- Annual Recurring Revenue (ARR)(1) grew to $248.1 million -

total growth of 93.3% inclusive of organic growth of 24.8% from

$128.3 million reported in Q3 '23

- Quarterly subscription service revenues increased 91.0%

year-over-year from Q3 '23

- PAR completed the sale of Rome Research Corporation,

completing the divestiture of PAR's Government segment

- PAR completed the acquisition of TASK Group Holdings Limited

(“TASK Group”), an Australia-based global foodservice transaction

platform

PAR Technology Corporation (NYSE: PAR) (“PAR Technology” or the

“Company”) today announced its financial results for the third

quarter ended September 30, 2024.

Savneet Singh, PAR Technology CEO commented, “We delivered

another strong quarter in Q3, driven by increased demand for our

enterprise foodservice software. Our organic ARR grew by

approximately 25% and total ARR grew by 93% in the quarter from Q3

‘23. Our performance in the quarter demonstrates the continued

execution of our strategic plan as we consistently demonstrate our

ability to deliver best-in-class products, while at the same time

proving our better together outcomes. Equally important we

delivered our first quarter of positive adjusted EBITDA since

current management took over the business. This reinforces our

belief that we will be able to demonstrate incredibly strong unit

economics, leveraging the platform we’ve built up over the past few

years.”

Q3 2024 Financial

Highlights(2)

(in millions, except % and per share

amounts)

GAAP

Non-GAAP(1)

Q3 2024

Q3 2023

vs. Q3 2023

Q3 2024

Q3 2023

vs. Q3 2023

Revenue

$96.8

$68.7

better 40.8%

Net Loss from Continuing

Operations/Adjusted EBITDA

$(20.7)

$(19.2)

worse $1.4 million

$2.4

$(6.6)

better $9.0 million

Diluted Net Loss Per Share from

Continuing Operations

$(0.58)

$(0.70)

better $0.12

$(0.09)

$(0.35)

better $0.26

Subscription Service Gross Margin

Percentage

55.3%

50.6%

better 4.7%

66.8%

69.4%

worse 2.6%

Year-to-Date 2024

Financial Highlights(2)

(in millions, except % and per share

amounts)

GAAP

Non-GAAP(1)

Q3 2024

Q3 2023

vs. Q3 2023

Q3 2024

Q3 2023

vs. Q3 2023

Revenue

$245.0

$206.8

better 18.5%

Net Loss from Continuing

Operations/Adjusted EBITDA

$(64.6)

$(60.1)

worse $4.5 million

$(12.1)

$(31.0)

better $18.9 million

Diluted Net Loss Per Share from

Continuing Operations

$(1.90)

$(2.19)

better $0.29

$(0.74)

$(1.53)

better $0.79

Subscription Service Gross Margin

Percentage

53.6%

48.0%

better 5.6%

66.4%

67.0%

worse 0.6%

(1) See “Key Performance Indicators and Non-GAAP Financial

Measures” for reconciliations and descriptions of non-GAAP

financial measures to corresponding GAAP financial measures.

Amounts presented in the reconciliations and other tables presented

herein may not sum due to rounding. (2) Results exclude historical

results from our Government segment which are reported as

discontinued operations.

The Company's key performance indicators ARR and Active Sites(1)

are presented as two subscription service product lines:

- Engagement Cloud consisting of Punchh, PAR Retail (formerly

Stuzo), PAR Ordering (formerly MENU), and Plexure product

offerings.

- Operator Cloud consisting of PAR POS (formerly Brink POS), PAR

Payment Services, PAR Pay, Data Central, and TASK product

offerings.

Highlights of Engagement Cloud - Third Quarter

2024(1):

- ARR at end of Q3 '24 totaled $154.7 million

- Active Sites as of September 30, 2024 totaled 117.8

thousand

Highlights of Operator Cloud - Third Quarter 2024(1):

- ARR at end of Q3 '24 totaled $93.4 million

- Active Sites as of September 30, 2024 totaled 32.7

thousand

(1) See “Key Performance Indicators and Non-GAAP Financial

Measures” below.

Earnings Conference Call.

There will be a conference call at 9:00 a.m. (Eastern) on

November 8, 2024, during which management will discuss the

Company's financial results for the third quarter ended September

30, 2024. The earnings conference call will be webcast live. To

access the webcast, please visit the PAR Technology Investor

Relations website at www.partech.com/investor-relations/. A

recording of the webcast will be available on this site after the

event.

About PAR Technology Corporation.

