Filed Pursuant to Rule 424(b)(5)

Registration No. 333-266405

Prospectus Supplement

(To Prospectus dated July 29, 2022)

Up to $2,750,000,000

Common Shares

Enbridge Inc. (the “Corporation”) has entered into an equity

distribution agreement with BMO Capital Markets Corp., CIBC World Markets Corp., National Bank of Canada Financial Inc., Scotia Capital

(USA) Inc., TD Securities (USA) LLC, Barclays Capital Inc., BofA Securities, Inc., Citigroup Global Markets Inc., Deutsche Bank Securities

Inc., Mizuho Securities USA LLC, Wells Fargo Securities, LLC, RBC Capital Markets, LLC, ATB Capital Markets USA Inc., Desjardins Securities

International Inc. and Morgan Stanley & Co. LLC (the “U.S. sales agents”) and BMO Nesbitt Burns Inc., CIBC World Markets

Inc., National Bank Financial Inc., Scotia Capital Inc., TD Securities Inc., Barclays Capital Canada Inc., Citigroup Global Markets Canada

Inc., Merrill Lynch Canada Inc., Mizuho Securities Canada Inc., Wells Fargo Securities Canada, Ltd., RBC Dominion Securities Inc., ATB

Securities Inc., Desjardins Securities Inc. and Morgan Stanley Canada Limited (the “Canadian sales agents” and, together with

the U.S. sales agents, the “sales agents”), pursuant to which the Corporation may offer and sell from time to time through

the sales agents, as agents, common shares of the Corporation (“Common Shares”) having an aggregate offering price of up to

$2.75 billion (or the equivalent in U.S. dollars determined using the exchange rate posted by Thomson Reuters on the date the Common

Shares are sold) (such offered Common Shares, the “Offered Shares”) in the United States and each of the provinces of Canada

pursuant to placement notices delivered by the Corporation to the sales agents from time to time in accordance with the terms of the equity

distribution agreement.

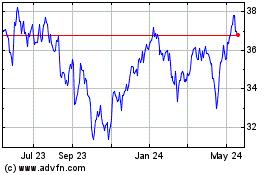

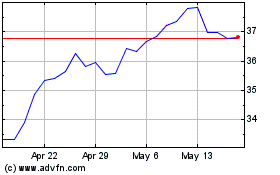

The Common Shares are listed on the New York

Stock Exchange (the “NYSE”) and on the Toronto Stock Exchange (the “TSX”) under the symbol

“ENB”. On May 14, 2024, the closing price of the Common Shares was US$36.99 per Common Share on the NYSE and $50.50

per Common Share on the TSX. The NYSE has authorized the listing of the Offered Shares that may be distributed under the offering,

subject to official notice of issuance. The TSX has conditionally approved the listing of the Offered Shares that may be distributed

under the offering, subject to the Corporation fulfilling all of the requirements of the TSX.

Sales of the Offered Shares, if any, under this prospectus supplement

will be made in sales deemed to be “at the market offerings” as defined in Rule 415 promulgated under the U.S. Securities

Act of 1933, including, without limitation, sales made on or through the NYSE or the TSX or any other marketplace in the United States

or Canada where the Common Shares may be traded. The sales agents may also sell the Offered Shares by any other method agreed by the Corporation

and the applicable sales agent and permitted by applicable law, including, without limitation, as block transactions. The U.S. sales agents

will only sell Offered Shares on marketplaces in the United States, and the Canadian sales agents will only sell Offered Shares on marketplaces

in Canada. Subject to the terms and conditions of the equity distribution agreement, the sales agents will use their commercially reasonable

efforts, consistent with normal trading and sales practices and in accordance with applicable law and regulations, to sell on the Corporation’s

behalf all of the Offered Shares designated by the Corporation pursuant to a placement notice. There is no arrangement for funds to be

received in an escrow, trust, or similar arrangement. The Offered Shares will be distributed at market prices prevailing at the time of

sale. As a result, prices at which Offered Shares are sold may vary between purchasers and during the period of any distribution. There

is no minimum amount of funds that must be raised under this offering. This means that this offering may terminate after raising only

a portion of the offering amount set out above, or none at all. See “Plan of Distribution” in this prospectus supplement for

more information.

This offering is being made concurrently in Canada under the terms

of a prospectus supplement to a short form base shelf prospectus filed with the securities commissions or similar authorities in each

of the provinces of Canada. Neither this prospectus supplement nor the accompanying prospectus constitutes a prospectus under Canadian

securities laws and therefore does not qualify the Offered Shares in Canada.

Under the equity distribution agreement, we

may also sell Offered Shares to the sales agents as principals for their own accounts, at a price to be agreed upon at the time of

sale. If we sell Offered Shares to the sales agents as principals, we will enter into a separate terms agreement with the sales

agents, and, to the extent required by applicable law, we will describe the agreement and the rate of compensation in a separate

prospectus supplement.

The compensation payable to the sales

agents for sales of Offered Shares sold pursuant to the equity distribution agreement will be up to 2.0% of the gross offering

proceeds per Offered Share sold under the equity distribution agreement, and will be paid in the same currency as the Offered Shares

to which such commission pertains were sold. The compensation shall be allocated among the sales agents in such amounts as may be

agreed to by the Corporation and the sales agents, regardless of which sales agent effects the sale. In connection with the sale of

the Offered Shares on our behalf, the sales agents may each be deemed to be an “underwriter” within the meaning of the

U.S. Securities Act of 1933, and the compensation paid to each of the sales agents may be deemed to be underwriting commissions or

discounts. We have also agreed to provide indemnification and contribution to the several sales agents with respect to certain

liabilities, including liabilities under the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934.

The U.S. sales agents are not registered as

investment dealers in any Canadian jurisdiction and, accordingly, the U.S. sales agents will only sell the Offered Shares in the

United States and will not, directly or indirectly, solicit offers to purchase or sell the Offered Shares in Canada.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE OR

CANADIAN SECURITIES COMMISSION OR REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR

ACCURACY OF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The enforcement by investors of civil liabilities under United States

federal securities laws may be affected adversely by the fact that we are incorporated and organized under the laws of Canada, that some

or all of our officers and directors are residents of Canada, that some or all of the sales agents or experts named in this prospectus

supplement or the accompanying prospectus are residents of Canada, and that all or a substantial portion of our assets and said persons

are located outside the United States.

Investing in the Offered Shares involves certain risks. See “Risk

Factors” beginning on page S-3 of this prospectus supplement, as well as the risk factors set forth under the heading “Item

1A. Risk Factors” in the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, incorporated

by reference into this prospectus supplement and the accompanying prospectus.

BMO

Capital

Markets |

CIBC Capital

Markets |

National

Bank of

Canada

Financial

Markets |

Scotiabank |

TD

Securities |

Barclays |

BofA

Securities |

Citigroup |

| |

|

|

|

|

|

|

|

Deutsche

Bank

Securities |

Mizuho |

Wells

Fargo

Securities |

RBC

Capital

Markets |

ATB

Capital

Markets |

Desjardins

Capital

Markets |

Morgan

Stanley |

|

May 15, 2024

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

IMPORTANT

NOTICE

This document is in two parts. The first part is

this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying prospectus, gives more

general information, some of which may not apply to the Offered Shares. The accompanying prospectus, dated July 29, 2022, is referred

to as the “prospectus” in this prospectus supplement.

