On October 22, 2024, The Interpublic Group of Companies, Inc. held a conference call to discuss its third-quarter and first-nine-months 2024 results. CALL PARTICIPANTS IPG PARTICIPANTS Philippe Krakowsky Chief Executive Officer Ellen Johnson Executive Vice President, Chief Financial Officer Jerry Leshne Senior Vice President, Investor Relations ANALYST PARTICIPANTS Adrien de Saint Hilaire BofA Securities David Karnovsky J.P.Morgan Tim Nollen Macquarie Equity Research Steven Cahall Wells Fargo Equity Research Michael Nathanson MoffettNathanson Craig A. Huber Huber Research Partners

2 COMPANY PRESENTATION AND REMARKS Operator: Good morning, and welcome to the Interpublic Group third-quarter 2024 conference call. . . . I would now like to introduce Mr. Jerry Leshne, Senior Vice President of Investor Relations. Sir, you may begin. Jerry Leshne, Senior Vice President, Investor Relations: Good morning. Thank you for joining us. This morning, we are joined by our CEO, Philippe Krakowsky, and by Ellen Johnson, our CFO. We have posted our earnings release and our slide presentation on our website, interpublic.com. We will begin with prepared remarks, to be followed by Q&A. We plan to conclude before market open at 9:30 Eastern time. During this call we will refer to forward-looking statements about our Company. These are subject to the uncertainties and the cautionary statement that are included in our earnings release and the slide presentation. These are further detailed in our 10-Q and other filings with the SEC. We will also refer to certain non-GAAP measures. We believe that these measures provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance. At this point, it is my pleasure to turn things over to Philippe Krakowsky. Philippe Krakowsky, Chief Executive Officer Thanks, Jerry. As usual, I’ll start the call with a high-level view of our results and the business overall. Ellen will then provide additional detail on the quarter. And I’ll conclude with highlights at our agencies and some strategic comments, to be followed by your Q&A. To begin, our revenue before billable expenses was unchanged organically from the same period a year ago. In terms of client sectors, the quarter was highlighted by very strong growth in consumer-facing industries like food & beverage and consumer goods, as well as our “Other” category of diversified and public sector clients. From the standpoint of disciplines, we saw solid growth at IPG Mediabrands, Octagon, Acxiom, Deutsch and our public relations offerings. However, our growth did slow from this year’s first half, due mainly to the timing of an account loss that we’ve discussed previously, which weighed on growth in Q3. During the quarter, we also saw meaningful progress in the strategic actions that we had talked about in July to address underperformance at our digital specialist agencies.

3 Reflecting where we are in that process, those assets became classified as held-for- sale. To note, third-quarter performance brings our organic growth over the first nine months to 1.0%. Regionally in the quarter, the U.S. was flat organically. In our international operations, we were paced by continued strong growth in Latin America, along with modest growth in our Other Markets group and Continental Europe. AsiaPac and the U.K. decreased from a year ago. Looking at our operating segments, IPG Mediabrands and Acxiom drove growth at our Media, Data and Engagement Solutions segment, but that was tempered by results at MRM. We saw an organic decrease in our Integrated Advertising and Creativity segment, with mixed performance by agency. And in our segment of Specialized Communications & Experiential solutions, growth in the quarter was driven by Octagon, Weber Shandwick and Golin. From the standpoint of client-sector performance, as mentioned, in addition to very significant increases in the food & beverage and consumer goods sectors, we had solid growth in our “Other” category and saw more modest increases in the healthcare, retail and financial services sectors. Decreases in the auto & transportation and tech & telecom sectors were due to account losses in late 2023. Turning to expenses and margin, I should first note that our third quarter included non-cash goodwill impairment expense of $232 million, related to our digital specialist agencies and our progress in the sale process of R/GA and Huge. The adjusted operating metrics we’ll cover with you today exclude that non-cash item. As you can see, our teams continue to effectively balance cost discipline with ongoing investment in the evolution of our business. Third-quarter adjusted EBITA margin was 17.2%, which matches our strong performance a year ago, and adjusted EBITA was $385.8 million. Compared to the same period last year, we had leverage on base payroll, temporary labor and incentives. We also continued to invest at higher levels in technology, business transformation and senior talent, particularly for centralized platform resources, which in turn resulted in increased office & other as well as SG&A expense. Diluted earnings per share in the quarter was $0.05 as reported and $0.70 as adjusted for the write-down of goodwill, acquired intangibles amortization and the impact of net business dispositions and held-for-sale. During the quarter, we repurchased 3.2 million shares, returning $100 million to shareholders. Turning to our outlook for the remainder of the year, there are several factors in play. Economic and political uncertainty in the U.S. and in many of the largest international markets remains a significant consideration. This is especially relevant given the

4 relatively high levels of discretionary project spend that characterizes Q4 and the holiday season. That said, our recent operating reviews have shown a strong pipeline for project work in Q4, as well as larger AOR assignments that would take effect in the new year. We’re focused on capitalizing on those opportunities, since we will be facing topline headwinds as we head into 2025 due to the news flow we’ve seen on some recent large account reviews. All in, for the balance of this year, we continue to believe we will deliver organic revenue growth of approximately 1%. And at that level of growth, we remain committed to our margin goal for the year of 16.6%. As I just mentioned, we’re looking to close this year as strongly as possible. Equally important, we have clear line of sight to the structural and market-facing changes that we need to make to improve our growth profile. Many of you’ve heard me speak before to the need to change our asset mix, which currently leans more heavily to capabilities that have more limited growth rates than the asset mix that one might find at some of our competitors. Also, in media, an area where we have always excelled, the recent shift in trading terms that has seen many clients accept and even embrace principal buying has clearly impacted our business. Those are all areas on which we are focused and making progress in transforming the business. Our very strong underlying financial position and our track record of operational delivery give us a solid foundation from which to drive the necessary changes in the composition and capabilities within the portfolio. I’ll have more to add on that score a bit later. But for now, I’ll turn things over to Ellen for a more detailed view of the quarter.

