false000005164400000516442024-10-222024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________

FORM 8-K

_______________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 22, 2024

THE INTERPUBLIC GROUP OF COMPANIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-6686 | 13-1024020 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

909 Third Avenue, New York, New York 10022

(Address of principal executive offices) (Zip Code)

(212)704-1200

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | IPG | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 22, 2024, The Interpublic Group of Companies, Inc. (i) issued a press release, a copy of which is attached hereto as Exhibit 99.1 and incorporated by reference herein, announcing its results for the third quarter and first nine months of 2024, (ii) held a conference call to discuss the foregoing results and (iii) posted an investor presentation, a copy of which is attached hereto as Exhibit 99.2 and incorporated by reference herein, on its website in connection with the conference call.

Item 9.01. Financial Statements and Exhibits.

Exhibit 99.1: Press release dated October 22, 2024 (furnished pursuant to Item 2.02)

Exhibit 99.2: Investor presentation dated October 22, 2024 (furnished pursuant to Item 2.02)

Exhibit 104: Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document (included as Exhibit 101).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | THE INTERPUBLIC GROUP OF COMPANIES, INC. |

| Date: October 22, 2024 | By: /s/ Andrew Bonzani |

| | Name: Andrew Bonzani

Title: Executive Vice President and General Counsel |

| | | | | | | | |

| FOR IMMEDIATE RELEASE | | New York, NY (October 22, 2024) |

Interpublic Announces Third Quarter and First Nine Months 2024 Results

•Total revenue including billable expenses was $2.63 billion

•Revenue before billable expenses ("net revenue") was $2.24 billion, with organic revenue unchanged from the third quarter of 2023

•Non-cash goodwill impairment expense of $232.1 million, related to digital specialist agencies and the sale process for R/GA and Huge

•Reported net income was $20.1 million

•Adjusted EBITA was $385.8 million

•Margin of adjusted EBITA was 17.2% on revenue before billable expenses

•Diluted earnings per share including goodwill charge was $0.05 as reported and $0.70 as adjusted

Philippe Krakowsky, CEO of Interpublic:

“Net revenue in the third quarter was unchanged organically from the same period a year ago, which brings organic growth over the first nine months of this year to 1.0%. During the quarter, we saw solid contributions to growth from media services, sports marketing, data management and public relations. Our adjusted EBITA margin was 17.2%, underscoring continued operating discipline as we continue our enterprise-wide investments in growth and business transformation.

“Third quarter results include non-cash goodwill impairment expense of $232 million related to our digital specialist agencies and progress with the strategic sales process for R/GA and Huge.

“The quarter also continued to see progress in the evolution of our offerings and organizational structure, as we invest in the stronger, growing areas within the portfolio. The launch of Interact marks the next evolution of our marketing intelligence engine, which integrates data flows across the campaign lifecycle and consumer journey. This core technology connects our entire portfolio, from brand research as well as audience insights and audience creation, all the way through to creative ideation, production, commerce, and personalized CRM programs through the use of generative AI. It also powers media activation and optimization, including earned and owned channels, delivering better marketing results across media channels and touchpoints for our clients, in real time.

“Looking forward, we are seeing a strong new business pipeline, for both Q4 activity and longer-term AOR opportunities, and we remain focused on achieving organic growth of

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

1

approximately 1% this year. At that level, we continue to target adjusted EBITA margin of 16.6%. Our long-standing commitment to capital returns remains an important priority and our strong balance sheet provides a solid foundation from which to continue to evolve our offerings and the solutions we provide for marketers.”

Summary

Revenue

•Third quarter 2024: Total revenue, which includes billable expenses, was $2.63 billion, compared $2.68 billion in the third quarter of 2023.

•Revenue before billable expenses ("net revenue") was $2.24 billion, a reported decrease of 2.9% from the third quarter of 2023.

•The organic change of net revenue was flat compared to the third quarter of 2023.

•First nine months 2024: Total revenue, which includes billable expenses, was $7.83 billion, compared $7.87 billion in the first nine months of 2023.

•Revenue before billable expenses ("net revenue") was $6.75 billion, a reported decrease of 0.9% from the first nine months of 2023.

•The organic increase of net revenue was 1.0% from the first nine months of 2023.

Operating Results

•In the third quarter of 2024, operating income was $132.9 million compared to $376.8 million in 2023. Operating results in the third quarter of 2024 include non-cash goodwill impairment of $232.1 million related to the write down of the carrying value of digital specialist agencies to fair value. Adjusted EBITA before restructuring charges was $385.8 million compared to $397.2 million for the same period in 2023. Third quarter 2024 margin of adjusted EBITA before restructuring charges was 17.2% on revenue before billable expenses.

•In the first nine months of 2024, operating income was $635.3 million compared to $875.8 million in 2023. Operating results in the first nine months of 2024 include non-cash goodwill impairment of $232.1 million in the third quarter related to the write down of the carrying value of digital specialist agencies to fair value. Adjusted EBITA before restructuring charges was $930.2 million compared to $938.2 million for the same period in 2023. First nine months 2024 margin of adjusted EBITA before restructuring charges was 13.8% on revenue before billable expenses.

•Refer to reconciliations in the appendix within this press release for further detail.

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

2

Net Results

•In the third quarter of 2024, the income tax provision was $85.3 million on income before income taxes of $109.5 million.

•Third quarter 2024 net income available to IPG common stockholders was $20.1 million, resulting in earnings of $0.05 per basic share and $0.05 per diluted share compared to earnings of $0.64 per basic share and $0.63 per diluted share for the same period in 2023. Net income and earnings per share in the third quarter of 2024 include after-tax expense of $211.4 million related to the non-cash charge to write down goodwill. Adjusted earnings were $0.70 per diluted share which was the same as a year ago. Third quarter 2024 adjusted earnings excludes after-tax amortization of acquired intangibles of $16.1 million, after-tax impairment of goodwill of $211.4 million, after-tax restructuring charges of $0.4 million and an after-tax loss of $16.5 million on the sales of businesses.

•In the first nine months of 2024, the income tax provision was $208.2 million on income before income taxes of $565.8 million.

•First nine months 2024 net income available to IPG common stockholders was $345.0 million, resulting in earnings of $0.92 per basic share and $0.91 per diluted share compared to earnings of $1.65 per basic share and $1.64 per diluted share for the same period in 2023. Net income and earnings per share in the first nine months of 2024 include after-tax expense of $211.4 million related to the non-cash charge to write down goodwill. Adjusted earnings were $1.66 per diluted share compared to adjusted earnings per diluted share of $1.81 a year ago. In 2023, earnings per share, both as reported and adjusted, included a benefit of $0.17 per diluted share related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018. First nine months 2024 adjusted earnings excludes after-tax amortization of acquired intangibles of $48.8 million, after-tax impairment of goodwill of $211.4 million, after-tax restructuring charges of $1.1 million and an after-tax loss of $22.9 million on the sales of businesses.

•Refer to reconciliations in the appendix within this press release for further detail.

Operating Results

Revenue

Revenue before billable expenses of $2.24 billion in the third quarter of 2024 decreased 2.9% compared with the same period in 2023. Compared to the third quarter of 2023, the effect of foreign currency translation was negative 0.5%, the impact of net dispositions was negative 2.4%, and organic net revenue was unchanged from prior year. The organic net revenue change in the third quarter excludes agencies R/GA and Huge, due to their classification as held-for-sale during the quarter.

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

3

Revenue before billable expenses of $6.75 billion in the first nine months of 2024 decreased 0.9% compared with the same period in 2023. Compared to the first nine months of 2023, the effect of foreign currency translation was negative 0.3%, the impact of net dispositions was negative 1.6%, and the resulting organic increase of net revenue was 1.0%.

Operating Expenses

In the third quarter of 2024, total operating expenses, excluding billable expenses, restructuring charges, and amortization and impairment of acquired intangibles decreased 2.9%. In the first nine months of 2024, total operating expenses, excluding billable expenses, restructuring charges, and amortization and impairment of acquired intangibles decreased 0.9% when compared to the first nine months of 2023.

In the third quarter of 2024, staff cost ratio, which is total salaries and related expenses as a percentage of revenue before billable expenses, decreased to 65.3% compared to 66.3% for the same period in 2023. Total salaries and related expenses in the third quarter of 2024 were $1.46 billion, a decrease of 4.4% from a year ago. The decrease was primarily driven by decreased base salaries, benefits and tax, performance-based employee compensation expense and temporary help expense. In the first nine months of 2024, staff cost ratio decreased to 68.0% compared to 69.1% for the same period in 2023. Total salaries and related expenses in the first nine months of 2024 were $4.59 billion, a decrease of 2.4% from a year ago. The decrease was primarily driven by factors similar to those noted above for the third quarter of 2024, partially offset by increased severance expense.