We are responsible for the information contained

and incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing prospectus we prepare

or authorize. We have not, and the sales agents have not, authorized anyone to give you any other information, and we take no responsibility

for any other information that others may give you. We are not, and the sales agents are not, making an offer of the Offered Shares in

any jurisdiction where the offer is not permitted. You should bear in mind that although the information contained in, or incorporated

by reference in, this prospectus supplement or the accompanying prospectus is intended to be accurate as of the date on the front of such

documents, such information may also be amended, supplemented or updated by the subsequent filing of additional documents deemed by law

to be or otherwise incorporated by reference into this prospectus supplement or the accompanying prospectus and by any amendments to the

prospectus or subsequently filed prospectus supplements.

To the extent there is a conflict between the information

contained in this prospectus supplement or any “free writing prospectus” we may authorize to be delivered to you and the information

contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus

supplement, you should rely on the information in this prospectus supplement or such free writing prospectus, as the case may be. If any

statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document

incorporated by reference in the accompanying prospectus — the statement in the document having the later date modifies or supersedes

the earlier statement.

In this prospectus supplement, all capitalized

terms and acronyms used and not otherwise defined herein have the meanings provided in the prospectus. In this prospectus supplement,

the prospectus and any document incorporated by reference, unless otherwise specified or the context otherwise requires, all dollar amounts

are expressed in Canadian dollars or “$” or “CDN$”. “U.S. dollars” or “US$” means the

lawful currency of the United States. Unless otherwise indicated, all financial information included in this prospectus supplement, the

prospectus and any document incorporated by reference is determined using U.S. GAAP. “U.S. GAAP” means generally accepted

accounting principles in the United States. Except as set forth under “Description of Share Capital” and unless otherwise

specified or the context otherwise requires, all references in this prospectus supplement, the prospectus and any document incorporated

by reference to “Enbridge”, the “Corporation”, “we”, “us” and “our” mean Enbridge

Inc. and its subsidiaries.

CANADIAN PROSPECTUS

This offering is being made concurrently in the

United States pursuant to this prospectus supplement and the accompanying base prospectus and in Canada pursuant to a prospectus supplement

to a short form base shelf prospectus filed with the securities commissions or similar authorities in each of the provinces of Canada.

This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the Canadian prospectus

supplement and short form base shelf prospectus. Neither this prospectus supplement nor the accompanying prospectus constitutes a prospectus

under Canadian securities laws and therefore does not qualify the Offered Shares in Canada.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The prospectus and this

prospectus supplement, including the documents incorporated by reference into the prospectus and this prospectus supplement, contain

both historical and forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended

(the “U.S. Securities Act”), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the

“U.S. Exchange Act”), and forward-looking information within the meaning of Canadian securities laws (collectively,

“forward-looking statements”). This information has been included to provide information about the Corporation and its

subsidiaries and affiliates, including management’s assessment of the Corporation’s and its subsidiaries’ future

plans and operations. This information may not be appropriate for other purposes. Forward-looking statements are typically

identified by words such as “anticipate”, “believe”, “estimate”, “expect”,

“forecast”, “intend”, “likely”, “plan”, “project”, “target”

and similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information or statements included

or incorporated by reference in the prospectus and this prospectus supplement include, but are not limited to, statements with

respect to the following: the Corporation’s corporate vision and strategy, including strategic priorities and enablers;

expected supply of, demand for, exports of and prices of crude oil, natural gas, natural gas liquids (“NGL”), liquefied

natural gas (“LNG”), renewable natural gas (“RNG”) and renewable energy; energy transition and lower-carbon

energy, and our approach thereto; environmental, social and governance goals, practices and performance; industry and market

conditions; anticipated utilization of the Corporation’s assets; dividend growth and payout policy; financial strength and

flexibility; expectations on sources of liquidity and sufficiency of financial resources; expected strategic priorities and

performance of the Liquids Pipelines, Gas Transmission, Gas Distribution and Storage, and Renewable Power Generation businesses; the

characteristics, anticipated benefits, financing and timing of our acquisitions and other transactions, including the acquisitions

of three United States gas utilities (the “Gas Utilities”) from Dominion Energy, Inc. (the “Acquisitions”)

and the joint venture with WhiteWater Midstream, LLC/I Squared Capital and MPLX LP (the “Whistler Parent JV”); expected

costs, benefits and in-service dates related to announced projects and projects under construction; expected capital expenditures;

investable capacity and capital allocation priorities; expected equity funding requirements for the Corporation’s commercially

secured growth program; expected future growth, development and expansion opportunities; expected optimization and efficiency

opportunities; expectations about the Corporation’s joint venture partners’ ability to complete and finance projects

under construction; our ability to complete the Acquisitions and successfully integrate the Gas Utilities; expected closing of other

acquisitions and dispositions and the timing thereof, including the remaining Acquisitions, and the Whistler Parent JV; expected

future actions of regulators and courts, and the timing and impact thereof; toll and rate cases discussions and proceedings and

anticipated timeline and impact therefrom, including those relating to the Gas Distribution and Storage business; operational, industry, regulatory, climate change and other risks associated with our

businesses; this offering, including the expected use of the net proceeds, if any, received therefrom by the Corporation; and our

assessment of the potential impact of the various risk factors identified in this prospectus supplement and the accompanying

prospectus, including the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

Although the Corporation believes these forward-looking

statements are reasonable based on the information available on the date such statements are made and processes used to prepare the information,

such statements are not guarantees of future performance and readers are cautioned against placing undue reliance on forward-looking statements.

By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which

may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements.

Material assumptions include assumptions about the following: the expected supply of, demand for, export of and prices of crude oil, natural

gas, NGL, LNG, RNG and renewable energy; anticipated utilization of assets; exchange rates; inflation; interest rates; availability and price

of labor and construction materials; the stability of the Corporation’s supply chain; operational reliability; maintenance of support

and regulatory approvals for the Corporation’s projects and transactions; anticipated in-service dates; weather; the timing, terms

and closing of acquisitions and dispositions, including the remaining Acquisitions, and the amount and timing of proceeds received from

this offering; the realization of anticipated benefits of transactions, including the Acquisitions; governmental legislation; litigation;

estimated future dividends and impact of the Corporation’s dividend policy on its future cash flows; the Corporation’s credit

ratings; capital project funding; hedging program; expected earnings before interest, income taxes, and depreciation and amortization;

expected earnings/(loss); expected future cash flows; and expected distributable cash flow. Assumptions regarding the expected supply

of and demand for crude oil, natural gas, NGL, LNG, RNG and renewable energy, and the prices of these commodities, are material to and underlie

all forward-looking statements, as they may impact current and future levels of demand for the Corporation’s services. Similarly,

exchange rates, inflation and interest rates impact the economies and business environments in which the Corporation operates and may

impact levels of demand for the Corporation’s services and cost of inputs, and are therefore inherent in all forward-looking statements.

The most relevant assumptions associated with forward-looking statements regarding announced projects and projects under construction,

including estimated completion dates and expected capital expenditures, include the following: the availability and price of labor and

construction materials; the stability of our supply chain; the effects of inflation and foreign exchange rates on labor and material costs;

the effects of interest rates on borrowing costs; the impact of weather and customer, government, court and regulatory approvals on construction

and in-service schedules; and cost recovery regimes.