For over four decades, PAR Technology Corporation (NYSE: PAR)

has been a leader in restaurant technology, empowering brands

worldwide to create lasting connections with their guests. Our

innovative solutions and commitment to excellence provide

comprehensive software and hardware that enable seamless

experiences and drive growth for over 120,000 foodservice locations

in more than 110 countries. Embracing our "Better Together" ethos,

we offer unified customer experience solutions, combining

point-of-sale, digital ordering, loyalty and back-office software

solutions as well as industry-leading hardware and drive-thru

offerings. To learn more, visit partech.com or connect with us on

LinkedIn, X (formerly Twitter), Facebook, and Instagram. The

Company's Environmental, Social, and Governance report can be found

at https://www.partech.com/company/ESG.

Key Performance Indicators and Non-GAAP Financial

Measures.

We monitor certain key performance indicators and non-GAAP

financial measures in the evaluation and management of our

business; certain key performance indicators and non-GAAP financial

measures are provided in this press release because we believe they

are useful in facilitating period-to-period comparisons of our

business performance. Key performance indicators and non-GAAP

financial measures do not reflect and should be viewed

independently of our financial performance determined in accordance

with GAAP. Key performance indicators and non-GAAP financial

measures are not forecasts or indicators of future or expected

results and should not have undue reliance placed upon them by

investors.

Where non-GAAP financial measures are included in this press

release, the most directly comparable GAAP financial measures and a

detailed reconciliation between GAAP and non-GAAP financial

measures is included in this press release under “Non-GAAP

Financial Measures”.

Unless otherwise indicated, financial and operating data

included in this press release is as of September 30, 2024.

As used in this press release,

“Annual Recurring Revenue” or “ARR” is the annualized

revenue from subscription services, including subscription fees for

our SaaS solutions and related software support, managed platform

development services, and transaction-based payment processing

services. We generally calculate ARR by annualizing the monthly

subscription service revenue for all Active Sites as of the last

day of each month for the respective reporting period.

“Active Sites” represent locations active on PAR’s

subscription services as of the last day of the respective

reporting period.

Trademarks.

“PAR®,” “PAR POS®” (formerly “Brink POS®”), “Punchh®,” “PAR

OrderingTM” (formerly “MENUTM”), “Data Central®,” "Open Commerce®,”

"PAR® Pay”, “PAR® Payment Services”, "StuzoTM," "PAR RetailTM," and

other trademarks appearing in this press release belong to us.

Forward-Looking Statements.

This press release contains forward-looking statements made

pursuant to the safe harbor provisions of Section 21E of the

Securities Exchange Act of 1934, as amended, Section 27A of the

Securities Act of 1933, as amended, and the Private Securities

Litigation Reform Act of 1995, the accuracy of such statements is

necessarily subject to risks, uncertainties and assumptions as to

future events that may not prove to be accurate. These statements

include, but are not limited to, express or implied forward-looking

statements relating to the plans, strategies and objectives of

management relating to PAR's growth, results of operations, and

financial performance, including service and product offerings, the

development, demand, market share, and competitive performance of

our products and services, continued growth of our business, our

ability to achieve and sustain profitability, acceleration or

improvement of financial results, annual recurring revenue (ARR)

growth, active sites, capital investment and re-investment, and

anticipated benefits of acquisitions, divestitures, and capital

markets transactions. These statements are neither promises nor

guarantees but are subject to a variety of risks and uncertainties,

many of which are beyond our control, which could cause actual

results to differ materially from those contemplated in these

forward-looking statements.

Factors, risks, trends and uncertainties that could cause actual

results to differ materially from those expressed or implied

include our ability to successfully develop or acquire and

transition new products and services and enhance existing products

and services to meet evolving customer needs and respond to

emerging technological trends, including artificial intelligence

(AI); our ability to successfully integrate acquisitions into our

operations, and realize the anticipated benefits, including the

acquisitions of Stuzo Holdings, LLC and TASK Group; macroeconomic

trends, such as a recession or slowed economic growth, fluctuating

interest rates, inflation, and changes in consumer confidence and

discretionary spending; our ability to successfully expand our

business or products into new markets or industries; geopolitical

events, such as the effects of the Russia-Ukraine war, tensions

with China and between China and Taiwan, hostilities in the Middle

East, including the Israel conflict(s); and uncertainty relating to

the U.S. presidential transition and the Trump administration's

policies and regulations, including potential changes to trade

agreements and tariffs; and the other factors discussed in our most

recent Annual Report on Form 10-K and other filings with the

Securities and Exchange Commission. Undue reliance should not be

placed on the forward-looking statements in this press release,

which are based on the information available to us on the date

hereof. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as may be required under

applicable securities law.