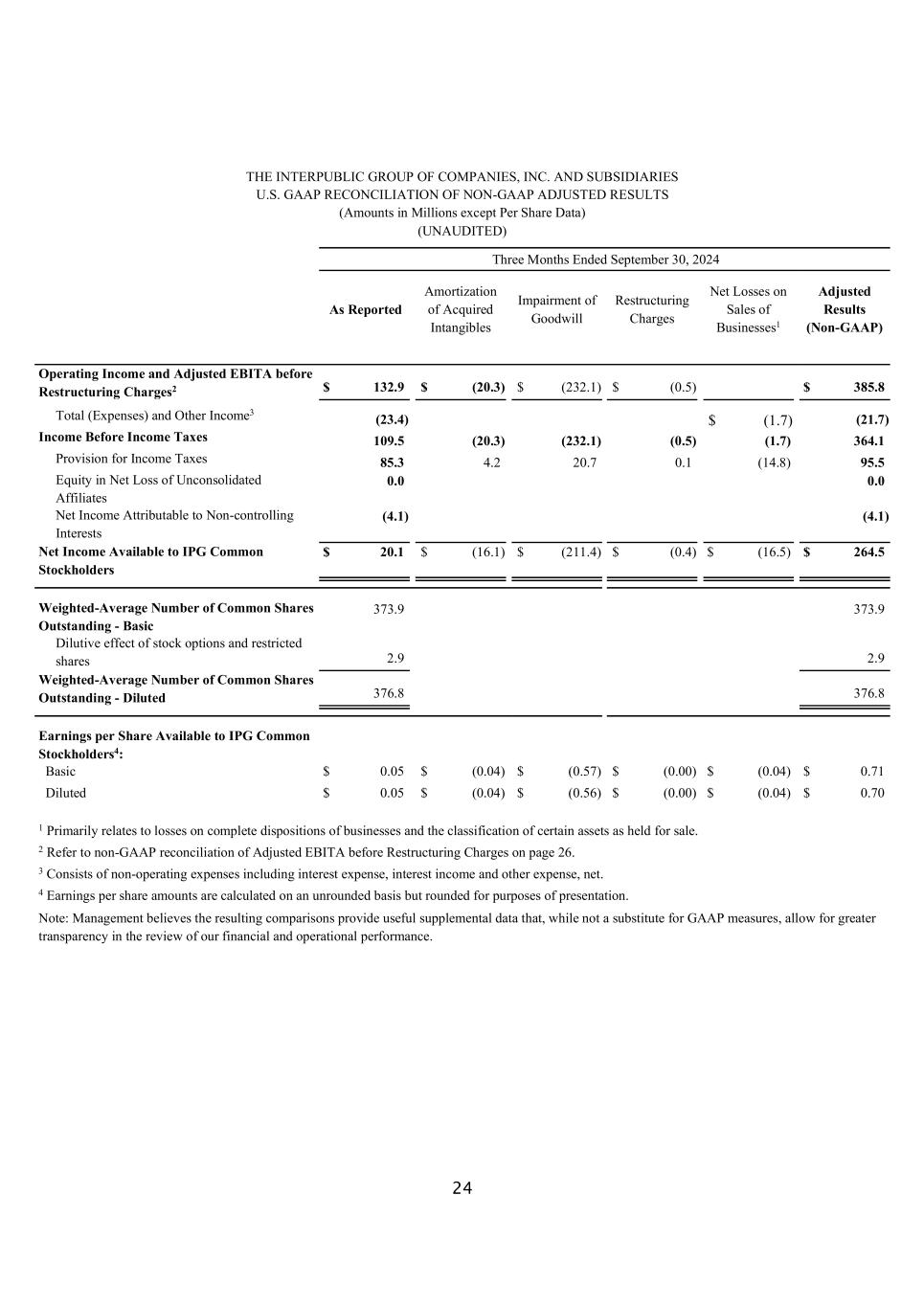

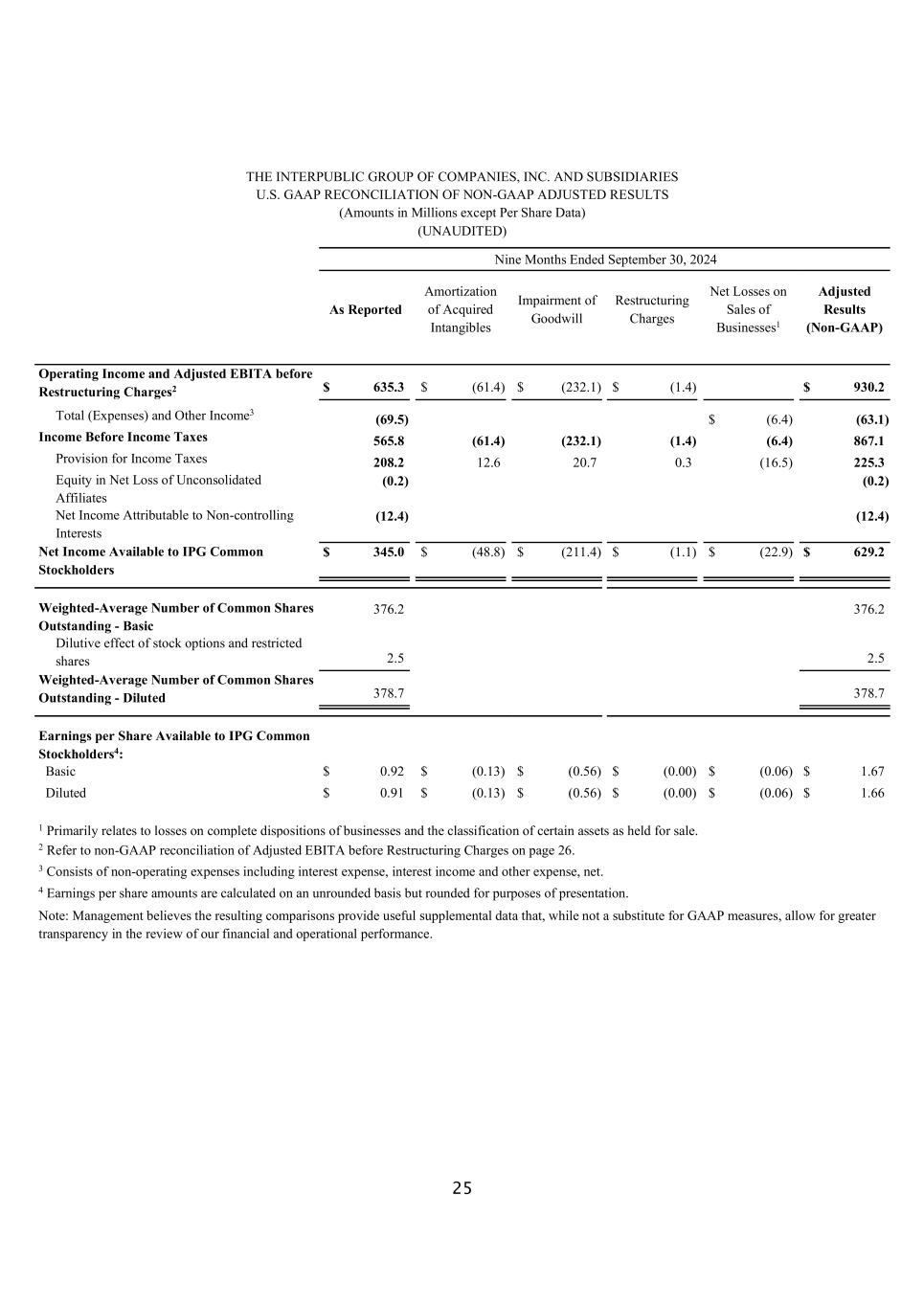

5 Ellen Johnson, Executive Vice President, Chief Financial Officer: Thank you, Philippe. As a reminder, my remarks will track to the presentation slides that accompany our webcast. Beginning with the highlights on slide 2 of the presentation, our third-quarter revenue before billable expenses, or net revenue, decreased 2.9%, with organic performance that was flat with a year ago. Our organic net revenue was unchanged in both the U.S. and our international markets. Over the first nine months of the year, our consolidated organic revenue increase was 1.0%. Third-quarter adjusted EBITA was $385.8 million, and our adjusted margin was 17.2%. In the quarter, we recognized a non-cash charge in operations of $232.1 million related to both the write down of goodwill to fair value at the digital specialist agencies and the planned sale of R/GA and Huge. Our diluted earnings per share was $0.05 cents as reported and $0.70 cents as adjusted. The adjustments exclude the after-tax impacts of the non-cash goodwill impairment charge, the amortization of acquired intangibles and the non-operating impact of sales of certain nonstrategic businesses and operations held for sale. We repurchased 3.2 million shares during the quarter, returning $100 million to our shareholders, and 7.3 million shares in the first nine months, for a total of $230 million year-to-date. Turning to slide 3, you’ll see our P&L for the quarter. I’ll cover revenue and operating expenses in detail in the slides that follow. Turning to third quarter revenue in more detail, on slide 4, our net revenue in the quarter was $2.24 billion: Compared to Q3-23, the impact of the change in exchange rates on revenue was negative 50 basis points. The impact of our net acquisitions and divestitures was negative 2.4%, which includes the held-for-sale classification of R/GA and Huge during the quarter. Our organic revenue was unchanged. For the nine months, our organic revenue increase was 1.0%. In terms of client sectors in the third quarter, performance was mixed, with six of our eight client sectors showing growth. Our growth was led by very strong performance in food & beverage, where we have a notable tailwind from account wins, and in consumer goods, as well as in our “Other” sector of diversified and public sector clients. The healthcare, retail and financial services sectors also grew in the quarter. Going the other way, we saw decreases in auto & transport and tech & telecom, due to account losses in 2023.

