- Total revenue including billable expenses was $2.63

billion

- Revenue before billable expenses ("net revenue") was

$2.24 billion, with organic revenue unchanged from the third

quarter of 2023

- Non-cash goodwill impairment expense of $232.1 million,

related to digital specialist agencies and the sale process for

R/GA and Huge

- Reported net income was $20.1 million

- Adjusted EBITA was $385.8 million

- Margin of adjusted EBITA was 17.2% on revenue before

billable expenses

- Diluted earnings per share including goodwill charge

was $0.05 as reported and $0.70 as adjusted

Philippe Krakowsky, CEO of Interpublic:

“Net revenue in the third quarter was unchanged

organically from the same period a year ago, which brings organic

growth over the first nine months of this year to 1.0%. During the

quarter, we saw solid contributions to growth from media services,

sports marketing, data management and public relations. Our

adjusted EBITA margin was 17.2%, underscoring continued operating

discipline as we continue our enterprise-wide investments in growth

and business transformation.

“Third quarter results include non-cash goodwill

impairment expense of $232 million related to our digital

specialist agencies and progress with the strategic sales process

for R/GA and Huge.

“The quarter also continued to see progress in

the evolution of our offerings and organizational structure, as we

invest in the stronger, growing areas within the portfolio. The

launch of Interact marks the next evolution of our marketing

intelligence engine, which integrates data flows across the

campaign lifecycle and consumer journey. This core technology

connects our entire portfolio, from brand research as well as

audience insights and audience creation, all the way through to

creative ideation, production, commerce, and personalized CRM

programs through the use of generative AI. It also powers media

activation and optimization, including earned and owned channels,

delivering better marketing results across media channels and

touchpoints for our clients, in real time.

“Looking forward, we are seeing a strong new

business pipeline, for both Q4 activity and longer-term AOR

opportunities, and we remain focused on achieving organic growth of

approximately 1% this year. At that level, we continue to target

adjusted EBITA margin of 16.6%. Our long-standing commitment to

capital returns remains an important priority and our strong

balance sheet provides a solid foundation from which to continue to

evolve our offerings and the solutions we provide for

marketers.”

Summary

Revenue

- Third quarter 2024: Total revenue, which includes billable

expenses, was $2.63 billion, compared $2.68 billion in the third

quarter of 2023.

- Revenue before billable expenses ("net revenue") was $2.24

billion, a reported decrease of 2.9% from the third quarter

of 2023.

- The organic change of net revenue was flat compared to the

third quarter of 2023.

- First nine months 2024: Total revenue, which includes billable

expenses, was $7.83 billion, compared $7.87 billion in the first

nine months of 2023.

- Revenue before billable expenses ("net revenue") was $6.75

billion, a reported decrease of 0.9% from the first nine

months of 2023.

- The organic increase of net revenue was 1.0% from the first

nine months of 2023.

Operating Results

- In the third quarter of 2024, operating income was $132.9

million compared to $376.8 million in 2023. Operating results in

the third quarter of 2024 include non-cash goodwill impairment of

$232.1 million related to the write down of the carrying value of

digital specialist agencies to fair value. Adjusted EBITA before

restructuring charges was $385.8 million compared to $397.2 million

for the same period in 2023. Third quarter 2024 margin of adjusted

EBITA before restructuring charges was 17.2% on revenue before

billable expenses.

- In the first nine months of 2024, operating income was $635.3

million compared to $875.8 million in 2023. Operating results in

the first nine months of 2024 include non-cash goodwill impairment

of $232.1 million in the third quarter related to the write down of

the carrying value of digital specialist agencies to fair value.

Adjusted EBITA before restructuring charges was $930.2 million

compared to $938.2 million for the same period in 2023. First nine

months 2024 margin of adjusted EBITA before restructuring charges

was 13.8% on revenue before billable expenses.

- Refer to reconciliations in the appendix within this press

release for further detail.

Net Results

- In the third quarter of 2024, the income tax provision was

$85.3 million on income before income taxes of $109.5 million.

- Third quarter 2024 net income available to IPG common

stockholders was $20.1 million, resulting in earnings of $0.05 per

basic share and $0.05 per diluted share compared to earnings of

$0.64 per basic share and $0.63 per diluted share for the same

period in 2023. Net income and earnings per share in the third

quarter of 2024 include after-tax expense of $211.4 million related

to the non-cash charge to write down goodwill. Adjusted earnings

were $0.70 per diluted share which was the same as a year ago.