PAR TECHNOLOGY

CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in thousands, except

share amounts)

Assets

September 30, 2024

December 31, 2023

Current assets:

Cash and cash equivalents

$

105,804

$

37,183

Cash held on behalf of customers

15,266

10,170

Short-term investments

12,578

37,194

Accounts receivable – net

60,298

42,679

Inventories

23,915

23,560

Other current assets

14,743

8,123

Current assets of discontinued

operations

—

21,690

Total current assets

232,604

180,599

Property, plant and equipment – net

14,865

15,524

Goodwill

803,084

488,918

Intangible assets – net

226,051

93,969

Lease right-of-use assets

7,651

3,169

Other assets

15,019

17,642

Noncurrent assets of discontinued

operations

—

2,785

Total Assets

$

1,299,274

$

802,606

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$

35,186

$

25,599

Accrued salaries and benefits

17,959

14,128

Accrued expenses

8,309

3,533

Customers payable

15,266

10,170

Lease liabilities – current portion

2,178

1,120

Customer deposits and deferred service

revenue

30,444

9,304

Current liabilities of discontinued

operations

—

16,378

Total current liabilities

109,342

80,232

Lease liabilities – net of current

portion

5,559

2,145

Long-term debt

466,735

377,647

Deferred service revenue – noncurrent

1,733

4,204

Other long-term liabilities

23,198

3,603

Noncurrent liabilities of discontinued

operations

—

1,710

Total liabilities

606,567

469,541

Shareholders’ equity:

Preferred stock, $0.02 par value,

1,000,000 shares authorized, none outstanding

—

—

Common stock, $0.02 par value, 116,000,000

shares authorized, 37,773,764 and 29,386,234 shares issued,

36,303,459 and 28,029,915 outstanding at September 30, 2024 and

December 31, 2023, respectively

749

584

Additional paid in capital

972,811

625,154

Accumulated deficit

(258,886

)

(274,956

)

Accumulated other comprehensive loss

(118

)

(939

)

Treasury stock, at cost, 1,470,305 shares

and 1,356,319 shares at September 30, 2024 and December 31, 2023,

respectively

(21,849

)

(16,778

)

Total shareholders’ equity

692,707

333,065

Total Liabilities and Shareholders’

Equity

$

1,299,274

$

802,606

See notes to unaudited interim condensed consolidated financial

statements included in the Company's quarterly report on Form 10-Q

for the quarter ended September 30, 2024 (the “Quarterly

Report”).

PAR TECHNOLOGY

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands, except

per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues, net:

Subscription service

$

59,909

$

31,363

$

143,160

$

89,700

Hardware

22,650

25,824

60,992

78,991

Professional service

14,195

11,514

40,825

38,123

Total revenues, net

96,754

68,701

244,977

206,814

Cost of sales:

Subscription service

26,789

15,497

66,424

46,655

Hardware

16,878

19,295

46,587

63,002

Professional service

10,056

8,775

30,849

31,925

Total cost of sales

53,723

43,567

143,860

141,582

Gross margin

43,031

25,134

101,117

65,232

Operating expenses:

Sales and marketing

10,500

9,532

31,237

29,005

General and administrative

27,352

17,525

77,896

52,926

Research and development

17,821

14,660

49,826

43,863

Amortization of identifiable intangible

assets

2,699

464

5,577

1,393

Adjustment to contingent consideration

liability

—

—

(600

)

(7,500

)

Gain on insurance proceeds

(147

)

—

(147

)

(500

)

Total operating expenses

58,225

42,181

163,789

119,187

Operating loss

(15,194

)

(17,047

)

(62,672

)

(53,955

)

Other expense, net

(1,400

)

(262

)

(1,710

)

(116

)

Interest expense, net

(3,417

)

(1,750

)

(6,755

)

(5,152

)

Loss from continuing operations before

(provision for) benefit from income taxes

(20,011

)

(19,059

)

(71,137

)

(59,223

)

(Provision for) benefit from income

taxes

(653

)

(175

)

6,520

(873

)

Net loss from continuing operations

(20,664

)

(19,234

)

(64,617

)

(60,096

)

Net income from discontinued

operations

832

3,718

80,687

8,973

Net income (loss)

$

(19,832

)

$

(15,516

)

$

16,070

$

(51,123

)

Net income (loss) per share (basic and

diluted):

Continuing operations

$

(0.58

)

$

(0.70

)

$

(1.90

)

$

(2.19

)

Discontinued operations

0.02

0.14

2.38

0.33

Total

$

(0.56

)

$

(0.56

)

$

0.48

$

(1.86

)

Weighted average shares outstanding (basic

and diluted)

35,865

27,472

33,931

27,412

See notes to unaudited interim condensed consolidated financial

statements included in the Quarterly Report.