6 The bottom of this slide is a look at our segments: Our Media, Data & Engagement Solutions segment increased 1.2% organically. We again saw solid growth at our media businesses and Acxiom, though that performance was partly offset by decreases at MRM. Our Integrated Advertising & Creativity Led Solutions segment decreased organically by 1.9%. We had very strong growth at Deutsch, but that was more than offset by decreases at IPG Health and McCann Worldgroup, mainly due to revenue headwinds from trailing account losses. At our Specialized Communications & Experiential Solutions segment, organic growth was 1.2%, led by very strong growth at Octagon in our Experiential Group and continued growth in public relations at Weber and Golin. Jack Morton and Momentum decreased in the quarter. Moving on to slide 5, which is a regional view of our organic net revenue performance: The U.S. was 65% of net revenue in the quarter and was flat organically. We were led by very strong domestic growth at IPG Mediabrands, Octagon, Weber Shandwick, Deutsch, and solid growth at Acxiom. That was offset by decreases elsewhere in the portfolio, notably at IPG Health, MRM and McCann. International markets were 35% of net revenue in the quarter and were also flat organically, across a range of performance by region: o The U.K. was 9% of net revenue in the quarter and decreased 70 basis points organically. Strong growth by Mediabrands was offset by soft performance elsewhere in the portfolio. o Continental Europe, which represented 8% of net revenue, increased organically by 60 basis points in the quarter. Among our largest national markets on the Continent, we saw advances in Spain and France, while Italy and Germany decreased. o AsiaPac was 7% of net revenue in the quarter and decreased 7.4% organically. The quarter was marked by decreases across our major markets in the region. o LatAm was 5% of net revenue in the quarter, and organic growth was 9.8%. We were led by IPG Mediabrands and McCann, with increases across all major national markets. o In our Other Markets group, which is comprised of Canada, the Middle East and Africa, and was 6% of our net revenue in the quarter, we grew 1.5% organically, led by growth in Canada, while the Middle East was flat. Moving on to slide 6 and operating expenses in the quarter: Our net operating expenses, which exclude billable expenses, the amortization of acquired intangibles and the non-cash goodwill impairment, decreased 2.9% from a year ago, which was in line with our reported net revenue decrease. o The result was our adjusted EBITA margin was unchanged at 17.2%, which, historically, is at the top end of the range for a third quarter in our seasonal business.

7 o As you can see on this slide, our total salaries & related expense as a percentage of net revenue was decreased by 100 basis points, to 65.3%, compared with 66.3% a year ago. o Underneath that result, we had lower expenses as a percent of net revenue for base payroll, benefits & tax, as well as for temporary labor and incentives. Our severance expense in the quarter ticked up 10 basis points to 1.1% of net revenue. Our headcount decreased 3% on an organic basis from a year ago and 4.4% in total. o Each of these ratios is presented in the appendix on slide 31. Also on this slide, our office & other direct expense was 14.6% of net revenue, compared with 13.8% a year ago. Underneath that comparison is planned investment in technology and business transformation, as we have highlighted previously. Our SG&A expense was 90 basis points to net revenue, compared with 70 basis points a year ago. The increase reflects higher levels of strategic investment in senior enterprise leadership and platform development. On slide 7 we present the detail on adjustments to our reported third-quarter results in order to provide better transparency and a picture of comparable performance. This begins on the left-hand side with our reported results and, from left to right, steps through to adjusted EBITA and our adjusted diluted EPS. Our expense for the amortization of acquired intangibles was $20.3 million. The non-cash impairment of goodwill was $232.1 million. Below operating income, net losses on businesses sold and held for sale was $1.7 million. It’s worth noting as well that this slide bridges our effective tax rate in the quarter as reported to the adjusted rate of 26.2%. At the foot of this slide is the bridge of our diluted EPS as reported at $0.05 to adjusted earnings of $0.70. Slide 8 tracks to similar adjustments for the nine-month period. Adjusted diluted earnings per share was $1.66 for the period. On slide 9 we turn to cash flow in the quarter: Cash from operations was $223.8 million, compared with $242.7 million in the third quarter of last year. Operating cash flow before working capital was $374.2 million, compared with $365.4 million a year ago. In our investing activities we used a net $41.4 million, primarily for cap-ex. Our financing activities used $219.3 million, primarily for our regular quarterly dividend and share repurchases in the quarter. Our net decrease in cash for the quarter was $15.3 million.

8 Slide 10 is the current portion of our balance sheet. We ended the quarter with $1.53 billion of cash and equivalents. Slide 11 depicts the maturities of our outstanding debt. As you can see on this schedule, total debt at quarter end was $2.9 billion, and our next maturity is not until 2028. In summary, on slide 12, our strong financial discipline continues, and the strength of our balance sheet and liquidity mean that we remain well-positioned both financially as well as commercially. I would like to express my gratitude for the efforts of our people. And with that, I’ll turn it back to Philippe.

9 Mr. Krakowsky: Thank you, Ellen. As I mentioned on the call with you last quarter, our organizational structure continues to evolve, and we’re investing in the stronger growth areas of our business and at the same time moving rapidly to address underperforming areas of the portfolio. One step forward on this front, that was announced just last week, was the launch of the next evolution of our marketing intelligence engine, which we’re calling Interact. Interact is an end-to-end framework that integrates data flow across the campaign lifecycle, from brand research as well as audience insights and audience creation, all the way through to creative ideation, production, commerce and personalized CRM programs. It also powers media activation and optimization, including earned and owned channels. Fueled by Acxiom’s privacy-compliant and globally scaled data about actual people, and our Real ID identity resolution capabilities, Interact delivers connectivity across our agencies and global reach. It serves as Interpublic’s core technology infrastructure, incorporating capabilities and tech from our partnerships with leading players in the AI space, and it connects the entire portfolio, so that all our agencies can drive better marketing results across media channels and touchpoints for our clients, all in real time. This includes our Unified Retail Media Networks solution, which is particularly relevant as marketers increasingly look to make informed investment decisions in this very dynamic space. Among the enhancements that we announced last week is a significant increase in speed to market, which will lead to improvements in business performance for our clients, especially in key sales channels. As we’ve discussed, we’ll continue to move to a more holistic solution driven from the corporate center, and to making greater personalization and performance a part of all our service offerings. Interact is key to that vision, as it ensures that the entire portfolio is connected to the horizontal platform capabilities we’ve been talking about, such as data, production, commerce and media activation. Now, our data expertise and technology tools have been core to our media offerings for some time and to the very strong performance of our Mediabrands unit. That said, as of a bit over a year ago, we are clearly operating in a competitive environment where macro uncertainty and other economic factors have put a much greater premium on cost and efficiency. Given that marketplace evolution, we continue to scale our practice in principal media buying. This represents an incremental option for value creation for prospective clients, which has been a decisive factor in some large pitches. It’s also an area of opportunity for growth with our existing client base. It’s worth noting that, when we all talk about “principal media,” there is actually a broad range of activities, whether that’s deal types and types of products that are available under this umbrella in order to generate volume-based value for marketers.

