North American Construction Group Ltd. Announces Normal Course Issuer Bid

October 30 2024 - 4:06PM

North American Construction Group Ltd. (“NACG” or “the Company”)

(TSX:NOA/NYSE:NOA) today announced that it intends to commence a

normal course issuer bid (the “NCIB”) to purchase, for

cancellation, up to 2,087,577 common shares in the capital of the

Company (“Common Shares”), which represents approximately 10% of

the public float (as defined in the TSX Company Manual) and

approximately 7.5% of the issued and outstanding Common Shares as

of October 24, 2024. As at October 24, 2024, the Company had

27,827,282 Common Shares issued and outstanding.

Purchases of Common Shares under the NCIB may be made through

the facilities of the Toronto Stock Exchange (“TSX”), the New York

Stock Exchange (“NYSE”) and alternative trading systems in Canada

and the United States by means of open market transactions or by

such other means as may be permitted under applicable securities

laws. Under the NCIB, and in order to comply with applicable

securities laws, the Company will purchase a maximum of 1,391,364

Common Shares (or approximately 5% of the issued and outstanding

voting common shares) on the NYSE and alternative trading

systems.

The Company believes that the current market price of its Common

Shares does not fully reflect their underlying value and that

current market conditions provide opportunities for the Company to

acquire Common Shares at attractive prices. In the Company’s view,

a repurchase of Common Shares would be an effective use of its cash

resources and would be in the best interests of the Company and its

shareholders. The Company believes that it would both enhance

liquidity for shareholders seeking to sell and provide an increase

in the proportionate interests of shareholders wishing to maintain

their positions.

The NCIB is expected to commence on or about November 4, 2024

and will terminate no later than November 3, 2025. All purchases of

Common Shares will be made in compliance with applicable TSX and

NYSE rules. The average daily trading volume of the Common Shares

on the TSX for the six calendar months preceding October 1, 2024 is

62,910 Common Shares. In accordance with the TSX rules and subject

to the exemption for block purchases, a maximum daily repurchase of

25% of this average may be made, representing 15,727 Common Shares.

The price per Common Share will be based on the market price of

such shares at the time of purchase in accordance with regulatory

requirements.

About NACGNACG is one of Canada

and Australia’s largest providers of heavy construction and mining

services. For over 70 years, NACG has provided services to mining,

resource, and infrastructure construction markets.

Jason Veenstra, CPA, CAChief Financial OfficerP: 780.960.7171E:

ir@nacg.ca

The information provided in this release

contains forward-looking statements. Forward-looking statements

include statements preceded by, followed by or that include the

words “expected”, “estimated” or similar expressions, including the

anticipated revenues and backlog to be generated by the contract.

The material factors or assumptions used to develop the above

forward-looking statements and the risks and uncertainties to which

such forward-looking statements are subject are highlighted in the

Company’s MD&A for the year ended December 31, 2023 and quarter

ending September 30, 2024. Actual results could differ materially

from those contemplated by such forward-looking statements because

of any number of factors and uncertainties, many of which are

beyond NACG’s control. For more complete information about NACG,

please read our disclosure documents filed with the SEC and the

CSA. These free documents can be obtained by visiting EDGAR on the

SEC website at www.sec.gov or on the CSA website at

www.sedarplus.com.

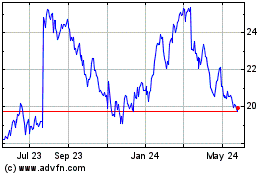

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Oct 2024 to Nov 2024

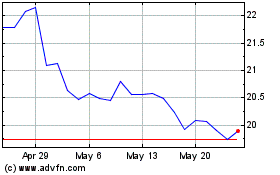

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Nov 2023 to Nov 2024