In the third quarter of 2024, office and other direct expenses as a percentage of revenue before billable expenses increased to 14.6% compared to 13.8% for the same period in 2023. Office and other direct expenses were $327.1 million in the third quarter of 2024, an increase of 2.6% from a year ago, reflecting increased expenses for technology and software, as well as professional consulting. In the first nine months of 2024, office and other direct expenses as a percentage of revenue before billable expenses increased to 14.9% compared to 14.5% for the same period in 2023. Office and other direct expenses were $1.01 billion in the first nine months of 2024, an increase of 1.8% from a year ago, primarily due to increases in technology and software costs and general corporate expenses, partially offset by decreases in occupancy expense.

Selling, general and administrative ("SG&A") expenses were $20.8 million in the third quarter of 2024, compared to $16.9 million a year ago, primarily due to increased strategic investment in base salaries, benefits and tax and technology & software. SG&A expenses were $86.4 million in the first nine months of 2024, compared to $43.7 million a year ago, primarily due to factors similar to those noted above for the third quarter of 2024.

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

4

Depreciation and amortization expense decreased by 1.1% and 1.8% during the third quarter and the first nine months of 2024, respectively.

During the third quarter and first nine months of 2024, we recorded goodwill impairment of $232.1 million.

Non-Operating Results and Tax

Net interest expense decreased by $2.9 million to $20.7 million in the third quarter of 2024 from a year ago, primarily attributable to higher interest rates, offset by lower average balances on net deposits. Net interest expense decreased by $10.8 million to $56.1 million in the first nine months of 2024 from a year ago, primarily due to factors similar to those noted above for the third quarter of 2024.

Other expense, net was $2.7 million in the third quarter of 2024, and primarily related to losses on sales of businesses and the classification of certain assets and liabilities as held for sale, as well as pension and postretirement costs. Other expense, net was $13.4 million in the first nine months of 2024, and primarily related to factors similar to those noted above for the third quarter of 2024.

The income tax provision in the third quarter of 2024 was $85.3 million on income before income taxes of $109.5 million. This compares to an income tax provision of $91.5 million for the third quarter of 2023 on income before income taxes of $339.5 million. The income tax provision in the first nine months of 2024 was $208.2 million on income before income taxes of $565.8 million. This compares to an income tax provision of $135.9 million for the first nine months of 2023 on income before income taxes of $784.1 million, which included a benefit of $64.2 million related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018, which was primarily non-cash.

Balance Sheet

At September 30, 2024, cash and cash equivalents totaled $1.53 billion, compared to $2.39 billion at December 31, 2023 and $1.57 billion on September 30, 2023. Total debt was $2.94 billion at September 30, 2024, compared to $3.20 billion at December 31, 2023.

Share Repurchase Program

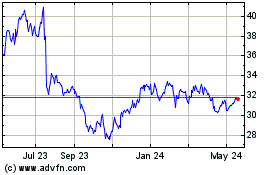

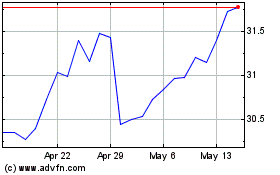

During the first nine months of 2024, the Company repurchased 7.3 million shares of its common stock at an aggregate cost of $230.1 million and an average price of $31.40 per share, including fees.

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

5

Common Stock Dividend

During the third quarter of 2024, the Company declared and paid a common stock cash dividend of $0.330 per share, for a total of $123.2 million.

For further information regarding the Company's financial results as well as certain non-GAAP measures including organic revenue before billable expenses change, adjusted EBITA, adjusted EBITA before restructuring charges and adjusted earnings per diluted share, and the reconciliations thereof, please refer to the appendix within this press release and our Investor Presentation filed on Form 8-K herewith and available on our website, www.interpublic.com.

# # #

About Interpublic

Interpublic (NYSE: IPG) (www.interpublic.com) is a values-based, data-fueled, and creatively-driven provider of marketing solutions. Home to some of the world’s best-known and most innovative communications specialists, IPG global brands include Acxiom, Craft, FCB, FutureBrand, Golin, Huge, Initiative, IPG Health, IPG Mediabrands, Jack Morton, KINESSO, MAGNA, McCann, Mediahub, Momentum, MRM, MullenLowe Global, Octagon, R/GA, UM, Weber Shandwick and more. IPG is an S&P 500 company with total revenue of $10.89 billion in 2023.

# # #

Contact Information

Tom Cunningham

(Press)

(212) 704-1326

Jerry Leshne

(Analysts, Investors)

(212) 704-1439

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

6

Cautionary Statement

This release contains forward-looking statements. Statements in this report that are not historical facts, including statements regarding goals, intentions and expectations as to future plans, trends, events, or future results of operations or financial position, constitute forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “project,” “forecast,” “plan,” “intend,” “could,” “would,” “should,” “will likely result” or comparable terminology are intended to identify forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results and outcomes to differ materially from those reflected in the forward-looking statements.

Actual results and outcomes could differ materially for a variety of reasons, including, among others:

◦the effects of a challenging economy on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition;

◦our ability to attract new clients and retain existing clients;

◦our ability to retain and attract key employees;

◦risks associated with the effects of global, national and regional economic and political conditions, including counterparty risks and fluctuations in interest rates, inflation rates and currency exchange rates;

◦the economic or business impact of military or political conflict in key markets;

◦the impacts on our business of any pandemics, epidemics, disease outbreaks or other public health crises;

◦risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a challenging economy;

◦potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments;

◦developments from changes in the regulatory and legal environment for advertising and marketing services companies around the world, including laws and regulations related to data protection and consumer privacy; and

◦the impact on our operations of general or directed cybersecurity events.

Investors should carefully consider the foregoing factors and the other risks and uncertainties that may affect our business, including those outlined in more detail under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K and our other SEC filings. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any of them in light of new information, future events, or otherwise.

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

7

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

| | | | | | | | | | | | | | | | | | | | |

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED SUMMARY OF EARNINGS

THIRD QUARTER REPORT 2024 AND 2023

(Amounts in Millions except Per Share Data)

(UNAUDITED) |

| | |

| | Three Months Ended September 30, |

| | 2024 | | 2023 | | Fav. (Unfav.)

% Variance |

| Revenue: | | | | | |

| Revenue before Billable Expenses | $ | 2,242.7 | | | $ | 2,309.0 | | | (2.9) | % |

| Billable Expenses | 386.1 | | | 369.5 | | | 4.5 | % |

| Total Revenue | 2,628.8 | | | 2,678.5 | | | (1.9) | % |

| | | | | | |

| Operating Expenses: | | | | | |

| Salaries and Related Expenses | 1,464.0 | | | 1,531.1 | | | 4.4 | % |

| Office and Other Direct Expenses | 327.1 | | | 318.8 | | | (2.6) | % |

| Billable Expenses | 386.1 | | | 369.5 | | | (4.5) | % |

| Cost of Services | 2,177.2 | | | 2,219.4 | | | 1.9 | % |

| Selling, General and Administrative Expenses | 20.8 | | | 16.9 | | | (23.1) | % |

| Depreciation and Amortization | 65.3 | | | 66.0 | | | 1.1 | % |

| Impairment of Goodwill | 232.1 | | | — | | | >(100)% |

| Restructuring Charges | 0.5 | | | (0.6) | | | >(100)% |

| Total Operating Expenses | 2,495.9 | | | 2,301.7 | | | (8.4) | % |

| Operating Income | 132.9 | | | 376.8 | | | (64.7) | % |

| | | | | | |

| Expenses and Other Income: | | | | | |

| Interest Expense | (54.9) | | | (58.7) | | | |

| Interest Income | 34.2 | | | 35.1 | | | |

| Other Expense, Net | (2.7) | | | (13.7) | | | |

| Total (Expenses) and Other Income | (23.4) | | | (37.3) | | | |

| | | | | | |

| Income Before Income Taxes | 109.5 | | | 339.5 | | | |

| Provision for Income Taxes | 85.3 | | | 91.5 | | | |

| Income of Consolidated Companies | 24.2 | | | 248.0 | | | |

| Equity in Net Loss of Unconsolidated Affiliates | — | | | (2.3) | | | |

| Net Income | 24.2 | | | 245.7 | | | |

| Net Income Attributable to Non-controlling Interests | (4.1) | | | (2.0) | | | |

| Net Income Available to IPG Common Stockholders | $ | 20.1 | | | $ | 243.7 | | | |

| | | | | |

Earnings Per Share Available to IPG Common Stockholders: | | | | | |

Basic | $ | 0.05 | | | $ | 0.64 | | | |

Diluted | $ | 0.05 | | | $ | 0.63 | | | |

| | | | | |

Weighted-Average Number of Common Shares Outstanding: | | | | | |

Basic | 373.9 | | | 383.6 | | | |

Diluted | 376.8 | | | 385.5 | | | |

| | | | | |

| Dividends Declared Per Common Share | $ | 0.330 | | | $ | 0.310 | | | |

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

A1

| | | | | | | | | | | | | | | | | | | | |

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED SUMMARY OF EARNINGS

THIRD QUARTER REPORT 2024 AND 2023

(Amounts in Millions except Per Share Data)

(UNAUDITED) |

| | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 | | Fav. (Unfav.)

