tax assets, net

82,484

66,485

Total assets

$

4,446,363

$

4,561,193

LIABILITIES AND EQUITY

Accounts payable

$

648,586

$

670,904

Income taxes payable

42,753

22,917

Accrued liabilities

437,017

357,427

Bank overdrafts

11,443

11,488

Current portion of long-term debt, net

80,097

222,940

Current maturities of operating leases

62,896

63,653

Payroll and other tax

28,056

27,791

Contingent consideration

3,399

1,788

Pension and postretirement benefits

18,491

16,570

Fresh Vegetables current liabilities held

for sale

244,669

291,342

Dividends payable and other current

liabilities

14,696

29,892

Total current liabilities

1,592,103

1,716,712

Long-term debt, net

866,075

845,013

Operating leases, less current

maturities

280,836

287,991

Deferred tax liabilities, net

79,598

92,653

Income taxes payable, less current

portion

6,210

16,664

Contingent consideration, less current

portion

4,007

7,327

Pension and postretirement benefits, less

current portion

129,870

121,689

Other long-term liabilities

52,746

52,295

Total liabilities

$

3,011,445

$

3,140,344

Redeemable noncontrolling interests

35,554

34,185

Stockholders’ equity:

Common stock — $0.01 par value; 300,000

shares authorized and 95,041 and 94,929 shares outstanding as of

December 31, 2024 and December 31, 2023, respectively

950

949

Additional paid-in capital

801,099

796,800

Retained earnings

657,430

562,562

Accumulated other comprehensive loss

(166,180

)

(110,791

)

Total equity attributable to Dole plc

1,293,299

1,249,520

Equity attributable to noncontrolling

interests

106,065

137,144

Total equity

1,399,364

1,386,664

Total liabilities, redeemable

noncontrolling interests and equity

$

4,446,363

$

4,561,193

Consolidated Statements of Cash Flows -

Unaudited

Year Ended

December 31, 2024

December 31, 2023

Operating Activities

(U.S. Dollars in thousands)

Net income

$

143,419

$

155,709

Loss from discontinued operations, net of

income taxes

28,880

21,818

Income from continuing operations

172,299

177,527

Adjustments to reconcile income from

continuing operations to net cash provided by (used in) operating

activities - continuing operations:

Depreciation and amortization

98,818

104,168

Impairment of goodwill

36,684

—

Impairment and asset write-downs of

property, plant and equipment

5,480

2,217

Net gain on sale of assets

(2,648

)

(54,108

)

Net gain on sale of businesses

(76,417

)

—

Net (gain) loss on financial

instruments

(12,397

)

2,004

Stock-based compensation expense

7,951

6,045

Equity method earnings

(8,308

)

(15,191

)

Amortization of debt discounts and debt

issuance costs

7,746

6,390

Deferred tax benefit

(17,588

)

(12,600

)

Pension and other postretirement benefit

plan expense

5,404

7,735

Dividends received from equity method

investees

7,049

9,388

Other

(247

)

47

Changes in operating assets and

liabilities:

Receivables, net of allowances

(20,603

)

58,794

Inventories

(70,810

)

20,688

Prepaids, other current assets and other

assets

(281

)

(27,521

)

Accounts payable, accrued liabilities and

other liabilities

130,589

13,022

Net cash provided by operating activities

- continuing operations

262,721

298,605

Investing Activities

Sales of assets

5,011

83,557

Capital expenditures

(82,435

)

(78,041

)

Proceeds from sale of business, net of

transaction costs

117,935

—

Insurance proceeds

527

1,054

Purchases of investments

(262

)

(1,153

)

(Purchases) sales of unconsolidated

affiliates

(1,769

)

1,013

Acquisitions, net of cash acquired

(926

)

(1,263

)

Other

(2,301

)

57

Net cash provided by investing activities

- continuing operations

35,780

5,224

Financing Activities

Proceeds from borrowings and

overdrafts

1,517,106

1,407,970

Repayments on borrowings and

overdrafts

(1,696,130

)

(1,576,067

)

Payment of debt issuance costs

—

(44

)

Dividends paid to shareholders

(30,551

)

(30,373

)

Dividends paid to noncontrolling

interests

(26,579

)

