- Fourth quarter 2024 GAAP diluted earnings per share (EPS) of

$2.25, an increase of 63%, and adjusted EPS of $2.95, an increase

of 12% constant currency

- Fourth quarter 2024 GAAP revenue of $2.52 billion, an increase

of 3%, and adjusted net revenue of $2.29 billion, an increase of

6.5% constant currency ex-dispositions

- Establishes growth targets for 2025 consistent with medium-term

outlook

- Increases expected operating income benefit from operational

transformation to $600 million

- Entering into $250 million accelerated share repurchase

plan

Global Payments Inc. (NYSE: GPN) today announced results for the

fourth quarter and year ended December 31, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250213651180/en/

"2024 was a pivotal year for Global Payments as we launched our

broad transformation agenda to set the future course for our

business,” said Cameron Bready, chief executive officer. "We

delivered solid financial performance consistent with our

expectations, while also successfully reorienting to a unified

operating model globally to address our complexity, enhance our

agility and better position the business to execute against our

refreshed strategy.”

Bready continued, “We are pleased with the progress we have made

since commencing our transformation to unlock substantial value and

position the business for long-term sustainable growth and success.

We now expect to deliver more than $600 million of annual run-rate

operating income benefits through our transformation by the first

half of 2027.”

Bready concluded, “As we look ahead, we remain confident that we

are on the right path with our renewed strategic focus to reach our

aspiration to become the worldwide partner of choice for commerce

solutions.”

Fourth Quarter 2024 Summary

- GAAP revenues were $2.52 billion, compared to $2.43 billion in

2023; diluted earnings per share were $2.25, compared to $1.38 in

the prior year; and operating margin was 33.1%, compared to 20.5%

in the prior year.

- Adjusted net revenues increased 5% (6.5% constant currency

excluding dispositions) to $2.29 billion, compared to $2.19 billion

in the fourth quarter of 2023.

- Adjusted earnings per share increased 11% (12% constant

currency) to $2.95, compared to $2.65 in the fourth quarter of

2023.

- Adjusted operating margin expanded 40 basis points to

45.2%.

Full Year 2024 Summary

- GAAP revenues were $10.11 billion, compared to $9.65 billion in

2023; diluted earnings per share were $6.16, compared to $3.77 in

the prior year; and operating margin was 23.1%, compared to 17.8%

in the prior year.

- Adjusted net revenues increased 6% to $9.15 billion, compared

to $8.67 billion in 2023.

- Adjusted earnings per share increased 11% to $11.55, compared

to $10.42 in 2023.

- Adjusted operating margin expanded 40 basis points to

45.0%.

2025 Outlook

“We are pleased with our performance during 2024, which

culminated with a sequential acceleration in constant currency

growth in both our Merchant and Issuer businesses, excluding

dispositions,” said Josh Whipple, chief financial officer. “We also

generated strong adjusted free cash flow during the year, while

effectively balancing returning capital to our shareholders and

reducing our net leverage position.”

Whipple continued, "Consistent with the medium-term outlook we

provided at our Investor Conference, we expect constant currency

adjusted net revenue growth to be in a range of 5% to 6%, excluding

dispositions, and constant currency adjusted earnings per share

growth to be in a range of 10% to 11% in 2025. Annual adjusted

operating margin is expected to expand 50 basis points excluding

dispositions. We also expect to return approximately $2 billion to

shareholders during the year.”

Whipple concluded, “Our outlook reflects the strategic

initiatives we are undertaking through our transformation and

assumes a stable macro environment. We are confident that the

business has good forward momentum as we execute against our

refocused strategy.”

Capital Allocation

Global Payments’ Board of Directors approved a dividend of $0.25

per share payable on March 28, 2025 to shareholders of record as of

March 14, 2025.

Conference Call

Global Payments’ management will host a live audio webcast

today, February 13, 2025, at 8:00 a.m. ET to discuss financial

results and business highlights. The audio webcast, along with

supplemental financial information, can be accessed via the

investor relations page of the company’s website at

investors.globalpayments.com. A replay of the audio webcast will be

archived on the company's website following the live event.

Non-GAAP Financial Measures

Global Payments supplements revenues, operating income,

operating margin and net income and earnings per share determined

in accordance with GAAP by providing these measures with certain

adjustments (such measures being non-GAAP financial measures) in

this earnings release to assist with evaluating our performance. In

addition to GAAP measures, management uses these non-GAAP financial

measures to focus on the factors the company believes are pertinent

to the daily management of our operations.

Global Payments also has provided supplemental non-GAAP

information to reflect the disposition of the consumer portion of

our Netspend business, which comprised our former Consumer

Solutions segment, which closed in April 2023. Management believes

that providing such supplemental financial information should

enhance shareholders’ ability to evaluate how the business will be

managed going forward.

Reconciliation of each non-GAAP financial measure to the most

directly comparable GAAP measure is included in the schedules to

this release, except for forward-looking measures where a

reconciliation to the corresponding GAAP measures is not available

due to the variability, complexity and limited visibility of the

items that are excluded from the non-GAAP outlook measures.

About Global Payments

Global Payments Inc. (NYSE: GPN) is a leading payments

technology company delivering innovative software and services to

our customers globally. Our technologies, services and team member

expertise allow us to provide a broad range of solutions that

enable our customers to operate their businesses more efficiently

across a variety of channels around the world.