% Variance |

| Revenue: | | | | | |

| Revenue before Billable Expenses | $ | 6,752.7 | | | $ | 6,814.4 | | | (0.9) | % |

| Billable Expenses | 1,082.0 | | | 1,051.6 | | | 2.9 | % |

| Total Revenue | 7,834.7 | | | 7,866.0 | | | (0.4) | % |

| | | | | | |

| Operating Expenses: | | | | | |

| Salaries and Related Expenses | 4,594.4 | | | 4,707.0 | | | 2.4 | % |

| Office and Other Direct Expenses | 1,007.6 | | | 989.6 | | | (1.8) | % |

| Billable Expenses | 1,082.0 | | | 1,051.6 | | | (2.9) | % |

| Cost of Services | 6,684.0 | | | 6,748.2 | | | 1.0 | % |

| Selling, General and Administrative Expenses | 86.4 | | | 43.7 | | | (97.7) | % |

| Depreciation and Amortization | 195.5 | | | 199.0 | | | 1.8 | % |

| Impairment of Goodwill | 232.1 | | | — | | | >(100)% |

| Restructuring Charges | 1.4 | | | (0.7) | | | >(100)% |

| Total Operating Expenses | 7,199.4 | | | 6,990.2 | | | (3.0) | % |

| Operating Income | 635.3 | | | 875.8 | | | (27.5) | % |

| | | | | | |

| Expenses and Other Income: | | | | | |

| Interest Expense | (175.6) | | | (164.2) | | | |

| Interest Income | 119.5 | | | 97.3 | | | |

| Other Expense, Net | (13.4) | | | (24.8) | | | |

| Total (Expenses) and Other Income | (69.5) | | | (91.7) | | | |

| | | | | | |

| Income Before Income Taxes | 565.8 | | | 784.1 | | | |

| Provision for Income Taxes | 208.2 | | | 135.9 | | | |

| Income of Consolidated Companies | 357.6 | | | 648.2 | | | |

| Equity in Net Loss of Unconsolidated Affiliates | (0.2) | | | (1.7) | | | |

| Net Income | 357.4 | | | 646.5 | | | |

| Net Income Attributable to Non-controlling Interests | (12.4) | | | (11.3) | | | |

| Net Income Available to IPG Common Stockholders | $ | 345.0 | | | $ | 635.2 | | | |

| | | | | |

Earnings Per Share Available to IPG Common Stockholders: | | | | | |

Basic | $ | 0.92 | | | $ | 1.65 | | | |

Diluted | $ | 0.91 | | | $ | 1.64 | | | |

| | | | | |

Weighted-Average Number of Common Shares Outstanding: | | | | | |

Basic | 376.2 | | | 385.0 | | | |

Diluted | 378.7 | | | 386.8 | | | |

| | | | | |

| Dividends Declared Per Common Share | $ | 0.990 | | | $ | 0.930 | | | |

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

A2

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES

U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS

(Amounts in Millions except Per Share Data)

(UNAUDITED)

|

| Three Months Ended September 30, 2024 |

| As Reported | | Amortization of Acquired Intangibles | | Impairment of Goodwill | | Restructuring Charges | | Net Losses on Sales of Businesses1 | | Adjusted Results (Non-GAAP) |

Operating Income and Adjusted EBITA before Restructuring Charges2 | $ | 132.9 | | | $ | (20.3) | | | $ | (232.1) | | | $ | (0.5) | | | | | $ | 385.8 | |

| | | | | | | | | | | |

Total (Expenses) and Other Income3 | (23.4) | | | | | | | | | $ | (1.7) | | | (21.7) | |

| Income Before Income Taxes | 109.5 | | | (20.3) | | | (232.1) | | | (0.5) | | | (1.7) | | | 364.1 | |

| Provision for Income Taxes | 85.3 | | | 4.2 | | | 20.7 | | | 0.1 | | | (14.8) | | | 95.5 | |

Equity in Net Loss of Unconsolidated Affiliates | 0.0 | | | | | | | | | | | 0.0 | |

| Net Income Attributable to Non-controlling Interests | (4.1) | | | | | | | | | | | (4.1) | |

| Net Income Available to IPG Common Stockholders | $ | 20.1 | | | $ | (16.1) | | | $ | (211.4) | | | $ | (0.4) | | | $ | (16.5) | | | $ | 264.5 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Weighted-Average Number of Common Shares Outstanding - Basic | 373.9 | | | | | | | | | | | 373.9 | |

| Dilutive effect of stock options and restricted shares | 2.9 | | | | | | | | | | | 2.9 | |

| Weighted-Average Number of Common Shares Outstanding - Diluted | 376.8 | | | | | | | | | | | 376.8 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Earnings per Share Available to IPG Common Stockholders4: | | | | | | | | | | | |

| Basic | $ | 0.05 | | | $ | (0.04) | | | $ | (0.57) | | | $ | (0.00) | | | $ | (0.04) | | | $ | 0.71 | |

| Diluted | $ | 0.05 | | | $ | (0.04) | | | $ | (0.56) | | | $ | (0.00) | | | $ | (0.04) | | | $ | 0.70 | |

| | | | | | | | | | | |

1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. |

2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page A5 in the appendix. |

3 Consists of non-operating expenses including interest expense, interest income and other expense, net. |

4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. |

Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

|

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

A3

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES

U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS

(Amounts in Millions except Per Share Data)

(UNAUDITED)

|

| Nine Months Ended September 30, 2024 |

| As Reported | | Amortization of Acquired Intangibles | | Impairment of Goodwill | | Restructuring Charges | | Net Losses on Sales of Businesses1 | | Adjusted Results (Non-GAAP) |

Operating Income and Adjusted EBITA before Restructuring Charges2 | $ | 635.3 | | | $ | (61.4) | | | $ | (232.1) | | | $ | (1.4) | | | | | $ | 930.2 | |

| | | | | | | | | | | |

Total (Expenses) and Other Income3 | (69.5) | | | | | | | | | $ | (6.4) | | | (63.1) | |

| Income Before Income Taxes | 565.8 | | | (61.4) | | | (232.1) | | | (1.4) | | | (6.4) | | | 867.1 | |

| Provision for Income Taxes | 208.2 | | | 12.6 | | | 20.7 | | | 0.3 | | | (16.5) | | | 225.3 | |

| Equity in Net Loss of Unconsolidated Affiliates | (0.2) | | | | | | | | | | | (0.2) | |

| Net Income Attributable to Non-controlling Interests | (12.4) | | | | | | | | | | | (12.4) | |

| Net Income Available to IPG Common Stockholders | $ | 345.0 | | | $ | (48.8) | | | $ | (211.4) | | | $ | (1.1) | | | $ | (22.9) | | | $ | 629.2 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Weighted-Average Number of Common Shares Outstanding - Basic | 376.2 | | | | | | | | | | | 376.2 | |

| Dilutive effect of stock options and restricted shares | 2.5 | | | | | | | | | | | 2.5 | |

| Weighted-Average Number of Common Shares Outstanding - Diluted | 378.7 | | | | | | | | | | | 378.7 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Earnings per Share Available to IPG Common Stockholders4: | | | | | | | | | | | |

| Basic | $ | 0.92 | | | $ | (0.13) | | | $ | (0.56) | | | $ | (0.00) | | | $ | (0.06) | | | $ | 1.67 | |

| Diluted | $ | 0.91 | | | $ | (0.13) | | | $ | (0.56) | | | $ | (0.00) | | | $ | (0.06) | | | $ | 1.66 | |

| | | | | | | | | | | |

1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. |

2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page A5 in the appendix. |

3 Consists of non-operating expenses including interest expense, interest income and other expense, net. |

4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. |

Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

|

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

A4

| | | | | | | | | | | | | | | | | | | | | | | |

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES

U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS

(Amounts in Millions)

(UNAUDITED)

|

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenue Before Billable Expenses | $ | 2,242.7 | | | $ | 2,309.0 | | | $ | 6,752.7 | | | $ | 6,814.4 | |

| | | | | | | |

| | | | | | | |

| Non-GAAP Reconciliation: | | | | | | | |

| Net Income Available to IPG Common Stockholders | $ | 20.1 | | | $ | 243.7 | | | $ | 345.0 | | | $ | 635.2 | |

| | | | | | | |

| Add Back: | | | | | | | |

| Provision for Income Taxes | 85.3 | | | 91.5 | | | 208.2 | | | 135.9 | |

| Subtract: | | | | | | | |

| Total (Expenses) and Other Income | (23.4) | | | (37.3) | | | (69.5) | | | (91.7) | |