(28,522

)

Other noncontrolling interest activity,

net

(124

)

(1,300

)

Payments of contingent consideration

(1,567

)

(1,662

)

Net cash used in financing activities -

continuing operations

(237,845

)

(229,998

)

Effect of foreign currency exchange rate

changes on cash

(15,241

)

5,448

Net cash provided by (used in) operating

activities - discontinued operations

22,592

(22,622

)

Net cash used in investing activities -

discontinued operations

(13,293

)

(8,492

)

Cash provided by (used in) discontinued

operations, net

9,299

(31,114

)

Increase in cash and cash equivalents

54,714

48,165

Cash and cash equivalents at beginning of

period, including discontinued operations

277,005

228,840

Cash and cash equivalents at end of

period, including discontinued operations

$

331,719

$

277,005

Supplemental cash flow

information:

Income tax payments, net of refunds

$

(77,967

)

$

(63,969

)

Interest payments on borrowings

$

(67,397

)

$

(82,367

)

Non-cash Investing and Financing

Activities:

Accrued property, plant and equipment

$

(2,983

)

$

(1,465

)

Reconciliation from Net Income to Adjusted EBITDA –

Unaudited

The following information is provided to give quantitative

information related to items impacting comparability. Refer to the

'Non-GAAP Financial Measures' section of this document for

additional detail on each item.

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(U.S. Dollars in thousands)

Net (loss) income (Reported

GAAP)

$

(31,597

)

$

28,934

$

143,419

$

155,709

Loss (income) from discontinued

operations, net of income taxes

61,231

(5,798

)

28,880

21,818

Income from continuing operations

(Reported GAAP)

29,634

23,136

172,299

177,527

Income tax expense

264

2,987

75,649

43,591

Interest expense

18,055

18,754

72,264

81,113

Mark to market (gains) losses

(11,356

)

5,450

(10,139

)

2,524

Gain on asset sales

(90

)

(9,139

)

(125

)

(52,495

)

Gain on disposal of businesses

(472

)

—

(76,417

)

—

Cyber-related incident

—

—

—

5,321

Impairment of goodwill

—

—

36,684

—

Other items4,5

1,023

1,833

(1,686

)

2,918

Adjustments from equity method

investments

9,294

4,309

16,258

10,714

Adjusted EBIT (Non-GAAP)

46,352

47,330

284,787

271,213

Depreciation

24,410

24,788

91,262

93,970

Amortization of intangible assets

1,776

2,472

7,556

10,198

Depreciation and amortization adjustments

from equity method investments

2,073

2,267

8,598

9,737

Adjusted EBITDA (Non-GAAP)

$

74,611

$

76,857

$

392,203

$

385,118

_______________________

4

For the three months ended December 31,

2024, other items is primarily comprised of $0.8 million of

impairment charges on property, plant and equipment and $0.4

million of costs for legal matters, partially offset by $0.2

million of insurance proceeds, net of asset writedowns. For the

three months ended December 31, 2023, other items is primarily

comprised of $1.9 million of asset write-downs, net of insurance

proceeds and $0.2 million of impairment charges on property, plant

and equipment, partially offset by other immaterial items.

5

For the year ended December 31, 2024,

other items is primarily comprised of $2.8 million of insurance

proceeds, net of asset writedowns, partially offset by $0.8 million

of impairment charges on property, plant and equipment and $0.4

million of costs for legal matters. For the year ended December 31,

2023, other items is primarily comprised of $3.0 million of asset

write-downs, net of insurance proceeds and $0.2 million of

impairment charges on property, plant and equipment, partially

offset by other immaterial items.

Reconciliation from Net Income attributable to Dole plc to

Adjusted Net Income – Unaudited

The following information is provided to give quantitative

information related to items impacting comparability. Refer to the

'Non-GAAP Financial Measures' section of this document for

additional detail on each item. Refer to the Appendix for

supplementary detail.