Headquartered in Georgia with approximately 27,000 team members

worldwide, Global Payments is a Fortune 500® company and a member

of the S&P 500 with worldwide reach spanning North America,

Europe, Asia Pacific and Latin America. For more information, visit

company.globalpayments.com and follow Global Payments on X,

LinkedIn and Facebook.

Forward-Looking Statements

Investors are cautioned that some of the statements we use in

this release contain forward-looking statements and are made

pursuant to the "safe-harbor" provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements,

which are based on current expectations, estimates and projections

about the industry and markets in which we operate, and beliefs of

and assumptions made by our management, involve risks and

uncertainties that could significantly affect the financial

condition, results of operations, business plans and the future

performance of Global Payments. Actual events or results might

differ materially from those expressed or forecasted in these

forward-looking statements. Accordingly, we cannot guarantee that

our plans and expectations will be achieved. Examples of

forward-looking statements include, but are not limited to,

statements we make regarding future financial and operating

results, including revenue, earnings estimates, liquidity, and

deleveraging plans, management’s expectations regarding future

plans, objectives and goals; market and growth opportunities;

capital available for allocation; the effects of general economic

conditions on our business; statements about the benefits of

acquisitions or dispositions, including future financial and

operating results, and the successful integration of our

acquisitions; statements about the completion of anticipated

benefits and strategic or operational initiatives; statements

regarding our success and timing in developing and introducing new

services and expanding our business; and other statements regarding

our future financial performance and the company’s plans,

objectives, expectations and intentions. Statements can generally

be identified as forward-looking because they include words such as

“believes,” “anticipates,” “expects,” “intends,” “plan,”

“forecast,” “could,” “should,” “will,” “would,” or words of similar

meaning. Although we believe that the plans and expectations

reflected in any forward-looking statements are based on reasonable

assumptions, we can give no assurance that our plans and

expectations will be attained, and therefore actual outcomes and

results may differ materially from what is expressed or forecasted

in such forward-looking statements.

In addition to factors previously disclosed in Global Payments’

reports filed with the SEC and those identified elsewhere in this

communication, the following factors, among others, could cause

actual results to differ materially from forward-looking statements

or historical performance: the effects of global economic,

political, market, health and social events or other conditions;

foreign currency exchange, inflation and rising interest rate

risks; difficulties, delays and higher than anticipated costs

related to integrating the businesses of acquired companies,

including with respect to implementing controls to prevent a

material security breach of any internal systems or to successfully

manage credit and fraud risks in business units; the effect of a

security breach or operational failure on our business; failing to

comply with the applicable requirements of Visa, Mastercard or

other payment networks or card schemes or changes in those

requirements; the ability to maintain Visa and Mastercard

registration and financial institution sponsorship; the ability to

retain, develop and hire key personnel; the diversion of

management’s attention from ongoing business operations; the

continued availability of capital and financing; increased

competition in the markets in which we operate and our ability to

increase our market share in existing markets and expand into new

markets; our ability to safeguard our data; risks associated with

our indebtedness; the potential effect of climate change including

natural disasters; the effects of new or changes in current laws,

regulations, credit card association rules or other industry

standards on us or our partners and customers, including privacy

and cybersecurity laws and regulations; and other events beyond our

control, and other factors included in the “Risk Factors” section

in our most recent Annual Report on Form 10-K and in other

documents that we file with the SEC, which are available at

https://www.sec.gov.

These cautionary statements qualify all of our forward-looking

statements, and you are cautioned not to place undue reliance on

these forward-looking statements. Our forward-looking statements

speak only as of the date they are made and should not be relied

upon as representing our plans and expectations as of any

subsequent date. While we may elect to update or revise

forward-looking statements at some time in the future, we

specifically disclaim any obligation to publicly release the

results of any revisions to our forward-looking statements, except

as required by law.

SCHEDULE 1

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands, except per share data)

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

% Change

2024

2023

% Change

Revenues

$

2,515,386

$

2,433,812

3.4

%

$

10,105,894

$

9,654,419

4.7

%

Operating expenses:

Cost of service

952,297

922,284

3.3

%

3,760,116

3,727,521

0.9

%

Selling, general and administrative

1,003,075

1,015,164

(1.2

)%

4,285,307

4,073,768

5.2

%

Net (gain) loss on business

dispositions

(273,134

)

(2,351

)

nm

(273,134

)

136,744

nm

1,682,238

1,935,097

7,772,289

7,938,033

Operating income

833,148

498,715

67.1

%

2,333,605

1,716,386

36.0

%

Interest and other income

42,596

38,881

9.6

%

169,168

113,711

48.8

%

Interest and other expense

(156,776

)

(169,687

)

(7.6

)%

(633,986

)

(660,150

)

(4.0

)%

(114,180

)

(130,806

)

(464,818

)

(546,439

)

Income before income taxes and equity in

income of equity method investments

718,968

367,909

95.4

%

1,868,787

1,169,947

59.7

%

Income tax expense

140,540

9,272

nm

295,133

209,020

41.2

%

Income before equity in income of equity

method investments

578,428

358,637

61.3

%

1,573,654

960,927

nm

Equity in income of equity method

investments, net of tax

19,855

13,795

43.9

%

70,499

67,896

3.8

%

Net income

598,283

372,432

60.6

%

1,644,153

1,028,823

nm

Net income attributable to noncontrolling

interests

(31,110

)