Third quarter 2024 adjusted earnings excludes after-tax

amortization of acquired intangibles of $16.1 million, after-tax

impairment of goodwill of $211.4 million, after-tax restructuring

charges of $0.4 million and an after-tax loss of $16.5 million on

the sales of businesses.

- In the first nine months of 2024, the income tax provision was

$208.2 million on income before income taxes of $565.8

million.

- First nine months 2024 net income available to IPG common

stockholders was $345.0 million, resulting in earnings of $0.92 per

basic share and $0.91 per diluted share compared to earnings of

$1.65 per basic share and $1.64 per diluted share for the same

period in 2023. Net income and earnings per share in the first nine

months of 2024 include after-tax expense of $211.4 million related

to the non-cash charge to write down goodwill. Adjusted earnings

were $1.66 per diluted share compared to adjusted earnings per

diluted share of $1.81 a year ago. In 2023, earnings per share,

both as reported and adjusted, included a benefit of $0.17 per

diluted share related to the settlement of U.S. Federal Income Tax

Audits for the years 2017-2018. First nine months 2024 adjusted

earnings excludes after-tax amortization of acquired intangibles of

$48.8 million, after-tax impairment of goodwill of $211.4 million,

after-tax restructuring charges of $1.1 million and an after-tax

loss of $22.9 million on the sales of businesses.

- Refer to reconciliations in the appendix within this press

release for further detail.

Operating Results

RevenueRevenue before billable

expenses of $2.24 billion in the third quarter of 2024 decreased

2.9% compared with the same period in 2023. Compared to the third

quarter of 2023, the effect of foreign currency translation was

negative 0.5%, the impact of net dispositions was negative 2.4%,

and organic net revenue was unchanged from prior year. The organic

net revenue change in the third quarter excludes agencies R/GA and

Huge, due to their classification as held-for-sale during the

quarter.

Revenue before billable expenses of $6.75

billion in the first nine months of 2024 decreased 0.9% compared

with the same period in 2023. Compared to the first nine months of

2023, the effect of foreign currency translation was negative 0.3%,

the impact of net dispositions was negative 1.6%, and the resulting

organic increase of net revenue was 1.0%.

Operating ExpensesIn the third

quarter of 2024, total operating expenses, excluding billable

expenses, restructuring charges, and amortization and impairment of

acquired intangibles decreased 2.9%. In the first nine months of

2024, total operating expenses, excluding billable expenses,

restructuring charges, and amortization and impairment of acquired

intangibles decreased 0.9% when compared to the first nine months

of 2023.

In the third quarter of 2024, staff cost ratio,

which is total salaries and related expenses as a percentage of

revenue before billable expenses, decreased to 65.3% compared to

66.3% for the same period in 2023. Total salaries and related

expenses in the third quarter of 2024 were $1.46 billion, a

decrease of 4.4% from a year ago. The decrease was primarily driven

by decreased base salaries, benefits and tax, performance-based

employee compensation expense and temporary help expense. In the

first nine months of 2024, staff cost ratio decreased to 68.0%

compared to 69.1% for the same period in 2023. Total salaries and

related expenses in the first nine months of 2024 were $4.59

billion, a decrease of 2.4% from a year ago. The decrease was

primarily driven by factors similar to those noted above for the

third quarter of 2024, partially offset by increased severance

expense.

In the third quarter of 2024, office and other

direct expenses as a percentage of revenue before billable expenses

increased to 14.6% compared to 13.8% for the same period in 2023.

Office and other direct expenses were $327.1 million in the third

quarter of 2024, an increase of 2.6% from a year ago, reflecting

increased expenses for technology and software, as well as

professional consulting. In the first nine months of 2024, office

and other direct expenses as a percentage of revenue before

billable expenses increased to 14.9% compared to 14.5% for the same

period in 2023. Office and other direct expenses were $1.01 billion

in the first nine months of 2024, an increase of 1.8% from a year

ago, primarily due to increases in technology and software costs

and general corporate expenses, partially offset by decreases in

occupancy expense.

Selling, general and administrative ("SG&A")

expenses were $20.8 million in the third quarter of 2024, compared

to $16.9 million a year ago, primarily due to increased strategic

investment in base salaries, benefits and tax and technology &

software. SG&A expenses were $86.4 million in the first nine

months of 2024, compared to $43.7 million a year ago, primarily due

to factors similar to those noted above for the third quarter of

2024.

Depreciation and amortization expense decreased

by 1.1% and 1.8% during the third quarter and the first nine months

of 2024, respectively.

During the third quarter and first nine months

of 2024, we recorded goodwill impairment of $232.1 million.