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(U.S. Dollars and shares in

thousands, except per share amounts)

Net (loss) income attributable to Dole

plc (Reported GAAP)

$

(39,149

)

$

22,337

$

125,513

$

124,063

Loss (income) from discontinued

operations, net of income taxes

61,231

(5,798

)

28,880

21,818

Income from continuing operations

attributable to Dole plc

22,082

16,539

154,393

145,881

Amortization of intangible assets

1,776

2,472

7,556

10,198

Mark to market (gains) losses

(11,356

)

5,450

(10,139

)

2,524

Gain on asset sales

(90

)

(9,139

)

(125

)

(52,495

)

Gain on disposal of businesses

(472

)

—

(76,417

)

—

Cyber-related incident

—

—

—

5,321

Impairment of goodwill

—

—

36,684

—

Other items6,7

1,023

1,833

(1,686

)

2,918

Adjustments from equity method

investments

7,926

604

9,708

1,956

Income tax on items above and discrete tax

items

(5,338

)

(1,709

)

13,162

5,243

NCI impact on items above

(271

)

(1,220

)

(12,239

)

(3,494

)

Adjusted Net Income for Adjusted EPS

calculation (Non-GAAP)

$

15,280

$

14,830

$

120,897

$

118,052

Adjusted earnings per share – basic

(Non-GAAP)

$

0.16

$

0.16

$

1.27

$

1.24

Adjusted earnings per share – diluted

(Non-GAAP)

$

0.16

$

0.16

$

1.27

$

1.24

Weighted average shares outstanding –

basic

95,019

94,929

94,967

94,917

Weighted average shares outstanding –

diluted

95,702

95,187

95,471

95,118

_______________________

6

For the three months ended December 31,

2024, other items is primarily comprised of $0.8 million of

impairment charges on property, plant and equipment and $0.4

million of costs for legal matters, partially offset by $0.2

million of insurance proceeds, net of asset writedowns. For the

three months ended December 31, 2023, other items is primarily

comprised of $1.9 million of asset write-downs, net of insurance

proceeds and $0.2 million of impairment charges on property, plant

and equipment, partially offset by other immaterial items.

7

For the year ended December 31, 2024,

other items is primarily comprised of $2.8 million of insurance

proceeds, net of asset writedowns, partially offset by $0.8 million

of impairment charges on property, plant and equipment and $0.4

million of costs for legal matters. For the year ended December 31,

2023, other items is primarily comprised of $3.0 million of asset

write-downs, net of insurance proceeds and $0.2 million of

impairment charges on property, plant and equipment, partially

offset by other immaterial items.

Supplemental Reconciliation from Net Income attributable to

Dole plc to Adjusted Net Income – Unaudited

The following information is provided to give quantitative

information related to items impacting comparability. Refer to the

'Non-GAAP Financial Measures' section of this document for

additional detail on each item.

Three Months Ended December

31, 2024

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administration expenses

Other operating items8

Operating Income

Reported (GAAP)

$

2,167,464

(2,009,045

)

158,419

7.3

%

(122,675

)

(935

)

$

34,809

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

1,776

—

1,776

Mark to market (gains) losses

—

(378

)

(378

)

—

—

(378

)

Gain on asset sales

—

—

—

—

(90

)

(90

)

Gain on disposal of businesses

—

—

—

—

(472

)

(472

)

Impairment of goodwill

—

—

—

—

—

—

Other items

—

564

564

459

—

1,023

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

2,167,464

(2,008,859

)

158,605

7.3

%

(120,440

)

(1,497

)

$

36,668

_______________________

8

Other operating items for the three months

ended December 31, 2024 is comprised of $2.2 million of impairment

charges and asset write-downs of property, plant and equipment,

partially offset by a $0.7 million gain on asset sales and a $0.5

million gain on the disposal of businesses, as reported in the

consolidated statements of operations.

Three Months Ended December

31, 2023

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administration expenses

Other operating items9

Operating Income

Reported (GAAP)

$

2,072,255

(1,920,077

)

152,178

7.3

%

(119,334

)

8,449

$

41,293

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

2,472

—

2,472

Mark to market (gains) losses

—

(189

)

(189

)

—

—

(189

)

Gain on asset sales

—

—

—

—

(9,139

)

(9,139

)

Cyber-related incident

—

—

—

—

—

—

Other items

—

2,120

2,120

(34

)

—

2,086

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

2,072,255

(1,918,146

)

154,109

7.4

%

(116,896

)

(690

)

$

36,523

Three Months Ended December

31, 2024

(U.S. Dollars in thousands)