Equity in Net Loss of Unconsolidated Affiliates | 0.0 | | | (2.3) | | | (0.2) | | | (1.7) | |

| Net Income Attributable to Non-controlling Interests | (4.1) | | | (2.0) | | | (12.4) | | | (11.3) | |

| Operating Income | 132.9 | | | 376.8 | | | 635.3 | | | 875.8 | |

| | | | | | | |

| | | | | | | |

| Add Back: | | | | | | | |

| Amortization of Acquired Intangibles | 20.3 | | | 21.0 | | | 61.4 | | | 63.1 | |

Impairment of Goodwill | 232.1 | | | — | | | 232.1 | | | — | |

| | | | | | | |

| Adjusted EBITA | $ | 385.3 | | | $ | 397.8 | | | $ | 928.8 | | | $ | 938.9 | |

| Adjusted EBITA Margin on Revenue before Billable Expenses % | 17.2 | % | | 17.2 | % | | 13.8 | % | | 13.8 | % |

| | | | | | | |

| Restructuring Charges | 0.5 | | | (0.6) | | | 1.4 | | | (0.7) | |

| | | | | | | |

| Adjusted EBITA before Restructuring Charges | $ | 385.8 | | | $ | 397.2 | | | $ | 930.2 | | | $ | 938.2 | |

| Adjusted EBITA before Restructuring Charges Margin on Revenue before Billable Expenses % | 17.2 | % | | 17.2 | % | | 13.8 | % | | 13.8 | % |

| | | | | | | |

Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

|

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

A5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES

U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS

(Amounts in Millions except Per Share Data)

(UNAUDITED)

|

| Three Months Ended September 30, 2023 |

| As Reported | | Amortization of Acquired Intangibles | | Restructuring Charges | | Net Losses on Sales of Businesses1 | | | | Adjusted Results (Non-GAAP) |

Operating Income and Adjusted EBITA before Restructuring Charges2 | $ | 376.8 | | | $ | (21.0) | | | $ | 0.6 | | | | | | | $ | 397.2 | |

| | | | | | | | | | | |

Total (Expenses) and Other Income3 | (37.3) | | | | | | | $ | (12.1) | | | | | (25.2) | |

| Income Before Income Taxes | 339.5 | | | (21.0) | | | 0.6 | | | (12.1) | | | | | 372.0 | |

| Provision for Income Taxes | 91.5 | | | 4.3 | | | (0.2) | | | 2.6 | | | | | 98.2 | |

| Equity in Net Loss of Unconsolidated Affiliates | (2.3) | | | | | | | | | | | (2.3) | |

| Net Income Attributable to Non-controlling Interests | (2.0) | | | | | | | | | | | (2.0) | |

| Net Income Available to IPG Common Stockholders | $ | 243.7 | | | $ | (16.7) | | | $ | 0.4 | | | $ | (9.5) | | | | | $ | 269.5 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Weighted-Average Number of Common Shares Outstanding - Basic | 383.6 | | | | | | | | | | | 383.6 | |

| Dilutive effect of stock options and restricted shares | 1.9 | | | | | | | | | | | 1.9 | |

| Weighted-Average Number of Common Shares Outstanding - Diluted | 385.5 | | | | | | | | | | | 385.5 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Earnings per Share Available to IPG Common Stockholders4: | | | | | | | | | | | |

| Basic | $ | 0.64 | | | $ | (0.04) | | | $ | 0.00 | | | $ | (0.02) | | | | | $ | 0.70 | |

| Diluted | $ | 0.63 | | | $ | (0.04) | | | $ | 0.00 | | | $ | (0.02) | | | | | $ | 0.70 | |

| | | | | | | | | | | |

1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. |

2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page A5 in the appendix. |

3 Consists of non-operating expenses including interest expense, interest income and other expense, net. |

4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. |

Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

|

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

A6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES

U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS

(Amounts in Millions except Per Share Data)

(UNAUDITED)

|

| Nine Months Ended September 30, 2023 |

| As Reported | | Amortization of Acquired Intangibles | | Restructuring Charges | | Net Losses on Sales of Businesses1 | | | | Adjusted Results (Non-GAAP) |

Operating Income and Adjusted EBITA before Restructuring Charges2 | $ | 875.8 | | | $ | (63.1) | | | $ | 0.7 | | | | | | | $ | 938.2 | |

| | | | | | | | | | | |

Total (Expenses) and Other Income3 | (91.7) | | | | | | | $ | (20.4) | | | | | (71.3) | |

| Income Before Income Taxes | 784.1 | | | (63.1) | | | 0.7 | | | (20.4) | | | | | 866.9 | |

| Provision for Income Taxes | 135.9 | | | 12.7 | | | (0.3) | | | 4.0 | | | | | 152.3 | |

| Equity in Net Loss of Unconsolidated Affiliates | (1.7) | | | | | | | | | | | (1.7) | |

| Net Income Attributable to Non-controlling Interests | (11.3) | | | | | | | | | | | (11.3) | |

| Net Income Available to IPG Common Stockholders | $ | 635.2 | | | $ | (50.4) | | | $ | 0.4 | | | $ | (16.4) | | | | | $ | 701.6 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Weighted-Average Number of Common Shares Outstanding - Basic | 385.0 | | | | | | | | | | | 385.0 | |

| Dilutive effect of stock options and restricted shares | 1.8 | | | | | | | | | | | 1.8 | |

| Weighted-Average Number of Common Shares Outstanding - Diluted | 386.8 | | | | | | | | | | | 386.8 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Earnings per Share Available to IPG Common Stockholders4,5: | | | | | | | | | | | |

| Basic | $ | 1.65 | | | $ | (0.13) | | | $ | 0.00 | | | $ | (0.04) | | | | | $ | 1.82 | |

| Diluted | $ | 1.64 | | | $ | (0.13) | | | $ | 0.00 | | | $ | (0.04) | | | | | $ | 1.81 | |

| | | | | | | | | | | |

1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale, as well as a loss related to the sale of an equity investment. |

2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page A5 in the appendix. |

3 Consists of non-operating expenses including interest expense, interest income and other expense, net. |

4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. |

5 Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018. |

Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

|

Interpublic Group 909 Third Avenue New York, NY 10022 212-704-1200 tel 212-704-1201 fax

A7

Interpublic Group October 22, 2024 THIRD QUARTER 2024 EARNINGS CONFERENCE CALL

2Interpublic Group of Companies, Inc. Organic change of Net Revenue, adjusted EBITA before Restructuring Charges and adjusted diluted EPS are non-GAAP measures. Management believes these metrics provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. See our non-GAAP reconciliations of Organic Change of Net Revenue on pages 19-20 and adjusted results on pages 21-22. • Total revenue including billable expenses was $2.6 billion ◦ Organic change of revenue before billable expenses (“net revenue”) was flat ◦ US and International organic net revenue were unchanged • R/GA and Huge classified as held-for-sale • Net income as reported was $20.1 million, which included non-cash goodwill impairment charge of $232.1 million related to Digital Specialist agencies • Adjusted EBITA was $385.8 million, with 17.2% margin on revenue before billable expenses • Diluted EPS was $0.05 as reported and $0.70 as adjusted • Repurchased 3.2 million shares returning $100.0 million to shareholders Overview — Third Quarter 2024

3Interpublic Group of Companies, Inc. Three Months Ended September 30, 2024 2023 Revenue Before Billable Expenses $ 2,242.7 $ 2,309.0 Billable Expenses 386.1 369.5 Total Revenue 2,628.8 2,678.5 Salaries and Related Expenses 1,464.0 1,531.1 Office and Other Direct Expenses 327.1 318.8 Billable Expenses 386.1 369.5 Cost of Services 2,177.2 2,219.4 Selling, General and Administrative Expenses 20.8 16.9 Depreciation and Amortization 65.3 66.0 Impairment of Goodwill 232.1 — Restructuring Charges 0.5 (0.6) Total Operating Expenses 2,495.9 2,301.7 Operating Income 132.9 376.8 Interest Expense, Net (20.7) (23.6) Other Income (Expense), Net (2.7) (13.7) Income Before Income Taxes 109.5 339.5 Provision for Income Taxes (1) 85.3 91.5 Equity in Net Loss of Unconsolidated Affiliates — (2.3) Net Income 24.2 245.7 Net Income Attributable to Non-controlling Interests (4.1) (2.0) Net Income Available to IPG Common Stockholders $ 20.1 $ 243.7 Earnings per Share Available to IPG Common Stockholders - Basic $ 0.05 $ 0.64 Earnings per Share Available to IPG Common Stockholders - Diluted $ 0.05 $ 0.63 Weighted-Average Number of Common Shares Outstanding - Basic 373.9 383.6 Weighted-Average Number of Common Shares Outstanding - Diluted 376.8 385.5 Dividends Declared per Common Share $ 0.330 $ 0.310 ($ in Millions, except per share amounts) Operating Performance (1) The provision for income taxes for the three months ended September 30, 2024 includes $14.8 related to the classification of certain assets as held for sale and a benefit of $20.7 related to impairment of goodwill.