Non-Operating Results and

TaxNet interest expense decreased by $2.9 million to $20.7

million in the third quarter of 2024 from a year ago, primarily

attributable to higher interest rates, offset by lower average

balances on net deposits. Net interest expense decreased by $10.8

million to $56.1 million in the first nine months of 2024 from a

year ago, primarily due to factors similar to those noted above for

the third quarter of 2024.

Other expense, net was $2.7 million in the third

quarter of 2024, and primarily related to losses on sales of

businesses and the classification of certain assets and liabilities

as held for sale, as well as pension and postretirement costs.

Other expense, net was $13.4 million in the first nine months of

2024, and primarily related to factors similar to those noted above

for the third quarter of 2024.

The income tax provision in the third quarter of

2024 was $85.3 million on income before income taxes of $109.5

million. This compares to an income tax provision of $91.5 million

for the third quarter of 2023 on income before income taxes of

$339.5 million. The income tax provision in the first nine months

of 2024 was $208.2 million on income before income taxes of $565.8

million. This compares to an income tax provision of $135.9 million

for the first nine months of 2023 on income before income taxes of

$784.1 million, which included a benefit of $64.2 million related

to the settlement of U.S. Federal Income Tax Audits for the years

2017-2018, which was primarily non-cash.

Balance SheetAt

September 30, 2024, cash and cash equivalents totaled $1.53

billion, compared to $2.39 billion at December 31, 2023 and

$1.57 billion on September 30, 2023. Total debt was $2.94

billion at September 30, 2024, compared to $3.20 billion at

December 31, 2023.

Share Repurchase ProgramDuring

the first nine months of 2024, the Company repurchased 7.3 million

shares of its common stock at an aggregate cost of $230.1 million

and an average price of $31.40 per share, including fees.

Common Stock DividendDuring the

third quarter of 2024, the Company declared and paid a common stock

cash dividend of $0.330 per share, for a total of $123.2

million.

For further information regarding the Company's

financial results as well as certain non-GAAP measures including

organic revenue before billable expenses change, adjusted EBITA,

adjusted EBITA before restructuring charges and adjusted earnings

per diluted share, and the reconciliations thereof, please refer to

the appendix within this press release and our Investor

Presentation filed on Form 8-K herewith and available on our

website, www.interpublic.com.

# # #

About Interpublic

Interpublic (NYSE: IPG) (www.interpublic.com) is

a values-based, data-fueled, and creatively-driven provider of

marketing solutions. Home to some of the world’s best-known and

most innovative communications specialists, IPG global brands

include Acxiom, Craft, FCB, FutureBrand, Golin, Huge, Initiative,

IPG Health, IPG Mediabrands, Jack Morton, KINESSO, MAGNA, McCann,

Mediahub, Momentum, MRM, MullenLowe Global, Octagon, R/GA, UM,

Weber Shandwick and more. IPG is an S&P 500 company with total

revenue of $10.89 billion in 2023.

# # #

Contact Information

Tom Cunningham(Press)(212) 704-1326

Jerry Leshne(Analysts, Investors)(212)

704-1439

Cautionary Statement

This release contains forward-looking

statements. Statements in this report that are not historical

facts, including statements regarding goals, intentions and

expectations as to future plans, trends, events, or future results

of operations or financial position, constitute forward-looking

statements. Without limiting the generality of the foregoing, words

such as “may,” “will,” “expect,” “believe,” “anticipate,”

“estimate,” “project,” “forecast,” “plan,” “intend,” “could,”

“would,” “should,” “will likely result” or comparable terminology

are intended to identify forward-looking statements.

Forward-looking statements are based on current expectations and

assumptions that are subject to risks and uncertainties, which

could cause our actual results and outcomes to differ materially

from those reflected in the forward-looking statements.

Actual results and outcomes could differ

materially for a variety of reasons, including, among others:

- the effects of a challenging economy on the demand for our

advertising and marketing services, on our clients’ financial

condition and on our business or financial condition;

- our ability to attract new clients and retain existing

clients;

- our ability to retain and attract key employees;

- risks associated with the effects of global, national and

regional economic and political conditions, including counterparty

risks and fluctuations in interest rates, inflation rates and

currency exchange rates;

- the economic or business impact of military or political

conflict in key markets;

- the impacts on our business of any pandemics, epidemics,

disease outbreaks or other public health crises;

- risks associated with assumptions we make in connection with

our critical accounting estimates, including changes in assumptions

associated with any effects of a challenging economy;

- potential adverse effects if we are required to recognize

impairment charges or other adverse accounting-related

developments;

- developments from changes in the regulatory and legal

environment for advertising and marketing services companies around

the world, including laws and regulations related to data

protection and consumer privacy; and

- the impact on our operations of general or directed

cybersecurity events.

