false

0000046765

0000046765

2025-01-16

2025-01-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 16, 2025

HELMERICH & PAYNE, INC.

(Exact name of registrant as specified in

its charter)

| DE |

|

1-4221 |

|

73-0679879 |

(State or other jurisdiction of

Incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

222 North Detroit Avenue

Tulsa, OK 74120

(Address of principal executive offices

and zip code)

(918) 742-5531

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2.):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading

symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock ($0.10 par value) |

|

HP |

|

NYSE |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

As previously disclosed, on July 24,

2024, Helmerich & Payne, Inc., a Delaware corporation (the “Company”), entered into that

certain Sale and Purchase Agreement (the “Purchase Agreement”), as amended by that certain Deed of

Amendment to the Purchase Agreement, dated as of December 20, 2024 (the “Deed of Amendment”), among

the Majority Sellers named therein (the “Majority Sellers”), the Management Seller named therein (the

“Management Seller”), Ocorian Limited, a private company limited by shares incorporated in Jersey, HP

Global Holdings Limited, a private company limited by shares incorporated in Jersey and a wholly owned subsidiary of the Company

(the “Purchaser”), and, for certain purposes set forth therein, KCA Deutag International Limited, a

private company limited by shares incorporated in Jersey (“KCA Deutag”), whereby, among other things, the

Purchaser acquired the entire issued share capital of KCA Deutag (collectively, the “Shares”) from the

Majority Sellers and all other shareholders of KCA Deutag (such purchase and sale, together

with the other transactions contemplated by the Purchase Agreement, the “Acquisition”). As disclosed in the Company’s press release dated July 25, 2024, total consideration for the Acquisition was estimated to be approximately

$1.9725 billion, consisting of (i) the purchase price for the Shares, subject to certain contractual adjustments set forth in the Purchase

Agreement and (ii) the contemporaneous repayment or redemption at Closing (as defined below) of certain of KCA Deutag’s outstanding indebtedness, subject

to ordinary course fluctuations in the amount of outstanding borrowings and accrued and unpaid interest thereunder.

| ITEM 2.01 |

COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS. |

On January 16, 2025 (the “Closing

Date”), the Company completed the Acquisition (the “Closing”) whereby the Purchaser acquired

the Shares for total consideration of approximately $897 million in cash, approximately $80 million of which was deposited into a customary

escrow on the Closing Date pending the resolution of certain potential tax obligations of KCA Deutag in accordance with the terms of

the Purchase Agreement.

The material terms of the Purchase Agreement were

previously disclosed in Item 1.01 of the Company’s Current Report on Form 8-K filed on July 24, 2024, which is incorporated

herein by reference. The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety

by reference to the full text of the Purchase Agreement and the Deed of Amendment, copies of which are filed as Exhibit 2.1 and Exhibit 2.2,

respectively, to this Current Report on Form 8-K and incorporated herein by reference.

| ITEM 7.01 |

REGULATION FD DISCLOSURE. |

On the Closing Date, the Company issued

a press release announcing the closing of the Acquisition. A copy of the press release is furnished as Exhibit 99.1 to this Current

Report on Form 8-K and incorporated herein by reference.

This information is being furnished pursuant to

Item 7.01 of Form 8-K and the press release attached hereto as Exhibit 99.1 shall

not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

In connection with the Closing, the Company and

KCA Deutag completed (a) the redemption in full of all of (i) KCA Deutag UK Finance PLC’s outstanding $500 million aggregate

principal amount of 9.875% Senior Secured Notes due 2025, (ii) KCA Deutag UK Finance PLC’s outstanding $250 million aggregate

principal amount of Senior Secured Floating Rate Notes due 2025 and (iii) KCA Deutag PIKCO PLC’s outstanding $272.2 million

aggregate principal amount (which includes approximately $72.2 million of accrued and capitalized interest) of 15.0%/17.5% Payment-In-Kind

Notes due 2027, and (b) the repayment of all of the (i) approximately $50 million of outstanding borrowings under KCA Deutag’s

Senior Secured Guarantee and Revolving Credit Facilities provided by Barclays Bank plc and (ii) approximately $50 million

of outstanding borrowings under KCA Deutag’s Senior Secured Revolving Credit Facilities provided by Deutsche Bank AG, in each case

including, as applicable, the payment of all accrued and unpaid interest, premiums and fees in connection with each such redemption or

repayment.

| Item 9.01 |

Financial Statements and Exhibits. |

(a) Financial statements of businesses or funds acquired.