4Interpublic Group of Companies, Inc. Revenue Before Billable Expenses Three Months Ended September 30, Nine Months Ended September 30, Change Change 2024 2023 (2) Organic Total 2024 2023 (2) Organic Total Media, Data & Engagement Solutions $ 1,025.7 $ 1,060.0 1.2% (3.2%) $ 3,050.5 $ 3,086.8 0.5% (1.2%) IPG Mediabrands, Acxiom and our digital specialist agencies, which includes MRM, R/GA, and Huge Integrated Advertising & Creativity Led Solutions $ 848.9 $ 877.7 (1.9%) (3.3%) $ 2,640.4 $ 2,656.5 1.4% (0.6%) McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies Specialized Communications & Experiential Solutions $ 368.1 $ 371.3 1.2% (0.9%) $ 1,061.8 $ 1,071.1 1.3% (0.9%) Weber Shandwick, Golin, our Experiential agencies, and IPG DXTRA Health (1) "Net Revenue". (2) Results for the three and nine months ended September 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. See reconciliation of Organic Change of Net Revenue on pages 19-20. ($ in Millions) Three Months Ended Nine Months Ended $ % Change $ % Change September 30, 2023 $ 2,309.0 $ 6,814.4 Foreign currency (10.4) (0.5%) (21.5) (0.3%) Net acquisitions/(divestitures) (56.1) (2.4%) (108.4) (1.6%) Organic 0.2 0.0% 68.2 1.0% Total change (66.3) (2.9%) (61.7) (0.9%) September 30, 2024 $ 2,242.7 $ 6,752.7 (1)

5Interpublic Group of Companies, Inc. Organic Change of Net Revenue by Region Three Months Ended September 30, 2024 0.0% United States -0.7% United Kingdom +0.6% Continental Europe +9.8% Latin America -7.4% Asia Pacific unchanged International unchanged Worldwide +1.5% All Other Markets “All Other Markets” includes Canada, the Middle East and Africa. Circle proportions represent consolidated Net Revenue distribution. See reconciliation of Organic Change of Net Revenue, including total Net Revenue change, on page 19.

6Interpublic Group of Companies, Inc. Operating Expenses % of Revenue Before Billable Expenses (1) Excludes amortization of acquired intangibles. (1) Three Months Ended September 30

7Interpublic Group of Companies, Inc. Three Months Ended September 30, 2024 As Reported Amortization of Acquired Intangibles Impairment of Goodwill Restructuring Charges (1) Net Losses on Sales of Businesses (2) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (3) $ 132.9 $ (20.3) $ (232.1) $ (0.5) $ 385.8 Total (Expenses) and Other Income (4) (23.4) $ (1.7) (21.7) Income Before Income Taxes 109.5 (20.3) (232.1) (0.5) (1.7) 364.1 Provision for Income Taxes 85.3 4.2 20.7 0.1 (14.8) 95.5 Effective Tax Rate 77.9 % 26.2 % Equity in Net Loss of Unconsolidated Affiliates 0.0 0.0 Net Income Attributable to Non-controlling Interests (4.1) (4.1) DILUTED EPS COMPONENTS: Net Income Available to IPG Common Stockholders $ 20.1 $ (16.1) $ (211.4) $ (0.4) $ (16.5) $ 264.5 Weighted-Average Number of Common Shares Outstanding 376.8 376.8 Earnings per Share Available to IPG Common Stockholders (5) $ 0.05 $ (0.04) $ (0.56) $ (0.00) $ (0.04) $ 0.70 ($ in Millions, except per share amounts) (1) Restructuring charges of $0.5 in the third quarter of 2024 are related to adjustments to our restructuring actions taken in 2022 and 2020. (2) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. (3) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (4) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (5) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. See full non-GAAP reconciliation of adjusted diluted earnings per share on page 21. Adjusted Diluted Earnings Per Share

8Interpublic Group of Companies, Inc. Nine Months Ended September 30, 2024 As Reported Amortization of Acquired Intangibles Impairment of Goodwill Restructuring Charges (1) Net Losses on Sales of Businesses (2) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (3) $ 635.3 $ (61.4) $ (232.1) $ (1.4) $ 930.2 Total (Expenses) and Other Income (4) (69.5) $ (6.4) (63.1) Income Before Income Taxes 565.8 (61.4) (232.1) (1.4) (6.4) 867.1 Provision for Income Taxes 208.2 12.6 20.7 0.3 (16.5) 225.3 Effective Tax Rate 36.8 % 26.0 % Equity in Net Loss of Unconsolidated Affiliates (0.2) (0.2) Net Income Attributable to Non-controlling Interests (12.4) (12.4) DILUTED EPS COMPONENTS: Net Income Available to IPG Common Stockholders $ 345.0 $ (48.8) $ (211.4) $ (1.1) $ (22.9) $ 629.2 Weighted-Average Number of Common Shares Outstanding 378.7 378.7 Earnings per Share Available to IPG Common Stockholders (5) $ 0.91 $ (0.13) $ (0.56) $ (0.00) $ (0.06) $ 1.66 ($ in Millions, except per share amounts) (1) Restructuring charges of $1.4 in the first nine months of 2024 are related to adjustments to our restructuring actions taken in 2022 and 2020. (2) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. (3) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (4) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (5) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. See full non-GAAP reconciliation of adjusted diluted earnings per share on page 22. Adjusted Diluted Earnings Per Share

9Interpublic Group of Companies, Inc. Three Months Ended September 30, 2024 2023 Net Income $ 24.2 $ 245.7 OPERATING ACTIVITIES: Impairment of goodwill 232.1 — Depreciation & amortization 83.3 78.4 Other non-cash items 19.9 6.2 Deferred taxes 19.0 23.5 Net losses on sales of businesses 1.7 12.1 Change in working capital, net (150.4) (122.7) Change in other non-current assets & liabilities (6.0) (0.5) Net cash provided by Operating Activities $ 223.8 $ 242.7 INVESTING ACTIVITIES: Capital expenditures (37.3) (47.8) Net proceeds from sale of businesses, net of cash sold (4.2) — Purchase of short-term marketable securities (0.4) — Acquisitions, net of cash acquired — — Net proceeds from investments — — Other investing activities 0.5 (0.8) Net cash used in Investing Activities $ (41.4) $ (48.6) FINANCING ACTIVITIES: Common stock dividends (123.2) (118.6) Repurchases of common stock (100.0) (91.0) Acquisition-related payments (6.6) (2.7) Distributions to noncontrolling interests (5.1) (5.2) Tax payments for employee shares withheld (0.1) (0.4) Proceeds from long-term debt — — Repayment of long-term debt — (0.1) Net increase (decrease) in short-term borrowings 15.9 (7.0) Other financing activities (0.2) (0.5) Net cash used in Financing Activities $ (219.3) $ (225.5) Currency effect 21.6 (21.3) Net decrease in cash, cash equivalents and restricted cash $ (15.3) $ (52.7) ($ in Millions) Cash Flow

10Interpublic Group of Companies, Inc. September 30, 2024 December 31, 2023 September 30, 2023 CURRENT ASSETS: Cash and cash equivalents $ 1,532.0 $ 2,386.1 $ 1,574.9 Accounts receivable, net 4,718.8 5,768.8 4,046.9 Accounts receivable, billable to clients 2,211.9 2,229.2 2,417.4 Prepaid expenses 474.0 415.8 420.7 Assets held for sale 223.4 21.9 9.9 Other current assets 97.6 128.6 175.6 Total current assets $ 9,257.7 $ 10,950.4 $ 8,645.4 CURRENT LIABILITIES: Accounts payable $ 7,061.6 $ 8,355.0 $ 6,448.4 Accrued liabilities 503.6 705.8 632.3 Contract liabilities 574.2 684.7 688.4 Short-term borrowings 23.9 34.2 31.0 Current portion of long-term debt 0.1 250.1 250.0 Current portion of operating leases 242.1 252.6 248.7 Liabilities held for sale 60.1 48.5 27.4 Total current liabilities $ 8,465.6 $ 10,330.9 $ 8,326.2 ($ in Millions) Balance Sheet — Current Portion