10 Our principal buying solution is purpose-built for the current media ecosystem, meaning that it’s an offering that includes the full range of inventory options. That includes connected TV, social search ads, retail media and other digital media formats. We’ve put in place the necessary guardrails to exclude low-quality inventory. It’s a bit like the skinny bundle approach taken by certain media owners to get consumers all of the content they need with advantageous pricing. This strategic approach gives us the ability to drive value for clients while also ensuring we can meet the needs of marketers who operate in highly regulated industries, and those that place a higher value on brand safety. Since launching this incremental dimension, or practice area, within the media offering, there’s been strong interest from existing and prospective clients. We’ve seen some early wins in new business, and many of our clients have already fully opted into this new trading model going forward as of the new year. As we build scale, we’ll also be well-positioned to incorporate data and tech components into the value propositions that we place before marketers. Now, we’ve already discussed the performance at some of our stronger assets, Mediabrands and Acxiom. Moving on to operating highlights from the quarter, Acxiom was recognized at the annual MarTech Breakthrough Awards for having the industry’s “Best Customer Intelligence Platform.” The award noted our leadership and innovation when it comes to people-based marketing and cited Acxiom’s capabilities in integrating high-performance audiences, the most comprehensive data sets and advanced identity resolution to deliver actionable and impactful insights for omnichannel experiences. At Mediabrands, the quarter saw the conclusion of the Unilever global media review, in which we retained existing assignments in global markets and won several additional new remits, including Canada and North Africa, from competitors. New client Etsy tapped Mediahub as its media AOR. And Mediabrands also expanded its leadership position in healthcare marketing by launching Mediabrands Health, which is a new offering that allows healthcare marketers to tap the full power of our media network, as well as capabilities within IPG Health’s SOLVE(D) offering and Acxiom Health, Interpublic’s category-specific customer intelligence data spine. At IPG Health, we continued to lead the sector when it comes to recognition of the quality of our work for clients. Two weeks ago we led all holding companies in trophies at the healthcare marketing industry’s premier awards competition, winning 27 Medical Marketing and Media awards across a range of clients, including Teva, Boehringer Ingelheim, Pfizer, and Jazz Pharmaceuticals, as well as categories such as Health-Tech Innovation, Best Purpose-Driven Campaign, and Use of Influencer Marketing. The last of those was fueled by IPG Health’s recently created “Influencer ID” unit, which provides tailored solutions for healthcare marketers as they seek to harness the power of influencers in the patient, caregiver and digital opinion leader communities. Among our other creative agencies, as mentioned earlier, Deutsch has been a standout this year. Based in Los Angeles, the agency recently completed a re-brand to “Deutsch” as a follow-on to our disposition of Deutsch New York and Hill Holliday earlier this

11 year. The agency during the quarter also won Behr Paint and launched breakthrough work for long-term clients Dr Pepper and Taco Bell. At McCann, the quarter included agency of record wins for Peroni globally and significant regional assignments on key Ferrero brands Kinder and Tic Tac. We also learned that the agency’s documentary to honor the creator of the “Because You’re Worth It” campaign, produced in partnership with L’Oréal, will be eligible for an Oscar nomination. Still within the IAC segment, we continued to see industry validation of the strength of our creative offerings. The recently released World Creative Rankings saw FCB New York take the top spot industry-wide, with four other IPG agencies in the top 20. And during the quarter, we were also honored as “2024 Holding Company of the Year” at the New York Festivals Awards, where McCann was named “Network of the Year.” Turning to our SC&E segment, our sports and entertainment division Octagon posted very strong growth. The agency secured landmark player contract extensions for two clients, making them the highest-paid individual players in the NBA and NHL. Octagon also assisted GEICO in securing their new MLB partnership and supported more than 50 talent clients participating in the Olympic Games, as well as a number of brand clients in activating their IOC sponsorships, including AB InBev, Cisco, Delta Air Lines, and Toyota. In the earned media space, Weber Shandwick announced new client partnerships with Primark, The Aspen Group and a leading clinical stage biopharmaceutical company, Bicycle Therapeutics. Golin saw good growth in the quarter across a number of practice groups, including influencer marketing, content creation and social. The agency continued to invest in talent, bringing on board a new executive to lead global AI learning who will drive the design, development and delivery of multimodal AI training programs for Golin’s employees worldwide, as we’ve mentioned before, an area in which Weber does a lot of training with our client base. Other developments of note in the quarter at the IPG level included our announcement of the arrival of a chief strategy officer for Interpublic, an exceptional practitioner who understands the current consumer landscape and the needs of modern marketers and who will help accelerate the rate at which all of our disciplines will lean into data, audience-led thinking and our other central platform resources. We also look forward to welcoming an industry leader shortly who will helm content production strategy at the Interpublic level. As mentioned last quarter, our production teams across the Group have the full breadth and range to deliver integrated and efficient solutions for our clients globally. We’ve unified all aspects of the content supply chain as a function of our agreement with Adobe, announced earlier this year, to use their generative AI technology as the common platform across Interpublic, and that is connected to the Interact marketing engine for data, insights and activation. Together this allows us to enhance the work we are doing with clients on mass personalization and bring the same level of precision and accountability to the creative sides of our business that we’ve been delivering in media and CRM for some time.

12 And by designating an owner and internal champion for production, which is another important platform layer of the business, we ensure that we’re driving the best outcomes for our clients but also maximizing our enterprise investments and partnerships in technology and AI. Along with our chief client and business officer, and now IPG-level discipline leaders in creativity, commerce and solutions architecture, these two appointments round out a strong senior corporate team that can move us forward as an increasingly integrated whole. As discussed previously, we remain focused on finishing out the year strongly. We have a strong pipeline in place, of both Q4 activity and longer-term AOR opportunities, and remain focused on achieving our organic growth of approximately 1% and, at that level, continue to target adjusted EBITA margin of 16.6%. Now, thinking beyond this year to some of the topics mentioned in my earlier remarks, we’ve begun the process of streamlining the portfolio in 2024, with divestitures from among our independent agencies and the process that we brought you up to speed on with two of our specialized digital agencies, which is moving along. We’re also looking closely at strategic options to drive incremental growth through internal combinations that help us to achieve scale or to connect complementary services, and we’re looking at actions that would further re-balance the asset mix through potential dispositions. We believe there is more to be done when it comes to our operational structure and profitability. That will mean better leveraging our platform services and growing investments at the enterprise level, further refining ways of working, and making even more effective use of near- and off-shoring. We’re also assessing structural actions such as moving to unified back office and leadership teams in many international markets, as well as our use of real estate, to both improve collaboration and eliminate unnecessary costs. In terms of additional growth drivers going forward, we’ve gone into some detail this morning on the status of principal media. That’s a lever that not only impacts performance in competitive reviews but will also allow us to offer existing clients a range of new products, and therefore represents a meaningful opportunity for organic growth within our current roster, with benefits in ’25 and beyond as we scale its development. We achieved consistent strong organic growth for many years through investment in talent and with limited, tactical M&A, with the one exception being Acxiom of course. M&A is an area in which we’ll lean in and consider a range of actions that can help us scale capabilities that are key for clients, and also those which can accelerate the change in our asset mix and growth profile. Specifically, we see strategic opportunity in specialized data assets in commerce and retail media; also, companies with retail media technology platforms and reach, given that’s a sector that’s growing quickly and should continue to thrive. Tactical options to enhance the scale of our media offerings, especially in certain international markets, are also ones that we are going to take under consideration.

13 It’s important to note that we’ve always been disciplined buyers and integrators of businesses and that we believe the type of M&A activity I’m alluding to is achievable consistent with our long-standing commitment to strong capital return. Our balance sheet and liquidity provide a strong foundation from which to move forward with this set of transformational actions, which represent significant drivers of value. Thanks for your time today. As always, thanks also need to go to our client partners and our people. And at this point, let’s open the floor to your questions.