(11,136

)

179.4

%

(73,788

)

(42,590

)

73.3

%

Net income attributable to Global

Payments

$

567,173

$

361,296

57.0

%

$

1,570,365

$

986,233

nm

Earnings per share attributable to Global

Payments:

Basic earnings per share

$

2.26

$

1.39

62.6

%

$

6.18

$

3.78

nm

Diluted earnings per share

$

2.25

$

1.38

63.0

%

$

6.16

$

3.77

nm

Weighted-average number of shares

outstanding:

Basic

251,123

260,375

254,291

261,126

Diluted

251,766

261,102

254,845

261,698

Note: nm = not meaningful.

SCHEDULE 2

NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands, except per share data)

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

% Change

2024

2023

% Change

Adjusted net revenue

$

2,289,015

$

2,186,240

4.7

%

$

9,154,007

$

8,670,965

5.6

%

Adjusted operating income

$

1,034,048

$

978,506

5.7

%

$

4,120,567

$

3,867,524

6.5

%

Adjusted net income attributable to Global

Payments

$

742,290

$

692,206

7.2

%

$

2,942,560

$

2,727,407

7.9

%

Adjusted diluted earnings per share

attributable to Global Payments

$

2.95

$

2.65

11.3

%

$

11.55

$

10.42

10.8

%

Supplemental Non-GAAP⁽¹⁾

Adjusted net revenue⁽¹⁾

$

2,289,015

$

2,186,240

4.7

%

$

9,154,007

$

8,525,523

7.4

%

Adjusted operating income⁽¹⁾

$

1,034,048

$

978,506

5.7

%

$

4,120,567

$

3,794,294

8.6

%

----------------------------------------------------------------------------------

(1)

The supplemental non-GAAP information

reflects the disposition of our consumer business which closed in

April 2023.

See Schedules 6 and 7 for a reconciliation

of each non-GAAP financial measure to the most comparable GAAP

measure, Schedules 8 and 9 for a reconciliation of adjusted net

revenue and adjusted operating income by segment and supplemental

non-GAAP information to the most comparable GAAP measure, and

Schedule 10 for a discussion of non-GAAP financial measures.

SCHEDULE 3

SEGMENT INFORMATION (UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands)

Three Months Ended

December 31, 2024

December 31, 2023

% Change

GAAP

Non-GAAP

GAAP

Non-GAAP

GAAP

Non-GAAP

Revenues:

Merchant Solutions

$

1,885,923

$

1,763,013

$

1,819,885

$

1,670,482

3.6

%

5.5

%

Issuer Solutions

646,284

542,099

629,674

530,649

2.6

%

2.2

%

Intersegment Elimination

(16,821

)

(16,098

)

(15,747

)

(14,891

)

(6.8

)%

(8.1

)%

$

2,515,386

$

2,289,015

$

2,433,812

$

2,186,240

3.4

%

4.7

%

Operating income:

Merchant Solutions

$

652,406

$

852,031

$

596,633

$

797,346

9.3

%

6.9

%

Issuer Solutions

119,925

254,440

117,419

251,003

2.1

%

1.4

%

Corporate

(212,317

)

(72,423

)

(217,688

)

(69,843

)

2.5

%

(3.7

)%

Net gain on business dispositions

273,134

—

2,351

—

nm

nm

$

833,148

$

1,034,048

$

498,715

$

978,506

67.1

%

5.7

%

Years Ended

December 31, 2024

December 31, 2023

% Change

GAAP

Non-GAAP

GAAP

Non-GAAP

GAAP

Non-GAAP

Revenues:

Merchant Solutions

$

7,688,703

$

7,103,338

$

7,151,793

$

6,536,966

7.5

%

8.7

%

Issuer Solutions

2,483,657

2,113,242

2,398,870

2,045,883

3.5

%

3.3

%

Consumer Solutions

—

—

182,740

163,027

nm

nm

Intersegment Elimination

(66,466

)

(62,573

)

(78,984

)

(74,911

)

15.8

%

16.5

%

$

10,105,894

$

9,154,007

$

9,654,419

$

8,670,965

4.7

%

5.6

%

Operating income:

Merchant Solutions

$

2,612,915

$

3,448,689

$

2,345,255

$

3,148,540

11.4

%

9.5

%

Issuer Solutions

442,442

982,849

409,807

948,799

8.0

%

3.6

%

Consumer Solutions

—

—

(3,908

)

73,230

nm

nm

Corporate

(994,886

)

(310,971

)

(898,024

)

(303,045

)

(10.8

)%

(2.6

)%

Net gain (loss) on business

dispositions

273,134

—

(136,744

)

—

299.7

%

nm

$

2,333,605

$

4,120,567

$

1,716,386

$

3,867,524

36.0

%

6.5

%

----------------------------------------------------------------------------------

See Schedules 8 and 9 for a reconciliation

of adjusted net revenue and adjusted operating income by segment to

the most comparable GAAP measures and Schedule 10 for a discussion

of non-GAAP financial measures.