11Interpublic Group of Companies, Inc. Senior Notes 4.65% 5.40%2.40% Total Debt = $2.9 billion ($ in Millions) 4.75% 3.375% ... ... Short-Term Debt ... 5.375% Debt Maturity Schedule

12Interpublic Group of Companies, Inc. Summary • Key drivers of growth ◦ Dynamic media offering, leading healthcare capabilities, and exceptional talent in marketing services ◦ Scaled data management and proprietary identity resolution products ◦ Seamless delivery of integrated client solutions ◦ Evolving our asset mix to focus on strongest growth opportunities • Furthering investment in emerging opportunities ◦ High-growth media channels, digital commerce and differentiated data assets ◦ Development of new media buying models ◦ Personalized, data-infused creativity, increase powered by Gen AI • Effective and proven expense management remains an ongoing priority ◦ Continued streamlining of operations and processes for greater efficiency ◦ Further deployment of enterprise systems and business transformation efforts underway • Financial strength is a continued source of value creation

13Interpublic Group of Companies, Inc. Appendix

14Interpublic Group of Companies, Inc. Nine Months Ended September 30, 2024 2023 Revenue Before Billable Expenses $ 6,752.7 $ 6,814.4 Billable Expenses 1,082.0 1,051.6 Total Revenue 7,834.7 7,866.0 Salaries and Related Expenses 4,594.4 4,707.0 Office and Other Direct Expenses 1,007.6 989.6 Billable Expenses 1,082.0 1,051.6 Cost of Services 6,684.0 6,748.2 Selling, General and Administrative Expenses 86.4 43.7 Depreciation and Amortization 195.5 199.0 Impairment of Goodwill 232.1 — Restructuring Charges 1.4 (0.7) Total Operating Expenses 7,199.4 6,990.2 Operating Income 635.3 875.8 Interest Expense, Net (56.1) (66.9) Other Expense, Net (13.4) (24.8) Income Before Income Taxes 565.8 784.1 Provision for Income Taxes (1)(2) 208.2 135.9 Equity in Net Loss of Unconsolidated Affiliates (0.2) (1.7) Net Income 357.4 646.5 Net Income Attributable to Non-controlling Interests (12.4) (11.3) Net Income Available to IPG Common Stockholders $ 345.0 $ 635.2 Earnings per Share Available to IPG Common Stockholders - Basic (3) $ 0.92 $ 1.65 Earnings per Share Available to IPG Common Stockholders - Diluted (3) $ 0.91 $ 1.64 Weighted-Average Number of Common Shares Outstanding - Basic 376.2 385.0 Weighted-Average Number of Common Shares Outstanding - Diluted 378.7 386.8 Dividends Declared per Common Share $ 0.990 $ 0.930 ($ in Millions, except per share amounts) Operating Performance (1) The provision for income taxes for the nine months ended September 30, 2024 includes $16.5 related to the classification of certain assets as held for sale and a benefit of $20.7 related to impairment of goodwill. (2) The provision for income taxes for the nine months ended September 30, 2023 includes a benefit of $64.2 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018, which is primarily non-cash. (3) Basic and Diluted earnings per share for the nine months ended September 30, 2023 includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018.

15Interpublic Group of Companies, Inc. Organic Change of Net Revenue by Region “All Other Markets” includes Canada, the Middle East and Africa. Circle proportions represent consolidated Net Revenue distribution. See reconciliation of Organic Change of Net Revenue, including total Net Revenue change, on page 20. Nine Months Ended September 30, 2024 +1.1% United States +1.0% United Kingdom +5.2% Continental Europe +5.9% Latin America -5.9% Asia Pacific +0.7% International +1.0% Worldwide -1.1% All Other Markets

16Interpublic Group of Companies, Inc. Operating Expenses % of Revenue Before Billable Expenses Nine Months Ended September 30 (1) (1) Excludes amortization of acquired intangibles.

17Interpublic Group of Companies, Inc. Nine Months Ended September 30, 2024 2023 Net Income $ 357.4 $ 646.5 OPERATING ACTIVITIES: Depreciation & amortization 248.8 236.7 Impairment of Goodwill 232.1 — Other non-cash items 43.3 22.8 Net losses on sales of businesses 6.4 18.9 Deferred taxes (24.9) (5.5) Change in working capital, net (619.1) (1,099.1) Change in other non-current assets & liabilities (56.9) (160.4) Net cash provided by (used in) Operating Activities $ 187.1 $ (340.1) INVESTING ACTIVITIES: Capital expenditures (107.2) (127.1) Net proceeds from sale of businesses, net of cash sold (31.4) 1.4 Purchase of short-term marketable securities (0.6) (97.6) Acquisitions, net of cash acquired — (6.3) Net proceeds from investments 2.3 21.7 Other investing activities 5.1 3.6 Net cash used in Investing Activities $ (131.8) $ (204.3) FINANCING ACTIVITIES: Common stock dividends (373.7) (361.2) Repayment of long-term debt (250.1) (0.2) Repurchases of common stock (230.1) (219.0) Tax payments for employee shares withheld (13.9) (58.4) Distributions to noncontrolling interests (13.7) (13.7) Acquisition-related payments (8.7) (12.8) Net decrease in short-term borrowings (5.7) (18.0) Proceeds from long-term debt 0.1 296.3 Other financing activities (1.8) (3.0) Net cash used in Financing Activities $ (897.6) $ (390.0) Currency effect (11.1) (35.0) Net decrease in cash, cash equivalents and restricted cash $ (853.4) $ (969.4) ($ in Millions) Cash Flow

18Interpublic Group of Companies, Inc. 2024 Q1 Q2 Q3 Q4 YTD 2024 Depreciation and amortization (1) $ 44.5 $ 44.6 $ 45.0 $ 134.1 Amortization of acquired intangibles 20.7 20.4 20.3 61.4 Amortization of restricted stock and other non-cash compensation 16.4 18.1 17.9 52.4 Net amortization of bond discounts and deferred financing costs 0.3 0.5 0.1 0.9 2023 Q1 Q2 Q3 Q4 FY 2023 Depreciation and amortization (1) $ 45.6 $ 45.3 $ 45.0 $ 44.4 $ 180.3 Amortization of acquired intangibles 20.9 21.2 21.0 20.9 84.0 Amortization of restricted stock and other non-cash compensation 11.1 12.8 12.1 10.7 46.7 Net amortization of bond discounts and deferred financing costs 0.7 0.7 0.3 0.3 2.0 ($ in Millions) (1) Excludes amortization of acquired intangibles. Depreciation and Amortization

19Interpublic Group of Companies, Inc. Components of Change Change Three Months Ended September 30, 2023 (1) Foreign Currency Net Acquisitions / (Divestitures) Organic Three Months Ended September 30, 2024 Organic Total SEGMENT: Media, Data & Engagement Solutions (2) $ 1,060.0 $ (6.5) $ (40.6) $ 12.8 $ 1,025.7 1.2% (3.2%) Integrated Advertising & Creativity Led Solutions (3) 877.7 (4.3) (7.5) (17.0) 848.9 (1.9%) (3.3%) Specialized Communications & Experiential Solutions (4) 371.3 0.4 (8.0) 4.4 368.1 1.2% (0.9%) Total $ 2,309.0 $ (10.4) $ (56.1) $ 0.2 $ 2,242.7 0.0% (2.9%) GEOGRAPHIC: United States $ 1,509.9 $ 0.0 $ (42.3) $ 0.2 $ 1,467.8 0.0% (2.8%) International 799.1 (10.4) (13.8) 0.0 774.9 0.0% (3.0%) United Kingdom 193.0 4.1 (2.0) (1.3) 193.8 (0.7%) 0.4% Continental Europe 178.3 0.5 (2.3) 1.0 177.5 0.6% (0.4%) Asia Pacific 175.3 (0.2) (5.3) (12.9) 156.9 (7.4%) (10.5%) Latin America 114.8 (12.8) (1.3) 11.2 111.9 9.8% (2.5%) All Other Markets 137.7 (2.0) (2.9) 2.0 134.8 1.5% (2.1%) Worldwide $ 2,309.0 $ (10.4) $ (56.1) $ 0.2 $ 2,242.7 0.0% (2.9%) ($ in Millions) Reconciliation of Organic Change of Net Revenue (1) Results for the three months ended September 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (2) Comprised of IPG Mediabrands, Acxiom and our digital specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our Experiential agencies, and IPG DXTRA Health.