Other (expense) income,

net

Interest income

Interest expense

Income tax (expense)

Equity earnings

Income from continuing

operations

(Loss) income from

discontinued operations, net of income taxes

Reported (GAAP)

$

11,137

2,410

(18,055

)

(264

)

(403

)

29,634

$

(61,231

)

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

61,231

Amortization of intangible assets

—

—

—

—

—

1,776

—

Mark to market (gains) losses

(10,978

)

—

—

—

—

(11,356

)

—

Gain on asset sales

—

—

—

—

—

(90

)

—

Gain on disposal of businesses

—

—

—

—

—

(472

)

—

Other items

—

—

—

—

—

1,023

—

Adjustments from equity method

investments

—

—

—

—

7,926

7,926

—

Income tax on items above and discrete tax

items

—

—

—

(5,240

)

(98

)

(5,338

)

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

159

2,410

(18,055

)

(5,504

)

7,425

23,103

$

—

_______________________

9

Other operating items for the three months

ended December 31, 2023 is comprised of a $10.7 million gain on

asset sales, partially offset by $2.2 million of impairment charges

and asset write-downs of property, plant and equipment, as reported

in the consolidated statements of operations.

Three Months Ended December

31, 2023

(U.S. Dollars in thousands)

Other expense, net

Interest income

Interest expense

Income tax benefit

(expense)

Equity earnings

Income from continuing

operations

(Loss) income from

discontinued operations, net of income taxes

Reported (GAAP)

$

(2,922

)

2,823

(18,754

)

(2,987

)

3,683

23,136

$

5,798

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

(5,798

)

Amortization of intangible assets

—

—

—

—

—

2,472

—

Mark to market losses

5,639

—

—

—

—

5,450

—

Gain on asset sales

—

—

—

—

—

(9,139

)

—

Other items

(253

)

—

—

—

—

1,833

—

Adjustments from equity method

investments

—

—

—

—

604

604

—

Income tax on items above and discrete tax

items

—

—

—

(1,610

)

(99

)

(1,709

)

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

2,464

2,823

(18,754

)

(4,597

)

4,188

22,647

$

—

Three Months Ended December

31, 2024

(U.S. Dollars and shares in

thousands, except per share amounts)

Net (loss) income

Net income attributable to

noncontrolling interests

Net (loss) income attributable

to Dole plc

Diluted net income per

share

Reported (GAAP)

$

(31,597

)

(7,552

)

$

(39,149

)

$

(0.41

)

Loss (income) from discontinued

operations, net of income taxes

61,231

—

61,231

Amortization of intangible assets

1,776

—

1,776

Mark to market (gains) losses

(11,356

)

—

(11,356

)

Gain on asset sales

(90

)

—

(90

)

Gain on disposal of businesses

(472

)

—

(472

)

Impairment of goodwill

—

—

—

Other items

1,023

—

1,023

Adjustments from equity method

investments

7,926

—

7,926

Income tax on items above and discrete tax

items

(5,338

)

—

(5,338

)

NCI impact on items above

—

(271

)

(271

)

Adjusted (Non-GAAP)

$

23,103

(7,823

)

$

15,280

$

0.16

Weighted average shares outstanding –

diluted

95,702

Three Months Ended December

31, 2023

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income

Net income attributable to

noncontrolling interests

Net income attributable to

Dole plc

Diluted net income per

share

Reported (GAAP)

$

28,934

(6,597

)

$

22,337

$

0.23

Loss (income) from discontinued

operations, net of income taxes

(5,798

)

—

(5,798

)

Amortization of intangible assets

2,472

—

2,472

Mark to market (gains) losses

5,450

—

5,450

Gain on asset sales

(9,139

)

—

(9,139

)

Cyber-related incident

—

—

—

Other items

1,833

—

1,833

Adjustments from equity method

investments

604

—

604

Income tax on items above and discrete tax

items

(1,709

)

—

(1,709

)

NCI impact on items above

—

(1,220

)

(1,220

)

Adjusted (Non-GAAP)

$

22,647

(7,817

)

$

14,830

$

0.16

Weighted average shares outstanding –

diluted

95,187

Year Ended December 31,

2024

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administration expenses

Other operating

items10

Operating Income

Reported (GAAP)