Investors should carefully consider the

foregoing factors and the other risks and uncertainties that may

affect our business, including those outlined in more detail under

Item 1A, Risk Factors, in our most recent Annual Report on Form

10-K and our other SEC filings. Investors are cautioned not to

place undue reliance on forward-looking statements, which speak

only as of the date they are made. We undertake no obligation to

update or revise publicly any of them in light of new information,

future events, or otherwise.

APPENDIX

|

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND

SUBSIDIARIESCONSOLIDATED SUMMARY OF EARNINGSTHIRD QUARTER REPORT

2024 AND 2023(Amounts in Millions except Per Share

Data)(UNAUDITED) |

| |

|

|

| |

|

Three Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

Fav. (Unfav.)% Variance |

|

Revenue: |

|

|

|

|

|

| |

Revenue before Billable

Expenses |

$2,242.7 |

|

$2,309.0 |

|

(2.9) % |

| |

Billable Expenses |

386.1 |

|

369.5 |

|

4.5 % |

| Total Revenue |

2,628.8 |

|

2,678.5 |

|

(1.9) % |

| |

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

| |

Salaries and Related

Expenses |

1,464.0 |

|

1,531.1 |

|

4.4 % |

| |

Office and Other Direct

Expenses |

327.1 |

|

318.8 |

|

(2.6) % |

| |

Billable Expenses |

386.1 |

|

369.5 |

|

(4.5) % |

| |

Cost of Services |

2,177.2 |

|

2,219.4 |

|

1.9 % |

| |

Selling, General and

Administrative Expenses |

20.8 |

|

16.9 |

|

(23.1) % |

| |

Depreciation and

Amortization |

65.3 |

|

66.0 |

|

1.1 % |

| |

Impairment of Goodwill |

232.1 |

|

— |

|

>(100)% |

| |

Restructuring Charges |

0.5 |

|

(0.6) |

|

>(100)% |

| Total Operating

Expenses |

2,495.9 |

|

2,301.7 |

|

(8.4) % |

| Operating

Income |

132.9 |

|

376.8 |

|

(64.7) % |

| |

|

|

|

|

|

|

| Expenses

and Other Income: |

|

|

|

|

|

| |

Interest Expense |

(54.9) |

|

(58.7) |

|

|

| |

Interest Income |

34.2 |

|

35.1 |

|

|

| |

Other Expense, Net |

(2.7) |

|

(13.7) |

|

|

| Total (Expenses)