20Interpublic Group of Companies, Inc. ($ in Millions) Components of Change Change Nine Months Ended September 30, 2023 (1) Foreign Currency Net Acquisitions / (Divestitures) Organic Nine Months Ended September 30, 2024 Organic Total SEGMENT: Media, Data & Engagement Solutions (2) $ 3,086.8 $ (12.1) (40.6) $ 16.4 $ 3,050.5 0.5% (1.2%) Integrated Advertising & Creativity Led Solutions (3) 2,656.5 (10.3) (43.7) 37.9 2,640.4 1.4% (0.6%) Specialized Communications & Experiential Solutions (4) 1,071.1 0.9 (24.1) 13.9 1,061.8 1.3% (0.9%) Total $ 6,814.4 $ (21.5) $ (108.4) $ 68.2 $ 6,752.7 1.0% (0.9%) GEOGRAPHIC: United States $ 4,512.3 $ 0.0 $ (94.1) $ 51.4 $ 4,469.6 1.1% (0.9%) International 2,302.1 (21.5) (14.3) 16.8 2,283.1 0.7% (0.8%) United Kingdom 548.1 14.0 (2.0) 5.4 565.5 1.0% 3.2% Continental Europe 534.5 (0.8) (5.3) 27.8 556.2 5.2% 4.1% Asia Pacific 511.8 (12.0) (2.8) (30.0) 467.0 (5.9%) (8.8%) Latin America 301.9 (17.3) (1.3) 17.9 301.2 5.9% (0.2%) All Other Markets 405.8 (5.4) (2.9) (4.3) 393.2 (1.1%) (3.1%) Worldwide $ 6,814.4 $ (21.5) $ (108.4) $ 68.2 $ 6,752.7 1.0% (0.9%) Reconciliation of Organic Change of Net Revenue (1) Results for the nine months ended September 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (2) Comprised of IPG Mediabrands, Acxiom and our digital specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our Experiential agencies, and IPG DXTRA Health.

21Interpublic Group of Companies, Inc. Three Months Ended September 30, 2024 As Reported Amortization of Acquired Intangibles Impairment of Goodwill Restructuring Charges (2) Net Losses on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 132.9 $ (20.3) $ (232.1) $ (0.5) $ 385.8 Total (Expenses) and Other Income (5) (23.4) $ (1.7) (21.7) Income Before Income Taxes 109.5 (20.3) (232.1) (0.5) (1.7) 364.1 Provision for Income Taxes 85.3 4.2 20.7 0.1 (14.8) 95.5 Effective Tax Rate 77.9 % 26.2 % Equity in Net Loss of Unconsolidated Affiliates 0.0 0.0 Net Income Attributable to Non-controlling Interests (4.1) (4.1) Net Income Available to IPG Common Stockholders $ 20.1 $ (16.1) $ (211.4) $ (0.4) $ (16.5) $ 264.5 Weighted-Average Number of Common Shares Outstanding - Basic 373.9 373.9 Dilutive effect of stock options and restricted shares 2.9 2.9 Weighted-Average Number of Common Shares Outstanding - Diluted 376.8 376.8 Earnings per Share Available to IPG Common Stockholders (6): Basic $ 0.05 $ (0.04) $ (0.57) $ (0.00) $ (0.04) $ 0.71 Diluted $ 0.05 $ (0.04) $ (0.56) $ (0.00) $ (0.04) $ 0.70 ($ in Millions, except per share amounts) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of $0.5 in the third quarter of 2024 are related to adjustments to our restructuring actions taken in 2022 and 2020. (3) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Reconciliation of Adjusted Results (1)

22Interpublic Group of Companies, Inc. ($ in Millions, except per share amounts) Reconciliation of Adjusted Results (1) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of $1.4 in the first nine months of 2024 represent adjustments to our restructuring actions taken in 2022 and 2020. (3) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Nine Months Ended September 30, 2024 As Reported Amortization of Acquired Intangibles Impairment of Goodwill Restructuring Charges (2) Net Losses on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 635.3 $ (61.4) $ (232.1) $ (1.4) $ 930.2 Total (Expenses) and Other Income (5) (69.5) $ (6.4) (63.1) Income Before Income Taxes 565.8 (61.4) (232.1) (1.4) (6.4) 867.1 Provision for Income Taxes 208.2 12.6 20.7 0.3 (16.5) 225.3 Effective Tax Rate 36.8 % 26.0 % Equity in Net Loss of Unconsolidated Affiliates (0.2) (0.2) Net Income Attributable to Non-controlling Interests (12.4) (12.4) Net Income Available to IPG Common Stockholders $ 345.0 $ (48.8) $ (211.4) $ (1.1) $ (22.9) $ 629.2 Weighted-Average Number of Common Shares Outstanding - Basic 376.2 376.2 Dilutive effect of stock options and restricted shares 2.5 2.5 Weighted-Average Number of Common Shares Outstanding - Diluted 378.7 378.7 Earnings per Share Available to IPG Common Stockholders (6): Basic $ 0.92 $ (0.13) $ (0.56) $ (0.00) $ (0.06) $ 1.67 Diluted $ 0.91 $ (0.13) $ (0.56) $ (0.00) $ (0.06) $ 1.66

23Interpublic Group of Companies, Inc. Reconciliation of Adjusted EBITA Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Revenue Before Billable Expenses $ 2,242.7 $ 2,309.0 $ 6,752.7 $ 6,814.4 Non-GAAP Reconciliation: Net Income Available to IPG Common Stockholders $ 20.1 $ 243.7 $ 345.0 $ 635.2 Add Back: Provision for Income Taxes 85.3 91.5 208.2 135.9 Subtract: Total (Expenses) and Other Income (23.4) (37.3) (69.5) (91.7) Equity in Net Income (Loss) of Unconsolidated Affiliates 0.0 (2.3) (0.2) (1.7) Net Income Attributable to Non-controlling Interests (4.1) (2.0) (12.4) (11.3) Operating Income $ 132.9 $ 376.8 $ 635.3 $ 875.8 Add Back: Amortization of Acquired Intangibles 20.3 21.0 61.4 63.1 Impairment of Goodwill 232.1 0.0 232.1 0.0 Adjusted EBITA $ 385.3 $ 397.8 $ 928.8 $ 938.9 Adjusted EBITA Margin on Revenue Before Billable Expenses % 17.2 % 17.2 % 13.8 % 13.8 % Restructuring Charges (2) 0.5 (0.6) 1.4 (0.7) Adjusted EBITA before Restructuring Charges $ 385.8 $ 397.2 $ 930.2 $ 938.2 Adjusted EBITA before Restructuring Charges Margin on Revenue Before Billable Expenses % 17.2 % 17.2 % 13.8 % 13.8 % (1) ($ in Millions) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of $0.5 and ($0.6) in the third quarter of 2024 and 2023, respectively, and restructuring charges of $1.4 and ($0.7) in the first nine months of 2024 and 2023, respectively, are related to adjustments to our restructuring actions taken in 2022 and 2020.

24Interpublic Group of Companies, Inc. Media, Data & Engagement Solutions (2) Integrated Advertising & Creativity Led Solutions (3) Specialized Communications & Experiential Solutions (4) Corporate and Other (5) IPG Consolidated (1) Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, 2024 2023 (6) 2024 2023 (6) 2024 2023 (6) 2024 2023 2024 2023 Revenue Before Billable Expenses $ 1,025.7 $ 1,060.0 $ 848.9 $ 877.7 $ 368.1 $ 371.3 $ 2,242.7 $ 2,309.0 Segment/Adjusted EBITA $ 194.9 $ 209.1 $ 134.0 $ 129.3 $ 78.5 $ 77.7 $ (22.1) $ (18.3) $ 385.3 $ 397.8 Restructuring Charges (7) 0.5 (0.1) 0.0 (0.5) 0.0 (0.2) 0.0 0.2 0.5 (0.6) Segment/Adjusted EBITA before Restructuring Charges $ 195.4 $ 209.0 $ 134.0 $ 128.8 $ 78.5 $ 77.5 $ (22.1) $ (18.1) $ 385.8 $ 397.2 Margin (%) of Revenue Before Billable Expenses 19.1 % 19.7 % 15.8 % 14.7 % 21.3 % 20.9 % 17.2 % 17.2 % ($ in Millions) (1) Adjusted EBITA before restructuring charges is calculated as net income available to IPG common stockholders before provision for incomes taxes, total (expenses) and other income, equity in net loss of unconsolidated affiliates, net income attributable to non-controlling interests, amortization of acquired intangibles and restructuring charges. (2) Comprised of IPG Mediabrands, Acxiom and our digital specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our Experiential agencies, and IPG DXTRA Health. (5) Corporate and Other is primarily comprised of selling, general and administrative expenses including corporate office expenses as well as shared service center and certain other centrally managed expenses that are not fully allocated to operating divisions. (6) Results for the three months ended September 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (7) Restructuring charges of $0.5 and ($0.6) in the third quarter of 2024 and 2023, respectively, are related to adjustments to our restructuring actions taken in 2022 and 2020. Adjusted EBITA before Restructuring Charges by Segment (1)