The Corporation’s forward-looking statements

are subject to risks and uncertainties pertaining to the successful execution of the Corporation’s strategic priorities; operating

performance; legislative and regulatory parameters; litigation; acquisitions (including the Acquisitions), dispositions and other transactions

and the realization of anticipated benefits therefrom; this offering; operational dependence on third parties; dividend policy; project

approval and support; renewals of rights-of-way; weather; economic and competitive conditions; public opinion; changes in tax laws and

tax rates; exchange rates; inflation; interest rates; commodity prices; access to and cost of capital; political decisions; global geopolitical

conditions; and the supply of, demand for and prices of commodities and other alternative energy, including but not limited to those risks

and uncertainties discussed in the prospectus, this prospectus supplement and in documents incorporated by reference into the prospectus

and this prospectus supplement. The impact of any one assumption, risk, uncertainty or factor on a particular forward-looking statement

is not determinable with certainty as these are interdependent and the Corporation’s future course of action depends on management’s

assessment of all information available at the relevant time. Except to the extent required by applicable law, the Corporation assumes

no obligation to publicly update or revise any forward-looking statement made in the prospectus and this prospectus supplement or otherwise,

whether as a result of new information, future events or otherwise. All forward-looking statements, whether written or oral, attributable

to the Corporation or persons acting on the Corporation’s behalf, are expressly qualified in their entirety by these cautionary

statements.

For more information on forward-looking statements,

the assumptions underlying them, and the risks and uncertainties affecting them, see “Note Regarding Forward-Looking Statements”

in the prospectus and “Risk Factors” in this prospectus supplement and the prospectus.

WHERE

YOU CAN FIND MORE INFORMATION

The Corporation is subject to the information requirements

of the U.S. Exchange Act, and in accordance therewith files reports and other information with the United States Securities and Exchange

Commission (the “SEC”). Such reports and other information are available on the SEC’s website at www.sec.gov and the

Corporation’s website at www.enbridge.com. The information contained on or accessible from the Corporation’s website does

not constitute a part of this prospectus supplement or the accompanying prospectus and is not incorporated by reference herein or therein.

Prospective investors may read and download the documents the Corporation has filed with the SEC’s Electronic Data Gathering and

Retrieval system at www.sec.gov.

We have filed with the SEC a registration statement

on Form S-3 relating to certain securities, including the Common Shares offered by this prospectus supplement. This prospectus supplement

and the accompanying prospectus are a part of the registration statement and do not contain all the information in the registration statement.

Whenever a reference is made in this prospectus supplement or the accompanying prospectus to a contract or other document, the reference

is only a summary and you should refer to the exhibits that are a part of the registration statement for a copy of the contract or other

document. You may review a copy of the registration statement through the SEC’s website.

DOCUMENTS

INCORPORATED BY REFERENCE

The SEC allows us to incorporate by reference the

information we file with the SEC. This means that we can disclose important information to you by referring to those documents and later

information that we file with the SEC. The information that we incorporate by reference is an important part of this prospectus supplement

and the accompanying prospectus. We incorporate by reference the following documents and any future filings that we make with the SEC

under Sections 13(a), 13(c) and 15(d) of the U.S. Exchange Act until the termination of the offering under this prospectus supplement:

| · | The description of our Common Shares in our Registration Statement on Form 8-A (Registration Statement No. 001-15254)

filed on April 20, 2018, as updated by the description of our Common Shares included in Exhibit 4.14 to our 2023

Annual Report, together with any amendment or report filed for the purpose of updating such description. |

Any statement contained in this prospectus supplement

or the accompanying prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this prospectus supplement or the accompanying prospectus to the extent that a statement contained therein

or herein or in a document incorporated or deemed to be incorporated by reference therein or herein or in any other subsequently filed

document which also is or is deemed to be incorporated by reference therein or herein modifies or supersedes such statement. The modifying

or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth

in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission

for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material

fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in

the light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

Copies of the documents incorporated herein by

reference (other than exhibits to such documents, unless such exhibits are specifically incorporated by reference in such documents) may

be obtained on request without charge from the Corporate Secretary of Enbridge Inc., Suite 200, 425 - 1st Street S.W., Calgary, Alberta,

Canada T2P 3L8 (telephone 1-403-231-3900). Documents that we file with or furnish to the SEC are also available on the SEC’s website

at www.sec.gov. This site contains reports, proxy and information statements and other information regarding issuers that file electronically

with the SEC. The information on that website is not part of this prospectus supplement.

SUMMARY

This summary highlights information contained

elsewhere in this prospectus supplement and the accompanying prospectus. It is not complete and may not contain all of the information

that you should consider before investing in the Offered Shares. You should read this entire prospectus supplement and the accompanying

prospectus, including the information incorporated by reference in this prospectus supplement and the accompanying prospectus, and in

particular the section entitled “Risk Factors” of this prospectus supplement and in such incorporated documents, as well as

our consolidated financial statements, incorporated by reference in this prospectus supplement and the accompanying prospectus, carefully.

The Corporation

Enbridge is a leading North American energy infrastructure

company. The Corporation’s core businesses include Liquids Pipelines, which consists of pipelines and terminals in Canada and the

United States that transport and export various grades of crude oil and other liquid hydrocarbons; Gas Transmission, which

consists of investments in natural gas pipelines and gathering and processing facilities in Canada and the United States; Gas Distribution

and Storage, which consists of natural gas utility operations that serve residential, commercial and industrial customers in Ontario and

Quebec; and Renewable Power Generation, which consists primarily of investments in wind and solar assets, as well as geothermal, waste

heat recovery and transmission assets, in North America and Europe.

Enbridge is a public company, with Common Shares

that trade on the TSX and the NYSE under the symbol “ENB”. The Corporation was incorporated under the Companies Ordinance

of the Northwest Territories on April 13, 1970 and was continued under the Canada Business Corporations Act on December 15, 1987.

Enbridge’s principal executive offices are located at Suite 200, 425 - 1st Street S.W., Calgary, Alberta, Canada T2P 3L8, and its

telephone number is 1-403-231-3900.

The Offering

| Common Shares offered |

Common Shares having an aggregate offering price of up to $2.75 billion. |

| |

|

| Manner of offering |

“At the market offering” that

may be made from time to time through our sales agents acting as principal or as our sales agents, including, without limitation,

sales made on or through the NYSE or the TSX or any other marketplace in the United States or Canada where the Common Shares may be

traded. The sales agents may also sell the Offered Shares by any other method agreed by the Corporation and the applicable sales

agent and permitted by applicable law, including, without limitation, as block transactions. If we sell Offered Shares to the sales

agents as principals, we will enter into a separate terms agreement with the sales agents, and, to the extent required by applicable

law, we will describe the agreement in a separate prospectus supplement. See “Plan of Distribution” for more

information.

|

| Use of proceeds |

We currently intend to use the

net proceeds we receive from this offering, if any, to finance a portion of the aggregate purchase price for the remaining Acquisitions

to be completed and any adjustments thereto and to pay related fees and expenses of this offering and such Acquisitions.

