Canceled Deals Put M&A Record at Risk -- WSJ

July 25 2016 - 2:02AM

Dow Jones News

By STEPHEN GROCER

It looks like 2007 may retain its crown after all. 2015 was a

record year for announced deals. Then the calendar flipped and

those transactions began falling apart. Now the value of announced

deals last year is on the cusp of falling below 2007's level, the

previous peak.

So far, acquirers have withdrawn 909 deals announced world-wide

last year valued at $782.8 billion, including six deals valued at

more than $30 billion. That brought the value of announced deals in

2015 down to $4.374 trillion, just $78 billion ahead of 2007's

total, according to Dealogic.

Yet the chances of 2015's total falling below 2007's increas-ed

last week after U.S. antitrust regulators filed lawsuits

challenging Anthem Inc.'s $55 billion proposed acquisition of Cigna

Corp. and Aetna Inc.'s $35 billion planned combination with Humana

Inc.

Aetna and Humana said they would "vigorously defend" their deal.

Anthem said it is "fully committed to challenging the Justice

Department's decision in court but will remain receptive to any

efforts to reach a settlement." Cigna, however, noted that Anthem

had led the regulatory process and said it is "currently evaluating

its options consistent with its obligations under the agreement"

with Anthem, a sign of lingering tension between the two firms.

Subtract those two deals and 2015's total slides to $4.284

trillion, just south of 2007's $4.296 trillion. The list of

acquisitions announced in 2015 that have since fallen apart include

Pfizer's $148 billion deal for Allergan PLC, Monsanto Co.'s $48

billion bid for Syngenta AG and Energy Transfer Equity LP's $33

billion acquisition of Williams Cos.

Stephen Grocer

(END) Dow Jones Newswires

July 25, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

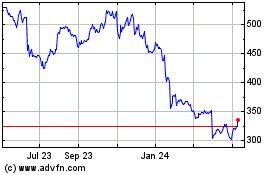

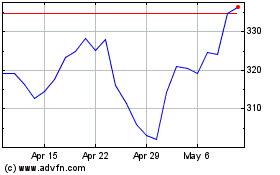

Humana (NYSE:HUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Humana (NYSE:HUM)

Historical Stock Chart

From Jul 2023 to Jul 2024