Note: Amounts may not sum due to

rounding.

Note: nm = not meaningful.

SCHEDULE 4

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands, except share data)

December 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

2,538,416

$

2,088,887

Accounts receivable, net

1,081,740

1,120,078

Settlement processing assets

1,620,921

4,097,417

Prepaid expenses and other current

assets

795,593

767,377

Total current assets

6,036,670

8,073,759

Goodwill

26,286,318

26,743,523

Other intangible assets, net

8,931,943

10,168,046

Property and equipment, net

2,277,593

2,190,005

Deferred income taxes

106,083

111,712

Notes receivable

772,297

713,123

Other noncurrent assets

2,479,351

2,570,018

Total assets

$

46,890,255

$

50,570,186

LIABILITIES AND EQUITY

Current liabilities:

Settlement lines of credit

$

503,407

$

981,244

Current portion of long-term debt

1,075,708

620,585

Accounts payable and accrued

liabilities

3,079,924

2,824,979

Settlement processing obligations

1,593,675

3,698,921

Total current liabilities

6,252,714

8,125,729

Long-term debt

15,164,659

15,692,297

Deferred income taxes

1,832,996

2,242,105

Other noncurrent liabilities

623,319

722,540

Total liabilities

23,873,688

26,782,671

Commitments and contingencies

Redeemable noncontrolling interests

160,623

507,965

Equity:

Preferred stock, no par value; 5,000,000

shares authorized and none issued

—

—

Common stock, no par value; 400,000,000

shares authorized at December 31, 2024 and 2023; 248,708,899 shares

issued and outstanding at December 31, 2024, and 260,382,746 shares

issued and outstanding at December 31, 2023

—

—

Paid-in capital

18,118,942

19,800,953

Retained earnings

4,774,736

3,457,182

Accumulated other comprehensive loss

(612,992

)

(258,925

)

Total Global Payments shareholders’

equity

22,280,686

22,999,210

Nonredeemable noncontrolling interests

575,258

280,340

Total equity

22,855,944

23,279,550

Total liabilities, redeemable

noncontrolling interests and equity

$

46,890,255

$

50,570,186

SCHEDULE 5

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands)

Years Ended December 31,

2024

2023

Cash flows from operating

activities:

Net income

$

1,644,153

$

1,028,823

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization of property

and equipment

493,003

458,157

Amortization of acquired intangibles

1,369,328

1,318,535

Amortization of capitalized contract

costs

138,051

123,405

Share-based compensation expense

164,244

208,994

Provision for operating losses and credit

losses

81,018

97,103

Noncash lease expense

58,728

65,307

Deferred income taxes

(346,228

)

(499,974

)

Paid-in-kind interest capitalized to

principal of notes receivable

(74,139

)

(46,524

)

Equity in income of equity method

investments, net of tax

(70,499

)

(67,896

)

Distributions received on investments

32,849

18,267

Technology asset charge

55,808

—

Net (gain) loss on business

dispositions

(273,134

)

136,744

Other, net

45,787

71,063

Changes in operating assets and

liabilities, net of the effects of business combinations:

Accounts receivable

(10,443

)

(78,647

)

Settlement processing assets and

obligations, net

338,341

(345,898

)

Prepaid expenses and other assets

(221,447

)

(289,826

)

Accounts payable and other liabilities

107,263

51,108

Net cash provided by operating

activities

3,532,683

2,248,741

Cash flows from investing

activities:

Business combinations and other

acquisitions, net of cash and restricted cash acquired

(487,056

)

(4,225,610

)

Capital expenditures

(674,917

)

(658,142

)

Issuance of notes receivable

—

(50,000

)

Repayment of notes receivable

—

50,000

Net cash from sales of businesses

962,435

479,067

Proceeds from sales of investments

19,008

42,135

Other, net

6,639

1,438

Net cash used in investing activities

(173,891

)

(4,361,112

)

Cash flows from financing

activities:

Net (repayments) borrowings from

settlement lines of credit

(442,713

)

220,682

Net (repayments) borrowings from

commercial paper notes

(1,367,859

)

1,367,859

Proceeds from long-term debt

9,635,049

10,336,850

Repayments of long-term debt

(8,334,846

)

(9,099,938

)

Payments of debt issuance costs

(33,056

)

(12,735

)

Repurchases of common stock

(1,551,950

)

(418,272

)

Proceeds from stock issued under

share-based compensation plans

43,009

60,345

Common stock repurchased - share-based

compensation plans

(56,229

)

(41,225

)

Purchase of subsidiary shares from

noncontrolling interest

(108,770

)

—

Distributions to noncontrolling

interests

(38,086

)

(32,997

)

Proceeds and contributions from

noncontrolling interests

4,044

26,205

Payment of deferred and contingent

consideration in business combination

(6,390

)

(5,222

)

Purchase of capped calls related to

issuance of convertible notes

(256,250

)

—

Dividends paid

(252,811

)

(260,431

)

Net cash (used in) provided by financing

activities

(2,766,858

)

2,141,121

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(112,834

)

12,519

Increase in cash, cash equivalents and

restricted cash

479,100

41,269

Cash, cash equivalents and restricted

cash, beginning of the period

2,256,875

2,215,606

Cash, cash equivalents and restricted

cash, end of the period

$

2,735,975

$

2,256,875

SCHEDULE 6

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES TO GAAP MEASURES (UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands, except per share data)