Pending completion of such Acquisitions, we may use all or a portion

of the net proceeds of this offering, if any, to reduce our existing short-term indebtedness and/or may invest a portion of the net proceeds

of this offering, if any, in deposit accounts, money market funds, short-term marketable debt securities, and United States government

sponsored enterprise obligations and corporate obligations. The consummation of any of such Acquisitions is not contingent upon the consummation

of any sales under this offering, and any sales under this offering are not contingent upon the consummation of any of such Acquisitions.

In the event that any or all of such Acquisitions are not completed, we may use the net proceeds from this offering, if any, to reduce

our existing indebtedness, finance future growth opportunities, including acquisitions, finance our capital expenditures or for other

general corporate purposes.

See “Use of Proceeds”

in this prospectus supplement for additional information.

|

| Risk factors |

Investing in the Offered Shares involves risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement and Part I, Item 1A “Risk Factors” in the 2023 Annual Report for a discussion of factors that you should refer to and carefully consider before deciding to invest in the Offered Shares. |

| |

|

| Other relationships |

Affiliates of some of the sales agents

participating in this offering may be lenders under the Corporation’s current, replacement or future credit facilities and may

receive a portion of the proceeds of this offering through our repayment of the indebtedness outstanding under our credit facilities

with such proceeds. Affiliates of some of the sales agents participating in this offering may hold debt securities or other

indebtedness of the Corporation. See “Use of Proceeds” in this prospectus supplement.

|

| NYSE symbol |

ENB |

RISK

FACTORS

You should consider carefully the following

risks and other information contained in and incorporated by reference into this prospectus supplement and the accompanying prospectus

before deciding to invest in the Offered Shares. In particular, we urge you to consider carefully the following risk factors, as well

as the risk factors set forth under the heading “Item 1A. Risk Factors” in the 2023 Annual Report, incorporated by reference

into this prospectus supplement and the accompanying prospectus. The following risks and uncertainties as well as risks and uncertainties

presently unknown to us could materially and adversely affect our financial condition and results of operations. In that event, the value

of our Common Shares may be adversely affected.

Risks Related to This Offering and Ownership

of our Common Shares

The price of our Common Shares may fluctuate

significantly, and you could lose all or part of your investment.

The market price of our Common Shares may fluctuate

due to a variety of factors relative to our business, including announcements of new developments, fluctuations in our operating results,

sales of our Common Shares in the marketplace, failure to meet analysts’ expectations, changes in expectations as to our future

financial performance, any public announcements made in regard to this offering, the impact of various tax laws or rates and general market

conditions, the operating and securities price performance of other companies that investors believe are comparable to us, or the worldwide

economy. In recent years, stock markets have experienced significant price fluctuations, which have been unrelated to the operating performance

of the affected companies. There can be no assurance that the market price of our Common Shares will not experience significant fluctuations

in the future, including fluctuations that are unrelated to our performance.

Our ability to declare and pay dividends

may be limited, and any return on investment may be limited to the value of our Common Shares.

Provisions of various trust indentures and credit

arrangements to which we are a party restrict our ability to declare and pay dividends under certain circumstances and, if such restrictions

apply, they may, in turn, have an impact on our ability to declare and pay dividends on our Common Shares.

Additionally, so long as any series of preference

shares of the Corporation is outstanding, we are not permitted to declare, pay or set apart for payment any dividends (other than stock

dividends in shares of the Corporation ranking junior to the Corporation’s preference shares) on our Common Shares or any other

shares of the Corporation ranking junior to the preference shares with respect to the payment of dividends unless all dividends up to

and including the dividends payable on the last preceding dividend payment dates on all preference shares then outstanding shall have

been declared and paid or set apart for payment at the date of any such action. We are not restricted from issuing additional preference

shares and may issue additional preference shares from time to time in the future.

We are not restricted from issuing additional

Common Shares, and the issuance and sale of a substantial amount of additional Common Shares or other securities could dilute the ownership

interest of holders of our Common Shares or depress the price of our Common Shares.

Except as described in this prospectus supplement

or the accompanying prospectus, or in the documents incorporated by reference herein or therein, we are not restricted from issuing additional

Common Shares, including any securities that are convertible into or exchangeable for, or that represent the right to receive, Common

Shares. We may issue our Common Shares or other securities from time to time as consideration for pending or future acquisitions and investments

in addition to funding a portion of the aggregate purchase prices for such acquisitions and investments with the issuance of our Common

Shares. If any such acquisition or investment is significant, the number of Common Shares, or the number or aggregate principal amount,

as the case may be, of other securities that we may issue may in turn be substantial.

Future sales or the availability for sale of substantial

amounts of our Common Shares (including in connection with an acquisition or investment) in the public market could adversely affect the

prevailing market price of our Common Shares. In addition, the issuance of additional Common Shares or such other securities will dilute

the ownership interest of the holders of our Common Shares. We cannot predict the size of future issuances of our Common Shares or the

effect, if any, that future issuances and sales of our Common Shares will have on the market price of our Common Shares.

The actual number of Offered Shares we

will issue under the equity distribution agreement, at any one time or in total, is uncertain.

Subject to certain

limitations in the equity distribution agreement and compliance with applicable law, we and our sales agents may mutually agree for

the sales agents to sell on our behalf Offered Shares at any time throughout the term of the equity distribution agreement, and the

sales agents will be obligated to use commercially reasonable efforts to sell the Offered Shares. The number of Offered Shares that

are sold by the sales agents after we request that sales be made will fluctuate based on the market price of the Common Shares

during the sales period and limits we set with the sales agents. Because the price per share of the Offered Shares sold will

fluctuate based on the market price of our Common Shares during the sales period, it is not possible at this stage to predict the

number of Offered Shares that will ultimately be issued by us under the equity distribution agreement.

The Offered

Shares will be sold in “at-the-market offerings,” and investors who buy Offered Shares at different times

will likely pay different prices.

Investors who purchase

Offered Shares in this offering at different times will likely pay different prices, and therefore may experience different outcomes

in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and number of Offered

Shares sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their Common Shares

as a result of sales of Common Shares made at prices lower than the prices they paid.

We are a holding company and as a result

are dependent on our subsidiaries to generate sufficient cash and distribute cash to us.

We are holding company and, as a result, our ability

to pay dividends or make payments on our indebtedness, fund our ongoing operations and invest in capital expenditures and any acquisitions

will depend on our subsidiaries’ ability to generate cash in the future and distribute that cash to us. It is possible that our

subsidiaries may not generate cash from operations in an amount sufficient to enable us to declare or pay dividends.

Our Common Shares are subordinate to

all of our debts and liabilities and you could lose all or part of your investment.

Our Common Shares are equity capital of the Corporation

which ranks subordinate to debt and preference shares, if any, in the event of an insolvency or winding-up of the Corporation. If we were

to become insolvent or be wound up, the Corporation’s assets would be used to pay liabilities and other debt before payments could

be made on the preference shares, if any, and, subsequently, on the Common Shares.

We intend to use the net proceeds from

this offering to fund a portion of the aggregate purchase price payable for the remaining Acquisitions to be completed. However, this

offering is not conditioned upon the closing of any such Acquisitions, and we will have broad discretion to determine alternative uses

of the proceeds.