$

8,475,343

(7,757,622

)

717,721

8.5

%

(474,058

)

36,901

$

280,564

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

7,556

—

7,556

Mark to market (gains) losses

—

(228

)

(228

)

—

—

(228

)

Gain on asset sales

—

—

—

—

(125

)

(125

)

Gain on disposal of businesses

—

—

—

—

(76,417

)

(76,417

)

Impairment of goodwill

—

—

—

—

36,684

36,684

Other items

—

(2,065

)

(2,065

)

459

—

(1,606

)

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

8,475,343

(7,759,915

)

715,428

8.4

%

(466,043

)

(2,957

)

$

246,428

_______________________

10

Other operating items for the year ended

December 31, 2024 is comprised of a $76.4 million gain on the

disposal of businesses and a $2.6 million gain on asset sales,

partially offset by a $36.7 million impairment charge of goodwill

and $5.5 million of impairment charges and asset write-downs of

property, plant and equipment, as reported in the consolidated

statements of operations.

Year Ended December 31,

2023

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administration expenses

Other operating

items11

Operating Income

Reported (GAAP)

$

8,245,268

(7,551,098

)

694,170

8.4

%

(473,903

)

51,891

$

272,158

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

10,198

—

10,198

Mark to market losses

—

(2,638

)

(2,638

)

—

—

(2,638

)

Gain on asset sales

—

—

—

—

(52,495

)

(52,495

)

Cyber-related incident

—

—

—

5,321

—

5,321

Other items

—

3,205

3,205

(34

)

—

3,171

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

8,245,268

(7,550,531

)

694,737

8.4

%

(458,418

)

(604

)

$

235,715

_______________________

11

Other operating items for the year ended

December 31, 2023 is comprised of a $54.1 million gain on asset

sales, partially offset by $2.2 million of impairment charges and

asset write-downs of property, plant and equipment, as reported in

the consolidated statements of operations.

Year Ended December 31,

2024

(U.S. Dollars in thousands)

Other income, net

Interest income

Interest expense

Income tax (expense)

Equity earnings

Income from continuing

operations

(Loss) income from

discontinued operations, net of income taxes

Reported (GAAP)

$

20,595

10,745

(72,264

)

(75,649

)

8,308

172,299

$

(28,880

)

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

28,880

Amortization of intangible assets

—

—

—

—

—

7,556

—

Mark to market (gains) losses

(9,911

)

—

—

—

—

(10,139

)

—

Gain on asset sales

—

—

—

—

—

(125

)

—

Gain on disposal of businesses

—

—

—

—

—

(76,417

)

—

Impairment of goodwill

—

—

—

—

—

36,684

—

Other items

(80

)

—

—

—

—

(1,686

)

—

Adjustments from equity method

investments

—

—

—

—

9,708

9,708

—

Income tax on items above and discrete tax

items

—

—

—

13,560

(398

)

13,162

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

10,604

10,745

(72,264

)

(62,089

)

17,618

151,042

$

—

Year Ended December 31,

2023

(U.S. Dollars in thousands)

Other income, net

Interest income

Interest expense

Income tax expense

Equity earnings

Income from continuing

operations

(Loss) income from

discontinued operations, net of income taxes

Reported (GAAP)

$

4,799

10,083

(81,113

)

(43,591

)

15,191

177,527

$

(21,818

)

Loss (income) from discontinued

operations, net of income taxes

—

—

—

—

—

—

21,818

Amortization of intangible assets

—

—

—

—

—

10,198

—

Mark to market losses

5,162

—

—

—

—

2,524

—

Gain on asset sales

—

—

—

—

—

(52,495

)

—

Cyber-related incident

—

—

—

—

—

5,321

—

Other items

(253

)

—

—

—

—

2,918

—

Adjustments from equity method

investments

—

—

—

—

1,956

1,956

—

Income tax on items above and discrete tax

items

—

—

—

5,643

(400

)

5,243

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

9,708

10,083

(81,113

)

(37,948

)

16,747

153,192

$

—

Year Ended December 31,

2024

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income

Net income attributable to

noncontrolling interests

Net income attributable to

Dole plc

Diluted net income per

share

Reported (GAAP)

