UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2016

Hercules Capital, Inc.

(formerly known as Hercules Technology Growth Capital, Inc.)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

814-00702 |

|

74-3113410 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 400 Hamilton Ave., Suite 310

Palo Alto, CA |

|

94301 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (650) 289-3060

Not Applicable

(Former

name or address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement

The Information set forth in Item 2.03 of this Form 8-K is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On March 8, 2016, Hercules Capital, Inc., through a special purpose wholly-owned subsidiary, Hercules Funding II LLC (“Hercules Funding II”),

entered into the Second Amendment to Amended and Restated Loan and Security Agreement (the “Wells Facility Amendment”) with Wells Fargo Capital Finance, LLC, as a lender and as the arranger and the administrative agent (“Wells

Fargo”), and the lenders party thereto from time to time.

The Wells Facility Amendment amends certain provisions of the Amended and Restated Loan

and Security Agreement entered into on June 29, 2015 (as amended, the “Wells Facility”), to, among other things, (i) modify one of the concentration limits in relation to eligible notes receivable and (ii) adjust the method

for calculating interest coverage ratio.

The foregoing description of the Wells Facility Amendment does not purport to be complete and is qualified in

its entirety by reference to the full text of the agreements attached hereto as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits

|

|

|

| 10.1 |

|

Second Amendment to Amended and Restated Loan and Security Agreement, dated as of March 8, 2016, by and among Hercules Funding II LLC as borrower, the lenders party thereto and Wells Fargo Capital Finance, LLC as a lender and

as the arranger and the administrative agent. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERCULES CAPITAL, INC. |

|

|

|

| March 8, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Melanie Grace |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Melanie Grace |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Counsel, Chief Compliance Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

& Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Second Amendment to Amended and Restated Loan and Security Agreement, dated as of March 8, 2016, by and among Hercules Funding II LLC as borrower, the lenders party thereto and Wells Fargo Capital Finance, LLC as a lender and as the

arranger and the administrative agent. |

Exhibit 10.1

EXECUTION VERSION

SECOND

AMENDMENT

TO

AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

THIS SECOND AMENDMENT TO AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT (this “Second Amendment” or this

“Amendment”) is entered into as of March 8, 2016, by and among HERCULES FUNDING II LLC, a Delaware limited liability company (“Borrower”), the lenders identified on the signature page hereof (such lenders,

together with their respective successors and assigns, are referred to hereinafter each individually as a “Lender” and collectively as the “Lenders”), and WELLS FARGO CAPITAL FINANCE, LLC, formerly known as Wells

Fargo Foothill, LLC, a Delaware limited liability company, as the arranger and administrative agent for the Lenders (in such capacity, “Agent”), with reference to the following facts, which shall be construed as part of this Second

Amendment:

RECITALS

A. Borrower, Lenders and Agent have entered into that certain Amended and Restated Loan and Security Agreement dated as of June 29, 2015,

as amended by that certain First Amendment to Amended and Restated Loan and Security Agreement dated as of December 16, 2015 (as amended, supplemented, replaced, renewed or otherwise modified from time to time, the “Loan

Agreement”), pursuant to which Lenders and Agent are providing financial accommodations to or for the benefit of Borrower upon the terms and conditions contained therein. Unless otherwise defined herein, capitalized terms or matters of

construction defined or established in the Loan Agreement shall be applied herein as defined or established therein.

B. Borrower, Lenders

and Agent have agreed to enter into this Second Amendment in order to add AloStar Bank of Commerce as a Lender, to increase the amount of the aggregate Commitments and Maximum Revolver Amount under the Loan Agreement, and to amend certain other

provisions of the Loan Agreement.

C. Immediately prior to the effectiveness of this Second Amendment, Wells Fargo Capital Finance, LLC is

the sole Lender under the Loan Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the continued performance by Borrower of its promises and obligations under the Loan Agreement and the

other Loan Documents, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Borrower, Lenders and Agent hereby agree as follows:

1. Ratification of Existing Loan Documents. Each of the parties acknowledges, confirms, and ratifies the provisions of the Loan

Agreement and the other Loan Documents, which shall be unmodified and shall continue to be in full force and effect in accordance with their terms except as expressly provided under this Second Amendment.

