Why Would Walmart Want to Buy an Insurer? The Retail Squeeze

March 30 2018 - 7:58AM

Dow Jones News

By Sarah Nassauer and Anna Wilde Mathews

First Walmart Inc. dropped "stores" from its legal name. Now the

retail giant, faced with shrinking profits and in search of growth,

is exploring an acquisition that would push far beyond its big box

roots.

On Thursday, The Wall Street Journal reported the world's

biggest retailer is in preliminary discussions to buy U.S. health

insurer Humana Inc., according to people familiar with the

situation. The companies are discussing various options, one person

said, and there is no guarantee they will agree on a merger or

pursue some other partnership.

Walmart's revenue eclipsed $500 billion in its latest fiscal

year -- more than Apple Inc. and Exxon Mobil Corp. combined. But

Walmart's profits have declined 30% over three years to $10.5

billion, squeezed by competition and e-commerce investments to fend

off Amazon.com Inc.

"The company is of such scale that the opportunities for future

expansion in the U.S. are limited," said Neil Saunders, managing

director of GlobalData Retail, a consulting firm. "Moving onto this

turf would give Walmart a whole new arena in which to expand," at a

time when retail margins are under pressure, he said.

Still "the risks of becoming entangled in the complex U.S.

health-care industry are considerable," Mr. Saunders added.

Taking over a health insurer would put the retailer into a

complicated and highly regulated business. Humana's business is

particularly tied to the government because it focuses on Medicare

coverage, at a time when health care is a political flashpoint.

Humana, however, has withdrawn from the Affordable Care Act's

exchanges, after suffering losses, and the private Medicare plans

it offers, known as Medicare Advantage, have recently been

protected by both Republicans and Democrats.

A Humana deal would also be a hefty expense for Walmart. Humana

has a market value of $37 billion and a buyer would need to pay a

premium. Walmart's largest acquisition to date came in 1999 when it

bought U.K.'s Asda Group PLC for $10.8 billion. Walmart ended its

fiscal year with less than $7 billion in cash on hand.

In recent years, Walmart has expanded the pharmacy and health

services it offers in stores, adding cheaper generic drugs for

sale, procedures like vaccinations and urgent-care locations. It is

part of an effort to give shoppers another reason to visit

Walmart's cavernous locations even as they buy more online.

Walmart is also the largest seller of food in the U.S., putting

it in a unique position to capitalize on shopper data or use a

health insurer's data to inform decisions on what products to carry

in stores. The average age of a Walmart shopper is 50, according to

Kantar Consulting, and it has gotten older over the last five years

in line with the broader U.S. shopper population.

"If I can get you in for your health care and your meds... then

you are hopefully going to buy some blue jeans and laundry

detergent," said Steve Barr, consumer markets leader at PwC.

Walmart and Humana have already partnered for over 10 years on a

popular Medicare drug plan that lets customers fill prescriptions

at Walmart pharmacies with low co-pays.

"They've proven these two companies can work together in a

retail setting," said John Gorman, chairman of Gorman Health Group,

a consulting firm focused on government health programs. A merged

Walmart-Humana could create a Medicare plan that could be sold in

Walmart stores and tap into Walmart's other potential health

offerings.

In addition, he said, Walmart's heft as a major purchaser of

goods including drugs might be able to generate savings for Humana

and its members. Humana already owns its own pharmacy-benefit

manager, but it is smaller than the giants in that business, such

as CVS Health Corp. and Express Scripts Holding Co., and has less

leverage with pharmaceutical companies. Express Scripts has agreed

to be bought by insurer Cigna Corp., while CVS aims to take over

Aetna Inc.

For Humana, joining Walmart could also bring chances to reach

consumers more closely, track them through richer data, and bring

down the cost of care by moving some services into a cheaper

setting. Humana has already been forging more deeply into health

care as a way to manage its members. It is working closely with

doctor groups and plans to buy a stake in a home-health and hospice

operator.

But Walmart's stores aren't as ubiquitous as CVS, said Sarah

James, an analyst with Piper Jaffray. "It's not going to give them

the same footprint as CVS," she said, as the stores aren't as

integrated into neighborhoods as the smaller drugstores. That may

limit Walmart's ability to be a convenient touchpoint for consumers

with routine health questions or needs, she said.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

March 30, 2018 08:43 ET (12:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

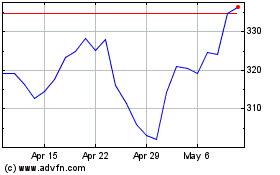

Humana (NYSE:HUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

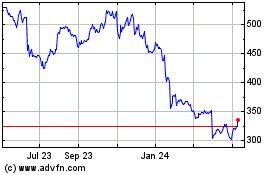

Humana (NYSE:HUM)

Historical Stock Chart

From Jul 2023 to Jul 2024