The Company intends to file financial statements

required by this Item 9.01(a) under the cover of an amendment to this Current Report on Form 8-K no later than seventy-one (71)

calendar days after the date on which this Form 8-K was required to be filed.

(b) Pro forma financial information.

The Company intends to file the pro forma financial

information that is required by this Item 9.01(b) under the cover of an amendment to this Current Report on Form 8-K no later

than seventy-one (71) calendar days after the date on which this Form 8-K was required to be filed.

(d) Exhibits.

Exhibit

Number |

|

Description |

| 2.1† |

|

Sale and Purchase Agreement, dated July 25, 2024, among Helmerich & Payne, Inc., the Majority Sellers named therein, the Management Seller named therein, Ocorian Limited, HP Global Holdings Limited and KCA Deutag International Limited (incorporated herein by reference to Exhibit 2.1 of the Company’s Form 8-K filed on July 25, 2024, SEC File No. 001-04221). |

| |

|

|

| 2.2 |

|

Deed of Amendment, dated December 20, 2024, among Helmerich & Payne, Inc., the Majority Sellers named therein, the Management Seller named therein, Ocorian Limited, HP Global Holdings Limited and KCA Deutag International Limited. |

| |

|

|

| 99.1 |

|

Press Release dated January 16, 2025, issued by Helmerich & Payne, Inc. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| † |

Certain of the schedules and exhibits to the agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished to the SEC upon request. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

HELMERICH & PAYNE, INC. |

| |

|

| |

By: |

/s/ William H. Gault |

| |

Name: |

William H. Gault |

| |

Title: |

Corporate Secretary |

| |

|

|

| |

Date: |

January 16, 2025 |

Exhibit 2.2

THIS

DEED of AMENDMENT is made on 20 December 2024

BETWEEN:

| (1) | THE PERSONS whose names and addresses

are set out in Part 1 of Schedule 1 (the Majority Sellers) to that certain Sale

and Purchase Agreement, by and among the parties hereto and the individual whose name and

address is set out in Part 2 of Schedule 1 to the Purchase Agreement (the Management

Seller), dated 25 July 2024 (the Purchase Agreement); |

| (2) | OCORIAN LIMITED a private company limited

by shares incorporated in Jersey (registered number 52417) whose registered office is at

26 New Street, St. Helier, JE2 3RA, Jersey in its capacity as trustee of the KCA Deutag Equity

Plan Employee Trust (the Trustee, together with the Majority Sellers and the Management

Seller, the Lead Sellers); |

| (3) | HP GLOBAL HOLDINGS LIMITED a private

company limited by shares incorporated in Jersey (registered number 155227) whose registered

office is at 1 IFC, St Helier, Jersey, JE2 3BX (the Purchaser); |

| (4) | HELMERICH & PAYNE, INC.,

a Delaware corporation whose principal office is at 1437 South Boulder Avenue, Suite 1400,

Tulsa, OK 74119, United States of America (the Purchaser’s Guarantor); and |

| (5) | solely for the purposes set forth in clause

18.5 of the Purchase Agreement, KCA Deutag International

Limited, a private company limited by shares incorporated in Jersey (registered

number 132385) whose registered office is 13-14 Esplanade, St Helier, JE1 0BF, Jersey (the

Company). |

BACKGROUND:

| (A) | Clause 18.10 of the Purchase Agreement provides

that variations may be made to any provision of the Purchase Agreement if such amendment

or variation is set out in writing, expressed to vary the Purchase Agreement and signed by

authorised representatives of each of the parties. |

| (B) | Pursuant to Clause 18.9 of the Purchase Agreement,

the consent of the Management Seller is not necessary for the variations contemplated by

this Deed of Amendment. |

| (C) | Each of the parties now intends to vary certain

provisions of the Purchase Agreement as follows. |

IT

IS AGREED as follows:

| 1.1 | Capitalised

terms used herein that are not otherwise defined have the meanings set forth in the Purchase

Agreement. |

| 1.2 | This

Deed of Amendment shall be deemed to be a Transaction Document and Clauses 14, 15, 18.4 and