- 1 -

EXECUTION VERSION

2. Amendments to the Loan Agreement. The Loan Agreement is hereby

amended as follows:

2.1 Addition of New Definitions. Section 1.1 of the Loan Agreement is amended by

adding in appropriate alphabetical order the following new definitions:

“Second Amendment” means the

Second Amendment to Amended and Restated Loan and Security Agreement, dated as of March 8, 2016, by and among Lenders, Agent and Borrower.

“Second Amendment Closing Date” means March 8, 2016.

“unfunded commitments of Borrower” means, as of any date, all unfunded commitments of Borrower, excluding

those unfunded commitments that require the Account Debtor’s achievement of a milestone or other funding hurdle that has not been met as of such date.

2.2 Amendment to Concentration Limits in Definition of Eligible Notes Receivable. Section 1.1 of the Loan

Agreement is amended by deleting the existing text of Concentration Limit (1) in the definition of “Eligible Notes Receivable” and replacing it with the following amended and restated version thereof:

(1) The portion of the Preliminary Eligible Notes Receivable Balance consisting of the aggregate outstanding principal amount

of all Eligible Notes Receivable that have been materially modified in accordance with Borrower’s Required Procedures, that exceeds ten percent (10%) of the Preliminary Eligible Notes Receivable Balance at such time; provided,

however, that whether an Eligible Notes Receivable has been “materially modified” shall be determined by Agent in its Permitted Discretion;

2.3 Amendment to Definition of Interest Coverage Ratio. Section 1.1 of the Loan Agreement is amended by

deleting the existing definition of the term “Interest Coverage Ratio” and replacing it with the following amended and restated version thereof:

“Interest Coverage Ratio” means, with respect to any Person for any period, the ratio of (i) Net

Investment Income for such period, plus interest expense (including unused line fees), plus depreciation and amortization (excluding amortization of issuance costs and financing fees), plus non-cash extraordinary losses, and minus

non-cash extraordinary gains, in each case determined in accordance with GAAP, to (ii) total interest expense (including unused line fees) to the extent paid or required to be paid during such period, in each case determined for such Person.

2.4 Revised Version of Schedule C-1 to Reflect Additional Commitment of New Lender. Schedule C-1 of

the Loan Agreement is amended by deleting the existing version thereof and replacing it with the amended and restated version attached as Exhibit A to this First Amendment.

- 2 -

EXECUTION VERSION

3. Conditions Precedent. Notwithstanding any other provision of

this Second Amendment, this Second Amendment shall be of no force or effect, and Lenders and Agent shall not have any obligations hereunder, unless and until each of the following conditions have been satisfied:

3.1 Receipt of Executed Second Amendment. Agent shall have received this Second Amendment, duly executed by Borrower,

each Lender, and Agent;

3.2 Agent’s Receipt of Fees Due Under the Fee Letter in Connection with Second

Amendment. Agent shall have received from Borrower the additional fees that are due and payable to Agent under the Fee Letter based upon the closing of this Second Amendment, which fees shall be fully-earned on the Second Amendment Closing Date;

3.3 Agent’s Receipt of Closing Fee Due to New Lender in Connection with Second Amendment. Agent shall have

received from Borrower for the account of AloStar Bank of Commerce the $50,000 closing fee that is due and payable to AloStar Bank of Commerce upon the closing of this Second Amendment, which fee shall be fully-earned by AloStar Bank of Commerce on

the Second Amendment Closing Date and shall be forwarded by Agent to AloStar Bank of Commerce no later than one (1) Business Day after Agent’s receipt of the payment due from AloStar Bank of Commerce in connection with the initial

Settlement reflecting the Commitment of AloStar Bank of Commerce; and

3.4 No Default or Event of Default. No

Default or Event of Default shall have occurred and be continuing.

4. Representations and Warranties Regarding Loan Agreement.

Borrower hereby represents and warrants that the representations and warranties contained in the Loan Agreement were true and correct in all material respects when made and are true and correct in all material respects as of the Second Amendment

Closing Date, except to the extent that (a) a particular representation or warranty by its terms expressly applies only to an earlier date, in which case such representation or warranty was true and correct as of such earlier date, or

(b) Borrower has previously advised Agent in writing as contemplated under the Loan Agreement. Borrower hereby further represents and warrants that no event has occurred and is continuing, or would result from the transactions contemplated

under this Second Amendment, that constitutes or would constitute a Default or an Event of Default.

5. Miscellaneous.

5.1 Headings. The various headings of this Second Amendment are inserted for convenience of reference only and shall not

affect the meaning or interpretation of this Second Amendment or any provisions hereof.