PAR TECHNOLOGY CORPORATION

SUPPLEMENTAL INFORMATION (unaudited)

Non-GAAP Financial Measures

In addition to disclosing financial results in accordance with

GAAP, this press release contains references to the non-GAAP

financial measures below. We believe these non-GAAP financial

measures provide investors with useful supplemental information

about our operating performance, enable comparison of financial

trends and results between periods where certain items may vary

independent of business performance, and allow for greater

transparency with respect to key metrics used by management in

operating our business and measuring our performance. The income

tax effect of the below adjustments, with the exception of

non-recurring income taxes, were not tax-effected due to the

valuation allowance on all of our net deferred tax assets.

Our non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with GAAP, and the financial results calculated in

accordance with GAAP and reconciliations from these results should

be carefully evaluated. Additionally, these measures may not be

comparable to similarly titled measures disclosed by other

companies.

Non-GAAP subscription service gross margin percentage is

adjusted to exclude amortization from acquired and internally

developed software, stock-based compensation, and severance costs

included within subscription service cost of sales.

Non-GAAP Measure or

Adjustment

Definition

Usefulness to management and

investors

Non-GAAP subscription service gross margin

percentage

Represents subscription service gross

margin percentage adjusted to exclude amortization from acquired

and internally developed software, stock-based compensation, and

severance.

We believe that non-GAAP subscription

service gross margin percentage and adjusted EBITDA provide useful

perspectives with respect to the Company's core operating

performance and ongoing cash earnings by adjusting for certain

non-cash and non-recurring charges that may not be indicative of

our financial performance.

Adjusted EBITDA

Represents net income (loss) before income

taxes, interest expense and depreciation and amortization adjusted

to exclude certain non-cash and non-recurring charges that may not

be indicative of our financial performance.

Non-GAAP diluted net loss per share

Represents net loss per share excluding

amortization of acquired intangible assets and certain non-cash and

non-recurring charges that may not be indicative of our financial

performance.

We believe that adjusting our non-GAAP

diluted net loss per share to remove non-cash and non-recurring

charges provides a useful perspective with respect to the Company's

operating performance as well as comparisons to past and competitor

operating results.

Stock-based compensation

Consists of charges related to our

employee equity incentive plans.

We exclude stock-based compensation

because management does not view these non-cash charges as part of

our core operating performance. This adjustment facilitates a

useful evaluation of our current operating performance as well as

comparisons to past and competitor operating results.

Contingent consideration

Adjustment reflects a non-cash reduction

to the fair market value of the contingent consideration liability

related to our acquisition of MENU Technologies AG.

We exclude changes to the fair market

value of our contingent consideration liability because management

does not view these non-cash, non-recurring charges as part of our

core operating performance. This adjustment facilitates a useful

evaluation of our current operating performance as well as

comparisons to past and competitor operating results.

Transaction costs

Adjustment reflects non-recurring

professional fees incurred in transaction due diligence, including

costs incurred in the acquisitions of Stuzo Blocker, Inc., Stuzo

Holdings, LLC and their subsidiaries (the "Stuzo Acquisition") and

TASK Group.

We exclude professional fees incurred in

corporate development because management does not view these

non-recurring charges, which are inconsistent in size and are

significantly impacted by the timing and valuation of our

transactions, as part of our core operating performance. This

adjustment facilitates a useful evaluation of our current operating

performance, comparisons to past and competitor operating results,

and additional means to evaluate expense trends.

Gain on insurance proceeds

Adjustment reflects the gain on insurance

proceeds due to the settlement of a legacy claim.

We exclude these non-recurring adjustments

because management does not view these costs as part of our core

operating performance. These adjustments facilitate a useful

evaluation of our current operating performance as well as

comparisons to past and competitor operating results.

Severance

Adjustment reflects severance tied to

non-recurring restructuring events included in cost of sales, sales

and marketing expense, general and administrative expense, and

research and development expense.

Discontinued operations

Adjustment reflects income from

discontinued operations related to the disposition of our

Government segment.

Impairment loss

Adjustment reflects impairment loss

included in general and administrative expense related to the

discontinuance of the Brink POS trade name.

Other expense, net

Adjustment reflects foreign currency

transaction gains and losses, rental income and losses, and other

non-recurring expenses recorded in other expense, net in the

accompanying statements of operations.