$

143,419

(17,906

)

$

125,513

$

1.31

Loss (income) from discontinued

operations, net of income taxes

28,880

—

28,880

Amortization of intangible assets

7,556

—

7,556

Mark to market (gains) losses

(10,139

)

—

(10,139

)

Gain on asset sales

(125

)

—

(125

)

Gain on disposal of businesses

(76,417

)

—

(76,417

)

Impairment of goodwill

36,684

—

36,684

Other items

(1,686

)

—

(1,686

)

Adjustments from equity method

investments

9,708

—

9,708

Income tax on items above and discrete tax

items

13,162

—

13,162

NCI impact on items above

—

(12,239

)

(12,239

)

Adjusted (Non-GAAP)

$

151,042

(30,145

)

$

120,897

$

1.27

Weighted average shares outstanding –

diluted

95,471

Year Ended December 31,

2023

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income

Net income attributable to

noncontrolling interests

Net income attributable to

Dole plc

Diluted net income per

share

Reported (GAAP)

$

155,709

(31,646

)

$

124,063

$

1.30

Loss (income) from discontinued

operations, net of income taxes

21,818

—

21,818

Amortization of intangible assets

10,198

—

10,198

Mark to market losses

2,524

—

2,524

Gain on asset sales

(52,495

)

—

(52,495

)

Cyber-related incident

5,321

—

5,321

Other items

2,918

—

2,918

Adjustments from equity method

investments

1,956

—

1,956

Income tax on items above and discrete tax

items

5,243

—

5,243

NCI impact on items above

—

(3,494

)

(3,494

)

Adjusted (Non-GAAP)

$

153,192

(35,140

)

$

118,052

$

1.24

Weighted average shares outstanding –

diluted

95,118

Supplemental Reconciliation of Prior

Year Segment Results to Current Year Segment Results –

Unaudited

Revenue for the Three Months

Ended

December 31, 2023

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

December 31, 2024

(U.S. Dollars in thousands)

Fresh Fruit

$

748,703

$

—

$

—

$

70,363

$

819,066

Diversified Fresh Produce - EMEA

862,865

(907

)

(7,425

)

56,071

910,604

Diversified Fresh Produce - Americas &

ROW

489,761

(1,575

)

(103,749

)

78,848

463,285

Intersegment

(29,074

)

—

—

3,583

(25,491

)

Total

$

2,072,255

$

(2,482

)

$

(111,174

)

$

208,865

$

2,167,464

Adjusted EBITDA for the Three

Months Ended

December 31, 2023

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

December 31, 2024

(U.S. Dollars in thousands)

Fresh Fruit

$

28,792

$

43

$

—

$

3,055

$

31,890

Diversified Fresh Produce - EMEA

32,638

(234

)

(14

)

97

32,487

Diversified Fresh Produce - Americas &

ROW

15,427

(23

)

(4,837

)

(333

)

10,234

Total

$

76,857

$

(214

)

$

(4,851

)

$

2,819

$

74,611

Revenue for the Year

Ended

December 31, 2023

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

December 31, 2024

(U.S. Dollars in thousands)

Fresh Fruit

$

3,135,866

$

—

$

—

$

157,661

$

3,293,527

Diversified Fresh Produce - EMEA

3,432,945

16,664

8,307

150,776

3,608,692

Diversified Fresh Produce - Americas &

ROW

1,800,168

(3,275

)

(343,868

)

233,256

1,686,281

Intersegment

(123,711

)

—

—

10,554

(113,157

)

Total

$

8,245,268

$

13,389

$

(335,561

)

$

552,247

$

8,475,343

Adjusted EBITDA for the Year

Ended

December 31, 2023

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

December 31, 2024

(U.S. Dollars in thousands)

Fresh Fruit

$

208,930

$

10

$

—

$

5,908

$

214,848

Diversified Fresh Produce - EMEA

133,570

281

139

(2,486

)

131,504

Diversified Fresh Produce - Americas &

ROW

42,618

(71

)

(18,974

)

22,278

45,851

Total

$

385,118

$

220

$

(18,835

)

$

25,700

$

392,203

Net Debt and Net Leverage Reconciliation – Unaudited

Net Debt is the primary measure used by management to analyze

the Company’s capital structure. Net Debt is a non-GAAP financial

measure, calculated as cash and cash equivalents, less current and

long-term debt. It also excludes debt discounts and debt issuance

costs. Net Leverage is calculated as total Net Debt divided by

Adjusted EBITDA for the financial year. The calculation of Net Debt

and Net Leverage as of December 31, 2024 is presented below. Net

Debt as of December 31, 2024 was $637.1 million and Net Leverage

was 1.6x.