5.2 Counterparts. This

Second Amendment may be executed by the parties hereto in several counterparts, each of which shall be deemed to be an original and all of

- 3 -

EXECUTION VERSION

which together shall be deemed to be one and the same instrument.

Delivery of an executed counterpart of a signature page to this Second Amendment by either (i) facsimile transmission or (ii) electronic transmission in either Tagged Image Format Files (TIFF) or Portable Document Format (PDF), shall be

effective as delivery of a manually executed counterpart thereof.

5.3 Interpretation. No provision of this Second

Amendment shall be construed against or interpreted to the disadvantage of any party hereto by any court or other governmental or judicial authority by reason of such party’s having or being deemed to have structured, drafted or dictated such

provision.

5.4 Complete Agreement. This Second Amendment constitutes the complete agreement between the parties

with respect to the subject matter hereof, and supersedes any prior written or oral agreements, writings, communications or understandings of the parties with respect thereto.

5.5 GOVERNING LAW. THIS SECOND AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH, THE

LAWS OF THE STATE OF NEW YORK.

5.6 Effect. Upon the effectiveness of this Second Amendment, each reference in

the Loan Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import shall mean and be a reference to the Loan Agreement as amended hereby and each reference in the other Loan Documents to the Loan

Agreement, “thereunder,” “thereof,” or words of like import shall mean and be a reference to the Loan Agreement as amended hereby.

5.7 Conflict of Terms. In the event of any inconsistency between the provisions of this Second Amendment and any

provision of the Loan Agreement, the terms and provisions of this Second Amendment shall govern and control.

5.8 No

Novation or Waiver. Except as specifically set forth in this Second Amendment, the execution, delivery and effectiveness of this Second Amendment shall not (a) limit, impair, constitute a waiver by, or otherwise affect any right, power or

remedy of, Agent or Lenders under the Loan Agreement or any other Loan Document, (b) constitute a waiver of any provision in the Loan Agreement or in any of the other Loan Documents or of any Default or Event of Default that may have occurred

and be continuing, or (c) alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Loan Agreement or in any of the other Loan Documents, all of which are ratified and affirmed

in all respects and shall continue in full force and effect.

[SIGNATURE PAGE FOLLOWS]

- 4 -

EXECUTION VERSION

IN WITNESS WHEREOF, the parties hereto have executed this Second

Amendment to Amended and Restated Loan and Security Agreement as of the day and year first above written.

|

|

|

| HERCULES FUNDING II LLC, a

Delaware limited liability company, as Borrower |

|

|

| By: |

|

/s/ Ben Bang |

| Name: |

|

Ben Bang |

| Title: |

|

Secretary |

|

| WELLS FARGO CAPITAL FINANCE, LLC,

formerly known as Wells Fargo Foothill, LLC, a Delaware limited

liability company, as Agent and a Lender |

|

|

| By: |

|

/s/ Jeff Carbery |

| Name: |

|

Jeff Carbery |

| Title: |

|

Region Credit Manager |

|

| ALOSTAR BANK OF COMMERCE, as

a Lender |

|

|

| By: |

|

/s/ Eddie Carpenter |

| Name: |

|

Eddie Carpenter |

| Title: |

|

Director |

- 5 -

EXECUTION VERSION

Exhibit A

to

Second Amendment

to Amended and Restated Loan and Security Agreement

Schedule C-1

Commitments

(as of

Second Amendment Closing Date)

|

|

|

|

|

| Lender |

|

Commitment |

|

| Wells Fargo Capital Finance, LLC |

|

$ |

75,000,000 |

|

| AloStar Bank of Commerce |

|

$ |

20,000,000 |

|

| Total for All Lenders |

|

$ |

95,000,000 |

|

- 6 -

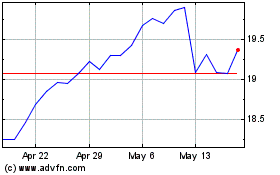

Hercules Capital (NYSE:HTGC)

Historical Stock Chart

From Jun 2024 to Jul 2024

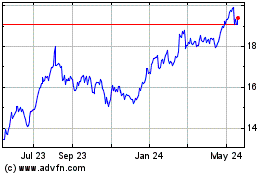

Hercules Capital (NYSE:HTGC)

Historical Stock Chart

From Jul 2023 to Jul 2024