Three Months Ended December 31,

2024

GAAP

Net Revenue Adjustments(1)

Earnings Adjustments(2)

Income Taxes on

Adjustments(3)

Non-GAAP

Revenues

$

2,515,386

$

(226,371

)

$

—

$

—

$

2,289,015

Operating income

$

833,148

$

327

$

200,573

$

—

$

1,034,048

Net income attributable to Global

Payments

$

567,173

$

327

$

203,824

$

(29,035

)

$

742,290

Diluted earnings per share attributable to

Global Payments

$

2.25

$

2.95

Diluted weighted average shares

outstanding

251,766

251,766

Three Months Ended December 31,

2023

GAAP

Net Revenue Adjustments(1)

Earnings Adjustments(2)

Income Taxes on

Adjustments(3)

Non-GAAP

Revenues

$

2,433,812

$

(247,572

)

$

—

$

—

$

2,186,240

Operating income

$

498,715

$

510

$

479,281

$

—

$

978,506

Net income attributable to Global

Payments

$

361,296

$

510

$

478,613

$

(148,213

)

$

692,206

Diluted earnings per share attributable to

Global Payments

$

1.38

$

2.65

Diluted weighted average shares

outstanding

261,102

261,102

----------------------------------------------------------------------------------

(1)

Includes adjustments to revenues

for gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the three months ended December 31,

2024 and 2023, net revenue adjustments also included $0.3 million

and $0.5 million, respectively, to eliminate the effect of

acquisition accounting fair value adjustments for software-related

contract liabilities associated with acquired businesses.

(2)

For the three months ended

December 31, 2024, earnings adjustments to operating income

included $332.8 million in cost of service (COS) and $140.9 million

in selling, general and administrative expenses (SG&A).

Adjustments to COS included amortization of acquired intangibles of

$332.6 million and other items of $0.2 million. Adjustments to

SG&A included share-based compensation expense of $29.9

million, acquisition, integration and separation expenses of $31.2

million, employee termination benefits of $4.3 million, facilities

exit charges of $6.8 million, charges for business transformation

activities of $39.9 million, non-cash asset write-offs of $18.2

million for discontinued initiatives, and other items of $10.6

million.

For the three months ended

December 31, 2024, earnings adjustments to operating income also

included the elimination of a $273.1 million gain on business

dispositions.

For the three months ended

December 31, 2023, earnings adjustments to operating income

included $332.5 million in COS and $149.2 million in SG&A.

Adjustments to COS consisted of amortization of acquired

intangibles of $332.5 million. Adjustments to SG&A included

share-based compensation expense of $35.7 million, acquisition,

integration and separation expenses of $97.5 million, facilities

exit charges of $3.5 million, employee termination benefits of $7.9

million, and other items of $4.6 million. Earnings adjustments to

operating income also included a $2.4 million gain on business

dispositions.

(3)

Income taxes on adjustments

reflect the tax effect of earnings adjustments to income before

income taxes. The tax rate used in determining the tax effect of

earnings adjustments is either the jurisdictional statutory rate in

effect at the time of the adjustment or the jurisdictional expected

annual effective tax rate for the period, depending on the nature

and timing of the adjustment. In addition, for the three months

ended December 31, 2023, income taxes on adjustments include the

removal of tax benefits related to corporate restructuring.

See "Non-GAAP Financial Measures"

discussion on Schedule 10.

Note: Amounts may not sum due to

rounding.

SCHEDULE 7

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES TO GAAP MEASURES (UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands, except per share data)

Year Ended December 31, 2024

GAAP

Net Revenue Adjustments(1)

Earnings Adjustments(2)

Income Taxes on

Adjustments(3)

Non-GAAP

Revenues

$

10,105,894

$

(951,887

)

$

—

$

—

$

9,154,007

Operating income

$

2,333,605

$

2,205

$

1,784,757

$

—

$

4,120,567

Net income attributable to Global

Payments

$

1,570,365

$

2,205

$

1,763,230

$

(393,240

)

$

2,942,560

Diluted earnings per share attributable to

Global Payments

$

6.16

$

11.55

Diluted weighted average shares

outstanding

254,845

254,845

Year Ended December 31, 2023

GAAP

Net Revenue Adjustments(1)

Earnings Adjustments(2)

Income Taxes on

Adjustments(3)

Non-GAAP

Revenues

$

9,654,419

$

(983,454

)

$

—

$

—

$

8,670,965

Operating income

$

1,716,386

$

(17,590

)

$

2,168,728

$

—

$

3,867,524

Net income attributable to Global

Payments

$

986,233

$

(17,590

)

$

2,186,359

$

(427,595

)

$

2,727,407

Diluted earnings per share attributable to

Global Payments

$

3.77

$

10.42

Diluted weighted average shares

outstanding

261,698

261,698

----------------------------------------------------------------------------------

(1)

Includes adjustments to revenues

for gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the years ended December 31, 2024 and

2023, net revenue adjustments also included $2.2 million and $2.1

million, respectively, to eliminate the effect of acquisition

accounting fair value adjustments for software-related contract

liabilities associated with acquired businesses. Adjustments for

the year ended December 31, 2023, also included a $19.7 million

adjustment to exclude revenues that were associated with certain

excluded expenses of our consumer business, which was disposed in

April 2023.