18.13 of the Purchase Agreement shall be incorporated into this Deed of Amendment mutadis

mutandis. |

| 2. | Warranties

OF THE PARTIES |

| 2.1 | Each

party hereto severally warrants as to itself only that: (i) it has the power and authority

to execute and deliver this Deed of Amendment and to perform its obligations hereunder and

has taken all action necessary to authorise such execution and delivery and the performance

of such obligations; and (ii) this Deed of Amendment constitutes, legal, valid and binding

obligations of such party in accordance with its terms. |

| 3.1 | Notwithstanding

Clauses 5.13 and 5.14 of the Purchase Agreement, the Purchaser may elect to repay, cash collateralise,

amend and/or keep in place any of the Existing Facilities. If the Purchaser elects to keep

any of the Existing Facilities in place, the Debt Repayment Schedule shall be amended accordingly. |

| 4. | AMENDMENTS

TO PURCHASE AGREEMENT |

| 4.1 | Clause

6.1 of the Purchase Agreement is hereby amended and restated as follows: |

“Completion shall take place on

the later of (i) fifteen (15) Business Days after (and not including) the date on which the last of the Conditions (other than those

Conditions that, by their terms, are to be satisfied immediately prior to Completion, but subject to the satisfaction or waiver of such

Conditions) to be satisfied is satisfied or waived in accordance with subclause 4.2 and (ii) 15 January 2025 (or at such other

place, at such other time and/or on such other date as the Seller Representatives and the Purchaser may agree in writing).”

| 4.2 | The

lead-in sentence to Clause 6.2 of the Purchase Agreement is hereby amended and restated as

follows: |

“Not less than fourteen (14) Business

Days prior to (and not including) the date of Completion, the Company shall deliver to the Purchaser a statement (the Completion Statement)

containing:”

| 4.3 | Clause

15.3 of the Purchase Agreement is hereby amended and restated as follows: |

“Notwithstanding subclause 15.1,

any Seller may assign its right to its Relevant Release Proportion of the Tax Escrow Amount without the prior written consent of the

Seller Representatives or the Purchaser so long as such assignee is either (a) a shareholder as of the date of this agreement, or

(b) an institutional trading desk which will hold the right to any Seller’s Relevant Release Proportion solely for the purposes

of facilitating transfers between shareholders as of the date of this agreement, with such intermediary entities only being permitted

to assign to a shareholder as of the date of this agreement, and in each case agrees to be bound by the terms of subclause 11.3. Any

assignment pursuant to this subclause 15.3 will not affect such assignor Seller’s rights or obligations under the remainder of

this agreement or any Transaction Document and will have no effect on the outstanding binding obligations of any Seller under any Transaction

Document.”

| 4.4 | The

definition of Escrow Account set forth on Schedule 6 (Interpretation) to the Purchase

Agreement is hereby amended and restated as follows: |

“Escrow Account means such

payment agent bank account as notified by the Company to the Purchaser not less than fourteen (14) Business Days prior to Completion

and which the Seller Representatives shall arrange on behalf of the Majority Sellers;”

| 4.5 | The

definition of Escrow Sellers Representative(s) set forth on Schedule 11 (Tax

Escrow) to the Purchase Agreement is hereby amended and restated as follows: |

“Escrow Seller Representative(s) means

the two Escrow Sellers (or an Affiliate of an Escrow Seller which is not itself an Escrow Seller) with that designation, one of which

must be designated by each of the largest and the second largest (collective) institutional entitlement of the Escrow Sellers to the

Tax Escrow Amount from time to time, such entitlement being measured by aggregating the Relevant Escrow Proportion of Escrow Sellers

which are Affiliates of each other and/or form part of the same institutional organisation (without double counting), and the provisions

of clause 20 of this agreement shall apply to such persons mutatis mutandis;”

| 4.6 | Schedule

11 (Tax Escrow) to the Purchase Agreement is hereby supplemented by inserting the following

definition immediately following the definition of Escrow Agent: |

“Escrow Agreement means

the escrow agreement to be entered into between the Escrow Agent, the Escrow Seller Representatives and the Purchaser between the date

of this Agreement and Completion memorialising the Escrow Agent’s rights and obligations in relation to the administration of the

Tax Escrow Account in accordance with this Agreement, as may be novated from time to time pursuant to clause 1.31;”

| 4.7 | Schedule

11 (Tax Escrow) to the Purchase Agreement is hereby supplemented by inserting the following

as a new Clause 1.31: |

“Each Escrow Seller Representative

shall be a party to the Escrow Agreement and any outgoing Escrow Seller Representative shall take all reasonable steps to novate the