25Interpublic Group of Companies, Inc. Media, Data & Engagement Solutions (2) Integrated Advertising & Creativity Led Solutions (3) Specialized Communications & Experiential Solutions (4) Corporate and Other (5) IPG Consolidated (1) Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, 2024 2023 (6) 2024 2023 (6) 2024 2023 (6) 2024 2023 2024 2023 Revenue Before Billable Expenses $ 3,050.5 $ 3,086.8 $ 2,640.4 $ 2,656.5 $ 1,061.8 $ 1,071.1 $ 6,752.7 $ 6,814.4 Segment/Adjusted EBITA $ 469.5 $ 433.5 $ 374.6 $ 358.4 $ 175.9 $ 194.2 $ (91.2) $ (47.2) $ 928.8 $ 938.9 Restructuring Charges (7) 0.8 (1.3) 0.3 (0.2) 0.3 0.7 0.0 0.1 1.4 (0.7) Segment/Adjusted EBITA before Restructuring Charges $ 470.3 $ 432.2 $ 374.9 $ 358.2 $ 176.2 $ 194.9 $ (91.2) $ (47.1) $ 930.2 $ 938.2 Margin (%) of Revenue Before Billable Expenses 15.4 % 14.0 % 14.2 % 13.5 % 16.6 % 18.2 % 13.8 % 13.8 % ($ in Millions) Adjusted EBITA before Restructuring Charges by Segment (1) (1) Adjusted EBITA before restructuring charges is calculated as net income available to IPG common stockholders before provision for incomes taxes, total (expenses) and other income, equity in net loss of unconsolidated affiliates, net income attributable to non-controlling interests, amortization of acquired intangibles and restructuring charges. (2) Comprised of IPG Mediabrands, Acxiom and our digital specialist agencies, which includes MRM, R/GA, and Huge. (3) Comprised of McCann Worldgroup, IPG Health, MullenLowe Group, Foote, Cone & Belding ("FCB"), and our domestic integrated agencies. (4) Comprised of Weber Shandwick, Golin, our Experiential agencies, and IPG DXTRA Health. (5) Corporate and Other is primarily comprised of selling, general and administrative expenses including corporate office expenses as well as shared service center and certain other centrally managed expenses that are not fully allocated to operating divisions. (6) Results for the nine months ended September 30, 2023 have been recast to reflect the transfer of certain agencies between reportable segments. (7) Restructuring charges of $1.4 and ($0.7) in the first nine months of 2024 and 2023, respectively, are related to adjustments to our restructuring actions taken in 2022 and 2020.

26Interpublic Group of Companies, Inc. Three Months Ended September 30, 2023 As Reported Amortization of Acquired Intangibles Restructuring Charges (2) Net Losses on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 376.8 $ (21.0) $ 0.6 $ 397.2 Total (Expenses) and Other Income (5) (37.3) $ (12.1) (25.2) Income Before Income Taxes 339.5 (21.0) 0.6 (12.1) 372.0 Provision for Income Taxes 91.5 4.3 (0.2) 2.6 98.2 Effective Tax Rate 27.0 % 26.4 % Equity in Net Loss of Unconsolidated Affiliates (2.3) (2.3) Net Income Attributable to Non-controlling Interests (2.0) (2.0) Net Income Available to IPG Common Stockholders $ 243.7 $ (16.7) $ 0.4 $ (9.5) $ 269.5 Weighted-Average Number of Common Shares Outstanding - Basic 383.6 383.6 Dilutive effect of stock options and restricted shares 1.9 1.9 Weighted-Average Number of Common Shares Outstanding - Diluted 385.5 385.5 Earnings per Share Available to IPG Common Stockholders (6): Basic $ 0.64 $ (0.04) $ 0.00 $ (0.02) $ 0.70 Diluted $ 0.63 $ (0.04) $ 0.00 $ (0.02) $ 0.70 ($ in Millions, except per share amounts) (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of ($0.6) in the third quarter of 2023 are related to adjustments to our restructuring actions taken in 2022 and 2020. (3) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Reconciliation of Adjusted Results (1)

27Interpublic Group of Companies, Inc. ($ in Millions, except per share amounts) Reconciliation of Adjusted Results (1) Nine Months Ended September 30, 2023 As Reported Amortization of Acquired Intangibles Restructuring Charges (2) Net Losses on Sales of Businesses (3) Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges (4) $ 875.8 $ (63.1) $ 0.7 $ 938.2 Total (Expenses) and Other Income (5) (91.7) $ (20.4) (71.3) Income Before Income Taxes 784.1 (63.1) 0.7 (20.4) 866.9 Provision for Income Taxes 135.9 12.7 (0.3) 4.0 152.3 Effective Tax Rate 17.3 % 17.6 % Equity in Net Loss of Unconsolidated Affiliates (1.7) (1.7) Net Income Attributable to Non-controlling Interests (11.3) (11.3) Net Income Available to IPG Common Stockholders $ 635.2 $ (50.4) $ 0.4 $ (16.4) $ 701.6 Weighted-Average Number of Common Shares Outstanding - Basic 385.0 385.0 Dilutive effect of stock options and restricted shares 1.8 1.8 Weighted-Average Number of Common Shares Outstanding - Diluted 386.8 386.8 Earnings per Share Available to IPG Common Stockholders (6)(7): Basic $ 1.65 $ (0.13) $ 0.00 $ (0.04) $ 1.82 Diluted $ 1.64 $ (0.13) $ 0.00 $ (0.04) $ 1.81 (1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. (2) Restructuring charges of ($0.7) in the first nine months of 2023 are related to adjustments to our restructuring actions taken in 2022 and 2020. (3) Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale, as well as a loss related to the sale of an equity investment. (4) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 23. (5) Consists of non-operating expenses including interest expense, interest income, and other expense, net. (6) Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. (7) Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018.

28Interpublic Group of Companies, Inc. Metrics Update

29Interpublic Group of Companies, Inc. Metrics Update CATEGORY: SALARIES & RELATED OFFICE & OTHER DIRECT FINANCIAL (% of Revenue Before Billable Expenses) (% of Revenue Before Billable Expenses) METRIC: Trailing Twelve Months Trailing Twelve Months Available Liquidity Base, Benefits & Tax Occupancy Expense Credit Facility Covenant Incentive Expense All Other Office & Other Direct Expenses Severance Expense Temporary Help All Other Salaries & Related Expense

30Interpublic Group of Companies, Inc. Salaries & Related Expenses % of Revenue Before Billable Expenses, Trailing Twelve Months

31Interpublic Group of Companies, Inc. Salaries & Related Expenses (% of Revenue Before Billable Expenses) Three and Nine Months Ended September 30 2024 2023

32Interpublic Group of Companies, Inc. Office & Other Direct Expenses % of Revenue Before Billable Expenses, Trailing Twelve Months

33Interpublic Group of Companies, Inc. Office & Other Direct Expenses (% of Revenue Before Billable Expenses) “All Other” primarily includes software and cloud based expenses, client service costs, travel and entertainment, professional fees, spending to support new business activity, telecommunications, non- pass through production expenses, office supplies, bad debt expense, foreign currency losses (gains), adjustments to contingent acquisition obligations and other expenses. 2024 2023 Three and Nine Months Ended September 30

34Interpublic Group of Companies, Inc. ($ in Millions) Available Liquidity Cash, Cash Equivalents + Available Committed Credit Facilities Available Committed Credit FacilityCash and Cash Equivalents

35Interpublic Group of Companies, Inc. Financial Covenant Four Quarters Ended September 30, 2024 Leverage Ratio (not greater than) (1) 3.50x Actual Leverage Ratio 1.64x CREDIT AGREEMENT EBITDA RECONCILIATION: Four Quarters Ended September 30, 2024 Net Income Available to IPG Common Stockholders $ 808.2 Non-Operating Adjustments (2) 433.9 Operating Income $ 1,242.1 + Depreciation and Amortization 324.1 + Other Non-cash Charges Reducing Operating Income 234.0 Credit Agreement EBITDA (1): $ 1,800.2 ($ in Millions) Credit Facility Covenant (1) The leverage ratio is defined as debt as of the last day of such fiscal quarter to EBITDA (as defined in the Credit Agreement) for the four quarters then ended. Management utilizes Credit Agreement EBITDA, which is a non-GAAP financial measure, as well as the amounts shown in the table above, calculated as required by the Credit Agreement, in order to assess our compliance with such covenants. (2) Includes adjustments of the following items from our consolidated statement of operations: provision for income taxes, total (expenses) and other income, equity in net loss of unconsolidated affiliates, and net income attributable to non-controlling interests.