As described under

“Use of Proceeds,” we intend to use the net proceeds from this offering to finance a portion of the aggregate purchase

price for the remaining Acquisitions to be completed and any adjustments thereto and to pay related fees and expenses of the

offering and the Acquisitions. However, this offering is not conditioned upon the closing of any of the Acquisitions. If any or all

of the Acquisitions are not consummated, we will have broad discretion in the application of the net proceeds from this offering,

such as using the net proceeds from this offering to reduce our existing indebtedness, finance future growth opportunities,

including acquisitions, finance our capital expenditures or for other general corporate purposes, and purchasers of our Offered

Shares in this offering will not have the opportunity as part of their investment decision to assess whether the net proceeds are

being used appropriately.

USE

OF PROCEEDS

We may issue and sell Offered Shares having aggregate

sales proceeds of up to $2.75 billion (or the equivalent in U.S. dollars) from time to time. Because there is no minimum offering amount

required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not

determinable at this time. There can be no assurance that we will sell any Offered Shares under or fully utilize the equity distribution

agreement with the sales agents as a source of financing. See “Plan of Distribution”. We may, from time to time, issue securities

(including equity securities) other than pursuant to this prospectus supplement.

We currently intend to use the net proceeds we

receive from this offering, if any, to finance a portion of the aggregate purchase price for the remaining Acquisitions to be completed

and any adjustments thereto and to pay related fees and expenses of this offering and such Acquisitions. Pending completion of such Acquisitions,

we may use all or a portion of the net proceeds of this offering, if any, to reduce our existing short-term indebtedness and/or may invest

a portion of the net proceeds of this offering, if any, in deposit accounts, money market funds, short-term marketable debt securities,

and United States government sponsored enterprise obligations and corporate obligations. The consummation of any such Acquisitions is

not contingent upon the consummation of any sales under this offering, and any sales under this offering are not contingent upon the consummation

of any such Acquisitions. In the event that any or all of such Acquisitions are not completed, we may use the net proceeds from this offering,

if any, to reduce our existing indebtedness, finance future growth opportunities, including acquisitions, finance our capital expenditures

or for other general corporate purposes. See the 2023 Annual Report, which is herein incorporated by reference, for a description of the

Acquisitions.

DESCRIPTION

OF SHARE CAPITAL

In this section, the terms “Corporation”

and “Enbridge” refer only to Enbridge Inc. and not to its subsidiaries, partnerships or joint venture interests. The following

sets forth the terms and provisions of the existing capital of the Corporation. The following description is subject to, and qualified

by reference to, the terms and provisions of the Corporation’s articles and by-laws. The Corporation is authorized to issue an unlimited

number of Common Shares and an unlimited number of preference shares, issuable in series.

Common Shares

General

Each Common Share of the Corporation entitles the

holder to one vote for each Common Share held at all meetings of shareholders of the Corporation, except meetings at which only holders

of another specified class or series of shares are entitled to vote, to receive dividends if, as and when declared by the board of directors

of the Corporation, subject to prior satisfaction of preferential dividends applicable to any preference shares, and to participate ratably

in any distribution of the assets of the Corporation upon a liquidation, dissolution or winding up, subject to prior rights and privileges

attaching to the preference shares.

Under the dividend reinvestment and share purchase

plan of the Corporation, which was suspended effective November 2, 2018 but may be reinstated by the Corporation in the future, subject

to compliance with applicable securities laws, registered shareholders may reinvest their dividends in additional Common Shares of the

Corporation or make optional cash payments to purchase additional Common Shares, in either case, free of brokerage or other charges.

The registrar and transfer agent for the Common

Shares in Canada is Computershare Trust Company of Canada at its principal transfer offices in Calgary, Alberta; Vancouver, British Columbia;

Toronto, Ontario; and Montréal, Québec, and in the United States is Computershare Trust Company, N.A. at its principal transfer

offices in Canton, Massachusetts; Jersey City, New Jersey; and Louisville, Kentucky.

Shareholder Rights Plan

The Corporation has a shareholder rights plan (the

“Shareholder Rights Plan”) that is designed to encourage the fair treatment of shareholders in connection with any take-over

bid for the Corporation. Rights issued under the Shareholder Rights Plan become exercisable when a person, and any related parties, acquires

or announces the intention to acquire 20% or more of the Corporation’s outstanding Common Shares without complying with certain

provisions set out in the Shareholder Rights Plan or without approval of the board of directors of the Corporation. Should such an acquisition

or announcement occur, each rights holder, other than the acquiring person and its related parties, will have the right to purchase Common

Shares of the Corporation at a 50% discount to the market price at that time. For further particulars, please refer to the Shareholder

Rights Plan, filed as Exhibit 4.13 to the 2023 Annual Report, which is herein incorporated by reference.

Preference Shares

Shares Issuable in Series

The preference shares may be issued at any time

or from time to time in one or more series. Before any shares of a series are issued, the board of directors of the Corporation shall

fix the number of shares that will form such series and shall, subject to the limitations set out in the articles of the Corporation,

determine the designation, rights, privileges, restrictions and conditions to be attached to the preference shares of such series, except

that no series shall be granted the right to vote at a general meeting of the shareholders of the Corporation or the right to be convertible

or exchangeable for Common Shares, directly or indirectly.

For preference shares issued that are to be convertible

into other securities of the Corporation, including other series of preference shares, no amounts will be payable to convert those preference

shares.

Priority

The preference shares of each series shall rank

on parity with the preference shares of every other series with respect to dividends and return of capital and shall be entitled to a

preference over the Common Shares and over any other shares ranking junior to the preference shares with respect to priority in payment

of dividends and in the distribution of assets in the event of liquidation, dissolution or winding-up of the Corporation, whether voluntary

or involuntary, or any other distribution of the assets of the Corporation among its shareholders for the purpose of winding-up its affairs.

Voting Rights

Except as required by law, holders of the preference

shares as a class shall not be entitled to receive notice of, to attend or to vote at any meeting of the shareholders of the Corporation,

provided that the rights, privileges, restrictions and conditions attached to the preference shares as a class may be added to, changed

or removed only with the approval of the holders of the preference shares given in such manner as may then be required by law, at a meeting

of the holders of the preference shares duly called for that purpose.

Stock Exchange Listing

Our Common Shares are listed on the NYSE and the

TSX under the trading symbol “ENB”.

MATERIAL

INCOME TAX CONSIDERATIONS

Material Canadian Federal Income Tax Considerations

The following is, as of the date hereof, a summary

of the principal Canadian federal income tax considerations under the Income Tax Act (Canada) and the regulations thereunder (the “Tax

Act”) generally applicable to a holder who acquires Offered Shares as beneficial owner pursuant to this offering who, at all relevant

times, for the purposes of the Tax Act, deals at arm’s length with the Corporation and each of the sales agents, is not affiliated

with the Corporation or any of the sales agents, and will acquire and hold such Offered Shares as capital property (each, a “Holder”),

all within the meaning of the Tax Act. The Offered Shares will generally be considered to be capital property to a Holder unless the Holder

holds or uses the Offered Shares or is deemed to hold or use the Offered Shares in the course of carrying on a business of trading or

dealing in securities or has acquired them or is deemed to have acquired them in a transaction or transactions considered to be an adventure

or concern in the nature of trade.