Escrow Agreement to the incoming Escrow Seller Representative as soon as reasonably practicable after it no longer qualifies as an Escrow

Seller Representative, and the Purchaser and any current, former or incoming Escrow Seller Representative shall take all reasonable steps

to facilitate such novation.”

| 4.8 | Schedule

11 (Tax Escrow) to the Purchase Agreement is hereby supplemented by inserting the following

as a new Clause 1.32: |

“If an Escrow Seller Representative

is designated as such and is not itself an Escrow Seller, each Escrow Seller which is an Affiliate of such Escrow Seller Representative

and/or forms part of the same institutional group shall procure that the Escrow Seller Representative complies with this Schedule 11,

including the obligation to become a party to the Escrow Agreement pursuant to clause 1.31.”

| 5.1 | Other

than as specifically set forth herein, all other terms and provisions of the Purchase Agreement

shall remain unaffected by the terms of this Deed of Amendment, and shall continue in full

force and effect. The Purchase Agreement and this Deed of Amendment shall be read and construed

as one document and references in the Purchase Agreement to the “agreement” shall

be to the Purchase Agreement as amended by this Deed of Amendment. |

| 5.2 | This

Deed of Amendment may be executed in counterparts, which taken together shall constitute

one and the same agreement, and any party (including any duly authorised representative of

a party) may enter into this agreement by executing a counterpart. Electronic signatures

and signatures delivered by email attachment shall be valid and binding to the same extent

as original signatures. |

| 5.3 | The

Trustee is entering into this Deed of Amendment in its capacity as trustee of the KCA Deutag

Equity Plan Employee Trust. Accordingly, notwithstanding anything to the contrary in this

Deed of Amendment, and without prejudice to any provision of this Deed of Amendment which

limits the liability of the Trustee to an extent greater than as provided by this clause,

the liability of the Trustee shall be limited at all times to the net unencumbered assets

of the KCA Deutag Equity Plan Employee Trust, which are in the Trustee’s possession

or control from time to time, other than where such liabilities are attributable to fraud

on the part of the Trustee. |

| 5.4 | This

Deed of Amendment and any non-contractual obligations arising out of or in connection with

it shall be governed by, and interpreted in accordance with the law of England. |

| 5.5 | All

disputes arising out of or in connection with this Deed of Amendment (including a dispute

relating to any non-contractual obligations arising out of or in connection with this Deed

of Amendment or any other Transaction Document) shall be exclusively and definitively settled

by arbitration pursuant to the LCIA Arbitration Rules, by three arbitrators appointed according

to those rules. The arbitrators shall decide according to English law. The language of the

arbitration shall be English. The place of arbitration shall be London. Nothing contained

in this clause shall limit the right of any party to seek from any court of competent jurisdiction,

pending appointment of an arbitral tribunal, interim relief in aid of arbitration or to protect

or enforce its rights under this Deed of Amendment. Notwithstanding any contrary provision

of the LCIA Arbitration Rules, the parties agree that no party may have recourse to any court

of competent jurisdiction: (i) for determination by that court of any question of law

arising in the course of the arbitration; or (ii) to appeal to that court on any question

of law arising out of any award made in the arbitration. |

| 5.6 | Each

of the Purchaser and the Purchaser’s Guarantor irrevocably appoints Helmerich &

Payne Technologies UK Limited of Spey House Dochfour Business Centre, Dochgarroch, Inverness, IV3

8GY, Scotland as its agent in the United Kingdom for service of process in the event that

recourse is sought to the English courts in relation to any arbitral proceedings contemplated

by clause 5.5. If such process agent ceases to be able to act as process agent or to

have an address in the United Kingdom, the Purchaser’s Guarantor irrevocably agrees

to appoint a new process agent in the United Kingdom and to inform the Lead Sellers in writing,

as soon as reasonably practicable following the appointment of its new process agent. |

| 5.7 | The

language of this Deed of Amendment and the transactions envisaged by it is English and all

notices, demands, requests, statements, certificates or other documents or communications

must be in English unless otherwise agreed in writing by the Purchaser and Seller Representatives. |

AS

WITNESS this Deed of Amendment has been signed by the parties (or their duly authorised representatives) on the date stated

at the beginning of this Deed of Amendment.