December 31, 2024

December 31, 2023

(U.S. Dollars in thousands)

Cash and cash equivalents (Reported

GAAP)

$

330,017

$

275,580

Debt (Reported GAAP):

Long-term debt, net

(866,075

)

(845,013

)

Current maturities

(80,097

)

(222,940

)

Bank overdrafts

(11,443

)

(11,488

)

Total debt, net

(957,615

)

(1,079,441

)

Less: Debt discounts and debt issuance

costs (Reported GAAP)

(9,531

)

(14,395

)

Total gross debt

(967,146

)

(1,093,836

)

Net Debt (Non-GAAP)

$

(637,129

)

$

(818,256

)

Adjusted EBITDA (Non-GAAP)

392,203

385,118

Net Leverage (Non-GAAP)

1.6x

2.1x

Free Cash Flow from Continuing

Operations Reconciliation – Unaudited

Year Ended

December 31, 2024

December 31, 2023

(U.S. Dollars in thousands)

Net cash provided by operating activities

- continuing operations (Reported GAAP)

$

262,721

$

298,605

Less: Capital expenditures (Reported

GAAP)12

(82,435

)

(78,041

)

Free cash flow from continuing

operations (Non-GAAP)

$

180,286

$

220,564

_______________________

12

Capital expenditures do not include

amounts attributable to discontinued operations.

Non-GAAP Financial Measures

Dole plc’s results are determined in accordance with U.S.

GAAP.

In addition to its results under U.S. GAAP, in this Press

Release, we also present Dole plc’s Adjusted EBIT, Adjusted EBITDA,

Adjusted Net Income, Adjusted EPS, Free Cash Flow from Continuing

Operations, Net Debt and Net Leverage, which are supplemental

measures of financial performance that are not required by, or

presented in accordance with, U.S. GAAP (collectively, the

"non-GAAP financial measures"). We present these non-GAAP financial

measures, because we believe they assist investors and analysts in

comparing our operating performance across reporting periods on a

consistent basis by excluding items that we do not believe are

indicative of our core operating performance. These non-GAAP

financial measures have limitations as analytical tools, and you

should not consider them in isolation or as a substitute for

analysis of our operating results, cash flows or any other measure

prescribed by U.S. GAAP. Our presentation of non-GAAP financial

measures should not be construed as an inference that our future

results will be unaffected by any of the adjusted items or that any

projections and estimates will be realized in their entirety or at

all. In addition, adjustment items that are excluded from non-GAAP

results can have a material impact on equivalent GAAP earnings,

financial measures and cash flows.

Adjusted EBIT is calculated from GAAP net income by: (1)

subtracting the income or adding the loss from discontinued

operations, net of income taxes; (2) adding the income tax expense

or subtracting the income tax benefit; (3) adding interest expense;

(4) adding mark to market losses or subtracting mark to market

gains related to unrealized impacts from certain derivative

instruments and foreign currency denominated borrowings, realized

impacts on noncash settled foreign currency denominated borrowings,

net foreign currency impacts on liquidated entities and fair value

movements on contingent consideration; (5) other items which are

separately stated based on materiality, which during the years

ended December 31, 2024 and December 31, 2023, included adding or

subtracting asset write-downs from extraordinary events, net of

insurance proceeds, subtracting the gain or adding the loss on the

disposal of business interests, subtracting the gain or adding the

loss on asset sales for assets held for sale and actively marketed

property, adding impairment charges on property, plant and

equipment, adding restructuring charges and costs for legal matters

not in the ordinary course of business, adding impairment charges

on goodwill and adding costs incurred for the cyber-related

incident; and (6) the Company’s share of these items from equity

method investments.