14 QUESTIONS AND ANSWERS Operator: Thank you. . . . And our first question comes from Adrien de Saint Hilaire with Bank of America. You may go ahead. Adrien de Saint Hilaire, BofA Securities: Hello. Good morning, everyone. Thanks for the presentation. Philippe Krakowsky, Chief Executive Officer: Good morning. Mr. de Saint-Hilaire: So I’ve got a couple of questions, please. So your guidance for ’24 seems to imply that Q4 will improve a little bit from Q3, notwithstanding the uncertainty that you talked about in the U.S. So, just curious if you could double-click a bit on what’s driving that exactly. What’s the recent tone of conversation with your clients? And then, secondly, from what we know today — and I appreciate that we don’t always know everything — but how big of a headwind do you think net new business is going to be for 2025 on your organic sales growth? Thanks a lot. Mr. Krakowsky: Sure. I think tone of business has been a bit of a journey this year. As you know, we came into the year, called out the fact that geopolitical and social uncertainty at the global level, and then I think domestic fiscal policy in the U.S., being pretty much stuck, was creating an impact on the operating environment, such that in the prior quarters, we were saying to you, things don’t feel as if they’re heading, not dramatically, but not in the right direction. But at this point, we definitely have the sense that things are improving. And I think clients seem to be looking past all of the — I think, it’s becoming, the global situation is becoming, a given. And then, fiscal policy, at least in the U.S., is moving in a, broadly speaking, positive direction. And I think people are assuming that regardless of what does happen, everybody will get through to the other side of the uncertainty caused by the political side of things. And so, as we said, activity has been picking up, and we’re definitely seeing a lot of opportunities show up. Both on the project side of things as we look to Q4, but we’re seeing a very active pipeline. I spoke to, and really can’t speak, so we’ve got a number of steps forward, now that principal is beginning to be kind of core to, or at least integrated into, our media offering. So, we’ve got a couple of confirmed wins on the media side that are not yet announced per the client, and therefore, it’s not something we can speak to. And then on your broader question, it’s hard to forecast the year ahead when you’re still in October. And that’s in any given year, and this is a year where we’ve been clear that we’ve definitely had a couple of headline reversals, whether it was earlier in the year with a pharma client on the creative side, obviously an Amazon decision that did not go as we would have liked to see it go. So, last quarter we said we’re neutral for

15 new business at that point in time. At this point through the year, we’re still neutral, and yet we know that we have these things that will be headwinds. But I don’t really think that we can give you kind of a line of sight to what that number is quite yet. I mean, obviously, when we head into ’25, we’ll as always be very transparent about the ins and outs of what’s going on in the business. But clearly, likely, we’re looking at headwinds going into next year on the top line. Mr. de Saint-Hilaire: Thank you, Philippe. Mr. Krakowsky: No, thank you. Operator: Thank you. Our next question is from David Karnovsky with JPMorgan. You may go ahead. David Karnovsky, J.P.Morgan: Hey. Thank you. Philippe, you — Philippe Krakowsky, Chief Executive Officer: Hi, David. Mr. Karnovsky: — you highlighted economic uncertainty as a consideration in the year end, and, same time, you’re giving good visibility in the year-end project work. Just wanted to see if you could square the two. Are marketers just simply moving ahead, regardless of whatever macro concerns are out there? And then on principal media buying, can you just clarify? Right, you noted a couple of times this would be a benefit, not just in reviews, but accretive with existing clients. Can you expand a bit on why that is? Why is it additive to growth, instead of clients just shifting and how they spend with you? Mr. Krakowsky: Sure. On the first question, I would say, as to Adrien’s question, the tone of the business is improving. And so, although the macro uncertainty was maybe an incremental negative to-date this year, I think it’s just been sort of baked in, and people are just getting on with it. And so it does feel as if, notwithstanding that noise, there’s more conviction. And as we said, we saw an improvement in the tone. And then on principal, I guess if I’m going to walk you through a series of sort of steps in the thought process, it’s definitely driving more of the decision making. Or it’s a criterion that has moved meaningfully upstream. It used to be a “don’t do this.” Now it’s part of the decision matrix for many clients. But what you have to understand is that it’s a bundled solution, which is sort of at the intersection of inventory and data and technology, right? So what you’re able to do to a

16 client is not just say where does spend go, but how will we take the budget into the marketplace to drive the greatest value for the client? And that can then mean that, as I said, there’s sort of product offerings that have not been part of what we’ve gone to market with, which we can now bundle and take to them. So that’s why we see it as a driver of incremental sort of organic, not new business, but true organic opportunity with our existing clients. I think the other thing is, the other implications that it has are, you have to be very choiceful and thoughtful in terms of how you go to market and who you go to market with. So, I think you pick fewer, bigger, more strategic partnerships on the media owner side. And that creates value that then benefits your clients, but that we obviously share in as well. And then I think the last observation I would make is that, if you’re sort of going to look at the two sides of the coin, there’s been a, I’ve called it sort of an underlying shift in the trading terms on the media side. Our model was very much one predicated on a consultative front end and total agnosticism on media. So, in this last 12-ish, call it 18-month period, as that shift has happened, others have been better positioned. But the other side of that coin is that, as a fast follower, I think we’ve got a lot of upside ahead. One of our senior media folks sort of said, we’ve got significant unencumbered billings that we haven’t committed into the market with this model, whereas perhaps others who are further along in applying this model have essentially already leaned into it. So, there’s more greenfield, we think, in terms of kind of what we can do that is good for clients, but also that will benefit us. Mr. Karnovsky: Thank you. Operator: Thank you. Our next question is from Tim Nollen with Macquarie. You may go ahead. Tim Nollen, Macquarie Equity Research: Hi, thanks. Philippe, I wanted to follow up on your question — or your comments about some of the, I guess, internal moves. Seems like there’s been quite a bit going on already. I wonder if you could give us a bit more in terms of, organically, what’s the scope of reorganizations and things that you’re going to be working through? And then, externally, we know that R/GA and Huge are on the block. Are you looking at other potential divestitures? Could you give us an update on R/GA and Huge? And what’s your kind of appetite for M&A? So, kind of altogether, internal and external reorganizations. Thanks. Philippe Krakowsky, Chief Executive Officer: Well, I think we’ve got a group of assets that have worked very well. You are — it’s a

17 service business, and it’s got a lot of scale and complexity to it. So, as you’re going to make changes, you want to be thoughtful and deliberate about it. I think we’ve been very direct and upfront with all of you about how we’ve moved through the thought process and what it has led us to, I think, on Huge and R/GA. We’re obviously far enough along there that the noise that you see on the goodwill side, you have a triggering event that says, okay, where and how are we sitting vis-a-vis that goodwill. But I think that we clearly feel that there is line of sight to a conclusion to that process. So, it’s a good ways down the track. And, I’ll talk, sort of knock wood, or try not to look at anybody in the room who might be staring daggers at me, because you don’t want to — obviously, we’re all superstitious, but we feel like a lot of work has gone into that, a lot of conversations. We’re well down the tracks on that. I think your question on — we’ve talked about the fact that we see benefit when we create scale or combine centers of excellence. So I don’t think we’re going to try to recreate miniature versions of the holding company, by putting things that are not alike together. But there is still a way to go in terms of sorting through whether or not — like any company in our space, we’re all carrying legacy. And I think incumbent upon us to sort of push on whether some of these assets would perform better if there were centralized leadership. Dispositions, I think, openness to, and we’ll look at what makes sense, and there is a bit of addition by subtraction when you’ve got things that are holding you back. I talked about our growth profile as a function of our asset mix. So I think that’s definitely going to be a filter we apply to a lot of the decision making around here going forward. And then, on M&A, I think you’ve seen some of the benefits that competitors have accrued. We’ve always been a build it from the talent. It’s worked out very, very well for us. But you look at something, whether it’s rate of change post-pandemic, whether it’s clearly the scale and the opportunity that retail media and commerce activity that is connected to retail media now. With our platform and with GenAI, you can really combine, you can push, you can sort of just connect it all. You’ve got a through line across the Group. So, I think, as I said, that’s another piece of the four or five key priorities that we’ll push harder on in ’25 still. Mr. Nollen: Great. Thanks for the color. Mr. Krakowsky: Thank you. Operator: Thank you. Our next question comes from Steven Cahall with Wells Fargo. You may go ahead. Steven Cahall, Wells Fargo Equity Research: Thank you.