(2)

For the year ended December 31,

2024, earnings adjustments to operating income included $1,369.1

million in COS and $688.8 million in SG&A. Adjustments to COS

included amortization of acquired intangibles of $1,369.3 million

and other items of $(0.2) million. Adjustments to SG&A included

share-based compensation expense of $164.2 million, acquisition,

integration and separation expenses of $211.6 million, employee

termination benefits of $80.1 million, facilities exit charges of

$13.4 million, charges for business transformation activities of

$99.1 million, non-cash charges of $55.8 million for technology

assets that will no longer be utilized under a revised technology

architecture development strategy, non-cash asset write-offs of

$18.2 million for discontinued initiatives, modernization charges

of $22.9 million, and other items of $23.5 million.

For the year ended December 31,

2024, earnings adjustments to operating income also included the

elimination of a $273.1 million gain on business dispositions.

For the year ended December 31,

2023, earnings adjustments to operating income included $1,321.2

million in COS and $710.8 million in SG&A. Adjustments to COS

included amortization of acquired intangibles of $1,318.5 million

and other items of $2.7 million. Adjustments to SG&A included

share-based compensation expense of $209.0 million, acquisition,

integration and separation expenses of $433.9 million, facilities

exit charges of $18.5 million, employee termination benefits of

$39.4 million, and other items of $10.0 million. Earnings

adjustments to operating income also included a $136.7 million loss

on business dispositions.

Acquisition, integration and

separation expenses for the year ended December 31, 2023 included

$93.6 million related to our disposed consumer business. These

incremental expenses, which include card and marketing expenses,

compensation and benefit expenses, and other expenses, were

incurred as a result of contractual obligations with the purchasers

of the consumer business and do not reflect the manner in which the

company would have operated the business and would not have

otherwise been incurred absent the transaction.

Earnings adjustments to net

income also included an allowance for current expected credit

losses (CECL) of $15.2 million within interest and other expense

related to the seller financing issued in connection with the

business dispositions.

(3)

Income taxes on adjustments

reflect the tax effect of earnings adjustments to income before

income taxes. The tax rate used in determining the tax effect of

earnings adjustments is either the jurisdictional statutory rate in

effect at the time of the adjustment or the jurisdictional expected

annual effective tax rate for the period, depending on the nature

and timing of the adjustment. In addition, for the year ended

December 31, 2023, income taxes on adjustments include the removal

of tax expense related to business dispositions and removal of tax

benefits related to corporate restructuring.

See "Non-GAAP Financial Measures"

discussion on Schedule 10.

Note: Amounts may not sum due to

rounding.

SCHEDULE 8

RECONCILIATION OF SEGMENT NON-GAAP

FINANCIAL MEASURES TO GAAP MEASURES (UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands)

Three Months Ended December 31,

2024

GAAP

Net Revenue Adjustments (1)

Earnings Adjustments(2)

Non-GAAP

Revenues:

Merchant Solutions

$

1,885,923

$

(122,910

)

$

—

$

1,763,013

Issuer Solutions

646,284

(104,185

)

—

542,099

Intersegment Elimination

(16,821

)

723

—

(16,098

)

$

2,515,386

$

(226,371

)

$

—

$

2,289,015

Operating income:

Merchant Solutions

$

652,406

$

(84

)

$

199,709

$

852,031

Issuer Solutions

119,925

411

134,104

254,440

Corporate

(212,317

)

—

139,894

(72,423

)

Net gain on business dispositions

273,134

—

(273,134

)

—

$

833,148

$

327

$

200,573

$

1,034,048

Three Months Ended December 31,

2023

GAAP

Net Revenue Adjustments (1)

Earnings Adjustments(2)

Non-GAAP

Revenues:

Merchant Solutions

$

1,819,885

$

(149,403

)

$

—

$

1,670,482

Issuer Solutions

629,674

(99,025

)

—

530,649

Intersegment Elimination

(15,747

)

856

—

(14,891

)

$

2,433,812

$

(247,572

)

$

—

$

2,186,240

Operating income:

Merchant Solutions

$

596,633

$

—

$

200,713

$

797,346

Issuer Solutions

117,419

510

133,074

251,003

Corporate

(217,688

)

—

147,845

(69,843

)

Net gain on business dispositions

2,351

—

(2,351

)

—

$

498,715

$

510

$

479,281

$

978,506

----------------------------------------------------------------------------------

(1)

Includes adjustments to revenues

for gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the three months ended December 31,

2024 and 2023, net revenue adjustments also included $0.3 million

and $0.5 million, respectively, to eliminate the effect of

acquisition accounting fair value adjustments for software-related

contract liabilities associated with acquired businesses.

(2)

For the three months ended

December 31, 2024, earnings adjustments to operating income

included $332.8 million in COS and $140.9 million in SG&A.

Adjustments to COS included amortization of acquired intangibles of

$332.6 million and other items of $0.2 million. Adjustments to

SG&A included share-based compensation expense of $29.9

million, acquisition, integration and separation expenses of $31.2

million, employee termination benefits of $4.3 million, facilities

exit charges of $6.8 million, charges for business transformation

activities of $39.9 million, non-cash asset write-offs of $18.2

million for discontinued initiatives, and other items of $10.6

million.