This summary does not apply to a Holder (a) that

is a “financial institution” for purposes of the mark-to-market rules contained in the Tax Act; (b) an interest

in which is or would constitute a “tax shelter investment” as defined in the Tax Act; (c) that is a “specified

financial institution” as defined in the Tax Act; (d) that reports its “Canadian tax results”, as defined in the

Tax Act, in a currency other than Canadian currency; (e) that is exempt from tax under the Tax Act; (f) that has entered into,

or will enter into, a “synthetic disposition arrangement” or a “derivative forward agreement” with respect to

the Offered Shares as those terms are defined in the Tax Act; or (g) a Holder that receives dividends on Offered Shares under or

as part of a “dividend rental arrangement” as defined in the Tax Act. Such Holders should consult their own tax advisors with

respect to an investment in the Offered Shares.

Additional considerations, not discussed herein,

may apply to a Holder that is a corporation resident in Canada, and is or becomes (or does not deal at arm’s length for purposes

of the Tax Act with a corporation resident in Canada that is or becomes), as part of a transaction or event or series of transactions

or events that includes the acquisition of the Offered Shares, controlled by a non-resident person or a group of persons comprised of

any combination of non-resident corporations, non-resident individuals or non-resident trusts that do not deal with each other at arm’s

length for purposes of the “foreign affiliate dumping” rules in section 212.3 of the Tax Act. Such Holders should consult

their own tax advisors with respect to the consequences of purchasing the Offered Shares pursuant to this offering.

This summary is based upon the current provisions

of the Tax Act and the Canada-United States Income Tax Convention (1980) (the “Treaty”) in force as of the date hereof, any

specific proposals to amend the Tax Act (the “Tax Proposals”) that have been published in writing by or on behalf of the Minister

of Finance (Canada) prior to the date hereof and counsel’s understanding of the current published administrative policies of the

Canada Revenue Agency (the “CRA”). This summary assumes that any Tax Proposals will be enacted in the form proposed and does

not take into account or anticipate any other changes in law, whether by way of judicial, legislative or governmental decision or action,

or change in administrative policies or assessing practices of the CRA, nor does it take into account other federal or any provincial,

territorial or foreign income tax legislation or considerations. No assurances can be given that the Tax Proposals will be enacted as

proposed or at all, or that legislative, judicial or administrative changes will not modify or change the statements expressed herein.

This summary is not exhaustive of all possible

Canadian federal income tax considerations applicable to an investment in the Offered Shares. This summary is of a general nature only

and is not intended to be, nor should it be construed to be, legal or income tax advice to any particular Holder. Holders should consult

their own income tax advisors with respect to the tax consequences applicable to them based on their own particular circumstances, including

the application and effect of the income and other tax laws of any country, province or other jurisdiction that may be applicable to the

Holder.

Currency

Generally, for purposes of the Tax Act, all amounts

relating to the acquisition, holding or disposition of Common Shares (including dividends, adjusted cost base and proceeds of disposition)

must be determined in Canadian dollars based on the relevant rate of exchange required under the Tax Act.

Residents of Canada

The following portion of this summary is generally

applicable to a Holder who, for the purposes of the Tax Act, is resident or deemed to be resident in Canada at all relevant times (each,

a “Resident Holder”). Certain Resident Holders whose Offered Shares might not otherwise qualify as capital property may be

entitled to make an irrevocable election pursuant to subsection 39(4) of the Tax Act to have the Offered Shares, and every other

“Canadian security” (as defined by the Tax Act) owned by such Resident Holder in the taxation year of the election and in

all subsequent taxation years, deemed to be capital property. Resident Holders should consult their own tax advisors for advice as to

whether an election under subsection 39(4) of the Tax Act is available or advisable in their particular circumstances.

Taxation of Dividends

Dividends received or deemed to be received on

the Offered Shares in the taxation year of a Resident Holder will be included in computing a Resident Holder’s income for the year.

In the case of a Resident Holder who is an individual (including certain trusts), dividends (including deemed dividends) received on the

Offered Shares will be subject to the gross-up and dividend tax credit rules applicable to taxable dividends received by an individual

from “taxable Canadian corporations” (as defined in the Tax Act), including the enhanced gross-up and dividend tax credit

in respect of taxable dividends properly designated by the Corporation as “eligible dividends” (as defined in the Tax Act)

in accordance with the provisions of the Tax Act. There may be limitations on the ability of the Corporation to designate dividends as

eligible dividends. Resident Holders who are individuals (including certain trusts) should consult their own tax advisors in this regard.

In the case of a Resident Holder that is a corporation,

dividends (including deemed dividends) received on the Offered Shares will be included in the Resident Holder’s income and will

generally be deductible in computing such Resident Holder’s taxable income. In certain circumstances, subsection 55(2) of the

Tax Act will treat a taxable dividend received (or deemed to be received) by a Resident Holder that is a corporation as proceeds of disposition

or a capital gain. Resident Holders that are corporations should consult their own tax advisors having regard to their own circumstances.

A Resident Holder that is a “private corporation”

or “subject corporation” (as such terms are defined in the Tax Act) may be liable to pay an additional tax (refundable in

certain circumstances) under Part IV of the Tax Act on dividends received or deemed to be received on the Offered Shares to the extent

that such dividends are deductible in computing the Resident Holder’s taxable income for the year.

Disposition of Offered Shares

A Resident Holder who disposes of, or is deemed

to have disposed of, an Offered Share (other than on a disposition to the Corporation that is not a sale in the open market in the manner

in which Offered Shares would normally be purchased by any member of the public in the open market) will generally realize a capital gain

(or incur a capital loss) equal to the amount by which the proceeds of disposition in respect of the Offered Share exceed (or are less

than) the aggregate of the adjusted cost base to the Resident Holder of such Offered Share immediately before the disposition or deemed

disposition and any reasonable costs of disposition. The adjusted cost base to a Resident Holder of an Offered Share will be determined

by averaging the cost of that Offered Share with the adjusted cost base (determined immediately before the acquisition of the Offered

Share) of all other Common Shares held as capital property at that time by the Resident Holder. The tax treatment of capital gains and

capital losses is discussed in greater detail below under the subheading “Taxation of Capital Gains and Losses”.

Taxation of Capital Gains and Losses

Currently, one-half of any capital gain (a “taxable

capital gain”) realized by a Resident Holder must be included in the Resident Holder’s income for the taxation year in which

the disposition occurs. Subject to and in accordance with the provisions of the Tax Act, one-half of any capital loss realized by a Resident

Holder (an “allowable capital loss”) must generally be deducted from taxable capital gains realized by the Resident Holder

in the taxation year in which the disposition occurs. Allowable capital losses in excess of taxable capital gains for the taxation year

of disposition may be carried back and deducted in any of the three preceding taxation years or carried forward and deducted in any subsequent

year against net taxable capital gains realized in such years, to the extent and in the circumstances set out in the Tax Act.