18 Maybe first, just to follow up on those last statements, Philippe. So, you mentioned the strong balance sheet and some of the things you’re doing to look to improve the portfolio. I think I take that to mean organic — sorry, inorganic — investments. So just wanted to see if you confirm that you are considering some potential inorganic growth, whether that’s to drive principal media buying or retail capability or others. So, is that correct? And if so, could you help us frame that maybe within the scope of what your appetite could be? Could something be as big as Acxiom once was, or a bit more modest? And then, Ellen, just on the guide, as we think about the 1% for the year, how do we think about what R/GA and Huge do within that? I think that you removed them from the quarterly organic growth, so, I’m guessing they’re out for the back half of the year. So, is that correct? And was there any real change to the underlying guide, based on what happened with R/GA and Huge, that we can interpret into the rest of the business? Thank you. Philippe Krakowsky, Chief Executive Officer: I’ll let Ellen go first on your question, and I’ll sort of pile on on my answer to the prior one. Ellen Johnson, Executive Vice President, Chief Financial Officer: Sure. Good morning. Our 1% does, for the rest of the year, exclude R/GA and Huge. I don’t think anything’s fundamentally changed to the underlying business that we’ve guided you in July. We just became far enough along in the sales process that asset held-for-sale accounting applies. And we’ve been very consistent with our practice and convention with organic, removing it from the beginning of the quarter. Mr. Krakowsky: It’s something we’ve done throughout. It just so happens that, as dispositions go, these are probably larger than what you would have seen us doing in the past, because before, prior, it was mostly de minimis cleanup of small international operations. And on your prior question, I think inorganic definitely has a role to play. And I think the places where we are most focused are retail media tech platform assets. Obviously, you look around at some of the deals that have been done in the space of late, in and around that space, and the multiples are pretty rich, but they’re clearly valuable assets. As I said, there’s tech that comes with. We’re interested in, I also pointed out, potentially incremental specialized data assets, in and around that space. So, I think those rise to kind of meaningful prioritization. Principal, we’re in a position to kind of put into effect. We have built it. It is now part of the offering. We’ll be, as I said, sort of developing it and enhancing it by adding that data and technology layer to it, by rolling it out in more markets. There’s a very clear plan to roll it out into six to eight international markets next year. So, I don’t think inorganic is particularly required there. If something opportunistic comes along that makes sense, as I said, we’ll look at it. Mr. Cahall: That’s very helpful. Thank you.

19 Mr. Krakowsky: Thank you. Operator: Thank you. The next question comes from Michael Nathanson with MoffettNathanson. You may go ahead. Michael Nathanson, MoffettNathanson: Hey, thank you. Good morning, Philippe. Question for you, and one for Ellen. On the idea of being a fast follower on principal media, and then the point you made about having an open, unencumbered billings slate ahead of you, could you talk a bit about what you’re finding when you talk to potential clients about your approach versus what competitors have done? And anything you could kind of help us with, potentially, the pipeline ahead as you go through those discussions? That’s one. Philippe Krakowsky, Chief Executive Officer: Sure. I mean, I’ve tried to really unpack all the component parts for you in the prepared remarks. But I would say to you that sort of adoption, as it were, so we had a sense of the overall U.S. Mediabrands’ client base, where we’d be at that point in terms of opt- ins. And you’re talking conversations in the 30, 40, 50 conversations that need to take place. Because clearly, people need to understand it. There’s a lot of rigor around, as we said, the guardrails, all of the — everybody, clarity as to what everybody is choosing to engage in opting into. So we found that those conversations are tracking ahead of where we thought they would be at this point. As I said to you, we’ve got kind of line of sight to the six or eight markets, ex-U.S., where, obviously, they’re the largest media markets in the world. And so it happens that a number of them are ones where we have a very significant standing and scale, whether that’s a couple of the big ones in Latin America, whether that’s Australia, or others. So in that sense, we feel like we clearly can move quickly. And then understand kind of where media owners’ heads are at, how deals are currently structured, and where, walking into the conversations at this point, we can think about them in ways that are kind of additive or whatever the current standard is. We also bring a very sizable data asset to the table, and that, I think, also changes the nature of what you can do and the math a bit. But I mean, I can’t really go into it much more than that, because it’s kind of proprietary enough that this is an awkward setting in which to give you much more than that. But we definitely see that, like I said, there are two sides to the coin. And it’s not been our friend to date, but at this point we do see how there’s opportunity to — there’s kind of more upside than you might find if this was already a very mature capability. Mr. Nathanson: Okay, thanks. —

20 Mr. Krakowsky: And then, — Mr. Nathanson: Sorry. Mr. Krakowsky: Remind us of the other question. Mr. Nathanson: Well, the other question I had for Ellen was going to be — that was it for media buying — Mr. Krakowsky: You didn’t ask it. I feel better. Okay. Mr. Nathanson: Exactly. I said that would be two. And then for Ellen — Philippe, I was going to ask her, if you had reclassified Huge and R/GA for the year, what would your organic growth be, right? So if you give us kind of apples to apples back amount for the year, how much better would your organic growth rate be? Ellen Johnson, Executive Vice President, Chief Financial Officer: You know, we’d have to go back and do that calculation. We’ve been very transparent up to this point of what the drag has been on R/GA and Huge. When we gave our guidance, as I mentioned, in July, we thought it was probable that it would get classified as assets held for sale, but you have to wait for the triggering event. And we’ve given you a lot of color on what we think about the tone for the rest of the year. So, I think I’ll leave it at that for now. Mr. Nathanson: Fair enough. Thank you. Mr. Krakowsky: Thank you. Operator: Thank you. Our next question comes from Craig Huber with Huber Research Partners. You may go ahead. Philippe Krakowsky, Chief Executive Officer: Hey, Craig. Craig A. Huber, Huber Research Partners: Yes, thank you. Just two questions. First, I know you touched on this before, but if 2024 ended today, what would be the headwind of the net losses for the year going into 2025? I mean, surely you have to

