KKR Announces Intra-Quarter Monetization Activity Update for the Fourth Quarter

December 17 2024 - 3:15PM

Business Wire

KKR today announced a monetization activity update for the

period from October 1, 2024 to December 17, 2024. Based on

information available to us as of today, with respect to the period

through December 17, 2024, KKR’s Asset Management segment has

earned total realized performance income, including realized

carried interest and realized incentive fees, and total realized

investment income in excess of $725 million. Realized carried

interest drove over half of our monetization activity

quarter-to-date. The quarter-to-date monetization activity is

driven by a combination of secondary sales and strategic

transactions that have closed quarter-to-date, dividends and

interest income, as well as incentive fees from Marshall Wace.

The estimate disclosed above is not intended to predict or

represent total realized performance income, total realized

investment income or total revenues for the full quarter ending

December 31, 2024, because it does not include the results or

impact of any other sources of income, including fee income, or

expenses, and we may realize further gains or losses relating to

total realized performance income and total realized investment

income after the date of this press release. The estimate disclosed

above is based on information available to us as of today with

respect to the period from October 1, 2024 through December 17,

2024. This estimate is also not necessarily indicative of the

results that may be expected for any other period, including the

entire year ending December 31, 2024.

About KKR KKR is a leading global investment firm that

offers alternative asset management as well as capital markets and

insurance solutions. KKR aims to generate attractive investment

returns by following a patient and disciplined investment approach,

employing world-class people, and supporting growth in its

portfolio companies and communities. KKR sponsors investment funds

that invest in private equity, credit and real assets and has

strategic partners that manage hedge funds. KKR’s insurance

subsidiaries offer retirement, life and reinsurance products under

the management of Global Atlantic Financial Group. References to

KKR’s investments may include the activities of its sponsored funds

and insurance subsidiaries. For additional information about KKR

& Co. Inc. (NYSE: KKR), please visit KKR’s website at

www.kkr.com. For additional information about Global Atlantic

Financial Group, please visit Global Atlantic Financial Group’s

website at www.globalatlantic.com.

Forward-Looking Statements This press release may contain

forward-looking statements, including estimated operating results

from certain monetization activities. Words such as “expect,”

“estimate,” “will,” “may” and “believe” or similar expressions may

identify forward-looking statements. These forward-looking

statements are subject to the inherent uncertainties in predicting

future results and conditions. Certain factors could cause actual

results to differ materially from those included in these

forward-looking statements, and investors should not place undue

reliance on such statements. These forward-looking statements speak

only as of the date of this press release, and we do not undertake

any obligation to update or revise any of the forward-looking

statements to reflect future events or circumstances, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217134574/en/

Investor Relations: Craig Larson 1-877-610-4910 (U.S.) /

212-230-9410 investor-relations@kkr.com Media: Kristi Huller

or Julia Kosygina 1-212-750-8300 media@kkr.com

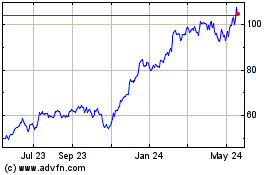

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

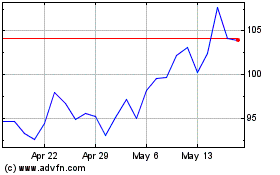

KKR (NYSE:KKR)

Historical Stock Chart

From Dec 2023 to Dec 2024