Aetna Doubles Dividend, Boosts Stock Buyback Plans

February 17 2017 - 2:25PM

Dow Jones News

By Maria Armental

Aetna Inc. is doubling its quarterly dividend and adding another

$4 billion to its stock-buyback authorization, days after it walked

away from its $34 billion merger deal with Humana Inc. over

government antitrust concerns.

A federal judge had ruled that merger would threaten

competition, harming seniors who buy private Medicare coverage as

well as some people who buy health plans through an Affordable Care

Act insurance exchange.

Now without the deal's expenses on the horizon, Aetna is able to

use its liquidity to buy back more stock and boost payouts to

shareholders. The increased buyback authorization means Aetna has

about $5.1 billion available to repurchase stock, which includes

approximately $1.1 billion left from previous authorizations in

2014.

The first payout under the raised 50-cent-a-share dividend will

be on April 28 to shareholders of record as of the close of

business on April 13.

Shares of the Connecticut-based insurer, up 19% over the past 12

months, fell 2.9% to $125.76 in recent trading Friday.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 17, 2017 15:10 ET (20:10 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

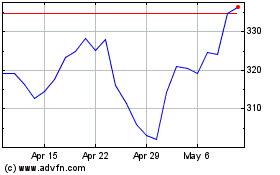

Humana (NYSE:HUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

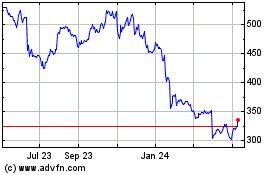

Humana (NYSE:HUM)

Historical Stock Chart

From Jul 2023 to Jul 2024