21 have a number in your head. I’m wondering if you’d be willing to share. It’s like a 3% headwind if the year ended today. So, there’s no unknowns out there, you know it, if year ended right now, the headwind for organic growth next year is at roughly, say, 3 percentage points. That’s my first question, please. I just want to get a sense of what you’re thinking for 2025. Mr. Krakowsky: That’s not how it works, so it’s not a question we can answer, right? In the sense that, we build a plan that kind of goes from, as we close the year, all the ins and outs. And so, it’s not math that we’ve done. And it’s an awkward question, because to answer it becomes like, well, what you — what’s in and what’s not? And, gee, what do you have baked in for organic growth opportunities now that you can take a more diversified product offering to clients on the media side? And then to answer it when you put a number out there and say, gee, it might be less than that number, it might be that number. It’s a slippery slope of — I can’t answer the question, because it’s not how we run the business. And it’s not actually, I would assume, how you would expect us to. So, as I said, I don’t think that we can forecast a year ahead in October, whether it’s this year or any year that I can ever remember. And it’s been a while that a number of us have been around this joint. So, I understand the question, and I guess that you’re trying to get clarity on that, but with what’s going on, on the data side where there’s meaningfully more opportunity with these ways of working; the platform on production creates opportunities too. So, I think there’ll be more of the true organic self-help push, a unified solution that has a tech component to it, but that’s a very different answer than you’re just sort of going purely on these three losses, which I’ll ringfence as X, Y, and Z, what does that do? And that’s not math that’s super constructive in trying to figure out how we get IPG to a better place. So, I don’t think we have an answer to that. Mr. Huber: Okay. And my second question, if I could: can you just help us understand how your healthcare area did organically year-over-year? And also technology, putting aside Huge and R/GA issues? Just what those two sectors did for you guys organically year-over- year please? Mr. Krakowsky: Sure. Tech had a Huge and R/GA issue, as we always said, very significant weighting of their client roster. And then we’d also talked about the fact that we had a handful of five of the largest tech companies in the world had kind of hit the brakes pretty hard on their activity. So, I think if you take out the losses — there’s a midsize, sort of a modest, loss on the media side going back that I think is in that category — but mostly it was the telco that we called out for you. If you take that all out, that sector clearly has found a floor and is looking as if there will be, as we said, a bit more conviction. We’re definitely seeing more conviction at a macro across the whole client base. But I think that sector has gotten to where it’s healthier. It’s not thriving, growing, kind of all caps, but that’s in a better place. And then healthcare is weighted by the one big client that then became a client reconsidering a portion of that. So, there was a large client in the healthcare space,

22 which we, I think, unpacked for you. It was a — it had an impact in first quarter, and it led us to reconsider our view to the year on the top line. But our healthcare asset has been a consistent strong performer. And so, that’s clearly the — we’re going to be sort of cycling out of that in the next couple of quarters. Mr. Huber: Okay. Thank you. Mr. Krakowsky: Thank you. Operator: Thank you. And that was our last question. I’ll now turn it back to Philippe for any final thoughts. Philippe Krakowsky, Chief Executive Officer: Thank you, Sue. I think the questions kind of get to the core of where our thinking and our focus is, which is essentially realigning the portfolio to where we see opportunities and where we see growth, continued go-forward opportunity on structural actions that mean that from a longer-term probability point of view, we’re feeling like there’s still runway. And then positioning to more effectively leverage the differentiated resources, again, because that’s clearly been something that we’ve been successful at, but the last, as I said, 12 to 18 months have been more challenging. So, stay tuned, and we look forward to talking in February. Operator: Thank you. This concludes today’s conference. You may disconnect at this time.

23 Cautionary Statement This transcript contains forward-looking statements. Statements in this transcript that are not historical facts, including statements regarding goals, intentions and expectations as to future plans, trends, events, or future results of operations or financial position, constitute forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “project,” “forecast,” “plan,” “intend,” “could,” “would,” “should,” “will likely result” or comparable terminology are intended to identify forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results and outcomes to differ materially from those reflected in the forward-looking statements. Actual results and outcomes could differ materially for a variety of reasons, including, among others: the effects of a challenging economy on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition; our ability to attract new clients and retain existing clients; our ability to retain and attract key employees; risks associated with the effects of global, national and regional economic and political conditions, including counterparty risks and fluctuations in interest rates, inflation rates and currency exchange rates; the economic or business impact of military or political conflict in key markets; the impacts on our business of any pandemics, epidemics, disease outbreaks or other public health crises; risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a challenging economy; potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments; developments from changes in the regulatory and legal environment for advertising and marketing services companies around the world, including laws and regulations related to data protection and consumer privacy; and the impact on our operations of general or directed cybersecurity events. Investors should carefully consider the foregoing factors and the other risks and uncertainties that may affect our business, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K and our other SEC filings. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any of them in light of new information, future events, or otherwise.

24 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Three Months Ended September 30, 2024 As Reported Amortization of Acquired Intangibles Impairment of Goodwill Restructuring Charges Net Losses on Sales of Businesses1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges2 $ 132.9 $ (20.3) $ (232.1) $ (0.5) $ 385.8 Total (Expenses) and Other Income3 (23.4) $ (1.7) (21.7) Income Before Income Taxes 109.5 (20.3) (232.1) (0.5) (1.7) 364.1 Provision for Income Taxes 85.3 4.2 20.7 0.1 (14.8) 95.5 Equity in Net Loss of Unconsolidated Affiliates 0.0 0.0 Net Income Attributable to Non-controlling Interests (4.1) (4.1) Net Income Available to IPG Common Stockholders $ 20.1 $ (16.1) $ (211.4) $ (0.4) $ (16.5) $ 264.5 Weighted-Average Number of Common Shares Outstanding - Basic 373.9 373.9 Dilutive effect of stock options and restricted shares 2.9 2.9 Weighted-Average Number of Common Shares Outstanding - Diluted 376.8 376.8 Earnings per Share Available to IPG Common Stockholders4: Basic $ 0.05 $ (0.04) $ (0.57) $ (0.00) $ (0.04) $ 0.71 Diluted $ 0.05 $ (0.04) $ (0.56) $ (0.00) $ (0.04) $ 0.70 1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 26. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

25 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Nine Months Ended September 30, 2024 As Reported Amortization of Acquired Intangibles Impairment of Goodwill Restructuring Charges Net Losses on Sales of Businesses1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges2 $ 635.3 $ (61.4) $ (232.1) $ (1.4) $ 930.2 Total (Expenses) and Other Income3 (69.5) $ (6.4) (63.1) Income Before Income Taxes 565.8 (61.4) (232.1) (1.4) (6.4) 867.1 Provision for Income Taxes 208.2 12.6 20.7 0.3 (16.5) 225.3 Equity in Net Loss of Unconsolidated Affiliates (0.2) (0.2) Net Income Attributable to Non-controlling Interests (12.4) (12.4) Net Income Available to IPG Common Stockholders $ 345.0 $ (48.8) $ (211.4) $ (1.1) $ (22.9) $ 629.2 Weighted-Average Number of Common Shares Outstanding - Basic 376.2 376.2 Dilutive effect of stock options and restricted shares 2.5 2.5 Weighted-Average Number of Common Shares Outstanding - Diluted 378.7 378.7 Earnings per Share Available to IPG Common Stockholders4: Basic $ 0.92 $ (0.13) $ (0.56) $ (0.00) $ (0.06) $ 1.67 Diluted $ 0.91 $ (0.13) $ (0.56) $ (0.00) $ (0.06) $ 1.66 1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 26. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