Non-recurring income taxes

Adjustment reflects a partial release of

our deferred tax asset valuation allowance resulting from the Stuzo

Acquisition.

We exclude these non-cash and

non-recurring adjustments for purposes of calculating non-GAAP

diluted net loss per share because management does not view these

costs as part of our core operating performance. These adjustments

facilitate a useful evaluation of our current operating

performance, comparisons to past and competitor operating results,

and additional means to evaluate expense trends.

Non-cash interest

Adjustment reflects non-cash amortization

of issuance costs and discount related to the Company's long-term

debt.

Acquired intangible assets

amortization

Adjustment reflects amortization expense

of acquired developed technology included within cost of sales and

amortization expense of acquired intangible assets.

The tables below provide reconciliations between net income

(loss) and adjusted EBITDA, diluted net income (loss) per share and

non-GAAP diluted net loss per share, and subscription service gross

margin percentage and non-GAAP subscription service gross margin

percentage.

(in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

Reconciliation of Net Income (Loss) to

Adjusted EBITDA

2024

2023

2024

2023

Net income (loss)

$

(19,832

)

$

(15,516

)

$

16,070

$

(51,123

)

Discontinued operations

(832

)

(3,718

)

(80,687

)

(8,973

)

Net loss from continuing operations

(20,664

)

(19,234

)

(64,617

)

(60,096

)

Provision for (benefit from) income

taxes

653

175

(6,520

)

873

Interest expense, net

3,417

1,750

6,755

5,152

Depreciation and amortization

10,575

6,549

26,702

20,133

Stock-based compensation

5,887

3,935

16,583

10,544

Contingent consideration

—

—

(600

)

(7,500

)

Transaction costs

1,125

—

6,103

—

Gain on insurance proceeds

(147

)

—

(147

)

(500

)

Severance

(48

)

—

1,680

253

Impairment loss

225

—

225

—

Other expense, net

1,400

262

1,710

116

Adjusted EBITDA

$

2,423

$

(6,563

)

$

(12,126

)

$

(31,025

)

(in thousands, except per share

amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

Reconciliation between GAAP and

Non-GAAP

Diluted Net Income (Loss) per share

2024

2023

2024

2023

Diluted net income (loss) per share

$

(0.56

)

$

(0.56

)

$

0.48

$

(1.86

)

Discontinued operations

(0.02

)

(0.14

)

(2.38

)

(0.33

)

Diluted net loss per share from continuing

operations

(0.58

)

(0.70

)

(1.90

)

(2.19

)

Non-recurring income taxes

—

—

(0.23

)

—

Non-cash interest

0.02

0.02

0.05

0.06

Acquired intangible assets

amortization

0.23

0.18

0.59

0.49

Stock-based compensation

0.16

0.14

0.49

0.38

Contingent consideration

—

—

(0.02

)

(0.27

)

Transaction costs

0.03

—

0.18

—

Gain on insurance proceeds

—

—

—

(0.02

)

Severance

—

—

0.05

0.01

Impairment loss

0.01

—

0.01

—

Other expense, net

0.04

0.01

0.05

—

Non-GAAP diluted net loss per share

$

(0.09

)

$

(0.35

)

$

(0.74

)

$

(1.53

)

Diluted weighted average shares

outstanding

35,865

27,472

33,931

27,412

Three Months Ended September

30,

Nine Months Ended September

30,

Reconciliation between GAAP and

Non-GAAP

Subscription Service Gross Margin

Percentage

2024

2023

2024

2023

Subscription Service Gross Margin

Percentage

55.3

%

50.6

%

53.6

%

48.0

%

Depreciation and amortization

11.4

%

18.4

%

12.6

%

18.8

%

Stock-based compensation

0.1

%

0.4

%

0.1

%

0.2

%

Severance

—

%

—

%

0.1

%

—

%

Non-GAAP Subscription Service Gross Margin

Percentage

66.8

%

69.4

%

66.4

%

67.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108976606/en/

Christopher R. Byrnes (315) 743-8376 cbyrnes@partech.com,

www.partech.com

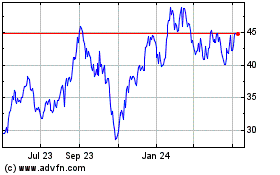

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Nov 2024 to Dec 2024

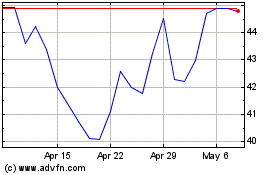

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Dec 2023 to Dec 2024