Signatories

EXECUTED

as a deed by KCA DEUTAG

INTERNATIONAL LIMITED

acting by Neil Gilchrist, a director

in the presence of: |

)

)

)

) |

s/Neil

Gilchrist

Director |

Witness's Signature

|

s/Alaina Ramsay

|

|

| Name: |

Alaina Ramsay |

|

| |

|

|

| Address: |

KCA Deutag

Bankhead Drive

City South Office

Park, Aberdeen

AB12 4XX |

|

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by AVENUE EUROPE SPECIAL SITUATIONS FUND

III (EURO), L.P., acting by Avenue Europe Capital

Partners III, LLC, its General Partner, acting by GL Europe

Partners III, LLC, its Managing Member

|

)

)

) |

s/Sonia

Gardner

Name: Sonia Gardner

Title: Member |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by AVENUE EUROPE SPECIAL SITUATIONS

FUND

III (U.S.), L.P., acting by Avenue Europe Capital Partners

III, LLC, its General Partner, acting by GL Europe Partners

III, LLC, its Managing Member

|

)

)

) |

s/Sonia

Gardner

Name: Sonia Gardner

Title: Member |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by AVENUE EUROPE SPECIAL SITUATIONS

FUND

IV (U.S.), L.P., acting by Avenue Europe Capital Partners

IV, LLC, its General Partner, acting by GL Europe Partners

IV, LLC, its Managing Member

|

)

)

) |

s/Sonia

Gardner

Name: Sonia Gardner

Title: Member |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by AVENUE-ASRS EUROPE OPPORTUNITIES

FUND, L.P., acting by Avenue-ASRS Europe

Opportunities Fund GenPar, LLC, its General Partner,

acting by GL Europe ASRS Partners, LLC, its Managing

Member

|

)

)

) |

s/Sonia

Gardner

Name: Sonia Gardner

Title: Member |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by ABN AMRO INVESTMENT SOLUTIONS acting

in

its capacity as Manager for ABN AMRO MULTI-

MANAGER FUNDS by BARING ASSET

MANAGEMENT LIMITED as Delegate |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARING GLOBAL UMBRELLA FUND PLC,

in

respect of its sub-fund BARINGS DEVELOPED AND

EMERGING MARKETS HIGH YIELD BOND FUND

Acting by its sub-investment manager BARINGS (U.K.)

LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS UMBRELLA FUND PLC in respect of its

sub-fund

BARINGS EUROPEAN HIGH YIELD BOND FUND

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS EUROPEAN LOAN LIMITED

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS EUROPEAN LOAN STRATEGY 1

LIMITED acting by its investment manager BARING

ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS UMBRELLA FUND PLC in respect of its

sub-fund

BARINGS GLOBAL HIGH YIELD BOND FUND

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS GLOBAL HIGH YIELD CREDIT

STRATEGIES LIMITED acting by its investment

manager

BARINGS LLC acting by its sub-investment manager

BARING INTERNATIONAL INVESTMENT

LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS GLOBAL LOAN AND HIGH YIELD

BOND LIMITED

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS GLOBAL LOAN LIMITED

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS GLOBAL LOAN STRATEGY 3

LIMITED

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS GLOBAL MULTI-CREDIT STRATEGY

4 LIMITED

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS UMBRELLA FUND PLC in respect of

its sub-fund

BARINGS GLOBAL SENIOR SECURED BOND

FUND acting by its investment manager

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS GLOBAL SHORT

DURATION HIGH YIELD FUND

By Baring International Investment Limited

as sub-adviser: |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

The foregoing is executed on behalf of Barings

Global Short Duration High Yield Fund (“Fund”), organized in the Commonwealth of Massachusetts under an Agreement and Declaration

of Trust dated May 19, 2011, as amended from time to time. The obligations of such Fund are not personally binding upon, nor shall

resort be had to the property of, any of the Trustees, shareholders, officers, employees or agents of such Fund, but only the Fund’s

property and assets shall be bound.