and Other Income |

(23.4) |

|

(37.3) |

|

|

| |

|

|

|

|

|

|

| Income

Before Income Taxes |

109.5 |

|

339.5 |

|

|

| |

Provision for Income

Taxes |

85.3 |

|

91.5 |

|

|

| Income of

Consolidated Companies |

24.2 |

|

248.0 |

|

|

| |

Equity in Net Loss of

Unconsolidated Affiliates |

— |

|

(2.3) |

|

|

| Net

Income |

24.2 |

|

245.7 |

|

|

| |

Net Income Attributable to

Non-controlling Interests |

(4.1) |

|

(2.0) |

|

|

| Net Income

Available to IPG Common Stockholders |

$20.1 |

|

$243.7 |

|

|

| |

|

|

|

|

|

| Earnings

Per Share Available to IPG Common Stockholders: |

|

|

|

|

|

|

Basic |

$0.05 |

|

$0.64 |

|

|

|

Diluted |

$0.05 |

|

$0.63 |

|

|

| |

|

|

|

|

|

| Weighted-Average

Number of Common Shares Outstanding: |

|

|

|

|

|

|

Basic |

373.9 |

|

383.6 |

|

|

|

Diluted |

376.8 |

|

385.5 |

|

|

| |

|

|

|

|

|

| Dividends Declared

Per Common Share |

$0.330 |

|

$0.310 |

|

|

|

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND

SUBSIDIARIESCONSOLIDATED SUMMARY OF EARNINGSTHIRD QUARTER REPORT

2024 AND 2023(Amounts in Millions except Per Share

Data)(UNAUDITED) |

| |

|

|

| |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

Fav. (Unfav.)% Variance |

|

Revenue: |

|

|

|

|

|

| |

Revenue before Billable

Expenses |

$6,752.7 |

|

$6,814.4 |

|

(0.9) % |

| |

Billable Expenses |

1,082.0 |

|

1,051.6 |

|

2.9 % |

| Total Revenue |

7,834.7 |

|

7,866.0 |

|

(0.4) % |

| |

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

| |

Salaries and Related

Expenses |

4,594.4 |

|

4,707.0 |

|

2.4 % |

| |

Office and Other Direct

Expenses |

1,007.6 |

|

989.6 |

|

(1.8) % |

| |

Billable Expenses |

1,082.0 |

|

1,051.6 |

|

(2.9) % |

| |

Cost of Services |

6,684.0 |

|

6,748.2 |

|

1.0 % |

| |

Selling, General and

Administrative Expenses |

86.4 |

|

43.7 |

|

(97.7) % |

| |

Depreciation and

Amortization |

195.5 |

|

199.0 |

|

1.8 % |

| |

Impairment of Goodwill |

232.1 |

|

— |

|

>(100)% |

| |

Restructuring Charges |

1.4 |

|

(0.7) |

|

>(100)% |

| Total Operating

Expenses |

7,199.4 |

|

6,990.2 |

|

(3.0) % |

| Operating

Income |

635.3 |

|

875.8 |

|

(27.5) % |

| |

|

|

|

|

|

|

| Expenses

and Other Income: |

|

|

|

|

|

| |

Interest Expense |

(175.6) |

|

(164.2) |

|

|

| |

Interest Income |

119.5 |

|

97.3 |

|

|

| |

Other Expense, Net |

(13.4) |

|

(24.8) |

|

|

| Total (Expenses)

and Other Income |

(69.5) |

|

(91.7) |

|

|

| |

|

|

|

|

|

|

| Income

Before Income Taxes |

565.8 |

|

784.1 |

|

|

| |

Provision for Income

Taxes |

208.2 |

|

135.9 |

|

|

| Income of

Consolidated Companies |

357.6 |

|

648.2 |

|

|

| |

Equity in Net Loss of

Unconsolidated Affiliates |

(0.2) |

|

(1.7) |

|

|

| Net

Income |

357.4 |

|

646.5 |

|

|

| |

Net Income Attributable to

Non-controlling Interests |

(12.4) |

|

(11.3) |

|

|

| Net Income

Available to IPG Common Stockholders |

$345.0 |

|

$635.2 |

|

|

| |

|

|

|

|

|

| Earnings

Per Share Available to IPG Common Stockholders: |

|

|

|

|

|

|

Basic |

$0.92 |

|

$1.65 |

|

|

|

Diluted |

$0.91 |

|

$1.64 |

|

|

| |

|

|

|

|

|

| Weighted-Average

Number of Common Shares Outstanding: |

|

|

|

|

|

|

Basic |

376.2 |

|

385.0 |

|

|

|

Diluted |

378.7 |

|

386.8 |

|

|

| |

|

|

|

|

|

| Dividends Declared

Per Common Share |

$0.990 |

|

$0.930 |

|

|

|

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIESU.S. GAAP

RECONCILIATION OF NON-GAAP ADJUSTED RESULTS(Amounts in Millions

except Per Share Data)(UNAUDITED) |

| |

Three Months Ended September 30, 2024 |

|

|

As Reported |

|

Amortization of Acquired Intangibles |

|

Impairment of Goodwill |

|

Restructuring Charges |

|

Net Losses on Sales of Businesses1 |

|

Adjusted Results

(Non-GAAP) |

| Operating Income and

Adjusted EBITA before Restructuring Charges2 |

$132.9 |

|

$(20.3) |

|

$(232.1) |

|

$(0.5) |

|

|

|

$385.8 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total (Expenses) and Other Income3 |

(23.4) |

|

|

|

|

|

|

|

$(1.7) |

|

(21.7) |

| Income Before Income

Taxes |

109.5 |

|

(20.3) |

|

(232.1) |

|

(0.5) |

|

(1.7) |

|

364.1 |

|

Provision for Income Taxes |

85.3 |

|

4.2 |

|

20.7 |

|

0.1 |

|

(14.8) |

|

95.5 |

|

Equity in Net Loss of Unconsolidated Affiliates |

0.0 |

|

|

|

|

|

|

|

|

|

0.0 |

|

Net Income Attributable to Non-controlling Interests |

(4.1) |

|

|

|

|

|

|

|

|

|

(4.1) |

| Net Income Available

to IPG Common Stockholders |

$20.1 |

|

$(16.1) |

|

$(211.4) |

|

$(0.4) |

|

$(16.5) |

|

$264.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-Average

Number of Common Shares Outstanding - Basic |

373.9 |

|

|

|

|

|

|

|

|

|

373.9 |

|

Dilutive effect of stock options and restricted shares |

2.9 |

|

|

|

|

|

|

|

|

|

2.9 |

| Weighted-Average

Number of Common Shares Outstanding - Diluted |

376.8 |

|

|

|

|

|

|

|

|

|

376.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per Share

Available to IPG Common Stockholders4: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$0.05 |