For capital gains realized on or after June 25,

2024, Tax Proposals announced in the Federal Budget released on April 16, 2024 (“2024 Budget Proposals”) would generally increase

the capital gains inclusion rate from one-half to two-thirds for corporations and trusts, and from one-half to two-thirds for individuals

on the portion of capital gains realized, including capital gains realized indirectly through a trust or partnership, in a taxation year

(or in each case the portion of the year beginning on June 25, 2024 in the case of the 2024 taxation year) that exceed $250,000. Under

the 2024 Budget Proposals, two-thirds of capital losses realized prior to 2024 will be deductible against capital gains included in income

at the two-thirds inclusion rate such that a capital loss will offset an equivalent capital gain regardless of the inclusion rate. The

2024 Budget Proposals do not include comprehensive rules (including draft legislation) implementing these changes and state that additional

details related to the change of the capital gains inclusion rate are forthcoming. Resident Holders who may be subject to the increased

inclusion rate for capital gains as a result of the 2024 Budget Proposals should consult their own tax advisors.

A capital loss realized on the disposition or deemed

disposition of an Offered Share by a Resident Holder that is a corporation may in certain circumstances be reduced by the amount of dividends

received or deemed to have been received by the Resident Holder on such share (or on a share for which such share was substituted) to

the extent and in the circumstances set out in the Tax Act. Similar rules may apply where a corporation is a member of a partnership

or a beneficiary of a trust that owns Offered Shares, directly or indirectly, through a partnership or trust. A Resident Holder to which

these rules may be relevant is urged to consult its own tax advisor.

A Resident Holder that is a “Canadian-controlled

private corporation” (as defined in the Tax Act) or that is or is deemed to be a “substantive CCPC” (as proposed to

be defined in the Tax Act pursuant to the Tax Proposals tabled in Parliament on November 30, 2023 as Bill C-59) at any time in a taxation

year may be liable to pay an additional tax (refundable in certain circumstances) on its “aggregate investment income” (as

defined in the Tax Act), which is defined to include an amount in respect of net taxable capital gains. Resident Holders should consult

their own tax advisors in this regard.

Alternative Minimum Tax

Capital gains realized and dividends received (or deemed to be received) by a Resident Holder who is an individual (other than certain

trusts) may give rise to alternative minimum tax under the Tax Act. Draft Tax Proposals to implement proposed amendments to the alternative

minimum tax for taxation years that begin after 2023 were tabled in Parliament on May 2, 2024 as Bill C-69. Resident Holders who are individuals

(including certain trusts) should consult their own tax advisors in this regard.

Non-Residents of Canada

The following portion of this summary is generally

applicable to a Holder who, for purposes of the Tax Act and any applicable income tax treaty or convention and at all relevant times:

(i) is not resident or deemed to be resident in Canada, (ii) deals at arm’s length with the Corporation, and (iii) does

not use or hold, and is not deemed to use or hold, Offered Shares in connection with a business carried on in Canada (each, a “Non-Resident

Holder”). Special considerations, which are not discussed in this summary, may apply to a Non-Resident Holder that is an insurer

that carries on an insurance business in Canada and elsewhere. Such Non-Resident Holders should consult their own tax advisors.

Taxation of Dividends

Dividends paid or credited, or deemed to be paid

or credited, to a Non-Resident Holder on the Offered Shares will be subject to Canadian withholding tax under the Tax Act at the rate

of 25% of the gross amount of the dividend, subject to any reduction in the rate of withholding to which the Non-Resident Holder is entitled

under any applicable income tax treaty or convention. For example, under the Treaty, the withholding tax rate on dividends paid or credited,

or deemed to be paid or credited, to a Non-Resident Holder who is the beneficial owner of the dividends and who is resident in the United

States for purposes of, and is fully entitled to the benefits of, the Treaty, is generally reduced to 15%. Non-Resident Holders should

consult their own tax advisors to determine their entitlement to benefits under any applicable income tax treaty or convention based on

their particular circumstances.

Disposition of Offered Shares

A Non-Resident Holder will not be subject to tax

under the Tax Act on any capital gain realized by such Non-Resident Holder on a disposition or deemed disposition of Offered Shares, unless

the Offered Shares constitute taxable Canadian property of the Non-Resident Holder at the time of the disposition and the Non-Resident

Holder is not entitled to relief under an applicable income tax treaty or convention. Generally, the Offered Shares will not constitute

taxable Canadian property to a Non-Resident Holder at a particular time provided that the shares are listed at that time on a designated

stock exchange for purposes of the Tax Act (which includes the TSX and NYSE), unless at any particular time during the 60-month period

that ends at that time (i) one or any combination of (a) the Non-Resident Holder, (b) persons with whom the Non-Resident

Holder does not deal at arm’s length (for the purposes of the Tax Act), and (c) partnerships in which the Non- Resident Holder

or a person described in (b) holds a membership interest directly or indirectly through one or more partnerships, owned 25% or more

of the issued shares of any class or series of the capital stock of the Corporation, and (ii) more than 50% of the fair market value

of the Offered Shares was derived directly or indirectly from one or any combination of: (a) real or immovable properties situated

in Canada, (b) “Canadian resource properties,” (c) “timber resource properties” and (d) options

in respect of, or interests in, or for civil law rights in, any of the foregoing property whether or not the property exists, each as

defined in the Tax Act. Notwithstanding the foregoing, in certain circumstances set out in the Tax Act, the Offered Shares may be deemed

to be taxable Canadian property.

Taxation of Capital Gains and Losses

In cases where a Non-Resident Holder disposes (or

is deemed to have disposed) of an Offered Share that is taxable Canadian property to that Non-Resident Holder, and the Non-Resident Holder

is not entitled to relief under an applicable income tax treaty or convention, the consequences described above under the heading “—Residents

of Canada—Taxation of Capital Gains and Losses” will generally be applicable to such disposition. Such Non-Resident Holders

should consult their own tax advisors.

Material United States Federal Income Tax Considerations

This section describes the material United States

federal income tax consequences of owning our Common Shares. It applies to you only if you acquire your Common Shares in this offering

and you hold your Common Shares as capital assets for United States federal income tax purposes. This discussion addresses only United

States federal income taxation and does not discuss all of the tax consequences that may be relevant to you in light of your individual

circumstances, including non-United States, state or local tax consequences, estate and gift tax consequences, and tax consequences arising

under the Medicare contribution tax on net investment income or the alternative minimum tax. This section does not apply to you if you

are a member of a special class of holders subject to special rules, including:

| · | a trader in securities that elects to use a mark-to-market method of accounting for securities holdings, |

| · | a tax-exempt organization, |

| · | a life insurance company, |

| · | a person that actually or constructively owns 10% or more of the combined voting power of our voting stock or of the total value of

our stock, |

| · | a person that holds Common Shares as part of a straddle or a hedging or conversion transaction, |

| · | a person that purchases or sells Common Shares as part of a wash sale for tax purposes, or |

| · | a U.S. holder (as defined below) whose functional currency is not the U.S. dollar. |

This section is based on the Internal Revenue Code

of 1986, as amended, its legislative history, existing and proposed regulations, published rulings and court decisions, all as currently

in effect, as well as on the Treaty. These authorities are subject to change, possibly on a retroactive basis.

If an entity or arrangement that is treated as

a partnership for United States federal income tax purposes holds the Common Shares, the United States federal income tax treatment of

a partner in such partnership will generally depend on the status of the partner and the tax treatment of the partnership. A partner in

a partnership holding the Common Shares should consult its tax advisor with regard to the United States federal income tax treatment of

an investment in the Common Shares.