Adjusted EBITDA is calculated from GAAP net income by: (1)

subtracting the income or adding the loss from discontinued

operations, net of income taxes; (2) adding the income tax expense

or subtracting the income tax benefit; (3) adding interest expense;

(4) adding depreciation charges; (5) adding amortization charges on

intangible assets; (6) adding mark to market losses or subtracting

mark to market gains related to unrealized impacts from certain

derivative instruments and foreign currency denominated borrowings,

realized impacts on noncash settled foreign currency denominated

borrowings, net foreign currency impacts on liquidated entities and

fair value movements on contingent consideration; (7) other items

which are separately stated based on materiality, which during the

years ended December 31, 2024 and December 31, 2023, included

adding or subtracting asset write-downs from extraordinary events,

net of insurance proceeds, subtracting the gain or adding the loss

on the disposal of business interests, subtracting the gain or

adding the loss on asset sales for assets held for sale and

actively marketed property, adding impairment charges on property,

plant and equipment, adding restructuring charges and costs for

legal matters not in the ordinary course of business, adding

impairment charges on goodwill and adding costs incurred for the

cyber-related incident; and (8) the Company’s share of these items

from equity method investments.

Adjusted Net Income is calculated from GAAP net income

attributable to Dole plc by: (1) subtracting the income or adding

the loss from discontinued operations, net of income taxes; (2)

adding amortization charges on intangible assets; (3) adding mark

to market losses or subtracting mark to market gains related to

unrealized impacts from certain derivative instruments and foreign

currency denominated borrowings, realized impacts on noncash

settled foreign currency denominated borrowings, net foreign

currency impacts on liquidated entities and fair value movements on

contingent consideration; (4) other items which are separately

stated based on materiality, which during the years ended December

31, 2024 and December 31, 2023, included adding or subtracting

asset write-downs from extraordinary events, net of insurance

proceeds, subtracting the gain or adding the loss on the disposal

of business interests, subtracting the gain or adding the loss on

asset sales for assets held for sale and actively marketed

property, adding impairment charges on property, plant and

equipment, adding restructuring charges and costs for legal matters

not in the ordinary course of business, adding impairment charges

on goodwill and adding costs incurred for the cyber-related

incident; (5) the Company’s share of these items from equity method

investments; (6) excluding the tax effect of these items and

discrete tax adjustments; and (7) excluding the effect of these

items attributable to non-controlling interests.

Adjusted Earnings per Share is calculated from Adjusted Net

Income divided by diluted weighted average number of shares in the

applicable period.

Net Debt is a non-GAAP financial measure, calculated as GAAP

cash and cash equivalents, less GAAP current and long-term debt. It

also excludes GAAP unamortized debt discounts and debt issuance

costs.

Net Leverage is a non-GAAP financial measure, calculated as Net

Debt divided by Adjusted EBITDA, both of which are defined

above.

Free cash flow from continuing operations is calculated from

GAAP net cash used in or provided by operating activities for

continuing operations less GAAP capital expenditures.

Like-for-like basis refers to the U.S. GAAP measure or non-GAAP

financial measure excluding the impact of foreign currency

translation movements and acquisitions and divestitures. The impact

of foreign currency translation represents an estimate of the

effect of translating the results of operations denominated in a

foreign currency to U.S. dollar at prior year average rates, as

compared to the current year average rates.

Dole is not able to provide a reconciliation for projected FY'25

results without taking unreasonable efforts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226327008/en/

Investor Contact:

James O'Regan, Head of Investor Relations, Dole plc

james.oregan@doleplc.com +353 1 887 2794

Media Contact:

Brian Bell, Ogilvy brian.bell@ogilvy.com +353 87 2436 130

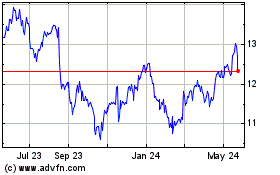

Dole (NYSE:DOLE)

Historical Stock Chart

From Feb 2025 to Mar 2025

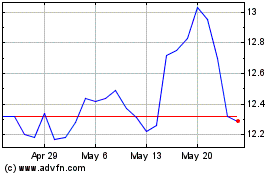

Dole (NYSE:DOLE)

Historical Stock Chart

From Mar 2024 to Mar 2025