For the three months ended

December 31, 2024, earnings adjustments to operating income also

included the elimination of a $273.1 million gain on business

dispositions.

For the three months ended

December 31, 2023, earnings adjustments to operating income

included $332.5 million in COS and $149.2 million in SG&A.

Adjustments to COS consisted of amortization of acquired

intangibles of $332.5 million. Adjustments to SG&A included

share-based compensation expense of $35.7 million, acquisition,

integration and separation expenses of $97.5 million, facilities

exit charges of $3.5 million, employee termination benefits of $7.9

million, and other items of $4.6 million. Earnings adjustments to

operating income also included a $2.4 million gain on business

dispositions.

(3)

See "Non-GAAP Financial Measures"

discussion on Schedule 10.

Note: Amounts may not sum due to

rounding.

SCHEDULE 9

RECONCILIATION OF SEGMENT NON-GAAP

FINANCIAL MEASURES TO GAAP MEASURES (UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

(In thousands)

Year Ended December 31, 2024

GAAP

Net Revenue Adjustments (1)

Earnings Adjustments(2)

Non-GAAP

Revenues:

Merchant Solutions

$

7,688,703

$

(585,365

)

$

—

$

7,103,338

Issuer Solutions

2,483,657

(370,415

)

—

2,113,242

Intersegment Elimination

(66,466

)

3,893

—

(62,573

)

$

10,105,894

$

(951,887

)

$

—

$

9,154,007

Operating income (loss):

Merchant Solutions

$

2,612,915

$

476

$

835,298

$

3,448,689

Issuer Solutions

442,442

1,728

538,678

982,849

Corporate

(994,886

)

—

683,915

(310,971

)

Net gain on business dispositions

273,134

—

(273,134

)

—

$

2,333,605

$

2,205

$

1,784,757

$

4,120,567

Year Ended December 31, 2023

GAAP

Net Revenue Adjustments(1)

Earnings Adjustments(2)

Non-GAAP

Consumer Business (3)

Supplemental Non-GAAP (3)

Revenues:

Merchant Solutions

$

7,151,793

$

(614,827

)

$

—

$

6,536,966

$

—

$

6,536,966

Issuer Solutions

2,398,870

(352,987

)

—

2,045,883

—

2,045,883

Consumer Solutions

182,740

(19,713

)

—

163,027

(163,027

)

—

Intersegment Elimination

(78,984

)

4,073

—

(74,911

)

17,585

(57,326

)

$

9,654,419

$

(983,454

)

$

—

$

8,670,965

$

(145,442

)

$

8,525,523

Operating income (loss):

Merchant Solutions

$

2,345,255

$

23

$

803,262

$

3,148,540

$

—

$

3,148,540

Issuer Solutions

409,807

2,100

536,892

948,799

—

948,799

Consumer Solutions

(3,908

)

(19,713

)

96,851

73,230

(73,230

)

—

Corporate

(898,024

)

—

594,979

(303,045

)

—

(303,045

)

Net loss on business dispositions

(136,744

)

—

136,744

—

—

—

$

1,716,386

$

(17,590

)

$

2,168,728

$

3,867,524

$

(73,230

)

$

3,794,294

----------------------------------------------------------------------------------

(1)

Includes adjustments to revenues

for gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefits to the company. For the years ended December 31, 2024 and

2023, net revenue adjustments also included $2.2 million and $2.1

million, respectively, to eliminate the effect of acquisition

accounting fair value adjustments for software-related contract

liabilities associated with acquired businesses. Adjustments for

the year ended December 31, 2023, also included a $19.7 million

adjustment to exclude revenues that were associated with certain

excluded expenses of our consumer business, which was disposed in

April 2023.

(2)

For the year ended December 31,

2024, earnings adjustments to operating income included $1,369.1

million in COS and $688.8 million in SG&A. Adjustments to COS

included amortization of acquired intangibles of $1,369.3 million

and other items of $(0.2) million. Adjustments to SG&A included

share-based compensation expense of $164.2 million, acquisition,

integration and separation expenses of $211.6 million, employee

termination benefits of $80.1 million, facilities exit charges of

$13.4 million, charges for business transformation activities of

$99.1 million, non-cash charges of $55.8 million for technology

assets that will no longer be utilized under a revised technology

architecture development strategy, non-cash asset write-offs of

$18.2 million for discontinued initiatives, modernization charges

of $22.9 million, and other items of $23.5 million.

For the year ended December 31,

2024, earnings adjustments to operating income also included the

elimination of a $273.1 million gain on business dispositions.

For the year ended December 31,

2023, earnings adjustments to operating income included $1,321.2

million in COS and $710.8 million in SG&A. Adjustments to COS

included amortization of acquired intangibles of $1,318.5 million

and other items of $2.7 million. Adjustments to SG&A included

share-based compensation expense of $209.0 million, acquisition,

integration and separation expenses of $433.9 million, facilities

exit charges of $18.5 million, employee termination benefits of

$39.4 million, and other items of $10.0 million. Earnings

adjustments to operating income also included a $136.7 million loss

on business dispositions.