You are a “U.S. holder” if you are

a beneficial owner of Common Shares and you are, for United States federal income tax purposes:

| · | a citizen or resident of the United States, |

| · | an estate whose income is subject to United States federal income tax regardless of its source, or |

| · | a trust if (1) a United States court can exercise primary supervision over the trust’s administration and one or more United

States persons are authorized to control all substantial decisions of the trust or (2) it has a valid election in effect under applicable

regulations to be treated as a domestic trust. |

You are a “non-U.S. holder” if you

are a beneficial owner of Common Shares and you are neither a United States person nor a partnership for United States federal income

tax purposes.

This summary is not exhaustive of all possible

United States federal income tax considerations applicable to an investment in the Common Shares. This summary is of a general nature

only and is not intended to be, nor should it be construed to be, legal or income tax advice to any particular holder.

YOU SHOULD CONSULT YOUR OWN TAX ADVISOR

REGARDING THE UNITED STATES FEDERAL, STATE, LOCAL AND OTHER TAX CONSEQUENCES OF OWNING AND DISPOSING OF COMMON SHARES IN YOUR PARTICULAR

CIRCUMSTANCES.

U.S. Holders

The tax consequences of your investment in the

Common Shares will depend in part on whether or not we are classified as a passive foreign investment company, or “PFIC,”

for United States federal income tax purposes. Except as discussed below under “—PFIC Classification,” this discussion

assumes that we are not, have not been and will not be classified as a PFIC for United States federal income tax purposes.

Distributions

Under the United States federal income tax laws,

the gross amount of any distribution we pay out of our current or accumulated earnings and profits (as determined for United States federal

income tax purposes), other than certain pro-rata distributions of our shares, will be treated as a dividend for United States federal

income tax purposes that is subject to United States federal income taxation. If you are a noncorporate U.S. holder, dividends that constitute

qualified dividend income will be taxable to you at the preferential rates applicable to long-term capital gains provided that you hold

the Common Shares for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date and meet other holding

period requirements. Dividends we pay with respect to the Common Shares generally will be qualified dividend income provided that, in

the year that you receive the dividend, either (i) the Common Shares are readily tradable on an established securities market in

the United States or (ii) we qualify for the benefits of the Treaty. Our Common Shares are listed on the NYSE and, assuming they

continue to be so listed, we expect that dividends will be qualified dividend income on that basis. Moreover, we believe that we are currently

eligible for the benefits of the Treaty and, assuming we continue to be eligible for such benefits, we expect that dividends on the Common

Shares will be qualified dividend income on that basis as well.

You must include any Canadian tax withheld from

the dividend payment (as discussed under “—Material Canadian Income Tax Considerations—Non-Residents of Canada—Taxation

of Dividends”) in this gross amount even though you do not in fact receive it. The dividend is taxable to you when you receive the

dividend, actually or constructively. The dividend will not be eligible for the dividends-received deduction generally allowed to United

States corporations in respect of dividends received from other United States corporations. The amount of the dividend distribution that

you must include in your income will be the U.S. dollar value of the Canadian dollars payments made, determined at the spot Canadian dollar/U.S.

dollar rate on the date the dividend is distributed, regardless of whether the payment is in fact converted into U.S. dollars. Generally,

any gain or loss resulting from currency exchange fluctuations during the period from the date the dividend is distributed to the date

you convert the payment into U.S. dollars will be treated as ordinary income or loss and will not be eligible for the special tax rate

applicable to qualified dividend income. The gain or loss generally will be income or loss from sources within the United States for foreign

tax credit limitation purposes. Distributions in excess of current and accumulated earnings and profits, as determined for United States

federal income tax purposes, will be treated as a non-taxable return of capital to the extent of your basis in the Common Shares and thereafter

as capital gain. However, we intend to treat all distributions as paid out of our current and accumulated earnings and profits (as determined

for United States federal income tax purposes). Accordingly, you should expect to generally treat all distributions received from us as

dividends.

Subject to certain limitations, any Canadian tax

withheld as discussed under “—Material Canadian Income Tax Considerations—Non-Residents of Canada—Taxation of

Dividends” and paid over to Canada will be creditable or deductible against your United States federal income tax liability.

Dividends will generally be income from sources

outside the United States and will generally be “passive” income for purposes of computing the foreign tax credit allowable

to you. However, if (a) 50% or more of our stock is owned, by vote or value, by United States persons and (b) at least 10% of

our earnings and profits are attributable to sources within the United States, then for foreign tax credit purposes, the United States

source ratio of our dividends would be treated as derived from sources within the United States. With respect to any dividend paid for

any taxable year, the United States source ratio of our dividends for foreign tax credit purposes would be equal to the portion of our

earnings and profits from sources within the United States for such taxable year, divided by the total amount of our earnings and profits

for such taxable year. Special rules apply in determining the foreign tax credit limitation with respect to dividends that are subject

to the preferential tax rates.

Sales or Dispositions

If you sell or otherwise dispose of your Common

Shares, you will recognize capital gain or loss for United States federal income tax purposes equal to the difference between the U.S.

dollar value of the amount that you realize and your tax basis, determined in U.S. dollars, in your Common Shares. Capital gain of a noncorporate

U.S. holder is generally taxed at preferential rates where the property is held for more than one year. The gain or loss will generally

be income or loss from sources within the United States for foreign tax credit limitation purposes.

PFIC Classification

We believe that we should not be currently classified

as a PFIC for United States federal income tax purposes and we do not expect to become a PFIC in the foreseeable future. However, this

conclusion is a factual determination that is made annually and thus may be subject to change. It is therefore possible that we could

become a PFIC in a future taxable year.

In general, we will be a PFIC in a taxable year

if:

| · | at least 75% of our gross income for the taxable year is passive income or |

| · | at least 50% of the value, determined on the basis of a quarterly average, of our assets in such taxable year is attributable to assets

that produce or are held for the production of passive income. |

“Passive income” generally includes

dividends, interest, gains from the sale or exchange of investment property, rents and royalties (other than certain rents and royalties

derived in the active conduct of a trade or business) and certain other specified categories of income. If a foreign corporation owns

at least 25% by value of the equity interests of another corporation or a partnership, the foreign corporation is treated for purposes

of the PFIC tests as owning its proportionate share of the assets of the other corporation or the partnership, and as receiving directly

its proportionate share of the other corporation’s or the partnership’s income.

If we are treated as a PFIC, you will generally

be subject to special rules with respect to:

| · | any gain you realize on the sale or other disposition of your Common Shares, and |

| · | any excess distribution that we make to you (generally, any distributions to you during a single taxable year, other than the taxable

year in which your holding period in the Common Shares begins, that are greater than 125% of the average annual distributions received

by you in respect of the Common Shares during the three preceding taxable years or, if shorter, your holding period for the Common Shares

that preceded the taxable year in which you receive the distribution). |

Under these rules:

| · | the gain or excess distribution will be allocated ratably over your holding period for the Common Shares, |

| · | the amount allocated to the taxable year in which you realized the gain or excess distribution or to prior years before the first

year in which we were a PFIC with respect to you will be taxed as ordinary income, |

| · | the amount allocated to each other prior taxable year will be taxed at the highest tax rate in effect for that year, and |