Newmont Announces Early Redemption of its 5.30% Notes Due 2026

January 27 2025 - 3:45PM

Business Wire

Committed to Reducing Debt and Further

Strengthening Newmont’s Financial Position

Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM)

(“Newmont” or the “Company”) and Newcrest Finance Pty Limited, a

wholly owned subsidiary of Newmont (“Newcrest Finance” and,

together with Newmont, the “Issuers”) today announced the

redemption of $927,754,000 in principal, fully retiring the 5.30%

Notes due 2026 (the “Notes”).

Including the early redemption of the 2026 Notes, Newmont will

have retired approximately $1.4 billion of its debt over the last

12 months, demonstrating the Company’s commitment to deleveraging

and strengthening its balance sheet.

The Notes will be redeemed on February 7, 2025 (the “Redemption

Date”) at a redemption price equal to the applicable make-whole

amount for the Notes, plus accrued and unpaid interest on the Notes

to, but excluding, the Redemption Date, in accordance with the

terms of the Notes. Interest on the Notes will cease to accrue on

and after the Redemption Date.

About Newmont

Newmont is the world’s leading gold company and a producer of

copper, zinc, lead, and silver. The Company’s world-class portfolio

of assets, prospects and talent is anchored in favorable mining

jurisdictions in Africa, Australia, Latin America & Caribbean,

North America, and Papua New Guinea. Newmont is the only gold

producer listed in the S&P 500 Index and is widely recognized

for its principled environmental, social, and governance practices.

Newmont is an industry leader in value creation, supported by

robust safety standards, superior execution, and technical

expertise. Founded in 1921, the Company has been publicly traded

since 1925.

At Newmont, our purpose is to create value and improve lives

through sustainable and responsible mining. To learn more about

Newmont’s sustainability strategy and initiatives, go to

www.newmont.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by these sections and other applicable laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the forward-looking statements. Forward-looking statements often

address our expected future business and financial performance and

financial condition; and often contain words such as “anticipate,”

“intend,” “plan,” “will,” “would,” “estimate,” “expect,” “believe,”

“pending” or “potential.” Forward-looking statements in this news

release may include, without limitation, statements relating to the

expected redemption of the Notes, future debt balances, future cash

flow generation, pending closing of asset divestitures and receipt

of proceeds and future capital allocation priorities. Estimates or

expectations of future events or results are based upon certain

assumptions, which may prove to be incorrect. Such assumptions,

include, but are not limited to Newmont’s operations remaining

consistent with plan and current expectations, market conditions

and other planning assumptions. For a more detailed discussion of

such risks, see Newmont’s Annual Report on Form 10-K for the year

ended December 31, 2023 filed with the SEC on February 29, 2024, as

well as Newmont’s other SEC filings, under the heading “Risk

Factors”, and other factors identified in Newmont’s reports filed

with the SEC, available on the SEC website or www.newmont.com.

Newmont does not undertake any obligation to release publicly

revisions to any “forward-looking statement,” including, without

limitation, outlook, to reflect events or circumstances after the

date of this news release, or to reflect the occurrence of

unanticipated events, except as may be required under applicable

securities laws. Investors should not assume that any lack of

update to a previously issued “forward-looking statement”

constitutes a reaffirmation of that statement. Continued reliance

on “forward-looking statements” is at investors’ own risk.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127695677/en/

Investor Contact – Global Neil Backhouse

investor.relations@newmont.com

Investor Contact – Asia Pacific Natalie Worley

apac.investor.relations@newmont.com

Media Contact – Global Shannon Lijek

globalcommunications@newmont.com

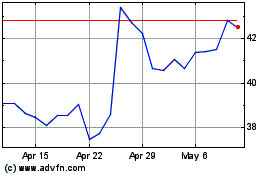

Newmont (NYSE:NEM)

Historical Stock Chart

From Feb 2025 to Mar 2025

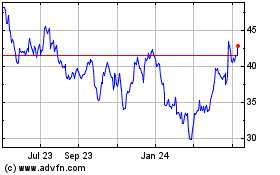

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Mar 2025