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by BARINGS GLOBAL SPECIAL SITUATIONS

CREDIT 3 S.à r.l.

acting by its investment manager

BARING ASSET MANAGEMENT LIMITED

acting by its attorney: |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by CROWN MANAGED ACCOUNTS SPC acting for

and on behalf of CROWN/BA 2 SEGREGATED

PORTFOLIO

acting by its trading advisor

BARING ASSET MANAGEMENT LIMITED |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FIDELITY GLOBAL SUB-IG FIXED INCOME

FUND, A SUB-FUND OF FIDELITY COMMON

CONTRACTUAL FUND II, ON BEHALF OF FIL

FUND MANAGEMENT (IRELAND) LIMITED

acting by its trading advisor

BARING ASSET MANAGEMENT LIMITED

acting by its attorney: |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by MASSMUTUAL ADVANTAGE FUNDS

on behalf of MASSMUTUAL GLOBAL CREDIT

INCOME OPPORTUNITIES FUND

By Baring International Investment Limited

as sub-adviser: |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

The foregoing is executed on behalf of BARINGS

GLOBAL CREDIT INCOME OPPORTUNITIES FUND, a series of Barings Funds Trust, organized under an Agreement and Declaration of Trust dated

May 3, 2013, as amended from time to time. The obligations of such series Trust are not personally binding upon, nor shall resort

be had to the property of, any of the Trustees, shareholders, officers, employees or agents of such Trust, or any other series of the

Trust but only the property and assets of the relevant series Trust shall be bound.

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by NYKREDIT PORTEFØLJE ADMINISTRATION

A/S on behalf of KAPITALFORENINGEN

INVESTIN PRO acting by its sub-investment

manager BARING INTERNATIONAL

INVESTMENT LIMITED

acting by its attorney: |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by RUSSELL INVESTMENTS CAPITAL INC.,

acting

in its capacity as the investment manager for RUSSELL

INVESTMENT INSTITUTIONAL FUNDS, LLC in

respect of HIGH YIELD BOND FUND

By: BARING INTERNATIONAL INVESTMENT

LIMITED as Sub-Investment Manager and Attorney-in-

fact |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by RUSSELL INVESTMENTS IRELAND LIMITED,

acting in its capacity as the manager for RUSSELL

INVESTMENT COMPANY PLC in respect of

RUSSELL GLOBAL HIGH YIELD BOND FUND

By: BARING INTERNATIONAL INVESTMENT

LIMITED as Sub-Investment Manager and Attorney-in-

fact |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by RUSSELL INVESTMENTS MANAGEMENT LLC,

acting in its capacity as the manager for RUSSELL

INVESTMENT COMPANY PLC in respect of GLOBAL

OPPORTUNISTIC CREDIT FUND

By: BARING INTERNATIONAL INVESTMENT

LIMITED as Sub-Investment Manager and Attorney-in-

fact |

)

)

)

)

)

)

)

) |

By: Chris

Sawyer

Title: Managing Director

By: Tom

Kilpatrick

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by DEUTSCHE BANK AG, LONDON BRANCH |

)

)

)

)

)

)

)

) |

By: A

Darbyshire

Title: Authorised Signatory

By: S

Glennie

Title: Authorised Signatory |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by D. E. SHAW GALVANIC INTERNATIONAL, INC. |

)

)

) |

s/Cecil

Boex

By: Cecil

Boex

Title: Authorized signatory |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by D. E. SHAW GALVANIC PORTFOLIOS, L.L.C |

)

)

) |

s/Cecil

Boex

By: Cecil

Boex

Title: Authorized signatory |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by DBSO TRG FUND (A) L.P.

By: DBSO TRG Fund (A) GP LLC, its general

partner |

)

)

) |

s/Avraham

Dreyfuss

By: Avraham

Dreyfuss

Title: Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by DRAWBRIDGE SPECIAL OPPORTUNITIES

FUND LP represented by Drawbridge Special

Opportunities GP LLC, its general partner |

)

)

) |

s/Avraham

Dreyfuss

By: Avraham

Dreyfuss

Title: Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by DRAWBRIDGE SPECIAL OPPORTUNITIES

FUND LTD represented by Drawbridge Special

Opportunities Advisors LLC, its investment manager |

)

)

) |

s/Avraham

Dreyfuss

By: Avraham

Dreyfuss

Title: Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCCO DESIGNATED ACTIVITY COMPANY |

)

)

) |

s/Sean

McKinley

By: Sean

McKinley

Title: Director |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA CENTRE STREET II (ER) LP

By: FCO MA Centre II GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA CENTRE STREET II (PF) LP

By: FCO MA Centre II GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA CENTRE STREET II (TR) LP

By: FCO MA Centre II GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA CENTRE STREET II EXP (ER) LP

By: FCO MA Centre II GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA CENTRE STREET II EXP (P) LP

By: FCO MA Centre II GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA CENTRE STREET II EXP (TR) LP

By: FCO MA Centre II GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA J5 L.P.