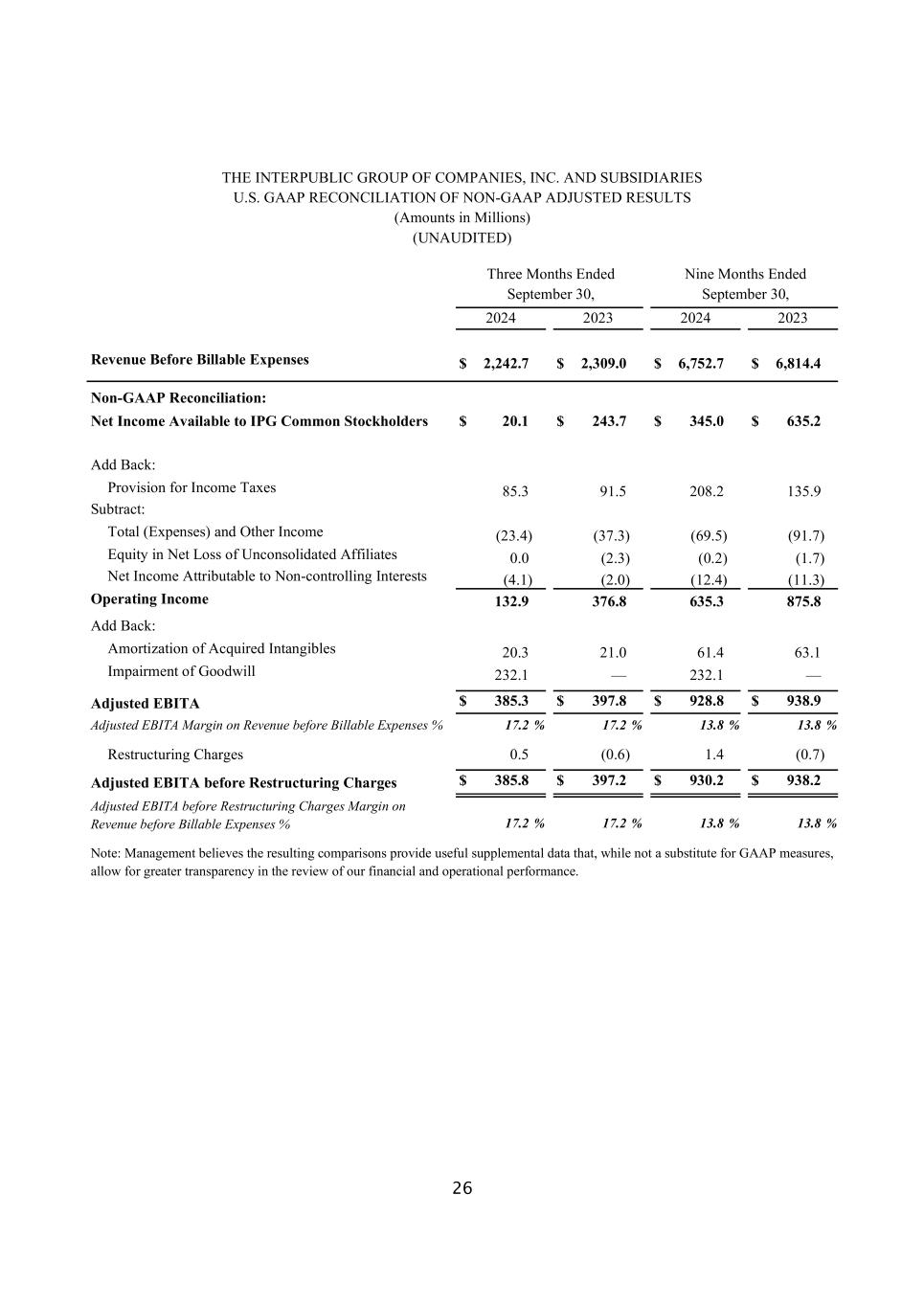

26 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions) (UNAUDITED) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Revenue Before Billable Expenses $ 2,242.7 $ 2,309.0 $ 6,752.7 $ 6,814.4 Non-GAAP Reconciliation: Net Income Available to IPG Common Stockholders $ 20.1 $ 243.7 $ 345.0 $ 635.2 Add Back: Provision for Income Taxes 85.3 91.5 208.2 135.9 Subtract: Total (Expenses) and Other Income (23.4) (37.3) (69.5) (91.7) Equity in Net Loss of Unconsolidated Affiliates 0.0 (2.3) (0.2) (1.7) Net Income Attributable to Non-controlling Interests (4.1) (2.0) (12.4) (11.3) Operating Income 132.9 376.8 635.3 875.8 Add Back: Amortization of Acquired Intangibles 20.3 21.0 61.4 63.1 Impairment of Goodwill 232.1 — 232.1 — Adjusted EBITA $ 385.3 $ 397.8 $ 928.8 $ 938.9 Adjusted EBITA Margin on Revenue before Billable Expenses % 17.2 % 17.2 % 13.8 % 13.8 % Restructuring Charges 0.5 (0.6) 1.4 (0.7) Adjusted EBITA before Restructuring Charges $ 385.8 $ 397.2 $ 930.2 $ 938.2 Adjusted EBITA before Restructuring Charges Margin on Revenue before Billable Expenses % 17.2 % 17.2 % 13.8 % 13.8 % Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

27 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Three Months Ended September 30, 2023 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Sales of Businesses1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges2 $ 376.8 $ (21.0) $ 0.6 $ 397.2 Total (Expenses) and Other Income3 (37.3) $ (12.1) (25.2) Income Before Income Taxes 339.5 (21.0) 0.6 (12.1) 372.0 Provision for Income Taxes 91.5 4.3 (0.2) 2.6 98.2 Equity in Net Loss of Unconsolidated Affiliates (2.3) (2.3) Net Income Attributable to Non-controlling Interests (2.0) (2.0) Net Income Available to IPG Common Stockholders $ 243.7 $ (16.7) $ 0.4 $ (9.5) $ 269.5 Weighted-Average Number of Common Shares Outstanding - Basic 383.6 383.6 Dilutive effect of stock options and restricted shares 1.9 1.9 Weighted-Average Number of Common Shares Outstanding - Diluted 385.5 385.5 Earnings per Share Available to IPG Common Stockholders4: Basic $ 0.64 $ (0.04) $ 0.00 $ (0.02) $ 0.70 Diluted $ 0.63 $ (0.04) $ 0.00 $ (0.02) $ 0.70 1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 26. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.

28 THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions except Per Share Data) (UNAUDITED) Nine Months Ended September 30, 2023 As Reported Amortization of Acquired Intangibles Restructuring Charges Net Losses on Sales of Businesses1 Adjusted Results (Non-GAAP) Operating Income and Adjusted EBITA before Restructuring Charges2 $ 875.8 $ (63.1) $ 0.7 $ 938.2 Total (Expenses) and Other Income3 (91.7) $ (20.4) (71.3) Income Before Income Taxes 784.1 (63.1) 0.7 (20.4) 866.9 Provision for Income Taxes 135.9 12.7 (0.3) 4.0 152.3 Equity in Net Loss of Unconsolidated Affiliates (1.7) (1.7) Net Income Attributable to Non-controlling Interests (11.3) (11.3) Net Income Available to IPG Common Stockholders $ 635.2 $ (50.4) $ 0.4 $ (16.4) $ 701.6 Weighted-Average Number of Common Shares Outstanding - Basic 385.0 385.0 Dilutive effect of stock options and restricted shares 1.8 1.8 Weighted-Average Number of Common Shares Outstanding - Diluted 386.8 386.8 Earnings per Share Available to IPG Common Stockholders4,5: Basic $ 1.65 $ (0.13) $ 0.00 $ (0.04) $ 1.82 Diluted $ 1.64 $ (0.13) $ 0.00 $ (0.04) $ 1.81 1 Primarily relates to losses on complete dispositions of businesses and the classification of certain assets as held for sale, as well as a loss related to the sale of an equity investment. 2 Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 26. 3 Consists of non-operating expenses including interest expense, interest income and other expense, net. 4 Earnings per share amounts are calculated on an unrounded basis but rounded for purposes of presentation. 5 Basic and diluted earnings per share, both As Reported and Adjusted Results (Non-GAAP), includes a positive impact of $0.17 related to the settlement of U.S. Federal Income Tax Audits for the years 2017-2018. Note: Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater transparency in the review of our financial and operational performance.