|

$(0.04) |

|

$(0.57) |

|

$(0.00) |

|

$(0.04) |

|

$0.71 |

| Diluted |

$0.05 |

|

$(0.04) |

|

$(0.56) |

|

$(0.00) |

|

$(0.04) |

|

$0.70 |

| |

|

|

|

|

|

|

|

|

|

|

|

| 1 Primarily

relates to losses on complete dispositions of businesses and the

classification of certain assets as held for sale. |

| 2 Refer to

non-GAAP reconciliation of Adjusted EBITA before Restructuring

Charges on page A5 in the appendix. |

| 3 Consists of

non-operating expenses including interest expense, interest income

and other expense, net. |

| 4 Earnings per

share amounts are calculated on an unrounded basis but rounded for

purposes of presentation. |

| Note: Management

believes the resulting comparisons provide useful supplemental data

that, while not a substitute for GAAP measures, allow for greater

transparency in the review of our financial and operational

performance. |

|

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIESU.S. GAAP

RECONCILIATION OF NON-GAAP ADJUSTED RESULTS(Amounts in Millions

except Per Share Data)(UNAUDITED) |

| |

Nine Months Ended September 30, 2024 |

|

|

As Reported |

|

Amortization of Acquired Intangibles |

|

Impairment of Goodwill |

|

Restructuring Charges |

|

Net Losses on Sales of Businesses1 |

|

Adjusted Results

(Non-GAAP) |

| Operating Income and

Adjusted EBITA before Restructuring Charges2 |

$635.3 |

|

$(61.4) |

|

$(232.1) |

|

$(1.4) |

|

|

|

$930.2 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total (Expenses) and Other Income3 |

(69.5) |

|

|

|

|

|

|

|

$(6.4) |

|

(63.1) |

| Income Before Income

Taxes |

565.8 |

|

(61.4) |

|

(232.1) |

|

(1.4) |

|

(6.4) |

|

867.1 |

|

Provision for Income Taxes |

208.2 |

|

12.6 |

|

20.7 |

|

0.3 |

|

(16.5) |

|

225.3 |

|

Equity in Net Loss of Unconsolidated Affiliates |

(0.2) |

|

|

|

|

|

|

|

|

|

(0.2) |

|

Net Income Attributable to Non-controlling Interests |

(12.4) |

|

|

|

|

|

|

|

|

|

(12.4) |

| Net Income Available

to IPG Common Stockholders |

$345.0 |

|

$(48.8) |

|

$(211.4) |

|

$(1.1) |

|

$(22.9) |

|

$629.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-Average

Number of Common Shares Outstanding - Basic |

376.2 |

|

|

|

|

|

|

|

|

|

376.2 |

|

Dilutive effect of stock options and restricted shares |

2.5 |

|

|

|

|

|

|

|

|

|

2.5 |

| Weighted-Average

Number of Common Shares Outstanding - Diluted |

378.7 |

|

|

|

|

|

|

|

|

|

378.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per Share

Available to IPG Common Stockholders4: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$0.92 |

|

$(0.13) |

|

$(0.56) |

|

$(0.00) |

|

$(0.06) |

|

$1.67 |

| Diluted |

$0.91 |

|

$(0.13) |

|

$(0.56) |

|

$(0.00) |

|

$(0.06) |

|

$1.66 |

| |

|

|

|

|

|

|

|

|

|

|

|

| 1 Primarily

relates to losses on complete dispositions of businesses and the

classification of certain assets as held for sale. |

| 2 Refer to

non-GAAP reconciliation of Adjusted EBITA before Restructuring

Charges on page A5 in the appendix. |

| 3 Consists of

non-operating expenses including interest expense, interest income

and other expense, net. |

| 4 Earnings per

share amounts are calculated on an unrounded basis but rounded for

purposes of presentation. |

| Note: Management

believes the resulting comparisons provide useful supplemental data

that, while not a substitute for GAAP measures, allow for greater

transparency in the review of our financial and operational

performance. |

|

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIES U.S. GAAP

RECONCILIATION OF NON-GAAP ADJUSTED RESULTS (Amounts in Millions)