Acquisition, integration and

separation expenses for the year ended December 31, 2023 included

$93.6 million related to our disposed consumer business. These

incremental expenses, which include card and marketing expenses,

compensation and benefit expenses, and other expenses, were

incurred as a result of contractual obligations with the purchasers

of the consumer business and do not reflect the manner in which the

company would have operated the business and would not have

otherwise been incurred absent the transaction.

Earnings adjustments to net

income also included an allowance for CECL of $15.2 million within

interest and other expense related to the seller financing issued

in connection with the business dispositions.

(3)

The supplemental non-GAAP

information excludes the results of the consumer business that was

disposed in April 2023.

See "Non-GAAP Financial Measures"

discussion on Schedule 10.

Note: Amounts may not sum due to

rounding.

SCHEDULE 10

OUTLOOK SUMMARY (UNAUDITED)

GLOBAL PAYMENTS INC. AND SUBSIDIARIES

2025 Growth

Revenues:

GAAP revenues

0%

to

1%

Adjustments(1)

0%

FX impact

~2%

Constant currency (CC) adj net revenue

2%

to

3%

Dispositions

~3%

CC adjusted net revenue excluding

dispositions

5%

to

6%

Earnings Per

Share:

GAAP diluted EPS

4%

to

5%

Adjustments(2)

~4%

FX impact

~2%

Constant currency adjusted EPS

10%

to

11%

(1)

Includes adjustments to revenues

for gross-up related payments (included in operating expenses)

associated with certain lines of business to reflect economic

benefit to the company. Amounts also included adjustments to

eliminate the effect of acquisition accounting fair value

adjustments for software-related contract liabilities associated

with acquired businesses.

(2)

Adjustments to 2024 GAAP diluted

EPS included the removal of 1) software-related contract liability

adjustments described above of $0.01, 2) acquisition related

amortization expense of $4.13, 3) share-based compensation expense

of $0.50, 4) acquisition, integration, and separation expense of

$0.64, 5) charges for business transformation activities of $0.30,

6) employee termination benefits of $0.24, 7) non-cash charges for

technology assets that will no longer be utilized under a revised

technology architecture development strategy of $0.17, 8)

modernization charges of $0.07, 9) non-cash asset write-offs for

discontinued initiatives of $0.06, 10) facilities exit charges of

$0.04, 11) gain/loss on business dispositions of $(0.83), 12) other

income and expense of $(0.05), 13) discrete tax items of $0.06, 14)

other items of $0.04, 15) the effect of noncontrolling interests

and income taxes, as applicable.

NON-GAAP FINANCIAL MEASURES

Global Payments supplements revenues, operating income,

operating margin and net income, and earnings per share (EPS)

determined in accordance with U.S. GAAP by providing these measures

with certain adjustments (such measures being non-GAAP financial

measures) in this document to assist with evaluating our

performance. In addition to GAAP measures, management uses these

non-GAAP financial measures to focus on the factors the company

believes are pertinent to the daily management of our operations.

The constant currency growth measures adjust for the impact of

exchange rates and are calculated using average exchange rates

during the comparable period in the prior year. Management uses

these non-GAAP financial measures, together with other metrics, to

set goals for and measure the performance of the business and to

determine incentive compensation. Adjusted net revenue, adjusted

operating income, adjusted operating margin, adjusted EPS should be

considered in addition to, and not as substitutes for, revenues,

operating income, EPS and net operating cash flows determined in

accordance with GAAP. The non-GAAP financial measures reflect

management's judgment of particular items, and may not be

comparable to similarly titled measures reported by other

companies.

Adjusted net revenue excludes gross-up related payments

associated with certain lines of business to reflect economic

benefits to the company. On a GAAP basis, these payments are

presented gross in both revenues and operating expenses. Management

believes adjusted net revenue more closely reflects the economic

benefits to the company's core business and allows for better

comparisons with industry peers.

Adjusted operating income, adjusted net income and adjusted EPS

exclude acquisition-related amortization expense, share-based

compensation expense, acquisition, integration and separation

expense, gains or losses on business dispositions, business

transformation activities, and certain other items specific to each

reporting period as more fully described in the accompanying

reconciliations in Schedules 6 and 7. The tax rate used in

determining the income tax impact of earnings adjustments is either

the jurisdictional statutory rate in effect at the time of the

adjustment or the jurisdictional expected annual effective tax rate

for the period, depending on the nature and timing of the

adjustment.

Adjusted operating margin is derived by dividing adjusted

operating income by adjusted net revenue.

The supplemental non-GAAP information excludes the results of

the consumer business that was disposed in April 2023. Management

believes that providing such supplemental financial information

should enhance shareholders’ ability to evaluate how the business

will be managed going forward.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213651180/en/

Investor contact: investor.relations@globalpay.com Winnie Smith

770-829-8478 Media contact: media.relations@globalpay.com Emily

Edmonds 770-829-8755

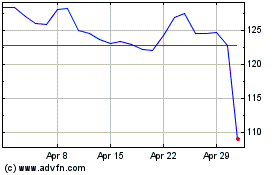

Global Payments (NYSE:GPN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Global Payments (NYSE:GPN)

Historical Stock Chart

From Feb 2024 to Feb 2025