By: FCO Fund V GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA MAPLE LEAF LP

By: FCO MA Maple Leaf GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA MI II L.P.

By: FCO MA MI II GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO MA V UB SECURITIES LLC |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCO V LSS SUB CO L.P.

By: FCO V LSS SubCo GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCOF V EXPANSION UB INVESTMENTS LP

By: FCOF V Expansion UB Investments Holdings GP LLC,

its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FCOF V UB INVESTMENTS L.P.

By: FCOF V UB Investments Holdings GP LLC, its general

partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FORTRESS CREDIT OPPORTUNITIES FUND V

EXPANSION MA-C L.P.

By: FCO Fund V MA-C GP LLC , its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FORTRESS CREDIT OPPORTUNITIES FUND V

EXPANSION MA-CRPTF LP

By: FCO Fund V MA-CRPTF GP LLC , its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FORTRESS VINTAGE SECURITIES FUND L.P.

By: Fortress Vintage Securities Fund GP LLC, its general

partner |

)

)

) |

s/Avraham

Dreyfuss

By: Avraham

Dreyfuss

Title: Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by FTS SIP II L.P.

By: FCO BT GP LLC, its general partner |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by SUP FCO MA III UB SECURITIES LLC |

)

)

) |

s/Valentin

Moscaliuc

By: Valentin

Moscaliuc

Title: Deputy Chief Financial

Officer |

Project Refine – SPA Amendment Deed

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by GLQ INTERNATIONAL PARTNERS LP

By: GLQ GP LTD, its general partner |

)

)

)

)

)

)

)

) |

By: J

Wilshire

Title: Director

By: T

Kilgallen

Title: Associate |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by PARTNER REINSURANCE COMPANY LTD. By:

Goldman Sachs Asset Management L.P., in its capacity of

Investment Adviser |

)

)

) |

s/Carey

Ziegler

By: Carey

Ziegler

Title: Managing Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by SCULPTOR SPECIAL MASTER FUND, LTD.

By: Sculptor Capital LP, its Investment Manager

By: Sculptor Capital Holding Corporation, its General

Partner |

)

)

) |

s/Wayne

Cohen

By: Wayne

Cohen

Title: President and

Chief Operating Officer |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by TRESIDOR EUROPE CREDIT LIMITED |

)

)

) |

s/John

Hamrock

By: John

Hamrock

Title: Director |

MAJORITY

SELLER

EXECUTED

and DELIVERED as a DEED

by TRESIDOR EUROPE CREDIT OPPORTUNITIES

LIMITED |

)

)

) |

s/John

Hamrock

By: John

Hamrock

Title: Director |

Executed

as a deed by HP GLOBAL

HOLDINGS LIMITED acting by

John Ruskin Bell who is

permitted to execute for HP Global

Holdings Limited under the laws of

Jersey |

|

s/John

Ruskin Bell

Authorised signatory |

| |

|

|

Executed

as a deed by HELMERICH

& PAYNE, INC. acting by

John W. Lindsay who is

permitted to execute for Helmerich &

Payne, Inc. under the laws of Delaware |

|

s/John

W. Lindsay

Authorised signatory |

EXECUTED as a deed

by OCORIAN LIMITED, in

its capacity as trustee of the KCA Deutag Equity Plan

Employee Trust, acting by two authorised signatories:

Adam Riccio and Craig Cameron |

|

)

)

)

) |

s/Adam

Riccio

Authorised signatory

s/Craig Cameron

Authorised signatory |

Exhibit 99.1

NEWS RELEASE

January 16, 2025

HELMERICH & PAYNE COMPLETES ACQUISITION

OF KCA DEUTAG

TULSA, Okla. – January 16, 2025 - Helmerich & Payne, Inc. (NYSE: HP) (“H&P” or the “Company”)

today announced that it has completed its acquisition of KCA Deutag International Limited (“KCA Deutag”), establishing a global

leader in onshore drilling.

President and CEO of H&P, John Lindsay, commented, “We are

excited to complete this transformative acquisition and welcome KCA Deutag’s talented employees to H&P. Today marks an important

milestone for our company, customers and shareholders as we create an organization with an enhanced global footprint, exceptional service

capability and superior technology offering. We are focused on ensuring a seamless transition and delivering on the strategic and financial

benefits of the transaction.”

Lindsay continued, “Over the past several months, team members

across the company have been diligently working on the planning associated with this integration and providing excellent service to our

customers. I am appreciative of and impressed by the entire team across our global operations for all of their hard work and commitment.