(UNAUDITED) |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

| Revenue Before

Billable Expenses |

$2,242.7 |

|

$2,309.0 |

|

$6,752.7 |

|

$6,814.4 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Non-GAAP

Reconciliation: |

|

|

|

|

|

|

|

| Net Income Available

to IPG Common Stockholders |

$20.1 |

|

$243.7 |

|

$345.0 |

|

$635.2 |

| |

|

|

|

|

|

|

|

| Add Back: |

|

|

|

|

|

|

|

|

Provision for Income Taxes |

85.3 |

|

91.5 |

|

208.2 |

|

135.9 |

| Subtract: |

|

|

|

|

|

|

|

|

Total (Expenses) and Other Income |

(23.4) |

|

(37.3) |

|

(69.5) |

|

(91.7) |

|

Equity in Net Loss of Unconsolidated Affiliates |

0.0 |

|

(2.3) |

|

(0.2) |

|

(1.7) |

|

Net Income Attributable to Non-controlling Interests |

(4.1) |

|

(2.0) |

|

(12.4) |

|

(11.3) |

| Operating

Income |

132.9 |

|

376.8 |

|

635.3 |

|

875.8 |

| |

|

|

|

|

|

|

|

| Add Back: |

|

|

|

|

|

|

|

|

Amortization of Acquired Intangibles |

20.3 |

|

21.0 |

|

61.4 |

|

63.1 |

|

Impairment of Goodwill |

232.1 |

|

— |

|

232.1 |

|

— |

| |

|

|

|

|

|

|

|

| Adjusted

EBITA |

$385.3 |

|

$397.8 |

|

$928.8 |

|

$938.9 |

| Adjusted EBITA Margin on

Revenue before Billable Expenses % |

17.2 % |

|

17.2 % |

|

13.8 % |

|

13.8 % |

| |

|

|

|

|

|

|

|

|

Restructuring Charges |

0.5 |

|

(0.6) |

|

1.4 |

|

(0.7) |

| |

|

|

|

|

|

|

|

| Adjusted EBITA before

Restructuring Charges |

$385.8 |

|

$397.2 |

|

$930.2 |

|

$938.2 |

| Adjusted EBITA before

Restructuring Charges Margin on Revenue before Billable Expenses

% |

17.2 % |

|

17.2 % |

|

13.8 % |

|

13.8 % |

| |

|

|

|

|

|

|

|

| Note: Management

believes the resulting comparisons provide useful supplemental data

that, while not a substitute for GAAP measures, allow for greater

transparency in the review of our financial and operational

performance. |

|

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIESU.S. GAAP

RECONCILIATION OF NON-GAAP ADJUSTED RESULTS(Amounts in Millions

except Per Share Data)(UNAUDITED) |

| |

Three Months Ended September 30, 2023 |

|

|

As Reported |

|

Amortization of Acquired Intangibles |

|

Restructuring Charges |

|

Net Losses on Sales of Businesses1 |

|

Adjusted Results

(Non-GAAP) |

| Operating Income and

Adjusted EBITA before Restructuring Charges2 |

$376.8 |

|

$(21.0) |

|

$0.6 |

|

|

|

$397.2 |

| |

|

|

|

|

|

|

|

|

|

|

Total (Expenses) and Other Income3 |

(37.3) |

|

|

|

|

|

$(12.1) |

|

(25.2) |

| Income Before Income

Taxes |

339.5 |

|

(21.0) |

|

0.6 |

|

(12.1) |

|

372.0 |

|

Provision for Income Taxes |

91.5 |

|

4.3 |

|

(0.2) |

|

2.6 |

|

98.2 |

|

Equity in Net Loss of Unconsolidated Affiliates |

(2.3) |

|

|

|

|

|

|

|

(2.3) |

|

Net Income Attributable to Non-controlling Interests |

(2.0) |

|

|

|

|

|

|

|

(2.0) |

| Net Income Available

to IPG Common Stockholders |

$243.7 |

|

$(16.7) |

|

$0.4 |

|

$(9.5) |

|

$269.5 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Weighted-Average

Number of Common Shares Outstanding - Basic |

383.6 |

|

|

|

|

|

|

|

383.6 |

|

Dilutive effect of stock options and restricted shares |

1.9 |

|

|

|

|

|

|

|

1.9 |

| Weighted-Average

Number of Common Shares Outstanding - Diluted |

385.5 |

|

|

|

|

|

|

|

385.5 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Earnings per Share

Available to IPG Common Stockholders4: |

|

|

|

|

|

|

|

|

|

| Basic |

$0.64 |

|

$(0.04) |

|

$0.00 |

|

$(0.02) |

|

$0.70 |

| Diluted |

$0.63 |

|

$(0.04) |

|

$0.00 |

|

$(0.02) |

|

$0.70 |

| |

|

|

|

|

|

|

|

|

|

| 1 Primarily

relates to losses on complete dispositions of businesses and the

classification of certain assets as held for sale. |

| 2 Refer to

non-GAAP reconciliation of Adjusted EBITA before Restructuring

Charges on page A5 in the appendix. |

| 3 Consists of

non-operating expenses including interest expense, interest income

and other expense, net. |

| 4 Earnings per

share amounts are calculated on an unrounded basis but rounded for

purposes of presentation. |

| Note: Management

believes the resulting comparisons provide useful supplemental data

that, while not a substitute for GAAP measures, allow for greater

transparency in the review of our financial and operational

performance. |

|

THE INTERPUBLIC GROUP OF COMPANIES, INC. AND SUBSIDIARIESU.S. GAAP

RECONCILIATION OF NON-GAAP ADJUSTED RESULTS(Amounts in Millions

except Per Share Data)(UNAUDITED) |

| |

Nine Months Ended September 30, 2023 |

|

|

As Reported |

|

Amortization of Acquired Intangibles |

|

Restructuring Charges |

|

Net Losses on Sales of Businesses1 |

|

Adjusted Results

(Non-GAAP) |

| Operating Income and

Adjusted EBITA before Restructuring Charges2 |

$875.8 |

|

$(63.1) |

|

$0.7 |

|

|

|

$938.2 |

| |

|

|

|

|

|

|

|

|

|

|

Total (Expenses) and Other Income3 |

(91.7) |

|

|

|

|

|

$(20.4) |

|

(71.3) |

| Income Before Income

Taxes |

784.1 |

|

(63.1) |

|

0.7 |

|

(20.4) |

|

866.9 |

|

Provision for Income Taxes |

135.9 |

|

12.7 |

|

(0.3) |

|

4.0 |

|

152.3 |

|

Equity in Net Loss of Unconsolidated Affiliates |

(1.7) |

|

|

|

|

|

|

|

(1.7) |

|

Net Income Attributable to Non-controlling Interests |

(11.3) |

|

|

|

|

|

|

|

(11.3) |

| Net Income Available

to IPG Common Stockholders |

$635.2 |

|

$(50.4) |

|

$0.4 |

|

$(16.4) |

|

$701.6 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Weighted-Average

Number of Common Shares Outstanding - Basic |

385.0 |

|

|

|

|

|

|

|

385.0 |

|

Dilutive effect of stock options and restricted shares |

1.8 |

|

|

|

|

|

|

|

1.8 |

| Weighted-Average

Number of Common Shares Outstanding - Diluted |

386.8 |

|

|

|

|

|

|

|

386.8 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Earnings per Share

Available to IPG Common Stockholders4,5: |

|

|

|

|

|

|

|

|

|

| Basic |

$1.65 |

|

$(0.13) |

|

$0.00 |

|

$(0.04) |

|

$1.82 |

| Diluted |

$1.64 |

|

$(0.13) |

|

$0.00 |

|

$(0.04) |

|

$1.81 |

| |

|

|

|

|

|

|

|

|

|

| 1 Primarily

relates to losses on complete dispositions of businesses and the

classification of certain assets as held for sale, as well as a

loss related to the sale of an equity investment. |

| 2 Refer to

non-GAAP reconciliation of Adjusted EBITA before Restructuring

Charges on page A5 in the appendix. |

| 3 Consists of

non-operating expenses including interest expense, interest income

and other expense, net. |

| 4 Earnings per

share amounts are calculated on an unrounded basis but rounded for

purposes of presentation. |

| 5 Basic and

diluted earnings per share, both As Reported and Adjusted Results

(Non-GAAP), includes a positive impact of $0.17 related to the

settlement of U.S. Federal Income Tax Audits for the years

2017-2018. |

| Note: Management

believes the resulting comparisons provide useful supplemental data

that, while not a substitute for GAAP measures, allow for greater

transparency in the review of our financial and operational

performance. |

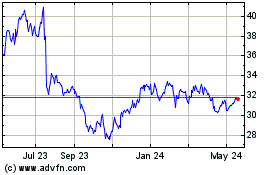

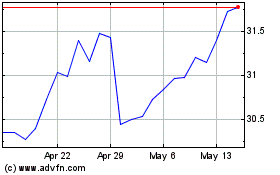

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Nov 2023 to Nov 2024