I’d also like to thank KCA Deutag CEO Joseph Elkhoury for his support throughout this integration planning process and wish him

the best in his future endeavors.”

With the acquisition of KCA Deutag, H&P expects to deliver near-

and long-term growth and value creation by:

| · | Accelerating the Company’s international growth strategy by

significantly increasing its Middle East presence: |

| · | Enhancing scale and diversification, with a robust geographic and

operational mix across U.S. and international crude oil and natural gas markets; and |

| · | Strengthening the Company’s cash flow with a more diversified

and durable revenue stream. |

As previously announced, H&P remains headquartered in Tulsa, Oklahoma,

and John Lindsay continues to serve as President and CEO. Joseph Elkhoury, CEO of KCA Deutag, will not continue with H&P.

H&P expects to provide an updated outlook for fiscal year 2025

in connection with reporting fiscal first quarter 2025 results.

About Helmerich & Payne, Inc.

Founded in 1920, Helmerich & Payne, Inc. is committed

to delivering industry leading drilling productivity and reliability. H&P operates with the highest level of integrity, safety and

innovation to deliver superior results for our customers and returns for shareholders. With operations in the most resilient basins throughout

the world, H&P delivers the technology and engineering solutions to ensure a secure, affordable and sustainable energy future. Through

its subsidiaries, the Company designs, fabricates and operates high-performance drilling rigs in conventional and unconventional plays

around the world. H&P also develops and implements advanced automation, directional drilling and survey management technologies.

For more information, visit www.helmerichpayne.com.

HP Contacts:

Investor Relations

Dave Wilson, Vice President of Investor Relations

investor.relations@hpinc.com

(918) 588-5190

Media

Stephanie Higgins

Director of Communications

Stephanie.Higgins@hpinc.com

(918) 588-2670

Disclaimer:

This news release contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements other than statements of historical facts included in this news release are forward-looking statements.

Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “believe,” “predict,”

“project,” “target,” “continue,” or the negative thereof or similar terminology, and such include,

but are not limited to, statements regarding the anticipated benefits of the acquisition, the anticipated impact of the acquisition on

the Company’s business and future financial and operating results, and statements regarding our future financial position, business

strategy, prospects, and plans and objectives of management. Forward-looking statements are based upon current plans, estimates, and expectations

that are subject to risks, uncertainties, and assumptions, many of which are beyond our control and any of which could cause actual results

to differ materially from those expressed in or implied by the forward-looking statements. Although we believe that the expectations reflected

in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. The inclusion

of such statements should not be regarded as a representation that such plans, estimates, or expectations will be achieved. Factors that

could cause actual results to differ materially from those expressed in or implied by such forward-looking statements include, but are

not limited to: our ability to achieve the strategic and other objectives relating to the acquisition; the risk that we are unable to

integrate KCA Deutag’s operations in a successful manner and in the expected time period; and our ability to successfully manage

the increased scale of our operations and expansion into new geographic operating regions.

Additional factors that could cause actual results to differ materially

from our expectations or results discussed in the forward-looking statements, please refer to H&P’s 2024 Annual Report on Form 10-K,

including under Part I, Item 1A— “Risk Factors” and Part II, Item 7— “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” thereof, as updated by subsequent reports we file with

the Securities and Exchange Commission. All forward-looking statements included in this news release and all subsequent written and

oral forward-looking statements, express or implied, are expressly qualified in their entirety by these cautionary statements. All forward-looking

statements speak only as of the date they are made and are based on information available at that time. Because of the underlying risks

and uncertainties, we caution you against placing undue reliance on these forward-looking statements. We assume no duty to update or revise

these forward-looking statements based on changes in internal estimates, expectations or otherwise, except as required by law.

Helmerich & Payne uses its Investor Relations website as

a channel of distribution of material company information. Such information is routinely posted and accessible on its Investor Relations

website at www.helmerichpayne.com. Information on our website is not part of this release.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

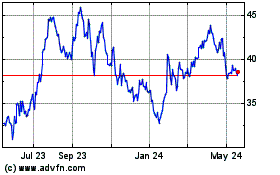

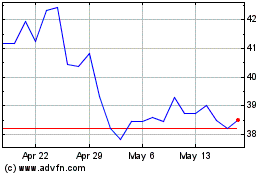

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Mar 2024 to Mar 2025